Content

What is the Current Water Soluble Fertilizers Market Size and Volume?

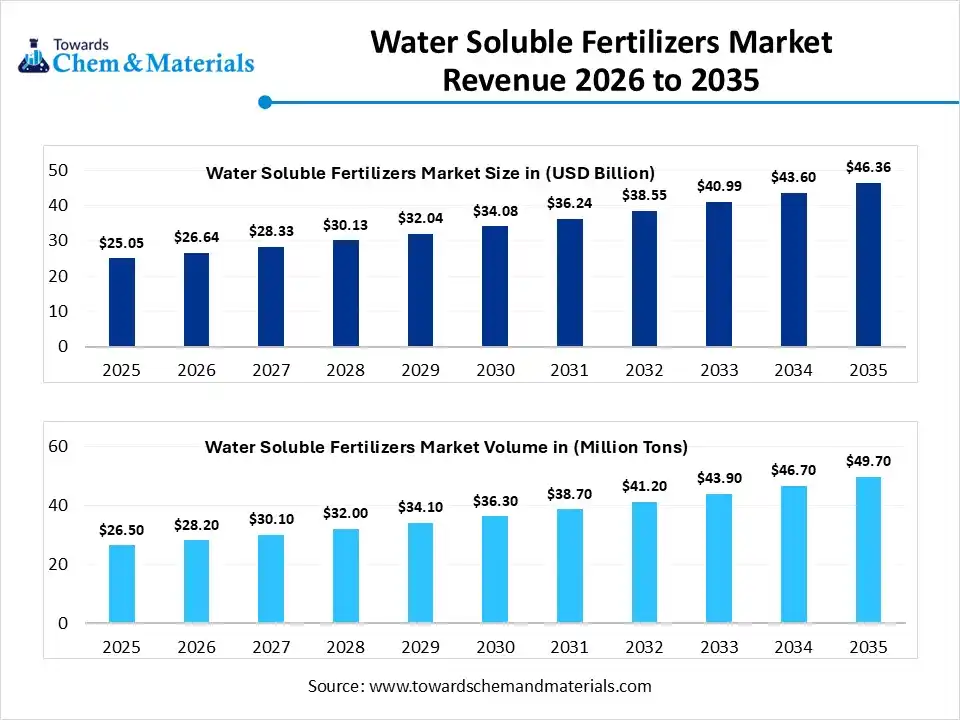

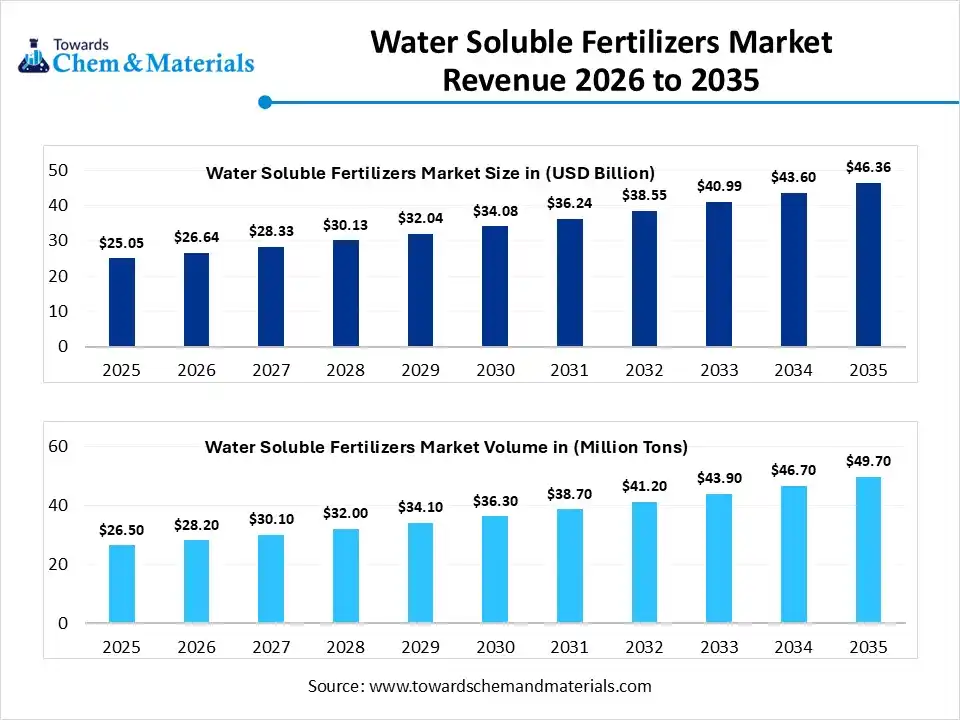

The global water soluble fertilizers market size was estimated at USD 25.05 billion in 2025 and is expected to increase from USD 26.64 billion in 2026 to USD 46.36 billion by 2035, growing at a CAGR of 6.35% from 2026 to 2035. In terms of volume, the market is projected to grow from 26.5 million tons in 2025 to 49.7 million tons by 2035. growing at a CAGR of 6.50% from 2026 to 2035. Asia Pacific dominated the water-soluble fertilizers market with the largest volume share of 42% in 2025. The growing food demand and the increased consumption of high-value crops drive market growth.

Market Highlights

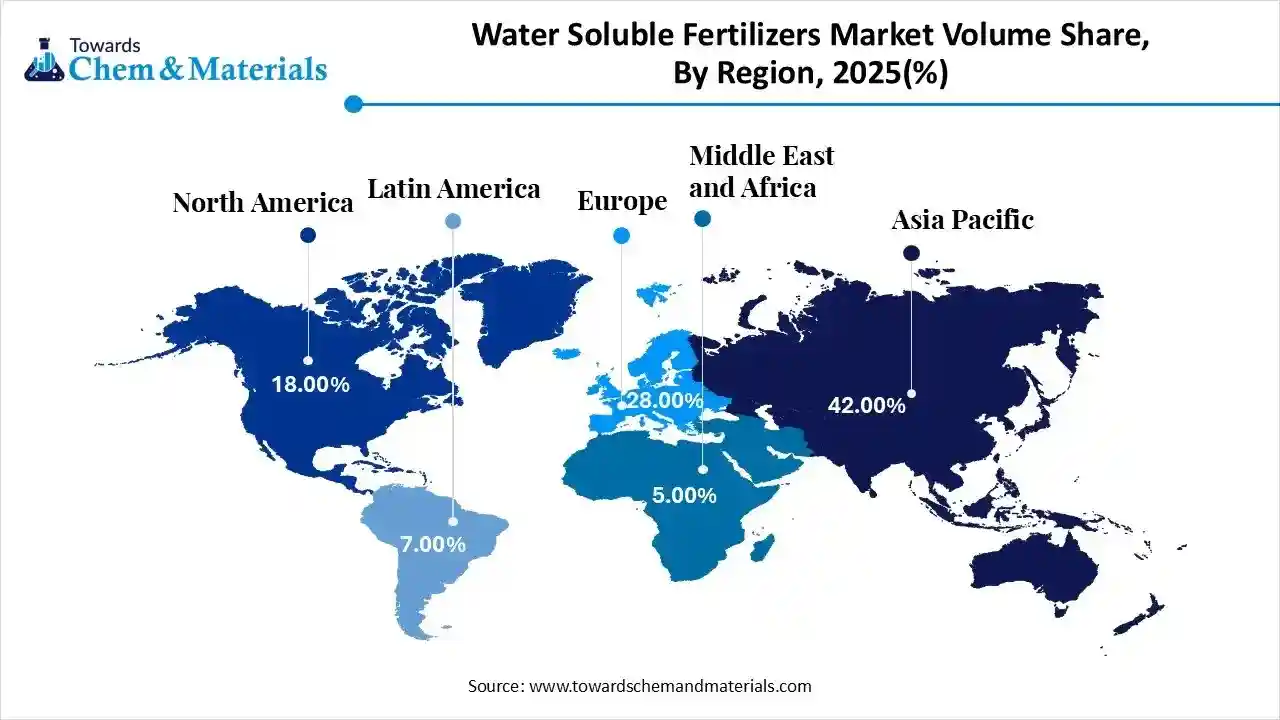

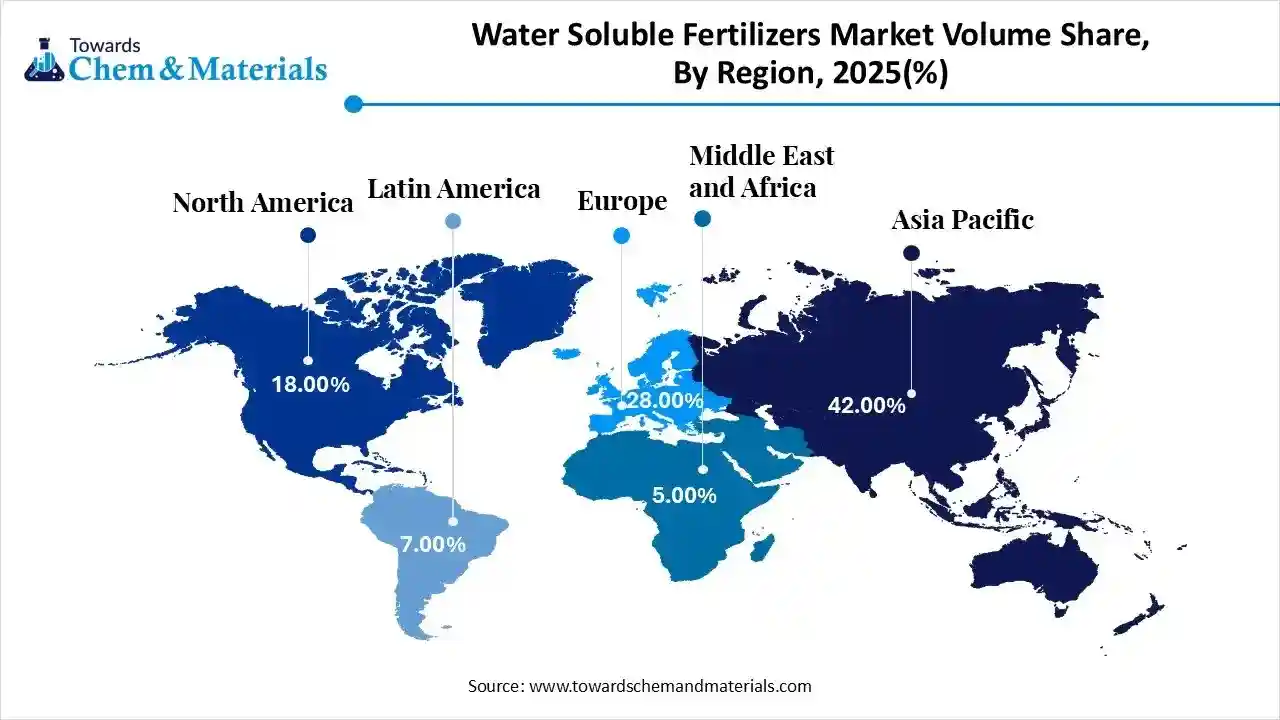

- The Asia Pacific dominated the global water soluble fertilizers market with the largest volume share of 42% in 2025.

- The water soluble fertilizers market in North America is expected to grow at a substantial CAGR of 7.33% from 2026 to 2035.

- The Europe water soluble fertilizers market segment accounted for the major volume share of 28.00% in 2025.

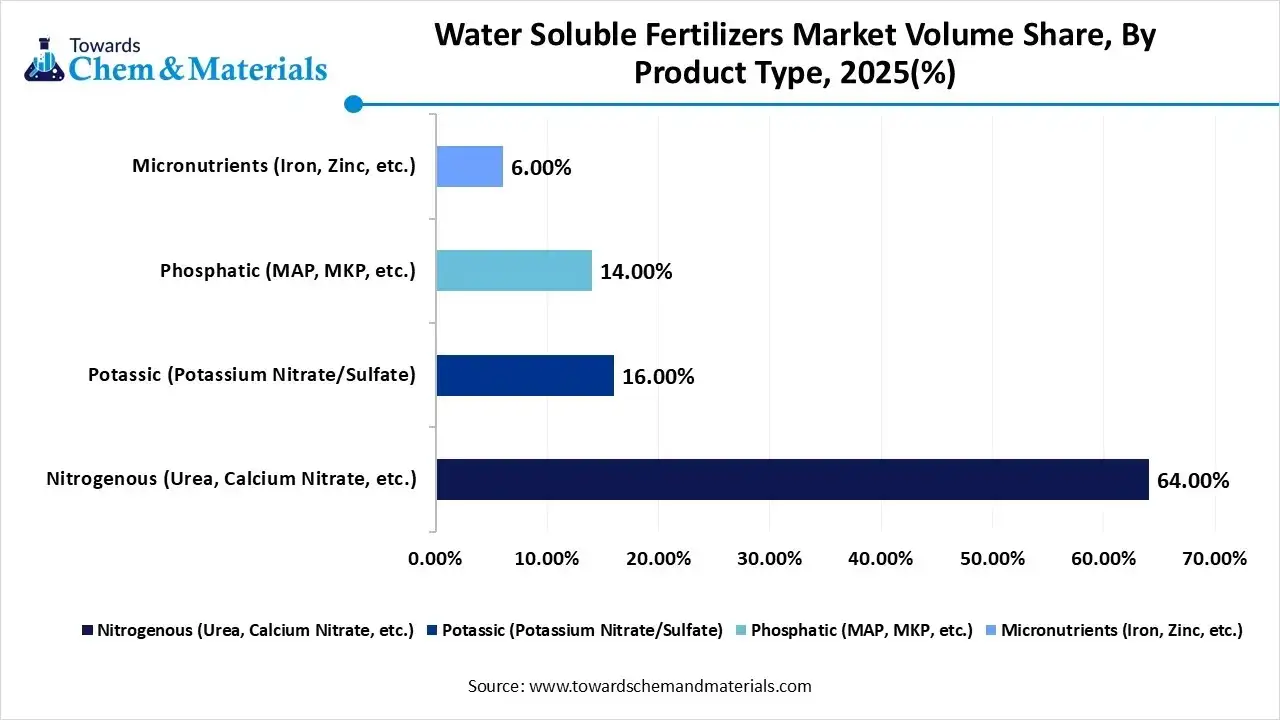

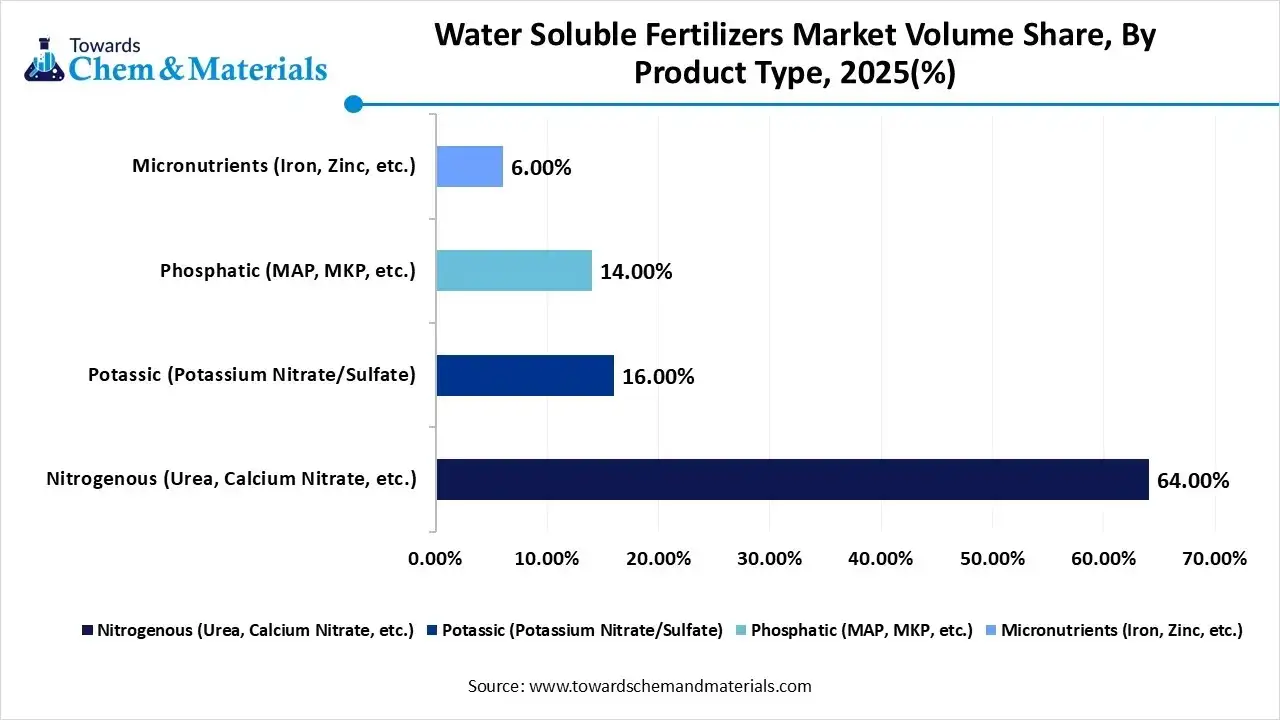

- By type, the nitrogenous segment dominated the market and accounted for the largest volume share of 64% in 2025.

- By type, the micronutrients segment is expected to grow at the fastest CAGR of 9.14% from 2026 to 2035 in terms of volume.

- By form, the dry segment led the market with the largest revenue volume share of 82% in 2025.

- By mode of application, the fertigation segment dominated the market and accounted for the largest volume share of 68% in 2025.

- By crop type, the horticultural crops segment led the market with the largest revenue volume share of 36% in 2025.

Market Overview

Water soluble fertilizers are nutrient concentrations that completely dissolve in water. It possesses characteristics like fast absorption, precise control, and complete solubility. It offers benefits like easy application, faster growth, high efficiency, enhances crop quality, cost-effectiveness, and lowers nutrient waste. The examples of water soluble fertilizers are diammonium phosphate, MKP, potassium sulfate, MAP, and Potassium Nitrate.

The water soluble fertilizers market growth is driven by a focus on agricultural productivity, growing precision farming, increased cultivation of high-quality crops, rise in soil degradation, focus on rapid nutrient availability, expansion of greenhouse cultivation, increasing use of eco-friendly products, and innovations in fertilizer formulation.

Water Soluble Fertilizers Market Trends:

- Rapid Expansion of Controlled Environment Agriculture:- The rapid growth in vertical farming and the focus on continuous harvests in any season increases demand for water soluble fertilizers. The expansion of hydroponics and the focus on precision nutrient delivery create demand for water soluble fertilizers.

- High Production of Specialty Crops:-The increasing awareness about plant-based diets and the increased spending on nutrient-rich foods increases demand for specialty crops that require water soluble fertilizers to maximize nutrient uptake.

- Focus on Sustainability:- The strong focus on lowering pollution and the growing consumption of sustainably produced food increases demand for water soluble fertilizers to lower the energy footprint.

- Growing Food Demand:- The rapid growth in the worldwide population and the changing dietary lifestyle of consumers increases demand for water soluble fertilizer. The rapid urbanization and the focus on food security increase demand for water soluble fertilizer.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 26.64 Billion / 28.2 Million Tons |

| Revenue Forecast in 2035 | USD 46.36 Billion / 49.7 Million Tons |

| Growth Rate | CAGR 6.35% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Form, By Mode of Application, By Crop Type, By Region |

| Key companies profiled | Yara International ASA, Nutrien Ltd., The Mosaic Company, ICL Group Ltd., Sociedad Química y Minera de Chile (SQM), K+S Aktiengesellschaft Haifa Group, EuroChem Group AG, Coromandel International Limited, CF Industries Holdings, Inc., Israel Chemicals Ltd. (ICL), Sinofert Holdings Limited, Grupa Azoty S.A. (COMPO EXPERT), OCP Group, Indian Farmers Fertiliser Cooperative Limited (IFFCO) |

Key Technological Shifts in the Water Soluble Fertilizers Market:

The water soluble fertilizers market is undergoing key technological changes driven by the demand for sustainability, high yields, and less waste. Advancements like smart manufacturing software, integration of IoT, VRT software, and machine learning lower the environmental impact and optimize the management of nutrients. The key technological advancement is the integration of AI, which optimizes the use of resources and enables precision application.

AI analyzes the soil conditions and understands the exact requirements of nutrients. AI incorporates variable rate technology and reduces the guesswork time for nutrients. AI determines optimal fertigation time and enhances the yield potential. AI uses remote sensing to monitor crop health and lower crop input costs. AI easily detects nutrient deficiencies and prevents nutrient runoff. Overall, AI is an automated way of applying fertilizer that enhances the environmental benefits.

Trade Analysis of Water Soluble Fertilizers Market: Import & Export Statistics

- China exported 3,075 shipments of water soluble fertilizer.

- Israel exported 704 shipments of water soluble fertilizer.

- India imported 4,821 shipments of water soluble fertilizer.

- From June 2024 to May 2025, India imported 1,981 shipments of water soluble fertilizer.

Water Soluble Fertilizers Market Value Chain Analysis

- Feedstock Procurement: The stage sources various raw materials like phosphorus, calcium, sulfur, nitrogen, iron, zinc, molybdenum, potassium, chelating agents, and manganese.

- Key Players:- Nutrien Ltd., K+S Group, Haifa Group, Yara International, EuroChem, Tessenderlo Kerley International

- Chemical Synthesis and Processing: The stage involves steps like raw material chemical reaction, synthesis, purification of products, granulation, drying of granules, coating, blending of nutrient granules, and bagging for distribution.

- Key Players:- ICL Group Ltd., K+S Aktiengesellschaft, IFFCO, Yara International ASA, SQM

- Quality Testing and Certifications: Quality testing focuses on measuring attributes like pH, crushing resistance, nutrient content, particle size, C:N ratio, pesticide residues, solubility, and bulk density. Certifications include ECOCERT, FCO, Zero Residue Certification, OMRI, and ISO.

- Key Players:- FARE Labs Pvt. Ltd., CTI, SGM National Lab, CFQCTI, Anacon Laboratories

Snapshot of Country-Wise Regulations of Water Soluble Fertilizers

| Country | Key Regulations | Major Crops Produced | Key Water Soluble Fertilizer Used |

| India | Fertiliser (Control) Order |

|

|

| United States |

|

|

|

| Germany |

|

|

|

| Brazil |

|

|

|

Segmental Insights

Product Type Insights

Why Nitrogenous Segment Dominates the Water Soluble Fertilizers Market?

The nitrogenous segment volume was valued at 17.0 million tons in 2025 and is projected to reach 31.0 million tons by 2035, expanding at a CAGR of 6.93% during the forecast period from 2025 to 2035. The nitrogenous segment dominated the water soluble fertilizers market with a 64% share in 2025. The strong focus on chlorophyll production and the increasing need for fast vegetative growth increase demand for nitrogenous fertilizers. The increased consumption of staple grains and the expansion of precision agriculture created demand for nitrogenous fertilizers. The intensive hydroponics cultivation and the strong focus on food security increase demand for nitrogenous fertilizers, driving the overall market growth.

The micronutrients segment volume was valued at 1.6 million tons in 2025 and is projected to reach 3.5 million tons by 2035, expanding at a CAGR of 9.14% during the forecast period from 2025 to 2035. The micronutrients segment is the fastest-growing in the market during the forecast period. The poor farming land management and the focus on exact nutrient delivery increase demand for micronutrients. The increasing need for enhancing fruit quality and the growth in regenerative farming increase demand for micronutrients. The intensive practices of greenhouse farming and increasing soil nutrient deficiencies create a higher demand for micronutrients, supporting the overall market growth.

Water Soluble Fertilizers Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume ( Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Nitrogenous (Urea, Calcium Nitrate, etc.) | 64.00% | 17.0 | 31.0 | 6.93% | 62.32% |

| Potassic (Potassium Nitrate/Sulfate) | 16.00% | 4.2 | 8.0 | 7.34% | 16.13% |

| Phosphatic (MAP, MKP, etc.) | 14.00% | 3.7 | 7.2 | 7.69% | 14.53% |

| Micronutrients (Iron, Zinc, etc.) | 6.00% | 1.6 | 3.5 | 9.14% | 7.02% |

Form Insights

How did the Dry Segment hold the Largest Share in the Water Soluble Fertilizers Market?

The dry segment held the largest revenue share of 82% in the market in 2025. The strong focus on precise nutrient application and the increased gardening activities increase demand for dry formulation. The compatibility of the dry form with automated irrigation helps market expansion. The cost-effectiveness, extended shelf life, high nutrient efficiency, and easy transportation of dry form drive the overall market growth.

The liquid segment is experiencing the fastest growth in the market during the forecast period. The growing advanced farming practices and the boosting production of higher-value crops increase demand for liquid formulation. The increasing groundwater pollution and the focus on better group growth increase demand for liquid formulation. The easy adaptability, faster action, and targeted application of liquid formulation support the overall market growth.

Mode of Application Insights

Which Mode of Application Dominated the Water Soluble Fertilizers Market?

The fertigation segment dominated the market with a 68% share in 2025. The growing adoption of smart farming practices and increased water scarcity concerns increase demand for fertigation. The growing popularity of horticulture and the increased production of higher yields create a higher demand for fertigation. The easy adaptability, high efficiency, excellent scalability, and environmental benefits of fertigation drive the overall market growth.

The foliar spray segment is the fastest-growing in the market during the forecast period. The focus on enhancing crop performance and the increasing food security issues increase demand for foliar spray. The emphasis on modern farming and the focus on quick nutrient correction increase demand for foliar spray. The growing number of various soil conditions requires foliar spray, supporting the overall market growth.

Crop Type Insights

How did the Horticultural Crops Segment hold the Largest Share in the Water Soluble Fertilizers Market?

The horticultural crops segment held the largest revenue share of 36% in the market in 2025. The growing demand for premium products and the focus on resource optimization increase demand for water soluble fertilizers. The increased consumption of nutrient-rich fruits and the growing demand for exotic horticultural products increase demand for water soluble fertilizers. The growing use of tailored formulas in horticultural crops drives market growth.

The greenhouse crops segment is experiencing the fastest growth in the market during the forecast period. The strong focus on reducing waste and the growth in year-round cultivation increases demand for water soluble fertilizer. The increased consumption of specialty vegetables and the increasing awareness bout water scarcity creates a higher demand for water soluble fertilizer. The controlled environment and sustainability in greenhouse crops support the overall market growth.

Regional Insights

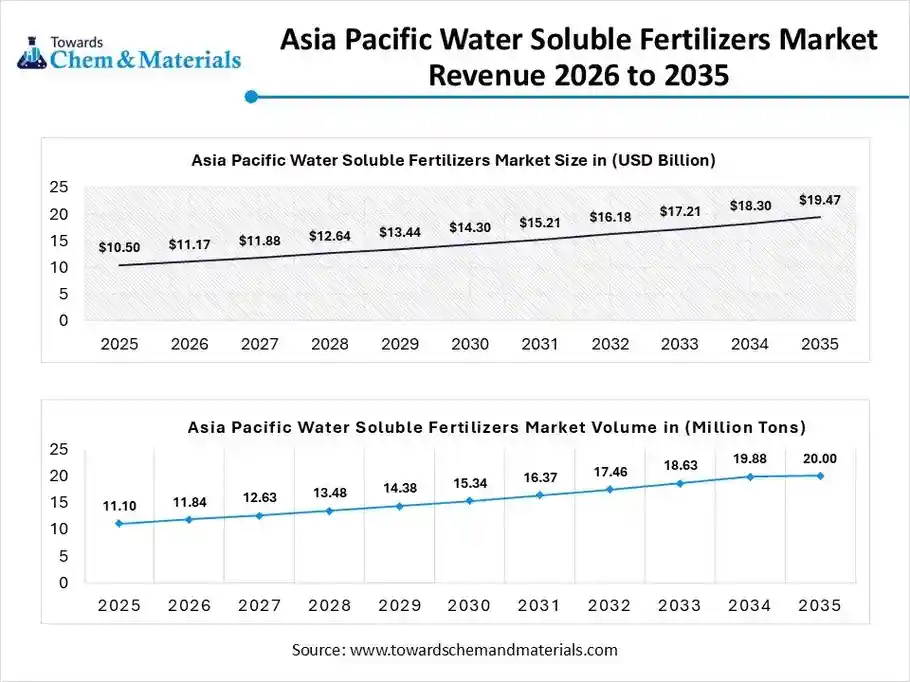

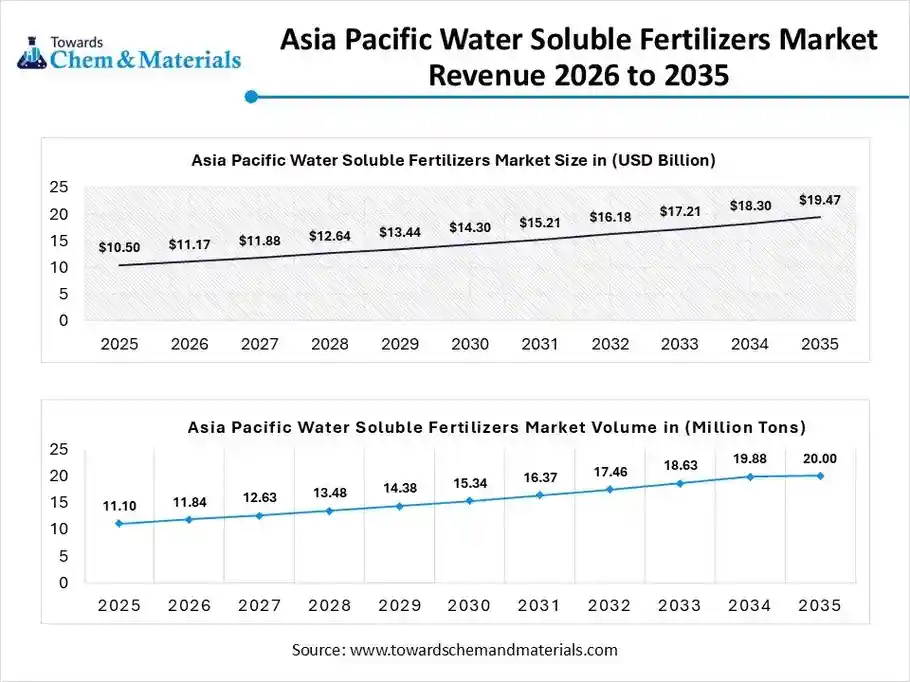

The Asia Pacific water soluble fertilizers market size was valued at USD 10.50 billion in 2025 and is expected to be worth around USD 19.47 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.37% over the forecast period from 2026 to 2035.

The Asia Pacific water soluble fertilizers volume was estimated at 11.1 million tons in 2025 and is projected to reach 20 million tons by 2035, growing at a CAGR of 70.00% from 2026 to 2035.Asia Pacific dominated the water soluble fertilizers market with a 42% share in 2025. The presence of a large population and the rise in the shrinkage of arable land increases demand for water soluble fertilizers. The strong government focus on modern irrigation, and the growing expansion of horticulture increases demand for water soluble fertilizers. The increased utilization of fertigation and the focus on conserving water require water soluble fertilizers. The increasing investment in agricultural modernization drives the market growth.

Precision Nutrition: China’s Powering Water Soluble Fertilizers

China is a major contributor to the market. The strong government focus on improving nutrient efficiency, and the transition towards precision farming increases demand for water soluble fertilizers. The rise of protected cultivation of crops and the increased consumption of fruits increases demand for water soluble fertilizers. The presence of large farming areas and the focus on crop intensification increase demand for water soluble fertilizers, supporting the overall market growth.

Latin America Water Soluble Fertilizers Market Trends

The Latin America water soluble fertilizers volume was estimated at 1.9 million tons in 2025 and is projected to reach 4.0 million tons by 2035, growing at a CAGR of 9.05% from 2026 to 2035. South America is experiencing the fastest growth in the market during the forecast period. The growing popularity of modern agricultural systems and the increased export of high-value crops increases demand for water soluble fertilizers. The increased awareness about the benefits of organic food consumption and the growing demand for coffee increase the adoption of water soluble fertilizers. The expansion of cultivation land and the focus on rapid nutrient uptake increase demand for water soluble fertilizer, driving the overall market growth.

Feeding Crops: Role of Water Soluble Fertilizer in Brazil

Brazil is a key contributor to the market. The surging production of high-value crops and the focus on maximizing farming output increase demand for water soluble fertilizers. The increasing use of micro-irrigation systems and the increasing need to lower nutrient leaching increase demand for water soluble fertilizers. The massive agricultural base supports the overall market growth.

Water Soluble Fertilizers Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume ( Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 18.00% | 4.8 | 9.0 | 7.33% | 18.12% |

| Europe | 28.00% | 7.4 | 14.0 | 7.34% | 28.21% |

| Asia Pacific | 42.00% | 11.1 | 20.0 | 6.70% | 40.12% |

| Latin America | 7.00% | 1.9 | 4.0 | 9.05% | 8.13% |

| Middle East & Africa | 5.00% | 1.3 | 2.7 | 8.21% | 5.42% |

Recent Developments

- In December 2025, Coromandel International Limited launched water soluble fertilizer, Fertinex. The fertilizer is applicable for fertigation application and offers efficient crop nutrition. The fertilizer is powered by Smart Signaling Technology and is useful across crops like vegetables, plantation crops, fruits, & pulses.(Source: www.agribusinessglobal.com)

- In August 2025, Kan Biosys and De Sangosse introduced ROFA 100% water-soluble fertilizers. The fertilizer offers precise nutrition and is effective across any weather conditions. The fertilizer enhances soil vitality and supports Indian farming.(Source: www.kanbiosys.com)

- In August 2024, Rallis India launched water soluble fertilizer, AQUAFERT Fertigation tomato range in Raipur. The fertilizer increases nutrient uptake and produces superior quality of tomato crops. The product range includes Subsequent Fruit Growth Stages, Bloom Stage, and Fruit Set Stage.(Source: www.passionateinmarketing.com)

Top Companies List

- Yara International ASA:- The Norwegian-based company produces water soluble fertilizers like straight fertilizers, biostimulants, NPKs, and Rexolin micronutrients for fertigation.

- Nutrien Ltd.:- The company manufactures various types of fertilizers like phosphate, potash, and nitrogen to support food production.

- The Mosaic Company:- The company’s brand Mosaic Reva manufactures diverse types of water soluble fertilizers like calcium nitrate, MKP, and potassium sulphate.

- ICL Group Ltd.:- The company produces liquid and solid water soluble fertilizers to support sustainable farming and precision agriculture.

- Sociedad Química y Minera de Chile (SQM):- The company manufactures fertilizers like Qrop, Allganic, Ultrasol, and Speedfol to serve the agricultural industry.

- K+S Aktiengesellschaft

- Haifa Group

- EuroChem Group AG

- Coromandel International Limited

- CF Industries Holdings, Inc.

- Israel Chemicals Ltd. (ICL)

- Sinofert Holdings Limited

- Grupa Azoty S.A. (COMPO EXPERT)

- OCP Group

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

Segments Covered

By Product Type

- Nitrogenous (Urea, Calcium Nitrate, etc.)

- Potassic (Potassium Nitrate/Sulfate)

- Phosphatic (MAP, MKP, etc.)

- Micronutrients (Iron, Zinc, etc.)

By Form

- Dry (Powder/Granules)

- Liquid

By Mode of Application

- Fertigation (Drip/Sprinkler)

- Foliar Spray

- Others (Hydroponics/Soil)

By Crop Type

- Horticultural Crops (Fruits/Vegetables)

- Field Crops (Corn, Wheat, Rice)

- Turf & Ornamentals

- Greenhouse Crops

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa