Content

What is the Current Biofuels Market Size and Share?

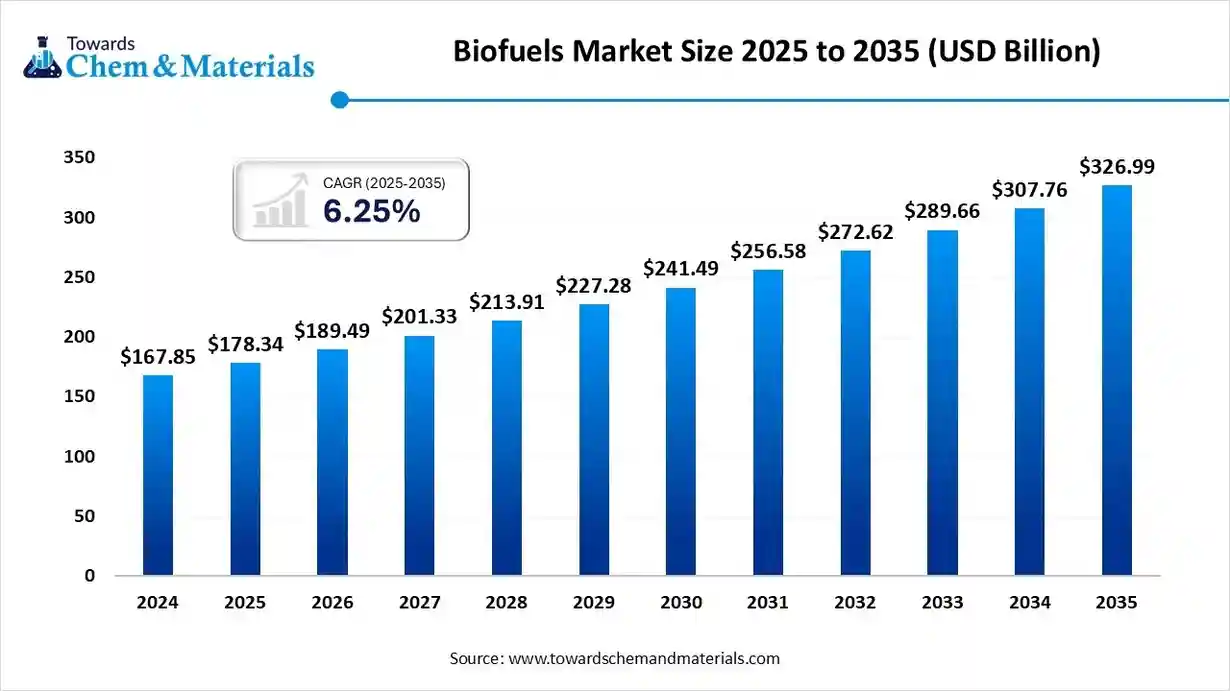

The global biofuels market size is calculated at USD 178.34 billion in 2025 and is predicted to increase from USD 189.49 billion in 2026 and is projected to reach around USD 326.99 billion by 2035, The market is expanding at a CAGR of 6.25% between 2025 and 2035. Asia Pacific dominated the Biofuels market with a market share of 43.50% the global market in 2024. The growing demand for energy and the depletion of fossil fuels drive the market growth.

Key Takeaways

- By region, Europe held a 43.5% share of the biofuels market in 2024.

- By region, Asia Pacific is growing at a 9.0% CAGR in the market during the forecast period.

- By type, the bioethanol segment held a 47.6% share in the biofuels market in 2024.

- By type, the biodiesel segment is expected to grow at a 7.6% CAGR in the market during the forecast period.

- By feedstock, the corn & sugarcane segment held a 48.5% share in the market for biofuels in 2024.

- By feedstock, the algae segment is expected to grow at a 7.7% CAGR in the market during the forecast period.

- By end-use industry, the automotive segment held a 54.3% share in the biofuels market in 2024.

- By end-use industry, the aviation segment is expected to grow at a 7.8% CAGR in the market during the forecast

- period.

Biofuel Boost: Unlocking Key Drivers Behind the Growth

Biofuels market growth is strongly supported by global efforts to reduce carbon emissions, as many countries adopt renewable fuel blending mandates and long-term climate targets. According to the International Energy Agency, global biofuel demand is expected to rise by more than 11 percent between 2023 and 2025, driven by expanding government policies that prioritise low-carbon transport fuels. Another key driver is the need for better air quality, since biodiesel and ethanol blends can reduce particulate matter, sulphur emissions, and carbon monoxide compared with conventional fossil fuels, which aligns with public health objectives highlighted by the World Health Organization.

Energy security concerns also add momentum because biofuels help reduce dependence on imported crude oil and support diversification of national fuel supplies. Growing transportation demand in emerging economies strengthens the consumption of liquid renewable fuels in sectors that are difficult to electrify, including aviation, marine transport, and heavy-duty vehicles.

What are Biofuels?

Biofuels are renewable fuels produced from biomass such as agricultural crops, forestry residues, organic waste, and algae. According to the International Energy Agency, biofuels are available in liquid, solid, and gaseous forms, with commonly used types including bioethanol, biodiesel, biogas, and bio-methanol.

They help reduce lifecycle greenhouse-gas emissions compared with fossil fuels, which supports global climate goals highlighted in international energy and environment assessments. Biofuels can also improve air quality by reducing pollutants such as sulphur and particulate matter, aligning with public health priorities identified by the World Health Organization. In addition, they strengthen energy security for many countries by diversifying fuel supplies and reducing dependence on imported petroleum.

Current Trends in Biofuels Market :

- Industry Growth Overview: According to the International Energy Agency (IEA), global biofuel demand is expected to increase by approximately 11 % by 2024, supported by existing policy mandates. A forecast by the IEA shows demand expanding by 38 billion litres (about a 30% increase) between 2023 and 2028, with emerging economies leading the growth. The market size was estimated at about USD 99.53 billion in 2023 and is projected to reach around USD 207.87 billion by 2030, corresponding to a compound annual growth rate (CAGR) of 11.3 %.

- Sustainability Trends: Biofuels provide a pathway to reduce lifecycle greenhouse-gas emissions and contribute to cleaner air by lowering sulphur and particulate emissions. By 2030, biofuels could supply about 12 exajoules, equivalent to 12 % of global transport fuel demand under certain scenarios. Supportive blending mandates, feedstock diversification toward waste and residual biomass, and sustainability certification programs are increasingly shaping production and consumption decisions.

- Global Expansion: Over 80 countries now maintain policies that support biofuel demand, reflecting global geographic expansion. Emerging economies such as Brazil, India, and Indonesia are forecast to account for about 70 % of global biofuel demand growth through 2028. Regions with strong feedstock availability, growing transport demand, and supportive regulation are becoming key production hubs for the next generation of biofuels.

- Major Investors: Investment in advanced biofuels, including renewable diesel and bio-based aviation fuels, is gaining traction among energy and chemical companies. The IEA data indicate that renewable fuels could account for around 5.5 % of energy consumption in industry, building, and transport sectors by 2030, highlighting the scale of potential investment opportunities. Financial incentives, blending mandates, and decarbonisation targets are prompting investors to scale up production capacity and upgrade existing infrastructure.

- Startup Ecosystem: Innovation in biofuels is increasingly focused on advanced pathways (such as sustainable aviation fuel from waste biomass), modular production systems, and new feedstock processing technologies. Startups are partnering with established players and research institutions to commercialise emerging technologies and scale production. As technology costs fall and regulatory support strengthens, the ecosystem of smaller entrants is poised to grow and diversify market offerings.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 189.49 Billion |

| Expected Size by 2035 | USD 326.99 Billion |

| Growth Rate from 2025 to 2035 | CAGR 6.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Segment Covered | By Type, By Feedstock, By End-Use Industry, By Region |

| Key Companies Profiled | Green Plains Inc., NextEra Energy Resources, LLC , Gevo Inc. , Pacific Ethanol, Inc. (now Alto Ingredients, Inc.) , World Energy, LLC, POET LLC, Archer Daniels Midland Company (ADM) , Renewable Energy Group Inc. (Chevron Renewable Energy Group) , Valero Energy Corporation, Neste U.S. Inc. , Cargill, Incorporated , Chevron Corporation , BP America Inc. , Shell USA, Inc. |

Key Technological Shifts in the Biofuels Market:

The biofuels market is experiencing significant technological advances driven by the need for greater efficiency, lower production costs, and improved sustainability across the entire value chain. A central shift is the increasing use of artificial intelligence, which supports real-time optimisation of conversion pathways and improves predictive decision-making for plant operators. Artificial Intelligence systems can analyse variations in biomass composition, moisture levels, and impurity content, which helps manufacturers fine-tune processes such as transesterification, hydrolysis, and fermentation for higher yield and lower energy consumption. These tools also accelerate research on new biofuel molecules by identifying patterns in feedstock behaviour and screening potential catalysts or microbial strains.

In addition, AI supports the efficient use of waste streams by mapping the quality and availability of residues and recommending the most economic routes for biofuel conversion. Companies are beginning to apply AI to improve blending practices, logistics planning and integration of biofuels into existing energy infrastructure. An example is Lootah BioFuels in the United Arab Emirates, which uses AI-based process control to enhance biodiesel yield and optimise feedstock use.

Trade Analysis of Biofuels Market: Import & Export Statistics

- Global scale and near-term growth outlook :The International Energy Agency projects global biofuel demand will rise by about 38 billion litres between 2023 and 2028, a near 30 percent increase that will expand trade opportunities for liquid biofuels such as ethanol and renewable diesel.

- Ethanol export leaders :Brazil and the United States have historically been the largest ethanol exporters, with the U.S. reporting record export volumes in 2023 and 2024 (U.S. ethanol exports reached about 1.43 billion gallons in 2023 and 1.91 billion gallons in 2024). These shipments underline the role of established producers in meeting rising mandate-driven demand abroad.

- Biodiesel and renewable diesel export dynamics :Major biodiesel exporters include Argentina, Indonesia and Malaysia, yet trade flows have been volatile owing to tariffs, anti-dumping measures and feedstock export controls that shift volumes and destinations. The U.S. International Trade Commission and news reporting document significant trade measures affecting these exporters.

- Policy and trade barriers shaping flows :The European Union has applied countervailing and anti-dumping duties on some biodiesel imports, and Indonesia has faced duties and WTO disputes relating to its biodiesel exports, which have substantially altered trade patterns and reduced shipments to some EU markets.

- Shifts to new markets and products :Where traditional export destinations tighten access, exporters have reoriented to alternative markets and higher value products such as renewable diesel and sustainable aviation fuel, or regional markets in Asia and Latin America, as documented in trade reports and industry analyses.

- Role of feedstock and domestic policy in export potential :Countries with abundant feedstock and supportive domestic mandates, such as Brazil, Indonesia, and India, are positioned to expand production and potentially export volumes, but domestic blending requirements and export curbs can limit cross-border shipments. OECD-FAO outlooks and national reports highlight these structural drivers.

- Data sources and granularity caveat :Detailed product-level trade statistics for specific biofuel types are best obtained from UN Comtrade and national customs databases; analysts should use UN Comtrade plus national reports to build partner-level flows and reconcile discrepancies caused by re-exports and fuel processing.

Biofuels Market Value Chain Analysis

- Feedstock Procurement :Feedstock procurement involves sourcing organic materials, such as oil crops, sugarcane, waste oils, corn, fats, and agricultural residues, which serve as the primary inputs for biofuel production. This stage requires reliable supply chains, seasonal crop management, and logistics planning to ensure steady availability. Feedstock cost is one of the most influential factors in the final production price of biofuels, making efficient procurement strategies essential.

- Key Players: Bunge, Valero Energy Corp, Targray, REG, ADM, Petrobras

- Chemical Synthesis and Processing : Chemical synthesis and processing include pathways such as Fischer-Tropsch synthesis, thermal cracking, transesterification, and hydrothermal liquefaction to convert biomass into liquid and gaseous biofuels. These processes determine fuel yield, carbon intensity, and overall operational efficiency. Advancements in catalysts, microbial strains, and reactor design are helping producers improve conversion rates while lowering energy input and waste generation.

- Key Players: Green Plains Inc., LanzaTech, Royal Dutch Shell plc, ADM, Neste Oyj

- Quality Testing and Certifications: Quality testing covers the analysis of physical properties, composition, impurities, emissions performance, and safety characteristics to ensure fuels meet regulatory standards. Certifications such as ISO, ISCC, EN 14214, and ASTM D6751 validate sustainability, consistency and compatibility with engines and existing fuel infrastructure. Accredited testing and certification help maintain market trust and support cross-border trade of regulated biofuel products.

- Key Players: Intertek, TUV SUD, FARE Labs, SGS, Bureau Veritas, AmSpec Group

From First to Fourth: Overview of Biofuel Generation

| Generation | Raw Material Used | Conversion Process | Output |

| First Generation (1G) |

|

Fermentation |

|

| Second Generation (2G) |

|

|

|

| Third Generation (3G) |

|

Thermochemical Processes |

|

| Fourth Generation (4G) |

|

|

|

Segmental Insights

Type Insights

Why the Bioethanol Segment Dominates the Biofuels Industry?

The bioethanol segment dominated the biofuels industry with a 47.6% share in 2024. The growing transportation sector and focus on minimizing greenhouse gas emissions increase demand for bioethanol. The growing energy security demand and the favorable government policies require bioethanol. The cost-effectiveness of bioethanol and the presence of abundant feedstocks like sugarcane & rice drive the overall market growth.The biodiesel segment is growing at a 7.6% CAGR in the market during the forecast period.

The strong focus on lowering carbon monoxide & hydrocarbons emissions and the increasing need for energy security increase demand for biodiesel. The growing use of biodiesel in generators, vehicles, and locomotives helps market growth. The increasing demand for power in areas like schools, residential zones, and hospitals requires biodiesel that supports the overall market growth.

The biogas segment is significantly growing in the market. The strong focus on energy independence and the increasing need for energy security require biogas. The growing applications like cooking, electricity generation, and heating require biogas. The increasing use of vehicles and the rising generation of power require biogas that supports the overall market growth.

Feedstock Insights

How did the Corn & Sugarcane Segment Hold the Largest Share in the Biofuels Market?

The corn & sugarcane segment held the largest revenue share of 48.5% in the biofuels market in 2024. The presence of high starch content and cost-effective conversion processes of sugarcane helps market growth. The increasing demand for high-yield biofuels and the high production volume of biofuels require corn & sugarcane. The well-established industrial and agricultural infrastructure drives the overall market growth.

The algae segment is growing at the fastest CAGR of 7.7% in the market during the forecast period. The strong focus on lowering greenhouse gas emissions and the increasing need for high lipid content require algae. The presence of non-arable land growing wastewater infrastructure increases the production of algae. The growing production of biogas, biodiesel, and bioethanol requires algae, supporting the overall market growth.

The waste oil & fats segment is growing at a significant rate in the market. The strong focus on improving the properties of biofuels and the increasing need for waste management require waste oils & fats. The cost-effectiveness and focus on lowering greenhouse gas emissions require waste oil & fats. The strong presence of waste oils and fats supports the overall market growth.

End-Use Industry Insights

Which End-Use Industry Dominated the Biofuels Market?

The automotive segment dominated the biofuels market with a 54.3% share in 2024. The growing road transport and increasing need for heavy transport vehicles require biofuels. The increasing use of commercial vehicles and light-duty passenger cars increases the adoption of biofuels. The strong focus on lowering greenhouse gas emissions and the expansion of the automotive sector require biofuels, driving the overall market growth.

The aviation segment is growing at a 7.8% CAGR in the market during the forecast period. The decarbonization goals in the aviation industry and strong government support for the adoption of SAF require biofuels. The increasing demand for sustainable & conventional jet fuels and the rise in air travel require biofuels. The focus on lowering emissions and initiatives like CORSIA require biofuels, supporting the overall market growth.

The marine segment is significantly growing in the market. The strong focus on lowering greenhouse gas emissions and regulations like the EU ETS requires biofuels. The focus on energy security and the increasing need for energy independence require biofuels. The availability of bio-LNG, FAME, & HVO and the increasing marine shipping support the overall market growth.

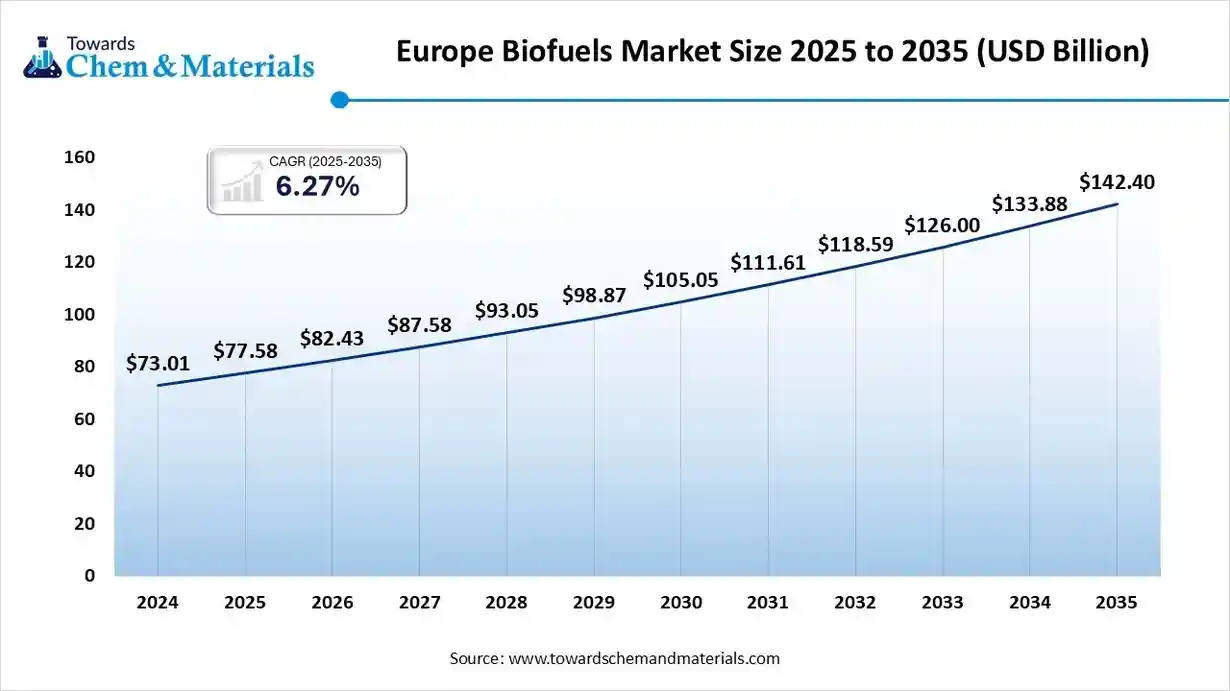

Regional Insights

The Europe biofuels market size was valued at USD 178.34 billion in 2025 and is expected to reach USD 326.99 billion by 2035, growing at a CAGR of 6.25% from 2025 to 2035. Europe dominated the biofuels market with a 43.5% share in 2024.

The well-established distribution & bio-refineries systems and sustainability policies like RED III increase demand for biofuels. The strong focus on energy security and the increasing need to lower greenhouse gas emissions require biofuels. The climate neutrality goals and presence of key feedstocks increase the production of biofuels. The growing investment in biofuel production facilities and innovations in conversion technologies drives the overall market growth.

Green Transition: What is Germany's Role in the Biofuels Revolution

Germany is a key contributor to the biofuels industry. The government targets for renewable energy and a shift towards sustainable fuels increase demand for biofuels. The increasing investment in renewable energy sources and decarbonization goals requires biofuels. The growing demand for electric mobility and a strong focus on energy security require biofuels. The growing expansion of the transportation sector and the expansion of HVO, driving the overall market growth.

- Germany exported 111 shipments of biodiesel.(Source: www.volza.com)

Asia Pacific Biofuels Market Trends

Asia Pacific is growing at a 9.0% CAGR in the market during the forecast period. The strong focus on energy independence and the growing need for sustainable energy make biofuels essential. The availability of feedstocks such as agricultural waste, sugarcane, and palm oil increases biofuel production. Government initiatives, such as the Ethanol Blending Program and mandates for biodiesel, support overall market growth.

From Farms to Fuel: India’s Contribution to the Biofuels Boom

India is a major contributor to the biofuels market. The availability of abundant feedstocks, such as agricultural residues and sugarcane, increases biofuel production. The government initiatives, like the National Policy on Biofuels, and programs like SATAT require biofuels. The growing demand for domestic energy security and commitments to address climate change are driving biofuels demand, supporting overall market growth.

- India exported 505 shipments of biogas.(Source: www.volza.com )

- Madhya Pradesh launched a biofuel scheme under the Madhya Pradesh Renewable Energy Policy to support sustainability. The scheme aims to lower dependence on fossil fuels, produce advanced biofuels, and offer financial incentives.(Source: www.energetica-india.net )

Biofuels Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 20.32% |

| Europe | 43.50% |

| Asia Pacific | 25.88% |

| Latin America | 6.19% |

| Middle East and Africa | 4.11% |

North America Biofuels Market Trends

North America is growing rapidly in the biofuels industry. The presence of abundant agricultural resources, such as biomass, corn, & soybeans, in countries like Canada and the U.S. supports market growth. The increasing investment in biofuel refineries and well-established biofuel infrastructure helps market growth. Strong government support through initiatives such as the Inflation Reduction Act’s tax credits and the presence of advanced biofuels drive overall market growth.

Biofuel Boom: United States Contribution towards Clean Energy

The United States is growing rapidly in the biofuels market. Government policies, such as the Renewable Fuel Standards and increased awareness of air pollution, increase demand for biofuels. The presence of diverse feedstocks, such as recycled cooking oil, wood, and crop waste, increases biofuel production. The growing expansion of the aviation & transportation sector and the high availability of SAF & renewable diesel support the overall market growth.

Powering Progress: Biofuels Industry Expansion in South America

South America is growing significantly in the biofuels market. The well-established agricultural sector and the presence of abundant resources, such as soybeans & sugarcane, increase biofuel production. The strong focus on reducing fossil fuel dependence and on lowering GHG emissions requires biofuels. The growing investment in biofuel production and climate change goals drives the overall market growth.

Brazil biofuels Industry Trends

Brazil contributes to the growth of the biofuels industry. The abundance of feedstocks such as corn & sugarcane, along with stringent climate goals, increases demand for biofuels. The strong focus on energy security and growing production of SAF & green diesel help market growth. Government initiatives, such as the RenovaBio Program, and innovations, such as flex-fuel vehicle technology, support overall market growth.

Middle East & Africa Biofuels Market Trends

The Middle East & Africa are growing in the biofuels market. The growing demand for energy and the strong focus on energy security are driving the adoption of biofuels. Government subsidies for biofuel production and investment in renewable energy projects help drive market growth. The availability of feedstocks such as sorghum & sugarcane increases biofuel production, driving overall market growth.

Saudi Arabia biofuels Sector Trends

Saudi Arabia is growing rapidly in the biofuels sector. The growing investment in research & development of biofuel and Saudi Green Initiatives helps market growth. The growing consumption of energy and increasing awareness of environmental issues are driving demand for biofuels. The availability of feedstocks such as used cooking oil, agricultural waste, and municipal solid waste increases biofuel production, supporting overall market growth.

Recent Developments

- In November 2025, Honeywell launched new technology, Biocrude Upgrading processing, for the production of renewable marine fuel from crop residues and wood chips. The technology manufactures SAF, low-carbon marine fuel, & gasoline.(Source: biofuels-news.com )

- In May 2025, NYK Group Company launched Japan’s first antioxidant, BioxiGuard, for marine biodiesel fuel. It enhances biodiesel oxidation stability and reduces biofuel degradation rate by 50%.

(Source: www.nyk.com) - In June 2025, Toyota launched biomass-based bioethanol to support the low-carbon fleet transition. The bioethanol produced from forestry by-products & rice straw, and the annual capacity of generating 60 kiloliters of bioethanol.

(Source: www.bioenergy-news.com) - In October 2025, EnviTec and Byont launched the first Belgian biogas plant. The daily production capacity of bio-LCO2 is 24 tons, and the project supports the development of decarbonized energy. The plant produces bio-LNG and biomethane.(Source: worldbiomarketinsights.com)

Top Companies in the Biofuels Market

- Green Plains Inc. – Green Plains is one of the largest ethanol producers in the U.S., with a strategic shift toward producing high-value bio-based products through advanced fermentation and carbon reduction technologies. The company also manufactures renewable corn oil, high-protein feed ingredients, and low-carbon fuel solutions that support decarbonized transportation markets.

- NextEra Energy Resources, LLC – NextEra is expanding beyond wind and solar into renewable fuels, including renewable natural gas and advanced biofuels. The company develops large-scale clean fuel projects that support fleet decarbonization, low-carbon transportation, and long-term U.S. energy transition goals.

- Gevo Inc. – Gevo specializes in producing sustainable aviation fuel, isobutanol-derived fuels, and renewable gasoline using advanced fermentation and alcohol-to-jet conversion technologies. The company focuses on low-carbon intensity fuels and integrates renewable electricity and carbon capture to reduce production emissions.

- Pacific Ethanol, Inc. (now Alto Ingredients, Inc.) – Alto Ingredients produces low-carbon ethanol, specialty alcohols, and high-quality animal feed co-products across its U.S. biorefineries. The company is diversifying into renewable fuels and specialty biochemicals, expanding its footprint in value-added bio-based markets.

- World Energy, LLC – World Energy is a major U.S. producer of biodiesel and sustainable aviation fuel, operating one of the largest commercial SAF facilities in California. The company supplies renewable jet fuel and low-carbon diesel to airlines, logistics providers, and transportation fleets seeking to meet clean-fuel commitments.

- POET LLC – A leading ethanol producer that operates a large network of biorefineries and offers co-products such as distillers grains and corn oil for feed and renewable fuel markets.

- Archer Daniels Midland Company (ADM) – ADM is a major producer of ethanol and biodiesel while also developing advanced biofuel technologies and carbon capture systems to reduce lifecycle emissions.

- Renewable Energy Group Inc. (Chevron Renewable Energy Group) – A leading biodiesel and renewable diesel producer with a nationwide footprint of biorefineries supplying low-carbon fuels to transportation and industrial markets.

- Valero Energy Corporation – A major producer of renewable diesel through its joint venture with Darling Ingredients, Diamond Green Diesel, supplying low-carbon fuel into domestic and export markets.

- Neste U.S. Inc. – The U.S. arm of Neste, a global leader in renewable diesel and sustainable aviation fuel, supplying large volumes of low-carbon fuels to transportation, aviation, and municipal fleets.

- Cargill, Incorporated – A producer of biodiesel and renewable fuel feedstocks, including vegetable oils and waste-based inputs, supporting both domestic production and global biofuel supply chains.

- Chevron Corporation – Expanding aggressively into renewable diesel, SAF, and renewable natural gas, integrating biofuel assets through acquisitions and joint ventures such as REG.

- BP America Inc. – Develops renewable diesel and sustainable aviation fuel projects and invests in biogas and waste-to-fuel technologies to support its low-carbon strategy.

- Shell USA, Inc. – Invests in renewable diesel, SAF, and waste-to-fuel technologies while developing hydrogen-ready and biofuel-integrated mobility solutions across the U.S.

Segments Covered

By Type

- Bioethanol

- Biodiesel

- Biogas

- Bio-butanol

By Feedstock

- Corn & Sugarcane

- Algae

- Waste Oil & Fats

- Cellulosic Material

By End-Use Industry

- Automotive

- Aviation

- Marine

- Industrial

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa