Content

Europe Ceramic Tiles Market Size & Growth Analysis Report, 2034

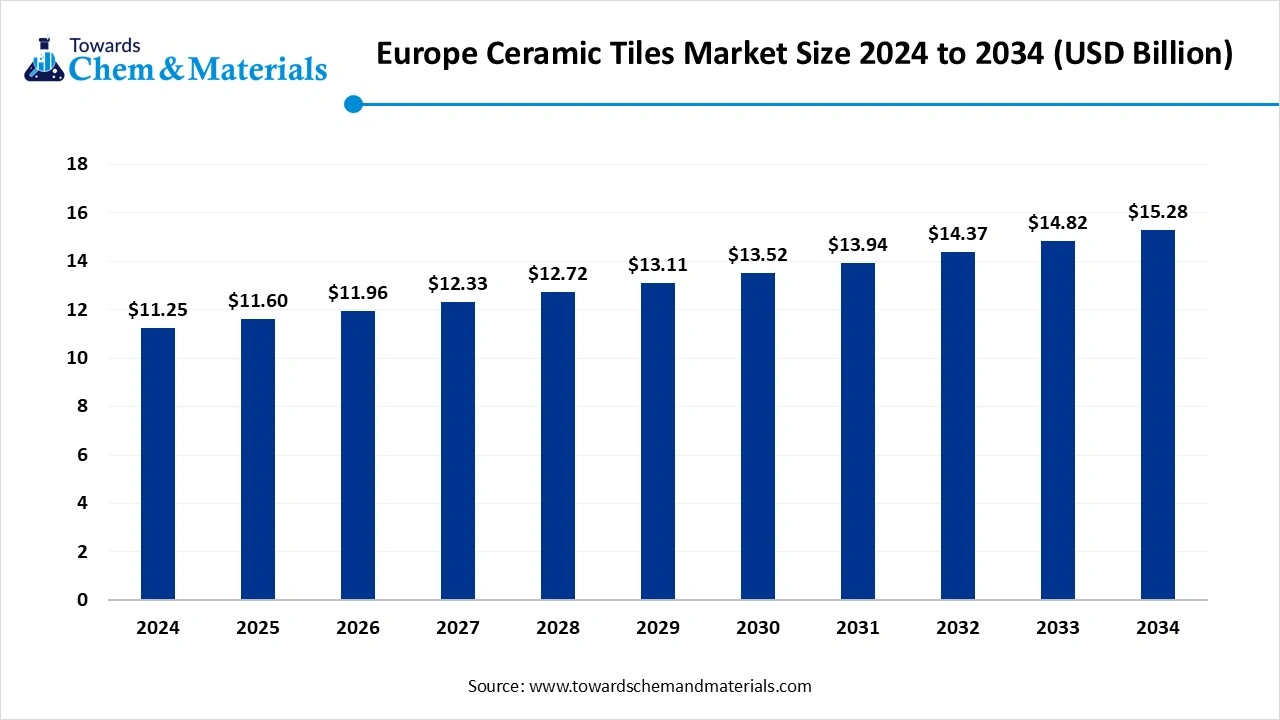

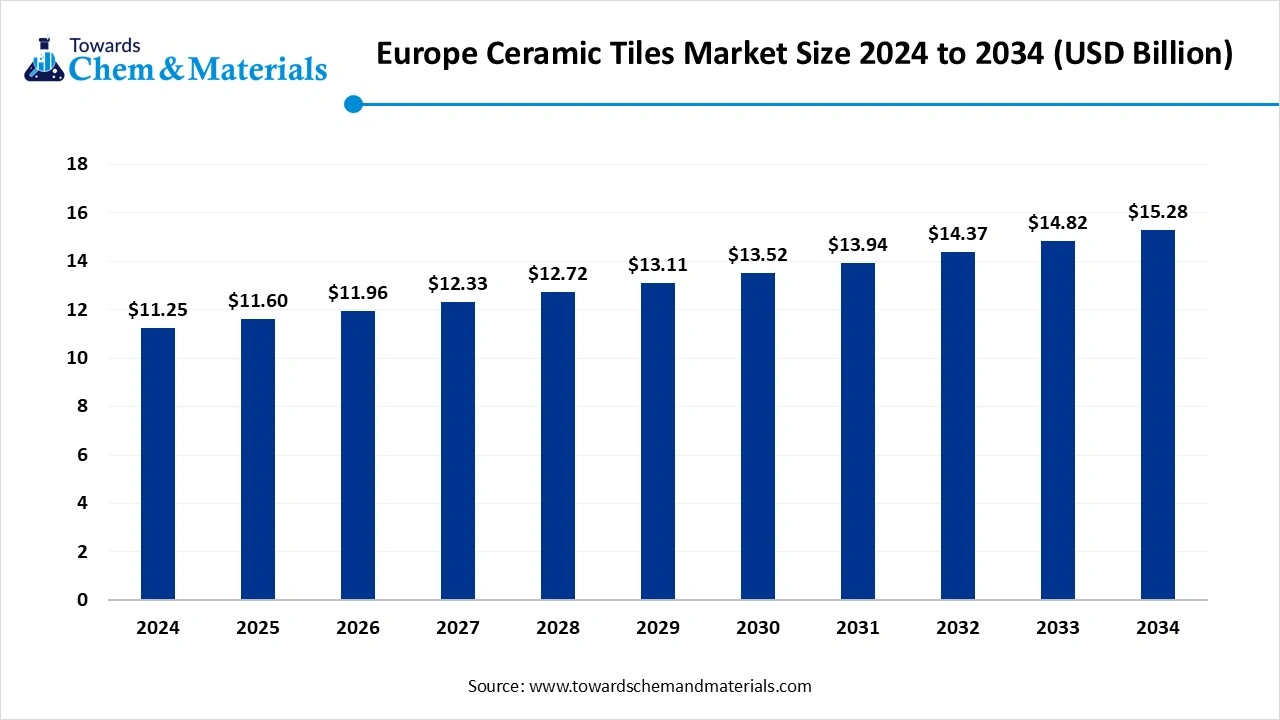

The Europe ceramic tiles market size accounted for USD 11.25 billion in 2024 and is predicted to increase from USD 11.60 billion in 2025 to approximately USD 15.28 billion by 2034, expanding at a CAGR of 3.11% from 2025 to 2034. The growing home renovation activities and the rise in the development of infrastructure projects drive the market growth.

Key Takeaways

- By product type, the porcelain stoneware segment held approximately 48% share in the market in 2024.

- By product type, the large format tiles & slabs segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By material, the single-fired porcelain segment held approximately 48% share in the market in 2024.

- By material, the double-fired porcelain segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By design, the stone look segment held approximately 35% share in the Europe ceramic tiles market in 2024.

- By design, the digitally-printed custom designs segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By thickness, the standard 6-10 mm segment held approximately a 60% share in the market in 2024.

- By thickness, the thin gauged porcelain panels (3-6 mm) segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the floor tiles segment held approximately a 60% share in the market in 2024.

- By application, the exterior paving and façade panels segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By End-User, the residential segment held approximately a 45% share in the Europe ceramic tiles market in 2024.

- By End-User, the commercial segment is expected to grow at the fastest CAGR in the market during the forecast period.

What do You Mean by Ceramic Tiles?

Factors like a rise in home renovations, a strong focus on aesthetic appeal, innovations in digital printing technology, growing adoption of green buildings, government support for infrastructure development, and the booming tourism & hospitality industry contribute to the growth of the Europe ceramic tiles market.

Ceramic tiles are a flat surface made up of water, clay, and sand. Ceramic tiles are made using steps like mixing, shaping, drying, firing, and glazing. They are available in various shapes, finishes, sizes, & colors. Ceramic tiles require low maintenance and have of higher water absorption rate. They are widely used in countertops, flooring, and walls.

Europe Ceramic Tiles Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expanding in high-margin niches such as hospitality, construction activities, residential development, and a rise in renovations. Growth is driven by the modernization of tourism, high rates of construction, and a thriving renovation industry, particularly in France, Italy, Germany, Spain, and the UK.

- Sustainability Trends: Sustainability is transforming the growth of Europe's ceramic tiles industry, with growing development of green manufacturing processes, utilization of recycled materials, and use of renewable energy sources. For instance, Vitra Tiles launched 100% recycled porcelain tile at Cersaie 2025 to enhance energy efficiency and lower carbon footprint.

- Major Investors: Private equity firms, international companies, and domestic manufacturers are actively investing in ceramic tiles due to stricter environmental regulations and a focus on the development of innovative tiles. Companies like Marazzi Group, Pamesa Ceramics, and Iris Ceramica Group are investing in the development of innovative production technology & premium products.

Key Technological Shifts in the Europe Ceramic Tiles Market:

The Europe ceramic tiles market is undergoing key technological shifts driven by energy-efficient manufacturing, product customization, and support for sustainable practices. One of the most significant evolutions is the adoption of digital printing, that enables custom designs, manufactures hyper-realistic textures, and offers 3D effects.

Digital printing enhances realism, expands design options, creates a dynamic experience, and develops specialized surface properties. For instance, Italcer Group uses digital printing to create distinctive finishes of porcelain and ceramic tiles.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 11.60 Billion |

| Expected Size by 2034 | USD 15.28 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Material / Body, By Design / Aesthetic, By Thickness / Technical Grade, By Application, By End-User / Sector |

| Key Companies Profiled | Pamesa Cerámica, RAK Ceramics, Grupo Lamosa, Mohawk Industries, Villeroy & Boch Fliesen, Panaria Ceramiche, Lea Ceramiche, Cotto d’Este, Ceramiche Refin, Keraben Grupo, Peronda Group, Ezarri, Caesar Ceramics, Sant’Agostino, Johnson Tiles |

Trade Analysis of the Europe Ceramic Tiles Market:

- Import & Export Statistics Spain exported 6,176 shipments of wall tile porcelain.(Source: www.volza.com)

- Italy exported 297,755 shipments of ceramic tile.(Source: www.volza.com)

- Spain exported 232,661 shipments of ceramic tile.(Source: www.volza.com)

- CERRAD SP ZOO is the leading supplier of ceramic tile in Germany.(Source: www.volza.com)

- Spain exported 873 shipments of unglazed ceramic tile.(Source: www.volza.com)

Europe Ceramic Tiles Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement is the process of sourcing feedstock like silica, clay, feldspar, glazing materials & additives.

- Key Players: INMATEC Technologies GmbH, Stephan Schmidt KG, Lasselsberger Group, Ruggi S.R.L

- Chemical Synthesis and Processing: The chemical synthesis & processing involve steps like raw material preparation, glaze application, sintering, and chemical interaction.

- Key Players: Marazzi Group, Villeroy & Boch, Iris Ceramica Group, and Porcelanosa Group

- Quality Testing and Certifications: The quality testing involves testing of properties like water absorption, scratch resistance, stain resistance, surface flatness, slip resistance, dimensions, & abrasion resistance, and certifications like CE marking, EN 14411.

Europe Ceramic Tiles Landscape: Regulations

| Country | Regulatory Body | Key Regulations | Focus Areas |

| Italy | 1. National Standardization Authority (UNI) 2. Confindustria Ceramic |

UNI 11493-1:2016, ISO 17889-1, EN 14411, EN ISO 10545, and Construction Products Regulations | o Performance Consistency o Eco-Friendly Production o Safety |

| United Kingdom | 1. British Standards (BSI) 2. The Tile Associations 3. UKCA Marking |

UKCA Marking, British Standards, EN 14411, and Construction Products Regulations | o Durability o Trade Protection o Quality Management |

| Germany | 1. German Institute for Standardization ( DIN) 2. German Environmental Agency (UBA) |

Construction Products Regulations (CPR) and EN14411 Standards | o Technical Characteristics o Sustainable Manufacturing o Waste Management |

| Spain | 1. Spanish Association for standardization (UNE) 2. ASCER |

Spanish Technical Building Code (CTE), EN 14411, and EN ISO 10545 Series | o Sustainability Credentials o Performance Compliance |

Market Opportunity

Growing Renovation Activities Open New Market Growth Avenues

The growing renovation of homes and commercial spaces in Europe increases demand for ceramic tiles. The modern interior design trends and increasing investment in the modernization of houses increase the adoption of ceramic tiles. The strong focus on sustainable solutions and aging infrastructure requires ceramic tiles.

The growing disposable incomes and increased investment in home improvements increase demand for ceramic tiles. The strong focus on aesthetic appeal and the rise in customization activities increase the adoption of ceramic tiles. The growing renovation activities in large-scale commercial projects and a focus on historic preservation require ceramic tiles. The growing renovation activities create an opportunity for the growth of the market.

Market Challenge

Why High Production Cost Limits the Europe Ceramic Tiles Market Growth?

Despite several benefits of the ceramic tiles in the European region, the high production cost restricts the market expansion. Factors like volatile raw material prices, advanced production processes, high consumption of energy, and environmental regulations are responsible for the high production cost.

The energy-intensive firing process in kilns and the fluctuating cost of raw materials like inorganic chemicals, clay, & feldspar increase the cost. The depletion of natural resources and stringent environmental emission regulations increase the cost. The higher firing temperatures and investment in digital printing directly affect the market. The high production cost hampers the growth of the market.

Segmental Insights

Product Type Insights

Why Porcelain Stoneware Segment Dominates the Europe Ceramic Tiles Market?

The porcelain stoneware segment dominated the market with approximately 48% share in 2024. The growing development of shopping malls and hotels increases demand for porcelain stoneware. The strong focus on residential flooring and the need to improve the aesthetic of buildings require porcelain stoneware. The exceptional durability and need for low maintenance for porcelain stoneware drive the overall market growth.

The large format tiles & slabs segment is the fastest-growing in the market during the forecast period. The strong focus on the development of a modern building look and the increasing adoption of luxury homes increases demand for large format tiles. The growing development of applications like furniture surfaces, commercial facades, and kitchens requires slabs & large format tiles. The rise in architectural innovations, retrofitting, and remodelling requires large format tiles, supporting the overall market growth.

Material / Body Insights

How did Single-Fired Porcelain Hold the Largest Share in the Europe Ceramic Tiles Market?

The single-fired porcelain segment held the largest revenue share of approximately 48% in the market in 2024. The growing aesthetic customization and rise in development of commercial spaces increase demand for single-fired porcelain. They offer high frost resistance, strength, and low porosity. The growing development of modern aesthetics and a strong focus on creating stylish walls & floors in bathrooms & kitchens requires single-fired porcelain, driving the overall market growth.

The double-fired porcelain segment is experiencing the fastest growth in the market during the forecast period. The growing demand for high-performance construction materials and the increasing adoption of sustainable solutions increase demand for double-fired porcelain. The booming construction activities and innovations in the production of double-fired porcelain help the market growth. The rise in renovation projects and increasing development of hotels, malls, & airports requires double-fired porcelain, supporting the overall market growth.

Design / Aesthetic Insights

Why the Stone Look Segment is Dominating the Europe Ceramic Tiles Market?

The stone look segment dominated the market with approximately 35% share in 2024. The growing renovation wave in countries like the UK, Germany, & France, and the adoption of sustainable building materials, increase demand for stone look. The strong focus on natural beauty and the increasing development of high-end interiors increase the adoption of the stone look. The growing stone looks applications in walls, patios, floorings, and backsplashes drives the overall market growth.

The digitally-printed custom designs segment is the fastest-growing in the market during the forecast period. The growing development of unique aesthetics and the increasing need for visually stunning interiors require digitally printed custom designs. The rise in the development of retail spaces, luxury residences, and boutique hotels increases the adoption of digitally printed custom designs. The growing renovation activities and the rise in the selection of premium looks support the overall market growth.

Thickness / Technical Grade Insights

How Standard 6-10 mm Segment Held the Largest Share in the Europe Ceramic Tiles Market?

The standard 6-10 mm segment held the largest revenue share of approximately 60% in the market in 2024. The growing residential construction activities and the rise in interior design projects increase demand for standard sizes. The applications, like bathroom & kitchen walls & floors, require 6-10 mm tile. The strong focus on the development of aesthetically pleasing designs and the rise in replacement & renovation activities require 6-10 mm tile, driving the overall market growth.

The thin gauged porcelain panels segment is experiencing the fastest growth in the market during the forecast period. The growing renovation of older buildings and focus on creating a luxurious look increases the adoption of thin gauged porcelain panels. The applications like kitchen splashbacks, building facades, countertops, and bathroom furniture require gauged porcelain panels. The green building initiatives and focus on minimalist aesthetics increase demand for gauged porcelain panels, supporting the overall market growth.

Application Insights

Is the Floor Tiles Segment Dominating the Europe Ceramic Tiles Market?

The floor tiles segment dominated the market with approximately 60% share in 2024. The growing remodelling projects and the rise in construction activities increase demand for floor tiles. The rising development of infrastructure projects and preference for open-plan living require floor tiles. The growing development of affordable housing and strong government support for energy-efficient building development require floor tiles, driving the overall market growth.

The exterior paving & façade panels segment is the fastest-growing in the market during the forecast period. The high investment in urban development and the expansion of indoor living spaces increases demand for façade panels. The growing expansion of gardens, patios, and terraces increases the adoption of ceramic paving. The growing development of premium aesthetics in residential & commercial projects supports the overall market growth.

End-User / Sector Insights

Which End-User Segment Held the Largest Share in the Europe Ceramic Tiles Market?

The residential segment held the largest revenue share of approximately 45% in the market in 2024. The strong government support for the development of affordable housing and the rise in new home construction increase demand for ceramic tiles. The rise in customization of homes and the growing development of sustainable buildings require ceramic tiles. The increasing investment in housing construction projects and green building initiatives drives the market growth.

The commercial segment is experiencing the fastest growth in the market during the forecast period. The growing expansion of resorts and hotels and increasing renovations of commercial spaces increase demand for ceramic tiles. The growing construction of food services, retail, office spaces, hospitality, shopping malls, and healthcare facilities requires ceramic tiles. The rise in institutional projects and focus on the development of tourist buildings requires ceramic tiles, supporting the overall market growth.

Country Insights

Western Europe Ceramic Tiles Market Trends

The Western region dominated the Europe ceramic tiles market with a 42% share in 2024. The growing hospitality & tourism sector and well-established industrial infrastructure increase demand for ceramic tiles. The strong government support for housing development and focus on sustainable production help the market growth. The increasing construction activities and development of energy-efficient buildings require ceramic tiles, driving the overall market growth.

Germany Ceramic Tiles Market Trends

Germany is a major contributor to the market. The rapid urbanization and growing development of infrastructure increase the adoption of ceramic tiles. The growing construction of commercial & residential activities and increasing spending on housing require ceramic tiles. The strong focus on building aesthetics and growing renovation activities increases the adoption of ceramic tiles, supporting the overall market growth.

Northern Europe Ceramic Tiles Market Trends

The Northern region is experiencing the fastest growth in the market during the forecast period. The stringent environmental regulations and the development of sustainable building materials increase the adoption of ceramic tiles. The growing trend of renovations of commercial spaces and the focus on the development of energy-efficient building materials require ceramic tiles. The increasing adoption of green buildings and the development of modern Nordic design require ceramic tiles, driving the overall market growth.

United Kingdom Ceramic Tiles Market Trends

The United Kingdom is a key contributor to the market. The growing commercial & residential construction activities and a strong focus on home renovations increase demand for ceramic tiles. The increasing development of public infrastructure projects and the expansion of real estate require ceramic tiles. The rise in the development of smart homes and smart home integration increases the adoption of ceramic tiles, supporting the overall market growth.

Recent Developments

- In September 2025, Nosa Elevates launched a range of premium porcelain tiles, Terra Tiles, in the UK. The range offers refined aesthetics, authenticity, & durability. The range elevates the look of living spaces & modern bathrooms by offering architectural tones, contemporary tones, & subtle tone looks.(Source: www.build-review.com)

- In March 2024, Gruppo Romani launched its first smart tiles for home automation systems. The project got financial support from MISE, and technical partners are Iprel, Trebax, Sacmi, Studio-IOT, & CNR. The size of the tile is 120*120 cm and consists of active components.(Source: www.ceramicworldweb.com)

- In May 2023, Romania’s Cesarom invested 1mln euros in a ceramic tiles rectification line facility. The line has a 40-tile-per-minute capacity and helps in increasing annual sales by 15%.(Source: seenews.com)

Top Companies List

- Florim Group: The Italian-based company offers high-quality porcelain stoneware products for applications like walls, architectural elements, floors, and counterstops.

- Marazzi Group: The leading producers of porcelain stoneware and ceramic products for exterior & interior decoration.

- Atlas Concorde: The Italian-based company focuses on premium quality & design of porcelain & ceramic tiles for commercial & residential applications.

- Iris Ceramica Group: The leading Italian manufacturer of design, flooring, and wall covering solutions supports sustainability.

- Porcelanosa Grupo: The leading manufacturer of porcelain, porous, & stoneware floor & wall tiles, and offers innovative building solutions.

Other Top Companies

- Pamesa Cerámica

- RAK Ceramics

- Grupo Lamosa

- Mohawk Industries

- Villeroy & Boch Fliesen

- Panaria Ceramiche

- Lea Ceramiche

- Cotto d’Este

- Ceramiche Refin

- Keraben Grupo

- Peronda Group

- Ezarri

- Caesar Ceramics

- Sant’Agostino

- Johnson Tiles

Segments Covered

By Product Type

- Porcelain stoneware

- Glazed ceramic tiles

- Unglazed ceramic tiles

- Vitrified tiles

- Mosaic tiles (ceramic & glass)

- Large format tiles (>600×600 mm)

- Slabs and rectified panels (>1200 mm)

- Specialty tiles (anti-slip, chemical-resistant)

By Material / Body

- Single-fired porcelain

- Double-fired ceramic

- Full-body porcelain

- Color-bodied ceramic

- Glass-based mosaics

By Design / Aesthetic

- Stone-look

- Wood-look

- Cement/concrete-look

- Metallic/industrial finishes

- Patterned/decorative

- Digitally-printed custom designs

By Thickness / Technical Grade

- Standard (6–10 mm)

- Thick (>10–20 mm)

- Thin gauged porcelain panels (3–6 mm)

By Application

- Floor tiles (interior)

- Wall tiles (interior)

- Exterior paving & façade panels

- Wet areas (bathrooms, pools)

- Kitchen worktops & countertops

- Industrial / chemical-resistant flooring

By End-User / Sector

- Residential

- Commercial

- Hospitality

- Institutional

- Infrastructure / public works

- Industrial facilities