Content

U.S. Renewable Diesel Market Size, Share, Trends and Forecasts 2034

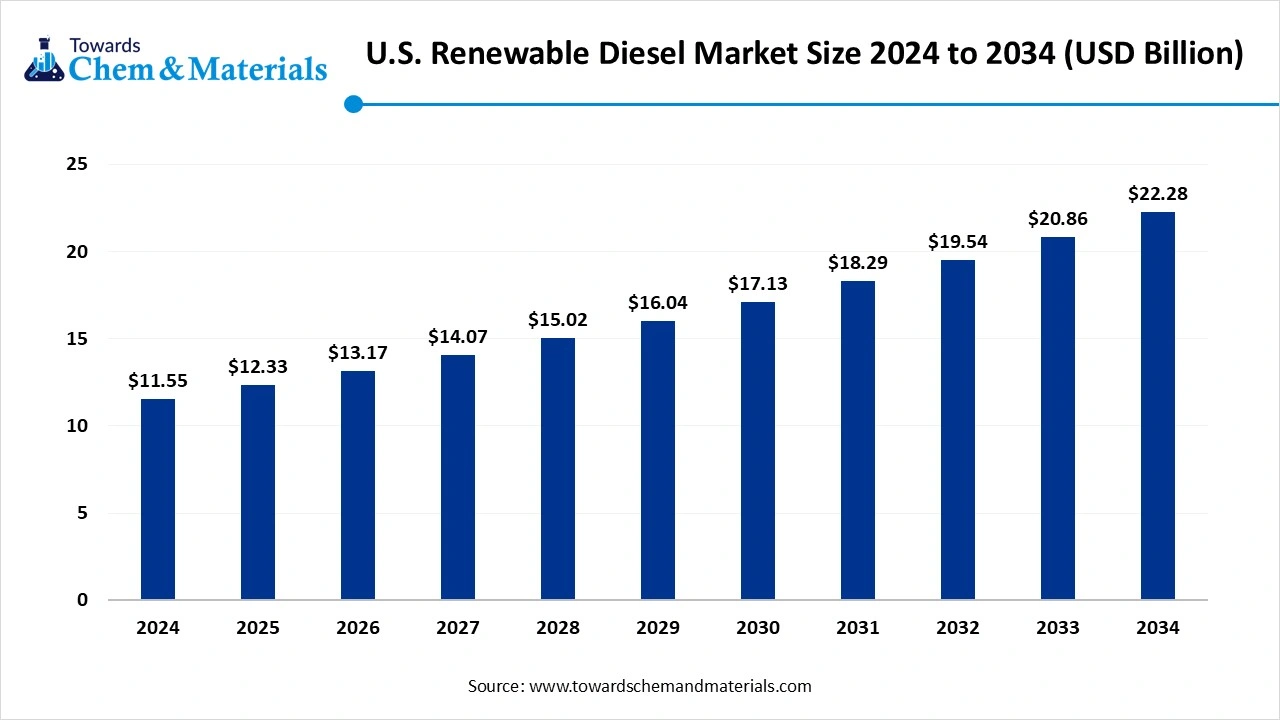

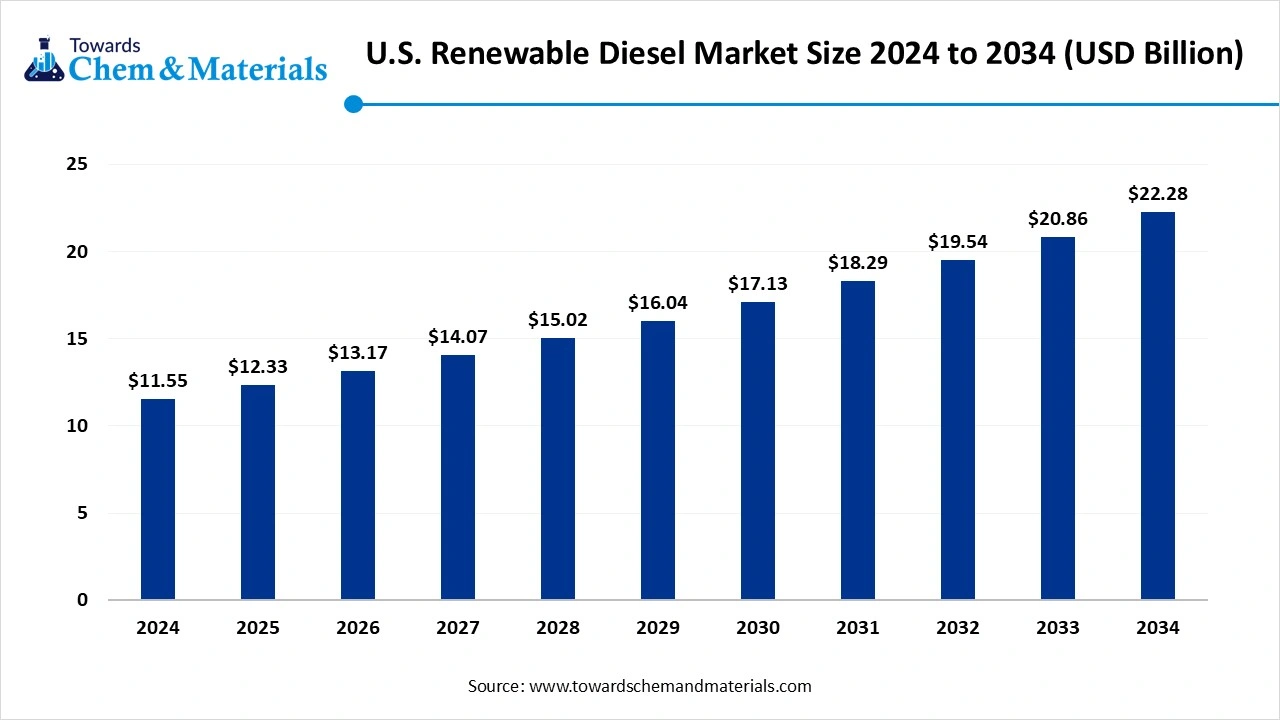

The U.S. renewable diesel market size is calculated at USD 11.55 billion in 2024, grew to USD 12.33 billion in 2025, and is projected to reach around USD 22.28 billion by 2034. The market is expanding at a CAGR of 6.79% between 2025 and 2034The growth of the market is driven by the growing and rapidly changing climate and concerns associated with it, which demand sustainable and eco-friendly alternatives in alignment with government policies.

Key Takeaways

- By feedstock type, the soybean oil segment dominated the renewable diesel market with an approximate share of 40% in 2024.

- By feedstock type, the used / waste cooking oil segment expects significant growth in the renewable diesel market during the forecast period.

- By product/fuel type, the B100 (pure renewable diesel) segment dominated the renewable diesel market with an approximate share of 50% in 2024.

- By product/fuel type, the blends for the commercial fleets segment are expected to experience significant growth in the renewable diesel market during the forecast period.

- By production tech, the hydroprocessing / hefa-hvo segment dominated the renewable diesel market with an approximate share of 65% in 2024.

- By production tech, the co-processing in the refineries segment is expected to experience significant growth in the renewable diesel market during the forecast period.

- By application, the transportation (road freight & buses) segment dominated the renewable diesel market with an approximate share of 55% in 2024.

- By application, the aviation/marine segment expects significant growth in the renewable diesel market during the forecast period.

- By end user, the commercial transport fleets segment dominated the renewable diesel market with an approximate share of 50% in 2024.

- By end users, the municipal / government fleets segment expects significant growth in the renewable diesel market during the forecast period.

Market Overview

What Is The Significance Of The U.S. Renewable Diesel Market?

The significance of the U.S. renewable diesel market is its ability to significantly lower greenhouse gas emissions and carbon intensity in transportation amid rising environmental concerns and a growing shift towards sustainability.

This also helps in managing and enhancing the national energy security by reducing the reliance on foreign oil, which helps in increasing the economy and provides income to the farmers. The net-zero initiatives and alignment with government policies help the market to grow.

U.S. Renewable Diesel Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the U.S. renewable diesel market is expected to witness rapid growth, supported by federal and state-level incentives such as the Renewable Fuel Standard (RFS) and California’s Low Carbon Fuel Standard (LCFS). Production capacity is expanding significantly, with oil majors and biofuel companies converting existing refineries or building new plants.

- Sustainability Trends: The market is strongly aligned with decarbonization goals, with renewable diesel offering lifecycle greenhouse gas reductions of up to 80% compared to petroleum diesel. Feedstock diversification is emerging as a sustainability focus, with producers increasingly sourcing used cooking oil, animal fats, and inedible corn oil, alongside soybean and canola oils.

- Global Expansion & Investments: Leading refiners and energy companies are expanding renewable diesel production facilities across the U.S., particularly in the Gulf Coast and West Coast regions. Partnerships between agricultural producers and energy firms are strengthening domestic feedstock supply chains.

Key Technological Shifts In The U.S. Renewable Diesel Market:

Key technological shifts in the market include advancements in hydrotreating and co-processing for greater efficiency, feedstock flexibility through improved use of waste oils and fats, and innovative blending strategies (like the Chevron UltraClean Blend) to improve cold-weather performance and overcome operational constraints.

These technologies, supported by policy initiatives such as the Inflation Reduction Act and the Renewable Fuel Standard (RFS), are driving capacity expansions, reducing costs, and positioning renewable diesel as a mainstream, drop-in fuel solution.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 12.33 Billion |

| Expected Size by 2034 | USD 22.28 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.79% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Feedstock Type, By Product / Fuel Type, By Application, By End-User |

| Key Companies Profiled | Neste Corporation (U.S. operations), Diamond Green Diesel (Valero & Darling Ingredients JV), World Energy, Phillips 66 / Renewable Diesel Projects , Marathon Petroleum Corporation, REG (Renewable Energy Group) , Cargill, Inc., Bunge Limited, ADM (Archer Daniels Midland Company), Chevron / Renewable Diesel Initiatives , Tyson Foods (feedstock/animal fats supply), Gevo, Inc. (advanced biofuels / renewable diesel projects) , Renewable Energy Group / REG Life Sciences , Pacific Biodiesel Technologies , Green Plains Inc. |

Trade Analysis Of the U.S. Renewable Diesel Market: Import & Export Statistics

- In January 2025, U.S. renewable diesel exports saw a sharp increase, with the Netherlands being the primary destination.

- U.S. renewable diesel exports saw a 95% jump in January 2025, reaching 31.8 million gallons.

The main export destinations in January 2025 were the Netherlands (30.4 million gallons) and the United Kingdom (1.5 million gallons). - The Netherlands is both a major importer of biofuels and a significant exporter and re-exporter, leveraging its strategic port infrastructure. It plays a crucial role in Europe's biofuel trade, importing U.S. renewable diesel and distributing it to other European markets.

- Led by Neste, Singapore has become a major global production hub for renewable fuels and is a key exporter to markets in Europe and North America.

- Argentina is one of the world's largest exporters of biofuels, with a strong focus on biodiesel derived from soybean oil.

U.S. Renewable Diesel Market-- Value Chain Analysis

- Chemical Synthesis and Processing: The renewable diesel is synthesised and processed through hydrotreating, gasification, pyrolysis, and biological sugar upgrading.

- Key players : Diamond Green Diesel, Chevron, Marathon Petroleum, Phillips 66, Honeywell UOP, and ExxonMobil Chemical

- Quality Testing and Certification: The renewable diesel requires ASTM D975, International Sustainability and Carbon Certification, and TOP TIER Diesel Fuel certification.

- Key players: ASTM International, UL Solutions, and the Environmental Protection Agency

- Distribution to Industrial Users: The renewable diesel is distributed to the Transportation and logistics, Construction and mining, Agriculture, power generation, and Industrial and commercial operations.

- Key players: Targray, Biofuel Express, Ezfuel, Repos Energy, and World Fuel Services.

Renewable Diesel Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. EPA (Environmental Protection Agency), California Air Resources Board (CARB), U.S. Department of Energy (DOE), ASTM International | - EPA Renewable Fuel Standard (RFS2, 40 CFR Part 80) → mandates blending of renewable fuels, creates RIN credits - CARB Low Carbon Fuel Standard (LCFS) → scarbon intensity reduction targets for fuels sold in California - ASTM D975 & D975 Annex → fuel quality specifications for diesel and renewable diesel - ASTM D975 & D7467 → biodiesel/renewable diesel blends - Blender’s Tax Credit (BTC, $1/gal) – federal tax incentive for renewable diesel producers |

- GHG reduction - Fuel quality & compatibility - Compliance with blending mandates - Incentives for production & use |

California LCFS provides the strongest demand pull, while federal RFS creates a nationwide credit market (RINs). ASTM standards ensure renewable diesel is fully interchangeable with petroleum diesel. Incentives like the BTC significantly boost the economy. |

Segmental Insights

Feedstock Type Insights

Which Feedstock Type Segment Dominated The U.S. Renewable Diesel Market In 2024?

The soybean oil segment dominated the market with an approximate share of 40% in 2024. Soybean oil remains a major renewable diesel feedstock in the U.S. due to its availability and integration with existing agricultural supply chains. It offers stable yields, supports farm-based economies, and benefits from federal incentives. Producers are expanding soybean processing capacity to meet growing demand for low-carbon fuels.

The used / waste cooking oil segment expects significant growth in the market during the forecast period. Used and waste cooking oil is gaining momentum as a sustainable feedstock for renewable diesel. Its circular economy benefits, and lower carbon intensity make it highly attractive. In the U.S., waste oil collection programs and partnerships with restaurants are increasing feedstock availability for large-scale fuel production.

Product / Fuel Type Insights

How Did the B100 (Pure Renewable Diesel) Segment Dominated The U.S. Renewable Diesel Market In 2024?

The B100 (pure renewable diesel) segment dominated the U.S. renewable diesel market with an approximate share of 50% in 2024. B100 renewable diesel offers a fully decarbonized alternative to petroleum diesel, meeting ASTM standards for direct substitution. It is used in specialized fleets seeking maximum emissions reduction. In the U.S., demand is driven by state-level low-carbon fuel programs and municipal fleet decarbonization initiatives.

The blends for the commercial fleets segment are expected to experience significant growth in the market during the forecast period. Blended renewable diesel provides a practical transition option for commercial fleets. It improves fuel performance, reduces greenhouse gases, and integrates seamlessly into existing infrastructure. In the U.S., long-haul trucking and logistics sectors are rapidly adopting blends to meet corporate sustainability goals while balancing operational costs.

Production Tech Insights

Which Production Tech Segment Dominated The U.S. Renewable Diesel Market In 2024?

The hydroprocessing / hefa-hvo segment dominated the market with an approximate share of 65% in 2024. Hydroprocessed esters and fatty acids (HEFA-HVO) technology dominates renewable diesel production in the U.S. It ensures high-quality fuel compatible with existing engines and infrastructure. HEFA plants are expanding rapidly, supported by investment incentives and commitments from major refiners and biofuel companies to scale domestic renewable capacity.

The co-processing in the refineries segment is expected to experience significant growth in the market during the forecast period. Co-processing allows petroleum refineries to integrate renewable feedstocks with fossil streams, offering a lower-cost, transitional pathway to renewable diesel. In the U.S., refiners are increasingly adopting this approach to comply with renewable fuel standards while maximizing utilization of existing infrastructure and reducing overall carbon intensity.

Application Insights

How Did the Transportation Segment Dominated The U.S. Renewable Diesel Market In 2024?

The transportation (road freight & buses) segment dominated the U.S. renewable diesel market with an approximate share of 55% in 2024. Road freight and buses are the largest consumers of renewable diesel in the U.S. Its drop-in compatibility, reduced particulate matter, and lower lifecycle emissions make it attractive for heavy-duty fleets. Federal and state incentives continue to push adoption, especially in California and other low-carbon standard states.

The aviation/marine segment expects significant growth in the market during the forecast period. The aviation and marine sectors are beginning to adopt renewable diesel, often as part of early trials and blended fuels. U.S. ports and airlines are exploring renewable options to meet international emission reduction targets. Growth is expected as sustainable aviation fuel (SAF) pathways overlap with renewable diesel technologies.

End-User Insights

Which End-User Segment Dominated The U.S. Renewable Diesel Market In 2024?

The commercial transport fleets segment dominated the market with an approximate share of 50% in 2024. Commercial fleets, including logistics and delivery operators, are major adopters of renewable diesel in the U.S. The fuel’s compatibility with existing engines reduces transition costs. Companies are turning to renewable diesel to meet ESG targets, achieve carbon neutrality, and comply with evolving state regulations.

The municipal / government fleets segment expects significant growth in the market during the forecast period. Municipal and government fleets play a leading role in renewable diesel adoption, especially in California, Oregon, and Washington. Public buses, waste management trucks, and emergency vehicles increasingly run on renewable diesel to lower emissions, demonstrating government commitment to decarbonization and supporting broader market expansion.

Recent Developments

- In July 2025, ExxonMobil expanded the retail availability of its Esso Renewable Diesel (R20) in Hong Kong, making the lower-emission fuel available at more service stations. The R20 blend contains a minimum of 20% renewable diesel made from waste oils and is advertised as providing a 15.4% reduction in life-cycle greenhouse gas emissions compared to conventional diesel.(Source : corporate.exxonmobil.com)

- In April 2025, Neste and DB Schenker initiated Singapore's first trial of renewable diesel for road transport, utilizing Neste MY Renewable Diesel made from waste and residue raw materials to significantly reduce greenhouse gas emissions.(Source : esgnews.com)

Top Players In The U.S. Renewable Diesel Market & Their Offerings:

- Neste Corporation (U.S. operations): a Finnish company specializing in refining waste and renewable raw materials into sustainable fuels and products. It is a global leader in producing sustainable aviation fuel (SAF) and renewable diesel.

- Diamond Green Diesel (Valero & Darling Ingredients JV): a joint venture between U.S. oil refiner Valero Energy Corporation and sustainable ingredients producer Darling Ingredients Inc. The company is a major producer of renewable diesel and sustainable aviation fuel (SAF) in North America.

- World Energy: World Energy is an advanced biofuel company and a leading producer of sustainable aviation fuel (SAF) in North America. The company primarily focuses on converting waste and inedible agricultural byproducts into clean fuels to decarbonize the transportation sector.

- Phillips 66 / Renewable Diesel Projects: Phillips 66 is actively transitioning its business to include renewable fuels, with its flagship Rodeo Renewed project in California representing a major step toward that goal. The company has focused on converting some of its existing refineries into renewable fuel facilities rather than building from scratch.

- Marathon Petroleum Corporation: Marathon Petroleum Corporation (MPC) is a major U.S. integrated downstream energy company that has been actively investing in renewable diesel to diversify its business. The company is converting some of its conventional refineries into renewable fuel facilities and has also entered key partnerships to secure feedstock.

Other Top Players Are

- Neste Corporation (U.S. operations)

- Diamond Green Diesel (Valero & Darling Ingredients JV)

- World Energy

- Phillips 66 / Renewable Diesel Projects

- Marathon Petroleum Corporation

- REG (Renewable Energy Group)

- Cargill, Inc.

- Bunge Limited

- ADM (Archer Daniels Midland Company)

- Chevron / Renewable Diesel Initiatives

- Tyson Foods (feedstock/animal fats supply)

- Gevo, Inc. (advanced biofuels / renewable diesel projects)

- Renewable Energy Group / REG Life Sciences

- Pacific Biodiesel Technologies

- Green Plains Inc.

Segments Covered

By Feedstock Type

- Soybean Oil

- Canola / Rapeseed Oil

- Animal Fats (tallow, lard)

- Used / Waste Cooking Oil

- Other Vegetable Oils (palm, sunflower, corn oil)

By Product / Fuel Type

- Pure Renewable Diesel (B100)

- Blends (B5, B20, B50)

By Production Technology

- Hydroprocessing / Hydrotreated Vegetable Oils (HEFA/HVO)

- Co-processing in Refineries

- Emerging Catalytic & Biochemical Routes

By Application

- Transportation (road freight, buses, marine diesel)

- Industrial (diesel engines, generators, machinery)

- Aviation (biojet fuel blends derived from renewable diesel streams)

- Power Generation / Grid Backup

By End-User

- Commercial Transportation Fleets (trucking, buses)

- Municipal & Government Vehicles

- Industrial / Manufacturing Units

- Aviation & Marine Operators

- Refineries & Blenders