Content

What is the Current Carbon Steel Market Size and Share?

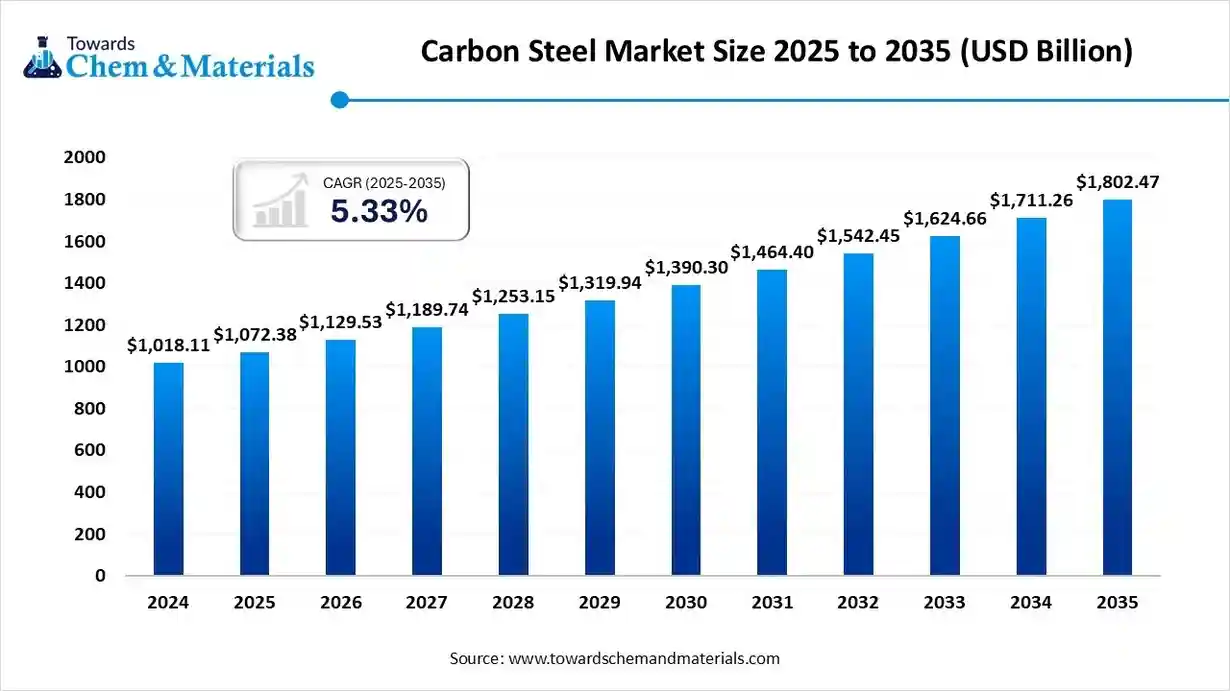

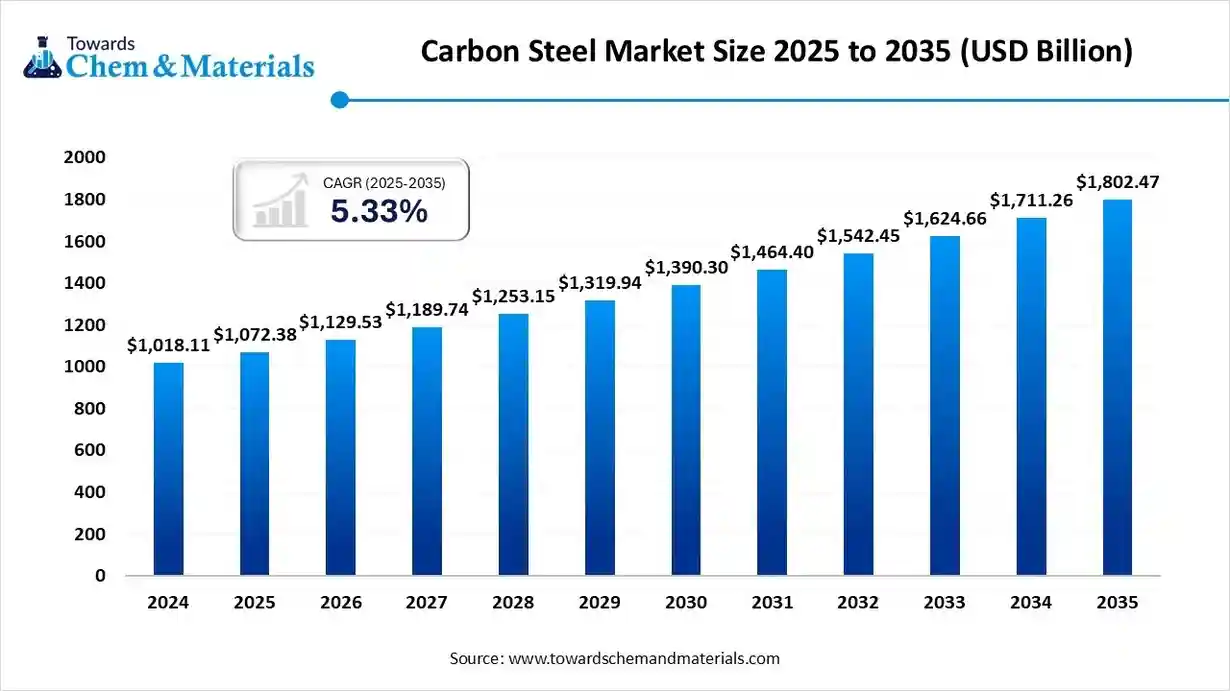

The global carbon steel market size is calculated at USD 1,072.38 billion in 2025 and is predicted to increase from USD 1,129.53 billion in 2026 and is projected to reach around USD 1,802.47 billion by 2035, The market is expanding at a CAGR of 5.33% between 2026 and 2035. Asia Pacific dominated the carbon steel market with a market share of 67.11% the global market in 2025.The growing expansion of the energy sector, increased construction activities, and growing demand across the automotive industry drive the market growth.

Key Takeaways

- The Asia Pacific carbon steel market held the largest share of 67.11% of the global market in 2025.

- By type, low carbon steel segment held the largest market revenue share of 57.19% in 2025.

- By Product Form, the flat products segment held the revenue share of 41.19% in 2025.

- By Process, the basic oxygen furnace segment held the revenue share of 66.11% in 2025.

- By End-Use, the flat construction & infrastructure segment held the revenue share of 37.43% in 2025.

- By Distribution Channel, the direct sales segment held the revenue share of 62.11% in 2025.

- By Grade, the AISI 1005-1020 series segment held the revenue share of 61.44% in 2025.

Carbon Steel: The Pillar of Modern Industry and Machinery

Carbon steel is a type of steel formed using carbon, iron, and other elements like silicon, phosphorus, manganese, & sulfur. In carbon steel, iron is the primary component, the content of a carbon content from 0.05% to 2.1%, and other elements present in small amounts. Carbon steel consists of excellent strength, greater hardness, weldability, and greater ductility. The various types of carbon steel include low-carbon steel, medium-carbon steel, and high-carbon steel. The rapid development of various infrastructure projects like transportation networks, buildings, bridges, and highways increases demand for carbon steel.

The growing production of a wide range of automotive components like engine parts, chassis, car bodies, and others increases demand for carbon steel. The growing applications in various industries like construction, manufacturing, consumer goods, energy, automotive, tools & machinery, shipbuilding, and defense & aerospace contribute to the overall market growth.

- India exported 407,136 shipments of carbon steel.(Source: www.volza.com)

- India exported 71,515 shipments of carbon steel pipe.(Source: www.volza.com)

- Vietnam exported 39,526 shipments of carbon steel plate (Source:www.volza.com)

- India exported 65,171 shipments of carbon steel tube. (Source: www.volza.com)

The Growing Energy Sector Propels Carbon Steel Market Growth

The growing expansion of the energy sector increases demand for carbon steel for extraction processes and energy infrastructure. The growing energy sector, including renewable energy and oil & gas, increases demand for carbon steel for various applications. The growth in the oil & gas industry increases demand for carbon steel industry increases demand for carbon steel for platforms, pipelines, and drilling equipment.

The increasing offshore and onshore extraction of oil & gas increases demand for carbon steel. The expansion of solar and wind energy is driving demand for carbon steel for transmission towers, wind turbines, and solar panel structures. The focus on the development of efficient power plants increases demand for a wide range of steel components. The demand for the development of energy infrastructures like pipelines is fueling the adoption of carbon steel. The growing energy sector is a key driver for the growth of the carbon steel market.

Market Trends

- Rapid Urbanization: The rapid urbanization in various regions increases demand for residential, commercial, and infrastructure development. The growing construction activities increase demand for carbon steel for the development of reinforcement bars, beams, and columns.

- The Growing Shipbuilding: The increasing development of large-scale shipbuilding projects increases demand for carbon steel for sustains in harsh marine environments like potential impacts, strong currents, and waves. The growing demand for creating different structures and components in shipbuilding increases demand for carbon steel for the development of hulls, decks, and piping.

- The Growing Demand for Industrial Machinery: The growing demand for industrial machinery like excavators, bulldozers, cranes, and other machinery in various industries requires carbon steel. The steel offers wear resistance, strength, and durability for industrial machinery.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 1,129.53 Biilion |

| Market Size by 2035 | USD 1,802.47 Billion |

| Growth Rate from 2026 to 2035 | CAGR 5.33% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026 - 2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Product Form, By Process, By Distribution Channel, By Grade, By Region |

| Key Profiled Companies | ArcelorMittal, Nippon Steel Corporation, POSCO, Baosteel Group Corporation, HBIS Group Co., Ltd., Tata Steel, United States Steel Corporation, JFE Steel Corporation, Nucor Corporation, Thyssenkrupp AG, EVRAZ plc, JSW Steel, Steel Authority of India Limited (SAIL), Gerdau S.A., Severstal, Hyundai Steel, Liberty Steel (GFG Alliance), China Steel Corporation (CSC), Essar Steel (Now AM/NS India), Shougang Group |

Market Opportunity

The Growing Automotive Industry Unlocks Opportunity for Carbon Steel

The growing automotive industry in various regions increases demand for carbon steel for various purposes. The rise in the manufacturing of vehicles fuels demand for carbon steel for manufacturing various parts of vehicles. The increasing production of various parts of vehicles like engine components, chassis, body panels, and many more increases the demand for carbon steel.

The increasing focus on lowering emissions and improving fuel efficiency of vehicles increases demand for steel like AHSS. The growing innovations in the automotive industry increase demand for carbon steel. The rise in electric vehicles increases the adoption of carbon steel for structural components and battery casing. The growing production of electric and conventional vehicles globally increases the demand for carbon steel. The growing automotive industry creates an opportunity for the carbon steel market.

Market Challenge

High Production Cost Limits Expansion of Carbon Steel Market

Despite several benefits of carbon steel in various industries, high production cost restricts the market growth. Factors like specific processing techniques, fluctuating raw materials prices, and complex production processes are responsible for the high production cost. Fluctuations in the prices of raw materials like coal, iron ore, and other alloying materials increase the production cost.

The complex production processes, like surface treatments, melting & casting, and electric arc furnace, fuel the production cost. The transportation cost of raw materials contributes to the production cost. Geopolitical factors like political instability, tariffs, and trade wars increase the production cost. The high production cost hampers the growth of the market.

Regional Insights

The Asia Pacific carbon steel market size was valued at USD 719.67 billion in 2025 and is expected to reach USD 1,210.54 billion by 2035, growing at a CAGR of 5.35% from 2026 to 2035. Asia Pacific dominated the carbon steel market in 2024 with a share of 67.11%.

The rapid urbanization and growing construction activities in the region increase demand for carbon steel. The strong government support for the steel industry and growing focus on domestic production of steel help the market growth. The growing development of infrastructure projects like buildings, highways, and bridges fuels demand for carbon steel. The increasing production of manufactured goods, machinery, and equipment increases demand for carbon steel. The growing expansion of the automotive industry drives the overall growth of the market.

China’s Carbon Steel Market Trends

China is a major contributor to the carbon steel market. The growing manufacturing and construction industry increases demand for carbon steel. The increasing government investment in infrastructure development, like urban development, high-speed rail, and bridges, helps in the market growth. The growing shipbuilding and automotive industries increase the adoption of carbon steel. The presence of key players like Shougang Group, Baosteel, and Hebei Iron & Steel Group, and high production of steel support the overall growth of the market.

- China exported 505,146 shipments of carbon steel.(Source: www.volza.com)

- China exported 105,519 shipments of carbon steel pipe.(Source: www.volza.com)

- China exported 50,186 shipments of carbon steel plate.(Source:www.volza.com)

- China exported 26,732 shipments of carbon steel tube. (Source: www.volza.com)

Why is the Middle East & Africa the Fastest Growing in the Carbon Steel Market?

The Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The growing construction projects, like infrastructure development, buildings, and transportation networks, increase demand for carbon steel. The rapid growth in the energy sector, especially oil & gas fuel demand for carbon steel, is helping the market growth. The strong government support for the use of steel in industries like energy and construction increases the adoption of carbon steel. The growing expansion of the automotive industry drives the market growth.

What are the Trends of Carbon Steel in South Africa?

South Africa is growing in the market. The growing urban development in cities like Durban, Johannesburg, and Cape Town increases demand for carbon steel. The increasing industrial, residential, and commercial construction helps in the market growth. The growing expansion of the automotive sector and increased vehicle manufacturing fuel demand for carbon steel. The focus on green steel initiatives and rising industrial activities like the production of equipment and machinery supports the overall growth of the market.

Segmental Insights

Type Insights

Why the Low Carbon Steel Segment Held the Largest Share of the Carbon Steel Market?

The low carbon steel segment led the carbon steel market in 2025 with a share of 57.19%. The growing production of automotive parts like structural components, body panels, and chassis increases demand for low carbon steel. The increasing production of general-purpose machinery and manufacturing equipment is fueling demand for low carbon steel, helping the market growth. Low Carbon steel is shaped into various forms and is easy to weld. The growing production of consumer goods and rising demand from construction applications like pipelines & many more drives the market growth.

The medium carbon steel segment is the fastest growing in the market during the forecast period. The growing construction activities and infrastructure development increase demand for medium carbon steel for the production of foundational elements, structural components, and reinforcing bars. The rising industrial expansion in sectors like machinery production and manufacturing helps in the market growth. Medium carbon steel has good formability and provides a good balance between ductility & strength. The growing production of automotive parts like crankshafts, chassis, and axles increases demand for medium carbon steel, supporting overall growth of the market.

Product Form Insights

How Flat Products Segment Dominates the Carbon Steel Market?

The flat products segment dominated the carbon steel market in 2025 with a share of 41.19%. The growing automotive manufacturing, like structural parts, panels, and chassis, increases demand for flat products. The requirement of building roofing and frameworks in construction activities increases demand for flat products, helping the market growth. The growing demand for plates, hot-rolled coils, and cold-rolled sheets in various industries drives the overall growth of the market.

The pipes and tubes segment is experiencing the fastest growth in the market during the forecast period. The increasing expansion of the oil & gas sector increases demand for pipes and tubes for various applications like transportation, refining, and others. The strong government support for infrastructure development, like energy infrastructure, transportation networks, and water supply systems, increases demand for pipes and tubes, helping the market growth. The growing demand for chemical processing supports the overall growth of the market.

Process Insights

Why did the Basic Oxygen Furnace Segment Hold the Largest Share of the Carbon Steel Market?

The basic oxygen furnace segment led the carbon steel market in 2025 with a share of 66.11%. The growing demand for the production of a large volume of steel increases demand for basic oxygen furnace. The focus on lower production costs and higher production rates helps in the market growth. Basic oxygen furnace needs less energy and offers high-quality steel. The growing demand from modern steel production drives the overall growth of the market.

The electric arc furnace segment is the fastest growing in the market during the forecast period. The growing consumer demand for green steel increases the adoption of electric arc furnace. The rising utilization of direct reduced iron in steelmaking helps in the market growth. The electric arc furnace reduces greenhouse gas emissions and uses electricity for the production of carbon steel. It consists of greater operational flexibility and is cost-effective. The growing focus on reducing carbon emissions increases the adoption of electric arc furnaces, supporting the overall growth of the market.

End-Use Industry Insights

Which End User Industry Dominated the Carbon Steel Market?

The construction & infrastructure segment dominated the carbon steel market in 2025 with a share of 37.43%. The rapid urbanization and growing construction activities increase demand for carbon steel. The government investment in infrastructure development, like bridges, highways, roads, and railways, helps in the market growth. The applications, like reinforcement bars, beams, and columns in construction activities, increase demand for carbon steel. The growing residential and commercial construction drives the overall growth of the market.

The automotive & transportation segment is experiencing the fastest growth in the market during the forecast period. The rapid growth in electric vehicle production and adoption increases demand for carbon steel. The growing manufacturing of vehicles helps in the market growth. The development of automotive systems, like hydraulic, exhaust, cooling, and fuel lines, increases demand for carbon steel. The growing automotive and transportation sector supports the overall growth of the market.

Distribution Channel Insights

How Direct Sales Segment Held the Largest Share of the Carbon Steel Market?

The direct sales segment led the carbon steel market in 2025 with a share of 62.11%. The growing demand for high quantities of carbon steel in projects like shipbuilding, infrastructure development, and large-scale construction increases demand for direct shipping. The growing demand for specialized carbon steel products helps the direct sales market. The growing focus on collaboration between end-users and producers increases demand for direct sales. The rise in e-commerce and focus on streamlining the procurement process drive the market growth.

The distributors & stockists segment is the fastest growing in the market during the forecast period. The growing demand for carbon steel in various industries increases purchases from distributors and stockists. The growing demand for customization of carbon steel, like value-added services, cutting, and fabrication, helps in the market growth. Distributors and stockists provide a variety of products in diverse shapes, grades, and sizes. They manage inventory levels and reduce procurement costs. The growing demand for the timely delivery of materials in manufacturing facilities and construction sites increases purchases from distributors and stockists, supporting the overall market growth.

Grade Insights

How AISI 1005-1020 Series Segment Dominates the Carbon Steel Market?

The AISI 1005-1020 series segment dominated the carbon steel market in 2025 with a share of 61.44%. The growing demand from a wide range of applications like construction, automotive parts, and machine components helps the market growth. AISI 1005-1020 has excellent machinability and creates complex parts. These types have good welding capabilities and easily formed in various shapes. It is cost-effective and easily available from various suppliers, which supports the overall growth of the market.

The ASTM A36, S355JR segment is experiencing the fastest growth in the market during the forecast period. The growing demand for materials to sustain in extreme temperatures, heavy loads, and pressures increases the adoption of ASTM A36. It consists of excellent weldability and provides a good balance of cost & strength. S355JR provides high yield strength and is easily weldable. S355JR offers a good balance of properties and offers good impact resistance. The growing demand across various applications like manufacturing, construction, and automotive drives the overall growth of the market.

Recent Developments

- In February 2025, Australia launched $1B green iron fund for low-carbon steel. The funds support the government's carbon-neutral strategy and provide benefits to several mining companies such as Rio, BlueScope Steel, BHP, and Tinto.(Source:senecaesg.com)

- In July 2023, ArcelorMittal introduced low-carbon emission steel tubes. The new steel tube lowers carbon dioxide emissions by 75%. Tubes are available to use in various applications like sprinklers, windmills, machinery, building frames, solar structures, and scaffolding. (Source:europe.arcelormittal.com)

- In June 2025, Tata Steel plans to develop a low-carbon steel plant in the UK. The new plant building is using electric arc furnace technology and produces 3.2 million tons of carbon steel each year. The company focuses on cost-cutting and offers a commitment to sustainability. (Source:www.goodreturns.in)

Top Companies List

- ArcelorMittal

- Nippon Steel Corporation

- POSCO

- Baosteel Group Corporation

- HBIS Group Co., Ltd.

- Tata Steel

- United States Steel Corporation

- JFE Steel Corporation

- Nucor Corporation

- Thyssenkrupp AG

- EVRAZ plc

- JSW Steel

- Steel Authority of India Limited (SAIL)

- Gerdau S.A.

- Severstal

- Hyundai Steel

- Liberty Steel (GFG Alliance)

- China Steel Corporation (CSC)

- Essar Steel (Now AM/NS India)

- Shougang Group

Segments Covered

By Type

- Low Carbon Steel (Mild Steel) (Carbon content ≤ 0.25%)

- Medium Carbon Steel (Carbon content 0.25% – 0.60%)

- High Carbon Steel (Carbon content > 0.60%)

- Ultra-High Carbon Steel (Carbon content > 1.00%)

By Product Form

- Flat Products

- Hot Rolled Coil (HRC)

- Cold Rolled Coil (CRC)

- Sheets & Plates

- Long Products

- Rebars

- Wire Rods

- Structural Sections

- Pipes & Tubes

- Seamless

- Welded (ERW, SAW)

- Bars

- Round Bars

- Square Bars

- Hexagonal Bars

By Process

- Basic Oxygen Furnace (BOF)

- Electric Arc Furnace (EAF)

By End-Use Industry

- Construction & Infrastructure

- Automotive & Transportation

- Shipbuilding

- Energy & Power

- Industrial Machinery

- Oil & Gas

- Consumer Goods & Appliances

- Railways & Metro

- Defense & Aerospace

By Distribution Channel

- Direct Sales (to OEMs/Industries)

- Distributors & Stockists

By Grade

- AISI/SAE 1005–1095 Series

- EN Standards (e.g., EN 10025 S275JR, S355JR)

- ASTM Grades (e.g., ASTM A36, AISI 1045, 1060)

- JIS Grades (e.g., SS400)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait