Content

What is the Current Surface Treatment Chemical Market Size and Volume?

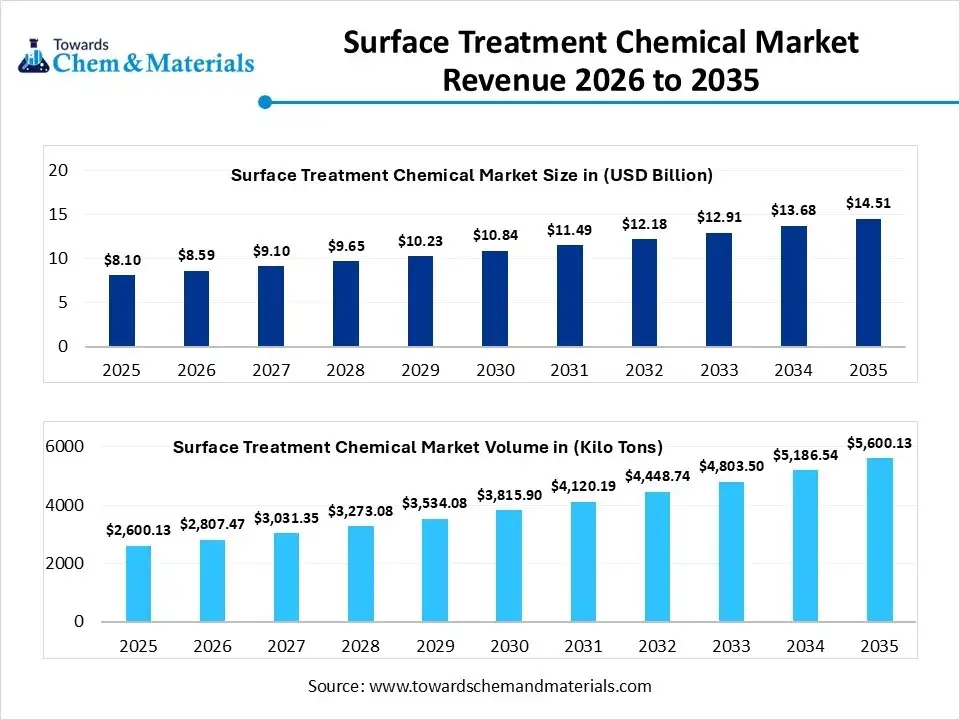

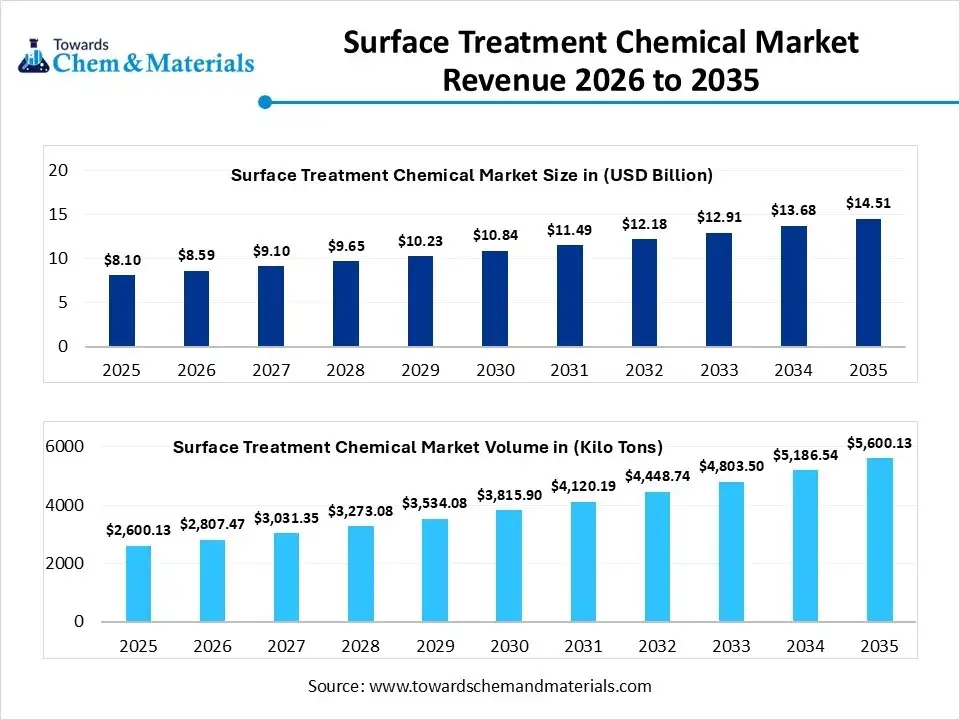

The global surface treatment chemical market size was estimated at USD 8.10 billion in 2025 and is expected to increase from USD 8.59 billion in 2026 to USD 14.51 billion by 2035, growing at a CAGR of 6% from 2026 to 2035. In terms of volume, the market is projected to grow from 2600.13 kilo tons in 2025 to 5600.13 kilo tons by 2035. growing at a CAGR of 7.97% from 2026 to 2035. Asia Pacific dominated the surface treatment chemical market with the largest volume share of 45%in 2025.The crucial need for corrosion protection, durability, and aesthetics in key sectors drives the growth and expansion of the market.

Market Highlights

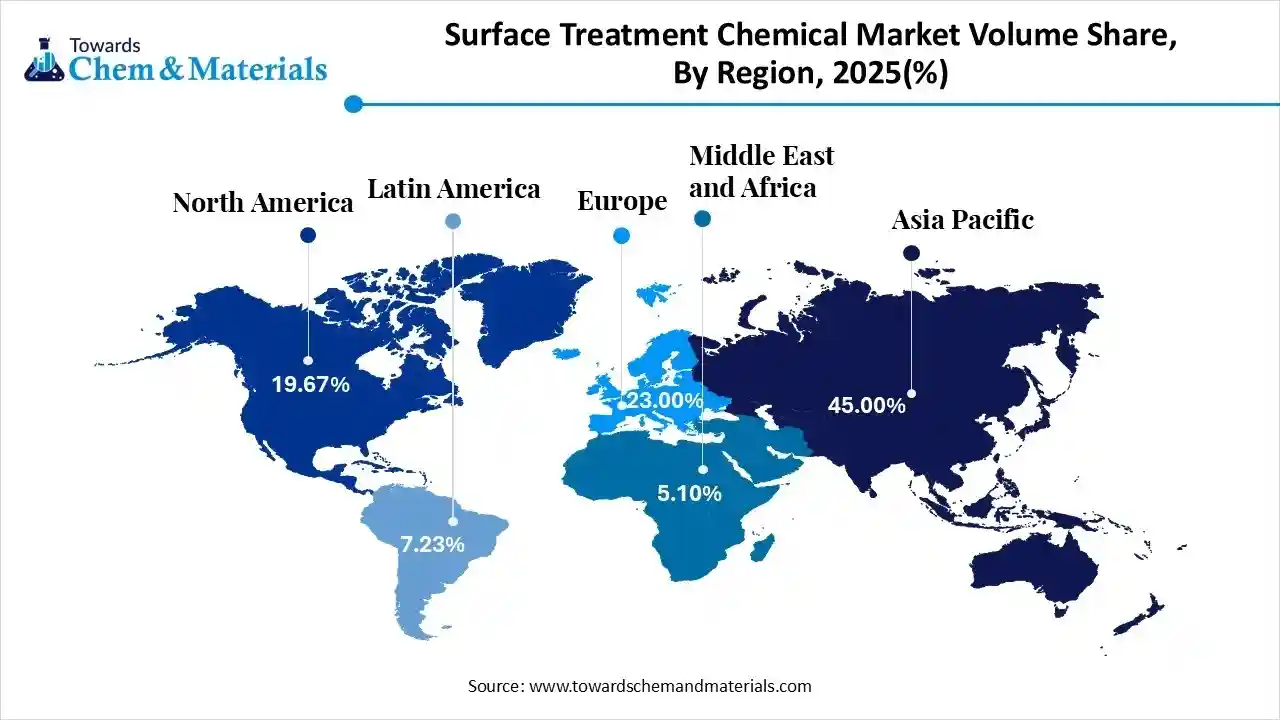

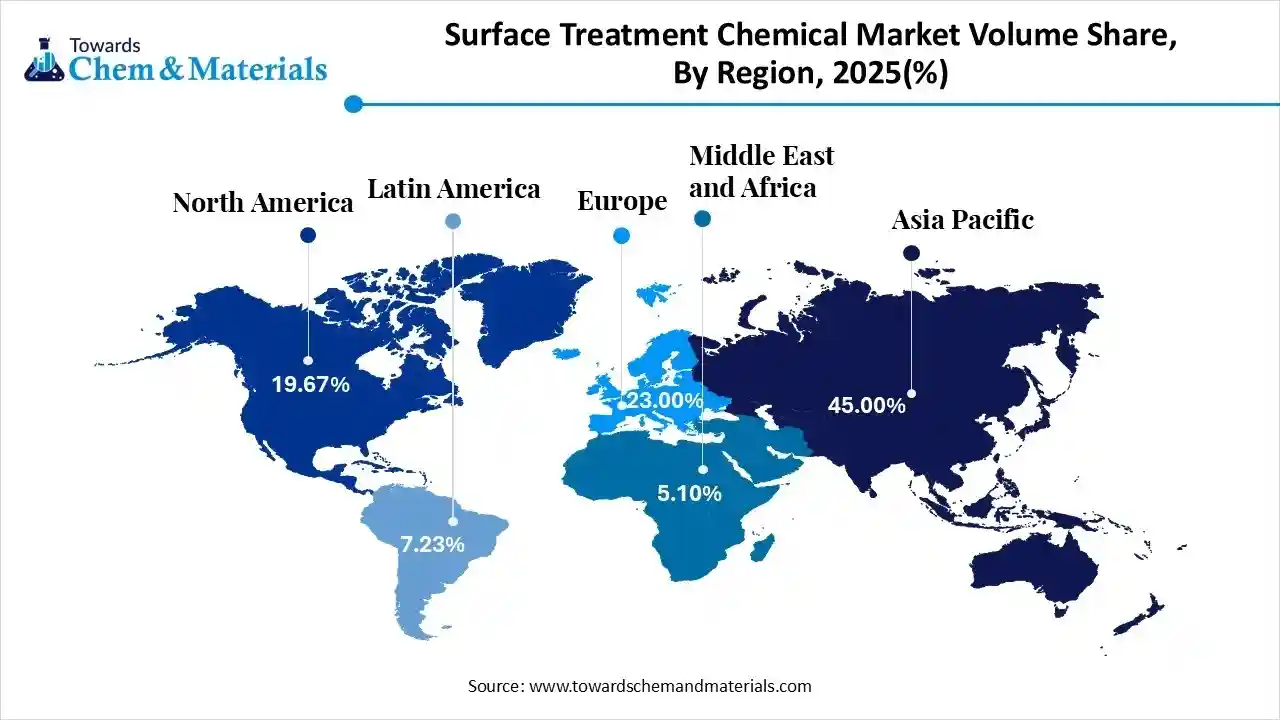

- The Asia Pacific dominated the surface treatment chemical market with the largest volume share of 45% in 2025.

- The surface treatment chemical market in Europe is expected to grow at a substantial CAGR of 7.29% from 2026 to 2035.

- The North America surface treatment chemical market segment accounted for the major volume share of 19.67% in 2025.

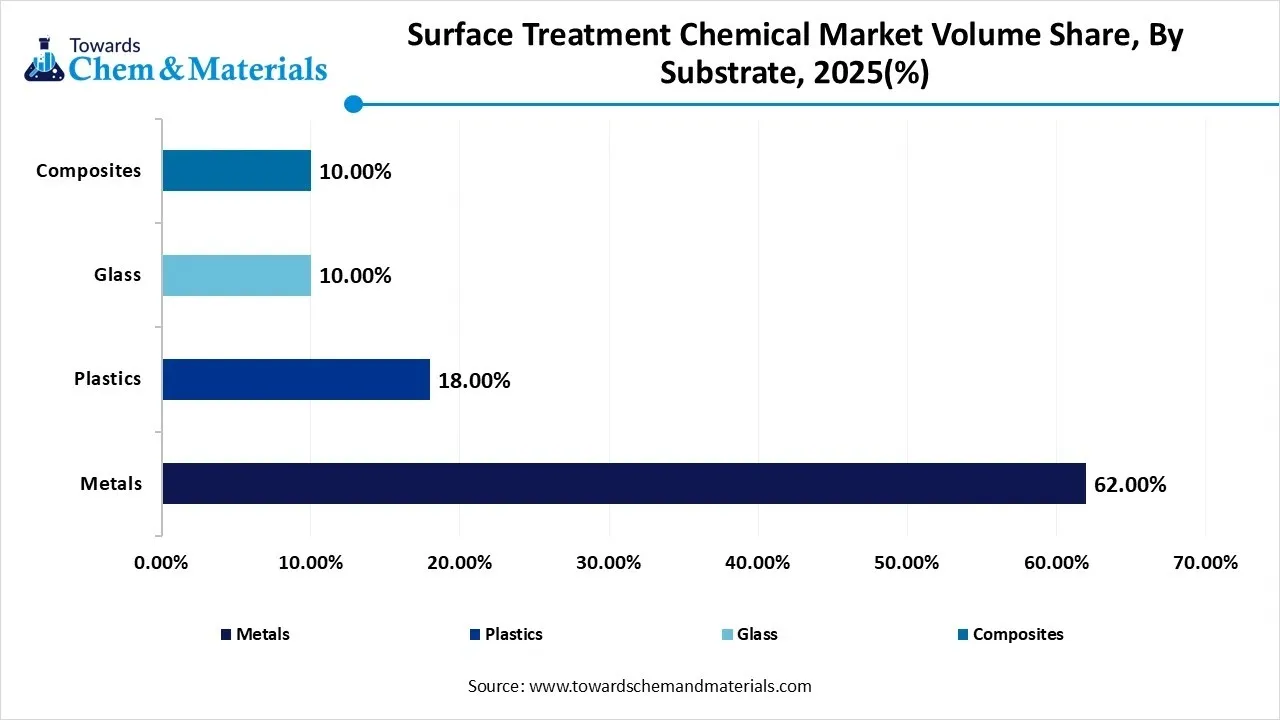

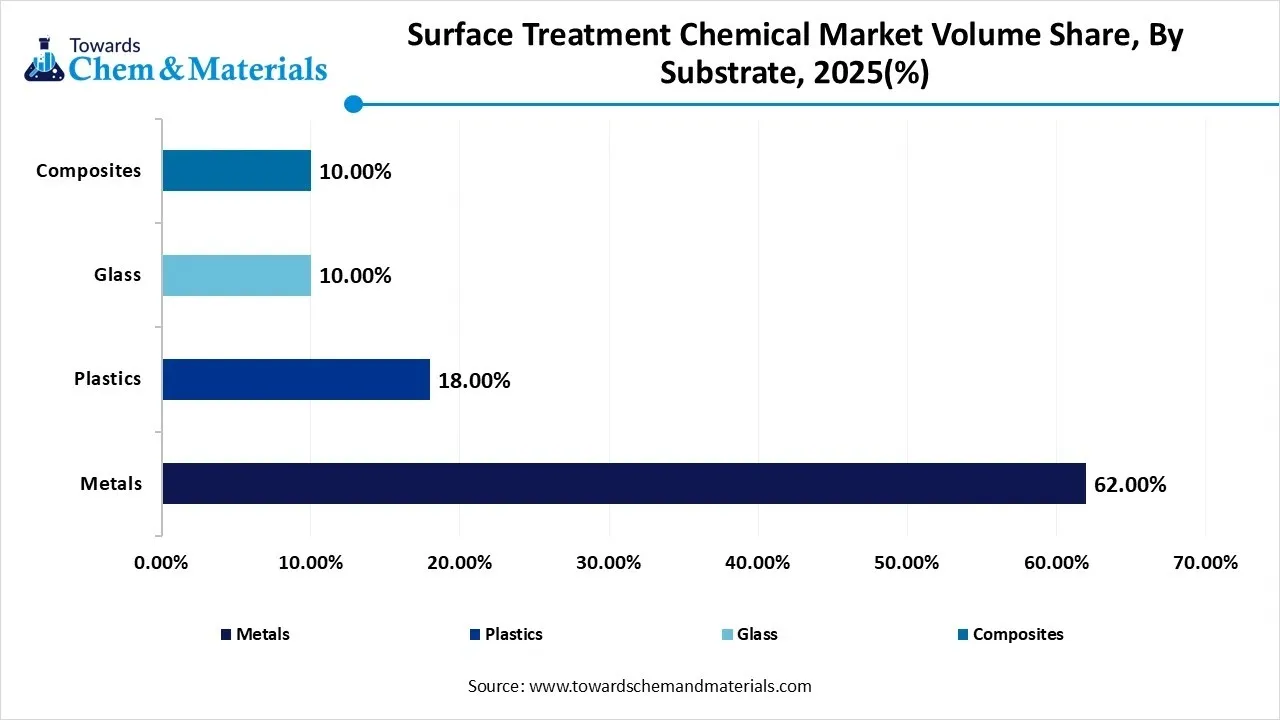

- By substrate, the metals segment dominated the market and accounted for the largest volume share of 62% in 2025.

- By substrate, the plastics segment is expected to grow at the fastest CAGR of 10.84% from 2026 to 2035 in terms of volume.

- By chemical type, the cleaners & degreasers segment led the market with the largest revenue volume share of 28% in 2025.

- By process type, the pretreatment segment dominated the market and accounted for the largest volume share of 45% in 2025.

- By end user, the automotive and transportation segment led the market with the largest revenue volume share of 32% in 2025.

Market Overview

What Is The Significance Of The Surface Treatment Chemical Market?

The surface treatment chemical market is significant because these chemicals enhance material performance, durability, and lifespan across industries like automotive, electronics, and construction, providing crucial corrosion/wear resistance, better adhesion, and specific electrical/thermal properties, while also driving innovation towards sustainable, eco-friendly solutions to meet strict environmental regulations. Its growth is fueled by the rise of advanced products like EVs and a global push for high-performance, long-lasting components, making it vital for modern manufacturing and infrastructure.

Surface Treatment Chemical Market Growth Trends:

- Sustainability Focus: Strong push for eco-friendly (low VOC, chromium-free) solutions to meet government mandates and reduce carbon footprints, notes Technavio.

- Technological Advancements: Development of efficient, high-performance chemicals for specific material needs (e.g., new alloys, electronics).

- Regional Dominance: Asia-Pacific is the largest and fastest-growing market due to robust manufacturing.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 8.59 Billion / 2807.47 Kilo Tons |

| Revenue Forecast in 2035 | USD 14.51 Billion / 5600.13 Kilo Tons |

| Growth Rate | CAGR 6% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Chemical Type, By Substrate Type, By Process Type, By End-User Industry, By Regions |

| Key companies profiled | Nihon Parkerizing Co., Ltd., Atotech / MKS, Akzo Nobel N.V.,BASF SE, The Sherwin-Williams Company, Quaker Chemical Corporation, Henkel AG & Co. KGaA, PPG Industries, Inc., Axalta Coating Systems, Solvay S.A., Nippon Paint Holdings, Chemetall, Coventya, MacDermid Enthone, Okuno Chemical Industries, JCU Corporation, Aalberts Surface Technologies, NOF Corporation |

Key Technological Shifts In The Surface Treatment Chemical Market:

Key technological shifts in the surface treatment chemical market focus on sustainability, nanotechnology, smart/functional coatings, and digitalization/automation, all driven by stricter environmental rules and demand for superior performance in sectors like automotive (EVs), aerospace, and electronics, moving from basic protection to advanced material enhancement.

Trade Analysis Of Surface Treatment Chemical Market: Import & Export Statistics

- Based on Global Export data, the world shipped 43 units of Metal Surface Treatment Chemical, exported by 9 exporters to 7 buyers. Most exports are heading to the United States, Vietnam, and Brazil.

- The top three exporters are the United Kingdom, Japan, and France, with the UK leading at 30 shipments, Japan with 7, and France with 4.

- Additionally, from June 2024 to May 2025 (TTM), 2,638 shipments of Chemical Surface Agent were exported worldwide by 466 exporters to 603 buyers, showing a 330% growth compared to the previous twelve months.

- The main destinations are Vietnam, Chile, and Russia. The leading exporters are Vietnam, China, and South Korea, with Vietnam exporting 861 shipments, China 576 shipments, and South Korea 386 shipments.

Surface Treatment Chemical Market Value Chain Analysis

- Chemical Formulation and Processing: Surface treatment chemicals are developed through processes such as chemical synthesis, formulation, blending, and conditioning to enable cleaning, etching, phosphating, anodizing, passivation, electroplating preparation, and corrosion protection for metal, plastic, and composite surfaces.

- Key players: Henkel AG & Co. KGaA, BASF SE, Solvay S.A., Atotech (MKS Instruments).

- Quality Testing and Certification:Surface treatment chemicals require certifications ensuring chemical performance, bath stability, worker safety, and environmental compliance. Key certifications include ISO 9001 and ISO 14001, REACH compliance, RoHS conformity, and ASTM surface treatment standards.

- Key players: ISO (International Organization for Standardization), ECHA (REACH), ASTM International, UL Solutions.

- Distribution to Industrial Users:Surface treatment chemicals are supplied to automotive OEMs, metal fabrication companies, aerospace manufacturers, electronics producers, construction material processors, and industrial coating applicators.

- Key players: Henkel AG & Co. KGaA, Atotech, Chemetall (BASF).

Surface Treatment Chemical Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| European Union | European Chemicals Agency (ECHA) & European Commission | REACH Regulation (EC 1907/2006) CLP Regulation (EC 1272/2008) Industrial Emissions Directive (IED) |

Chemical registration & hazard classification Emission/effluent limits Worker protection & labeling |

REACH governs registration of all substances in surface treatment products (e.g., phosphates, chromium VI precursors), and CLP mandates hazard labeling. IED/BREFs set emission limits for facilities using chemical surface treatments. |

| China | Ministry of Ecology and Environment (MEE); SAMR | MEE Order No.12 (New Chemical Substance Registration) Air & Water Pollution Prevention Laws Solid Waste Pollution Prevention Law |

New chemical registration Emissions & effluent control Hazardous waste management |

Surface treatment chemistries (cleaners, etchants) must be registered for manufacture/import; strict VOC, sulfur, and metallic emissions limits apply to plating and surface treatment shops under local inspections. |

| India | MoEFCC (Ministry of Environment, Forest & Climate Change) & CPCB (Central Pollution Control Board) | Chemical (Management & Safety) Rules (proposed) Hazardous & Other Wastes (Management & Transboundary Movement) Rules Air/Water Acts |

Chemical hazard control Emission & effluent limits Hazardous waste handling & disposal |

India is moving toward REACH-like chemical registration; plating and surface treatment facilities must control emissions and handle chemical wastes per CPCB notifications. |

Segmental Insights

Chemical Type Insights

Which Chemical Type Segment Dominated The Surface Treatment Chemical Market In 2025?

The cleaners & degreasers segment dominated the market accounting for approximately 28% share in 2025. Cleaners and degreasers form a foundational segment in the market as they are essential for removing oils, grease, dirt, oxides, and contaminants before further processing. Growth is supported by increasing adoption of water-based and low-VOC formulations due to environmental regulations.

The conversion coatings segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Conversion coatings are widely used to enhance corrosion resistance, improve paint adhesion, and extend substrate life, particularly for metals such as aluminum, steel, and zinc. The market is shifting toward chromate-free and environmentally friendly alternatives, driven by tightening regulations and sustainability initiatives across industrial manufacturing sectors.

Substrate Insights

How Did the Metals Segment Dominated The Surface Treatment Chemical Market In 2025?

The metals segment volume was valued at 1612.08 kilo tons in 2025 and is projected to reach 3436.80 kilo tons by 2035, expanding at a CAGR of 8.78% during the forecast period from 2025 to 2035. The metals segment dominated the market accounting for approximately 62% share in 2025. Metal substrates dominate the market due to their extensive use across automotive, industrial machinery, electronics, and infrastructure applications. Rising vehicle production, infrastructure investments, and demand for high-performance metal components continue to drive sustained consumption of metal-specific surface treatment chemicals globally.

The plastics segment volume was valued at 468.02 kilo tons in 2025 and is projected to reach 1181.63 kilo tons by 2035, expanding at a CAGR of 10.84% during the forecast period from 2025 to 2035. Surface treatment chemicals for plastics are increasingly important as plastics replace metals in lightweight automotive components, electronics housings, and consumer products. Growth is supported by rising use of engineered plastics and composites, particularly in automotive and electronics applications requiring functional and decorative coatings.

The plastics segment volume was valued at 468.02 kilo tons in 2025 and is projected to reach 1181.63 kilo tons by 2035, expanding at a CAGR of 10.84% during the forecast period from 2025 to 2035. Surface treatment chemicals for plastics are increasingly important as plastics replace metals in lightweight automotive components, electronics housings, and consumer products. Growth is supported by rising use of engineered plastics and composites, particularly in automotive and electronics applications requiring functional and decorative coatings.

Surface Treatment Chemicals Market Volume and Share, By Substrate, 2025-2035

| By Substrate | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Metals | 62.00% | 1612.08 | 3436.80 | 8.78% | 61.37% |

| Plastics | 18.00% | 468.02 | 1181.63 | 10.84% | 21.10% |

| Glass | 10.00% | 260.01 | 515.77 | 7.91% | 9.21% |

| Composites | 10.00% | 260.01 | 465.93 | 6.70% | 8.32% |

Process Type Insights

Which Process Type Segment Dominated The Surface Treatment Chemical Market In 2025?

The pretreatment segment dominated the market accounting for approximately 45% share in 2025. Pre-treatment processes represent a critical stage in surface treatment, preparing substrates for painting, plating, or coating operations. Increasing automation in manufacturing lines and rising quality standards across the automotive and electronics industries are driving consistent demand for advanced pre-treatment chemical solutions.

The electroplating & electroless plating segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Electroplating and electroless processes are used to deposit protective or functional metal layers onto substrates, enhancing corrosion resistance, conductivity, and aesthetics. Growth is supported by expanding electronics manufacturing and increasing demand for high-performance surface finishes in industrial and consumer products.

End-User Insights

How Did the Automotive And Transportation Segment Dominated The Surface Treatment Chemical Market In 2025?

The automotive & transportation segment dominated the market accounting for approximately 32% share in 2025. The automotive and transportation sector is a major end user of surface treatment chemicals, driven by stringent corrosion protection standards and high aesthetic requirements. Rising electric vehicle production, increased use of aluminum and composites, and global vehicle manufacturing growth continue to support market expansion.

The electronics & electrical segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Electronics and electrical applications rely heavily on surface treatment chemicals to ensure conductivity, corrosion resistance, and long-term reliability of components. Miniaturization trends and increased complexity of electronic components further drive the need for advanced, precision surface treatment chemical solutions.

Regional Insights

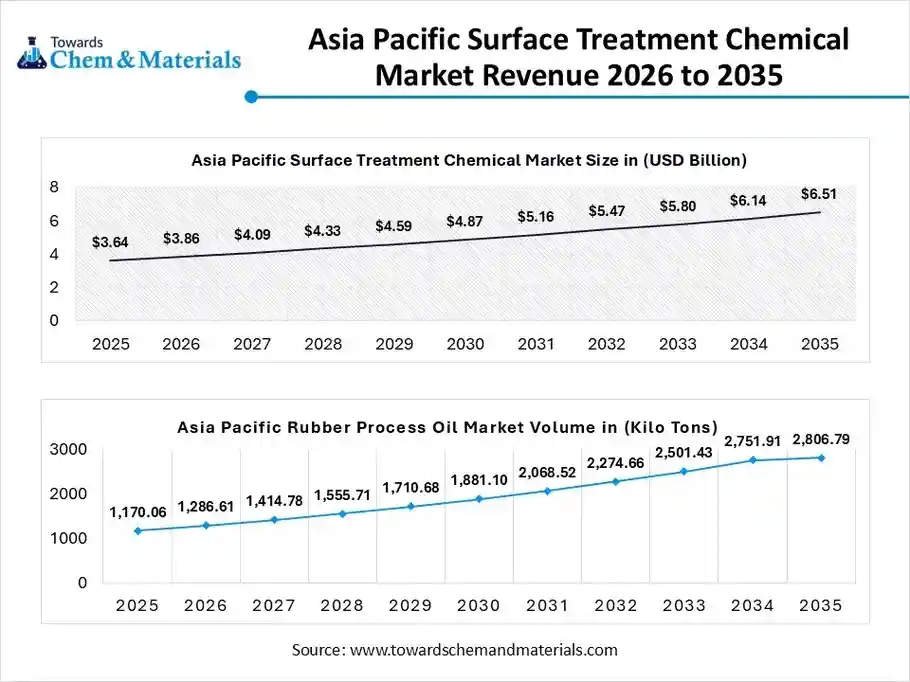

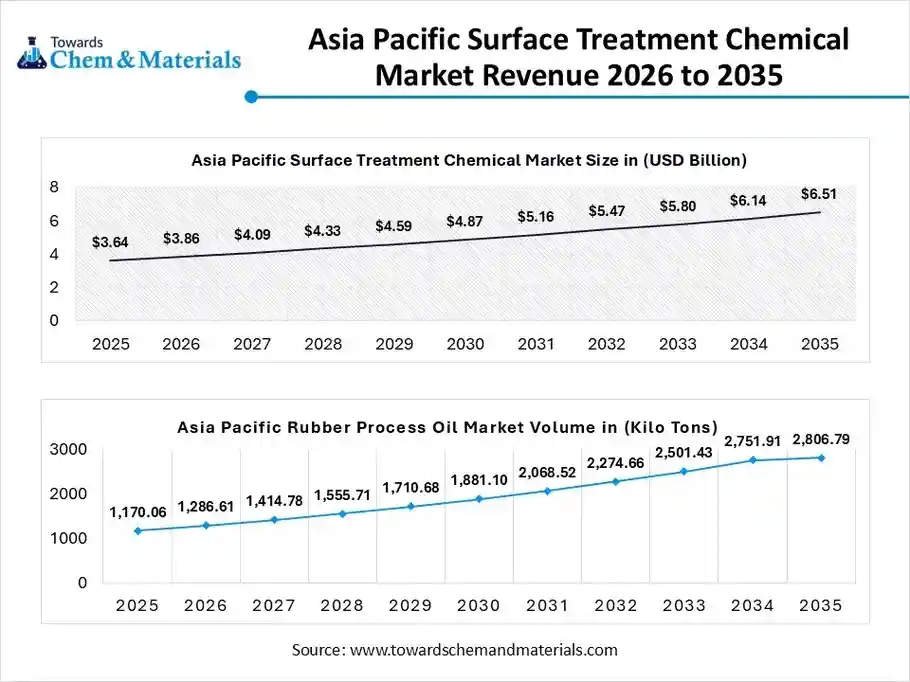

The Asia Pacific surface treatment chemical market size was valued at USD 3.64 billion in 2025 and is expected to be worth around USD 6.51 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.99% over the forecast period from 2026 to 2035.

The Asia Pacific surface treatment chemical volume was estimated at 1,170.06 kilo tons in 2025 and is projected to reach 2,806.79 kilo tons by 2035, growing at a CAGR of 9.14% from 2026 to 2035. Asia Pacific dominated the market with a share of approximately 45% in 2025. Asia Pacific represents the largest market for surface treatment chemicals, driven by rapid industrialization, strong manufacturing bases, and expanding sectors. The region benefits from large-scale metal processing, electronics fabrication, and infrastructure development, which significantly increases demand. Cost-competitive production and favorable government manufacturing initiatives further support market growth.

China: Surface Treatment Chemical Market Growth Trends

China dominates the Asia Pacific market due to its extensive metal finishing, automotive manufacturing, electronics assembly, and heavy industrial activities. The country has a strong presence of electroplating, anodizing, and coating facilities supporting export-oriented manufacturing. Strict environmental regulations are also driving the adoption of low-VOC, water-based, and environmentally compliant surface treatment formulations.

Europe Surface Treatment Chemical Market Growth Is Driven By Growing Manufacturing Units

The Europe surface treatment chemical volume was estimated at 598.03 kilo tons in 2025 and is projected to reach 1126.75 kilo tons by 2035, growing at a CAGR of 7.29% from 2026 to 2035. Europe is expected to have fastest growth in the market in the forecast period between 2026 and 2035. Europe represents a technologically advanced and regulation-intensive market for surface treatment chemicals. Strong automotive manufacturing, industrial equipment production, and renewable energy infrastructure drive consistent demand. European markets are emphasizing sustainability, worker safety, and environmental compliance, leading to an increased use of chromium-free, low-emission, and water-based surface treatment chemicals.

Germany: Surface Treatment Chemical Market Growth Trends

Germany is the largest contributor to the European surface treatment chemical market, supported by its globally competitive automotive, engineering, and metal processing industries. The country focuses heavily on precision surface finishing, corrosion protection, and high-performance coatings. Strong industrial standards and environmental regulations encourage innovation in sustainable and high-efficiency chemical formulations.

Surface Treatment Chemicals Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 19.67% | 511.45 | 1070.18 | 8.55% | 19.11% |

| Europe | 23.00% | 598.03 | 1126.75 | 7.29% | 20.12% |

| Asia Pacific | 45.00% | 1170.06 | 2806.79 | 10.21% | 50.12% |

| South America | 7.23% | 187.99 | 366.81 | 7.71% | 6.55% |

| Middle East & Africa | 5.10% | 132.61 | 229.61 | 6.29% | 4.10% |

Recent Developments

- In October 2025, Chemetall, BASF Coatings' surface treatment unit, introduced Gardolene D, a chromium-free and fluoride-free passivation solution for copper foils globally. A partnership with Londian Wason was announced to implement this technology in China.(Source: www.indianchemicalnews.com)

- In September 2025, Azelis and Chemetall, a BASF business unit, expanded their distribution agreement to cover surface treatment products in Southeast Asia. This partnership includes Malaysia, Thailand, Vietnam, the Philippines, and Indonesia, aiming to enhance Azelis's market presence and provide Chemetall with wider access to its surface treatment technologies.(Source: www.indianchemicalnews.com)

Top players in the Surface Treatment Chemical Market & Their Offerings:

- Nihon Parkerizing Co., Ltd.: Specialized in phosphate and passivation chemistries, Nihon Parkerizing supplies surface treatment solutions for corrosion resistance and paint adhesion, particularly for automotive and industrial applications.

- Atotech / MKS: Atotech (an MKS company) is a key provider of electroplating and surface treatment chemicals, offering plating baths, cleaners, passivating agents, and corrosion protection systems used in electronics, automotive, and decorative metal finishes.

- Akzo Nobel N.V.: Akzo Nobel offers surface treatment and finishing chemistries alongside its coatings portfolio, including cleaners, conversion coatings, and pre-treatment systems designed to improve corrosion resistance and coating adhesion.

- BASF SE

- The Sherwin-Williams Company

- Quaker Chemical Corporation

- Henkel AG & Co. KGaA

- PPG Industries, Inc.

- Axalta Coating Systems

- sElement Solutions Inc.

- Solvay S.A.

- Nippon Paint Holdings

- Chemetall

- Coventya

- MacDermid Enthone

- Okuno Chemical Industries

- JCU Corporation

- Aalberts Surface Technologies

- NOF Corporation

Segments Covered

By Chemical Type

- Cleaners & Degreasers

- Conversion Coatings

- Plating Chemicals

- Anodizing Chemicals

- Others (Pickling, Passivation, Sealers)

By Substrate Type

- Metals

- Plastics

- Glass

- Composites

By Process Type

- Pretreatment Processes

- Electroplating & Electroless Plating

- Anodizing

- Post-treatment & Finishing

By End-User Industry

- Automotive & Transportation

- Industrial Machinery & Equipment

- Aerospace & Defense

- Construction

- Electronics & Electrical

- Others

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa