Content

U.S. Recycled Polyethylene Terephthalate Market Size and Share 2034

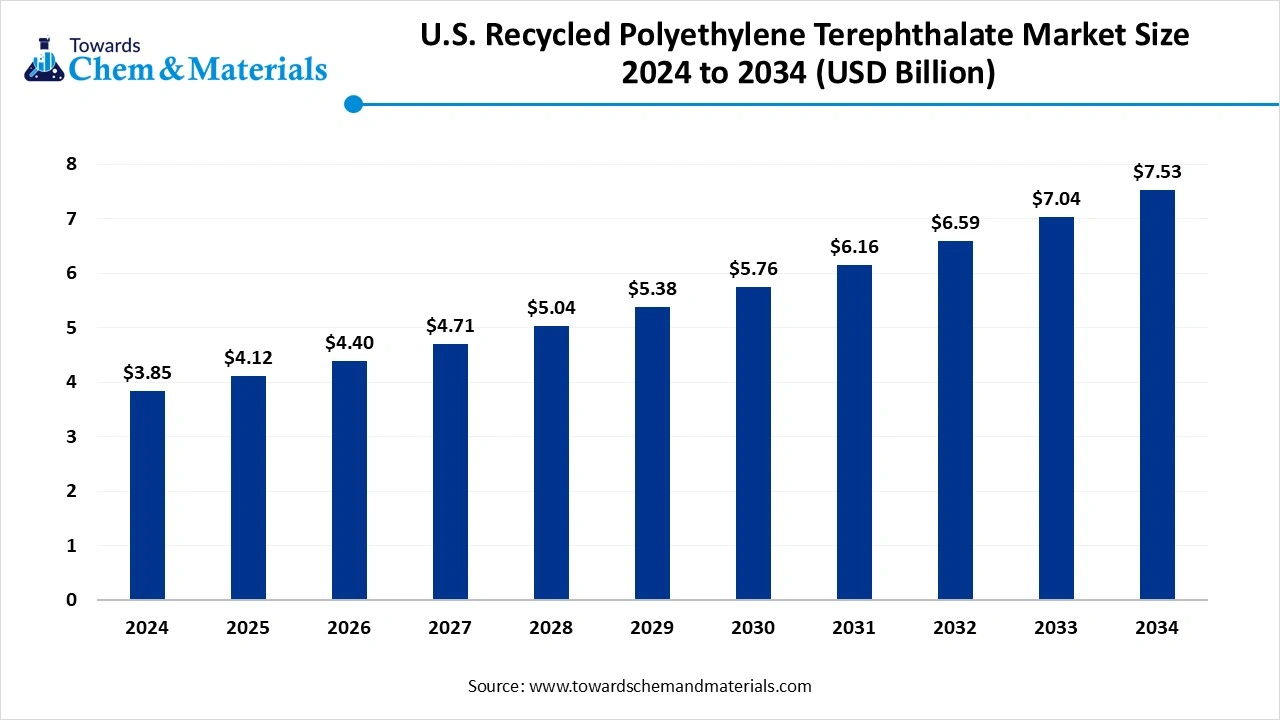

The U.S. recycled polyethylene terephthalate market size is calculated at USD 3.85 billion in 2024, grew to USD 4.12 billion in 2025, and is projected to reach around USD 7.53 billion by 2034. The market is expanding at a CAGR of 6.94% between 2025 and 2034. The increasing awareness about plastic pollution, stringent government regulations, and the expansion of the packaging industry drive the market growth.

Key Takeaways

- By product form, the rPET flakes segment held approximately a 50% share in the U.S. recycled polyethylene terephthalate market in 2024 due to the growing production of textiles.

- By product form, the rPET pellets segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing production of food containers.

- By recycling process, the mechanical recycling segment held approximately a 70% share in the market in 2024 due to its cost-effectiveness.

- By recycling process, the chemical recycling segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing need for high-quality rPET.

- By grade, the food-grade rPET segment held approximately a 60% share in the market in 2024 due to the growing food & beverage industry.

- By grade, the non-food grade segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing packaging of household items.

- By End-Use Industry, the food & beverages segment held approximately a 50% share in the market in 2024 due to the growing consumption of packaged foods.

- By End-Use Industry, the textiles & automotive segment is expected to grow at the fastest CAGR in the market during the forecast period due to the strong focus on sustainable fashion.

Role of U.S rPET in Industrial Manufacturing and Sustainability

The U.S. recycled polyethylene terephthalate (rPET) is a process of collecting, processing, and re-manufacturing PET waste into new products. The PET waste is commonly found in food containers, water bottles, packaging, and soda bottles. The rPET processes post-consumer and post-industrial PET plastic waste into recycled PET flakes, pellets, or fibers.

The rPET is widely used in beverage bottles, food containers, textiles, automotive parts, and packaging films. Factors like corporate commitments to the circular economy, increasing consumer preference for eco-friendly packaging, sustainability mandates, government recycling targets, and advanced recycling technologies contribute to the growth of the U.S. recycled polyethylene terephthalate market.

- From May 2024 to April 2025, the United States exported 226 shipments of recycled PET.(Source: www.volza.com)

Growing Automotive Industry Drives Market Growth

The growing automotive industry and focus on improving the fuel efficiency of vehicles increase demand for rPET. The growing production of interior automotive components like acoustic insulation, trunk liners, seat upholstery, and floor carpets increases demand for rPET. The stricter emission standards of vehicles and the growing adoption of sustainable materials in vehicles increase demand for rPET.

The focus on lowering the weight of vehicles and improving vehicle energy efficiency increases demand for rPET. The rise in electric vehicles and the increasing production of various automotive parts like under-the-hood components, mattresses, interior panels, and bumpers increases demand for rPET. The increasing manufacturing of durable car components and a strong focus on lowering carbon footprint increase demand for rPET. The growing automotive industry is a key driver for the growth of the U.S. recycled polyethylene terephthalate market.

Market Trends

- Growing Demand for Sustainable Packaging: The increasing need for sustainable packaging in industries like consumer goods, food & beverages increases the adoption of rPET to promote sustainability.

- Growing Textile Industry: The increasing production of various textiles like upholstery, sportswear, shirts, curtains, cushions, carpets, and other clothing increases demand for rPET.

- Technological Advancements: The ongoing technological advancements, like AI-enabled sorting, innovations in chemical recycling, vacuum decontamination, and super-clean recycling, increase the production of rPET.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 4.12 Billion |

| Expected Size by 2034 | USD 7.53 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.94% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Form, By Recycling Process, By Grade, By End-Use Industry, |

| Key Companies Profiled | Indorama Ventures Public Company Limited (U.S. operations), CarbonLITE Industries, Phoenix Technologies International LLC, Evergreen Plastics, Inc., Far Eastern New Century (FENC) USA, Perpetual Recycling Solutions, Clear Path Recycling LLC, Custom Polymers PET, LLC, Plastipak Holdings, Inc., PolyQuest, Inc., UltrePET, LLC, Evergreen Fiber Technologies, Niagara Bottling, LLC (in-house rPET use), Unifi, Inc. (REPREVE® fibers), DAK Americas LLC |

Market Opportunity

Growing Expansion of the Packaging Industry Unlocks Market Opportunity

The increasing demand for sustainable packaging and the expansion of the packaging industry increase the adoption of rPET. The strong focus on extending the shelf life of packaged products and the high demand for packaged goods increase the adoption of rPET. The focus on extending food & beverage shelf life and high consumption of bottled beverages increases demand for rPET. The increasing consumption of packaged food and the rise in online shopping fuel demand for rPET. The need for high-quality packaging in industries like pharmaceuticals and e-commerce increases demand for rPET.

The growing packaging demand in applications like personal care products, edible oils, soft drinks, and water increases demand for rPET. The growing expansion of the packaging industry creates an opportunity for the growth of the U.S. recycled polyethylene terephthalate market.

Market Challenge

High Production Cost Limits Expansion of the Market

With several benefits of recycled PET in various industries across the United States, the high production cost restricts the market growth. Factors like limited feedstocks, stringent regulatory environments, high cost of processing, need for specialized technology, volatility in prices of virgin PET, and limited recycling infrastructure are responsible for the high production cost. The energy-intensive processes like collection, sorting PET waste, cleaning, and converting it to rPET require a high cost.

The need for advanced technology and the limited availability of high-quality raw materials increase the cost. The high maintenance cost of equipment and the need for well-established infrastructure increase the cost. The stringent quality requirements and high operating costs increase the cost. The high production cost hampers the growth of the U.S. recycled polyethylene terephthalate market.

Country Insights

South U.S. Recycled Polyethylene Terephthalate Market Trends

The South region dominated the market in 2024. The growing consumer preference for sustainable packaging and stringent environmental regulations increases the adoption of rPET. The well-established recycling infrastructure and corporate initiatives increase demand for rPET. The rise in e-commerce and the presence of major companies like PepsiCo & Coca-Cola increase demand for rPET. The growing demand for rPET in industries like automotive, food, healthcare, & beverages drives the overall growth of the market.

Midwest U.S. Recycled Polyethylene Terephthalate Market Trends

The Midwest region is experiencing the fastest growth in the market during the forecast period. The well-established manufacturing base and growing food processing industry increase demand for rPET. The presence of major brands like Nestle, PepsiCo, and Coca-Cola increases the adoption of rPET. The stricter government regulations and advancements in recycling, like chemical recycling, increase the production of rPET. The strong focus on sustainable packaging and stricter sustainability goals increases demand for rPET, supporting the overall growth of the market.

Segmental Insights

Product Form Insights

What made rPET Segment Dominate the U.S. Recycled Polyethylene Terephthalate Market?

The rPET flakes segment dominated the market in 2024. The growing production of products like textile fibers, automotive interior components, containers, films, and strapping increases the adoption of rPET flakes. The cost-effectiveness of flakes and a less energy-intensive process helps market growth. The increasing production of textile products like carpets, apparel, and other fabrics increases demand for rPET. The focus on resource conservation and waste reduction increases demand for rPEt, driving the overall growth of the market.

The rPET pellets segment is the fastest-growing in the market during the forecast period. The increasing production of food containers, bottles, and trays increases demand for rPET pellets. The increasing development of interior components like insulation materials, seat fabrics, and carpets increases demand for rPET pellets. The growing demand for eco-friendly products and stricter government regulations increases the adoption of rPET pellets. The growing rPET pellets in industries like personal care, food, & beverage support the overall growth of the market.

Recycling Process Insights

How the Mechanical Recycling Segment Held the Largest Share in the U.S. Recycled Polyethylene Terephthalate Market?

The mechanical recycling segment held the largest revenue share in the market in 2024. The growing food-grade application and the need for a cost-effective process increase demand for mechanical recycling. The high decontamination efficiencies and well-established infrastructure increase the demand for mechanical recycling. The focus on preserving molecular structure and a strong focus on lowering carbon footprint increase demand for mechanical recycling, driving the overall growth of the market.

The chemical recycling segment is experiencing the fastest growth in the market during the forecast period. The growing environmental awareness about plastic pollution and stringent government regulations increases the adoption of chemical recycling. The increasing need for sustainable packaging and sustainability goals increases demand for chemical recycling. The increasing production of food-contact packaging and the need for high-quality rPET support the overall growth of the market.

Grade Insights

Why did the Food-Grade rPET Segment Dominate the U.S. Recycled Polyethylene Terephthalate Market?

The food-grade rPET segment dominated the market in 2024. The growing demand for beverage bottles and the expansion of the food & beverage industry increase demand for food-grade rPET. The need for sustainable food packaging and focus on lowering the carbon footprint of the food & beverage industry increases the adoption of food-grade rPET. The growing production of food containers, films, beverage bottles, sheets, trays, and clamshells increases demand for food-grade rPET, driving the overall growth of the market.

The non-food-grade segment is the fastest-growing in the market during the forecast period. The growing demand for products like cosmetics, shampoos, and detergents increases the adoption of non-food-grade rPET. The increasing production of construction materials and the increasing packaging of household items increase demand for non-food-grade rPET. The growing development of automotive components like interior panels, seat fillings, and insulation increases demand for non-food-grade rPET, supporting the overall market growth.

End-Use Industry Insights

Which End-Use Industry Held the Largest Share in the U.S. Recycled Polyethylene Terephthalate Market?

The food & beverages segment held the largest revenue share in the market in 2024. The growing consumption of carbonated drinks and bottled water increases demand for rPET. The increasing packaging of items like drinks, sauces, and condiments increases the adoption of rPET. The increasing consumption of packaged food and the need for single-serving packaging formats increase demand for rPET, driving the overall growth of the market.

The textiles & automotive segment is experiencing the fastest growth in the market during the forecast period. The increasing consumer demand for recycled materials and focus on sustainable fashion initiatives increase demand for rPET. The growing production of textiles like shirts, crease-free suits, and other products increases demand for rPET. The focus on enhancing the fuel efficiency of vehicles and the rise in electric vehicles increases demand for rPET. The growing production of various PET fibers and the development of automotive parts increase demand for rPET, supporting the overall market growth.

U.S. Recycled Polyethylene Terephthalate Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement for U.S. rPET includes post-consumer PET, like bottles, containers, jars, & household packaging, and post-industrial PET.

- Quality Testing & Certification: The quality testing and certification involve verification of recycled content, material’s physical property testing, food-grade compliance, & batch consistency and certification like FDA & Global Recycled Standard.

- Regulatory Compliance and Safety Monitoring: The regulatory compliance and safety monitoring includes FDA approval, purity standards, food safety, & decontamination and migration testing.

Recent Developments

- In February 2023, Coca-Cola plans to launch 100% rPET bottles in six U.S. states. The new rPET bottles are available for Diet Coke, Strawberry Coke, Strawberry Vanilla Coke, Coca-Cola, Coca-Cola Sugar-Free, and Vanilla Coke. The bottle is available in states like Florida, Mississippi, Alabama, Tennessee, and Louisiana.(Source: www.aceretech.com)

- In October 2023, Chlorophyll Water, a U.S. company, launched 100% rPET bottles with Avery Dennison label technology. The bottle uses CleanFlake label technology and offers high-quality recycled PET flakes. The rPET bottles received Clean Label Project Certification.(Source: www.sustainableplastics.com)

- In August 2025, Circularix expanded a new rPET facility in Florida and Pennsylvania. The new plant is starting in Ocala, Florida, and increases the production of food-grade rPET. The rPET is widely used in consumer products, food, & beverage packaging.(Source: www.chemanalyst.com)

U.S. Recycled Polyethylene Terephthalate Market Top Companies

- Indorama Ventures Public Company Limited (U.S. operations)

- CarbonLITE Industries

- Phoenix Technologies International LLC

- Evergreen Plastics, Inc.

- Far Eastern New Century (FENC) USA

- Perpetual Recycling Solutions

- Clear Path Recycling LLC

- Custom Polymers PET, LLC

- Plastipak Holdings, Inc.

- PolyQuest, Inc.

- UltrePET, LLC

- Evergreen Fiber Technologies

- Niagara Bottling, LLC (in-house rPET use)

- Unifi, Inc. (REPREVE® fibers)

- DAK Americas LLC

Segments Covered

By Product Form

- rPET Flakes

- rPET Pellets

- rPET Fibers

- rPET Sheets/Films

By Recycling Process

- Mechanical Recycling

- Chemical Recycling (Depolymerization, Glycolysis, Methanolysis)

By Grade

- Food-Grade rPET

- Non-Food-Grade rPET

By End-Use Industry

- Food & Beverages

- Textiles & Apparel

- Automotive & Transportation

- Consumer Goods

- Industrial & Manufacturing