Content

Functional Coatings Market Size and Growth 2025 to 2034

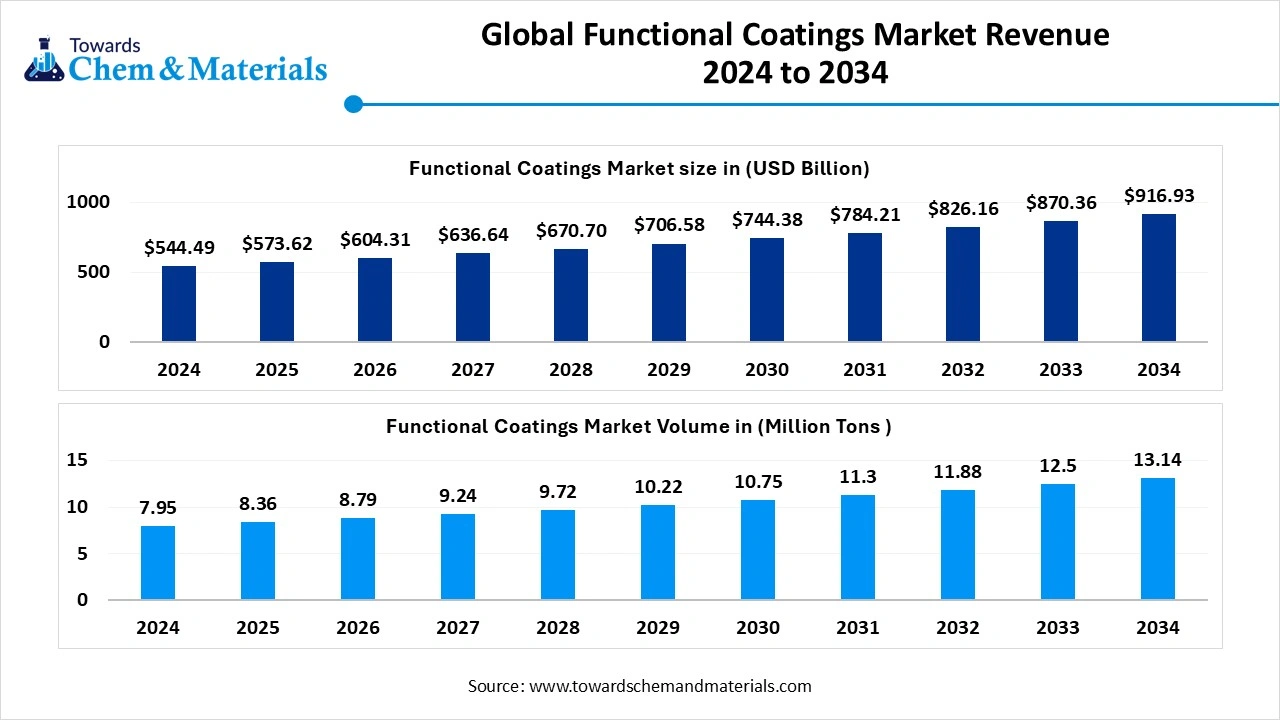

The global functional coatings market volume was reached at 7.95 million tons in 2024 and is expected to be worth around 13.14 million tons by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2025 to 2034. The growing demand for functional coatings from various sectors is the key factor driving market growth. Also, a surge in awareness of sustainability, coupled with the increasing demand for improved product performance, can fuel market growth further.

Key Takeaways

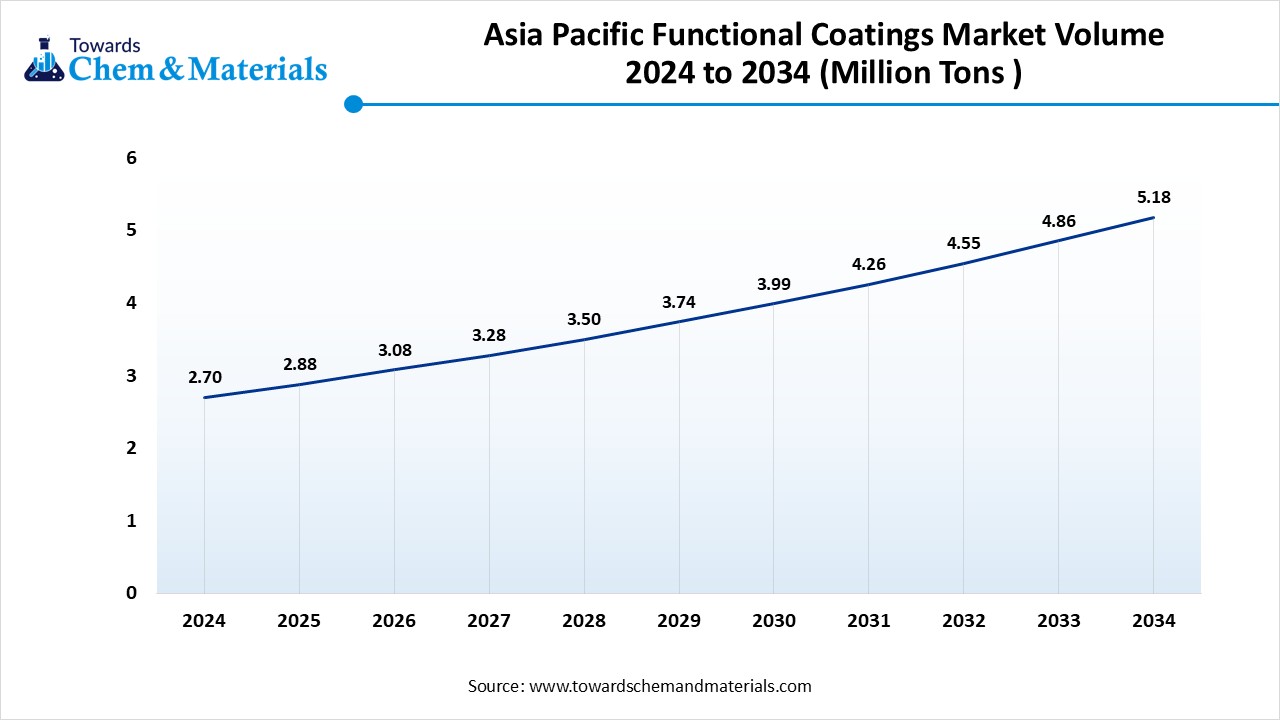

- The Asia Pacific functional coatings market volume is estimated at 2.88 million tons in 2025 and is expected to reach 5.18 million tons by 2034, growing at a CAGR of 9.95% from 2025 to 2034.

- By region, North America expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the ongoing technological advancements in coating technology.

- By type, the anti-corrosion coatings segment dominated the functional coatings market with a 30% market share in 2024. The dominance of the segment can be attributed to the rise in infrastructure development and the need to safeguard assets from corrosion in adverse environments.

- By type, the anti-microbial coatings segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing health concerns, coupled with the innovations in coating technology.

- By application, the automotive segment held a 25% market share in 2024. The dominance of the segment can be linked to the surge in the use of functional coatings in the automotive sector to enhance the durability, performance, and functionality of automotive components.

- By application, the healthcare segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the rise in the incidence of chronic diseases and the increasing number of minimally invasive procedures globally.

Advancements in Technology are Expanding Market Growth

The Functional Coatings Market refers to the segment of the coatings industry focused on the development and application of coatings that provide specific functional properties to the surface they cover, beyond mere aesthetic enhancement. These properties include anti-corrosion, anti-microbial, anti-fingerprint, self-cleaning, thermal insulation, fire resistance, and electrical conductivity. Functional coatings are used across various industries, including automotive, aerospace, electronics, construction, and packaging, to improve product performance, longevity, and safety. Ongoing innovations in technology, including nanocoatings, smart coatings, and high-durability coatings, can further impact positive market growth.

What Are the Key Trends Influencing the Functional Coatings Market?

- The growing demand for functional coatings in the electronic sector is the latest trend in the market. Functional coatings are utilised in various electronic devices such as laptops, smartphones, and televisions. These coatings provide several benefits to electronic devices, like protection from wear, abrasion, and corrosion.

- The healthcare sector is also one of the major drivers of the market. Functional coatings are used in different medical devices such as surgical instruments, implants, and diagnostic equipment. This coating enhances the performance of medical devices by minimizing infection risk and increasing their biocompatibility.

- Technological advancements in coating materials and applications are another trend shaping a positive market trajectory. The development of anti-fouling and self-cleaning coatings, which provide improved durability with lower maintenance costs, has gained substantial prominence in the automotive and marine sectors.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 8.36 Million Tons |

| Expected Volume by 2034 | 13.14 Million Tons |

| Growth Rate from 2025 to 2034 | CAGR 5.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Application, By Region |

| Key Companies Profiled | AkzoNobel N.V., BASF SE, PPG Industries, Inc., Sherwin-Williams Company, Dow Chemical Company, Henkel AG & Co. KGaA,Jotun Group, Valspar Corporation, RPM International Inc., Arkema S.A., 3M Company, Huntsman Corporation, Covestro AG, Nippon Paint Holdings Co., Ltd., Asian Paints Ltd., Kansai Paint Co., Ltd., Hempel A/S, Sika AG, DSM Coating Resins, Mitsubishi Chemical Corporation |

Market Opportunity

Growing Use of Lightweight Materials

The rising use of lightweight materials like composites, aluminum, and plastic in various sectors is a major factor creating lucrative opportunities in the market. Lightweight materials offer benefits such as reduced emissions, enhanced fuel efficiency, and enhanced performance. Furthermore, functional coatings can help to safeguard lightweight materials from corrosion and damage while improving their performance.

- In May 2025, Innovia Films, a leading film manufacturer, announced the launch of its latest film coating line at its Zacapú plant in Mexico. The company will also be adding advanced metallizing capabilities in the upcoming months (Source: https://www.packagingstrategies.com)

Market Challenges

Application Complexity

Functional coatings often need specialized application techniques and controlled environments, which can constrain their use in certain sectors or regions, due to a lack of necessary infrastructure. Moreover, limited awareness among end-user industries regarding the benefits of functional coatings can hamper their adoption, especially in developing regions, hindering market growth further.

Regional Insight

The Asia Pacific functional coatings market volume was estimated at 2.7 million tons in 2024 and is anticipated to reach 5.18 million tons by 2034, growing at a CAGR of 9.95% from 2025 to 2034. Asia Pacific dominated the functional coatings market with a 40% market share in 2024.

The dominance of the region can be attributed to the strong presence of emerging economies, including China and India, along with the surge in investments in infrastructure development. In addition, other countries in the region are also witnessing substantial growth in the market because of rising investments in R&D activities.

The dominance of the region can be attributed to the strong presence of emerging economies, including China and India, along with the surge in investments in infrastructure development. In addition, other countries in the region are also witnessing substantial growth in the market because of rising investments in R&D activities.

Functional Coatings Market in China

In the Asia Pacific, China led the market owing to the rise in infrastructure spending, rapid industrialization, and an increase in emphasis on green and smart manufacturing. Also, initiatives such as "Made in China 2025" support the adoption of cutting-edge materials such as functional coatings, propelling advancements and market expansion in the country.

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the ongoing technological advancements in coating technology, coupled with the robust industrial base. Furthermore, government regulations supporting energy efficiency and minimizing the use of hazardous chemicals are also impacting regional growth, leading to the development of more sustainable coatings.

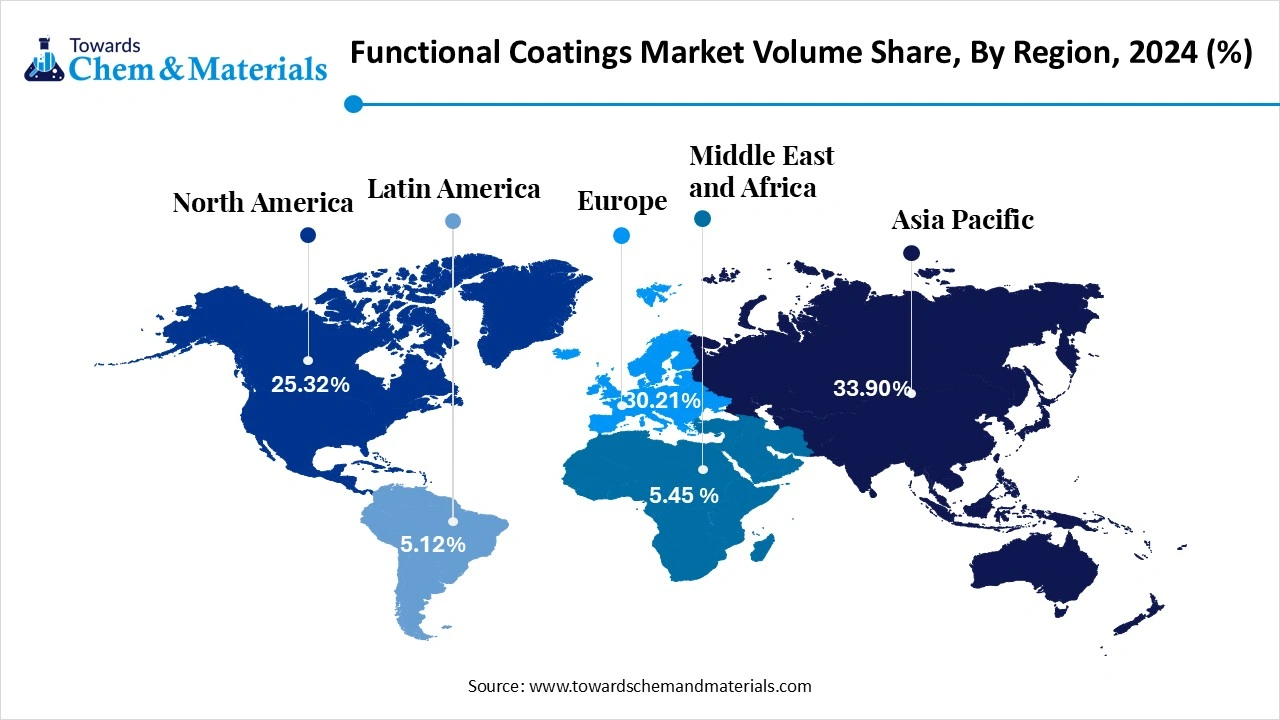

Functional Coatings Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume - 2024( Million Tons) | Volume Share, 2034 (%) | Market Volume - 2034( Million Tons) | CAGR (2025 - 2034) |

| North America | 25.32% | 2.01 | 24.32% | 3.20 | 5.27% |

| Europe | 30.21% | 2.40 | 28.43% | 3.74 | 5.03% |

| Asia Pacific | 33.90% | 2.70 | 36.90% | 4.85 | 6.74% |

| South America | 5.12% | 0.41 | 5.12% | 0.67 | 5.74% |

| Middle East & Africa | 5.45% | 0.43 | 5.23% | 0.69 | 5.26% |

| Total | 100% | 7.95 | 100% | 13.14 | 5.15% |

Functional Coatings Market in the U.S.

In North America, the U.S. dominated the market by holding the largest market share due to growing demand for functional coatings from various industries such as construction, automotive, and electronics. Moreover, the increasing focus on sustainability leads to eco-friendly coatings. In the U.S., the construction sector, especially the West and the Midwest, is witnessing significant growth, boosting demand for industrial coatings soon.

Who are the Top Export Countries of Paints, Printing Ink, and Allied Products in 2023-24?

| Top Countries | Export Value in USD Mn |

| U ARAB EMTS | 1054.16 |

| USA | 135.66 |

| BANGLADESH PR | 100.23 |

| GERMANY | 79.66 |

| NEPAL | 69.92 |

Segmental Insight

Type Insight

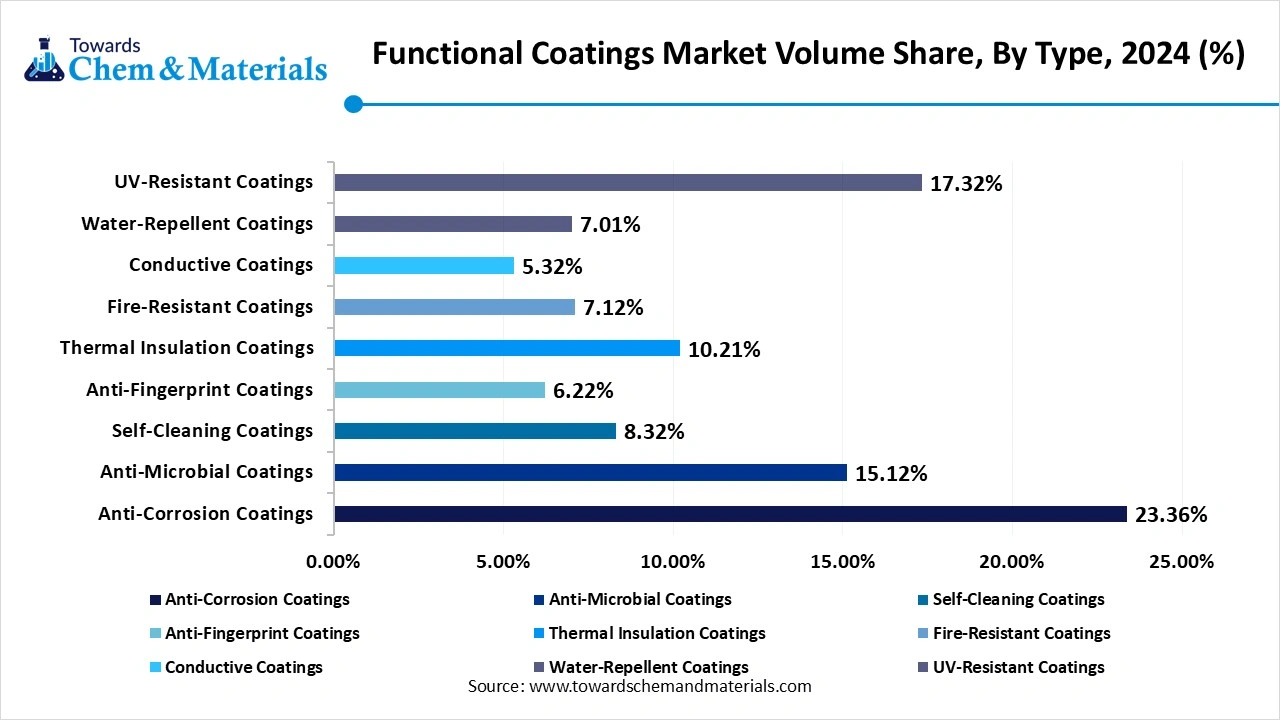

Which Type Segment Dominated the Functional Coatings Market in 2024?

The anti-corrosion coatings segment dominated the market with a 30% market share in 2024. The dominance of the segment can be attributed to the rise in infrastructure development and the need to safeguard assets from corrosion in adverse environments. In addition, these coatings are important for extending the lifespan of structures and equipment by minimizing maintenance costs and ensuring safety across different sectors such as marine, oil and gas, and automotive.

The anti-microbial coatings segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing health concerns, coupled with the innovations in coating technology. The construction industry is witnessing growing demand for antimicrobial coatings in buildings to extend the life of paint by preventing microbial growth. Antimicrobial coatings are also utilized in packaging and food processing applications.

Functional Coatings Market Volume Share, By Type, 2024-2034 (%)

| By Type | Volume Share, 2024 (%) | Market Volume - 2024( Million Tons) | Volume Share, 2034 (%) | Market Volume - 2034( Million Tons) | CAGR (2025 - 2034) |

| Anti-Corrosion Coatings | 23.36% | 1.86 | 16.11% | 2.12 | 1.47% |

| Anti-Microbial Coatings | 15.12% | 1.20 | 20.32% | 2.67 | 9.27% |

| Self-Cleaning Coatings | 8.32% | 0.66 | 10.21% | 1.34 | 8.17% |

| Anti-Fingerprint Coatings | 6.22% | 0.49 | 7.32% | 0.96 | 7.67% |

| Thermal Insulation Coatings | 10.21% | 0.81 | 11.23% | 1.48 | 6.87% |

| Fire-Resistant Coatings | 7.12% | 0.57 | 6.23% | 0.82 | 4.18% |

| Conductive Coatings | 5.32% | 0.42 | 6.03% | 0.79 | 7.22% |

| Water-Repellent Coatings | 7.01% | 0.56 | 7.12% | 0.94 | 5.93% |

| UV-Resistant Coatings | 17.32% | 1.38 | 15.43% | 2.03 | 4.39% |

| Total | 100% | 7.95 | 100% | 13.14 | 5.15% |

Application Insight

Why Did the Automotive Segment Dominated the Functional Coatings Market in 2024?

The automotive segment held the largest market share of 25% share in 2024. The dominance of the segment can be linked to the surge in the use of functional coatings in the automotive sector to enhance the durability, performance, and functionality of automotive components. Moreover, regulations supporting eco-friendly and low-VOC coatings are impelling market players to adopt and develop sustainable coating solutions, impacting positive segment growth further.

The healthcare segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a rise in the incidence of chronic diseases and the increasing number of minimally invasive procedures globally, along with the rapid innovations in material science, which lead to advancements in coating technologies. Functional coatings such as lubricious and antimicrobial coating plays a crucial role in minimizing the risk of infections associated with medical devices.

Recent Developments

- In May 2025, Henkel, a world leader in sealants, adhesives, and functional coatings, announced a strategic collaboration with Sasol =, a leading player in Fischer-Tropsch technology, emphasizing minimizing the environmental impact of hot melt adhesives. Henkel is offering innovative adhesive solutions with a minimum carbon emission impact.(Source: www.prnewswire.com)

- In August 2024, PPG declared the completion of expansion of its industrial coatings plant in Vietnam. The advancements include a new manufacturing line dedicated to PPG AQUACRON™ functional coatings for the electronics sector. The new plant is equipped with cutting-edge six production lines and aims to minimize overall turnaround times.(Source: https://www.businesswire.com)

Functional Coatings Market Top Companies

- AkzoNobel N.V.

- BASF SE

- PPG Industries, Inc.

- Sherwin-Williams Company

- Dow Chemical Company

- Henkel AG & Co. KGaA

- Jotun Group

- Valspar Corporation

- RPM International Inc.

- Arkema S.A.

- 3M Company

- Huntsman Corporation

- Covestro AG

- Nippon Paint Holdings Co., Ltd.

- Asian Paints Ltd.

- Kansai Paint Co., Ltd.

- Hempel A/S

- Sika AG

- DSM Coating Resins

- Mitsubishi Chemical Corporation

Segments Covered

By Type

- Anti-Corrosion Coatings

- Metal Protection Coatings

- Concrete Protection Coatings

- Marine Coatings

- Anti-Microbial Coatings

- Healthcare Applications

- Textile Coatings

- Food Packaging Coatings

- Self-Cleaning Coatings

- Glass Coatings

- Building Material Coatings

- Textile Coatings

- Anti-Fingerprint Coatings

- Consumer Electronics Coatings

- Automotive Coatings

- Luxury Goods Coatings

- Thermal Insulation Coatings

- Industrial Equipment Coatings

- Automotive Coatings

- Building Insulation Coatings

- Fire-Resistant Coatings

- Structural Steel Coatings

- Aerospace Coatings

- Electrical Component Coatings

- Conductive Coatings

- Electronics Coatings

- Automotive Coatings

- Antistatic Coatings

- Water-Repellent Coatings

- Textile Coatings

- Building Coatings

- Automotive Coatings

- UV-Resistant Coatings

- Outdoor Equipment Coatings

- Automotive Coatings

- Construction Coatings

By Application

- Automotive

- Vehicle Exterior Coatings

- Automotive Glass Coatings

- Interior Coatings

- Aerospace

- Aircraft Exterior Coatings

- Aerospace Engine Coatings

- Interior Coatings

- Construction

- Building Material Coatings

- Concrete Protection Coatings

- Roof Coatings

- Electronics

- Circuit Board Coatings

- Display Coatings

- Antenna Coatings

- Packaging

- Food Packaging Coatings

- Beverage Packaging Coatings

- Medical Packaging Coatings

- Healthcare

- Medical Device Coatings

- Surgical Instrument Coatings

- Antimicrobial Hospital Equipment Coatings

- Consumer Goods

- Electronics Coatings

- Kitchen Appliance Coatings

- Luxury Goods Coatings

- Marine

- Ship Hull Coatings

- Boat Coatings

- Marine Component Coatings

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait