Content

What is the U.S. Textile Market Size?

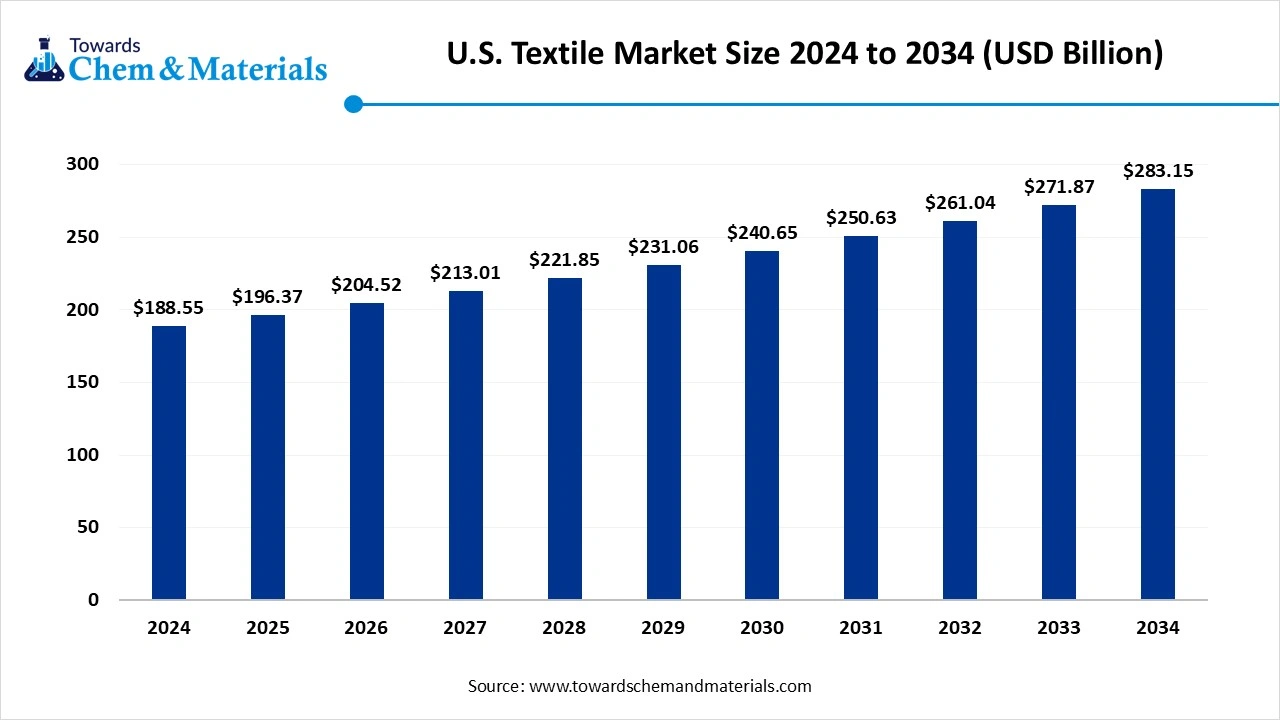

The U.S. textile market size was valued at USD 188.55 billion in 2024 and is expected to hit around USD 283.15 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.15% over the forecast period from 2025 to 2034. The growth of the market is driven by technological advancements, growing consumer demand for sustainable and high-quality products, and the expansion of e-commerce.

Key Takeaways

- By product, the natural fibre segment dominated the market in 2024.

- By product, the nylon segment is expected to grow significantly in the market during the forecast period.

- By raw material, the chemical segment dominated the market in 2024.

- By raw material, the silk segment is expected to grow in the forecast period.

- By application, the fashion segment dominated the market in 2024.

- By application, the technical segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The U.S. Textile Market?

The significance of the U.S. textile market lies in its economic contribution through jobs and exports, its role as a global importer, and its technological advancement and focus on specialised products like technical textiles. The U.S. employs hundreds of thousands of workers, produces billions in output, and is a major player in global trade. It is also an important part of national defence and is evolving with innovations in smart fabrics and sustainability.

U.S. Textile Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the U.S. textile market is expected to grow steadily, supported by rising demand for technical textiles, sustainable fabrics, and high-performance materials. The market is seeing a resurgence in domestic manufacturing due to supply chain localisation efforts and the adoption of advanced automation technologies.

- Sustainability Trends: Sustainability remains a defining trend across the U.S. textile industry. Manufacturers are transitioning toward recycled fibres, organic cotton, and bio-based polymers to align with ESG goals and meet consumer preferences for eco-friendly products. Waterless dyeing, energy-efficient spinning, and fibre-to-fibre recycling technologies are gaining traction.

- Domestic Expansion & Innovation: U.S. textile producers are investing in advanced R&D and expanding capabilities in speciality and technical textiles. Strategic collaborations between textile manufacturers, research institutions, and apparel brands are driving material innovation and digital manufacturing solutions.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 204.52 Billion |

| Expected Size by 2034 | USD 283.15 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Raw Material, By Application |

| Key Companies Profiled | Parkdale Mills, Unifi, Inc., Cone Denim, Burlington IndU.S.tries LLC, INVISTA S.R.L., IBENA Inc., Belton IndU.S.tries, Inc., Dewitt, TenCate, Mogul Co., Ltd., Siang May Pte Ltd., terrafix Geosynthetics, HUESKER International, Morenot |

Key Technological Shifts In The U.S. Textile Market:

Key technological shifts in the U.S. textile market include the rise of smart and high-performance textiles, automation and AI in manufacturing, digital supply chain technologies, and advanced materials like those created through nanotechnology and 3D printing. These innovations are driven by a demand for greater functionality, sustainability, efficiency, and customisation, impacting areas from healthcare and defence to high fashion and consumer apparel.

Trade Analysis Of the U.S. Textile Market: Import & Export Statistics

- In 2024, the United States exported $24.7 billion worth of textiles, making it the 14th most exported product overall. The primary destinations for these goods were Mexico ($6.07B), Canada ($4.32B), and China ($2.1B), among others.(Source: oec.world)

- The U.S. has exported 3,801 shipments of textiles and clothing. These shipments originated from 295 U.S. exporters and were sent to six buyers. The primary destinations for these U.S. textile and clothing exports are India, Pakistan, and South Korea.

- Globally, the top three exporters of Textiles and Clothing, based on shipment volume, are India, China, and the United States. India leads the world with 10,096 shipments, while China follows with 6,660 shipments, and the United States takes the third spot with 4,863 shipments.(Source: www.volza.com)

- As per the United States export data for textile products, the country has a total of 20,310 suppliers who collectively export to 7,745 buyers worldwide. In the period between November 2023 and October 2024, 3,665 of these suppliers were active, with TYSON FRESH MEATS INC, DEERE AND COMPANY, and HELVETIA CONTAINER LINE together accounting for a majority (52%) of the United States' total textile products exports.

- TYSON FRESH MEATS INC is the leading supplier of textile products in the United States, accounting for 29% of the total market share with 7,914 shipments. Following in second place is DEERE AND COMPANY, which holds a 14% share, equivalent to 3,765 shipments. HELVETIA CONTAINER LINE is the third-largest supplier, making up 10% of the total with 2,651 shipments.(Source: www.volza.com)

U.S. Textile Market Value Chain Analysis

- Chemical Synthesis and Processing : Textiles in the U.S. are produced through fibre spinning, weaving, knitting, dyeing, and finishing using both natural fibres (cotton, wool) and synthetic fibres (polyester, nylon). Automation, digital printing, and sustainable textile manufacturing are key trends in production.

- Key players : DuPont de Nemours Inc., Milliken & Company, Elevate Textiles, Unifi Inc., Parkdale Mills

- Quality Testing and Certification : U.S. textiles are tested for strength, colourfastness, flame resistance, and chemical safety following ASTM, ISO, and OEKO-TEX standards. Certifications like GOTS and ISO 9001 ensure quality and sustainability compliance.

- Key players: ASTM International, SGS, Intertek, Bureau Veritas

- Distribution to Industrial Users : Textiles are distributed across apparel, home furnishings, automotive, and industrial sectors through retailers, wholesalers, and direct supply chains.

- Key players: Milliken & Company, Elevate Textiles, Burlington Industries, Unifi Inc.

U.S. Textile Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Frameworks | Focus. Areas | Notable Notes |

| United States | U.S. Environmental Protection Agency (EPA) | - Clean Water Act (CWA) - Clean Air Act (CAA) - Toxic Substances Control Act (TSCA) - Resource Conservation and Recovery Act (RCRA) |

- Effluent and air emission controls - Chemical safety in dyeing/finishing - Hazardous U.S. waste management |

The EPA regulates textile manufacturing under NPDES permits for wastewater discharge and monitors VOCs and formaldehyde emissions. Textile auxiliaries and dyes are reviewed under TSCA risk assessments. |

| Federal Trade Commission (FTC) | - Textile Fibre Products Identification Act (1958) - Wool Products Labelling Act (1939) - Fur Products Labelling Act (1951) |

- Fibre content and origin labelling - Truth in advertising - Product identification and consumer protection |

FTC ensures all textile products display accurate fibre composition, origin, and care instructions. Mislabeling violations result in penalties under the Textile Act. | |

| Consumer Product Safety Commission (CPSC) | - Flammable Fabrics Act (FFA, 1953) - Consumer Product Safety Improvement Act (CPSIA, 2008) |

- Flammability testing - Safety of children’s clothing and textiles - Product recalls and labelling |

CPSC mandates flammability and lead content testing for textiles and apparel. The 16 CFR Part 1610 outlines methods for flammability classification. | |

| U.S. Customs and Border Protection (CBP) U.S. Department of Commerce (DOC) |

- Tariff Act of 1930 (Section 307) - Uyghur Forced Labour Prevention Act (UFLPA, 2021) - Berry Amendment (10 U.S.C. §2533a) |

- Import compliance and human rights standards - Forced labour traceability - Domestic sourcing for defence textiles |

The UFLPA bans textiles made with forced labour in China’s Xinjiang region. The Berry Amendment mandates U.S.-made textiles for military use. CBP enforces origin verification and supply chain audits. | |

| Department of Energy (DOE) | - Industrial Efficiency and Decarbonization Program (2022) | - Energy-efficient textile production - Emission reduction and renewable energy use |

DOE supports textile mills in adopting low-carbon, energy-efficient processes under the U.S. Industrial Decarbonization Roadmap. | |

| U.S. Department of Agriculture (U.S.DA) | - Organic Foods Production Act (1990) - National Organic Program (NOP) |

- Certification of organic cotton and fibres - Sustainable textile sourcing |

U.S. DA’s NOP certifies organic cotton and wool for textiles labelled as “organic.” Alignment with GOTS (Global Organic Textile Standard) is common for export-oriented manufacturers. |

Segmental Insights

Product Insight

Which Product Segment Dominated The U.S. Textile Market In 2024?

The natural fibre segment dominated the U.S. textile market in 2024. Natural fibres such as cotton, wool, and silk form a significant portion of the market, catering to both apparel and home furnishing sectors. These fibres are preferred for their comfort, breathability, and biodegradability, aligning with the rising consumer shift toward sustainable and eco-friendly fabrics. The demand is also supported by innovation in organic and recycled fibre processing technologies.

The nylon segment expects significant growth in the market during the forecast period. Nylon-based textiles are widely used for their strength, elasticity, and resistance to abrasion and chemicals. In the U.S. market, nylon finds extensive applications in sportswear, industrial fabrics, and automotive textiles. Continuous U.S. advancements in polymer modification and recycling have made nylon a preferred synthetic option, particularly for high-performance and technical textile applications requiring durability and moisture resistance.

Polyester has seen notable growth as a synthetic fibre in the market due to its cost-effectiveness, versatility, and easy dyeing properties. It is extensively used in clothing, upholstery, and industrial applications. The introduction of recycled polyester (rPET) made from post-consumer plastic bottles is further driving growth, aligning with sustainability and waste reduction initiatives.

Raw Material Insight

How Did the Chemical Segment Dominated The U.S. Textile Market In 2024?

- The chemical segment dominated the market in 2024. Chemically derived raw materials such as polyester and nylon dominate the U.S. textile manufacturing landscape due to their cost efficiency and adaptability. These materials enable large-scale production of versatile fabrics for apparel, home textiles, and industrial applications. The segment benefits from ongoing R&D in bio-based and recycled chemical fibres to meet sustainability goals and reduce the carbon footprint.

- The silk segment expects significant growth in the market during the forecast period. Silk remains a premium raw material segment in the market, primarily serving luxury fashion, interior design, and niche product categories. Valued for its lustre, smooth texture, and biodegradability, the silk market is growing due to increasing consumer interest in high-quality natural fabrics. Import dependency and innovations in artificial silk production also influence segment growth dynamics.

- Cotton has seen a notable growth in the U.S. textile market. Cotton remains a cornerstone of the U.S. textile sector due to its comfort, breathability, and biodegradability. It is extensively used in apparel, household furnishings, and medical textiles. The emphasis on organic and sustainably grown cotton has increased, driven by environmental regulations and consumer awareness about ethical textile sourcing and eco-labels.

Application Insight

Which Application Segment Dominated The U.S. Textile Market In 2024?

- The fashion segment dominated the market in 2024. The fashion segment represents the largest application area in the market, driven by consumer demand for diverse, comfortable, and sustainable clothing options. Both luxury and fast fashion brands are incorporating organic and recycled materials. E-commerce expansion, personalisation trends, and circular textile initiatives further enhance fabric innovation and production scalability within this segment.

- The technical segment expects significant growth in the U.S. textile market during the forecast period. Technical textiles are gaining momentum in the U.S. market due to their functionality across sectors like automotive, healthcare, defence, and construction. These textiles are engineered for durability, insulation, and protective performance rather than aesthetics. The segment benefits from advancements in smart fabrics, nanotechnology, and high-performance composites supporting industrial and specialised end-use applications.

- The household segment has seen notable growth in the market. Household textiles, including bedding, curtains, carpets, and upholstery, represent a stable market segment driven by home décor trends and lifestyle changes. The demand for sustainable, antimicrobial, and easy-care fabrics is rising. Domestic production and imports continue to serve a growing consumer base focused on comfort and interior aesthetics.

Recent Developments

- In July 2025, Major U.S. retail, apparel, and footwear groups have signed a Memorandum of Understanding to launch Textile Pro, a California initiative aimed at managing textile waste and promoting a circular economy in response to the state's Extended Producer Responsibility rule.(Source: apparelresources.com)

- In July 2025, the Textiles Recycling Expo U.S.A. will serve as a platform for driving textile recycling and circularity in North America. The event aims to connect stakeholders across the textile value chain to exchange knowledge and advance progress in textile recycling.(Source: www.innovationintextiles.com)

- In July 2025, Avient Corporation's Dyneema launched a new generation of Dyneema Woven Composites, a fabric designed for high-performance outdoor gear that is both stronger and lighter than its predecessor. This new composite U.S. Dyneema fibre is used in both the core and the exterior woven face.(Source: www.fibre2fashion.com)

Top U.S. Textile Market Companies

Milliken & Company

Corporate Information

- Milliken & Company is a privately held U.S. industrial manufacturer headquartered in Spartanburg, South Carolina.

- Founded in 1865, the company has grown into a diversified materials science business operating in specialties including textiles/performance fabrics, protective apparel, specialty chemicals, flooring, healthcare, and more.

History and Background

- Milliken’s origins go back to 1865 as a woolen fabrics distributor, progressing into textile manufacturing, and then broadening into chemicals, flooring, performance materials and protective textiles.

- Over the decades, the company developed key textile innovations (for instance in the 1960s 70s they developed reinforcement scrims, engineering fabrics, composite supports, etc.).

Key Developments and Strategic Initiatives

- In 2024, Milliken & Company was again named to the “America’s Most Innovative Companies” list by Fortune & Statista, recognizing its innovation culture in product, process and organization.

- The company recently released its 2024 Sustainability Report, outlining progress toward 2030 net zero and detailing reductions in scope 1 & 2 emissions (e.g., a 42 % reduction from 2018 baseline) and other sustainability initiatives.

Mergers & Acquisitions

- In 2019, Milliken acquired Andover Healthcare (via its healthcare business) and rebranded that business as OVIK Health (formerly “Milliken Healthcare Products”).

- In 2015, Milliken acquired Springfield LLC, a U.S. manufacturer of technical, performance and flame resistant fabrics for safety apparel, first responders and military. This expanded Milliken’s protective fabrics business.

Partnerships & Collaborations

- A notable recent collaboration is with Tidal Vision (biomolecular technologies) to leverage chitosan based biodegradable chemistries for scalable solutions across Milliken’s markets.

- Partnership with Paris based carpet reuse company Orak through investment and alignment with Milliken’s circular economy program (N/XT Life™) to manage end of life carpet tile and flooring reuse.

Product Launches / Innovations

- Milliken entered the outdoor performance fabrics market in July 2022 with its “Milliken Outdoor Fabrics” line, enabling fabrics designed to move from indoor to outdoor use.

- The company is the first textile manufacturer to offer non PFAS materials for all three layers of firefighter turnout gear (outer shell, moisture barrier, thermal liner) a major innovation in protective apparel.

Key Technology Focus Areas

- Performance textiles (protective fabrics, flame resistant fabrics, military/first responder apparel)

- Sustainable materials: elimination of PFAS in textiles; biodegradable chemistries; circular economy initiatives

- Specialty chemicals and additives: e.g., microencapsulation, surfactants, polymers, coatings

R&D Organisation & Investment

- Milliken emphasises innovation as a core differentiator: The company has “developed one of the largest collections of patents held by a private U.S. company.”

- Their corporate communications indicate deliberate investment in R&D and sustainable manufacturing processes (e.g., investment of more than US$35 million since 2018 to eliminate coal, cogeneration, energy efficiency and modernizing manufacturing operations).

SWOT Analysis

Strengths

- Strong heritage & brand: 150+ years; deep experience in textiles and materials.

- Diversified portfolio across chemicals, textiles, flooring, protective materials

reducing dependency on one market. - High innovation capability: large patent portfolio, strong R&D culture.

- Leadership in sustainability (non PFAS, net zero targets, circular economy) gives competitive advantage.

- Global manufacturing footprint, recent expansions (Asia chemical plant) enhance geographic reach.

Weaknesses

- Being privately held limits transparency of financials (may affect credit/partner perceptions).

- Diversification may dilute focus maintaining leadership across many product lines is complex.

- Manufacturing in developed markets may incur higher cost vs lower cost global competitors, especially in textiles.

Opportunities

- Growing demand for sustainable textiles and materials (eco friendly, performance fabrics, biodegradable chemistries).

- Increased regulation (PFAS bans, sustainability mandates) plays to Milliken’s pre emptive innovation.

Expansion in emerging markets (Asia, Middle East) via new plants and partnerships. - Cross industry applications (defence, first responders, healthcare) where high performance fabrics are required.

- Circular economy and reuse models (e.g., flooring reuse partnerships) capture new value chains.

- Threats

- Global textile & materials market competition (low cost manufacturers, substitution by new materials).

- Raw material cost volatility (fibres, chemicals, energy) affecting margins.Technology disruption: new materials (e.g., advanced composites, smart textiles) might challenge legacy positions if not ahead.

- Regulatory risk: although Milliken is proactive, changes could impose costs or require rapid adaptation.

- Macroeconomic pressures: manufacturing, supply chain disruptions, trade tensions, cost inflation.

Recent News & Strategic Updates

- April 2025: Milliken announced the opening of its first chemical plant in Asia (Singapore) to support microencapsulation technology and advanced material solutions.

- March 2024: Milliken was named to the “America’s Most Innovative Companies” list (Fortune/Statista) for the second year running.

- Parkdale Mills: One of the largest yarn manufacturers in North America, Parkdale specialises in cotton and blended yarns, supplying major apparel and home textile brands.

- Unifi, Inc.: Renowned for its REPREVE® brand of recycled fibres, Unifi develops eco-friendly polyester and nylon yarns for use in apparel, footwear, and home furnishings.

- Cone Denim: A heritage denim manufacturer producing premium and sustainable denim fabrics for major apparel brands, with advanced dyeing and finishing technologies.

- Burlington IndU.S.tries LLC: Specialises in woven fabrics and advanced performance textiles for apparel, military, and industrial applications, emphasising durability and comfort.

- INVISTA S.R.L.

- IBENA Inc.

- Belton IndU.S.tries, Inc.

- Dewitt

- TenCate

- Mogul Co., Ltd.

- Siang May Pte Ltd.

- terrafix Geosynthetics

- HUESKER International

- Morenot

Segments Covered

By Product

- Natural Fibres

- Polyester

- Nylon

- Others

By Raw Material

- Cotton

- Chemical

- Wool

- Silk

- Others

By Application

- Household

- Bedding

- Kitchen

- Upholstery

- Towel

- Others

- Technical

- Construction

- Transportation

- Protective

- Medical

- Others

- Fashion

- Apparel

- Ties & Clothing

- Handbags

- Others

- Others