Content

Renewable Polypropylene Market Size and Companies Analysis

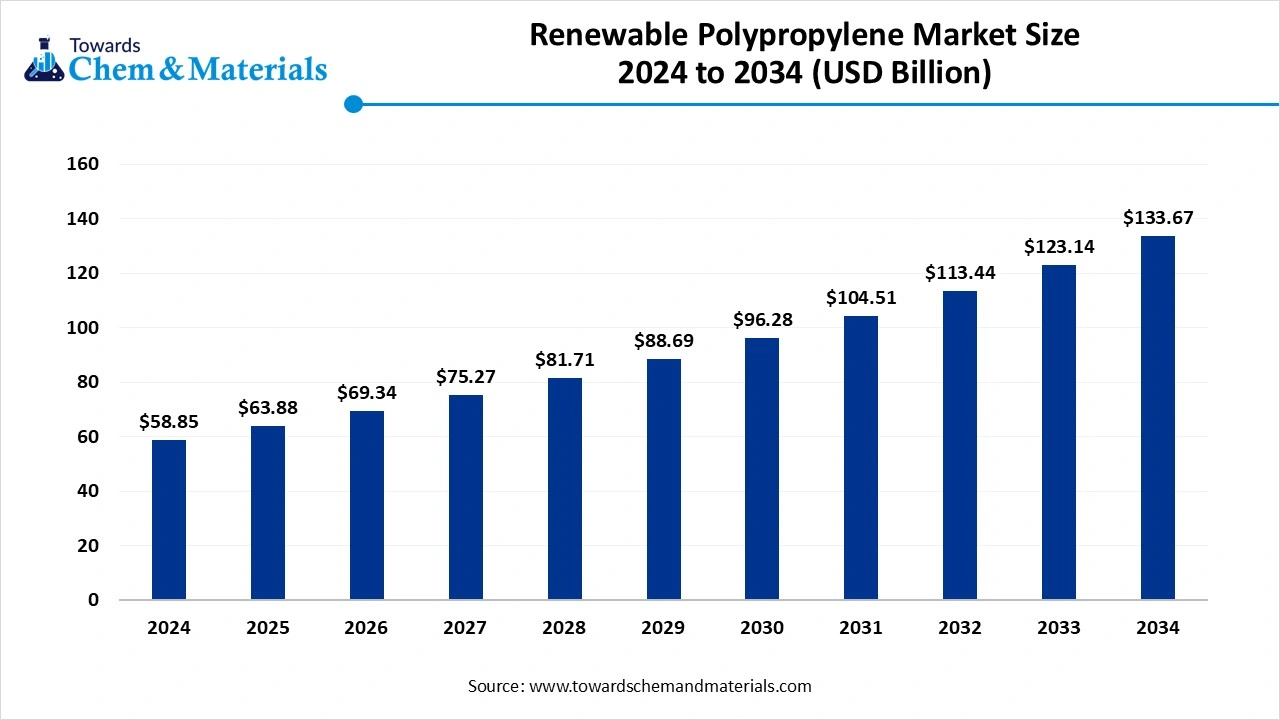

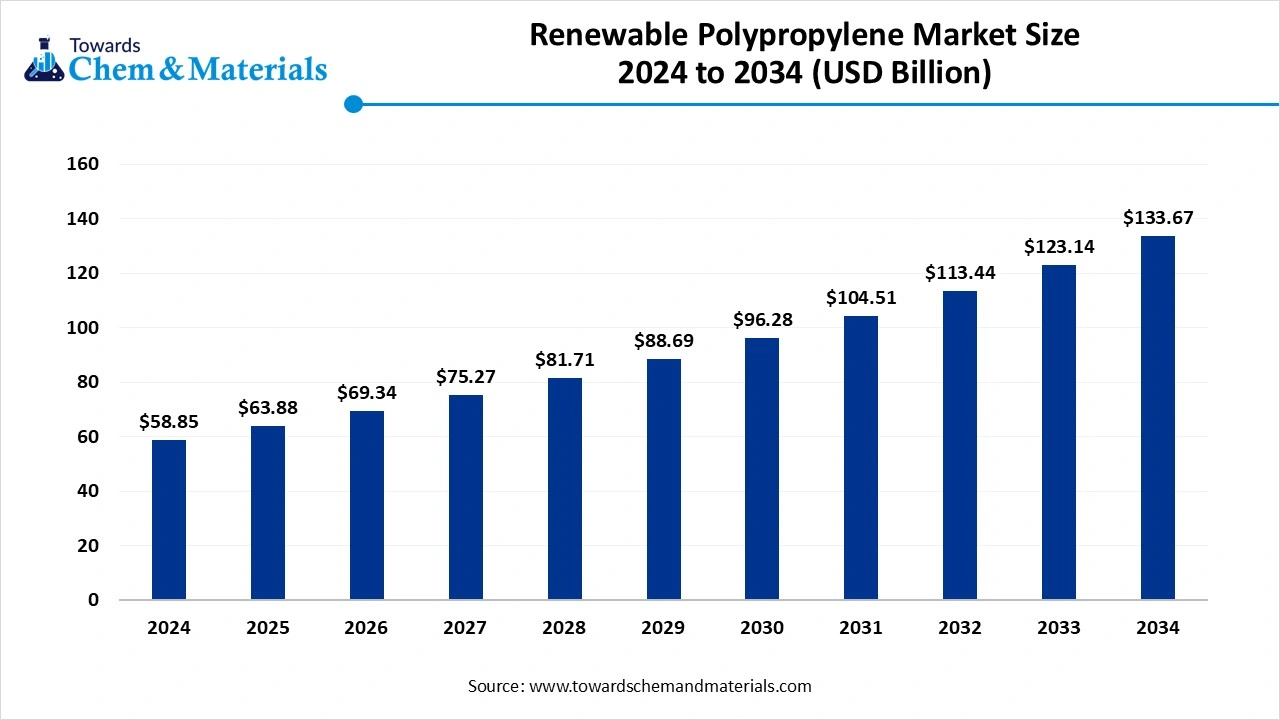

The global renewable polypropylene market size was valued at USD 58.85 billion in 2024 and is expected to hit around USD 133.67 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.55% over the forecast period from 2025 to 2034. The global shift towards sustainability has improved the performance and scalability of the sector in recent years.

Key Takeaways

- By region, North America dominated the renewable polypropylene market in 2024.

- By region, Asia Pacific is expected to grow at a notable rate in the future.

- By source type, the sugarcane-based segment dominated the market in 2024.

- By source type, the biomass-based segment is expected to grow at the fastest rate in the market during the forecast period.

- By end user type, the food and beverage industry segment dominated the market in 2024.

- By end user type, the automotive industry segment is expected to grow at the fastest rate in the market during the forecast period.

What is Renewable Polypropylene?

The renewable polypropylene refers to the plastic which is made from the eco-friendly materials such the plants, agricultural waste, and captured carbon. Also, the manufacturers are increasingly converting materials like sugars, bioethanol, and biomass into polypropylene. Moreover, these polypropylene materials also have strength, recyclability, and heat resistance.

Renewable Polypropylene Market Outlook:

- Industry Growth Overview : Between 2025 and 2034, as the global push towards lower-carbon plastic and sustainable manufacturing, the renewable polypropylene is set to create competitive advantages in the production spaces during the forecast period. Also, the heavy investment in the biorefineries and recycling plants is supported capital growth and economic activity in the sector.

- Sustainability Trends: the major brands are applying and implementing several strategies for making renewable polypropylene more eco-friendly in recent years. Also, the certification and transparent supply chains have been regarded as a major technological advancement in the current period.

- Global Expansion: advanced regions like Europe and North America have seen in exporting modern recycling technology to Latin America and the Asia Pacific in recent years. Also, the Asia Pacific manufacturers have offered low-cost polypropylene production advantages to the global brands in the past few years.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 63.88 Billion |

| Expected Size by 2034 | USD 133.67 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Source, By End-Use Industry, By Region |

| Key Companies Profiled | Biobent Holdings, LLC, Neste Oyj, Exxon Mobil Corporation, Trellis Earth Products, Inc., LyondellBasell Industries N.V., DuPont de Nemours, Inc. |

Key Technological Shifts in the Renewable Polypropylene Market:

The renewable polypropylene manufacturers are increasingly moving towards crop-based routes to the low-carbon conversion methods in recent years. Also, the modular micro refineries have gained major industry attention due to their lower capital needs and ability to enable local production facilities.

Trade Analysis of the Renewable Polypropylene Market: Import & Export Statistics

- India exported a significant amount of plastic in August 2024 and worth approximately USD 1,065.(Source : plexconcil.org)

- China’s PP export is likely to touch 2.6 million tonnes in 2024.(Source: www.icis.com)

- The United States has exported a huge amount of polypropylene in its primary forms, and the estimated cost of this export is 1,848,819.21USD.(Source : wits.worldbank.org)

Valus Chain Analysis of the Renewable Polypropylene Market:

- Distribution to Industrial Users : Majorly, the chemical companies and biopolymer producers have been dominating in the distribution and industrial utilization of renewable polypropylene in recent years.

- Chemical Synthesis and Processing : Chemical synthesis and the processing of renewable polypropylene include the production of propylene monomers and standard polymerization.

- Regulatory Compliance and Safety Monitoring : The safety and regulatory process of renewable polypropylene is mainly associated with respective regional standards.

Renewable Polypropylene Market’s Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Environmental Protection Agency (EPA) | Toxic Substances Control Act (TSCA) | Environmental impact of production | This agency regulates the environmental impact of renewable PP production, including air and water emissions. |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC) No 1907/2006 | Circular economy principles | This agency manages the registration, evaluation, authorization, and restriction of chemicals under REACH. |

| China | Ministry of Ecology and Environment (MEE) | Environmental Protection Law of the People's Republic of China | Environmental Compliance | The agencies oversee environmental regulations for the production of renewable PP, including waste management and emissions. |

| India | Ministry of Environment, Forest and Climate Change (MoEFCC) | Plastic Waste Management Rules, 2016 (amended in 2021 and 2022) | Waste management | This agency oversees environmental regulations for plastics, including waste management. |

Segmental Insights

Source Type Insights

How did the Sugarcane-Based Segment Dominate the Renewable Polypropylene Market in 2024?

The sugarcane-based segment dominated the market in 2024 due to factors such as the cost-effectiveness and bio-based feedstock, which has abundant availability across the globe. Moreover, in several regions, the manufacturers are seen in converting sugarcane ethanol into propylene with traditional biorefinery infrastructure, which is actively leading the industry growth in recent years. Also, the trend towards eco-friendliness has contributed to the segment growth in the past few years.

The biomass–based segment is expected to grow at a notable rate during the forecast period, owing to the industrial shift towards the non-food feedstock. Moreover, the manufacturers are actively choosing these non-food feedstocks to avoid competition with agricultural lands. Also, the ongoing governmental push towards sustainability with attractive subsidies is providing huge attention to the segment in recent years.

End Use Insights

Why does the Food and Beverage Segment Dominate the Renewable Polypropylene Market?

The food and beverage segment dominated the market in 2024 because of the massive demand for sustainable packaging materials. Global beverage brands and food processors are replacing single-use plastics with renewable and recyclable polypropylene to meet consumer and regulatory pressure. Renewable PP provides the same durability, clarity, and heat resistance as traditional PP but with a lower carbon footprint. Packaging firms favor it for bottles, films, and containers since it supports both environmental labeling and brand reputation.

The automotive industry segment is expected to grow at a notable rate during the forecast period, because of the massive demand for sustainable packaging materials. Global beverage brands and food processors are replacing single-use plastics with renewable and recyclable polypropylene to meet consumer and regulatory pressure. Renewable PP provides the same durability, clarity, and heat resistance as traditional PP but with a lower carbon footprint. Packaging firms favor it for bottles, films, and containers since it supports both environmental labeling and brand reputation.

Regional Insights

North America Renewable Polypropylene Market Trends

North America dominated the market in 2024, owing to having a modern biopolymer R&D infrastructure and the implementation of stronger rules and regulations of sustainability. Moreover, the major brand manufacturers have seen a heavy investment in renewable plastic production and replacement of hazardous traditional plastic in the region nowadays.

What Drives the United States' Supremacy in the Renewable Polypropylene Industry?

The United States maintained its dominance in the market, owing to access to the advanced bioplastic-making technology. Moreover, the availability of greater agricultural feedstock has driven the industry's growth over the past few years. Moreover, the enlarged expansion of the automotive and packaging industry has contributed to favorable market economics for the country’s industry.

Asia Pacific Renewable Polypropylene Market Trends

Asia Pacific is expected to capture a major share of the market during the forecast period, akin to the ongoing and huge industrialization in recent years, as the region has seen in heavy sustainability initiatives adoption. Also, the regional countries like India, China, and Japan are rapidly expanding renewable polypropylene stock to serve major regional sectors like packaging and automotive in the current period.

What Makes China a Rising Star in the Sustainable Plastic Revolution?

China is expected to emerge as a prominent country for the renewable polypropylene market in the coming years, as China has seen greater investment towards green chemistry. Also, the availability of cost-effective biomass and sugar-based feedstock is likely to provide a vast consumer base to the country during the forecast period. Moreover, the government is pushing carbon neutrality initiatives, which are expected to drive industry growth in the coming years.

Country-level Investments & Funding Trends for the Renewable Polypropylene Industry:

- Germany: Borealis has invested significantly in the production of recyclable foam innovation, and the estimated investment amount is EUR 100 million.(Source: www.borealisgroup.com)

- India: India has invested ₹10,000 crore in the PET recycled industry in the past three years.(Source: www.thehindu.com)

Recent Development

- In June 2025, INEOS started its own production of recycled plastic, which includes modern and advanced production facilities, as per the report published by the company recently.(Source: www.chemanalyst.com)

- In October 2025, Integra Plastics AD converted its own polypropylene production facility to a mechanical recycling technology. Furthermore, the company is likely to use post-consumer polyolefin waste to develop new products in the coming years.(Source: www.borealisgroup.com)

- In August 2025, Lummus Technology plans to establish the world's first recycled polypropylene plant in Belgium. Also, the company is expected to use Novolen® polypropylene (PP) technology in this newly established plant, as per the published report.(Source: www.lummustechnology.com)

Top Vendors in the Renewable Polypropylene Market & Their Offerings:

- Global Bioenergies SA: A French industrial biotech company focused on developing a process to convert renewable resources into hydrocarbons for fuels, cosmetics, and plastics.

- Braskem SA: A Brazilian petrochemical company and one of the largest producers of thermoplastic resins in the Americas, known for being a pioneer in producing biopolymers from sugarcane ethanol.

- The Dow Chemical Company: a multinational materials science corporation headquartered in Michigan that produces a wide array of chemical and plastic solutions for packaging, infrastructure, and coatings.

- Mitsubishi Chemical Holdings Corporation: A diversified chemical company from Japan that produces a wide range of chemical products, performance polymers, and healthcare solutions.

Other Key Players

- Biobent Holdings, LLC

- Neste Oyj

- Exxon Mobil Corporation

- Trellis Earth Products, Inc.

- LyondellBasell Industries N.V.

- DuPont de Nemours, Inc.

Segments Covered in the Report

By Source

- Sugarcane

- Corn

- Biomass

- Others

By End-Use Industry

- Automotive

- Packaging

- Building & Construction

- Consumer Goods

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait