Content

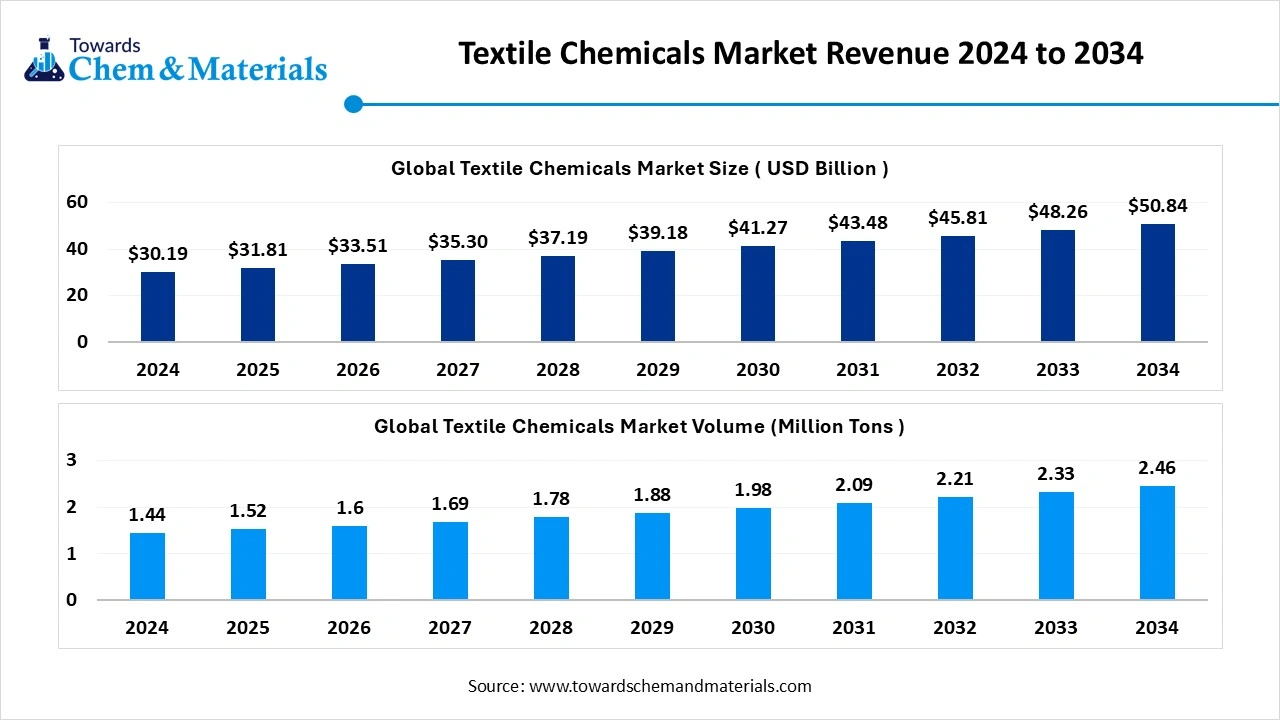

Textile Chemicals Market Volume to Reach USD 2.46 Million Tons by 2034

The global textile chemicals market volume is expected to produce approximately 1.52 million tons in 2025, with a forecasted increase to 2.46 million tons by 2034, growing at a CAGR of 5.49% from 2025 to 2034.

The global textile chemicals market size was reached at USD 30.19 billion in 2024 and is expected to be worth around USD 50.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.35% over the forecast period 2025 to 2034. The industry growth is attributed to the rapid infrastructural development and increasing sustainability practices in the current period.

Key Takeaways

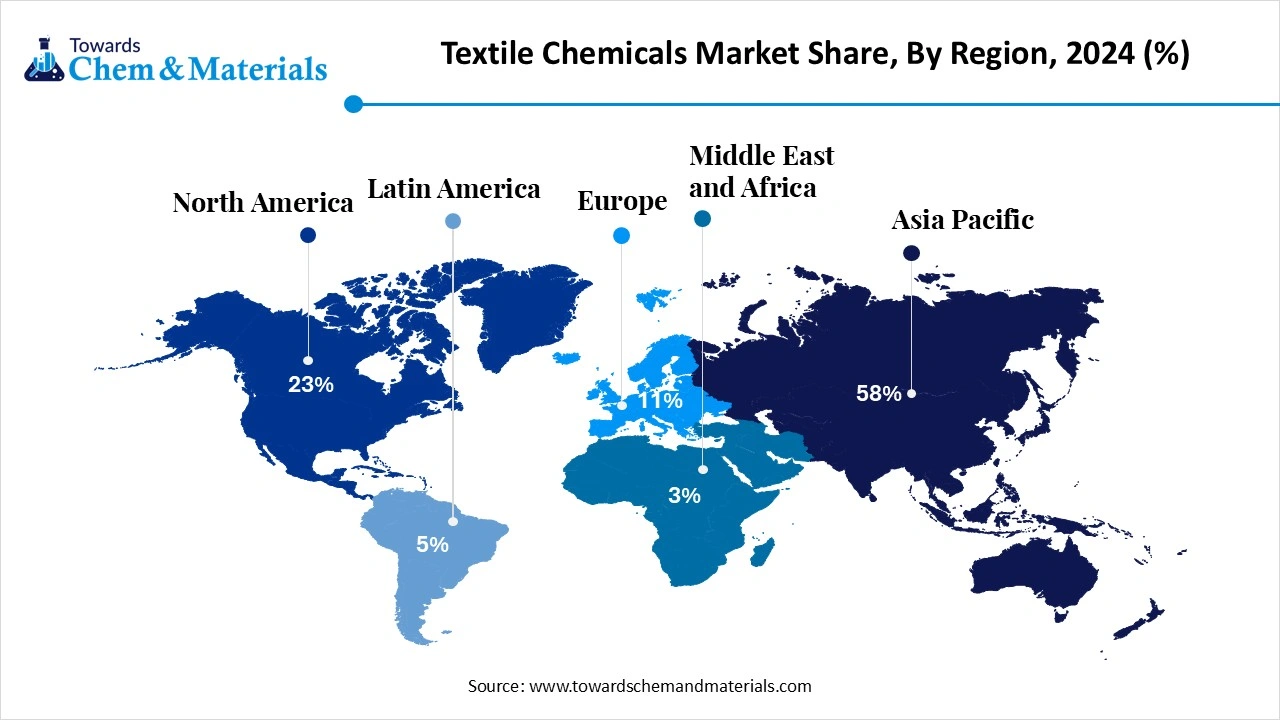

- The Asia Pacific textile chemicals market held the largest share of 58% of the global market in 2024..

- By region, North America is anticipated to experience the fastest growth rate during the forecast period, owing to increasing demand for high-performance textiles in

- By process type, the coating segment held the dominating share of the market in 2024 due to its ability to enhance fabric properties like water resistance, stain repellence, and UV protection.

- By process type, the treatment of finished products segment is expected to experience significant market growth in the future, akin to its crucial role in preparing fabrics for further processing.

- By product type, the finishing agent segments are expected to grow at the fastest rate in the market during the forecast period, owing to their unique properties.

- By product type, the coating and sizing segment dominated the market with the largest share in 2024, owing to its vital role in enhancing fabric strength, durability, and appearance

- By application, the apparel segment held the dominating share of the textile chemicals market in 2024 due to the constant demand for fashion and functional clothing.

- By application, the technical textiles segment is expected to experience significant market growth in the future, owing to its versatile applications across multiple industries.

From Functionality to Sustainability: The New Era of Textile Chemicals Market

The textile chemicals market is witnessing fast-paced growth, attributed to evolving demands of the apparel, home furnishing, and technical textile industries. The rising importance of performance-enhancing treatments, such as waterproofing and anti-bacterial finishes, is heavily contributing to the market dynamics in the current period.

Also, the manufacturers are increasingly focusing on sustainable chemical formulations to meet regulatory and consumer expectations. Moreover, automation and smart production processes are gaining popularity while improving operational efficiency across industries recently.

The market’s expansion is further driven by rapid urbanization and a fast-paced lifestyle, particularly in developing countries. The enlarged end-user sectors, such as fashion, healthcare, and automotive textiles, are offering diversified growth prospects in the current market situation. Sustainability, functionality, and innovation are majorly seen in influencing investment and R&D efforts.

The surging demand for eco-friendly and bio-based textile chemicals is driving the industry's growth recently. This trend is largely influenced by stricter environmental regulations and increasing consumer preference for sustainable products. Also, brands and manufacturers are increasingly seen in adopting green chemistry solutions to reduce their carbon footprints.

- Moreover, the shift toward waterless dyeing technologies and non-toxic auxiliaries has gained popularity in the market nowadays. Investment in research for biodegradable and plant-derived chemical alternatives has increased in recent years. Retailers are also pushing suppliers for transparency and certifications, further enhancing textile chemicals market conditions

Market Trends

- Chemicals having unique properties such as anti-bacterial, UV-protection, and moisture management are constantly driving the textile chemicals market in the current period. Also, demand from sectors like healthcare, sportswear, and fashion is particularly strong.

- Manufacturers are seen as focusing on precision formulations for performance-driven applications. Moreover, the innovation in nanotechnology and bio-based finishes has been heavily contributing to the industry's growth recently.

- Automation and data-driven systems are increasingly integrated into chemical application processes for textiles nowadays. Also, real-time monitoring and Artificial intelligence-based quality control are seen in optimizing production efficiency and reducing waste. Moreover, companies have been investing in digital manufacturing solutions to gain a substantial market advantage in recent years.

- Manufacturers are increasingly establishing their production lines closer to end-user markets to cut logistics costs and meet region-specific demands in the current period. Localization is also helping companies adapt to fast-changing regulatory environments. Also, the developing countries are increasingly encouraging manufacturers by offering different types of subsidies in recent years.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 31.81 Billion |

| Expected Size by 2034 | USD 50.84 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Process Type, By Product Type, By Application, By Region |

| Key Companies Profiled | AB Enzymes, Archroma, BASF SE, BioTex Malaysia, Dow, Ethox Chemicals, LLC, Evonik Industries AG., Fibro Chem, LLC, German Chemicals Ltd., Govi N.V., Huntsman International LLC, Kemira Oyj, Kiri Industries Ltd., LANXESS, OMNOVA Solutions Inc., Omya United Chemicals, Organic Dyes and Pigments, Resil Chemicals Pvt. Ltd., Solvay S.A, The Lubrizol Corporation |

Market Opportunity

Customized Chemistry Sparks New Growth in the Textile Industry

As consumer preferences shift rapidly, textile manufacturers are seeking chemical solutions that enable faster dyeing, better colorfastness, and unique textures, which is expected to create significant industry opportunities during the forecast period. Chemical companies can offer customized and scalable solutions that can heavily contribute to the industry's growth during the projected period. Flexibility and innovation are likely to create growth opportunities in the upcoming years, as per observation.

Market Challenge

From Risk to Strategy: Adapting to Raw Material Price Instabilities

Frequent fluctuations in the prices of key raw materials are expected to hamper the textile chemicals market growth during the forecast period, while disrupting the cost and supply chain in the future.

Manufacturers can face increased difficulty in maintaining profitability and stable pricing for end-users upcoming years. These instabilities of the market are encouraging brands to explore alternative sourcing strategies.

Regional Insights

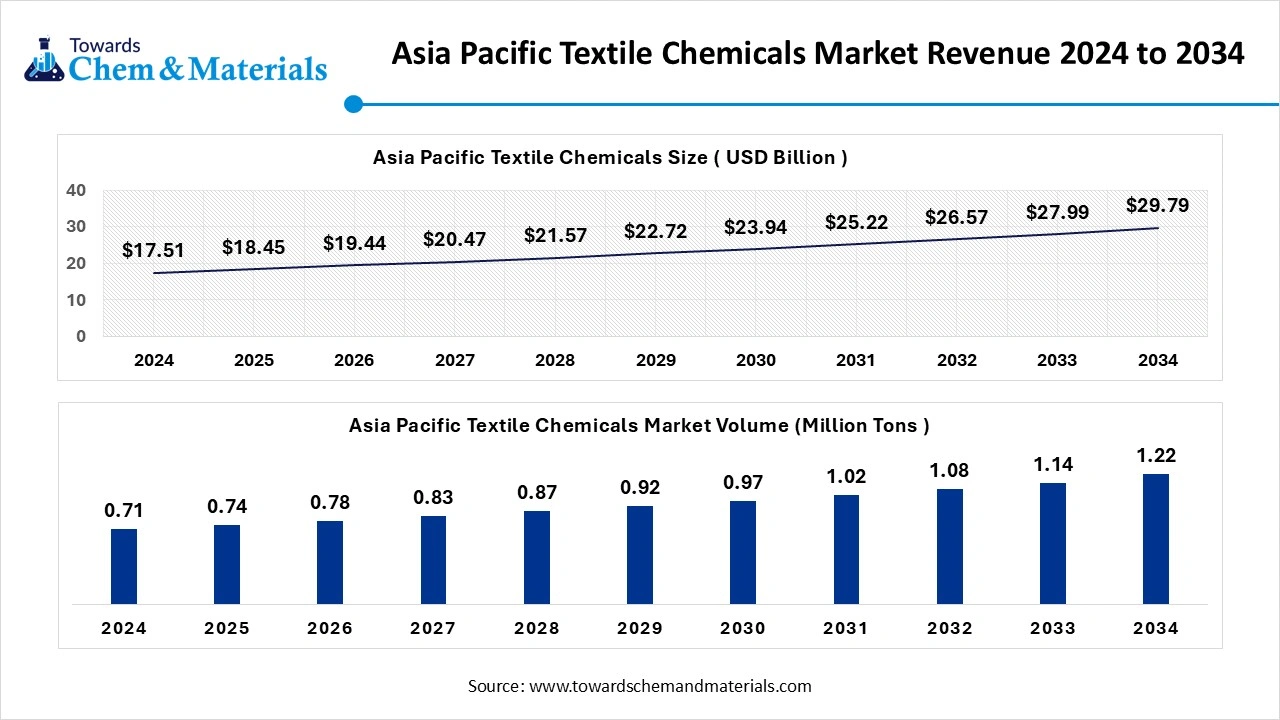

Asia Pacific Textile Chemicals Market Size, Industry Report 2034

The Asia Pacific textile chemicals market volume is approximately 0.74 million tons in 2025 and is forecast to reach 1.22 million tons by 2034, growing at a CAGR of 5.56% from 2025 to 2034.

The Asia Pacific textile chemicals market size was valued at USD 17.51 billion in 2024 and is expected to reach USD 29.79 billion by 2034, growing at a CAGR of 5.46% from 2025 to 2034.The Asia Pacific dominated the textile chemicals market in 2024.

Asia Pacific leads the market owing to its large-scale textile production and cost-efficient manufacturing industry atmosphere. The presence of raw materials is increasingly contributing to the region’s growth in the current period. Rising disposable incomes are seen in driving higher demand for diverse textile applications. Also, the ongoing investments in technology and innovation are supporting production efficiency and product quality in the region nowadays. Moreover, government policies are observed in promoting industrial growth, further fueling the sector's expansion.

Smart Factories and Green Chemistry Power China’s Textile Leadership

China has maintained its dominance in the Asia Pacific region for the past period. China is the largest producer and consumer of textile chemicals globally, which is creating robust opportunities for textile chemicals manufacturers in the current period. Its massive domestic textile industry, driven by export and internal demand, creates massive advantages for the country nowadays. However, like other countries in the Asia Pacific region, China is seen as heavily investing in green chemical technologies while following stringent environmental standards. The country's focus on digitalizing production through smart factories is contributing to the country's growth prospects in recent years.

Product export - According to The Observatory of Economic Complexity survey,

North America is expected to grow at the fastest pace in the coming period due to its strong manufacturing infrastructure and the rising demand for high-performance textiles across industries like automotive, fashion, and healthcare. The region is also focusing on sustainability, pushing for eco-friendly chemical solutions and innovations. Additionally, the presence of leading textile chemical manufacturers and advanced R&D capabilities is anticipated to drive ve country's growth in the coming years. Furthermore, Government regulations and consumer preferences for sustainable products further fuel the market's growth in the region.

First Mover Advantage: United States Invests Heavily in Next-Gen Textile Chemical

The United States is expected to play a crucial role in the development of the textile chemicals market during the forecast period. In the United States, the market can gain substantial benefits from a robust demand for smart textiles and performance-enhancing fabrics while contributing to its uniqueness. Also, increasing adoption of technologies like nanotechnology and smart textiles is expected to gain major market share in the modern era. Moreover, several manufacturers are seen investing in research and development activities to gain a first mover advantage in the United States.

- Government Initiative - For instance, in 2025, according to UNEP guidelines, the government of America is encouraging textile manufacturers to apply sustainable practices with UNEP policy support.

Segmental Insights

Process Type Insights

The coating segment held the dominating share of the textile chemicals market in 2024 due to its ability to enhance fabric properties like water resistance, stain repellence, and UV protection. This method allows for greater control over fabric performance, meeting the specific needs of various industries, such as fashion and outdoor apparel.

Furthermore, it offers higher durability compared to other processes, leading to long-term product reliability, which is driving the segment growth in the current period. With the growing demand for high-performance textiles, the coating process can gain major market traction. Manufacturers are increasingly adopting advanced coatings, driven by consumer

The treatment of finished products segment is expected to experience significant market growth in the future, owing to factors such as rising consumer expectations for enhanced fabric functionality and others in the current period. Moreover, brands are seen as increasingly focused on delivering textiles with superior properties like stain resistance, water repellency, and antimicrobial effects recently as per observation, which is expected to drive segment growth during the forecast period.

Also, this shift is driven by the heavy demand for high-performance apparel, home furnishings, and technical textiles across global markets. Furthermore, manufacturers are investing in innovative post-treatment solutions to differentiate their offerings and meet sustainability targets is likely to capture major market share in the coming years.

Product Type Insights

The coating and sizing segment dominated the textile chemicals market with the largest share in 2024, owing to its vital role in enhancing fabric strength, durability, and appearance. These chemicals improve the resistance of textiles to wear, moisture, and other environmental factors, making them essential in textile production in the current period.

The demand for improved performance and aesthetics in fabrics across various industries, such as fashion, automotive, and upholstery, further drives industry growth. Moreover, the compatibility with advanced textile production technologies of the segment contributes to their market dominance. The growing demand for high-performance fabrics in industrial applications is also a major factor. These chemicals enable cost-efficient production

The finishing agent segments are expected to grow at the fastest rate in the textile chemicals market during the forecast period. Having the ability to convey additional functional properties to fabrics is expected to lead to segment growth during the projected period. With increasing consumer demand for fabrics with specific characteristics, such as anti-wrinkle, moisture-wicking, and UV protection, finishing agents are gaining significant traction. The segment's rapid growth is driven by innovations in functional coatings and smart textiles. The demand for eco-friendly and sustainable products is also shaping this growth, as consumers increasingly seek sustainable textiles. Additionally, advancements in nanotechnology and other cutting-edge methods are creating new opportunities for the segment.

Application Insights

The apparel segment held the dominating share of the textile chemicals market in 2024 due to the constant demand for fashion and functional clothing. Innovations in textile finishes, dyes, and coatings enhance fabric performance, appealing to both manufacturers and consumers in the current period. Chemical treatments improve properties such as softness, durability, and moisture management. The widespread use of synthetic fibers, which require chemical treatments, also fuels growth in this segment. Furthermore, the need for cost-effective and mass-produced apparel has driven continuous advancements in chemical technologies in the coming years.

The technical textiles segment is expected to experience significant textile chemicals market growth in the future, owing to its versatile applications across multiple industries, including automotive, healthcare, and construction. Increasing demand for high-performance materials with specialized properties, like strength and fire resistance, is projected to drive the demand for the segment in the upcoming years. Moreover, Innovation in smart textiles and materials with functionalities is expanding market opportunities.

Sustainability trends also push growth, as industries seek eco-friendly and durable solutions. The ongoing development of advanced manufacturing processes enhances the capabilities of technical textiles. The increasing integration of technology into textiles is likely to gain substantial market share in the upcoming period.

Recent Developments

- Archroma Product Launch: In 2024, Archroma introduced its latest production of solutions following the environmental sustainability for textiles. Also, the solution is called super systems+.

- Techtextil Area Expansion: In 2025, Techtextil unveiled that they created a new dyes and chemicals area separately. This area’s expansion mainly focused on the increasing importance of the global textile industry, as per the company's claim.

- The University of Coimbra (UC) Research Project: In 2025, scientists at the University of Coimbra started research on cost-effective and sustainable dye making. Also, this project received 1.4 million in funding from the Calouste

Top Companies list

- AB Enzymes

- Archroma

- BASF SE

- BioTex Malaysia

- Dow

- Ethox Chemicals, LLC

- Evonik Industries AG.

- Fibro Chem, LLC

- German Chemicals Ltd.

- Govi N.V.

- Huntsman International LLC

- Kemira Oyj

- Kiri Industries Ltd.

- LANXESS

- OMNOVA Solutions Inc.

- Omya United Chemicals

- Organic Dyes and Pigments

- Resil Chemicals Pvt. Ltd.

- Solvay S.A

- The Lubrizol Corporation

Segment covered

By Process Type

- Pretreatment

- Bleaching Agents

- Desizing Agents

- Scouring Agents

- Others

- Coating

- Anti-Piling

- Protection

- Waterproofing

- Water Repellant

- Others

- Treatment Of Finished Products

- Softening

- Stiffening

- Others

By Product Type

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Dispersants/levelant

- Fixative

- UV absorber

- Others

- Finishing Agents

- Antimicrobial or anti-inflammatory

- Flame retardants

- Repellent and release

- Others

- Surfactants

- Detergents & Dispersing Agents

- Emulsifying Agents

- Lubricating Agents

- Wetting Agents

- Denim Finishing Agents

- Anti-back Staining Agents

- Bleaching Agents

- Crush Resistant Agents

- Defoamers

- Enzymes

- Resins

- Softeners

- Others

By Application

- Apparel

- Innerwear

- Outerwear

- Sportswear

- Others

- Home Furnishing

- Carpet

- Drapery

- Furniture

- Oers

- Technical Textiles

- Agrotech

- Buildtech

- Geotech

- Indutech

- Medtech

- Mobiltech

- Packtech

- Protech

- Others

- Other Applications

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait