Content

What is the Current Industrial Absorbent Market Size and Share?

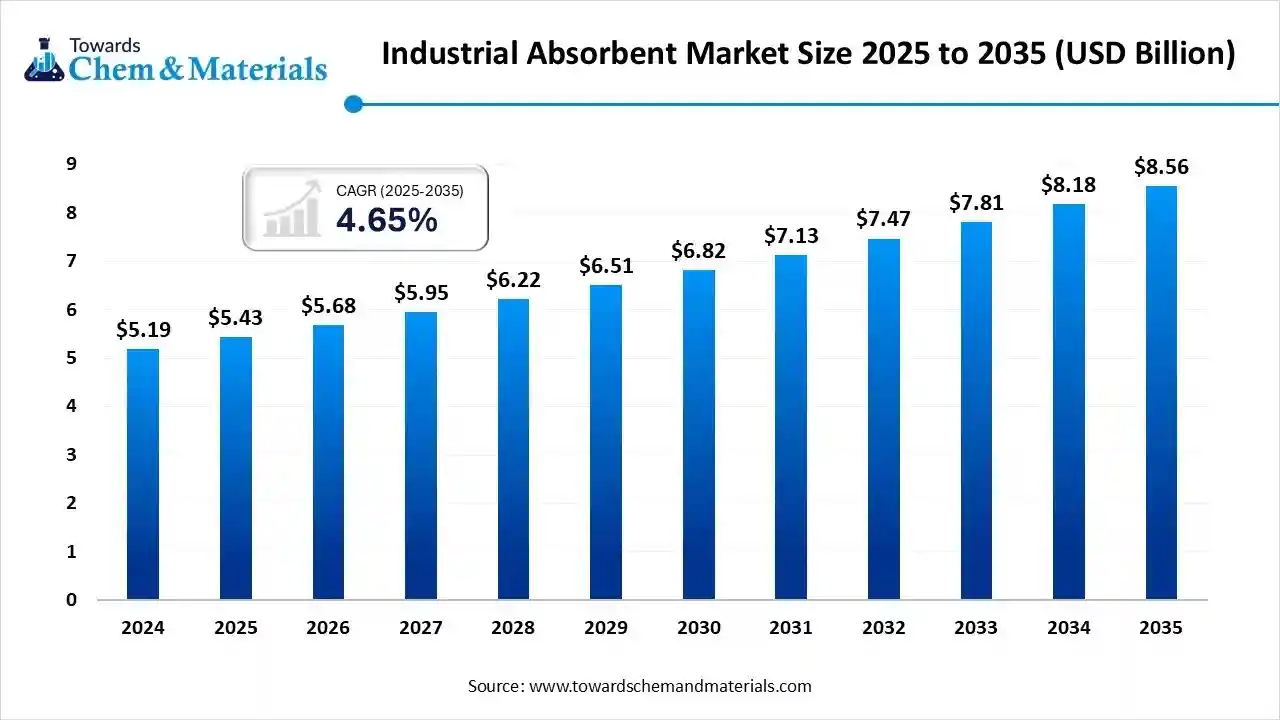

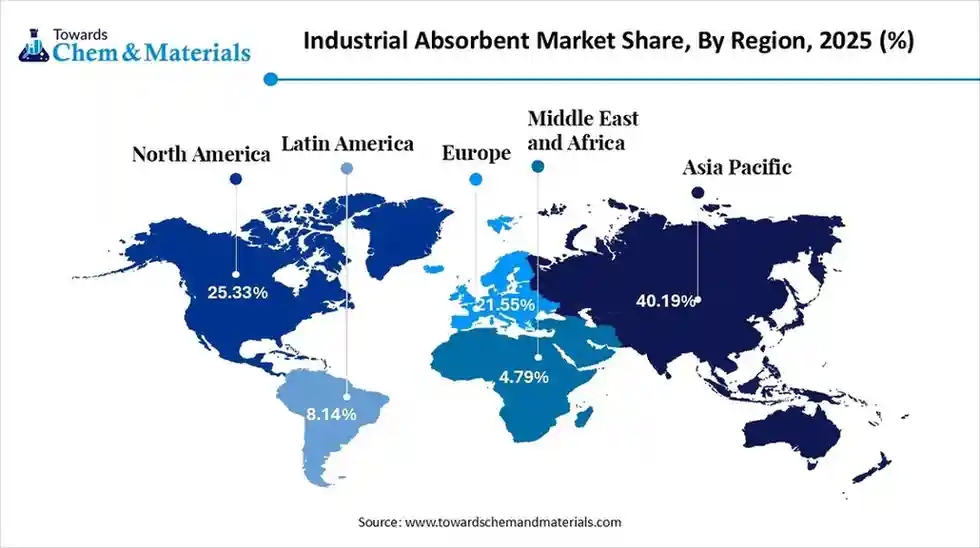

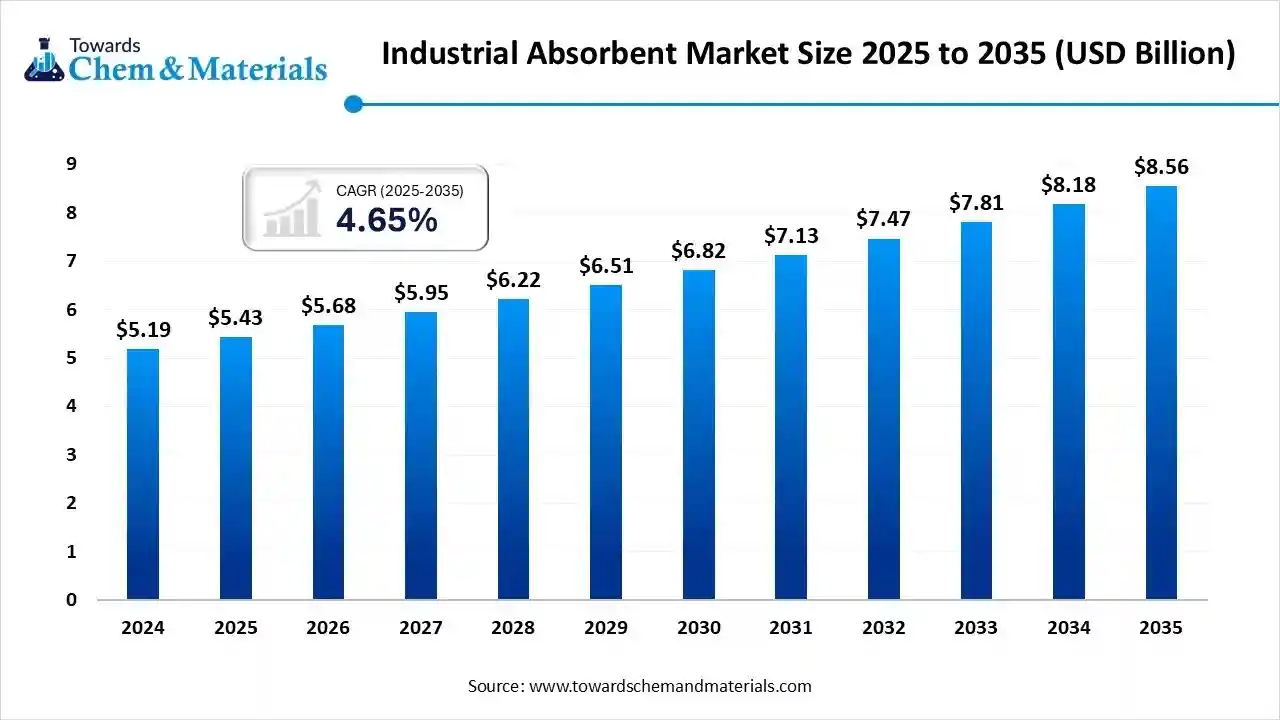

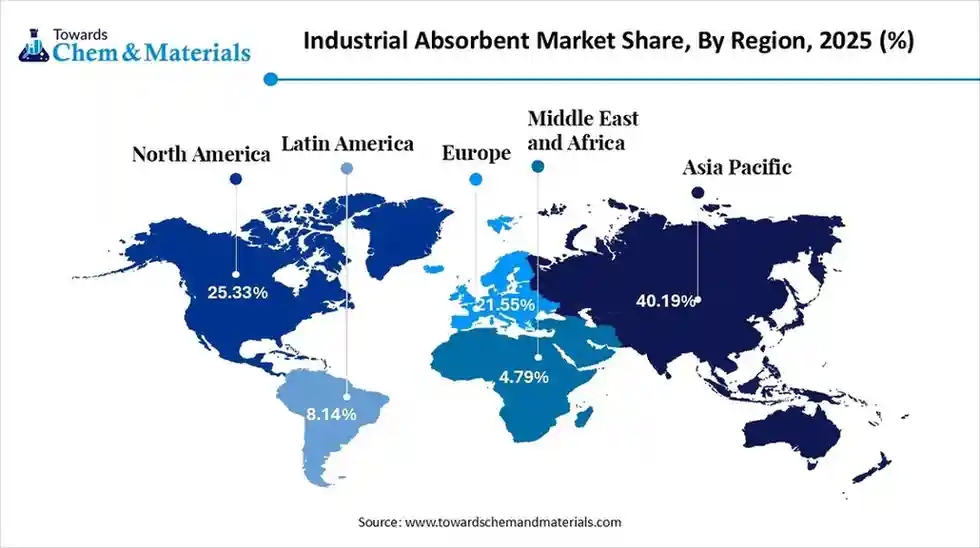

The global industrial absorbent market size is calculated at USD 5.43 billion in 2025 and is predicted to increase from USD 5.68 billion in 2026 and is projected to reach around USD 8.56 billion by 2035, The market is expanding at a CAGR of 4.65% between 2026 and 2035. Asia Pacific dominated the industrial absorbent market with a market share of 40.19% the global market in 2025. The market is driven by increasing environmental regulations and industrial expansion, particularly in the oil & gas and chemical sectors.

Key Takeaway

- Asia Pacific dominated the industrial absorbent market and accounted for the largest revenue share of 40.19% in 2025.

- The industrial absorbent in the U.S. is expected to grow at a substantial CAGR of 4.5% from 2026 to 2035.

- By material, the natural organic materials segment is expected to grow at a considerable CAGR of 5.28% from 2026 to 2035 in terms of revenue.

- By product, the booms & socks segment is expected to grow at a considerable CAGR of 5.18% from 2026 to 2035 in terms of revenue.

- By absorbent type, the oil-only absorbents segment is expected to grow at a considerable revenue CAGR of 4.95% from 2026 to 2035.

Market Overview

What is the significance of the Industrial Absorbent Market?

The significance of the industrial absorbent market lies in its crucial role in ensuring workplace safety and environmental protection by containing and cleaning up oil, chemical, and other liquid spills. These materials help prevent accidents, reduce contamination, and limit damage to equipment and surrounding areas. They are widely used in factories, warehouses, transportation hubs, and refineries where spill risks are common.

The market is growing due to stricter regulations, rising industrial activity, and increasing environmental awareness, which are driving demand for absorbent materials such as pads, booms, and granules. Many countries have introduced stronger workplace safety rules and spill response standards, which require companies to keep reliable absorbent products on-site. Growing industrial expansion has also increased the number of facilities that handle hazardous substances, further supporting market demand.

Current Trends in Industrial Absorbent Market :

- Industry Growth Overview: Between 2025 and 2030, the industrial absorbent sector is expected to grow steadily due to increasing regulatory pressure related to spill control, workplace safety and hazardous waste management. Industries such as manufacturing, chemicals, oil and gas, automotive and food processing are adopting absorbents to handle leaks, drips and operational spills more efficiently. The rise in global environmental compliance standards is also pushing companies to invest in reliable spill management systems to reduce downtime and improve workplace safety performance.

- Sustainability Trends: Sustainability is becoming a major driver in the industrial absorbent industry as industries seek alternatives to petroleum-based absorbents. Manufacturers are introducing biodegradable, recycled and plant-based absorbents designed to reduce landfill waste and environmental impact. Materials such as cellulose fibres, bio-based polymers, agricultural waste fibres and recycled cotton are gaining adoption due to their high absorbency and reduced ecological footprint. Many companies are also integrating closed-loop waste strategies to ensure that spent absorbents are safely collected, processed or recycled where possible.

- Global Expansion and Innovation: Leading absorbent manufacturers are expanding their product portfolios to include high-performance pads, socks, booms and granular absorbents tailored for oil, chemical and multipurpose spill control. Growth in international trade, offshore operations and chemical processing facilities is increasing the need for specialised absorbents with improved durability and faster uptake rates. Companies are also investing in automation, advanced fibre-processing technologies and integrated spill response systems that combine detection, containment and cleanup tools to support efficient risk management.

- Major Investors: Major investors include global safety equipment companies, industrial cleaning solution providers and chemical manufacturers that are acquiring or partnering with absorbent producers to strengthen their safety and compliance offerings. Investments are flowing into advanced manufacturing lines for eco-friendly absorbents, high-capacity processing facilities and research programs focused on new materials with superior absorption and lower environmental impact. Large distributors and facility management companies are also investing in private-label absorbent products to serve the growing demand for spill kits in industrial and commercial settings.

- Startup Ecosystem: The startup ecosystem in the industrial absorbent space is growing, with emerging companies developing bio-based absorbents, reusable spill control materials and smart monitoring solutions that support predictive leak detection. Startups are experimenting with natural fibres, agricultural residues and recycled textile materials to create cost-effective and environmentally responsible absorbents. Some young companies are focusing on digital spill management platforms that offer real-time compliance tracking and automated refill systems for spill stations. Their innovations are helping industries reduce waste, improve response times and strengthen regulatory compliance.

Key Technological Shifts in the Industrial Absorbent Market

Significant technological progress in the industrial absorbent sector includes the transition to eco-friendly materials, such as biodegradable, plant-based alternatives to conventional petroleum-derived products. This shift aligns with stronger global sustainability goals, as many industries now prioritize products that reduce long-term environmental impact. Companies are increasingly adopting natural fibres and renewable materials to meet both regulatory expectations and customer demand for greener spill control solutions.

Advances in material science are improving absorbency, durability and reusability, supporting the shift toward products that can be used repeatedly before disposal. Enhanced fibre bonding, improved structural strength, and better liquid retention capabilities allow absorbents to last longer during spill response. These improvements help reduce waste volumes, lower replacement costs, and increase overall efficiency in industrial environments.

Report Scope

| Report Attribute | Details |

| The Market Size Value in 2026 | USD 5.68 Billion |

| The Revenue Forecast in 2035 | USD 8.56 Billion |

| Growth Rate | CAGR 4.65% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments covered | By Type, By Product, By Material Type, By End-Use Industry, By Region |

| Key companies profiled | Evonik Industries AG, BASF SE, Darcy Spillcare Manufacture, Chemtex Inc, 3M, New Pig Corporation , Brady Worldwide, Inc. , Johnson Matthey , Tolsa S.A. , Ansell Ltd. , Meltblown Technologies Inc., Cleanis SAS , Sukano AG , W. W. Grainger, Inc. , SPC (Brady subsidiary) , EP Minerals , JXY International |

Trade Analysis Of Industrial Absorbent Market: Import & Export Statistics

- According to Volza's Global Export data, the World exported 762,897 shipments of Absorber from Jun 2025 to May 2025 (TTM). These exports were made by 30,765 Exporters to 32,517 Buyers, marking a 9% growth rate compared to the preceding twelve months. Most of the absorbers exported from the World go to Vietnam, Mexico, and Ukraine.

- Globally, the top three exporters of Absorber are China, Japan, and Turkey. China leads the world in Absorber exports with 555,200 shipments, followed by Japan with 222,152 shipments, and Turkey taking the third spot with 203,225 shipments.(Source: www.volza.com )

- According to Volza's India Export data, India exported 11 shipments of Super Absorbent Polymer from Sep 2023 to Aug 2025 (TTM). These exports were made by 7 Indian Exporters to 9 Buyers, marking a growth rate of -27% compared to the preceding twelve months Most of the Super Absorbent Polymer exports from India go to Nepal, the Maldives, and Mexico.

- Globally, the top three exporters of Super Absorbent Polymer are South Korea, China, and Singapore. South Korea leads the world in Super Absorbent Polymer exports with 11,278 shipments, followed by China with 7,513 shipments, and Singapore taking the third spot with 2,634 shipments.(Source : www.volza.com)

Industrial Absorbent Industry Value Chain Analysis

- Chemical Synthesis and Processing : Industrial absorbents are produced from materials such as polypropylene, cellulose, clay, and superabsorbent polymers through processes including melt-blowing, air-laying, granulation, and chemical treatment to enhance absorbency and retention. These production steps allow manufacturers to create absorbents suited for oil spills, chemical leaks, and general industrial maintenance. Each material type offers different performance benefits, which helps companies match the right absorbent to specific workplace hazards.

- Key players: 3M Company, Brady Corporation, Oil-Dri Corporation of America, Kimberly-Clark Corporation, New Pig Corporation.

- Quality Testing and Certification: Absorbents undergo quality checks for absorption capacity, chemical compatibility, flammability, and durability under standards such as ASTM F726 and EPA spill containment guidelines. These evaluations ensure that products perform reliably during spill response and meet workplace safety requirements. Regular testing also helps manufacturers maintain compliance with environmental regulations and industry standards.

- Key players: ASTM International, UL Solutions, SGS, Intertek.

- Distribution to Industrial Users : Industrial absorbents are supplied to manufacturing, oil and gas, chemical processing, and environmental cleanup sectors through safety suppliers, industrial distributors, and direct corporate sales. This distribution network ensures rapid availability of absorbents during emergencies and supports routine maintenance activities across various facilities. Strong partnerships with distributors also help companies reach diverse industrial customers efficiently.

- Key players: New Pig Corporation, Brady Corporation, Oil-Dri Corporation of America, 3M Company.

Industrial Absorbent Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Standards | Focus Areas | Notes |

| United States | Environmental Protection Agency (EPA) Occupational Safety & Health Administration (OSHA) Department of Transportation (DOT) |

- EPA Oil Pollution Prevention (SPCC Rule) - RCRA (Resource Conservation and Recovery Act) – hazardous waste classification & disposal - OSHA 29 CFR 1910 – Hazard communication, spill response, PPE - DOT Hazardous Materials Regulations |

- Spill control & secondary containment - Absorbent waste disposal (hazardous vs. non-hazardous) - Worker safety during cleanup - Transport of contaminated absorbents |

Absorbents used for oils/chemicals may be considered hazardous waste after use. SPCC rules require specific oil-spill response kits for regulated facilities. EPA encourages sorbents that are non-leaching and landfill-safe. |

| European Union | ECHA European Commission (DG Environment) CEN Standards (EN) |

- REACH & CLP Regulations (chemical safety, labelling) - Waste Framework Directive (WFD) - Industrial Emissions Directive (IED) - EN 14079 / EN 1504 (absorbent materials) |

- Chemical classification of absorbent products - Safe disposal of used sorbents - Spill-response preparedness (Seveso & COMAH sites) |

EU stresses hazardous waste tracking and restricted chemicals in absorbents. Industrial sites must keep formal spill kits as part of COMAH/Seveso risk plans. |

| China | Ministry of Ecology and Environment (MEE) SAMR / AQSIQ SAC (GB Standards) |

- Solid Waste Pollution Prevention Law - Hazardous Chemical Management Regulation - GB standards for absorbent materials & sorbent pads |

- Disposal of chemical/oil-contaminated absorbents - Registration & labelling of absorbents used at chemical sites - Environmental compliance for spill-response products |

China mandates strict hazardous-waste disposal for spent absorbents. GB standards increasingly align with EU norms for export-grade absorbents. |

| India | MoEFCC / CPCB / SPCBs BIS (Standards) |

- Hazardous Waste Management Rules (2016, amendments) - Chemical Accidents Rules (1996) - National Disaster Management Guidelines (Industrial Safety) |

- Standards for absorbents in oil/chemical spill kits - Handling & disposal of contaminated absorbents - Mandatory spill-control measures for chemical and refinery sites |

Absorbents used in refineries, ports & chemical plants are subject to hazardous waste rules. BIS standards are emerging for oil-spill cleanup materials used in marine environments. |

| Brazil / Latin America | IBAMA ANP (for oil sites) ABNT Standards |

- National Environmental Policy Act - Oil Spill Contingency Plan Regulations - ABNT NBR standards for sorbents |

- Marine & onshore oil-spill response materials - Worker safety & hazardous waste handling |

The offshore oil sector requires certified absorbents (booms, pads). Strict marine-spill preparedness for Petrobras & relevant operators. |

Segmental Insights

Type Insights

Which Type Segment Dominated The Industrial Absorbent Market In 2025?

- The universal segment dominated the industrial absorbent market in 2025. Universal absorbents are designed to handle a wide range of non-aggressive liquids, including water-based solutions, coolants, and oils. They are widely used in manufacturing, automotive workshops, and maintenance operations due to their versatility in managing everyday leaks and spills.

- The HAZMAT/ chemical expects significant growth in the industrial absorbent industry during the forecast period. HAZMAT absorbents are engineered for handling caustic, corrosive, and hazardous chemical spills, making them essential for laboratories, chemical plants, and pharma manufacturing facilities. Their high resistance to aggressive substances ensures safe handling and quick containment in environments with strict safety compliance requirements.

- The oil-only segment has seen notable growth in the industrial absorbent sector. Oil-only absorbents selectively capture hydrocarbons while repelling water, making them ideal for marine spills, offshore operations, and industrial oil leak management. They are widely used in oil refineries, transport hubs, and machinery maintenance, where precise removal of oil contamination is required.

Product Insights

How Did Pads Segment Dominated The Industrial Absorbent Market In 2025?

- The pads segment dominated the industrial absorbent market in 2025. Absorbent pads offer

fast spill control and are commonly used on shop floors, machinery areas, and industrial assembly lines. Their convenience, uniform thickness, and ease of disposal make them one of the most widely adopted absorbent formats for routine maintenance. - The rolls segment expects significant growth in the industrial absorbent industry during the forecast period. Absorbent rolls cover large areas and can be cut to size, providing flexible coverage for walkways, workstations, and storage zones. They are particularly effective in preventing slip hazards and are commonly used in logistics centres and high-traffic industrial environments.

- The pillows segment has seen notable growth in the industrial absorbent sector. Absorbent pillows are used for high-volume leaks and hard-to-reach areas, offering concentrated absorbency in compact form. They are ideal for placing under machinery, containment pallets, and valve assemblies where localised containment is critical.

Material Type Insights

Which Material Type Segment Dominated The Industrial Absorbent Market In 2025?

- The natural organic segment dominated the industrial absorbent market in 2025. Made from renewable materials such as cellulose, coir, or cotton fibres, natural organic absorbents provide environmentally friendly spill solutions. They offer high absorbency and are favoured by industries moving toward biodegradable and sustainable safety materials.

- The synthetic segment is expected to see significant growth in the industrial absorbent market during the forecast period. Synthetic absorbents, typically made from polypropylene, offer superior absorption capacity and chemical resistance. They are widely used in demanding industrial environments where durability, quick response, and compatibility with oils and chemicals are essential.

- The natural inorganic segment has seen notable growth in the industrial absorbent industry. Inorganic absorbents such as clay, vermiculite, and diatomaceous earth are cost-effective options for chemical and oil spill containment. These granular absorbents are often used in outdoor, industrial, or emergency situations that require rapid deployment.

End User Insights

How Did the Oil And Gas Segment Dominated The Industrial Absorbent Market In 2025?

- The oil and gas segment dominated the industrial absorbent market in 2025. The oil & gas sector uses a wide range of absorbents for pipeline maintenance, refinery operations, offshore platforms, and emergency spill response. Their adoption is driven by stringent environmental norms and the need to safely manage frequent hydrocarbon leaks.

- The healthcare segment is expected to drive significant growth in the industrial absorbent sector during the forecast period. Hospitals and medical facilities rely on absorbents to manage biofluids, chemicals, disinfectants, and routine spills in clinical and laboratory settings. High hygiene standards and regulatory requirements are driving strong demand for chemical-safe, universal absorbent products.

- The chemical segment has seen notable growth in the industrial absorbent industry. Chemical manufacturers depend heavily on specialised HAZMAT absorbents for handling corrosive and reactive spill scenarios. Their use ensures compliance with industrial safety standards and protects workers during chemical transfer, processing, and storage operations.

Regional Analysis

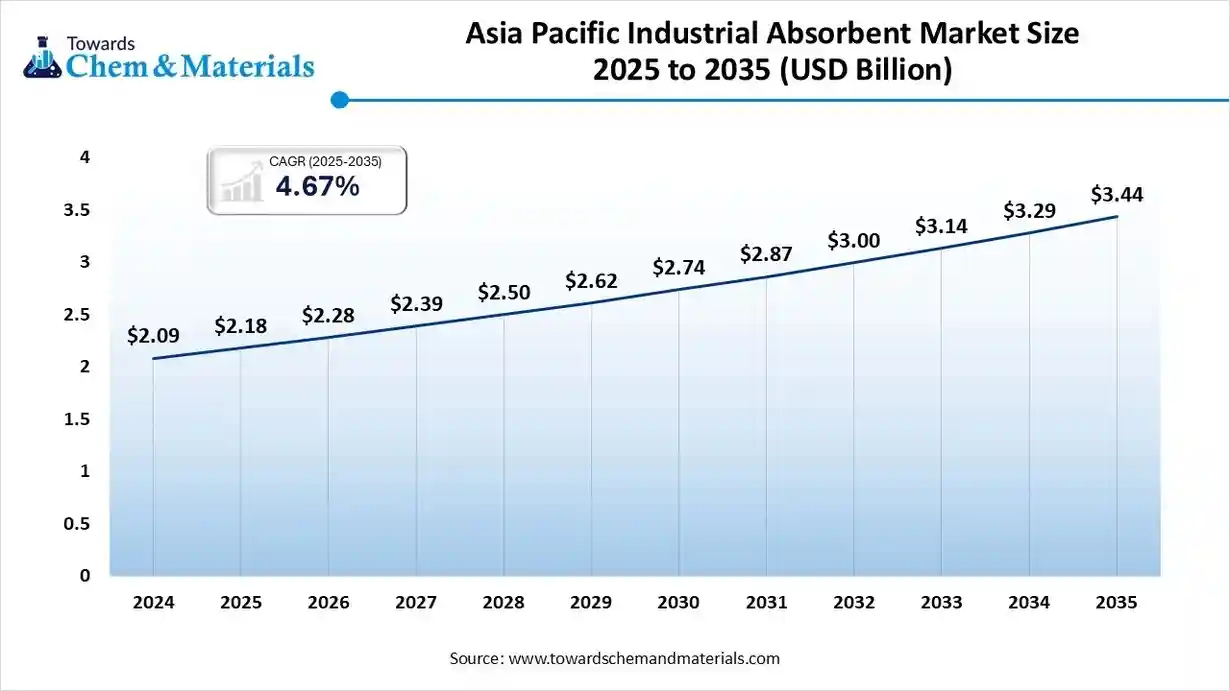

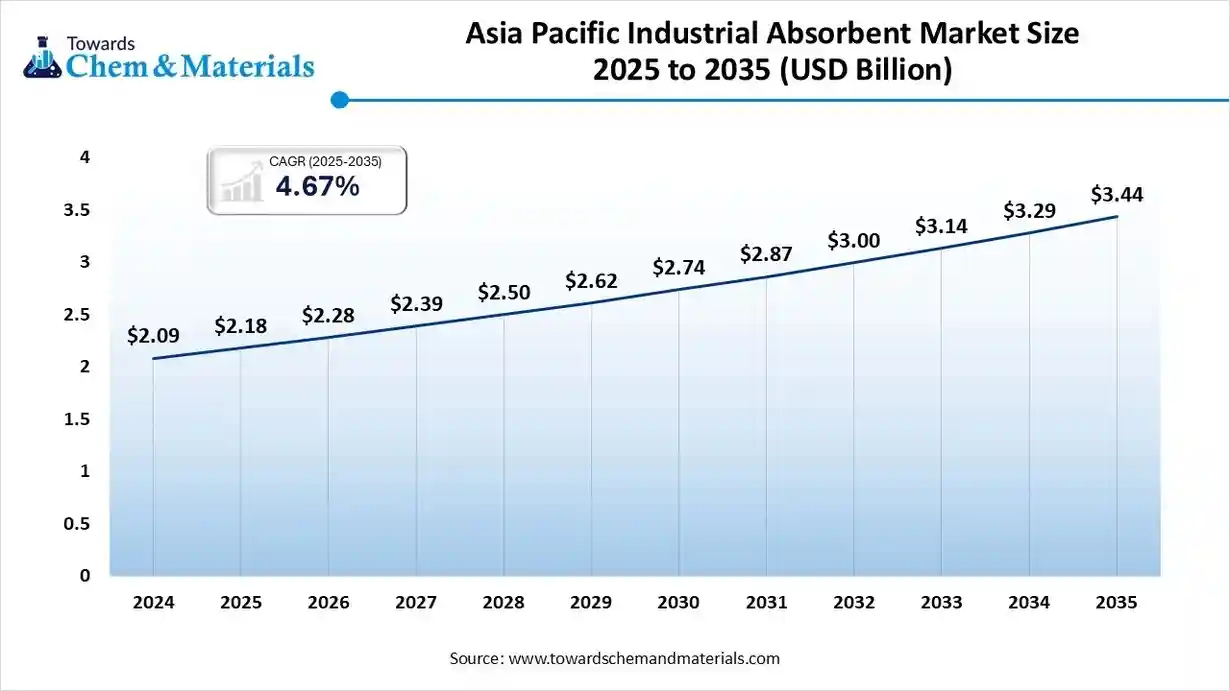

Asia Pacific industrial absorbent market size was valued at USD 2.18 billion in 2025 and is expected to reach USD 3.44 billion by 2035, growing at a CAGR of 4.67% from 2026 to 2035. Asia Pacific is the fastest-growing region in the forecast period, driven by rapid industrialisation, expanding manufacturing hubs, and rising oil and gas operations.

Many countries in the region continue to expand their chemical, automotive, electronics, and petrochemical sectors, increasing the likelihood of spills and leakage incidents during production and transport. As these industries scale up, the need for reliable absorbent materials rises accordingly.

Growing awareness of workplace safety and environmental management is increasing the use of industrial absorbents across factories, ports, and refineries. Governments and regulatory bodies have been strengthening safety standards and encouraging companies to adopt better spill-prevention practices. This has led industries to maintain higher inventories of pads, rolls, booms, and granular absorbents to ensure faster response and compliance.

How Did North America Dominated The Industrial Absorbent Market In 2025?

North America dominates the industrial absorbent market due to strong industrial, oil and gas, and chemical manufacturing activity.The region has a large number of refineries, production plants, and transport terminals, where spill risks are frequent, creating a continuous demand for reliable absorbent products. High operational intensity across these facilities keeps the need for spill response materials consistently high.

Strict environmental compliance laws, particularly around spill control and hazardous waste handling, create a steady demand for high-performance absorbents. Regulations from agencies such as the Environmental Protection Agency and the Occupational Safety and Health Administration require businesses to implement fast and effective spill management practices. As a result, companies maintain a regular stock of absorbents to meet safety standards and avoid penalties.

United States: Industrial Absorbent Market Growth Trends

The U.S. leads regional consumption, driven by stringent EPA regulations, large-scale oil refining capacity, and robust manufacturing sectors. These industries operate in environments where spills, leaks, and routine equipment maintenance require reliable absorbent products, making the U.S. one of the strongest demand centers in the region. Compliance with federal spill-prevention requirements underscores the need for high-quality absorbents.

Demand for universal, oil-only, and chemical absorbents is high across petrochemicals, automotive, maritime, and industrial maintenance. Each of these sectors handles large volumes of liquids, including hazardous chemicals and petroleum products, which must be controlled quickly to protect workers and prevent contamination. As facilities expand production and increase automation, absorbent usage becomes even more crucial for daily operations.

India: Industrial Absorbent Market Growth Trends

India shows strong growth due to expansion in the chemicals, pharmaceuticals, and petroleum refining sectors. These industries handle large volumes of liquids and hazardous substances, which increases the need for efficient spill control materials. As production capacity grows and new facilities come online, demand for industrial absorbents continues to rise across major manufacturing clusters.

Rising enforcement of pollution control norms and accident-prevention regulations is boosting the adoption of industrial absorbents in factories and at hazardous-material-handling sites. National and state authorities have strengthened rules on spill response, waste management, and workplace safety, encouraging companies to maintain adequate spill kits and absorbent supplies. This regulatory pressure supports greater use in day-to-day operations and emergency response.

Europe Has Seen Growth Driven By The Established Industrial Sectors

Europe’s industrial absorbent industry is shaped by strong environmental laws, circular economy initiatives, and established industrial sectors. These policies guide companies toward safer production practices and encourage the use of materials that reduce long-term environmental impact. As a result, industrial facilities across Europe are placing greater emphasis on spill prevention and responsible waste management, thereby strengthening demand for high-quality absorbents.

The region prioritises eco-friendly absorbents made from cellulose, natural fibres, and recycled materials. This focus aligns with the European Union's sustainability goals, which encourage industries to reduce reliance on petroleum-based materials and increase the use of renewable resources. Many manufacturers are introducing greener product lines to comply with these expectations while maintaining strong performance in industrial applications.

Germany: Industrial Absorbent Market Growth Trends

Germany is a key contributor due to its advanced manufacturing base, especially in automotive and heavy engineering. These industries operate complex production lines and machinery that require strict control of oils, coolants, and other chemical fluids, thereby increasing the routine use of industrial absorbents. High production output and continuous operations make spill prevention and quick cleanup essential for maintaining efficiency.

Adoption of high-efficiency absorbents is supported by rigorous environmental compliance standards and workplace safety norms. Germany follows strong regulatory frameworks that require companies to manage hazardous liquids responsibly and minimise contamination risks. These rules encourage factories, logistics centers, and engineering facilities to maintain reliable absorbent products on hand for both emergency response and daily maintenance.

South America Market Growth Driven By The Increasing Environmental Efforts

South America’s market is expanding steadily, supported by vibrant oil and gas production, mining, and chemical processing. These sectors handle large volumes of liquids and hazardous materials, which increases the need for reliable spill control products. As industrial activity grows across countries such as Brazil, Argentina, and Chile, facilities rely more heavily on absorbents to maintain safe and efficient operations.

Increasing environmental oversight and efforts to reduce spill-related contamination are driving demand for absorbents. Governments and regulatory agencies in the region are strengthening rules that require companies to adopt better spill prevention and cleanup practices. This has encouraged both large industries and mid-sized operations to keep proper absorbent materials available on-site to avoid fines and mitigate environmental damage.

Brazil: Industrial Absorbent Market Growth Trends

Brazil leads the region due to its large petroleum sector, strong mining activity, and expanding manufacturing footprint. These industries handle significant volumes of fuels, lubricants, chemicals, and process fluids, which increases the need for reliable spill control solutions. As Brazil continues to scale up extraction activities and industrial output, the use of absorbents becomes essential for maintaining operational safety.

Industrial absorbents are widely used for spill control, equipment maintenance, and hazardous leak prevention. Facilities rely on pads, booms, rolls, and granular absorbents to manage routine drips and accidental releases across production sites, refineries, and transport terminals. Their consistent use helps protect workers, prevent costly shutdowns, and maintain cleaner work environments.

Middle East & Africa (MEA): Growth Supported By Regulatory Enhancements

The Middle East and Africa’s demand is strongly linked to high oil and gas activity, petrochemical expansion, and ongoing infrastructure development. These industries handle large volumes of crude oil, refined products, chemicals, and industrial fluids, making effective spill control a critical part of daily operations. As regional energy projects continue to grow, the requirement for reliable absorbent materials increases across drilling sites, storage facilities, and transport hubs.

Industrial absorbents are essential for spill containment, pipeline maintenance, and refinery operations. They help prevent contamination, reduce equipment damage, and support safer working conditions in environments where leaks and drips are common. Absorbents are also widely used during routine inspections and maintenance activities to ensure the smooth functioning of high-value assets.

South Africa: Industrial Absorbent Market Growth Trends

South Africa is a major MEA market due to its developed mining, manufacturing, and chemicals industries. These sectors involve frequent handling of fuels, solvents, and process liquids, which makes spill control a routine operational need. As mining sites, factories, and processing plants operate at high capacity, industrial absorbents play an important role in maintaining workplace safety and preventing equipment contamination.

Increased regulatory compliance and environmental protection requirements drive the use of absorbents in industrial plants and transportation hubs. National authorities have strengthened rules related to spill management, hazardous material handling, and pollution prevention, which encourage companies to maintain adequate spill response materials. These regulations apply to ports, rail terminals, and road transport operators, further supporting widespread adoption.

Recent Developments

- In September 2025, the Council of Scientific & Industrial Research (CSIR) and Filament Factory launched a nano-reinforced polymer composite material for various manufacturing processes, including 3D printing. This material offers a combination of lightweight properties, mechanical strength, and enhanced electrical and radio frequency absorption, making it suitable for aerospace, electronics, healthcare, and industrial applications.(Source: www.voxelmatters.com)

- In November 2025, RZLabs introduced the FOLIDOTA series, a 3D-printed non-Newtonian composite material for sports protective gear. This material uses patented technology to absorb over 95% of impact energy, meeting CE certification requirements and targeting applications in extreme sports and general protective wear.(Source : www.digitaljournal.com)

- In April 2025, Planet Smart introduced a biodegradable material specifically formulated for hygiene products. This innovation is presented as a sustainable substitute to address environmental concerns within the hygiene sector.(Source : worldbiomarketinsights.com)

Top players in the Industrial Absorbent Industry & Their Offerings:

- Evonik Industries AG - Produces speciality superabsorbent polymers (SAPs) used in industrial spill control, wastewater treatment, and chemical containment. Evonik focuses on high-performance polymer technologies that enhance absorbency and environmental safety.

- BASF SE - A major producer of chemical absorbents and superabsorbent materials for industrial spill management. BASF's portfolio includes SAPs, chemical-neutralising absorbents, and sustainable sorbent solutions used across industrial and environmental applications.

- Oil-Dri Corporation of America - Specialises in clay-based and mineral absorbents for oil, chemical, and industrial spill clean-up. Their products include granular absorbents, mats, and sweeping compounds used in manufacturing, automotive, and environmental services.

- Darcy Spillcare Manufacture - Specialises in spill response products, including oil spill absorbents, chemical absorbents, granules, and custom spill kits. Serves oil & gas, marine, and industrial sectors with compliance-focused solutions.

- Chemtex Inc - Manufactures oil-only, chemical, and universal absorbents along with spill kits, booms, and pillows. Chemtex products are widely used in environmental cleanup, marine operations, and industrial safety.

- 3M – 3M produces a wide range of industrial absorbents, spill control pads, rolls, and booms designed for oil, chemical, and water-based spills. The company emphasizes fast absorption, safety compliance, and high-performance materials.

- New Pig Corporation – New Pig specializes in spill control products including absorbent socks, mats, booms, and containment solutions. The company is widely recognized for workplace spill kits and industrial leak-control systems.

- Brady Worldwide, Inc. – Brady provides industrial absorbents and spill management products through its SPC division. Its offerings include chemical, universal, and oil-only absorbents used in manufacturing and environmental cleanup.

- Johnson Matthey – Johnson Matthey offers specialty absorbent and filtration materials used in industrial processes, emission control, and chemical handling. The company focuses on high-performance materials engineered for safety and environmental protection.

- Tolsa S.A. – Tolsa manufactures mineral-based absorbents, including sepiolite and bentonite products, used for industrial spill cleanup, environmental remediation, and chemical containment.

- Ansell Ltd. – Ansell supplies safety solutions including protective gloves, gear, and absorbent materials used for chemical handling and spill control in industrial environments.

- Meltblown Technologies Inc. – Meltblown Technologies produces meltblown polypropylene absorbents including pads, rolls, socks, and booms for oil, chemical, and universal spill applications with high absorption capacity.

- Cleanis SAS – Cleanis manufactures sanitary absorbent and containment products used in healthcare and hygiene settings. Its solutions focus on safe liquid management and contamination control.

- Sukano AG – Sukano develops additive masterbatches used in absorbent and specialty polymer products. Its materials enhance fluid absorption, processing efficiency, and product performance.

- W. W. Grainger, Inc. – Grainger distributes a broad range of industrial absorbents, spill containment kits, and workplace safety supplies. The company partners with top manufacturers to serve industrial, commercial, and government clients.

- SPC (Brady subsidiary) – SPC provides high-performance absorbents including meltblown polypropylene mats, pads, and booms engineered for chemical, oil, and industrial spill control applications.

- EP Minerals – EP Minerals produces mineral-based absorbents including diatomaceous earth, clay, and perlite products for spill cleanup, filtration, and industrial applications. Its absorbents are known for strong liquid retention.

- JXY International – JXY International manufactures absorbent pads, booms, rolls, and spill kits, supplying global industrial and marine spill response markets. The company focuses on meltblown polypropylene technology and OEM production.

Segments Covered:

By Type

- Universal

- Oil-only

- HAZMAT/Chemical

By Product

- Pads

- Rolls

- Pillows

- Granules

- Booms & Socks

- Sheets & Socks

- Sheets & Mats

- Others (Rags, Lids, Towels, and Skimmers)

By Material

- Natural Organic Materials

- Cellulose

- Cotton Fibers

- Peat Moss

- Sawdust/Wood Fibers

- Other Natural Organic Materials

- Natural Inorganic Materials

- Clay

- Perlite

- Vermiculite

- Diatomaceous Earth

- Other Inorganic Organic Materials

- Synthetic Polymers

- Polypropylene (PP)

- Polyester (PET)

- Superabsorbent Polymers

- Other Synthetic Polymers

By Absorbency Capacity

- Low Absorbency

- Medium Absorbency

- High Absorbency

By End Use

- Oil & Gas

- Food & Beverage Processing

- Chemical & Petrochemical

- Pharmaceutical & Healthcare

- Automotive & Transportation

- Water & Wastewater Treatment

- Other End Use

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa