Content

What is the Current Iron and Steel Market Size and Share?

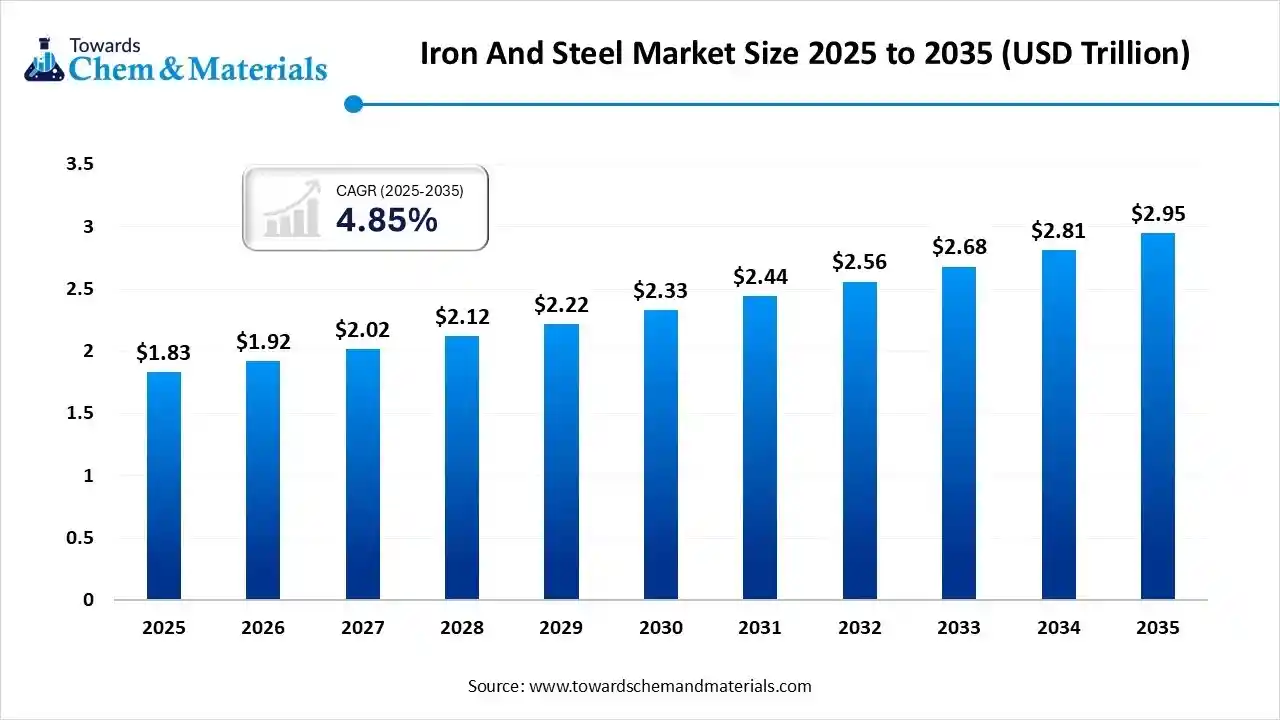

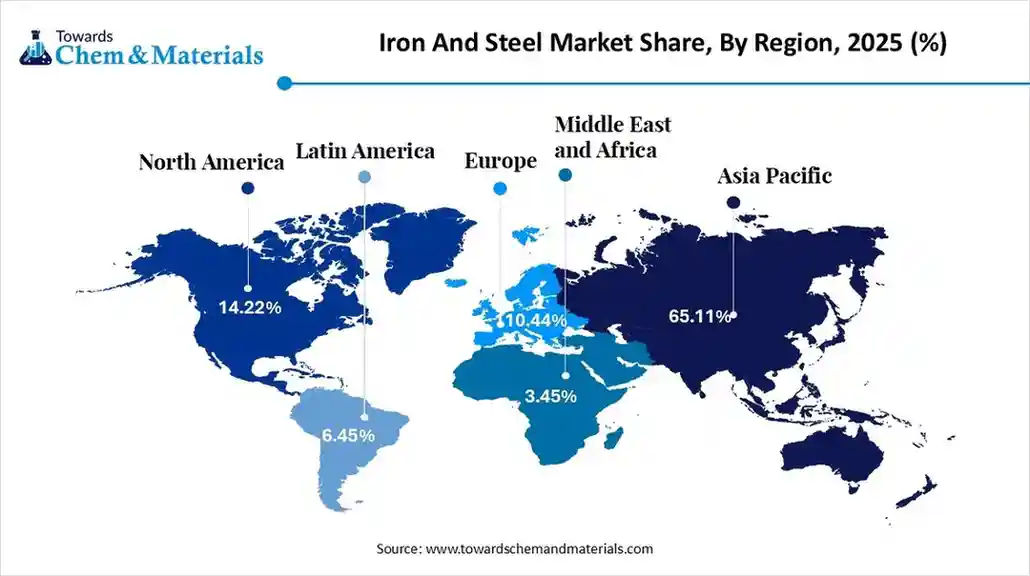

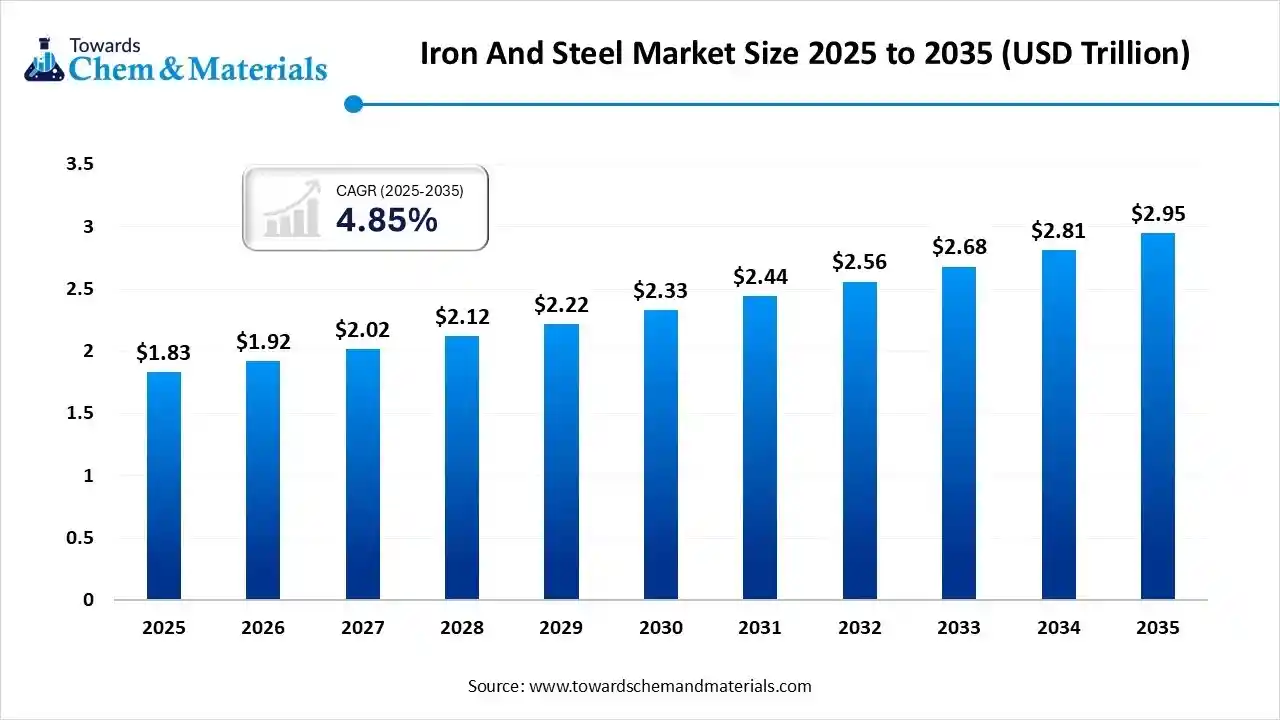

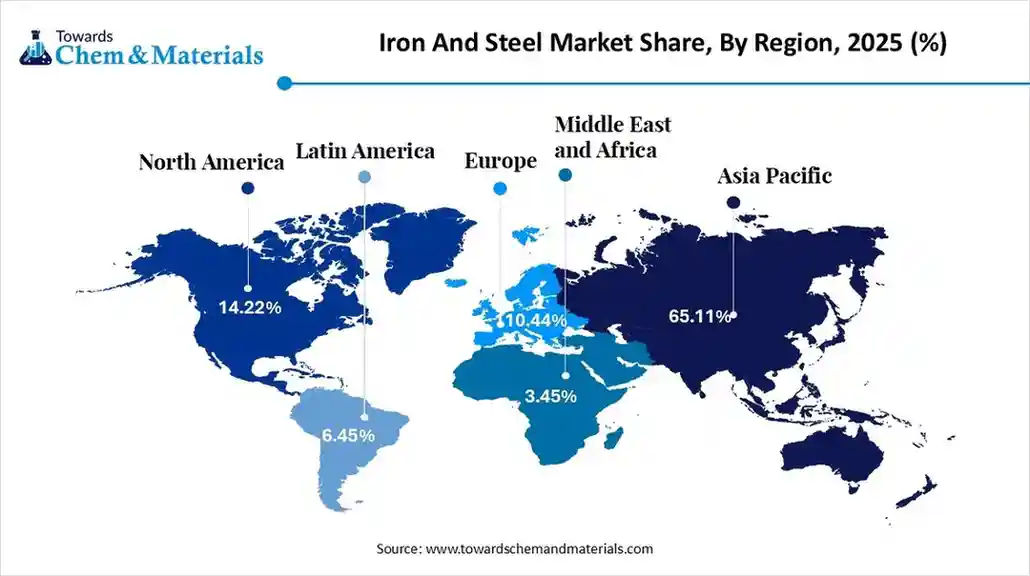

The global iron and steel market size is calculated at USD 1.83 trillion in 2025 and is predicted to increase from USD 1.92 trillion in 2026 and is projected to reach around USD 2.95 trillion by 2035, The market is expanding at a CAGR of 4.85% between 2026 and 2035. Asia Pacific dominated the iron and steel market with a market share of 65% the global market in 2025. Growing emphasis on sustainability and recycling is the key factor driving market growth. Also, ongoing urbanization, coupled with extensive infrastructure and construction development, can fuel market growth further.

Key Takeaways

- Asia-Pacific dominated the iron and steel market with a revenue share of 65% in 2025.

- By product type, the finished steel segment led the market and accounted for 55% of the global revenue share in 2025.

- By steel type, the carbon steel segment accounted for the largest revenue share of 65% in 2025.

- By production method, the basic oxygen furnace (BOF) segment dominated with the largest revenue share of 60% in 2025.

- By application, the construction & infrastructure segment dominated the market and accounted for the largest revenue share of 50% in 2025.

- By end user industry, the commercial & infrastructure construction segment accounted for the largest market revenue share of 45% in 2025.

What are Iron and Steel Market?

The iron and steel market comprise the production, processing, distribution, and consumption of iron ore, crude steel, finished steel products, and value-added steel grades used across construction, automotive, machinery, energy, shipbuilding, aerospace, packaging, and household appliances.

The market covers raw material processing (iron ore, pellets, scrap), primary steelmaking (BOF, EAF), secondary refining, rolling and finishing operations, fabrication, and specialized alloy development.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 1.92 Trillion |

| Revenue Forecast in 2035 | USD 2.95 Trillion |

| Growth Rate | CAGR 15.75% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments covered | By Product Type, By Steel Type, By Production Method, By Application, By End-User Industry, By Region |

| Key companies profiled | HBIS Group, Jiangsu Shagang Group, POSCO HOLDINGS INC., Tata Steel Limited, JFE Steel Corporation, Shougang Group, China BaoWu Steel Group Corporation Limited |

Global Iron and Steel Market Trends:

- The integration of Artificial Intelligence, automation, and data analytics is the latest trend in the market, helping major players to boost production efficiency, streamline energy consumption, and enhance quality control.

The market is rapidly moving towards greener production methods, like using direct reduced iron (DRI) with green hydrogen and electric arc furnaces (EAFs) with recycled scraps. This trend was further fuelled by pressure from investors and consumers. - There is a growing demand for high-strength steel utilized in the automotive industry, particularly for electric vehicles, which need lightweight materials to strengthen energy efficiency, driving market expansion soon.

- Major companies are making significant investments and forming partnerships in capacity expansion and green technology, for instance, Japan's JFE Steel and JSW Steel have formed a joint venture in India to propel the growth of the Indian market.

- Governments across the globe are increasingly implementing incentives and policies like the U.S. government's "Buy American" mandates and India's "Make in India" program for infrastructure projects, to promote the manufacturing of domestic steel and minimize reliance on imports.

How Cutting Edge Technologies are Revolutionizing the Global Iron and Steel Market?

Advanced technologies are transforming the market by boosting efficiency, increasing safety, enhancing quality, and minimizing overall environmental impact through automation and AI. These technologies are fuelling the production and handling of hazardous tasks by enabling real-time monitoring and control.

Trade Analysis of Global Iron and Steel Market: Import & Export Statistics:

- In the 2025-26 period, China led the world in iron ore exports, with a value of $70.84 billion, which represented 15.7% of the global total.

- In the 2025-26 period, the United States was the seventh-largest global exporter of iron, with exports valued at $19.59 billion, representing 4.3% of the worldwide market share.

- According to 2025-26 iron export data, Germany ranked second globally with $30.93 billion in iron exports, representing 6.9% of the global market share.

Global Iron and Steel Market Value Chain Analysis

- Feedstock Procurement :It is the process of acquiring the primary raw materials needed for steel production, including iron ore, coking coal, limestone, and steel scrap. Efficient procurement strategies and long-term supplier agreements are essential to ensure consistent quality, cost-effectiveness, and uninterrupted production.

- Major Players: ArcelorMittal, Nucor Corporation

- Chemical Synthesis and Processing :This process includes the crucial chemical reactions and related physical manipulations utilized to convert raw materials (iron ore, coke, limestone) into various types of steel. Advanced technologies such as electric arc furnaces and oxygen converters help improve efficiency, reduce energy consumption, and allow customization of steel properties for different applications.

- Major Players: Linde India Ltd, TEKNA Plasma Inc

- Packaging and Labelling :It is an important stage used to safeguard steel products from damage during storage and transport, to offer safety information throughout the supply chain. Proper packaging and labeling also help in tracking inventory, ensuring compliance with logistics standards, and facilitating international exports.

- Major Players: Avery Dennison Corporation, Amcor Plc

- Regulatory Compliance and Safety Monitoring :This is a critical process for adhering to an extensive range of laws and standards related to worker safety, product quality, and environmental protection. Continuous monitoring, audits, and adoption of best practices help steel manufacturers minimize risks, avoid legal penalties, and maintain a sustainable production footprint.

Global Iron and Steel Market t's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| China | China is focusing on reducing emissions as part of its 14th Five-Year Plan (2021–2025). By 2025, over 80% of steelmaking capacity is required to meet ultra-low emissions standards. |

| European Union | To address global overcapacity and unfair trade, the EU has proposed significant import restrictions, including reducing tariff-free quotas for steel and implementing a 50% tariff on excess imports. |

| India | India has implemented policies to favor domestically manufactured steel for government procurement. The country also considers raising safeguard duties on imported steel to counter cheap imports, with a provisional 12% duty potentially increasing to 24%. |

Segment Insights

Product Type Insight

How Much Share Did the Finished Steel Segment Held in 2025?

The finished steel segment dominated the market with nearly 55% share in 2025. The dominance of the segment can be attributed to the growing product demand from major end-use industries, specially building and construction, along with increasing focus on sustainability initiatives.

The direct reduced iron (DRI) segment is expected to grow at the fastest CAGR of approximately 7–9% over the forecast period. The growth of the segment can be credited to the surging industrialization in developing countries, and nearshoring trends are boosting the demand for steel-intensive manufacturing. The growth of the ferrochrome segment can be fuelled by the growing demand for stainless steel across the globe. Ferrochrome (FeCr) is an essential alloy that offers stainless steel with its crucial properties such as strength, corrosion resistance, and durability.

Steel Type Insight

Which Steel Type Segment Dominated the Global Iron and Steel Market in 2025?

The carbon steel segment held nearly 65% market share in 2025. The dominance of the segment can be linked to the extensive infrastructure development, ongoing urbanization, and the growing product demand from the construction and automotive industries.

The AHSS & advanced alloy steel segment is expected to grow at the fastest CAGR of nearly 8–10% over the forecast period. The growth of the segment can be driven by the rising need for lightweight, fuel-efficient, and safer vehicles, coupled with the strict environmental regulations and safety standards implemented by governments globally.

The stainless-steel segment held a significant market share in 2025. The growth of the segment can be boosted by the surging use of stainless-steel scrap and its growing consumption in construction. Also, Reindustrialization in emerging economies is expanding segment growth soon.The growth of the tool steel segment can be propelled by growing demand for durable tools, and sustainability policies emphasize production efficiency and recycling. The growth of the forging industry directly impacts positive market growth further.

Production Method Insight

How Much Share Did the Basic Oxygen Furnace (BOF) Segment Held in 2025?

The basic oxygen furnace (BOF) segment dominated the market with nearly 60% share in 2025. The dominance of the segment is owing to the ongoing urbanization and industrialization in developing economies, particularly in the Asia-Pacific region, which requires cost-effective and high-volume steel production for construction.

The electric arc furnace (EAF) segment is expected to grow at the fastest CAGR of approximately 10–12% during the forecast period. The growth of the segment is due to growing scrap metal availability, increasing demand for sustainable "green steel and environmental regulations implementations. The open-hearth segment held a major market share in 2025. The growth of the segment can be fuelled by growing emphasis on sustainable and high-performance steel solutions, along with the modernization of massive infrastructure projects.

The growth of the induction furnace segment can be boosted by growing product demand from the automotive and infrastructure sectors, coupled with the technological innovations in energy efficiency and automation, with supportive government initiatives in developing economies.

Application Insight

How Much Share Did the Construction & Infrastructure Segment Held in 2025?

The construction & infrastructure segment dominated the market with nearly 50% share in 2025. The dominance of the segment can be attributed to the ongoing government investments in public works and the growing need for sustainable and high-strength steel materials globally.

The automotive & energy sectors segment is expected to grow at the fastest CAGR of nearly 8–10% during the projected period. The growth of the segment can be credited to the surge in manufacturing of electric and fuel-efficient vehicles, which requires heavy investments in renewable energy infrastructure.

The growth of the shipbuilding segment can be driven by rapid innovations in material technology, a surge in global trade, and growing demand for fuel-efficient vessels. Ships operate in harsh environments, which makes corrosion resistance a critical factor.

The appliances & consumer goods are the critical segment in the market. The growing demand for "smart" home appliances with advanced features is fuelling the need for specialized and precision-processed steel types, leading to further segment growth.

End-User Industry Insight

Which End-User Segment Dominated the Global Iron and Steel Market in 2025?

The commercial & infrastructure construction segment held a nearly 45% market share in 2025. The dominance of the segment can be linked to the growing demand to modernize aging infrastructure and rising government investments in public projects.

The OEM manufacturing segment is expected to grow at the fastest CAGR of approximately 9% during the study period. The growth of the segment can be driven by increasing demand for specialty and high-strength steels. Advancements in steel production are making steel a more competitive material.

The growth of the residential construction segment can be propelled by increasing demand for sustainable and durable building materials and technological innovations that enable innovative designs. Steel is a non-combustible material that improves the safety of residential buildings.

The industrials & manufacturing segment held a significant market share in 2025. The dominance of the segment can be boosted by growing emphasis on minimizing carbon emissions and adopting environmentally friendly practices. The growth of the global automotive industry is expected to lead to positive market growth shortly.

Regional Insights

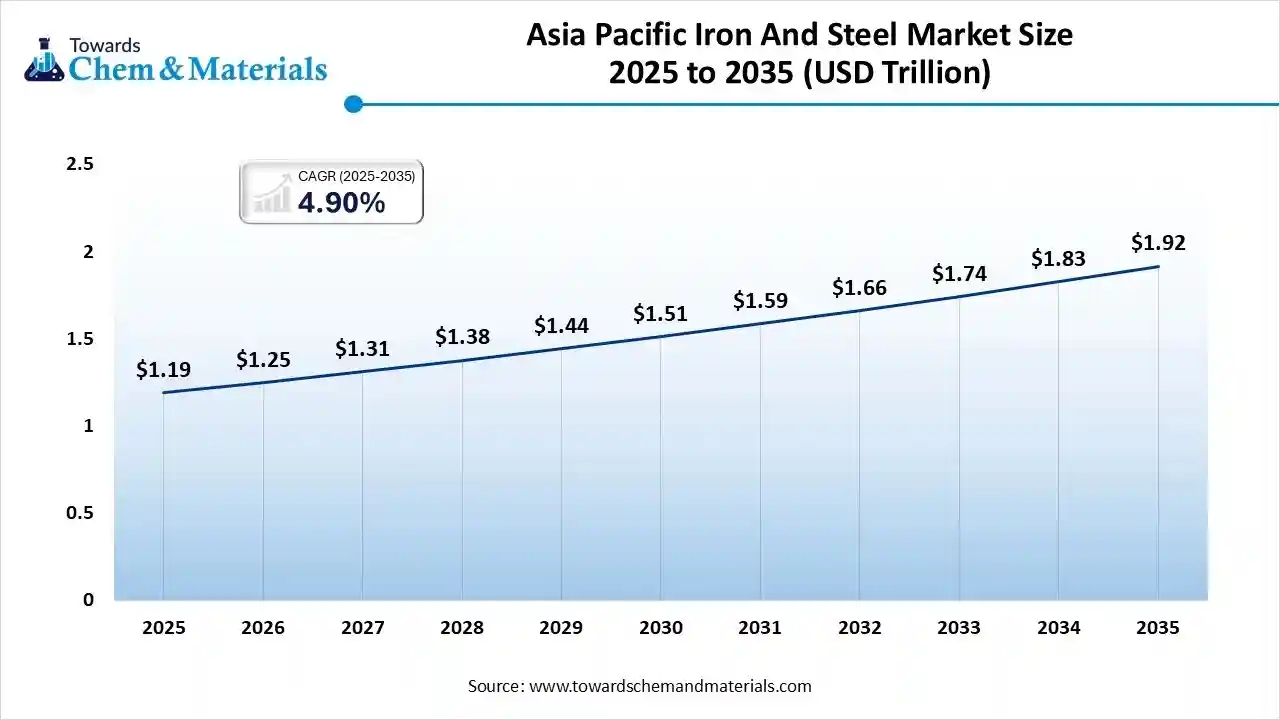

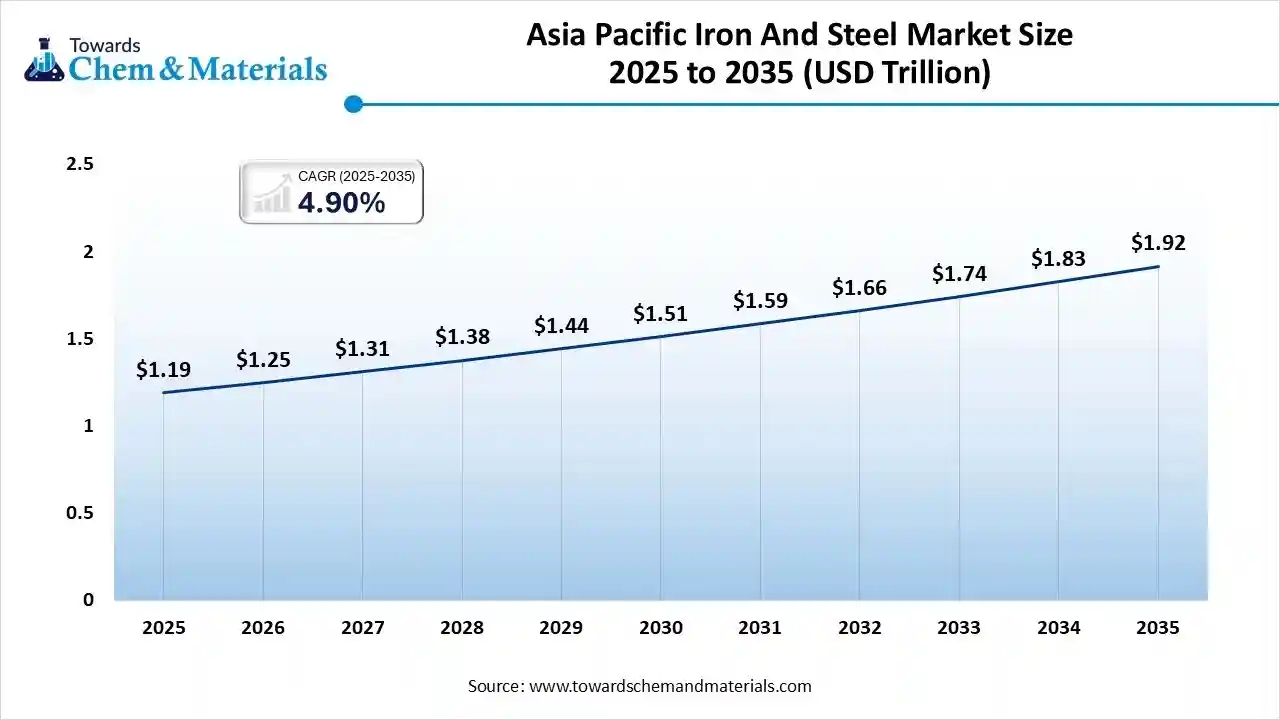

The Asia Pacific iron and steel market size was valued at USD 1.19 trillion in 2025 and is expected to reach USD 1.92 trillion by 2035, growing at a CAGR of 4.90% from 2025 to 2035. The Asia-Pacific dominated the market with nearly 65–70% share in 2025. The dominance of the region can be attributed to its expanding infrastructure development in countries like China and India, along with the rapid urbanisation. Also, there is an increasing need for high-strength stainless steel for applications in automotive, construction, and packaging.

Government initiatives like “Make in India” and National Steel Policy 2017, which aim to increase domestic steel production and promote technological innovation, are also supporting expansion. Rising foreign investments, growing construction activity, and advancements in steel processing technologies are collectively strengthening India’s position as a key driver in the Asia Pacific iron and steel market.

India Iron and Steel Market Trends

In the Asia Pacific region, India emerged as a leading market for iron and steel, driven by robust investment in large-scale infrastructure projects, including highways, railways, metro systems, and smart city developments. The country’s rapid urbanization, industrialization, and focus on modernizing transportation networks are fueling consistent demand for structural steel, rolled products, and specialty steel grades. Additionally, sectors such as aerospace, defense, and renewable energy are increasingly relying on high-performance steel for aircraft components, defense equipment, and wind turbine manufacturing, further boosting market growth.

Middle East and Africa Iron and Steel Market Trends:

The Middle East & Africa region is expected to grow at the fastest CAGR of approximately 8–10% over the forecast period. The growth of the region can be credited to the growing demand for specialized products like high-strength steel because of the rapidly expanding construction and automotive sectors. Also, the ongoing adoption of pre-engineered buildings (PEBs) is growing due to their structural integrity.

Additionally, the country’s growing automotive sector, particularly the production of electric vehicles, is boosting the need for high-strength steel for vehicle chassis, frames, and body components. Investments in industrial zones, ports, and logistics hubs are further supporting the steel sector, while government policies to localize production and reduce dependence on imports are enhancing domestic manufacturing capacity. Rising adoption of advanced steel production technologies, coupled with an emphasis on sustainable and energy-efficient practices, is expected to drive continued market growth in the coming years.

Saudi Arabia Iron and Steel Market Trends

In the Middle East & Africa, Saudi Arabia dominated the market due to large construction and infrastructure projects, especially those under the Vision 2030. The production of vehicles such as electric vehicles fuels the demand for steel for components such as chassis, frames, and bodies, driving market growth further. The country’s growing automotive sector, particularly the rise in electric vehicle production, is increasing the need for high-strength steel for chassis, frames, and vehicle bodies. Additionally, government policies supporting local steel manufacturing, investment in modern production facilities, and initiatives to reduce imports are boosting domestic production capacity.

How is North America Booming in Iron and Steel Market?

North America is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by increasing emphasis on sustainability, which leads to the modernization of facilities and raises the adoption of electric arc furnaces (EAFs) in the major cities of the region. Additionally, government policies promoting domestic manufacturing and reducing dependency on imports are driving the production and consumption of high-quality steel products across construction, energy, and machinery industries.

U.S. Iron and Steel Market Trends

The growth of the market in the U.S. can be fuelled by significant federal infrastructure spending and increasing emphasis on sustainable manufacturing methods. Government trade polices also impacted the import-export balance to meet domestic demands. Large-scale infrastructure projects under federal and state initiatives, such as highway modernization, smart city development, and renewable energy installations, are increasing steel consumption. The growing focus on high-strength, lightweight, and specialty steel for automotive and aerospace applications is encouraging domestic production and technological innovation in steel processing.

Europe Iron and Steel Market Analysis:

The growth of the market in the European region can be propelled by its strong push towards "green steel" production to fulfil the EU's climate goals, along with the rapid technological shifts towards sustainable practices. Furthermore, Steelmakers in the region are shifting towards cleaner manufacturing methods to fulfil climate objectives.

Countries in the region are adopting circular economy practices, including steel recycling and energy-efficient production processes. Increasing demand for high-performance steel in automotive, aerospace, and renewable energy sectors, coupled with investments in modern production facilities, is further driving market growth.

Germany Global Iron and Steel Market Trends

In Europe, Germany led the market due to government support for sustainable production methods and rapid investments in new technologies such as hydrogen-based steelmaking. Germany's advanced production sector, such as machinery and automotive, is a major consumer of steel.

Recent Developments

- In September 2025, Egypt introduced a 10-year strategy to revolutionize its iron and steel industry into a regional hub. The strategy emphasizes using Egypt's geographic location, resources, and industrial base for manufacturing.

Major Companies in the Market

- HBIS Group

- Jiangsu Shagang Group

- POSCO HOLDINGS INC.

- Tata Steel Limited

- JFE Steel Corporation

- Shougang Group

- China BaoWu Steel Group Corporation Limited

Segments Covered in the Report

By Product Type

- Iron

- Pig Iron

- Direct Reduced Iron (DRI)

- Sponge Iron

- Steel

- Crude Steel

- Finished Steel (Flat + Long Products)

- Ferroalloys

- Ferrochrome

- Ferromanganese

- Ferrosilicon

By Steel Type

- Carbon Steel

- Alloy Steel

- Stainless Steel

- Tool Steel

- Advanced High-Strength Steel (AHSS)

By Production Method

- Basic Oxygen Furnace (BOF)

- Electric Arc Furnace (EAF)

- Open Hearth (residual/legacy)

- Induction Furnace

By Application

- Construction & Infrastructure

- Automotive & Transportation

- Machinery & Heavy Equipment

- Energy (wind, oil & gas, power)

- Shipbuilding

- Appliances & Consumer Goods

- Packaging (steel cans, drums)

By End-User Industry

- Commercial Construction

- Residential Construction

- Industrials & Manufacturing

- OEMs (Automotive, Machinery)

- Utilities & Energy

- Defense & Marine

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa