Content

Asia Pacific Green Hydrogen Market Size | Top Companies Analysis

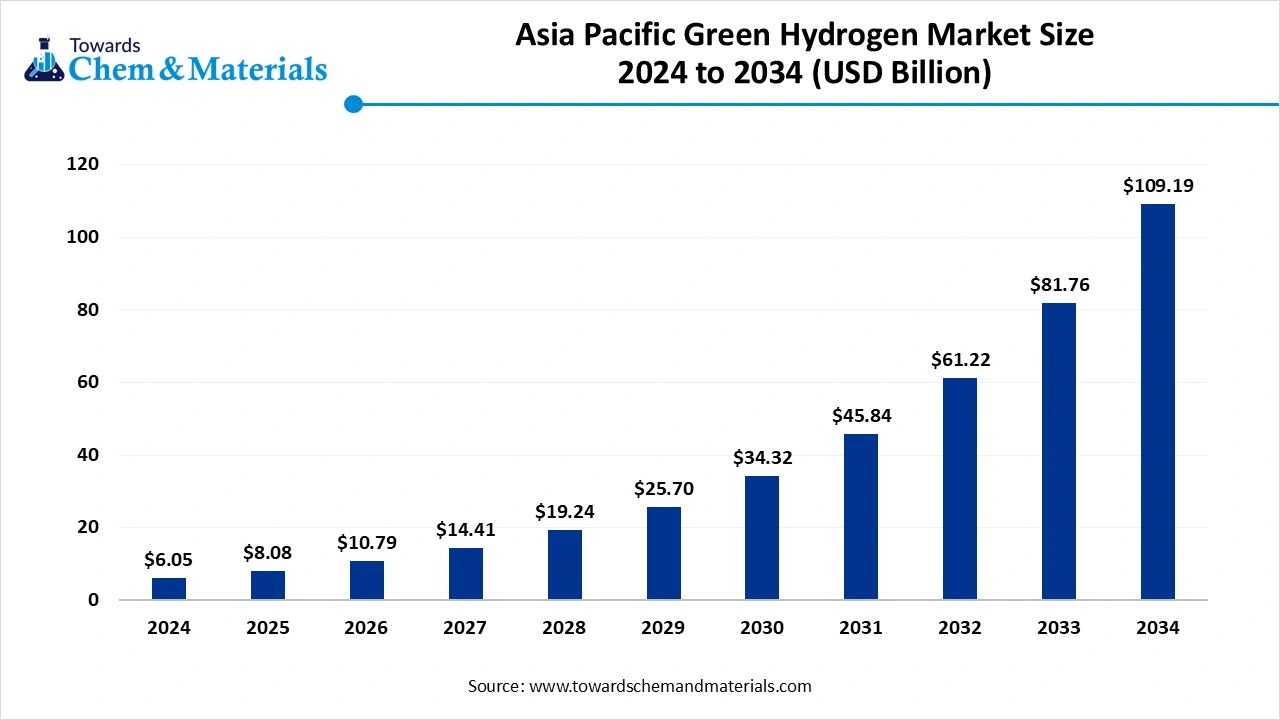

The Asia Pacific green hydrogen market size was reached at USD 6.05 Billion in 2024 and is expected to be worth around USD 109.19 billion by 2034, growing at a compound annual growth rate (CAGR) of 33.55% over the forecast period 2025 to 2034. The strong focus on decarbonization efforts and increasing demand for energy security drives the market growth.

Key Takeaways

- By supply, the alkaline electrolyzers segment held approximately a 40% share in the market in 2024.

- By supply, the solid oxide electrolyzers segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end-use, the ammonia & fertilizer segment held approximately a 30% share in the market in 2024.

- By end-use, the export & shipping fuels segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By business model, the domestic industrial offtake segment held approximately a 55% share in the market in 2024.

- By business model, the export (green ammonia/liquid H₂) segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By project scale, the industrial co-located plants segment held approximately a 42% share in the market in 2024.

- By project scale, the distributed or on-site small scale segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Green Hydrogen?

Asia Pacific green hydrogen market growth is driven by the supportive government policies, expansion of renewable energy, growing transportation sector, strong focus on energy security, growing industrial activities, and strong focus on lowering carbon emissions.

Green hydrogen is a fuel produced using renewable energy sources by splitting water into oxygen & hydrogen. This process is carbon-neutral and supports decarbonization goals. Green hydrogen lowers GHG emissions, supports achieving a low-carbon future, and reduces energy dependence. Green hydrogen is widely used in applications like energy storage, transportation, production of methanol & ammonia, electricity generation, and green steel manufacturing.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 8.08 Billion |

| Expected Size by 2034 | USD 109.19 Billion |

| Growth Rate from 2025 to 2034 | CAGR 33.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Supply / Production Technology, By End-Use / Application, By Business Model / Commercial Route, By Project Scale |

| Key Companies Profiled | TotalEnergies , Aboitiz, Siemens Energy , Nel Hydrogen, Plug Power , JERA , Kawasaki , POSCO, Hyundai , KOGAS, Reliance (India) , Woodside Energy, Santos (Australia), Sunfire, ITM Power, H-TEC |

Asia Pacific Green Hydrogen Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expected to see accelerated growth in niches such as transportation, energy security, and decarbonization commitments. Growth is being reinforced by falling renewable energy prices, growing steel production, & increasing demand for energy, particularly in China & India.

- Sustainability Trends: Sustainability is transforming the Asia Pacific green hydrogen industry, with ambitious decarbonization goals, integration with renewable energy, and development of large-scale projects. For instance, Adani Industries' green hydrogen plant completely depends on its own renewable energy sources for the electrolysis process.

- Major Investors: Institutional investors, private equity firms, and strategic corporate investors are actively investing in the space, due to a strong focus on enhancing energy security & lowering fossil fuel reliance. Companies like Tata Power, Mitsui, ITOCHU, Adani Group, and Toshiba are investing in the green hydrogen ecosystem.

Key Technological Shifts in the Asia Pacific Green Hydrogen Market:

The Asia Pacific green hydrogen market is massively undergoing key technological shifts driven by the lowering operational cost and boosting green hydrogen yield. One of the most significant transformations is the integration with artificial intelligence (AI). It helps in integrating renewable energy by smart scheduling and predicting availability. Artificial Intelligence optimizes electrolyzer performance, detects early failures of equipment, effectively manages supply chains, and reduces downtime.

- For instance, Envision Energy, a China-based company, uses an AI-powered system for an off-grid renewable energy system & battery storage for optimizing production of ammonia & green hydrogen.

Investments in the Asia Pacific Green Hydrogen Market

| Country | Investment |

| India |

|

| South Korea |

|

Asia Pacific Green Hydrogen Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement includes renewable electricity like hydro, solar, & wind, and water.

- Chemical Synthesis & Processing : The chemical synthesis & processing includes the electrolysis process, like solid oxide electrolysis, alkaline electrolysis, & PEM electrolysis.

- Quality Testing & Certifications : The quality testing involves testing of properties like emission & decarbonization testing, purity analysis, and material & infrastructure testing, and certifications like APEC, BEE, & GHCI.

Best Operational Green Hydrogen Plant in Asia Pacific

| Plant | Hydrogen Capacity (Tonnes/Year) | Location |

| Taksago Hydrogen Park | 780 tonnes/year | Hyogo Prefecture, Japan |

| Fukushima Hydrogen Energy Research Field | Approximately 900 tonnes /year | Japan |

| Sinopec Kuqa Green Hydrogen Pilot Project | 20000 tonnes/year | Xinjiang, China |

Market Opportunity

Growing Industrialization Surges Green Hydrogen Demand

The rapid urbanization and growing industrial activities increase demand for green hydrogen. The growing industries like oil refining, steel production, & chemical production increase the adoption of green hydrogen. The increasing manufacturing of fertilizers and the production of iron require green hydrogen.

The strong government support for industrial activities and focus on energy security increases demand for green hydrogen. The strong focus on industrial decarbonization and high production of ammonia requires green hydrogen. The increasing manufacturing activities and development of new industrial processes require green hydrogen. The growing industrialization creates an opportunity for the growth of the Asia Pacific green hydrogen market.

Market Challenge

High Production Cost Limits Market Expansion

Despite several benefits of green hydrogen in the Asia Pacific region, the high production cost restricts the market growth. Factors like electrolyzer installation cost, infrastructure development, need for specialized equipment, high consumption of energy, and renewable electricity cost are responsible for the high production cost.

The development of power electrolyzers and the purchase of electrolyzers increase the cost. The high consumption of energy and the development of infrastructure facilities increase the cost. The energy-intensive manufacturing processes and the need for specialized equipment require a high cost. The high production cost hampers the growth of the Asia Pacific green hydrogen market.

Segmental Insights

Supply Insights

Why Alkaline Electrolyzers Segment Dominates the Asia Pacific Green Hydrogen Market?

The alkaline electrolyzers segment dominated the Asia Pacific green hydrogen market in 2024 with approximately 40% share. The cost-effective raw materials and well-established operational efficiency increase demand for alkaline electrolyzers. The high degree of reliability and strong government support help the market growth. The growing transportation sector and increasing industrial activities require alkaline electrolyzers, driving the overall market growth.

The solid oxide electrolyzers segment is the fastest-growing in the market during the forecast period. The strong focus on high efficiency and integration with industrial processes increases the adoption of solid oxide electrolyzers. The large-scale production of hydrogen and nuclear power integration increases the adoption of solid oxide electrolyzers. The technological advancements in cell fabrication support the overall market growth.

End-Use Insights

Which End-Use Segment Held the Largest Share in the Asia Pacific Green Hydrogen Market?

The ammonia & fertilizer segment held the largest revenue share of approximately 30% in the market in 2024. The growing expansion of the agriculture sector and focus on food security increase demand for fertilizer & ammonia. The increasing production of food and focus on enhancing crop yields require ammonia & fertilizer. The growing awareness about sustainable agriculture practices and increased utilization of nitrogenous fertilizers drives the overall growth of the market.

The export & shipping fuels segment is experiencing the fastest growth in the market during the forecast period. The growing export of liquid hydrogen and ammonia helps market growth. The strong focus on eliminating harmful pollutants and reducing air pollution requires green hydrogen shipping fuels. The strong focus on energy security and the development of large-scale projects supports the overall market growth.

Business Model Insights

Why Domestic Industrial Offtake Segment Dominating the Asia Pacific Green Hydrogen Market?

The domestic industrial offtake segment dominated the Asia Pacific green hydrogen market in 2024 with approximately 55% share. The growing production of petroleum refining products and high manufacturing of ammonia increases demand for green hydrogen. The increasing manufacturing activities and high synthesis of chemicals require green hydrogen. The growing demand for fertilizer production, methanol, petroleum refineries, and steel requires green hydrogen, driving the overall growth of the market.

The export (green ammonia/liquid H2) segment is the fastest-growing in the market during the forecast period. The strong focus on decarbonization and growing heavy transportation increases the export of liquid H2. The expansion of renewable energy sources and the focus on the storage of energy increase demand for liquid H2. The growing production of fertilizer and a strong focus on food security increase demand for green ammonia, supporting the overall market growth.

Project Scale Insights

How Industrial Co-Located Plants Segment Held the Largest Share in the Asia Pacific Green Hydrogen Market?

The industrial co-located plants segment held the largest revenue share of approximately 42% in the market in 2024. The growing development of green hydrogen pipeline networks and growth in the transportation sector increase demand for industrial co-located plants. The rapid growth in chemical manufacturing & oil refineries and focus on lowering import dependence support the overall market growth.

The distributed or on-site small scale segment is experiencing the fastest growth in the market during the forecast period. The strong focus on zero-carbon solutions and rising demand for energy security increases demand for on-site small scale green hydrogen. The growing focus on energy independence and strong government support for green hydrogen production supports in development of on-site small scale plants. The rise in fuel cell electric vehicles and steel manufacturing supports the overall market growth.

Country Insights

Decarbonization Goals Drive Green Hydrogen Expansion in China

China dominated the Asia Pacific green hydrogen market in 2024. The growing production of wind & solar energy and focus on industrial decarbonization increase demand for green hydrogen. The expansion of electrolyzer capacity and the abundant presence of feedstocks increase the production of green hydrogen. The expansion of renewable energy and increasing investment in green hydrogen projects drive the overall growth of the market.

Green Hydrogen Powering Clean Energy in India

India is growing in the market. The government initiatives, like the National Green Hydrogen Mission, and growing industries like steel, fertilizers, & petroleum, increase the production of green hydrogen. The presence of abundant renewable energy sources and the rise in hydrogen fuel cell vehicles increase demand for green hydrogen. The strong focus on lowering dependence on fossil fuels and growing export activities supports the overall market growth.

- In September 2025, India launched its first port-based green hydrogen project in Thoothukudi, Tamil Nadu. The project is expected to produce green hydrogen of 10 cubic meters and focuses on supporting EV charging stations & power port streetlights.(Source: www.gasworld.com)

Recent Developments

- In August 2025, the Government of Uttar Pradesh launched a green hydrogen plant in Gorakhpur. The plant is manufactured by Torrent Gas & Torrent Power, and the production capacity of green hydrogen is 72 tonnes per year. The aim of the project is to improve public health, lowering carbon dioxide, and protect biodiversity.(Source: www.gasworld.com)

- In July 2025, Envision Energy launched the world’s largest green hydrogen plant. The plant is integrated with AI to manage operations and works on renewable energy sources. The facility supports industrial decarbonization and clean energy.(Source: carboncredits.com)

- In August 2024, Horizon with Rockcheck Steel launched a green hydrogen project in China. The project is using 5-megawatt hydrogen units & 13-megawatt solar setup for the production of green hydrogen.(Source: bioenergytimes.com)

Top Companies List

- Fortescue: The green technology company present in Australia focuses on decarbonization and produces green hydrogen.

- ACEN: The renewable energy company that operates, develops, & builds geothermal, solar, & wind energy.

- Toshiba: The Japan-based company generates renewable energy-based power and supports green hydrogen production projects.

- Adani Green Energy: The leading renewable energy company based in India supports the clean energy transition and develops integrated green hydrogen.

- KEPCO: The South Korea-based based produces a mix of power sources and supports large-scale green hydrogen hubs in Australia.

Other Companies List

- TotalEnergies

- Aboitiz

- Siemens Energy

- Nel Hydrogen

- Plug Power

- JERA

- Kawasaki

- POSCO

- Hyundai

- KOGAS

- Reliance (India)

- Woodside Energy

- Santos (Australia)

- Sunfire

- ITM Power

- H-TEC

Segments Covered

By Supply / Production Technology

- Alkaline Electrolyzers

- PEM Electrolyzers

- AEM Electrolyzers

- Solid Oxide Electrolyzers

- Emerging Electrolyzers

By End-Use / Application

- Ammonia & Fertilizer

- Refining & Chemical Feedstock

- Steel & Heavy Industry

- Export & Shipping fuels (ammonia / LOHC)

- Power generation & seasonal storage

- Mobility (fuel cells/trucks/buses)

By Business Model / Commercial Route

- Domestic industrial offtake

- Export (green ammonia / liquid H₂)

- Power-sector seasonal storage & grid services

- Transport/mobility pilots & refuelling

By Project Scale

- Large export-scale hubs (>100 MW electrolyzer)

- Industrial co-located plants (10–100 MW)

- Distributed / on-site small scale (<10 MW)