Content

U.S. Powder Coatings Market Size and Share 2034

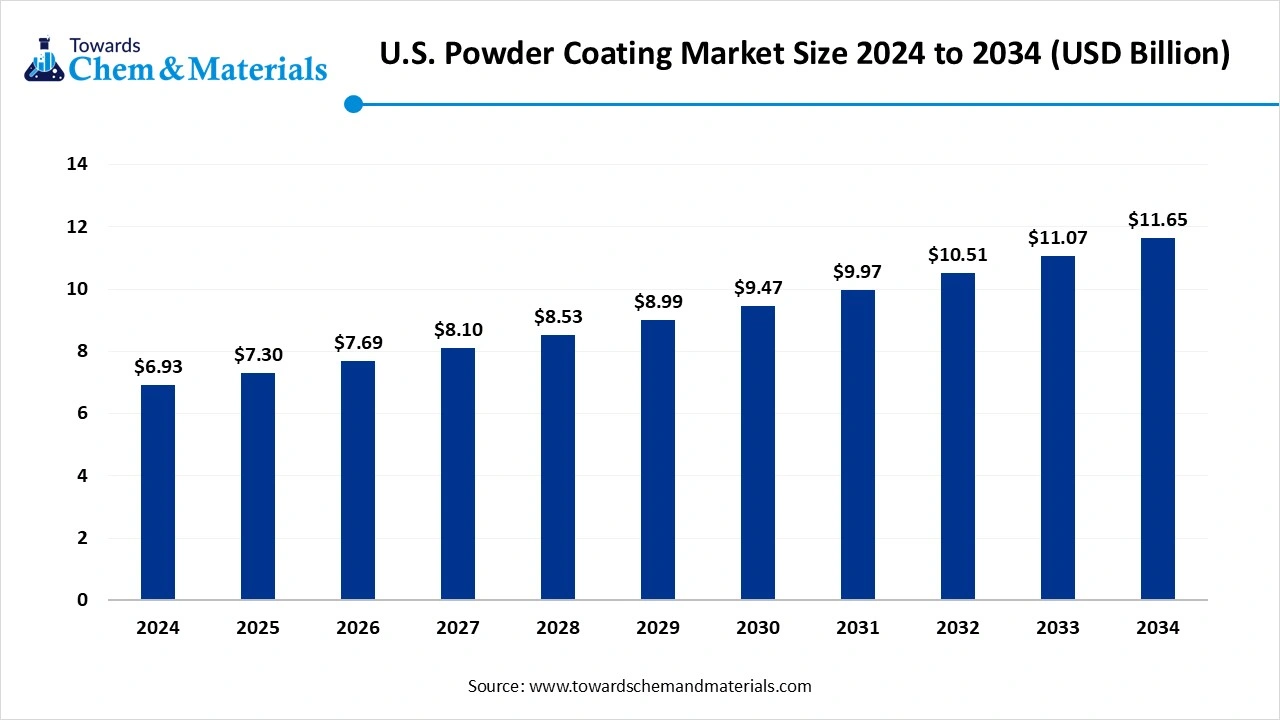

The U.S. powder coatings-market size was valued at USD 6.93 billion in 2024, grew to USD 7.30 billion in 2025, and is expected to hit around USD 11.65 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.33% over the forecast period from 2025 to 2034. The growth of the market is driven by the growing demand across industries due to its application because of its properties like durability, resistance, and aesthetic qualities, which increase the demand for the product.

Key Takeaways

- By resin/ chemistry, the polyester (TGIC-free) segment dominated the market in 2024. The polyester (TGIC-free) segment held approximately 37% share in the market in 2024. These coatings are widely used in architectural, automotive, and general industrial applications.

- By resin/ chemistry, the polyurethane segment is expected to grow significantly in the market during the forecast period. These coatings offer a smooth finish with excellent gloss retention, making them ideal for appliances, furniture, and automotive components.

- By application technology, the electrostatic spray (corona) segment dominated the market in 2024. The electrostatic spray (corona) segment held approximately 62% share in the market in 2024. The technique ensures uniform coverage, reduced material waste, and strong adhesion on complex geometries.

- By application technology, the fluidized bed segment is expected to grow in the forecast period. It is particularly employed for coating valves, pipes, and wire goods.

- By cure temperature, the medium cure (140–180 °c) segment dominated the market in 2024. The medium cure (140–180 °c) segment held approximately 55% share in the market in 2024. These formulations are widely used in appliances, architectural products, and industrial equipment.

- By cure temperature, the low-temperature cure segment is expected to grow in the forecast period. These coatings cure effectively at reduced energy levels, helping manufacturers lower costs and emissions.

- By end-use industry, the appliances / white goods segment dominated the market in 2024. The appliances / white goods segment held approximately 22% share in the market in 2024. The demand for enhancing aesthetic appeal drives the growth of the market.

- By end-use industry, the architectural & building products segment is expected to grow in the forecast period. The growing construction industry drives the demand for the product due to its properties.

- By distribution channel, the direct sales segment dominated the market in 2024. The direct sales segment held approximately 50% share in the market in 2024. Direct sales allow companies to engage in collaborative product development.

- By distribution channel, the online / e-commerce segment is expected to grow in the forecast period. These platforms provide greater accessibility, product variety, and price transparency.

Market Overview

What Is The Significance Of The U.S. Powder Coatings Market?

Powder coatings are solid, particulate coatings applied electrostatically and cured under heat to form a continuous, protective, and decorative film. They are solvent-free, environmentally friendly, and widely used in industrial and consumer applications. Its properties, like superior durability, enhanced protection, aesthetic appeal, environmental friendliness, efficiency, cost-effectiveness, uniform finish, and versatile application, are of key significance, which increases the demand and growth of the market and product.

What Are The Key Growth Drivers That Support The Growth Of the Powder Coating Market?

The growth of the market is driven by the growing demand from industries like automotive, appliances, construction, and furniture. This is due to its durability, dielectric and thermal management properties, resistance to abrasion and chemicals, high quality, and good gloss resistance, which further boost the demand for the market.

The other key growth drivers are the environmental and regulatory factors, like eco-friendly formulations, strict VOC regulations, economic and technological drivers like economic growth, technological advancements, and innovation, and cost-effectiveness, which drives the growth and expansion of the market in the US.

Market Trends

- Durability and Performance: The superior resistance of powder coatings to chipping, scratching, and fading, along with their high durability, continues to drive demand across various sectors.

- Eco-Friendly Solutions: Strict regulations on low-VOC (volatile organic compound) coatings favor powder coatings, which are solvent-free and minimize material waste.

- Technological Advancements: Innovations in application techniques and the development of low-temperature curing chemistries for heat-sensitive substrates are enhancing market growth.

- End-Use Industry Demand: Growth in key industries such as automotive, appliances, construction, and general industrial applications significantly contributes to the market expansion.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 7.30 Billion |

| Expected Size by 2034 | USD 11.65 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.33% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Resin / Chemistry, By Application Technology, By Cure Temperature, By End-Use IndustryBy Distribution Channel |

| Key Companies Profiled | PPG Industries, The Sherwin-Williams Company, Axalta Coating Systems, AkzoNobel, BASF, Asian Paints, Kansai Paint, Jotun, Allnex, Mankiewicz Coatings, Teknos Group, Tiger Coatings, Prismatic Powders, Hentzen Coatings, RPM International, Valspar (Sherwin-Williams), Allied Powder Coatings, Europowder, ICI Powder Coatings, Cardinal Paints |

Market Opportunity

The Rising Demand From Various Industries

Powder coatings have a promising market due to their eco-friendly nature, durability, and cost-effectiveness. This is driving demand in growing industries like automotive, appliances, architecture, and furniture. There are specific opportunities for developing coatings that cure at lower temperatures, expanding into the Asia Pacific, and innovating sustainable and metallic finishes.

As the demand for eco-friendly coatings that meet strict VOC regulations grows, powder coatings are a top choice because they're solvent-free and reduce waste. With their inherent durability, corrosion resistance, and cost-saving benefits - including less material waste and lower operational costs than some liquid coatings - powder coatings are a preferred choice for many applications.

Market Challenge

Supply Chain Management And Price Volatility

The key growth challenges that limit the growth of the market are the market-specific challenges, like raw material volatility, shortage, and fluctuation in raw material pricing, and less availability, which leads to supply chain disruption, leading to material delays affecting the production capacity in various sectors, hindering the growth of the market. The high initial investments and technical and application challenges, like heat-sensitive substrates, quality control issues, and limited finishing options, also contribute to the limited growth of the market.

Segmental Insights

Resin / Chemistry Insights

Which Resin/Chemistry Segment Dominated The U.S. powder coatings market In 2024?

The polyester (TGIC-free) segment dominated the market in 2024. Polyester (TGIC-free) resins dominate the U.S. powder coatings market due to their durability, weather resistance, and compliance with environmental standards. These coatings are widely used in architectural, automotive, and general industrial applications because they provide excellent outdoor performance without harmful emissions.

With growing regulatory pressure to reduce toxic compounds, TGIC-free polyester formulations are gaining preference. Their balance of cost-effectiveness, aesthetic appeal, and sustainable chemistry supports rising adoption across manufacturers, particularly in architectural coatings and consumer goods, where eco-compliance is critical.

The polyurethane segment expects significant growth in the market during the forecast period. Polyurethane-based powder coatings are increasingly used in the market for applications requiring superior aesthetics, chemical resistance, and durability. These coatings offer a smooth finish with excellent gloss retention, making them ideal for appliances, furniture, and automotive components.

Polyurethanes also provide higher resistance to abrasion and corrosion compared to conventional coatings, supporting their use in high-value sectors. With manufacturers focusing on premium finishes and performance, polyurethane powder coatings are steadily growing as a preferred option in both consumer and industrial applications.

Application Technology

How Did the Electrostatic Spray (Corona) Segment Dominated The U.S. powder coatings market In 2024?

The electrostatic spray (corona) segment dominated the market in 2024. Electrostatic spray is the most widely used powder coating application method in the US due to its efficiency and versatility. The technique ensures uniform coverage, reduced material waste, and strong adhesion on complex geometries.

It is extensively used in industries such as appliances, automotive, and construction. With advancements in spray guns and automated systems, electrostatic spray is becoming more cost-effective and sustainable. Its compatibility with various resins, including polyester and polyurethane, further reinforces its position as the dominant application technology.

The fluidized bed segment expects significant growth in the market during the forecast period. Fluidized bed coating technology is used for applying thick, protective layers of powder coating, primarily in industrial and heavy-duty applications. In the U.S. market, it is particularly employed for coating valves, pipes, and wire goods, where enhanced corrosion resistance and mechanical strength are required. Though less versatile compared to electrostatic spraying, fluidized bed techniques offer superior edge coverage and high build thickness. This makes them valuable in niche applications within oil & gas, infrastructure, and industrial equipment manufacturing.

Cure Temperature Insights

Which Cure Temperature Segment Dominated The U.S. powder coatings market In 2024?

The medium cure (140–180 °c) segment dominated the market in 2024. Medium cure powder coatings dominate the market as they strike a balance between energy efficiency and performance. These formulations are widely used in appliances, architectural products, and industrial equipment. Medium-cure powders provide excellent mechanical strength and surface finish while reducing energy costs compared to high-temperature curing systems. Manufacturers are investing in these solutions to meet regulatory standards for sustainability and to lower operational expenses, further solidifying medium-cure coatings as the mainstream choice across multiple industries.

The low-temperature cure segment expects significant growth in the market during the forecast period. Low-temperature cure powder coatings are gaining popularity in the US due to their ability to coat heat-sensitive substrates such as MDF, plastics, and composites. These coatings cure effectively at reduced energy levels, helping manufacturers lower costs and emissions. Their application is growing in furniture, electronics, and specialty industrial goods where materials cannot withstand high heat. This segment is also driven by sustainability goals, as reduced curing temperatures align with the industry’s efforts to improve energy efficiency and eco-friendly practices.

End-Use Industry Insights

How Did the Appliances / White Goods Segment Dominated The U.S. powder coatings market In 2024?

The appliances / white goods segment dominated the market in 2024. Appliances and white goods represent a major end-use sector for powder coatings in the US. Powder coatings are extensively applied on refrigerators, washing machines, and microwaves due to their durability, resistance to heat and chemicals, and ability to deliver aesthetic finishes. With growing consumer demand for energy-efficient and durable appliances, manufacturers increasingly prefer powder coatings over conventional liquid coatings. This segment continues to expand, supported by rising residential construction, higher disposable incomes, and the trend toward long-lasting, eco-friendly consumer products.

The architectural & building products segment expects significant growth in the market during the forecast period. Architectural and building applications are another significant driver of the U.S. powder coatings market. Powder coatings are widely used on aluminum extrusions, window frames, doors, and cladding due to their superior weatherability and design flexibility. The demand for sustainable construction solutions has fueled the use of powder coatings, given their low-VOC emissions and recyclability. With increased urbanization and the growth of commercial and residential projects, powder coatings in architecture are expected to see steady demand for both functional and decorative purposes.

Distribution Channel Insights

Which Distribution Channel Segment Dominated The U.S. powder coatings market In 2024?

The direct sales segment dominated the market in 2024. Direct sales account for a substantial share of the market as manufacturers maintain strong relationships with OEMs and large-scale industrial users. This channel ensures customized solutions, reliable supply, and technical support, making it the preferred route for high-volume buyers in automotive, appliances, and construction industries. Direct sales also allow companies to engage in collaborative product development, meeting the evolving performance requirements of end users. As a result, this channel continues to dominate bulk and industrial-scale transactions.

The online / e-commerce segment expects significant growth in the U.S. powder coatings market during the forecast period. Online and e-commerce channels are gradually expanding in the market, particularly for small to medium-sized businesses and specialty buyers. These platforms provide greater accessibility, product variety, and price transparency. With the rise of digitalization and the shift toward online procurement, many suppliers are developing dedicated e-commerce platforms. This channel benefits end users requiring smaller volumes and quicker deliveries, such as independent contractors and repair services. Though still emerging, online distribution is set to complement traditional sales channels.

U.S. Powder Coatings Market Value Chain Analysis

- Chemical Synthesis and Processing: Production of powder coatings involves a sequence of mixing, melt-blending, and grinding steps.

- Key players: PPG Industries, Inc., Axalta Coating Systems, and AkzoNobel

- Quality Testing and Certification: The powder coatings require Powder Coating Institute (PCI) Certification, ISO 9001 Certification, and Environmental certifications and compliance certification.

- Key players: ASTM International and UL Solutions

- Distribution to Industrial Users: The powder coatings are distributed to the packaging, automotive, electronics, and construction industries.

- Key players: The Sherwin-Williams Company, AkzoNobel, Axalta Coating Systems, and BASF SE

Recent Developments

- In June 2025, Jotun launched its new product in the powder coating system, which helps in enhancing the design and safety, durability, and high performance of batteries for electric vehicles. They also provide sustainable and cost-effective alternatives.(Source: www.coatingsworld.com)

- In May 2025, PPG announced the launch of a new and innovative power costing product with recycled plastic content, which is up to 18% including post-industrial recycled plastic. The PPG EnviroLuxe Plus powder coatings product aligns with the sustainability initiatives, with enhanced properties and advanced technology for long-lasting protection.(Source: www.indianchemicalnews.com)

U.S. Powder Coatings Market Top Companies

- PPG Industries

- The Sherwin-Williams Company

- Axalta Coating Systems

- AkzoNobel

- BASF

- Asian Paints

- Kansai Paint

- Jotun

- Allnex

- Mankiewicz Coatings

- Teknos Group

- Tiger Coatings

- Prismatic Powders

- Hentzen Coatings

- RPM International

- Valspar (Sherwin-Williams)

- Allied Powder Coatings

- Europowder

- ICI Powder Coatings

- Cardinal Paints

Segments Covered

By Resin / Chemistry

- Polyester (TGIC-free)

- Polyester (TGIC-containing)

- Epoxy

- Epoxy-Polyester Hybrid

- Polyurethane (Polyester-Urethane)

- Acrylic

- Fluoropolymer

- Nylon

- Others (phenolic, silicone, polyolefin)

By Application Technology

- Electrostatic Spray (Corona)

- Electrostatic Spray (Tribo)

- Fluidized Bed Dipping

By Cure Temperature

- Low-Temperature Cure (<140 °C)

- Medium-Temperature Cure (140–180 °C)

- High-Temperature Cure (>180 °C)

By End-Use Industry

- Automotive & Transportation

- Appliances / White Goods

- Architectural & Building Products

- Furniture

- General Industrial Manufacturing

- Agricultural & Construction Equipment

- Oil & Gas / Energy

- Marine & Offshore

- Electrical & Electronics

- Medical Devices & Equipment

- Consumer Goods

- Packaging & Drums

By Distribution Channel

- Direct Sales (to OEMs)

- Distributors (national/regional/local)

- Online / E-commerce

List of Figures

- Figure 1: U.S. Powder Coatings Market Size, 2024–2034 (USD 6.93 Billion in 2024, CAGR 5.33%)

- Figure 2: U.S. Powder Coatings Market Share by Resin/Chemistry, 2024 (%): Polyester (TGIC-free) 37%, Polyester (TGIC-containing) 15%, Epoxy 14%, Epoxy-Polyester Hybrid 10%, Polyurethane (Polyester-Urethane) 11%, Acrylic 5%, Fluoropolymer 3%, Nylon 2%, Others (Phenolic, Silicone, Polyolefin) 3%

- Figure 3: U.S. Powder Coatings Market Share by Application Technology, 2024 (%): Electrostatic Spray (Corona) 62%, Electrostatic Spray (Tribo) 23%, Fluidized Bed Dipping 15%

- Figure 4: U.S. Powder Coatings Market Share by Cure Temperature, 2024 (%): Low-Temperature Cure (<140 °C) 20%, Medium-Temperature Cure (140–180 °C) 55%, High-Temperature Cure (>180 °C) 25%

- Figure 5: U.S. Powder Coatings Market Share by End-Use Industry, 2024 (%): Appliances/White Goods 22%, Automotive & Transportation 18%, Architectural & Building Products 16%, Furniture 10%, General Industrial Manufacturing 9%, Agricultural & Construction Equipment 7%, Oil & Gas/Energy 5%, Marine & Offshore 3%, Electrical & Electronics 3%, Medical Devices & Equipment 2%, Consumer Goods 3%, Packaging & Drums 2%

- Figure 6: U.S. Powder Coatings Market Share by Distribution Channel, 2024 (%): Direct Sales (to OEMs) 50%, Distributors (national/regional/local) 35%, Online/E-commerce 15%

- Figure 7: U.S. Powder Coatings Market Value Chain Analysis

- Figure 8: U.S. Powder Coatings Market Growth Drivers, Restraints, Opportunities, and Challenges

- Figure 9: Competitive Landscape – Market Share of Key Players, 2024

- Figure 10: Recent Developments in the U.S. Powder Coatings Market (2025)

List of Tables

- Table 1: U.S. Powder Coatings Market Size and Forecast, 2024–2034 (USD 6.93 Billion in 2024, CAGR 5.33%)

- Table 2: U.S. Powder Coatings Market Share by Resin/Chemistry, 2024 (%): Polyester (TGIC-free) 37%, Polyester (TGIC-containing) 15%, Epoxy 14%, Epoxy-Polyester Hybrid 10%, Polyurethane (Polyester-Urethane) 11%, Acrylic 5%, Fluoropolymer 3%, Nylon 2%, Others (Phenolic, Silicone, Polyolefin) 3%

- Table 3: U.S. Powder Coatings Market Share by Application Technology, 2024 (%): Electrostatic Spray (Corona) 62%, Electrostatic Spray (Tribo) 23%, Fluidized Bed Dipping 15%

- Table 4: U.S. Powder Coatings Market Share by Cure Temperature, 2024 (%): Low-Temperature Cure (<140 °C) 20%, Medium-Temperature Cure (140–180 °C) 55%, High-Temperature Cure (>180 °C) 25%

- Table 5: U.S. Powder Coatings Market Share by End-Use Industry, 2024 (%): Appliances/White Goods 22%, Automotive & Transportation 18%, Architectural & Building Products 16%, Furniture 10%, General Industrial Manufacturing 9%, Agricultural & Construction Equipment 7%, Oil & Gas/Energy 5%, Marine & Offshore 3%, Electrical & Electronics 3%, Medical Devices & Equipment 2%, Consumer Goods 3%, Packaging & Drums 2%

- Table 6: U.S. Powder Coatings Market Share by Distribution Channel, 2024 (%): Direct Sales (to OEMs) 50%, Distributors (national/regional/local) 35%, Online/E-commerce 15%

- Table 7: U.S. Powder Coatings Market Key Trends and Growth Drivers

- Table 8: U.S. Powder Coatings Market Recent Developments, 2024–2025

- Table 9: U.S. Powder Coatings Market Competitive Benchmarking of Key Companies

- Table 10: Certifications and Compliance in Powder Coatings Industry (PCI, ISO 9001, Environmental)