Content

What is the Current Oilfield Chemicals Market Volume and Size?

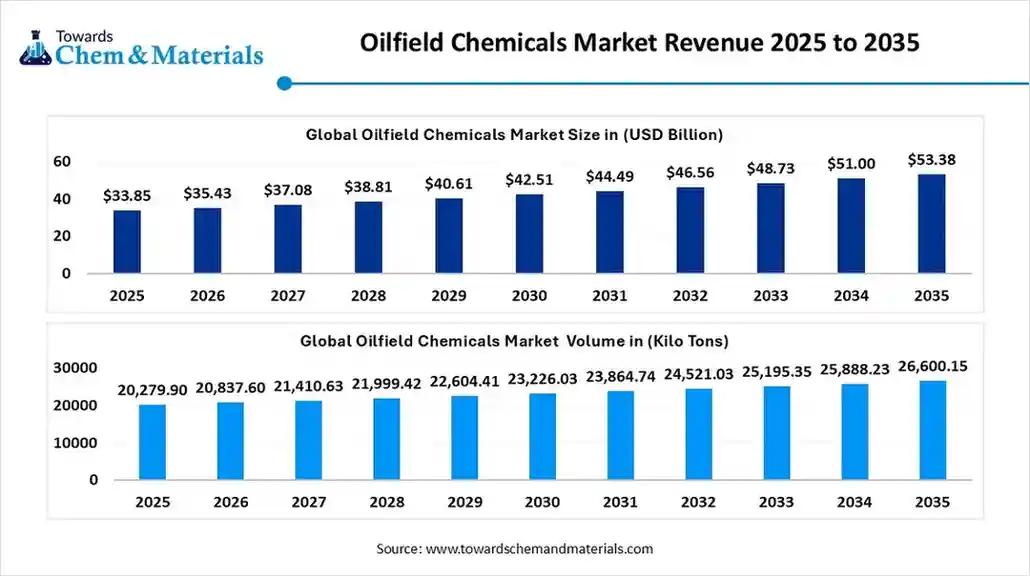

The global oilfield chemicals market is expected to reach a volume of approximately 20,279.9 kilo tons in 2025, with a forecasted increase to 26,600.2 kilo tons by 2035, growing at a CAGR of 2.75% from 2026 to 2035.

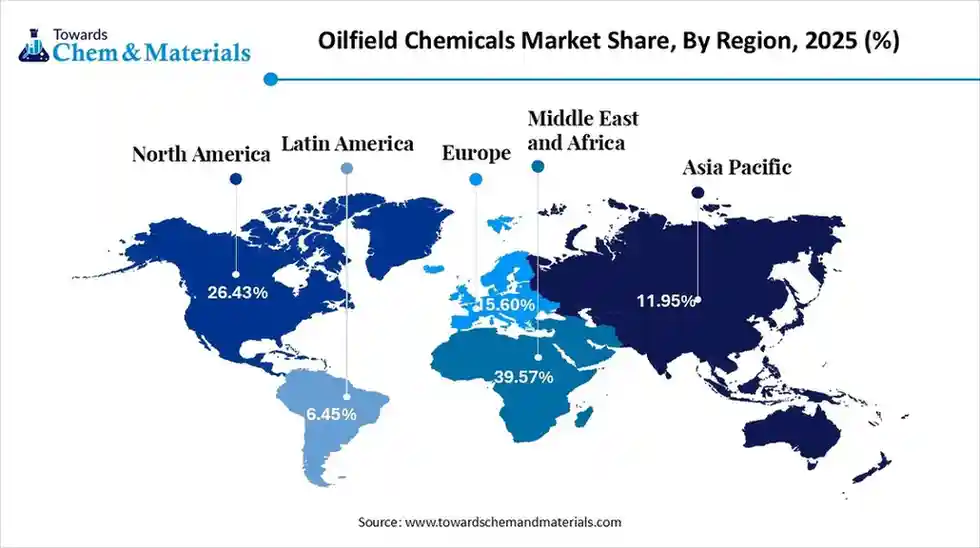

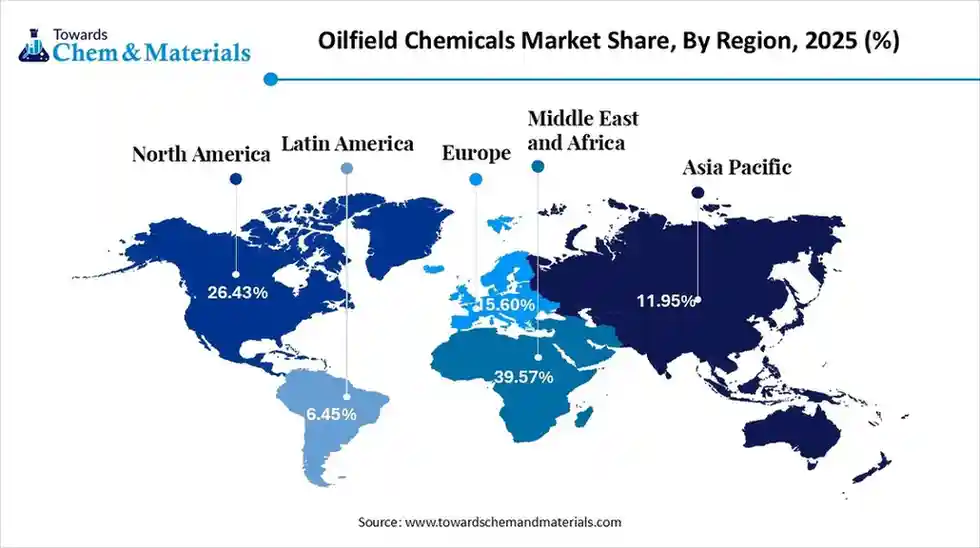

The global oilfield chemicals market size is calculated at USD 33.85 billion in 2025 and is predicted to increase from USD 35.43 billion in 2026 and is projected to reach around USD 53.38 billion by 2035, The market is expanding at a CAGR of 4.66% between 2026 and 2035. North America dominated the oilfield chemicals market with a market share of 26.43% the global market in 2025. The global need for smooth oil and gas operations has fueled the industry's growth in recent years.

Key Takeaways

- The Middle East and Africa oilfield chemicals market held the largest share of 39.57% of the global market in 2025.

- By Region, North America as the fastest growing region the market share of 26.43% in 2025.

- By product, the biocides modifiers segment held the highest market share of 22.45% in 2025.

- By application, the workover & completion modifiers segment held the highest market share of 51.20% in 2025.

- By location, the onshore segment held the largest revenue share of 71.15% in 2025.

- By well type, the onshore segment dominated the market share of 45.20%. 2025.

- By end user, the IOC / NOC / national oil companies segment dominated the market share of 41.20%. 2025.

Essential Field Chemistry: The Backbone of Safe and Smooth Oil & Gas Performance

The oilfield chemicals refer to the special liquids, additives, and powders which used during drilling, production, cementing, and maintenance to keep oil and gas operations running efficiently. Furthermore, by helping in controlling pressure, protecting equipment from rust while stopping blockages, the oilfield chemicals are earning attention for reshaping industry norms in the past few years. Also, the companies are actively using the oilfield chemicals to avoid the expense of the operation.

Oilfield Chemicals Industry Trends:

- The emergence of the smart fluid has enabled the innovation-driven growth in the sector in recent years. Moreover, these fluids have a small sensing particle which has seen in reacting to pressure, heat, and rock type while automatically adjusting flow and thickness as per the latest information.

- The development of low-carbon and water-saving chemicals has led to the emergence of high-impact solutions in the industry in recent years. Moreover, several manufacturers are shifting towards plant-based and low-carbon binders while avoiding the heavy industrial raw material in the past period.

- The integration of the digital monitoring tools is positioning the industry for long-term expansion. Also, several major manufacturers have been using small sensors, cloud dashboards, and tablet applications in recent years.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 35.43 Billion |

| Revenue Forecast in 2035 | USD 53.38 Billion |

| Growth Rate | CAGR 4.66% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Middle East & Africa |

| Fastest Growing Region | North America |

| Segments covered | By Product / Chemical Type, By Application, By Terrain / Well Type, By Region |

| Key companies profiled | Apergy, BASF SE , Dow ,Nalco Champion , Solvay , Albemarle Corporation , Ashland , Clariant , Croda International , Flotek Industries , Innospec , Chevron Phillips Chemical Company (Huntsman ), Lubrizol , The Lubrizol Corporation (additives) ,Elementis, Kemira Nouryon , CES Energy Solutions , Zirax Ltd. |

Adaptive Wellsite Blenders: Reducing Cost and Boosting Accuracy

A major technology shift is the move toward small, modular machines that mix chemicals directly at the wellsite instead of shipping large pre-made batches. These machines adjust formulas instantly based on local pressure, temperature, and water quality. This reduces storage, spills, transport costs, and delays. It also gives operators fresh, perfectly balanced chemicals for every job.

Value Chain Analysis of the Oilfield Chemicals Market:

- Distribution to Industrial Users :Oilfield chemicals are distributed to industrial users primarily through a combination of large, integrated oilfield service companies and specialized chemical distributors. The largest industrial users, such as National Oil Companies (NOCs) and International Oil Companies (IOCs), often establish direct contracts with major manufacturers and service providers for bulk supply to their operational sites.

- Key Players: BASF SE, Solvay S.A., Clariant, and Nouryon

- Chemical Synthesis and Processing :The chemical synthesis and processing of oilfield chemicals is a specialized sector dominated by major multinational chemical producers and integrated oilfield service companies. These players develop and manufacture a diverse range of products, such as corrosion inhibitors, surfactants, and drilling fluids, essential for efficient oil and gas exploration and production.

- Key Players: Saint-Gobain (France), Imerys (France/U.S.), Ltd., and HarbisonWalker International (HWI) (U.S.)

- Regulatory Compliance and Safety Monitoring :Regulatory compliance and safety monitoring in the oilfield chemicals market involve adhering to a complex, multi-layered framework of international, national, and local regulations designed to protect human health and the environment.The primary goal is to mitigate the risks associated with the manufacture, transport, use, storage, and disposal of hazardous substances inherent in oil and gas operations

- Key Agencies: Environmental Protection Agencies, Occupational Safety and Health Administration (OSHA), and Bureau of Safety and Environmental Enforcement (BSEE)

Oilfield Chemicals Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Occupational Safety and Health Administration (OSHA) | Clean Water Act (CWA) | Transparency in chemical use (especially fracking fluids) |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC) No 1907/2006 | Ensuring the safe use of all chemicals |

| China | Ministry of Ecology and Environment (MEE) | Environmental Protection Law | Strengthening environmental protection |

Segmental Insights:

Product/Chemical Type Insights

How did the Drilling Fluids & Production Chemicals Segment Dominate the Oilfield Chemicals Market in 2025?

- The drilling fluids & production chemicals segment dominated the market in 2025 due to its use in every well work and job. Moreover, by keeping the hole stability, while colling the drill bit, the drilling fluids have gained major industry attention in recent years. Moreover, the production chemicals have seen an offering of corrosion-resistant and bacterial protection.

- On the other hand, the enhanced oil recovery (EOR) / specialty recovery chemistries (surfactants, polymers) segment is expected to grow at a significant rate owing to companiese seeking more clever ways to get more oil from old fields. Moreover, the factors such as the affordability and greener initiatives of the EOR are likely to create lucrative opportunities in the coming years.

- The cementing additives segment is also notably growing, owing to having better durability in deeper drills and tougher conditions. Furthermore, by delivering greater water resistance while handling pressure, the cementing additives have created their own presence in the industry in the past few years.

Application Insights

Why does the Drilling Segment Dominate the Oilfield Chemicals Market by Application?

- The drilling segment dominated the market in 2025, because it's step one for finding and producing oil and gas. Every new well needs drilling fluids and many chemicals to keep the operation safe and efficient. Drilling jobs also happen in many locations- onshore, offshore, deepwater, where the demand is widespread.

- The stimulation segment is expected to grow at a rapid rate because more wells need help to produce enough oil or gas. Stimulation like hydraulic fracturing or acid treatments- opens tiny rock pathways so hydrocarbons flow better. As easy reservoirs decline, operators rely on stimulation to boost output from tight, shale, and ageing fields.

- The well intervention & workover segment is also notably growing because many older wells need repairs, upgrades, or production boosts. Instead of drilling new wells, companies fix or improve existing ones to extend life and cut costs. Interventions use chemicals for scale removal, corrosion control, and cleanouts.

Terrain/Well Type Insights

How did the Onshore Segment Dominate the Oilfield Chemicals Market in 2025?

- The onshore segment dominated the market in 2025, because most oil and gas wells are on land and onshore projects cost less to drill and operate than offshore. Onshore rigs are easier to reach, need simpler logistics, and use common, well-proven chemicals. Countries with big land production, such as the United States, China, and Brazil, create huge local demand for supplies.

- On the other hand, the offshore segment is expected to grow at a significant rate because many easy onshore fields are mature, and future large reserves often sit under deep water. Offshore projects need advanced chemicals for high-pressure, high-salt, and extreme conditions, so higher-value products are used.

End User/Buyer Insights

Why does the IOC / NOC / National Oil Companies Segment Dominate the Oilfield Chemicals Market by End User?

- The IOC / NOC / national oil companies segment dominated the market in 2025 because they control the largest fields, big projects, and long-term contracts. IOCs and NOCs run mega-projects- refineries, offshore platforms, and national basins that need enormous volumes of chemicals and long supplier relationships.

- The independent operators / E&P companies segment is expected to grow at a rapid rate because they run many of the flexible, fast-moving projects that define future production. These companies focus on faster returns, modular field development, and marginal wells-- where targeted chemicals and cost-effective solutions matter most.

- The service companies/oilfield service providers segment is also notably growing because they deliver the hands-on work and technology that operators need, especially for complex or remote jobs. These firms bundle chemicals with equipment, skilled crews, and digital monitoring so operators can avoid in-house complexity.

Regional Analysis:

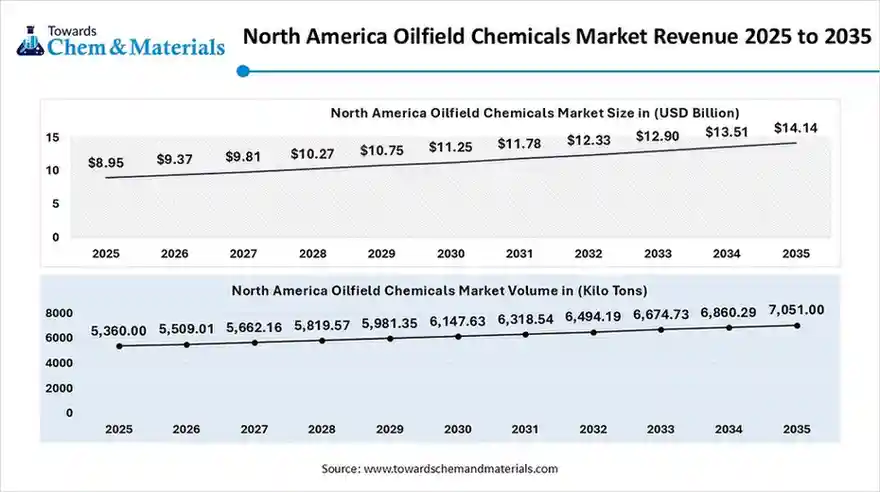

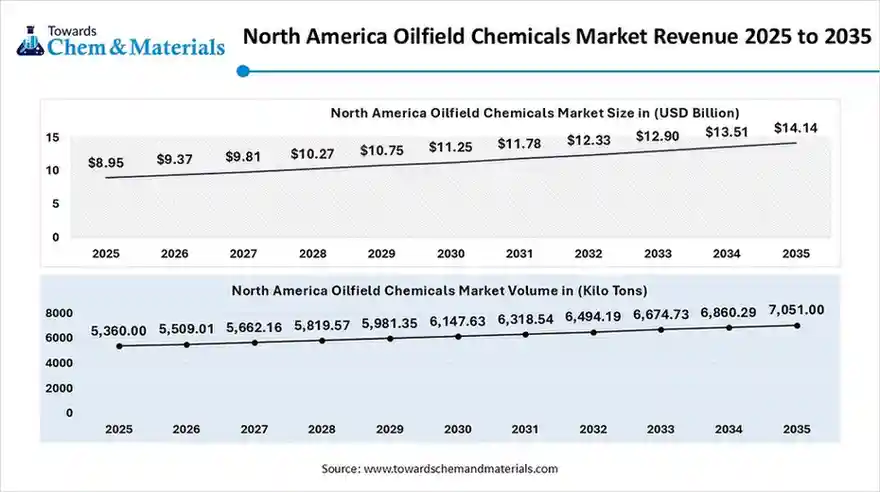

The North America oilfield chemicals market size was valued at USD 8.95 billion in 2025 and is expected to surpass around USD 14.14 billion by 2035, expanding at a compound annual growth rate (CAGR) of 4.68% over the forecast period from 2025 to 2035. The North America oilfield chemicals market stands at 5,360.0 kilo tons in 2025 and is forecast to reach 7,051.0 kilo tons by 2035, growing at a CAGR of 8.49% from 2026 to 2035.

North America Oilfield Chemicals Market Trends

North America is expected to grow at the fastest rate in the oilfield chemicals market, owing to the region has seen under heavy drilling activity while stronger shale production in recent years. Moreover, the presence of the major service companies has contributed to regional growth in the past few years. Also, the early adoption of advanced technology is driving industry growth in the region nowadays.

Robust Gas and Shale Output Drives United States Chemical Demand

United States maintained its dominance in the North America’s oilfield chemicals market due to the country has one of the world's largest gas and shale oil industries in the current period. Moreover, regions like New Mexico, Texas, and Pennsylvania have observed under the heavy demand of drilling fluids, production chemicals, and well care additives in recent years. Also, the stronger supply chain is another factor in the country's growth nowadays.

Middle East and Africa Oilfield Chemicals Market’s Dominance

Middle East and Africa dominated the oilfield chemicals market, owing to the region being known for their world's largest oil and gas fields, where the need for long-term chemical support is a major factor. Moreover, in the Middle East, regional governments have actively invested in new drilling, enhanced oil recovery, and gas expansion programs, while Africa has preferred longer contracts with large suppliers and a stable atmosphere, which is likely to lead to heavy future demand.

Long Life Energy Projects Boost Saudi Arabia’s Chemical Demand

Saudi Arabia is expected to emerge as a prominent country for the oilfield chemicals market in the coming years, owing to ongoing investment in long-life projects as per the latest survey. Moreover, the country's oil giants are heavily upgrading petrochemical and refinery operations, where the demand for the chemicals is likely to create lucrative opportunities in the coming years for corrosion control and inhibitor scaling.

Asia Pacific Oilfield Chemical Sector Evaluation

Asia Pacific is a notably growing region due to greater investment in the local energy securities in the current period. Also, many major brands are seen as using advanced chemicals for the wells to handle high temperatures, tight formulations, and offshore conditions in the current period. Furthermore, the government's push for the advanced oilfield projects has actively supported the industry's growth in recent years.

China’s Deep Offshore Investments Transform the Oilfield Chemicals Landscape

China is expected to gain a major industry share, akin to the ongoing governmental push towards the development of the local oil and gas fields and deep offshore basins. Also, the having the stronger manufacturing base, country has seen under heavy oil field chemicals where the advanced technology has played major role in recent years.

Oilfield Chemicals Market Study in Europe

Europe is expected to capture a notable share of the oilfield chemicals market because it is modernizing aging fields, improving offshore operations, and shifting to cleaner, more efficient production methods. Strict environmental rules encourage the adoption of low-toxicity, low-emission, and water-efficient chemicals.

Can Germany’s Energy Transition Boost Its Oilfield Chemicals Market?

Germany is expected to emerge as a prominent country for the oilfield chemicals market in the coming years because it has one of the world's strongest chemical and engineering industries, which helps develop safer, cleaner, and high-performance oilfield chemicals. Germany focuses on improving refinery efficiency, maintaining older wells, and supporting energy transition projects like hydrogen and synthetic fuels.

Recent Developments

- In June 2025, Nouryon unveiled the establishment of the Innovation Centre for oilfield solutions. Moreover, the company is focused on sustainable, innovative, and tailored solutions for the oilfields as per the published report.(Source: www.indianchemicalnews.com)

Top Vendors in the Oilfield Chemicals Market & Their Offerings:

- Baker Hughes: Baker Hughes is an energy technology company providing a range of products and services for the oil and gas industry, as well as broader energy and industrial sectors.

- SLB: SLB (formerly Schlumberger) is a global technology company that provides digital solutions and innovative technologies to unlock performance and sustainability for the global energy industry.

- Halliburton: Halliburton is one of the world's largest providers of products and services to the energy industry, helping customers maximize asset value throughout the well lifecycle.

- ChampionX: ChampionX, a part of the Apergy Corporation, provides chemistry programs and engineering services to optimize production and protect assets in the oil and gas field.

Other Key Players

- Apergy

- BASF SE

- Dow

- Nalco Champion

- Solvay

- Albemarle Corporation

- Ashland

- Clariant

- Croda International

- Flotek Industries

- Innospec

- Chevron Phillips Chemical Company (Huntsman

- Lubrizol

- The Lubrizol Corporation (additives)

- Elementis

- Kemira

- Nouryon

- CES Energy Solutions

- Zirax Ltd.

Segments Covered in the Report

By Product / Chemical Type

- Drilling fluids & additives (mud systems, weighting agents, rheology modifiers)

- Production chemicals (corrosion inhibitors, scale inhibitors, demulsifiers, paraffin/wax inhibitors, biocides, H₂S scavengers

- Stimulation chemicals (fracturing fluids, friction reducers, gelling agents, breakers)

- Cementing additives (retarders, accelerators, dispersants)

- Well intervention & completion chemicals (cleaners, packer fluids, spotting fluids)

- Enhanced Oil Recovery (EOR) / specialty recovery chemistries (surfactants, polymers)

- Environmentally friendly/green formulations

By Application

- Drilling

- Production & Flow Assurance

- Stimulation (fracturing, acidizing)

- Well Intervention & Workover

- EOR & Specialty Applications (chemical EOR, CO₂-compatible chemistries)

By Terrain / Well Type

- Onshore (shallow & unconventional)

Offshore (shallow & deepwater)

By End User / Buyer

- IOC / NOC / National oil companies (Direct supply & long-term contracts)

- Independent operators / E&P companies (growing shares in shale/unconventional)

- Service companies/oilfield service providers

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa