Content

What is the Current Physical Vapor Deposition Market Size and Share?

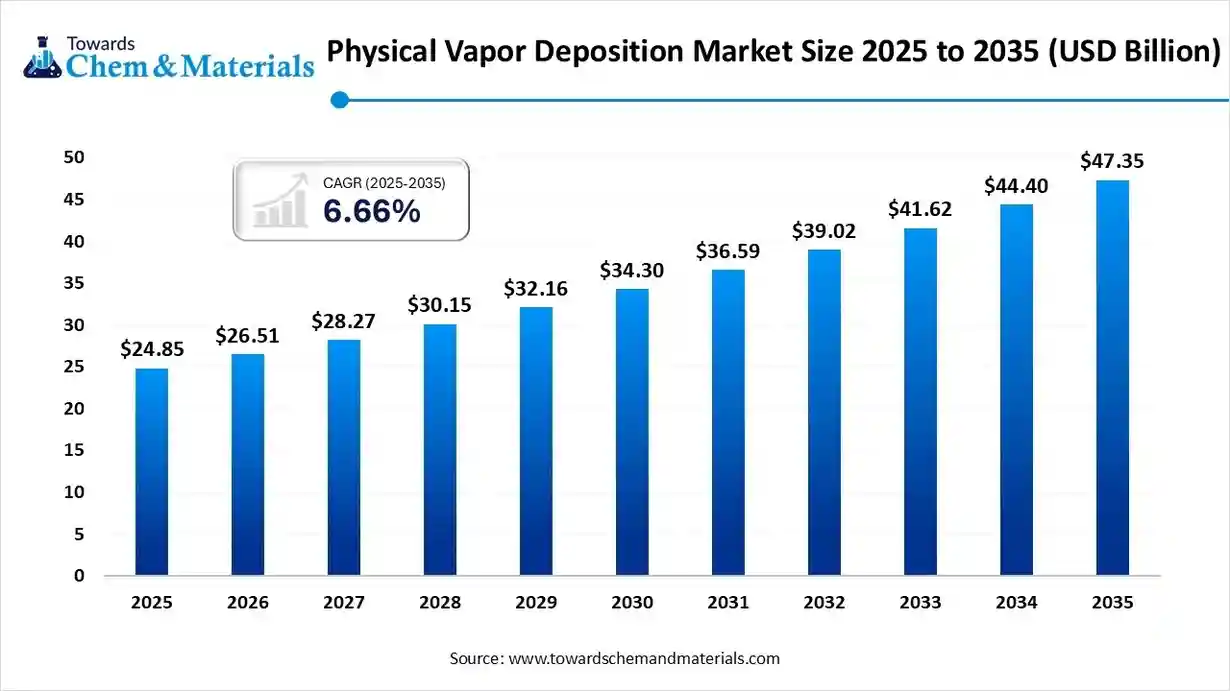

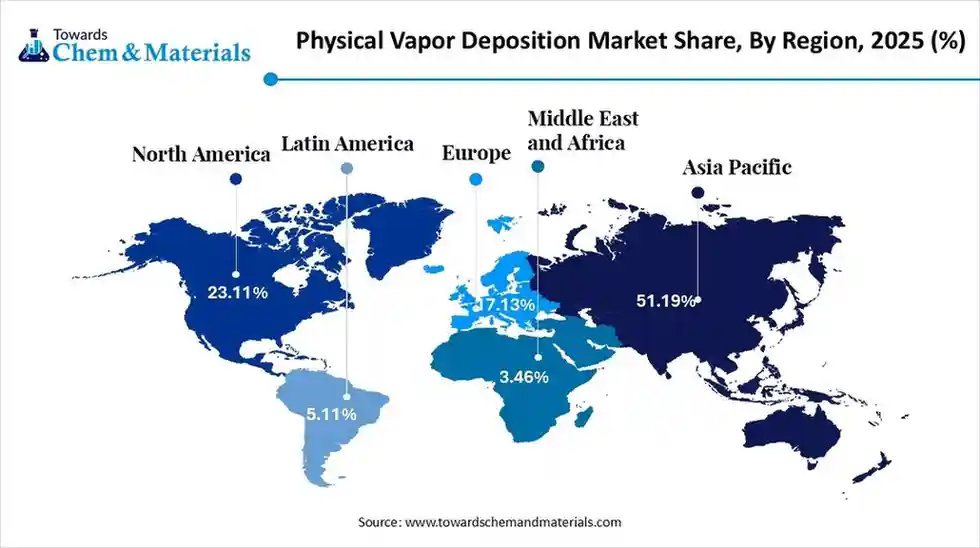

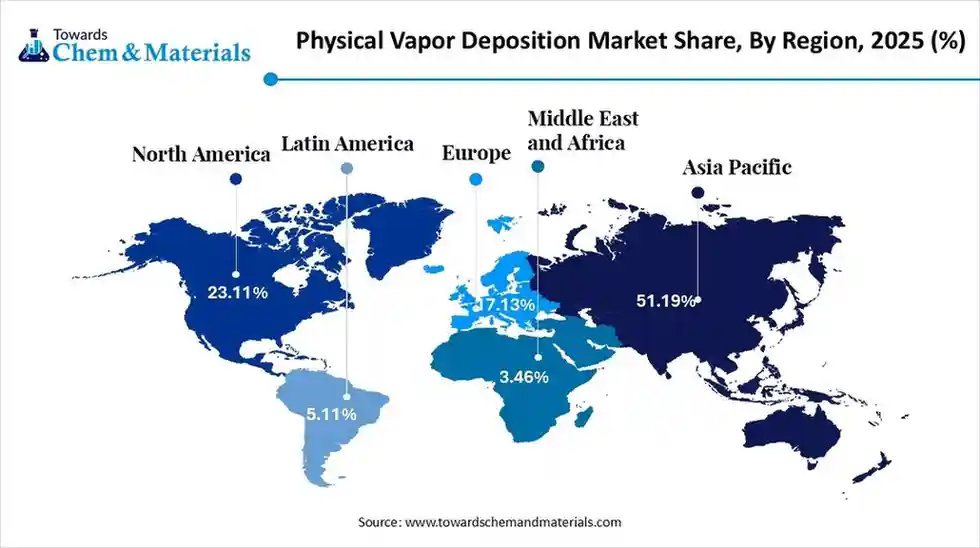

The global physical vapor deposition market size is calculated at USD 24.85 billion in 2025 and is predicted to increase from USD 26.51 billion in 2026 and is projected to reach around USD 47.35 billion by 2035, The market is expanding at a CAGR of 6.66% between 2026 and 2035. Asia Pacific dominated the physical vapor deposition market market with a market share of 51.19% the global market in 2025. The growing electronics industry and the expansion of renewable energy drive the market growth.

Key Takeaways

- Asia Pacific dominated the physical vapor deposition market and accounted for the largest revenue share of 51.19% in 2024..

- Europe is growing at the fastest CAGR in the market during the forecast period.

- By technology, the sputter deposition segment led the market with 47% share in 2025.

- By technology, the HiPIMS or pulsed magnetron sputtering segment is growing at the fastest CAGR in the market during the forecast period.

- By product, the PVD equipment or systems segment led the market in 2025.

- By product, the PVD services & contract coating segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By coating material, the metallic coatings segment led the market in 2025.

- By coating material, the transparent conductive oxides segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end-use, the semiconductors & electronics segment led the market in 2025.

- By end-use, the automotive segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Physical Vapor Deposition?

- Physical vapor deposition (PVD) market growth is driven by the growing use of consumer electronics, expansion of solar energy, development of fuel-efficient vehicle components, rise in manufacturing of medical devices, and innovations in PVD technology.

- Physical vapor deposition (PVD) is a vacuum-based thin-film coating technology that deposits diverse materials on various substrates through various processes, like thermodynamic, mechanical, and electrochemical. PVD coating offers corrosion resistance, decorative finishes, wear protection, and electrical functionality.

- The PVD technique involves three steps like vaporization, transportation of vaporized particles, and condensation of particles into thin films. PVD offers benefits like high strength, hardness, high adhesion, excellent film deposition rates, and durability. PVD is widely used in applications like engine parts, protective films, optical lenses, solar panels, medical devices, and microchips.

Physical Vapor Deposition Market Trends:

- Renewable Energy Expansion:- The growing shift towards renewable energy sources and the development of solar cells increases the adoption of PVD to use as conductive & anti-reflective coatings. PVD enhances the durability and efficiency of thin-film solar cells and supports in maintenance of renewable energy resources. For instance, VON ARDENNE created a PVD solution for TOPCon solar cells.

- Preference for Eco-Friendly Processes:- The strong focus on sustainability and stricter environmental regulations increases demand for eco-friendly processes like PVD to replace methods like electroplating. PVD creates less hazardous waste and uses environmentally-friendly materials like chromium nitride & titanium nitride.

- Growing Electronic Industry:- The growing popularity of electronic devices like laptops, smartphones, computers, wearables, and others increases demand for PVD to create high-performance coatings for electronic components like display panels, integrated circuits, and memory chips.

- Rapid Growth in Medical Devices:- The growing manufacturing of medical devices like surgical instruments, dental implants, and other medical implants requires PVD coatings to enhance wear resistance and biocompatibility. The growing development of durable medical devices and advancements in healthcare require PVD coating.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 26.51 Billion |

| Revenue Forecast in 2035 | USD 47.35 Billion |

| Growth Rate | CAGR 6.66% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segments covered | By Technology / Process, By Product / Offering, By Coating Material / Chemistry, By Application / End-Use, By Region |

| Key companies profiled | OC Oerlikon / Oerlikon Balzers, Kurt J. Lesker Company , IHI / IHI Hauzer, Platit AG, Bühler / Buhler Alzenau GmbH, Singulus Technologies AG, Denton Vacuum / AJA International / Angstrom Engineering, Intevac, Inc., Mustang Vacuum Systems, Advanced Energy Industries, NAURA Technology Group, Semicore Equipment / CHA Industries, Impact Coatings AB |

Key Technological Shifts in the Physical Vapor Deposition Market:

The physical vapor deposition market is undergoing key technological shifts driven by the demand for enhanced reliability, efficient production, and lower material waste. One of the most significant transformations is the integration of artificial intelligence and machine learning, which enhances equipment reliability and enables predictive maintenance. AI helps to develop high-quality coatings and prevents equipment downtime. AI identifies the root cause of defects and develops customized coating solutions. Artificial Intelligence accelerates the development of PVD materials & equipment and offers real-time feedback.

- For instance, B2COAT uses AI in its PVD coating services to optimize process parameters for the development of consistent & uniform coatings.

Physical Vapor Deposition Market Value Chain Analysis

- Feedstock Procurement :The sourcing of high-purity raw materials like chromium, silicon, titanium, aluminum, & other metals for the development of PVD coatings. The raw material is available in condensed or solid phase. The feedstocks, like PS-PVD, sputtering, and evaporation materials, are required for PVD techniques.

- Key Players: Materion Corporation, Stanford Advanced Materials, Plasmamaterials, Inc., MSE Supplies LLC.

- Chemical Synthesis and Processing :The chemical synthesis and processing involve steps like substrate preparation, chamber evacuation, vaporization of material, transportation of vaporized material, and deposition of vaporized particles.

- Key Players: American Elements, Plansee SE, Alfa Chemistry, MSE Supplies LLC

- Quality Testing and Certifications :Quality testing involves evaluation of properties like adhesion, surface roughness, corrosion resistance, coating thickness, hardness, chemical composition, & wear resistance, and certifications like ISO 9001, ISO 10993, ASTM, & AS9100.

- Key Players: Techmetals, Inc., Acree Technologies, Inc., Ionbond, BryCoat, Inc.

PVD Coating Applications Across Diverse Sectors

| Sector | PVD Coating Used | Application Area | Coating Purpose |

| Automotive |

|

|

|

| Electronics |

|

|

|

| Medical |

|

|

|

| Energy and Power |

|

|

|

Segmental Insights

Technology Insights

Why the Sputter Deposition Segment Dominates the Physical Vapor Deposition Market?

- The sputter deposition segment dominated the physical vapor deposition market with 47% share in 2025 The growing complexity of electronic components and the development of aerospace parts require sputter deposition. The excellent uniformity, substrate compatibility, and high deposition rates of sputter deposition help market growth. The growing solar cell production, semiconductor fabrication, and display panels require sputter deposition, driving the overall market growth.

- The HiPIMS or pulsed magnetron sputtering segment is the fastest-growing in the market during the forecast period. The growing production of medical implants and the development of anti-fingerprint surfaces require HiPIMS. The improved film quality and enhanced film properties of HiPIMS help market growth. The growing expansion of sectors like optics, automotive, and electronics requires pulsed magnetron sputtering that supports the overall market growth.

- The thermal evaporation or e-beam evaporation segment is significantly growing in the market. The cost-effectiveness and high deposition rates of thermal evaporation help market growth. The increasing use of metals like silver, chromium, aluminum, and gold in various applications, like decorative coatings, requires thermal evaporation. The development of miniaturized electronic components and medical device manufacturing uses e-beam evaporation, supporting the overall market growth.

Product Insights

How did PVD equipment or the Systems Segment hold the Largest Share in the PVD Market?

- The PVD equipment or systems segment held the largest revenue share in the PVD market in 2025. The growing semiconductor manufacturing and expansion of consumer electronics require PVD equipment. The development of lightweight automotive parts and the increasing need for solar panels require PVD systems. The growing deposition of various materials like ceramics, metals, & alloys on substrates like metals, glass, and plastic requires PVD equipment, driving the overall market growth.

- The PVD services and contract coating segment is experiencing the fastest growth in the market during the forecast period. The growing manufacturing of solar cells, electronic components, and semiconductors requires PVD services. The rise in electric vehicles and the development of lightweight vehicle components require contract coating. The strong focus on enhancing the performance of aerospace components and the development of medical implants requires PVD contract coating, supporting the overall market growth.

- The PVD consumables segment is growing at a significant rate in the market during the forecast period. The growing demand for consumer electronics like laptops & smartphones, and the rise in electric vehicles, requires PVD consumables. The development of autonomous driving systems and long-lasting cutting tools requires PVD consumables, driving the overall market growth.

Coating Material Insights

Why the Metallic Coatings Segment is Dominating the Physical Vapor Deposition Market?

- The metallic coatings segment dominated the physical vapor deposition market in 2025. The strong focus on enhancing conductivity, wear resistance, and corrosion protection in sectors like aerospace, electronics, and automotive requires metallic coatings. The growing use of on-cutting tools and semiconductor fabrication requires metallic coatings. The growing industrial manufacturing base and the rise use of medical devices require metallic coatings, driving the overall market growth.

- The transparent conductive oxides (TCOs) segment is the fastest-growing in the market during the forecast period. The increasing popularity of flat-panel displays and smartphones requires TCOs. The growing expansion of renewable energy and the development of wearable & flexible devices require TCOs. The growing use of laptops, smartphones, and tablets increases the adoption of TCOs that support the overall market growth.

- The nitrides, oxides, and carbides segment is significantly growing in the market. The strong focus on enhancing the longevity, hardness, and wear resistance of components and tools requires nitrides, oxides, and carbides. The growing development of surgical instruments and medical implants requires nitrides, oxides, and carbides. The growing manufacturing in industries like aerospace, electronics, and automotive requires nitrides, oxides, and carbides, supporting the overall market growth.

End-Use Insights

Which End-Use held the Largest Share in the PVD Market?

- The semiconductors and electronics segment held the largest revenue share in the PVD market in 2025. The growing miniaturization of electronic devices and increasing popularity of devices like tablets, wearables, smartphones, & laptops requires PVD. The development of data storage, integrated circuits, memory, and displays requires PVD. The growing semiconductor fabrication and expansion of 5G uses PVD, driving the overall market growth.

- The automotive segment is experiencing the fastest growth in the market during the forecast period. The development of fuel-efficient and lightweight vehicle parts & components requires PVD. The rise in electric vehicles and the increasing use of autonomous driving require PVD for the development of sensors, battery cells, and electrical connectors. The strong focus on enhancing the aesthetic appeal of vehicles and the development of protective finishes requires PVD, supporting the overall market growth.

- The medical devices segment is growing at a significant rate in the market during the forecast period. The growing demand for medical implants and surgical instruments requires PVD. The growing expansion of the medical device industry and strong government support for medical device manufacturing require PVD. The growing development of dental implants, pacemakers, surgical instruments, and orthopedic implants requires PVD, supporting the overall market growth.

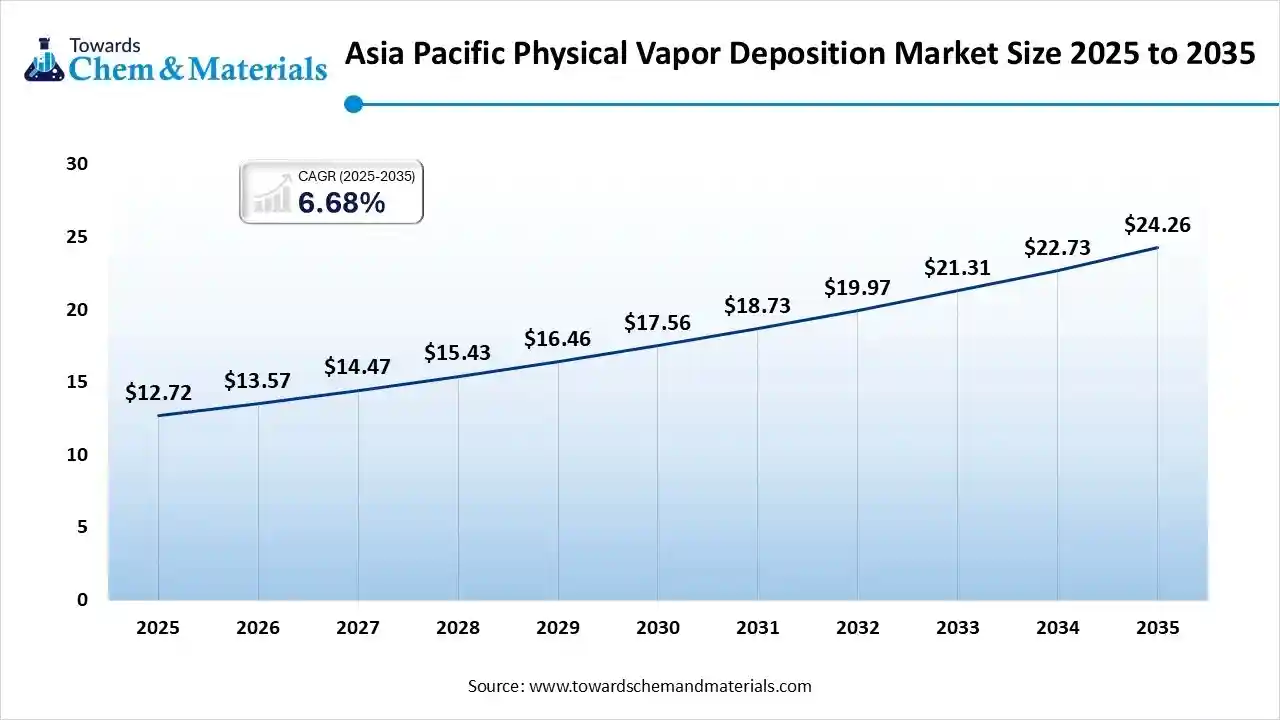

Regional Insights

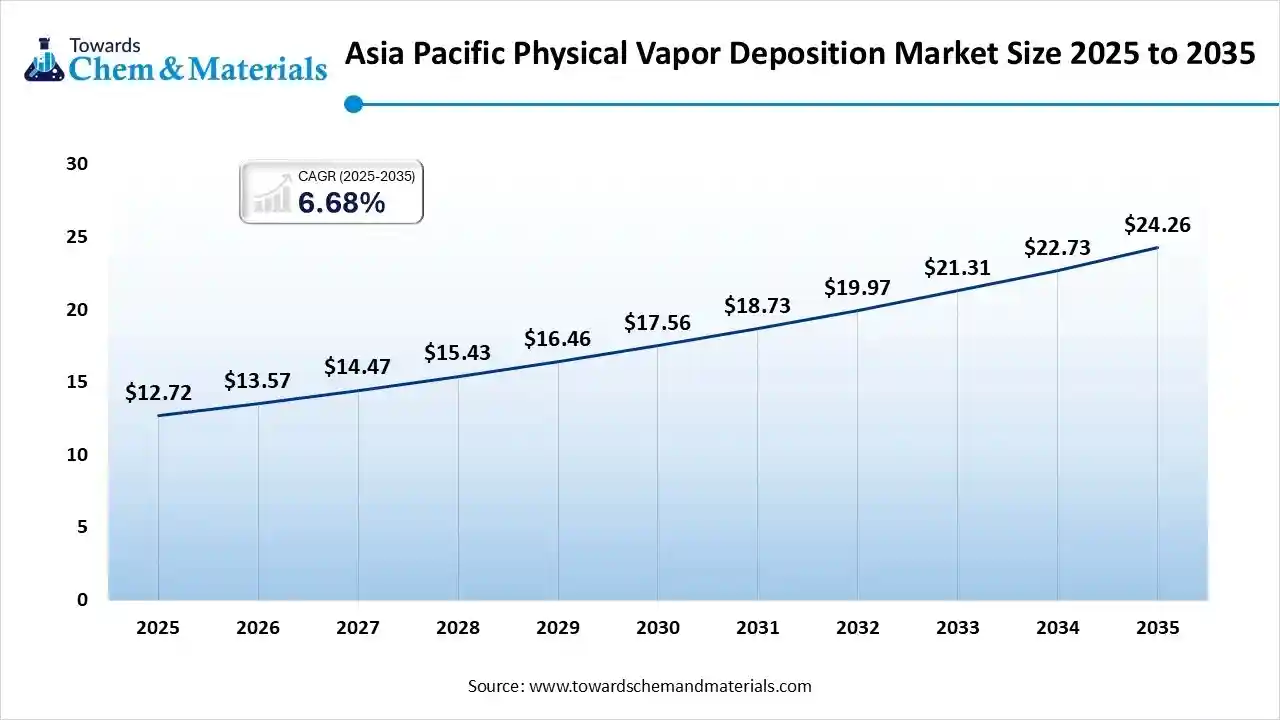

The Asia Pacific physical vapor deposition market size was valued at USD 24.85 billion in 2025 and is expected to reach USD 47.35 billion by 2035, growing at a CAGR of 6.68% from 2026 to 2035.Asia Pacific dominated the physical vapor deposition market in 2025.

The growing manufacturing of microelectronic devices, semiconductors, and LEDs increases demand for PVD. The strong government support for semiconductor and electronics manufacturing in countries like India and China requires PVD. The growing use of PVD coatings on engine parts, aerospace materials, and electric vehicle components helps market growth. The expansion of solar panel manufacturing and increasing industrial activities drive the overall market growth.

Coating Tomorrow: China’s Leadership in PVD Innovations and Development

China is a major contributor to the PVD market. The growing manufacturing of solar equipment and electronic devices requires PVD systems. The strong government support for advanced manufacturing and low production costs helps market growth. The shift towards new energy vehicles and increasing use of PVD systems in the production of display technologies, semiconductors, and microelectronics supports the overall market growth.

Europe Physical Vapor Deposition Market Trends

Europe experiences the fastest growth in the market during the forecast period. The expansion of the automotive industry and the growing manufacturing of aerospace components requires PVD to enhance the aesthetics and functionality of parts. The increasing manufacturing of medical devices requires PVD for the development of biocompatible coatings. The booming semiconductor industry and focus on longevity of solar panels require PVD that drives the overall market growth.

Surface Solutions: Germany's Contribution to PVD Technology

Germany is a key contributor to the PVD market. The well-established automotive manufacturing base and strong presence of microelectronics increase demand for PVD coatings. The strong focus on enhancing the functionality, durability, and biocompatibility of medical devices increases the adoption of PVD. The growing solar industry and well-established industrial base require PVD technology, supporting the overall market growth.

North America Physical Vapor Deposition Market Trends

North America is growing at a notable rate in the market. The strong presence of industries like electronics, aerospace, and medical devices increases demand for PVD to develop high-performance coatings. The rise in autonomous vehicles and the expansion of 5G infrastructure require PVD. The growing government investment in the defense sector and the development of aircraft parts require PVD for the creation of coatings that drive the overall market growth.

United States Role in Physical Vapor Deposition Production and Technology

The United States is rapidly growing in the PVD market. The strong presence of the semiconductor industry and increasing use of solar products require PVD for the development of microelectronics, photovoltaic cells, and electronic components. The increasing spending on advanced medical devices requires PVD for coating purposes. The rise in adoption of electric vehicles requires PVD to enhance component aesthetic and durability, supporting the overall market growth.

From Andes to Atlantic: South America’s Emerging PVD Capabilities

South America is significantly growing in the market. The growing use of autonomous and electric vehicles and the expansion of solar energy capacity require PVD for coatings of solar panels, battery cells, electrical connectors, and sensors. The expanding healthcare sector requires PVD coating to enhance the biocompatibility of surgical & medical devices, driving the overall market growth.

Brazil Physical Vapor Deposition Market Trends

Brazil is growing at a significant rate in the PVD market. The growing expansion of electronics and automotive manufacturing, and advancements in the healthcare sectors, require PVD. The growing construction activities and strong focus on the development of solar energy require PVD for the creation of PVD finishes and solar panels that support the overall market growth.

Middle East & Africa Physical Vapor Deposition Market Trends

The Middle East & Africa are growing in the PVD market. The growing manufacturing of automotive and the expansion of electronics manufacturing require PVD to be used as coatings. The growing development of medical instruments and implants requires PVD for the creation of antimicrobial and biocompatible coatings. The increasing use of renewable energy solutions and focus on boosting defense capabilities require PVD, driving the overall market growth.

Industrial Growth: PVD Progress and Initiatives in Saudi Arabia

Saudi Arabia contributes to the physical vapor deposition market. The strong government focus on lowering reliance on oil through initiatives like Vision 20230 and the Saudi Semiconductor Program increases the adoption of PVD. The increasing investment in semiconductor ecosystems and the development of lightweight vehicle components require PVD. The growing demand for high-performance coatings across various industries supports the overall market growth.

Recent Developments

- In October 2025, Danko Vaccum Technology launched its enhanced portfolio of PVD coating machines. The machine accelerates innovation and controls quality in sectors like electronics, medical, automotive, and jewelry. The features of machines are multi-source capability, uniform coating deposition, energy efficiency, compact design, advanced vaccum systems, uniform coating deposition, and energy efficiency.(Source: www.digitaljournal.com)

- In September 2025, Oerlikon Balzers launched high-performance PVD coating, BALINT OPTURA, for drilling in steel and cast iron. The coating offers high process reliability, enhances productivity, and provides longer tool service life.(Source: www.oerlikon.com)

- In September 2025, Tokyo Electron launched a new sputtering system, LEXIA™-EX. The system supports various applications like 3D NAND devices, advanced logic, and DRAM. The system lowers CO2 emissions by 14% and achieves superior environmental performance. (Source: www.tel.com )

Top Companies List

- Applied Materials, Inc.: The U.S.-based company manufactures and designs equipment for the physical vapor deposition process, and its contributions to PVD systems are the Impulse PVD platform, Endura platform, & Ioniq PVD systems.

- Lam Research: The American-based company offers equipment for back-end wafer-level packaging and systems for wet processing, film deposition, & plasma etch.

- Tokyo Electron (TEL): The Japanese-based company sells, develops, and manufactures a range of PVD systems like EXIM™/LEXIA™-EX and Triase+™ Series for the semiconductor industry.

- Veeco Instruments Inc.: The U.S.-based company offers PVD systems and equipment to support diverse applications like data storage, MEMS, advanced semiconductors, sensors, photonics, and power electronics.

- ULVAC, Inc.: The company supplies, manufactures, and designs various range of PVD equipment and systems to support industries like flat panel displays, electronic devices, semiconductors, and solar cells.

Other Companies List

- OC Oerlikon / Oerlikon Balzers

- Kurt J. Lesker Company

- IHI / IHI Hauzer

- Platit AG

- Bühler / Buhler Alzenau GmbH

- Singulus Technologies AG

- Denton Vacuum / AJA International / Angstrom Engineering

- Intevac, Inc.

- Mustang Vacuum Systems

- Advanced Energy Industries

- NAURA Technology Group

- Semicore Equipment / CHA Industries

- Impact Coatings AB

Segments Covered

By Technology / Process

- Sputter deposition

- Thermal evaporation / e-beam evaporation

- Cathodic arc evaporation (Arc PVD)

- HiPIMS / Pulsed magnetron sputtering

By Product / Offering

- PVD Equipment / Systems

- PVD Consumables

- PVD Services & Contract Coating

By Coating Material / Chemistry

- Metallic coatings (Ti, Cr, Al, their alloys)

- Nitrides (TiN, CrN), oxides (ITO, Al₂O₃), carbides

- Transparent conductive oxides (ITO/IZO) for displays/solar

By Application / End-Use

- Semiconductors & Electronics

- Tooling & Cutting (wear-resistant coatings)

- Automotive (decorative trim, wear coatings, battery thermal layers)

- Medical devices (stents, instruments, implants)

- Optical & Display coatings (mirrors, AR coatings, ITO)

- Solar PV (anti-reflective / conductive films)

- Architectural glass & decorative coatings

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa