Content

Super Absorbent Polymer Market Volume and Growth 2025 to 2034

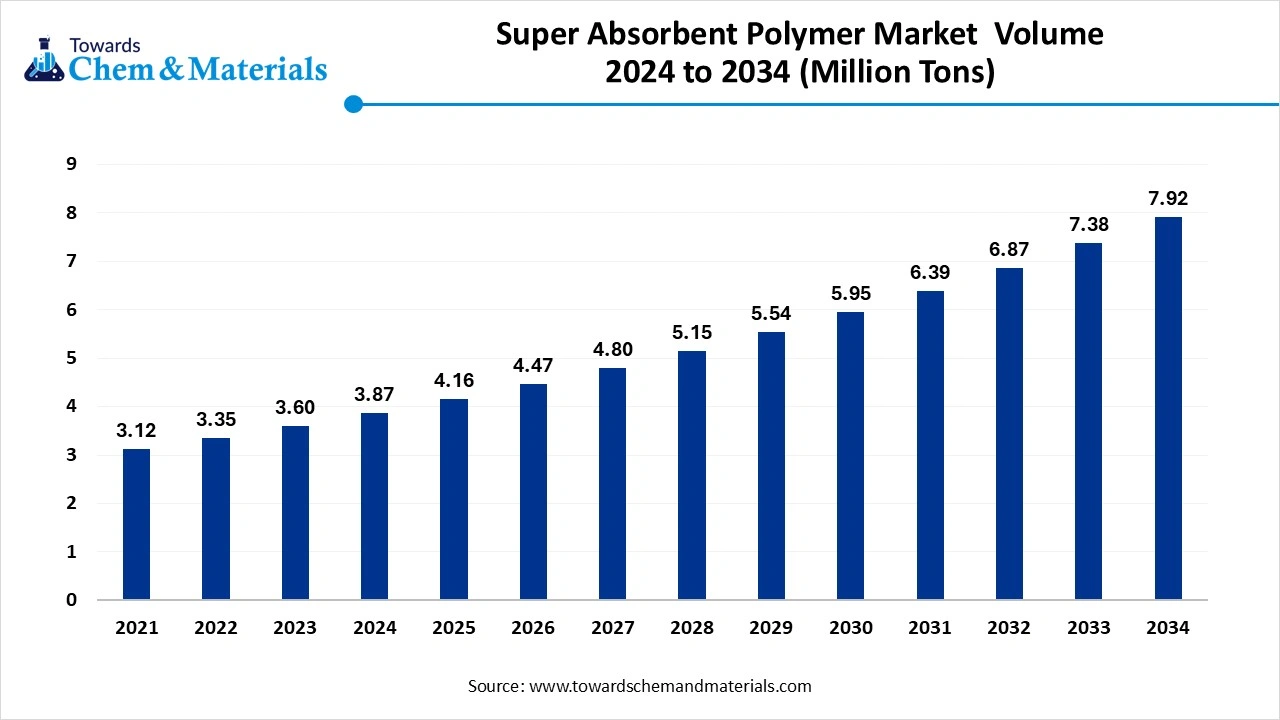

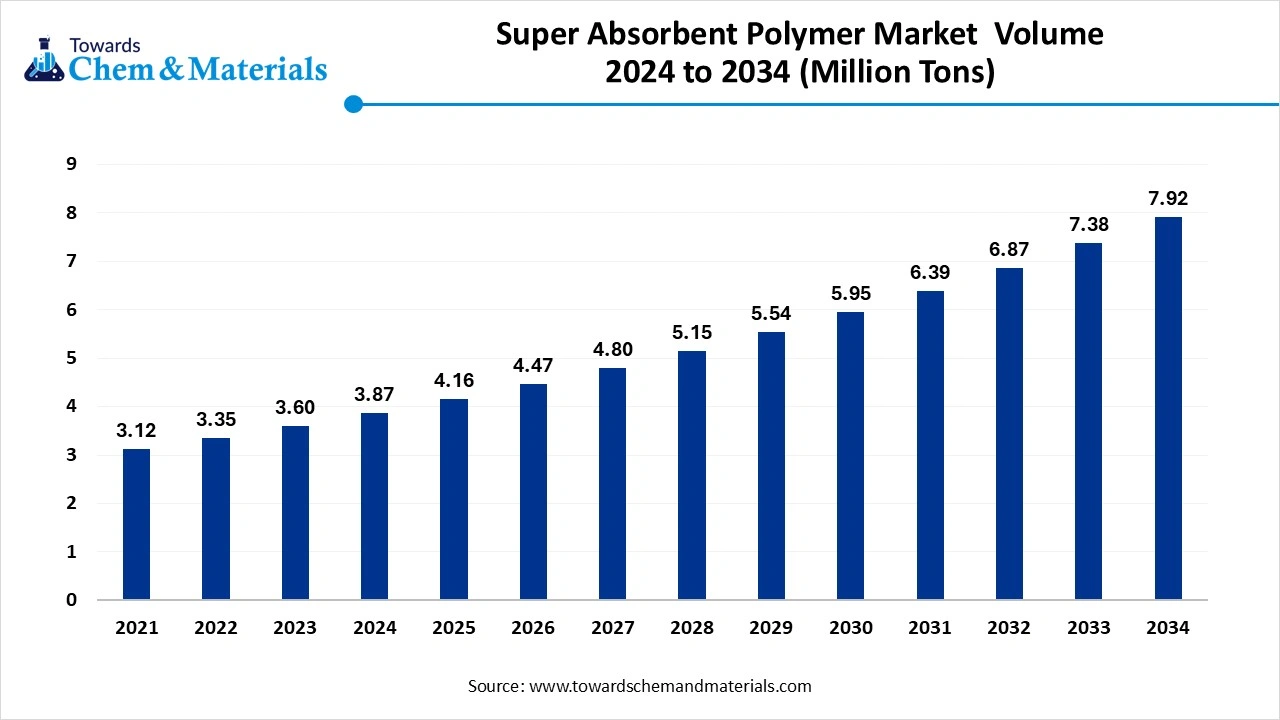

The global super absorbent polymer market volume accounted for 4.16 million tons in 2025 and is forecasted to hit around 7.92 million tons by 2034, representing a CAGR of 7.43% from 2025 to 2034. The growth of the market is driven by the increasing demand for personal hygiene products, agriculture, and water treatment, which increases the growth of the market.

Key Takeaways

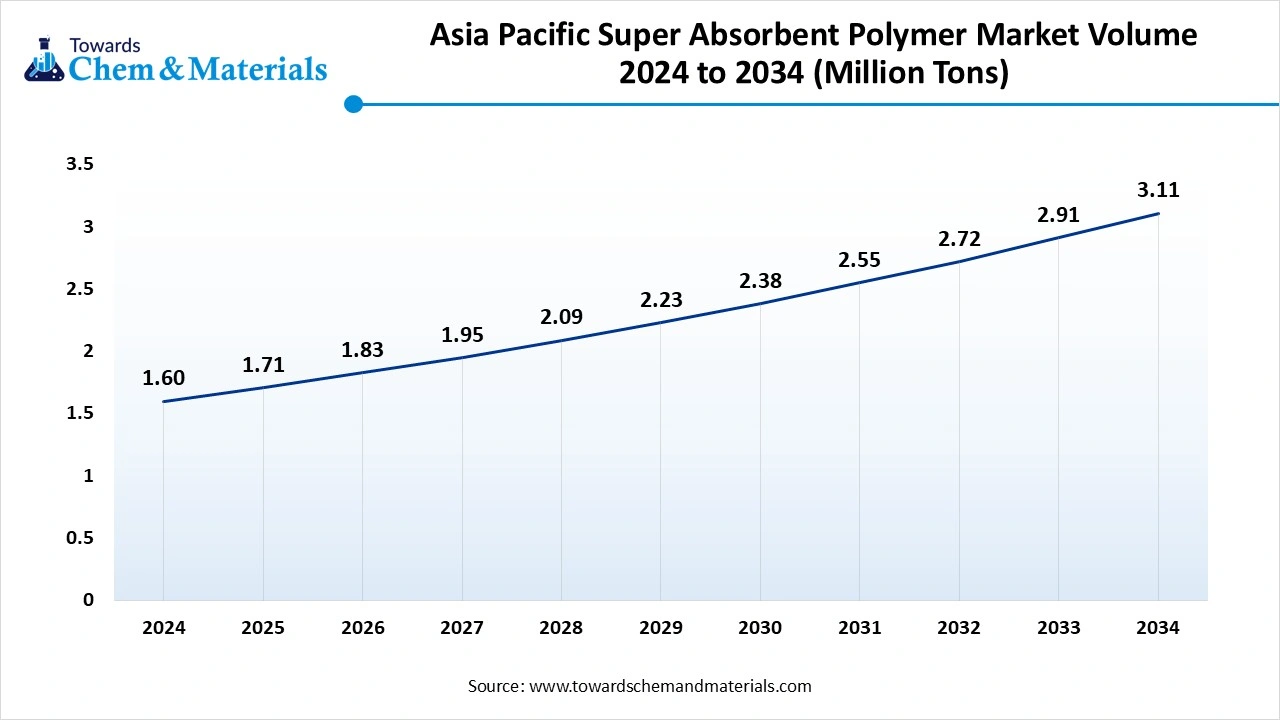

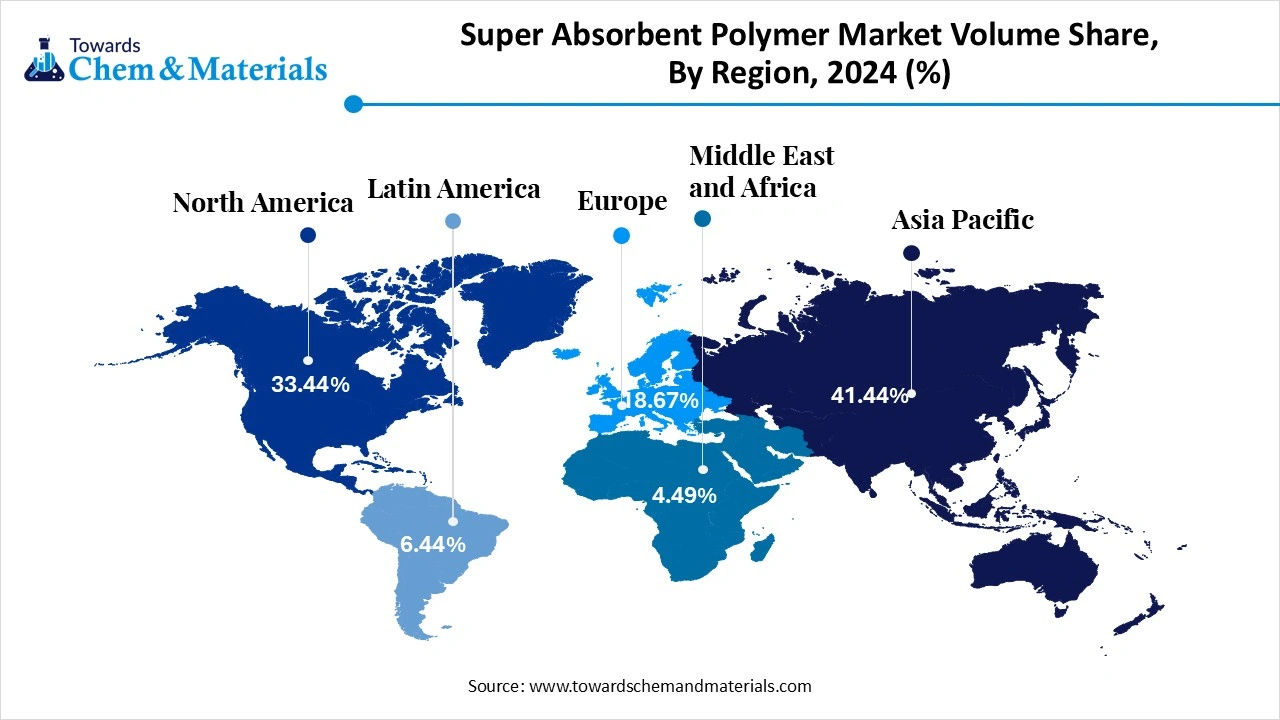

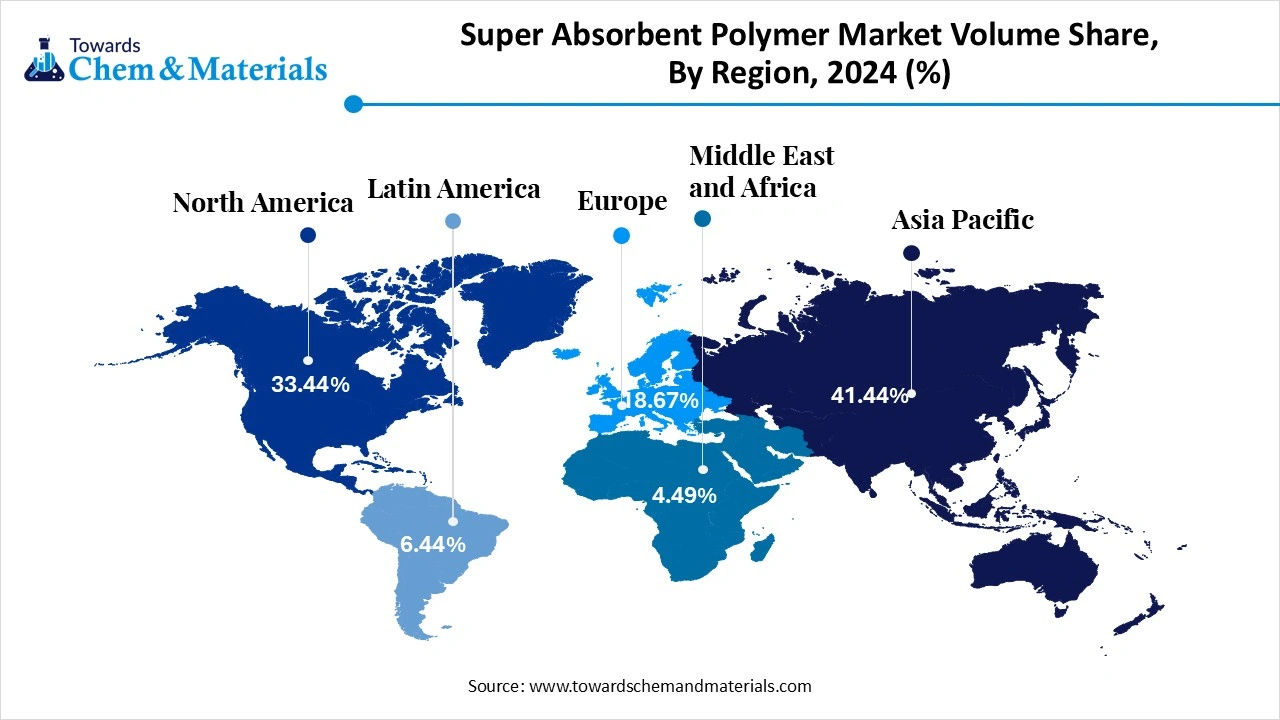

- The Asia Pacific Super Absorbent Polymer market held the largest Volume Share of 41.44% of the global market in 2024.

- The North America Super Absorbent Polymer market is expected to register the fastest CAGR of 7.32% over the forecast period by 2025-2034

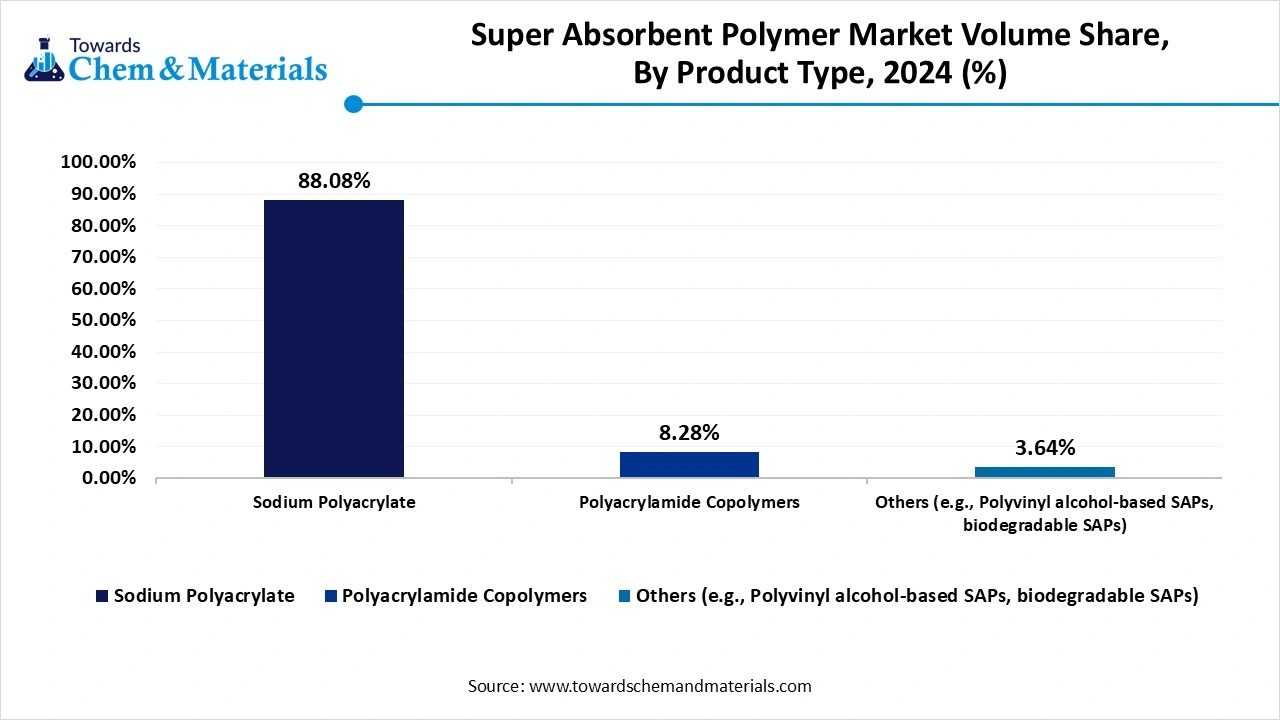

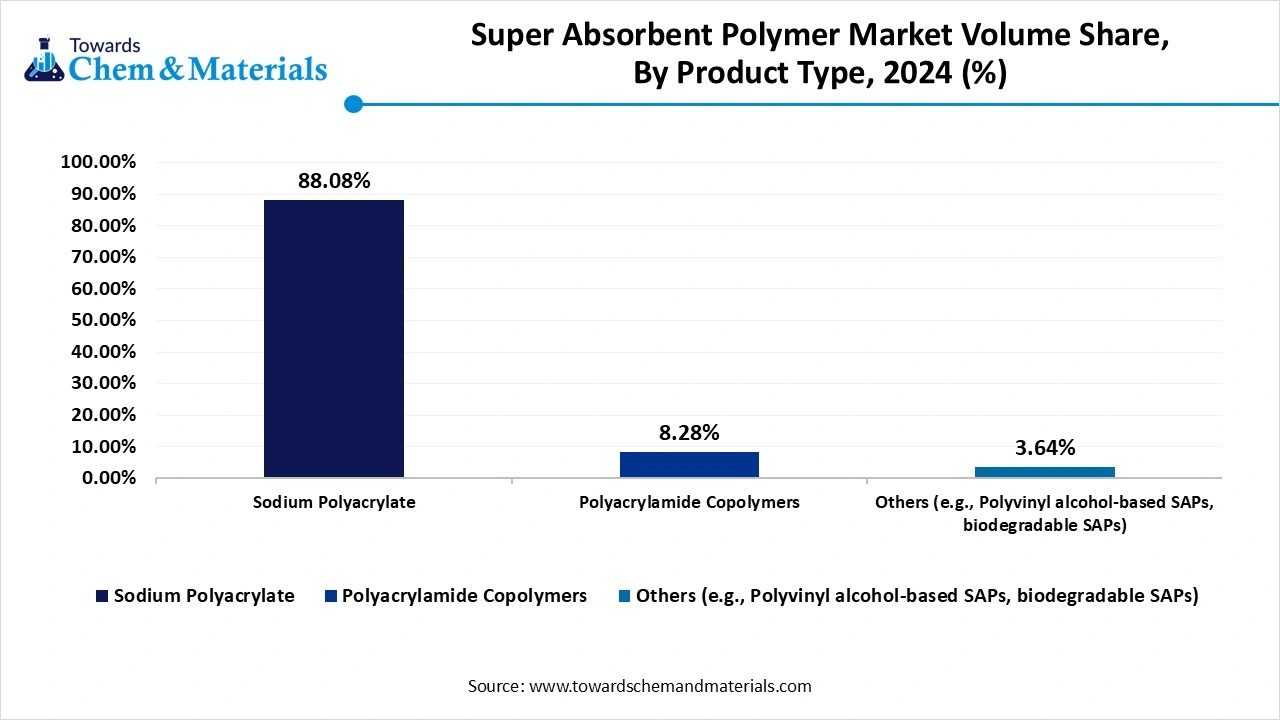

- By Product Type, the Sodium Polyacrylate segment dominated the market with the largest Volume Share of 88.08% in 2024.

- By Product Type, the Polyacrylamide Copolymers segment is projected to grow at the fastest CAGR of 10.84% over the forecast period by 2025-2034

- By form, the powder segment dominated the market in 2024. The powder segment held a 60% share in the market in 2024.

- By form, the film segment is expected to grow in the forecast period. The growing demand from industries boosts the demand.

- By source, the synthetic (petro-based) segment dominated the market in 2024. The synthetic (petro-based) segment held an 85% share in the market in 2024.

- By source, the bio-based SAPs segment is expected to grow in the forecast period. Demand for environment-friendly products drives the growth.

- By application, the personal hygiene segment dominated the market in 2024. The personal hygiene segment held a 75% share in the market in 2024.

- By application, the agriculture and horticulture segment is expected to grow in the forecast period. The demand for products fuels the growth of the market.

- By end use, the personal care segment dominated the market in 2024. The personal care segment held a 70% share in the market in 2024.

- By end use, the agriculture segment is expected to grow in the forecast period. The growing sector in various regions drives the growth.

- By distribution channel, the retail/ E-commerce segment dominated the market in 2024. The retail/ E-commerce segment held a 45% share in the market in 2024.

- By distribution channel, the direct sales to the agri-players segment are expected to grow in the forecast period. The demand from key players drives the growth.

Market Overview

Rising Demand for Durable Materials: Super Absorbent Polymer Market to Expand

Super Absorbent Polymers (SAPs) are either synthetic or natural substances capable of absorbing and holding vast quantities of liquids, such as water or aqueous solutions, relative to their weight, sometimes hundreds or thousands of times more. These materials are usually cross-linked, hydrophilic polymers that form gel-like structures upon hydration. The primary application of SAPs is in hygiene products like diapers, adult incontinence items, and sanitary pads. They are also used in agriculture to improve soil water retention and decrease irrigation needs. Additional applications include water-blocking cables, artificial snow, spill containment, and some medical uses. SAPs can be classified into synthetic types most common, made from acrylic acid or acrylamide and natural types, which are derived from materials such as cellulose, chitosan, or starch.

What Are the Key Drivers Responsible for The Growth of The Super Absorbent Polymer Market?

The key growth drivers responsible for the growth of the market are the demand for personal hygiene products due to increasing awareness, especially for adult incontinence and baby diapers, in agriculture to improve water retention in soil, and optimize water usage and reduce irrigation frequency especially for the arid and semi-arid regions which increases the demand for the market. The growing demand for efficient water treatment, like sludge dewatering and wastewater treatment. Other key drivers are the growing trend towards adoption and use of biobased and biodegradable SAP to minimize environmental impacts and medical applications like medical dressings and wound care products due to its highly absorbent property, driving the growth and expansion of the market.

Market Trends

- The technological advancements to improve the performance and sustainability for the development of new products and increasing the application drive the growth.

- The growing environmental concerns and growing adoption of biobased and biodegradable products are a growing trend in the market, responsible for the growth.

- The rising demand for hygiene products due to increasing awareness of heavily and advanced SAP applications drives the growth.

- The specialty applications, like SAP, are increasing in use in industrial applications like water treatment, soil stabilization, and spill containment drives the growth.

Market Report Scope

| Report Attributes | Details |

| Market Volume in 2025 | 4.16 Million Tons |

| Market Volume by 2034 | 7.92 Million Tons |

| Growth rate from 2024 to 2025 | CAGR 7.43% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Form, By Source, By Application, By End-use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | BASF SE (Germany), Evonik Industries AG (Germany), Nippon Shokubai Co., Ltd. (Japan), Sumitomo Seika Chemicals Co., Ltd. (Japan), LG Chem Ltd. (South Korea), SDP Global Co., Ltd. (Japan) , Yixing Danson Technology (China), Zhejiang Satellite Petrochemical Co., Ltd. (China), Chase Corp (USA) , Formosa Plastics Corporation (Taiwan), Songwon Industrial Co., Ltd. (South Korea), Sanyo Chemical Industries, Ltd. (Japan), Shandong Nuoer Biological Technology Co., Ltd. (China) , Toshima Manufacturing Co., Ltd. (Japan) , Henan Xinlianxin Fertilizer Co., Ltd. (China) , Acuro Organics Ltd. (India), Axchem International (France) , Chemtex Speciality Limited (India), SNF Group (France) , M2 Polymer Technologies, Inc. (USA) |

Market Opportunity

What Is the Key to Opportunity Responsible for The Growth of The Super Absorbent Polymer Market?

The key growth opportunity responsible for the growth of the market is the growing demand for personal hygiene products and technological advancements, which help the growth of the market. The demand for diapers and incontinence products, which have superior liquid absorption for is in growing demand along with feminine hygiene products due to rising awareness of personal hygiene and changing lifestyles, which boosts the consumption of SAP, which helps in the growth of the market. The technological advancements with ongoing research and development in SAP technology for the production of more efficient and eco-friendly products help in the growth and expansion of the market.

Market Challenge

What Are the Key Challenges That Hinder the Growth of The Market?

The key challenge that hinders the growth of the market is the rising environmental concerns due to the non-biodegradable nature of the Superabsorbent polymer which increases the concern due to its long-term impact on the environment which lowers the adoption and demand for biobased and biodegradable alternative which also increases the cost of production and final cost of the product which limits the growth and hinders the expansion of the market.

Regional Insights

How Did Asia Pacific Dominate the Super Absorbent Polymer Market In 2024?

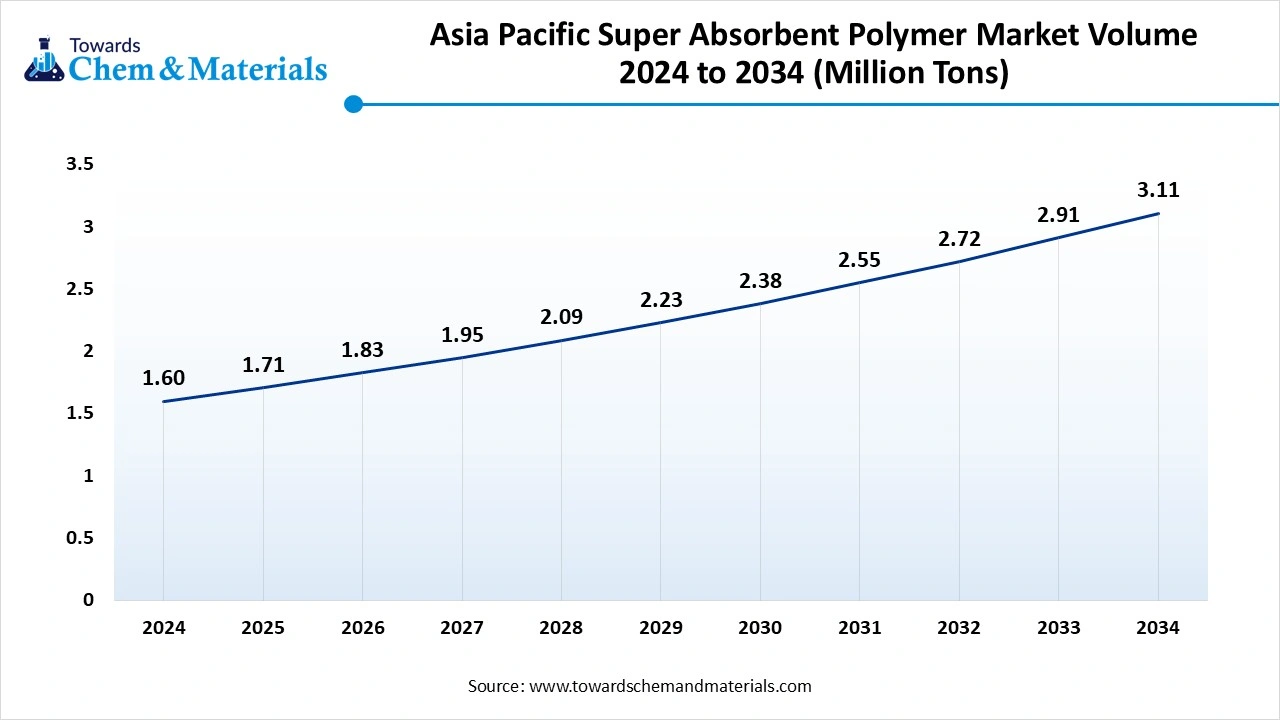

The Asia Pacific Super Absorbent Polymer market volume amounted to nearly 1.71 million tons worldwide in 2025 and is expected to rise to around 3.11 million tons by 2034, growing at a healthy CAGR of 6.87% between 2025 an 2034. Asia Pacific dominated the Specialty Polymers market with a market Volume share of 41.44% in 2024.

The growth of the market in the Asia Pacific is driven by the growing demand for personal hygiene products, urbanization, and population growth, which increases the demand for the product. Increasing disposable income contributes to the higher adoption of personal hygiene products. The growing application due to increasing industrialization in the region, like agricultural applications to enhance water retention and in industries for wastewater treatment, drives the growth of the market in the region. Nippon Shokubai, BASF, Sumitomo Seika Chemicals, Sanyo Chemical, and Evonik Industries are among the major players in the Asia Pacific SAP market, which plays a crucial role in the growth and development of innovative products which increasing the growth of the market.

The growth of the market in the Asia Pacific is driven by the growing demand for personal hygiene products, urbanization, and population growth, which increases the demand for the product. Increasing disposable income contributes to the higher adoption of personal hygiene products. The growing application due to increasing industrialization in the region, like agricultural applications to enhance water retention and in industries for wastewater treatment, drives the growth of the market in the region. Nippon Shokubai, BASF, Sumitomo Seika Chemicals, Sanyo Chemical, and Evonik Industries are among the major players in the Asia Pacific SAP market, which plays a crucial role in the growth and development of innovative products which increasing the growth of the market.

India Is Experiencing a Robust Growth in The Super Absorbent Polymer Market.

The growth of the market in India is driven by the increasing government initiatives like the Affordable Care Act (ACA) and Medicaid, in India help increase access to healthcare and hygiene products which contributing to the growth and expansion of the market in the country. The growth is also driven by the increasing demand for hygiene products, increased agriculture applications, and medical applications, which fuel the growth of the market in the country.

- The world shipped out 97 Super Absorbent Polymer Granule shipments from September 2023 to August 2024 (TTM). These exports were handled by 29 global exporters to 29 buyers, showing a growth rate of 234% over the previous 12 months.(Source: www.volza.com)

- Globally, China, South Korea, and India are the top exporters of Super Absorbent Polymer Granules. China is the global leader in Super Absorbent Polymer Granule exports with 65 shipments, followed closely by South Korea with 54 shipments, and India in 3rd place with 22 shipments.

(Source: www.volza.com)

Super Absorbent Polymer By Region, 2024-2034 (%)

| By Region Volume (Million Tons) | Market Volume Shares (%)2024 | Market Volume (Million Tons)(2024) | Market Volume Shares (%)2034 | Market Volume (Million Tons)(2034) | CAGR 2025-2034 |

| North America | 33.44% | 1.29 | 33.13% | 2.6 | 7.32% |

| Europe | 18.67% | 0.72 | 20.23% | 1.6 | 8.29% |

| Asia Pacific | 41.44% | 1.60 | 39.32% | 3.1 | 6.87% |

| South America | 6.44% | 0.25 | 7.32% | 0.6 | 8.81% |

| Middle East | 4.49% | 0.17 | 5.01% | 0.4 | 8.63% |

North America Has Seen Notable Growth, Driven by The Increasing Application in Different Sectors.

North America is experiencing notable growth in the super absorbent polymer market in 2024. North America has seen a notable growth in the market driven by the growing hygiene products sector, an increase in the aging population, increasing agriculture applications, and increased use in the packaging sector, which drives the growth of the market in the region. The market is experiencing growth due to the rising concerns over the environmental impact, which increases the adoption of biobased SAP and increases the demand for sustainable products. The key players also play a major role in the growth, aligning with the government support and policies for innovation and product development, increasing the growth and expansion of the market in the region.

The U.S. Super Absorbent Polymer Market

The growth of the market is driven by the growing demand for the products due to increasing medical applications, and agricultural applications, which drives the growth of the market in the country. The growth is also driven by the government support for waste management technologies and biodegradable SAPs amid rising environmental concerns, which further boosts the growth of the market in the country.

Segmental Insights

Product Type Insights

How Did the Sodium Polyacrylate Segment Dominate the Superabsorbent Polymer Market In 2024?

The sodium polyacrylate segment dominated the super absorbent polymer market in 2024. The sodium polyacrylate segment dominates the superabsorbent polymer market owing to its excellent water absorption and retention capabilities. Widely used in personal hygiene products like diapers, sanitary napkins, and adult incontinence products, it can absorb hundreds of times its weight in water. Additionally, sodium polyacrylate is employed in agriculture for soil conditioning and water conservation, as well as in medical and industrial applications. Its cost-effectiveness and high efficiency continue to drive market demand.

The polyacrylamide copolymer segment has seen a notable growth in the super absorbent polymer market during the forecast period. The polyacrylamide copolymer segment in the superabsorbent polymer market is gaining traction due to its versatile properties and specialized applications. Unlike sodium polyacrylate, polyacrylamide copolymers are widely used in industrial and agricultural sectors, particularly for water treatment, sludge dewatering, and soil stabilization. These copolymers improve water retention in soil, enhance plant growth, and support erosion control. Their excellent gel strength and customizable absorption capabilities make them an ideal choice for diverse environmental and engineering applications.

Super Absorbent Polymer By Product Type , 2024-2034 (%)

| By Product Type Volume (Million Tons) | Market Volume Shares (%)2024 | Market Volume (Million Tons)(2024) | Market Volume Shares (%)2034 | Market Volume (Million Tons)(2034) | CAGR 2025-2034 |

| Sodium Polyacrylate | 88.08% | 3.4 | 83.25% | 6.6 | 6.81% |

| Polyacrylamide Copolymers | 8.28% | 0.3 | 11.32% | 0.9 | 10.84% |

| Others (e.g., Polyvinyl alcohol-based SAPs, biodegradable SAPs) | 3.64% | 0.1 | 5.43% | 0.4 | 11.81% |

Form Insights

Which Form Segment Dominated the Super Absorbent Polymer Market In 2024?

The powder segment dominated the super absorbent polymer market in 2024. The powder form segment holds a significant share in the market due to its easy handling, fast absorption rate, and versatility. Powdered superabsorbent polymers are widely used in personal hygiene products, agriculture, medical dressings, and industrial absorbents. Their fine particle size allows for quick and uniform distribution in various formulations, enhancing efficiency. Additionally, powder form is preferred in soil conditioning and water retention applications, as it can be easily mixed and integrated into different systems.

The film segment expects significant growth in the super absorbent polymer market during the forecast period. The film-form segment of the market is valued for its specialized use in advanced hygiene and medical applications. Super absorbent polymer films are thin, flexible layers that offer controlled absorption and superior moisture barrier properties. They are commonly used in wound care dressings, surgical pads, and high-performance sanitary products to ensure dryness and prevent leakage. Their lightweight nature, ease of integration, and ability to conform to body shapes make them ideal for enhancing comfort and protection.

Source Insights

How Did the Synthetic (Petro-Based) Segment Dominate the Super Absorbent Polymer Market In 2024?

The synthetic (petro-based) segment dominated the super absorbent polymer market in 2024. The synthetic petro-based segment dominates the market due to its high performance, cost-effectiveness, and consistent quality. Derived from acrylic acid and other petroleum-based chemicals, these polymers—such as sodium polyacrylate—offer excellent absorption and retention capabilities, making them indispensable in diapers, feminine hygiene products, and adult incontinence pads. Their established manufacturing processes and reliable supply chains further support widespread adoption. However, growing environmental concerns are prompting interest in more sustainable, bio-based alternatives in some regions.

The bio-based SAPs segment expects significant growth in the super absorbent polymer market during the forecast period. The bio-based super absorbent polymers (SAPs) segment is emerging as a promising alternative in response to rising environmental and sustainability concerns. Derived from renewable sources like starch, cellulose, and other natural polymers, these SAPs offer biodegradable and eco-friendly solutions without compromising on absorbency. They are increasingly used in agriculture for soil moisture management, as well as in sustainable hygiene products. Though currently more expensive and less widely produced than synthetic options, bio-based SAPs are expected to gain market traction as green initiatives expand.

Application Insights

Which Application Segment Dominated the Super Absorbent Polymer Market In 2024?

The personal hygiene segment dominated the super absorbent polymer market in 2024. The personal hygiene application dominates the market, accounting for the largest share due to its widespread use in baby diapers, feminine hygiene products, and adult incontinence pads. Super absorbent polymers in these products ensure rapid liquid absorption, excellent retention, and superior dryness, enhancing user comfort and preventing skin irritation. Growing global populations, increasing birth rates in emerging economies, rising aging populations, and greater awareness of personal hygiene drive this segment's growth. Continuous product innovations in thinness and absorbency further strengthen market demand.

The agriculture and horticulture segment expects significant growth in the super absorbent polymer market during the forecast period. The agriculture and horticulture application segment in the market is expanding steadily due to rising focus on water conservation and sustainable farming practices. Super absorbent polymers are used to improve soil water retention, reduce irrigation frequency, and enhance seed germination and plant growth, especially in drought-prone areas. These polymers help maintain soil moisture near roots, prevent nutrient leaching, and support healthier crops. As global agricultural challenges intensify, SAPs offer an effective solution for boosting productivity while addressing environmental and resource concerns.

End Use Insights

How Did the Personal Care Segment Dominate the Super Absorbent Polymer Market In 2024?

The personal care segment dominated the super absorbent polymer market in 2024. The personal care segment is the largest and most significant end-use category in the market, driven by the widespread demand for hygiene products. Super absorbent polymers are essential in baby diapers, adult incontinence products, and feminine hygiene items, where they provide exceptional fluid absorption and retention, ensuring dryness and comfort. Rising global awareness of hygiene, growing aging populations, and increasing disposable incomes continue to boost demand in this segment. Innovation in thinner, more absorbent products further supports market expansion.

The agriculture segment expects significant growth in the super absorbent polymer market during the forecast period. The agriculture segment represents a rapidly growing end-use category in the market, fueled by increasing concerns over water scarcity and the need for efficient irrigation. Super absorbent polymers are used to improve soil moisture retention, enhance seed germination, and support plant growth, especially in arid and drought-prone regions. By reducing the frequency of watering and preventing nutrient leaching, SAPs help farmers achieve higher crop yields and promote sustainable farming practices. Their adoption supports food security and water conservation initiatives globally.

Distribution Channel Insights

Which Distribution Channel Segment Dominated the Super Absorbent Polymer Market In 2024?

The retail/ E-commerce segment dominated the super absorbent polymer market in 2024. The retail and e-commerce segment plays a crucial role in the market, especially for consumer hygiene products like diapers, sanitary pads, and adult incontinence products. With the growing popularity of online shopping, consumers increasingly prefer the convenience and wide selection offered by e-commerce platforms. Retail outlets also remain essential for immediate purchases and brand visibility. Together, these channels enhance product accessibility, support brand growth, and cater to evolving consumer preferences for fast, convenient, and discreet purchasing options.

The direct sales to the agri-players segment are expected to experience significant growth in the super absorbent polymer market during the forecast period. The direct sales to the agri-players segment are a vital distribution channel in the market, particularly for agricultural applications. Through this channel, manufacturers supply SAPs directly to large farming companies, horticulturists, and agribusinesses for use in soil conditioning, water retention, and drought mitigation. This approach enables customized solutions, better technical support, and stronger relationships with end users. By improving soil moisture levels and enhancing crop yield, direct sales to agri-players support sustainable farming practices and help address water scarcity challenges.

Recent Developments

- In April 2025, Plant Smart, a company that focuses on reducing the plastic crisis which are related to disposable hygiene products, launched a product, PlantSorb, which is a biodegradable super absorbent polymer bioSAP. (Source:worldbiomarketinsights.com )

- In July 2024, ZymoChem, a leading biotech company that focuses on developing sustainable materials for everyday producers, launched BAYSE, a scalable, 100% biobased, biodegradable Super Absorbent Polymer (SAP).

(Source:www.chemanalyst.com )

Top Companies List

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Nippon Shokubai Co., Ltd. (Japan)

- Sumitomo Seika Chemicals Co., Ltd. (Japan)

- LG Chem Ltd. (South Korea)

- SDP Global Co., Ltd. (Japan)

- Yixing Danson Technology (China)

- Zhejiang Satellite Petrochemical Co., Ltd. (China)

- Chase Corp (USA)

- Formosa Plastics Corporation (Taiwan)

- Songwon Industrial Co., Ltd. (South Korea)

- Sanyo Chemical Industries, Ltd. (Japan)

- Shandong Nuoer Biological Technology Co., Ltd. (China)

- Toshima Manufacturing Co., Ltd. (Japan)

- Henan Xinlianxin Fertilizer Co., Ltd. (China)

- Acuro Organics Ltd. (India)

- Axchem International (France)

- Chemtex Speciality Limited (India)

- SNF Group (France)

- M2 Polymer Technologies, Inc. (USA)

Segments Covered

By Product Type

- Sodium Polyacrylate

- Polyacrylamide Copolymers

- Others (e.g., Polyvinyl alcohol-based SAPs, biodegradable SAPs)

By Form

- Powder

- Liquid

- Granules

- Flakes

- Film

By Source (Feedstock)

- Synthetic (Petroleum-based)

- Natural/Bio-based SAPs (e.g., starch, cellulose-based)

By Application

- Personal Hygiene

- Baby Diapers

- Adult Incontinence Products

- Feminine Hygiene Products

- Agriculture & Horticulture

- Soil Moisture Preservation

- Water Retention Granules

- Medical

- Wound Care Dressings

- Surgical Pads

- Industrial

- Oil & Chemical Spill Control

- Cable Wrapping

- Packaging

- Food Preservation Pads

- Others (Pet Training Pads, Toys)

By End-use Industry

- Healthcare

- Personal Care

- Agriculture

- Waste Management

- Packaging

- Construction (e.g., Concrete Curing)

- Food Processing

By Distribution Channel

- Direct Sales (OEMs, Large Contracts)

- Distributors / Wholesalers

- Retail / E-commerce

- Specialty Chemical Suppliers

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait