Content

Green Steel Market Size, Share & Industry Analysis

The global green steel-market size was valued at USD 718.55 billion in 2024, grew to USD 763.10 billion in 2025, and is expected to hit around USD 1,311.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.20% over the forecast period from 2025 to 2034. Growing investor pressure for sustainable practices is the key factor driving market growth. Also, a surge in concern over climate change, coupled with the advancements in technologies, can fuel market growth further.

Key Takeaways

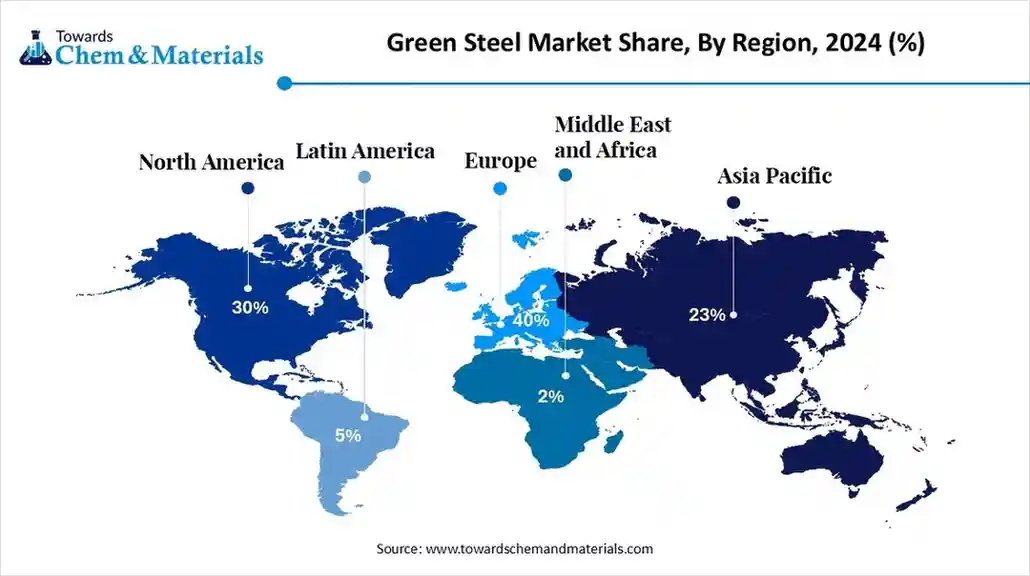

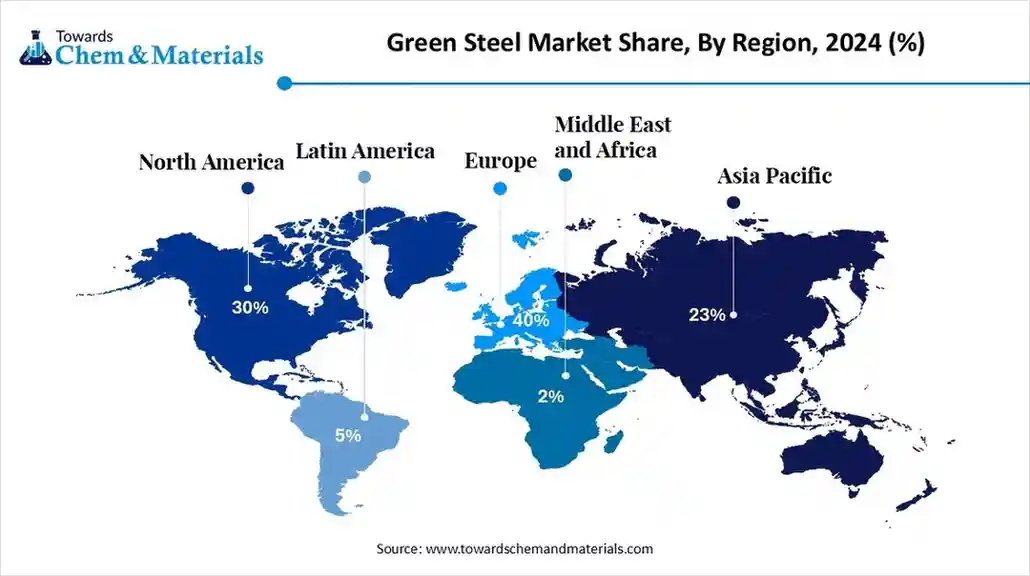

- By region, Europe dominated the market with a 40% share in 2024.

- By region, Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

- By production technology, the electric arc furnace segment dominated the market with a 45% share in 2024.

- By production technology, the hydrogen-based direct reduction segment is expected to grow at the fastest CAGR over the forecast period.

- By product type, the flat steel segment held a 60% market share in 2024.

- By product type, the finished steel segment is expected to grow at the fastest CAGR over the forecast period.

- By end-use industry, the building & construction segment dominated the market with a 35% share in 2024.

- By end-use industry, the automotive & transportation segment is expected to grow at the fastest CAGR during the projected period.

What is Green Steel?

The market refers to the industry that produces steel using eco-friendly practices that substantially minimize or eliminate carbon emissions and other environmental impacts.

This transformation involves replacing high-emissions and conventional processes with cleaner technologies such as electric furnaces powered by hydrogen-based reduction and renewable energy. The market is growing due to stringent environmental regulations and a rise in demand from the end-user industry, along with the growing demand for low-carbon materials.

What Are the Key Trends Influencing the Green Steel Market?

- Governments across the globe are increasingly implementing incentives and policies like tax breaks, carbon pricing, and subsidies to boost the adoption of low-carbon steelmaking technologies. Also, top steel manufacturers are setting ambitious sustainability goals, leading to further market growth.

- The smart manufacturing and digitalization techniques, such as the use of Artificial Intelligence (AI) and IoT, can boost green steel manufacturing processes, which is the latest trend in the market. These technological developments, along with the supportive governmental regulations, are impacting positive market growth.

- Major market players are rapidly forming strategic alliances and investing in strategic collaborations to develop green steel production. The ongoing establishment of new green-steel hubs in sectors with low-cost energy and feedstock is also a major factor in expanding market growth.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 763.10 Billion |

| Expected Size by 2034 | USD 1,311.30 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.20% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Production Technology, By Product Type, By End-Use Industry, By Region |

| Key Companies Profiled | SSAB, Baowu Steel Group, Nucor Corporation, Thyssenkrupp AG, Outokumpu, Nippon Steel Corporation, ArcelorMittal, voestalpine AG, Emirates Steel Arkan, Salzgitter AG, Tata Steel, POSCO, HBIS Group, JSW Steel Limited, Baotou Steel, Techint Group, Jindal Steel & Power, Cleveland-Cliffs Inc., Liberty Steel Group, United States Steel Corporation |

Market Opportunity

Growing Demand for Sustainable Practices

The surge in demand for sustainable practices across the globe is a major factor creating lucrative opportunities in the market. Many organisations are committing to the carbon-free targets by investing heavily in low-carbon solutions. Furthermore, advancements like the use of hydrogen in steel production, developed by major players, showcase their commitment to minimizing carbon emissions.

Market Challenge

Supply Chain Disruptions

Ensuring a convenient supply chain for raw materials such as scrap steel, high-grade iron ore, and renewable energy remains a complex challenge in the market, hindering market growth. Moreover, the manufacturing process necessitates a strong infrastructure for renewable energy generation, storage, and transportation, which is underdeveloped in many regions.

Regional Insight

Europe Green Steel Market Size, Industry Report 2034

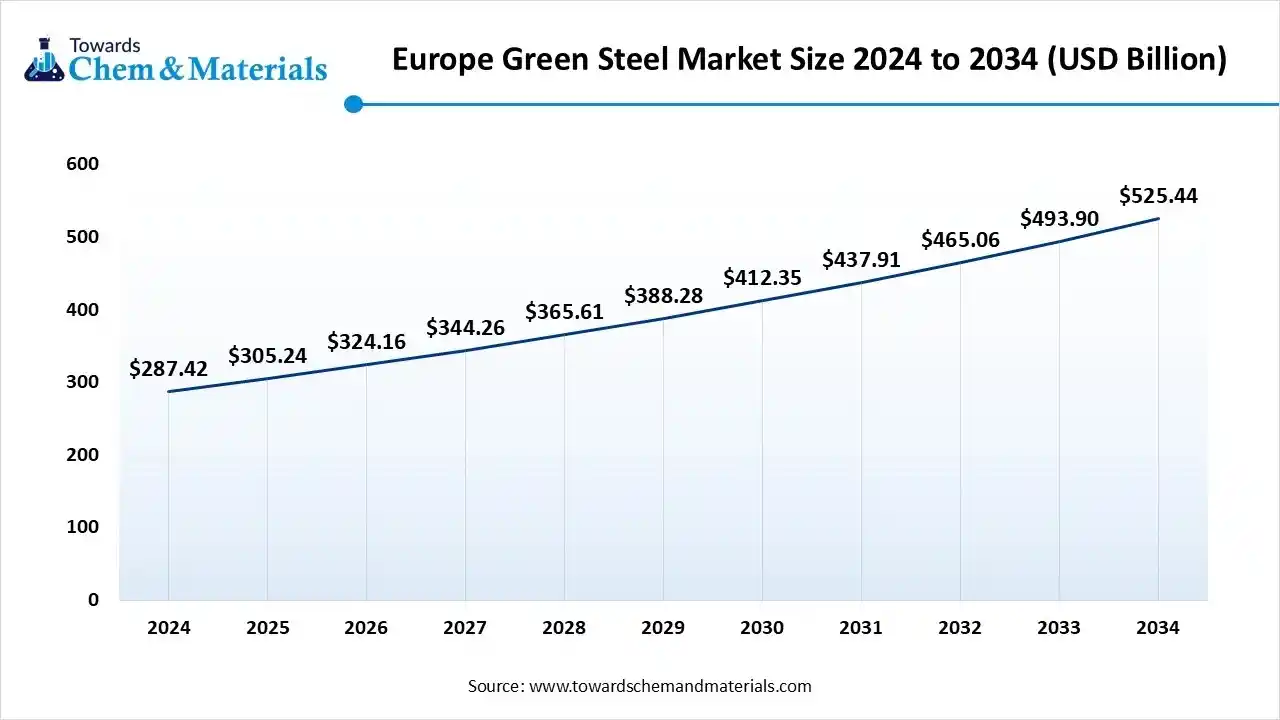

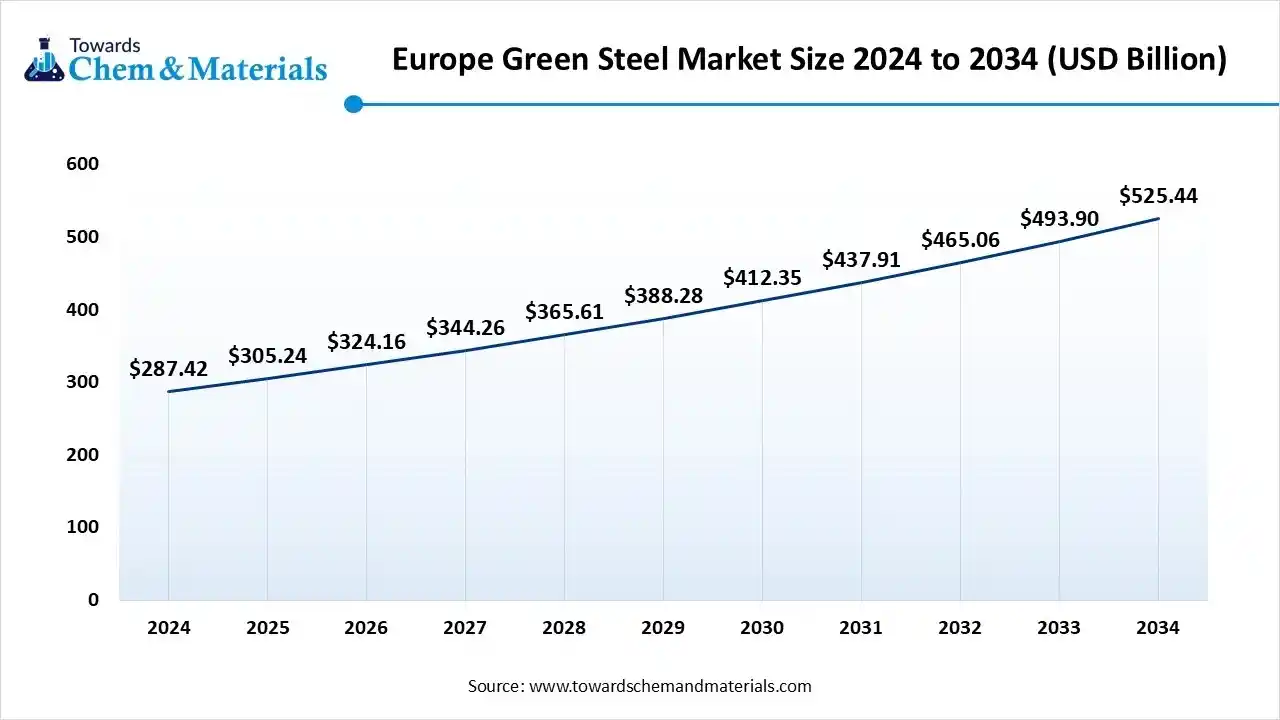

The Europe green steel market size was estimated at USD 287.42 billion in 2024 and is projected to reach USD 525.44 billion by 2034, growing at a CAGR of 6.22% from 2025 to 2034. Europe dominated the market with a 40% share in 2024.

The dominance of the region can be attributed to the growing consumer demand for sustainable products along with the stringent EU environmental regulations, such as the Green Deal. In addition, the EU's focus on the circular economy promotes the adoption and development of eco-friendly materials such as green steel in the region.

Asia Pacific Green Steel Market Trends

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the rapid urbanisation, industrialization, and an increasing push towards a circular economy. Furthermore, governments in the region, such as China, India, and Japan, are increasingly implementing nationwide hydrogen policies toward low-emission steel manufacturing.

Segmental Insight

Production Technology Insight

Which Production Technology Segment Dominated the Green Steel Market in 2024?

The electric arc furnace segment dominated the market with a 45% share in 2024. The dominance of the segment can be attributed to the growing need for sustainable steel and technological innovations in EAFs and the renewable energy sector. Additionally, EAFs heavily depend on recycled steel scrap, which aligns with the circular economy principles, minimizing the demand for new iron ore.

The hydrogen-based direct reduction segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid innovations in green hydrogen production and electrolysis, coupled with the rising preference for sustainable products that encourage market players to invest in sustainable production practices such as H2-DR.

Product Type Insight

How Much Share Did the Flat Steel Segment Held in 2024?

The flat steel segment held a 60% market share in 2024. The dominance of the segment can be linked to the growing product demand from the automotive and construction sectors, fuelled by sustainability mandates. In addition, flat steel products, like cold-rolled and hot-rolled coils, are valued for their durability, strength, and formability, which makes them suitable for an extensive range of applications.

The finished steel segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rising government support through funding and incentives, along with the growth of the renewable energy sector. Also, innovations in carbon capture and storage provide an innovative pathway to green steel, driving segment growth soon.

End-Use Industry Insight

Why Building & Construction Segment Dominated the Green Steel Market in 2024?

The building & construction segment dominated the market with a 35% share in 2024. The dominance of the segment is owed to the growing demand for green buildings and rising environmental awareness globally. Green steel is rapidly being integrated into bridges, frameworks, and other structural components for new construction infrastructure, which helps regions and cities to lower their carbon footprints.

The automotive & transportation segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the increasing need for low-carbon materials to minimize the supply chain's carbon footprint. Furthermore, the expanding electric vehicle (EV) market is a major driver, with manufacturers actively pursuing carbon-free materials, leading to the segment's growth.

Green Steel Market Value Chain Analysis

- Feedstock Procurement : It involves sourcing raw materials and decreasing agents for low-carbon steel production.

- Chemical Synthesis and Processing : It is the technology used in the market that involves cutting-edge chemical processes and reactions to reduce carbon dioxide emissions.

- Packaging and Labelling: It refers to the use of eco-friendly packaging materials and high-grade labels to communicate a steel product's environmental performance.

- Regulatory Compliance and Safety Monitoring: It involves the stringent adherence to occupational safety standards and environmental regulations, particularly as the market shifts towards low-carbon manufacturing methods.

Recent Development

- In May 2025, India's JSW Steel introduced its latest low-emission steel brand called GreenEdge, which can help consumers decrease Scope 3 emissions. The company also says that GreenEdge allows it to minimize its carbon emissions without compromising productivity.(Source: gmk.center)

Green Steel Market Top Companies

- SSAB

- Baowu Steel Group

- Nucor Corporation

- Thyssenkrupp AG

- Outokumpu

- Nippon Steel Corporation

- ArcelorMittal

- voestalpine AG

- Emirates Steel Arkan

- Salzgitter AG

- Tata Steel

- POSCO

- HBIS Group

- JSW Steel Limited

- Baotou Steel

- Techint Group

- Jindal Steel & Power

- Cleveland-Cliffs Inc.

- Liberty Steel Group

- United States Steel Corporation

Segments Covered

By Production Technology

- Electric Arc Furnace (EAF)

- Scrap-based EAF

- Direct Reduced Iron (DRI)-based EAF

- Hydrogen-based Direct Reduction (H2-DR)

- Hydrogen-based Sponge Iron

- Hydrogen-based Hot Briquetted Iron (HBI)

- Molten Oxide Electrolysis (MOE)

- Pilot-scale MOE

- Commercial-scale MOE

- Biomass-based Reduction

- Charcoal-based Reduction

- Wood Pellet-based Reduction

By Product Type

- Flat Steel

- Hot Rolled Coil

- Cold Rolled Coil

- Coated Steel (Galvanized, Galvalume)

- Long Steel

- Rebars

- Wire Rods

- Sections (Angles, Channels, Beams)

- Semi-Finished Products

- Billets

- Bloom

- Slab

- Finished Steel

- Steel Plates

- Steel Sheets

- Steel Tubes & Pipes

By End-Use Industry

- Building & Construction

- Structural Steel

- Reinforcement Bars (Rebars)

- Steel Plates

- Automotive & Transportation

- Body Panels

- Chassis Components

- Engine Parts

- Machinery & Industrial Equipment

- Heavy Machinery Components

- Industrial Tools

- Energy & Power Generation

- Wind Turbine Components

- Solar Panel Frames

- Consumer Goods & Packaging

- Household Appliances

- Steel Cans & Drums

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait