Content

Fertilizer Catalysts Market Size | Companies Analysis 2034

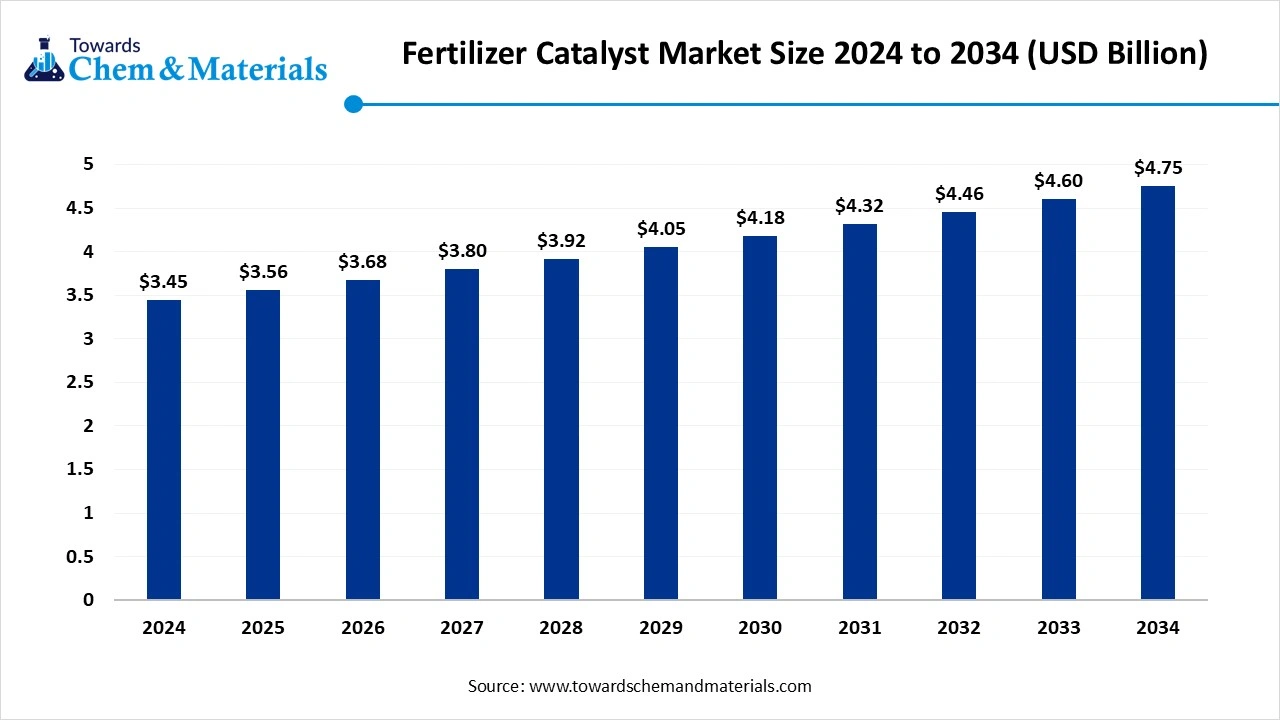

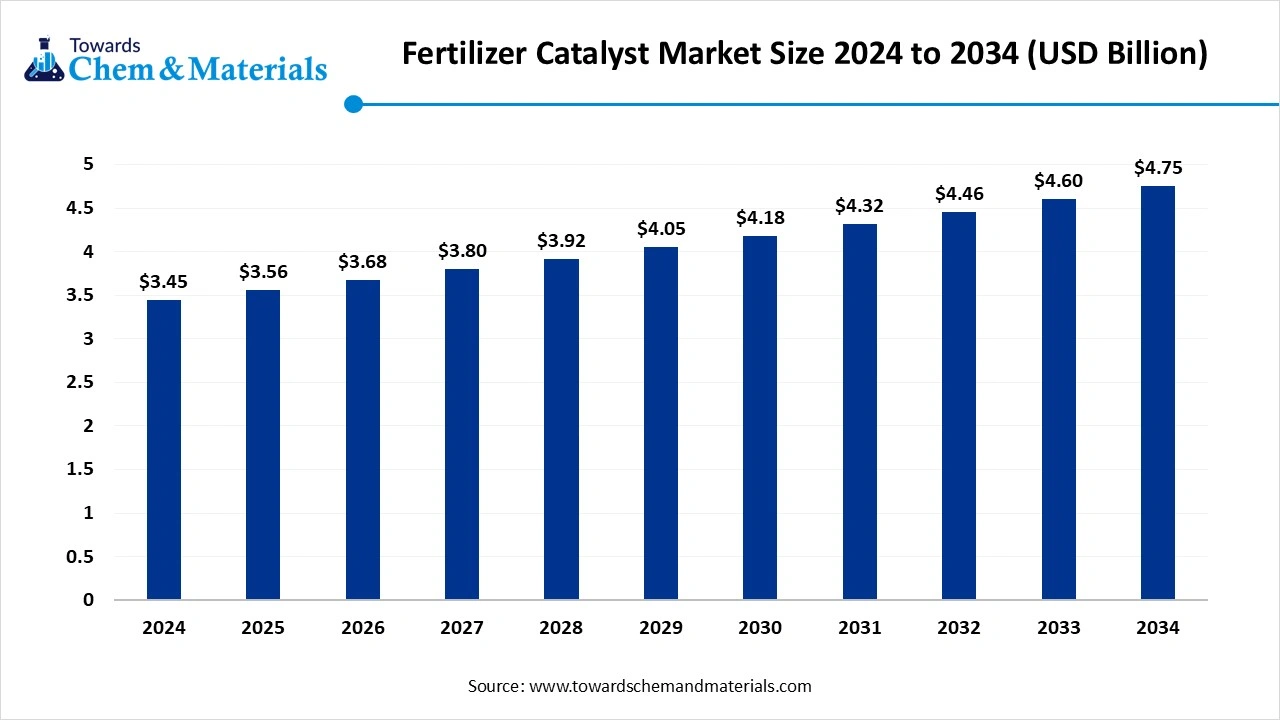

The fertilizer catalysts market size is calculated at USD 3.45 billion in 2024, grew to USD 3.56 billion in 2025, and is projected to reach around USD 4.75 billion by 2034. The market is expanding at a CAGR of 3.25% between 2025 and 2034. Increasing demand for food security is the key factor driving market growth. Also, technological innovations such as nano catalysts coupled with the stringent environmental regulations focusing on cleaner production can fuel market growth further.

Key Takeaways

- By region, Asia Pacific dominated the market by holding the largest market share in 2024.

- By region, North America is expected to grow at the fastest CAGR over the forecast period.

- By process, the Haber-Bosch process segment dominated the market with the largest share in 2024.

- By process, the urea production process segment is expected to grow at the fastest CAGR over the forecast period.

- By product, the iron-based catalysts segment held the largest market share in 2024.

- By product, the nickel-based catalysts segment is expected to grow at the fastest CAGR during the projected period.

What is Fertilizer Catalyst?

The market is fuelled by the growing need for higher crop yields and increasing global food demand. It is the market for specialized substances that boosts chemical reactions in the manufacturing of fertilizers. These catalysts, like platinum, iron, and rhodium compounds, are essential for enhancing the efficiency, yield, and sustainability of production processes such as ammonia synthesis, nitric acid production, and urea formation.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 3.56 Billion |

| Expected Size by 2034 | USD 4.75 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Process, By Product, By Region |

| Key Companies Profiled | Albemarle Corporation, LKAB Minerals AB, Quality Magnetite, OhamIndustries, Axens, Agricen,Thyssenkrupp AG |

Fertilizer Catalysts Market Outlook:

- Industry Growth Overview: Between 2025-2034, the market is anticipated to witness substantial growth due to innovations in catalyst technology, such as nano catalysts, minimizing energy consumption and reducing greenhouse gas emissions, which makes them more attractive to manufacturers.

- Sustainability Trends: This trend in the market includes the development of sustainable catalysts for bio-based fertilizers and an emphasis on process innovation to minimize greenhouse gas emissions. Also, there is an increasing trend towards using waste materials through processes such as catalytic pyrolysis.

- Global Expansion: Major players such as CF Industries are focusing on expanding their manufacturing facilities to fulfill the increasing demand for fertilizer catalysts. Also, many companies are entering into joint ventures and strategic collaborations to improve supply chain efficiency.

Key Technological Shifts in the Fertilizer Catalysts Market:

Key technological shifts in the market are mainly fuelled by demand for energy efficiency, sustainability, and operational enhancements in fertilizer manufacturing. The market is moving more towards sustainable and potentially decentralized manufacturing methods.

- Clariant AG recently developed the AmoMax series, such as the innovative catalyst AmoMax-10, for smooth and efficient ammonia production. This catalyst can offer significant energy savings and has been adopted in various large-scale ammonia plants.(Source: www.clariant.com)

Trade Analysis of Fertilizer Catalysts Market: Import & Export Statistics

- China's fertilizer exports surged in Q1 2025, reaching 7.16 million tons, a 44.5% year-on-year increase. Export revenue for the period was $1.436 billion, a 42.7% increase.(Source: www.echemi.com)

- India's fertilizer export value was approximately $37.58 million in 2023–24, a significant drop from $130.43 million in 2022–23.(Source: www.eximpedia.app)

Value Chain Analysis of the Fertilizer Catalysts Market:

- Feedstock Procurement : It is the process of acquiring the raw materials required to manufacture catalysts. These catalysts are necessary for the manufacturing of fertilizers.

- Chemical Synthesis and Processing : It is the process where catalysts are used on a very large scale in chemical reactions to create the necessary fertilizer components.

Packaging and Labelling : This stage refers to the material and other information utilized to identify products for transport, storage, and handling. - Regulatory Compliance and Safety Monitoring : It involves the detailed framework of rules, standards, and oversight procedures, which control the manufacturing, handling, and use of catalysts.

Fertilizer Catalysts Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States (USA) | The EPA's regulations under 40 CFR section 261.4(a)(21) provide conditions for recycling hazardous secondary materials to make zinc fertilizers, including strict contaminant limits for heavy metals. |

| India | The government introduced the Fertilizer (Control) Fourth Amendment Order, 2025, which sets new standards for biostimulants, microbial formulations, and other innovative fertilizers to support sustainable farming practices |

| China | It is illegal to produce, import, or sell unregistered fertilizers in China. The Ministry of Agriculture and Rural Affairs (MARA) oversees a registration system with different categories based on the fertilizer type.. |

Market Opportunity

Surge in Development of Low-Carbon Catalysts

A major growth opportunity for the market lies in the development of sustainable technologies. With rising global emphasis on sustainability to minimize emissions of greenhouse gases, fertilizer manufacturers are increasingly adopting cleaner manufacturing techniques. Furthermore, cutting-edge catalysis designed to function at much lower temperatures and pressures can substantially cut overall carbon output.

Market Challenge

Competition from Conventional Fertilizers

The strong availability of conventional and less-expensive fertilizers, particularly in emerging regions, is the major factor hindering the market growth. These traditional alternatives can limit the adoption of more costly and state-of-the-art catalyst technologies. Moreover, some chemicals utilized in fertilizer manufacturing and other processes can pose certain health risks.

Segmental Insights

Process Insights

Which Process Type Segment Dominated the Fertilizer Catalysts Market in 2024?

The Haber-Bosch process segment dominated the market with the largest share in 2024. The dominance of the segment can be attributed to the increasing demand for efficient nitrogen-based fertilizers along with the ongoing development of more sustainable and cost-effective catalyst technologies. Additionally, the use of high-performance and low-cost catalysts such as iron is a major factor contributing to the segment's dominance.

The urea production process segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rise in adoption of sustainable farming practices, coupled with the government support for fertilizers. Advancements in catalyst technology aim to minimize greenhouse gas emissions from ammonia plants, which is a crucial step in the production of urea.

Product Insights

How Much Share Did the Iron-Based Catalysts Segment Held in 2024?

The iron-based catalysts segment held the largest market share in 2024. The dominance of the segment can be linked to its cost-effectiveness and environmental benefits, such as lower emissions. Moreover, iron catalysts can bear the high temperatures and pressures most common in fertilizer production, which results in a long operational life and lower maintenance needs.

The nickel-based catalysts segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by increasing emphasis on cleaner manufacturing practices, along with the rapid advancements in catalyst formulation and design, which lead to more durable and effective catalysts. Furthermore, nickel-based catalysts are more efficient in hydrogenation processes.

Regional Insights

Asia Pacific dominated the market by holding the largest market share in 2024.

The dominance of the region can be attributed to the rapid urbanisation and economic development in the region, coupled with the advent of new government initiatives to fuel agricultural productivity. In addition, governments of developing countries are implement ting policies and offering financial support to incentivize the use of catalysts.

China Fertilizer Catalysts Market Trends

In the Asia Pacific, China led the market due to the ongoing inclination towards more efficient and sustainable technologies, along with the stringent government regulations. Also, China is the major consumer of fertilizers globally due to its large population and agricultural sector.

North America is expected to grow at the fastest CAGR over the forecast period.

The growth of the region can be credited to the stringent environmental regulations and a surge in agricultural efficiency. Furthermore, the region boasts a robust R&D infrastructure often fuelled by partnerships between universities and industry, which can impact positive regional growth soon.

U.S. Fertilizer Catalysts Market Trends

In North America, the U.S. dominated the market by holding the largest market share due to innovations in catalyst technology and stringent environmental regulations. The move towards "green ammonia" production creates new market avenues for catalysts compatible with these processes.

Country-level Investments & Funding Trends for the Fertilizer Catalysts Market:

- India: A major global consumer and the third-largest producer of fertilizers, India sees significant government investment in its fertilizer sector.

- United States: The U.S. is investing in technologies that enhance sustainability and improve energy efficiency, especially due to volatile natural gas prices, which are a key cost driver for ammonia production.

- China: The largest global producer and consumer of fertilizers, China's fertilizer catalysts market is supported by strong agricultural activity and government initiatives.

Recent Development

- In March 2024, Clariant Chemical Company announced the launch of CLARITY™ Prime, a cutting-edge digital service for syngas plants. The premium edition gives ML-based catalyst performance projections along with advanced technical support.(Source: www.clariant.com)

Top Vendors in Fertilizer Catalysts Market & Their Offerings:

- Clariant AG: Clariant AG is a leading global supplier of catalysts for the fertilizer market, particularly for ammonia and methanol production.

- Johnson Matthey (JM): Johnson Matthey (JM) is a significant player in the fertilizer catalysts market, providing catalysts for syngas production and other chemical processes that are essential for fertilizer manufacturing.

- Unicat Catalyst Technologies: Unicat Catalyst Technologies is a prominent manufacturer and supplier in the global fertilizer catalysts market, with a strong focus on catalysts for ammonia and syngas production.

Other Players

- Albemarle Corporation

- LKAB Minerals AB

- Quality Magnetite

- Oham Industries

- Axens

- Agricen

- Thyssenkrupp AG

Segment Covered

By Process

- Haber-Bosch Process

- Potassium Fertilizer Production

- Nitric Acid Production

- Contact Process

- Urea Production

By Product

- Iron-Based Catalysts

- Nickel Based Catalysts

- Cobalt Based Catalysts

- Vanadium Based Catalysts

- Zinc Based Catalysts

- Ruthenium Based Catalysts

- Rhodium Based Catalysts

- Chromium Based Catalysts

- Molybdenum Based Catalysts

- Copper Chromite Catalyst

- Platinum Based Catalysts

- Palladium Based Catalysts

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait