Content

Recycled Engineering Plastics Market Size and Companies Analysis

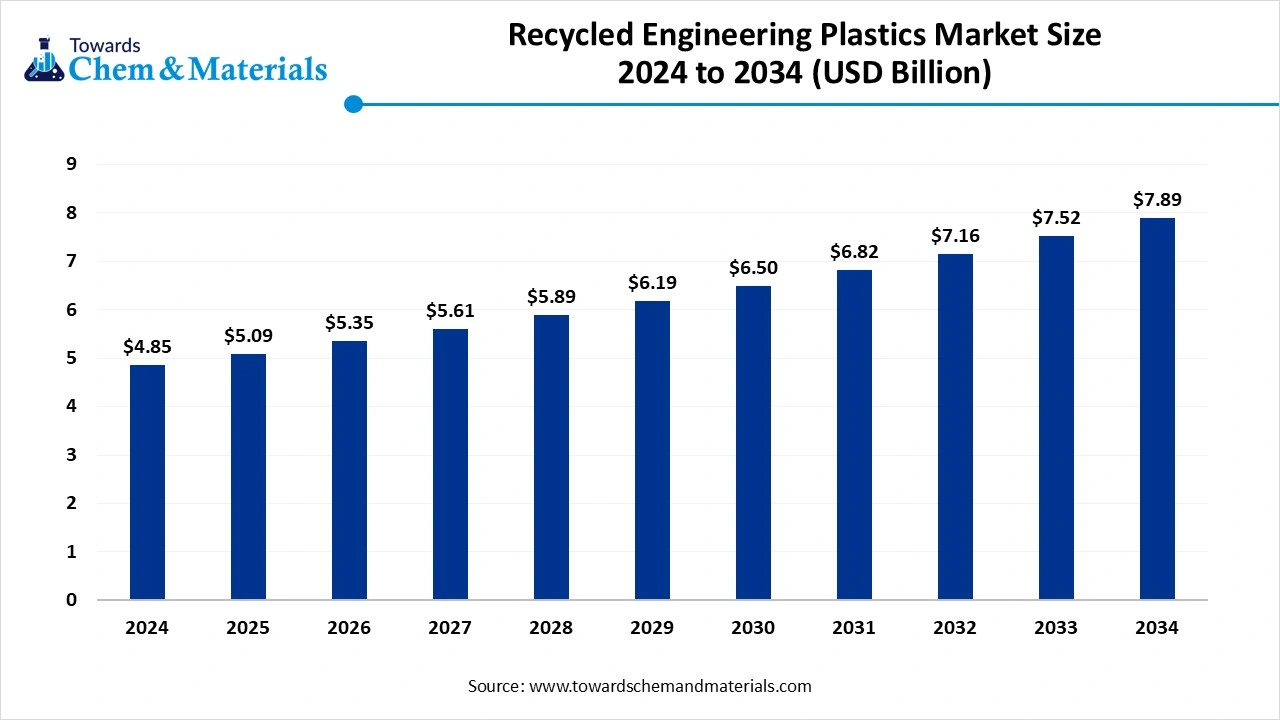

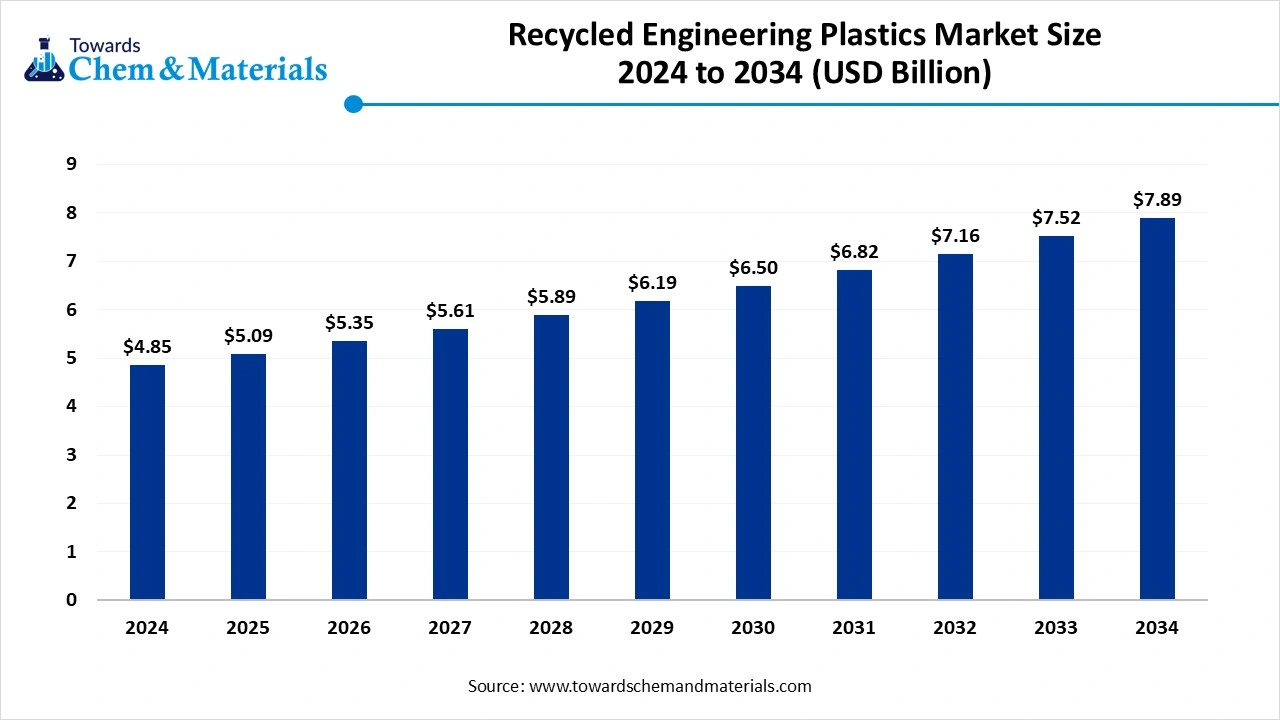

The global recycled engineering plastics market size was valued at USD 4.85 billion in 2024 and is expected to hit around USD 7.89 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.99% over the forecast period from 2025 to 2034. The growth of the market is driven by the growing demand for valuable and thermal property materials, and demand for sustainable and eco-friendly materials alternative to traditional plastics drives the growth of the market.

Key Takeaways

- The global recycled engineering plastics market was valued at USD 4.85 billion in 2024.

- It is estimated to reach around USD 5.09 billion in 2025.

- The market is projected to grow to approximately USD 7.89 billion by 2034.

- This reflects a compound annual growth rate (CAGR) of about 4.99% during 2025-2034.

- Top Players in recycled engineering plastics market MBA Polymers, Inc.; Banyan Nation; Polyplastics Group; Covestro AG; Eastman Chemical Company; Trinseo; Veolia Environnement S.A.; Borealis; Dow Inc.; Polyvisions Inc.

- Asia Pacific dominated the global recycled engineering plastics market and accounted for largest revenue share of 47.19% in 2024.

- Polycarbonate (PC) dominated the recycled engineering plastics market across the Product segmentation in terms of revenue, accounting for a market share of 28.11% in 2024.

- Mechanical recycling dominated the recycled engineering plastics market across the recycling process segmentation in terms of revenue, accounting for a market share of 73.11% in 2024.

- Automotive dominated the recycled engineering plastics market across the application segmentation in terms of revenue, accounting for a market share of 28.32% in 2024.

Market Overview

What Is The Significance Of The Recycled Engineering Plastics Market?

The significance of the recycled engineering plastics market lies in the advancing environmental sustainability and demand for sustainable and eco-friendly materials, which increases the demand for the material, aligning with the sustainability sue to rising environmental concerns. The ability to reduce waste and decrease energy consumption, and lower greenhouse gas emissions is also a major factor for growth. The growing application in various industrial sectors further drives the growth of the armlet.

Recycled Engineering Plastics Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the recycled engineering plastics market is expected to witness strong growth, fueled by rising demand in automotive, electronics, and packaging industries. Companies are increasingly incorporating recycled grades of ABS, PC, PA, and PBT into high-performance applications to meet sustainability goals and reduce dependency on virgin polymers.

- Sustainability Trends: Sustainability is driving innovation in recycled engineering plastics through improved sorting, purification, and reprocessing technologies that enhance material quality and performance consistency. Circular economy initiatives and corporate sustainability targets are accelerating adoption in durable goods and mobility sectors.

- Global Expansion & Partnerships: Key players are expanding recycling facilities and forging partnerships with automotive OEMs, electronics manufacturers, and packaging companies to secure consistent post-consumer feedstock. Strategic collaborations between resin producers and recyclers are improving material recovery rates and boosting the availability of certified recycled resins.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 5.09 Billion |

| Expected Size by 2034 | USD 7.89 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.99% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By Recycling Process, By Application, By Region |

| Key Companies Profiled | MEastman Chemical Company, Trinseo, Veolia Environnement, Borealis, Dow Inc., Indorama Ventures, Alpek S.A.B. de C.V., Far Eastern New Century Corporation, Berry Global Inc , Plastipak Holdings, Inc. , Biffa |

Key Technological Shifts In The Recycled Engineering Plastics Market:

The key technological shift in the recycled engineering plastics market is the advancement in recycling, especially chemical recycling, which helps create high-quality materials which is similar to those of traditional virgin plastics but with more durable and enhanced properties, aligning with the growing environmental concerns.

The integration of Artificial Intelligence and ML in the sorting and production of advanced materials and the development of enhanced and advanced additives and composites, which help in enhancing the properties of recycled plastics, creates a growing demand and opportunity for the growth of the market with improved processing efficiency.

Trade Analysis Of the Recycled Engineering Plastics Market:

- Import & Export Statistics The World exported 1,658 shipments of Recycled Plastics pellets from Nov 2023 to Oct 2024 (TTM). These exports were made by 143 Exporters to 225 Buyers.(Source: www.volza.com)

- Marking a growth rate of 40% compared to the preceding twelve months(Source: www.volza.com)

- In October 2024 alone, 30 Recycled Plastics Pellet export shipments were made Worldwide.(Source: www.volza.com)

- Most of the Recycled Plastics pellets exported from the World go to China, the United States, and Vietnam.(Source : www.volza.com)

- The top three exporters of Recycled Plastics Pellets are Vietnam, Malaysia, and the United States.(Source : www.volza.com)

- Vietnam leads the world in Recycled Plastics Pellet exports with 3,001 shipments, followed by Malaysia with 258 shipments, and the United States taking the third spot with 226 shipments.(Source: www.volza.com)

Recycled Engineering Plastics Market Value Chain Analysis

- Chemical Synthesis and Processing : Recycled engineering plastics are produced through collection, sorting, shredding, washing, and chemical or mechanical recycling processes such as depolymerisation and re-extrusion to obtain high-performance polymers.

- Key players: BASF SE, Covestro AG, SABIC, Dow Inc., Mitsubishi Chemical Group.

- Quality Testing and Certification : Recycled plastics are tested for tensile strength, heat resistance, and purity, adhering to standards like ISO 9001, ISO 14001, and REACH compliance for sustainable quality.

- Key players: SGS, TÜV SÜD, Intertek, UL Solutions.

- Distribution to Industrial Users : Recycled engineering plastics are supplied to automotive, electronics, and construction sectors for durable and lightweight components.

- Key players: LyondellBasell Industries, Ascend Performance Materials, Celanese Corporation, Covestro AG.

Recycled Engineering Plastics Regulatory Landscape: Global Regulations

| Region / Country | Regulatory Body | Key Regulations / Standards | Focus Areas | Notable Notes |

| United States | U.S. Environmental Protection Agency (EPA), Food and Drug Administration (FDA), ASTM International | - Resource Conservation and Recovery Act (RCRA) - EPA Recycling Framework (2021) - ASTM D7209, D7611 – resin identification and recycled content standards - FDA 21 CFR 177 – for recycled plastics in food contact |

- Post-consumer recycled (PCR) certification - Waste recovery and recycling guidelines - Material safety for reuse in packaging and automotive |

U.S. initiatives focus on increasing recycled content and product traceability. California mandates 30% recycled content in plastic bottles by 2028. Automotive and electronics sectors promote closed-loop recycling. |

| European Union | European Commission (DG ENV), European Chemicals Agency (ECHA), European Committee for Standardisation (CEN) | - EU Waste Framework Directive (2008/98/EC) - Circular Economy Action Plan (2020) - EU Plastics Strategy (2018) - REACH & RoHS compliance - EN 15343 – traceability of recycled plastics |

- Material traceability and safety - Recycled content certification - Hazardous substance limits (RoHS/REACH) |

The EU enforces mandatory recycled content targets in packaging and automotive components. The EN 15343 standard defines a chain-of-custody for recycled polymers. |

| China | Ministry of Ecology and Environment (MEE), General Administration of Customs, Standardisation Administration of China (SAC) | - Circular Economy Promotion Law (amended 2018) - GB/T 40006-2021 – Recycled plastics classification - Catalogue of Waste Import Restrictions (2021) |

- Recycled plastic quality standards - Waste import restrictions - Industrial recycling and sorting standards |

China has banned the import of post-consumer plastic waste since 2018. Focus on domestic recycling under the “Made in China 2025” green manufacturing initiative. |

| India | Ministry of Environment, Forest and Climate Change (MoEFCC), Central Pollution Control Board (CPCB), Bureau of Indian Standards (BIS) | - Plastic Waste Management Rules, 2016 (amended 2022) - IS 14534:1998 – Guidelines for recycling of plastics - EPR Guidelines, 2022 |

- Extended producer responsibility - Quality and traceability of recycled resins - Ban on non-recyclable plastics |

India mandates EPR targets for producers and importers to source from registered recyclers. BIS is working to upgrade standards for recycled engineering-grade plastics (ABS, PC, PA6). |

| Japan | Ministry of the Environment (MOE), METI (Ministry of Economy, Trade and Industry), JISC | - Plastic Resource Circulation Act (2022) - JIS K 6922, K 6924 – standards for recycled and biodegradable plastics |

- Recyclability labelling - Industrial waste recovery - Quality testing and safety |

Japan focuses on high-purity mechanical recycling and chemical depolymerisation of engineering plastics for electronics and automotive reuse. The 2022 Act strengthens eco-design mandates. |

Segmental Insights

Product Insights

How Did The Polycarbonate Segment Dominate The Recycled Engineering Plastics Market In 2024?

The polycarbonate segment dominated the market in 2024. Recycled polycarbonate is widely used for its durability, heat resistance, and transparency, making it ideal for automotive lighting, electronics casings, and construction components.

Growing environmental awareness and technological advancements in material recovery have boosted the use of recycled polycarbonate in high-performance engineering applications across multiple industries.

Recycled acrylonitrile butadiene styrene segment expects significant growth in the recycled engineering plastics market during the forecast period. Recycled ABS offers strength, toughness, and flexibility, making it suitable for automotive interiors, electronic housings, and consumer goods. Its cost-effectiveness and ability to maintain key performance characteristics after recycling are driving its demand in manufacturing sectors, emphasising sustainability and waste reduction.

Recycling Process Insights

Which Recycling Process Segment Dominated The Recycled Engineering Plastics Market In 2024

The mechanical recycling segment held the largest market share in 2024. Mechanical recycling remains the dominant process for engineering plastics, involving physical reprocessing methods like shredding, melting, and remoulding. It offers cost efficiency and is ideal for materials like ABS and polycarbonate, though quality control and contamination remain challenges for achieving high-grade recycled outputs.

The chemical recycling segment expects fastest growth during the forecast period. Chemical recycling is gaining traction as it breaks down plastics into monomers for re-polymerisation, restoring material properties equivalent to virgin plastics. This method supports circularity and addresses limitations of mechanical recycling, especially for mixed or contaminated plastic waste streams, promoting high-value material recovery in engineering applications.

Application Insights

How Did the Automotive Segment Dominate the Recycled Engineering Plastics Market In 2024

The automotive segment dominated the market in 2024. The automotive sector extensively utilises recycled engineering plastics for lightweight, durable, and sustainable vehicle components. Parts such as dashboards, bumpers, and lighting housings are increasingly made from recycled ABS and polycarbonate, helping manufacturers reduce carbon emissions and comply with environmental regulations.

The electrical & electronics segment expects significant growth in the recycled engineering plastics market during the forecast period. In electrical and electronics, recycled engineering plastics are used for casings, connectors, and insulation components. Their superior strength and thermal stability make them suitable for high-performance devices. Growing e-waste recycling initiatives and sustainability-focused product design are driving adoption across consumer and industrial electronics manufacturing.

Regional Insights

How Did Asia Pacific Dominates The Recycled Engineering Plastics Market In 2024?

Asia Pacific dominates the recycled engineering plastics market in 2024, due to rapid industrialisation, increasing adoption of sustainability practices, and strong demand from the automotive and electronics sectors. Countries like China, Japan, and South Korea are investing heavily in recycling infrastructure to reduce plastic waste and promote circular economy initiatives.

China Has Seen Significant Growth, Driven By The Huge Manufacturing Base

China represents the largest market within the Asia Pacific, driven by massive manufacturing capacity and government policies encouraging plastic recycling. The nation’s focus on sustainable material usage, technological advancements in recycling, and growing automotive and electronics production make it a central hub for recycled engineering plastic adoption.

North America Market Has Seen Growth, Driven The Presence Of Strong Regulatory Bodies

North America is expected to have significant growth in the market in the forecast period. North America shows robust market growth supported by stringent environmental regulations and corporate sustainability goals. Increased recycling of high-performance plastics such as polycarbonate and ABS is driving their use in automotive, electronics, and construction applications, while advanced recycling technologies enhance material recovery and reduce environmental footprint.

The United States has Seen Growth In The Market, Which Is Influenced By The Demand For Sustainable Materials

The United States leads the North American market due to strong circular economy initiatives, expanding recycling facilities, and rising corporate commitments to sustainable materials. The automotive and electronics sectors particularly drive demand, with growing investments in mechanical and chemical recycling innovations to improve recycled plastic quality and performance.

Country-level Investments & Funding Trends for the Recycled Engineering Plastics Industry:

- India: Policies like the ban on single-use plastics and initiatives like the Swachh Bharat Mission are promoting sustainable practices.

- India: The PET recycling industry alone has seen ₹10,000 crore in investment over the last three years.(Source: www.thehindu.com)

- USA: Three of America’s Plastic Makers are making a significant investment in the newly minted Closed Loop Circular Plastics Fund, created to increase the amount of recycled plastic available to handle the increasing demand for highly efficient recycled content in packaging and product.(Source:plasticmakers.org)

- Germany: Germany's plastics industry spends up to €3 billion annually on sustainable innovation, including the development of advanced recycling technologies and bio-based plastics.(Source: www.gtai.de)

Recent Developments

- In September 2025, the Integrated Teaching and Learning Program (ITLP) at the University of Colorado Boulder's College of Engineering and Applied Science launched a 3D printing recycling initiative that repurposes failed prints and excess plastic into durable sheets for student projects.(Source: www.colorado.edu)

- In June 2025, INEOS Olefins & Polymers Europe launched a new production process utilising advanced recycling to create virgin-quality polymers from pyrolysis oil derived from difficult-to-mechanically-recycle plastic packaging. Produced at the company's Lavera, France cracker and certified under ISCC PLUS, these recycled polyethene and polypropylene are suitable for sensitive applications such as food and medical packaging.(Source: www.hydrocarbonengineering.com)

- In August 2025, Techtextil India will launch a new "ReCycle Zone" at its 2025 exhibition in Mumbai from November 19 to 21 to promote circularity and sustainability in technical textiles. The initiative, in partnership with the Society of Plastics Engineers India, will showcase technologies for converting textile and plastic waste into valuable materials and feature educational sessions on recycling solutions.(Source: fashionunited.in)

Top players in the Recycled Engineering Plastics Market & Their Offerings:

- BA Polymers: a global leader in recovering high-value engineering plastics from complex waste streams like end-of-life electronics and vehicles. Using proprietary, patented technology, the company produces high-quality, post-consumer recycled (PCR) resins that can replace virgin plastics in new products.

- Banyan Nation: an award-winning Indian technology-driven plastic recycling company that is a key player in the circular economy for plastics. Based in Hyderabad, the vertically integrated company produces high-quality, post-consumer recycled (PCR) granules that are comparable to virgin plastic.

- Polyplastics Group: a Japanese-based manufacturer, is a key player in the recycled engineering plastics market, particularly for its innovative materials and advanced recycling technologies.

- Covestro: a major global manufacturer of high-performance polymer materials, making it a significant player in the market. With a strong corporate focus on a circular economy, the company is developing a broad portfolio of sustainable products that incorporate recycled content from both mechanical and advanced chemical recycling processes.

Other Top Players Are

- MEastman Chemical Company

- Trinseo,

- Veolia Environnement,

- Borealis,

- Dow Inc.

- Indorama Ventures,

- Alpek S.A.B. de C.V.

- Far Eastern New Century Corporation:

- Berry Global Inc

- Plastipak Holdings, Inc.

- Biffa

Segments Covered

By Product

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyamide (Nylon)

- Polyethene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Others

By Recycling Process

- Mechanical Recycling

- Chemical Recycling

By Application

- Automotive

- Electrical & Electronics

- Building & Construction

- Consumer Goods

- Industrial Machinery

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait