December 2025

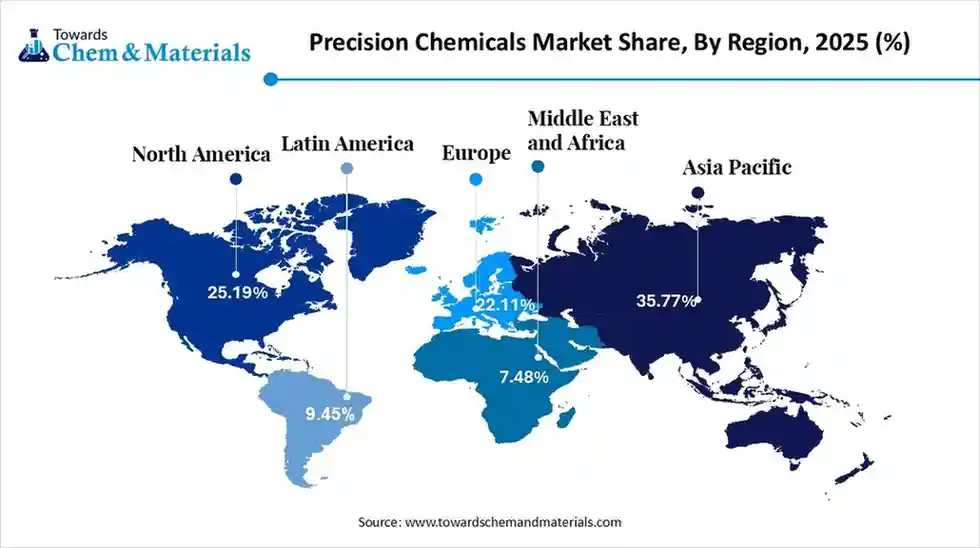

The global precision chemicals market size was estimated at USD 63.92 billion in 2025 and is predicted to increase from USD 68.47 billion in 2026 and is projected to reach around USD 127.16 billion by 2035, The market is expanding at a CAGR of 7.12% between 2026 and 2035. Asia Pacific dominated the precision chemicals market with a market share of 35.77% the global market in 2025.The shift towards higher purity materials has accelerated market growth in recent years.

The precision chemicals refer to precisely developed chemical products that are primarily made in a very controlled way for exact delivery of performance for the specific task. Moreover, these chemicals are not generally produced in bulk quantities, as per the recent observation. Furthermore, the sector such as electronics, specialty polymers, healthcare, and micro manufacturing has seen under heavy demand for these chemicals over the past few years.

| Report Attribute | Details |

| Market Size Value in 2026 | USD 68.47 Billion |

| Revenue Forecast in 2035 | USD 127.16 Billion |

| Growth Rate | CAGR 7.12% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Product / Type, By Service / Manufacturing Model, By Application / End-Use Industry, By Purity / Quality Tier, By Region |

| Key companies profiled | Thermo Fisher Scientific, Lonza Group, BASF SE, Evonik Industries, Cambrex Corporation, Jubilant Ingrevia, Wuxi AppTec / Wuxi Biologics, Sumitomo Chemical, Syngene International, CordenPharma, Piramal Pharma Solutions, Asymchem, Samsung Biologics, Johnson Matthey, Honeywell / UOP, Clariant, Albemarle / Arkema |

Companies now use smart computer tools to design chemicals before making them in real life. Computers can test thousands of chemical ideas in seconds, so scientists only create the ones that work. This saves time, money, and a lot of wasted materials. Factories are also using tiny, automated reactors that adjust temperature, mixing, and purity on their own, which makes the chemicals very accurate.

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | Toxic Substances Control Act (TSCA) | Risk-based assessment of new and existing chemicals, public transparency |

| European Union | European Chemicals Agency (ECHA) | REACH Title II (Registration) | High level of protection for human health and the environment |

| China | Ministry of Ecology and Environment (MEE) | MEE Order No. 12 | Environmental management and registration of new chemical substances |

How did the Active Pharmaceutical Ingredients (APIs) & Advanced Intermediates Segment Dominate the Precision Chemicals Market in 2025?

The active pharmaceutical ingredients (APIs) & advanced intermediates segment led the market with nearly 40.55% market share in 2025, due to growing demand for tiny amounts of pure and well-documented chemicals in recent years. Moreover, by meeting the safety rules, fast reformulations, and clinical needs have been driving the segment growth in recent years, as per the observation.

The high-purity / electronic chemicals segment is expected to grow with approximately 22.88% market share, akin to the sudden surge in energy devices and electronics manufacturing in recent years. Moreover, the products like batteries, displays, semiconductors, and sensors rely on ultra-pure chemicals and materials where near-zero impurities are recommended, which is supporting the segment growth in recent years.

Why does the Custom Synthesis / Contract Research & Manufacturing (CDMO / CMO) Segment Dominate the Precision Chemicals Market?

The custom synthesis/contract research & manufacturing (CDMO / CMO) segment dominated the market with approximately 54.67% market share in 2025, akin to the many clients' need for unique, small-volume molecules that off-the-shelf products cannot supply. Precision-chemistry firms build dedicated processes, scale methods, and regulatory documentation for each customer. Drug developers, agrochemical innovators, and specialty electronics firms pay these providers to reduce time to market, avoid in-house scale-up risks, and protect IP.

The merchant / off-the-shelf high-purity products segment is expected to grow at a rapid CAGR. Due to the many factories seeking fast access to validated chemicals without the wait for custom work. As electronics and battery makers scale, they prefer trusted, ready-made chemistries that plug straight into their production lines.

How did the Pharmaceuticals Segment Dominate the Precision Chemicals Market in 2025?

The pharmaceuticals segment dominated the market with approximately 42.66% market share in 2025, owing to the making medicines requiring super clean and reliable chemicals. Even tiny impurities can change how a drug works, so companies choose suppliers who can guarantee purity every time. Pharma firms also need lots of documents, testing data, and stable batches, and precision chemical makers are built for that.

The electronics & semiconductors segment is expected to grow with fastest market share, akin to their increasing need for the chemicals that are almost perfectly clean. If even a dust-sized impurity lands on a chip, the whole wafer can fail. With the increased demand for more phones, data centers, electric cars, and smart gadgets, companies need even more of these ultra pure chemicals.

Why does the High-Purity / Electronic-Grade Segment Dominate the Precision Chemicals Market?

The high-purity / electronic-grade segment dominated the largest revenue share of 38.94% in 2025, due to the many modern products like chips, batteries, and sensors that need chemicals that are almost perfectly clean. Even tiny impurities can ruin a full production run, so factories prefer chemicals that come with detailed purity checks. Suppliers have built special clean facilities to make sure nothing contaminates these chemicals.

The specialty GMP / pharma-grade segment is expected to grow at a rapid CAGR due to more companies being seen in the requirement for the chemicals made at a medicine-level quality. These chemicals are created in clean, carefully checked facilities and come with full safety and purity records. it's not just drug makers, medical device companies, testing labs, and even health-food brands that now want GMP-quality inputs.

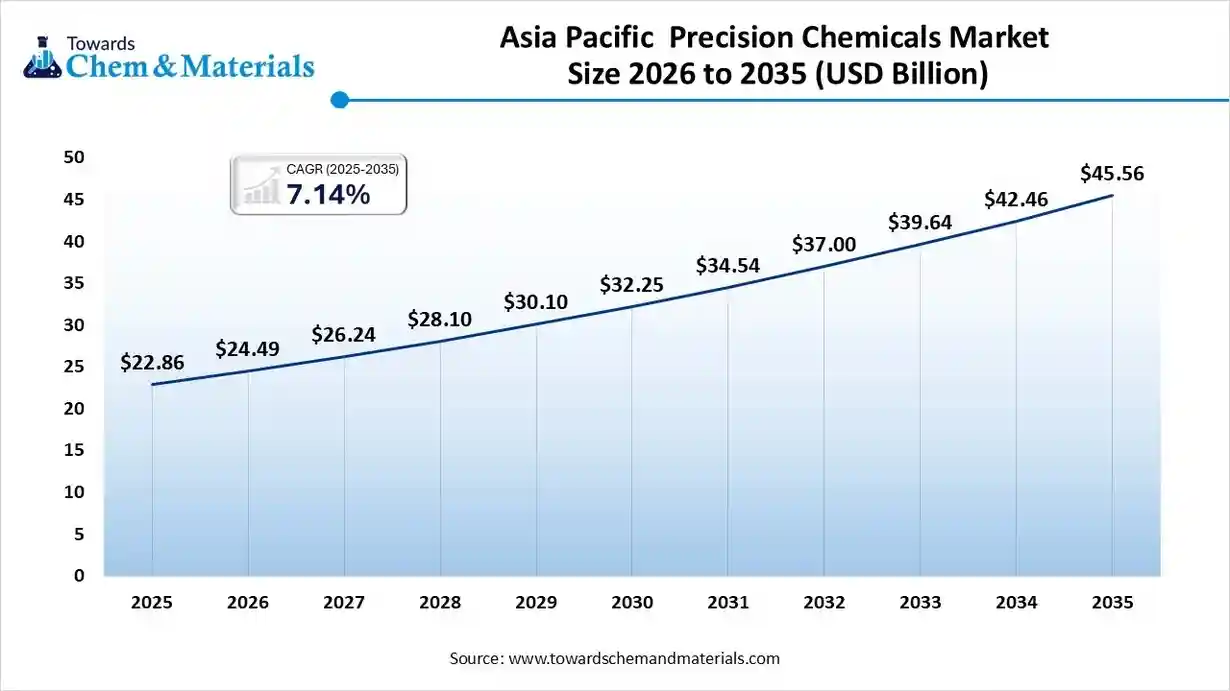

The Asia Pacific precision chemicals market size was valued at USD 22.86 billion in 2025 and is expected to reach USD 45.56 billion by 2035, growing at a CAGR of 7.14% from 2026 to 2035. Asia Pacific dominated the precision chemicals market in 2025, owing to the region having massive production units of manufacturing electronics, cars, and consumer goods, where precision chemicals have become a crucial element in recent years. Moreover, the regional countries such as India, China, and Japan have seen in heavier investment in battery parks and ultra-clean chemicals plants in recent years.

China’s Strong Local Supply Chain Continues to Anchor Its Precision Chemical Leadership

China maintained its dominance in the precision chemicals market, akin to the greater investment towards the strengthening foundation of the local supply chain and production in the past few years. Moreover, factors such as low cost, faster delivery, and deep raw material supply have elevated the earning potential for producers in the current period, as per the country survey.

North America Precision Chemicals Market Examination

North America is expected to capture a major share of the market with a rapid CAGR, due to the ongoing advanced manufacturing and establishment of battery plants and biotech. Moreover, the region is looking for the minimization of export dependence while boosting local production facilities, where the governments are increasingly involved in recent years.

High Purity Chemicals' Leadership is Positioning the United States as a Key Global Market

The United States is expected to emerge as a prominent country for the precision chemicals market in the coming years, due to the emergence of global brands for high-purity chemicals in the region. Moreover, the manufacturers are heavily focused on tight supply security and IP protection for these types of high-purity products in the region nowadays.

Europe Precision Chemicals Market Evaluation

Europe is a notably growing region owing to the prioritization of high-quality, niche technology, and sustainability by local manufacturers. Moreover, the presence of the stronger automotive sector and semiconductor sectors is set to enable high return ventures for precision chemicals manufacturers in the coming years as per the future industry expectations.

Germany Emerges as a Hub for Tailored Chemistries

Germany is expected to gain a major industry, akin to the increasing demand for the low-volatility, green, and tightly specified chemistries for the specific and advanced engine parts and industrial coatings in the coming years. Moreover, the region has an engineering and research institutions culture which supports the development of bespoke chemistry in recent years.

Precision Chemicals Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the industry owing as these regions are observed in building factories and not just selling raw oil. New hubs for solar panels, medicines, and hi-tech parts need special chemicals that were once imported. Countries like the UAE, Saudi Arabia, and South Africa are inviting foreign companies to build clean chemical plants close to factories, cutting delivery time.

Clean Plants and Fast Delivery Models are Enhancing Saudi Arabia’s Precision Chemical Supply Chain Saudi Arabia is expected to emerge as a prominent country for the precision chemicals market in the coming years due to changing fast and the need for better chemicals for new industries. Big projects and factories mean more demand for pure, specialty chemicals used in batteries, medicines, and high-tech coatings. The country is building clean plants near the places that use these chemicals, so deliveries are quick.

South America Precision Chemicals Market Evaluation

South America is a notably growing region. As factories are slowly moving from rough-and-ready ways to more careful, modern production, it is better for precision chemicals. Mines, food plants, and car part makers need cleaner, specialist chemicals to make better products. Local companies want nearby suppliers, so they don't wait weeks for imports.

Brazil’s Shift Towards the Tech-Driven Manufacturing

Brazil is expected to gain a major industry owing to the factories in the country are getting more modern. Food, medicine makers, and car parts factories want purer, dependable chemicals to make products that sell globally. Brazil is also moving into battery parts and other tech fields, which need special chemical ingredients.

Recent Developments

By Product / Type

By Service / Manufacturing Model

By Application / End-Use Industry

By Purity / Quality Tier

By Region

December 2025

December 2025

December 2025

December 2025