Content

U.S. Polyvinyl Butyral Market Size and Share 2034

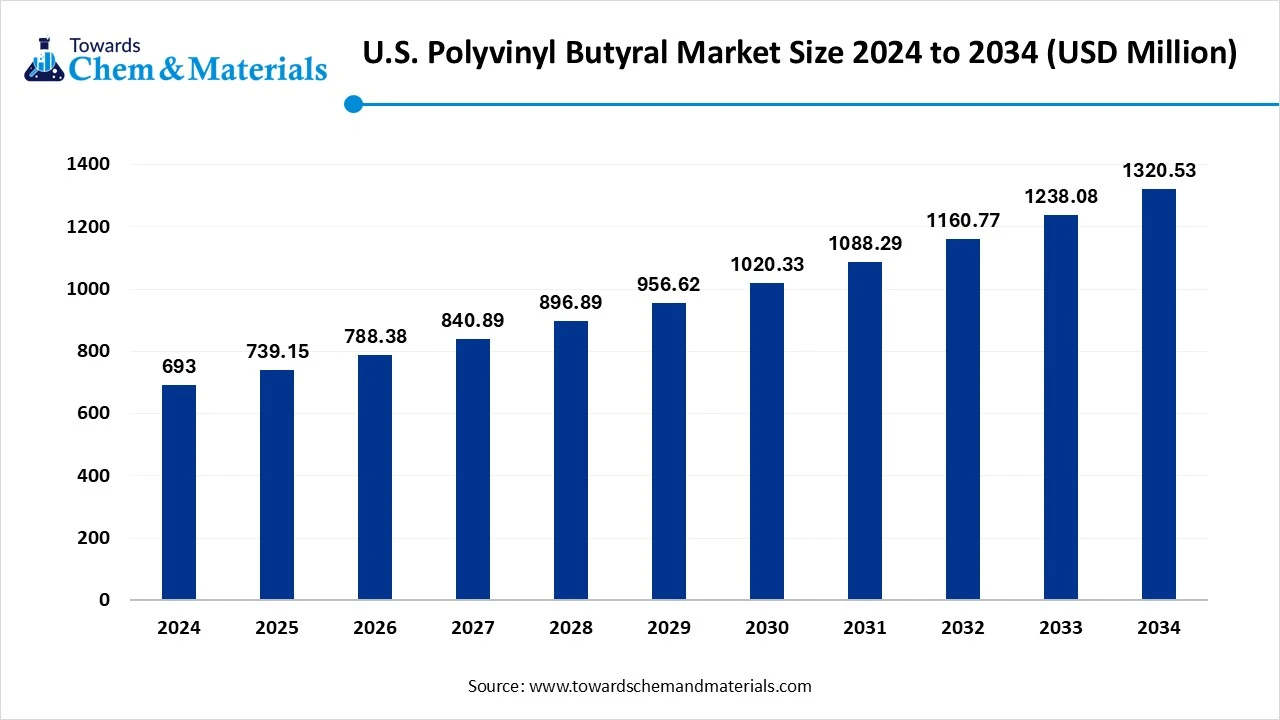

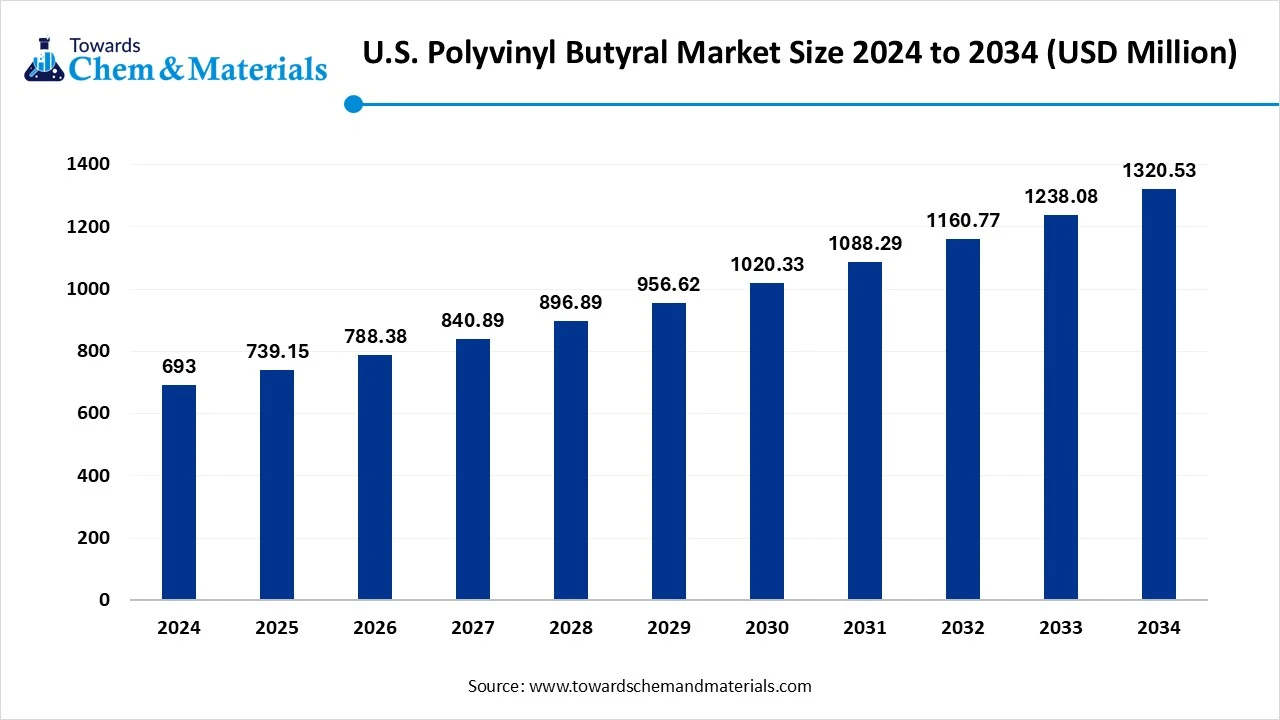

The U.S. polyvinyl butyral market size was reached at USD 693 million in 2024 and is expected to be worth around USD 1,320.53 million by 2034, growing at a compound annual growth rate (CAGR) of 6.66% over the forecast period 2025 to 2034. Growing product demand in various sectors is the key factor driving market growth. Also, the rapid shift towards renewable energy sources, coupled with the advancements in PVB film production, can fuel market growth further.

Key Takeaways

- By region, the Midwest region dominated the market with a 35% U.S. polyvinyl butyral market share in 2024. The dominance of the region can be attributed to the rising demand for soundproofing solutions.

- By region, the South region is expected to grow at the fastest CAGR during the forecast period. The growth of the region can be credited to the surge in construction activity, especially in residential and commercial buildings.

- By form, the PVB films & sheets segment dominated the market with a 65% share in 2024. The dominance of the segment can be attributed to the rising product demand in the construction and automotive sectors.

- By form, the PVB resin segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing adoption of PVB in solar panel lamination.

- By application, the automotive laminated glass segment held a 55% market share in 2024. The dominance of the segment can be linked to the innovations in automotive glass technology.

- By application, the photovoltaic (Solar) modules segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the rising adoption of solar energy.

- By end use, the automotive segment led the market by holding 58% share in 2024. The dominance of the segment is owed to the surge in vehicle production.

- By end use, the renewable energy segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the rise in adoption of solar energy, with the material's key properties.

- By distribution channel, the direct sales to the OEM segment dominated the market with a 70% share in 2024. The dominance of the segment can be attributed to the growing demand for laminated safety glass.

- By distribution channel, the specialty chemical distributors segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the rising demand for PVB films in different applications.

Technological Advancements are Expanding Market Growth

The U.S. Polyvinyl Butyral (PVB) market covers the domestic production, processing, and sale of PVB resin and films, a specialty polymer known for its high transparency, strong adhesion, toughness, and flexibility. In the U.S., PVB is primarily used in laminated safety glass for automotive windshields and building glazing, offering impact resistance and improved shatter protection.

It is also employed in photovoltaic (PV) modules, coatings, and adhesives. The market is supported by stringent automotive and building safety standards, growing construction of energy-efficient buildings, and rising adoption of solar energy systems. Common PVB forms in the U.S. market include resin (pellets or powder) and film/sheet grades, manufactured through processes such as extrusion and casting.

What Are the Key Trends Influencing the U.S. Polyvinyl Butyral Market?

- Rising demand for security and safety glazings is the latest trend driving positive market growth. There is a growing demand for laminated glass with PVB interlayers in residential, commercial, and automotive applications because safety grades become more stringent and security concerns develop.

- Increasing adoption of efficient glazing solutions is another trend impacting positive market growth. PVB interlayer-based energy-efficient glazing alternatives are increasingly becoming more popular as sustainability, green building requirements, and energy conservation are getting more attention.

- The ongoing technological innovations in glass manufacturing are leading the market expansion further. By offering unique solutions and goods, advancements such as UV-stable interlayers, colored interlayers, and smart glass technologies are contributing to market growth during the forecast period.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 739.15 Million |

| Expected Size by 2034 | USD 1,320.53 Million |

| Growth Rate from 2025 to 2034 | CAGR 6.66% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Form, By Application, By End-Use Industry, By Distribution Channel, By Region (U.S. Focus), |

| Key Companies Profiled | Eastman Chemical Company, Kuraray America, Inc., Sekisui Specialty Chemicals America, LLC, Everlam USA, Huakai Plastic (Chongqing) Co., Ltd., Chang Chun Plastic (USA), Inc. |

Market Opportunity

Rising Adoption of Photovoltaic Modules

The rise in renewable energy projects with an emphasis on the production of solar power offers a greater opportunity for polyvinyl butyral (PVB) as an alternative photovoltaic (PV) module. Furthermore, PVB protects PV cells from environmental factors such as dust and moisture while maintaining durability and performance over time. As the capacity of solar photovoltaic expands efficiently, the demand for premium encapsulation materials like PVB also rises significantly.

- In November 2024, Eastman introduced Saflex Evoca RSL, the latest product under its brand. This new PVB interlayer is designed for EV side window applications, providing improved design flexibility to accomplish a balance between door system weight and acoustic comfort.(Source: www.glassonweb.com )

Challenge

Competition from Alternative Materials

The market is currently facing competition from other materials like ionoplast interlayers and ethylene vinyl acetate (EVA), which provide similar properties in applications such as laminated glass, with much lower costs and easier processing. Moreover, the production process for PVB, particularly for specialized films and high-quality products, can be expensive and complex, especially compared to alternatives like EVA, hindering market growth further.

Country Insights

U.S. Polyvinyl Butyral Market Trends

The Midwest region dominated the market with a 35% market share in 2024. The dominance of the region can be attributed to the rising demand for soundproofing solutions and the strong presence of major automotive manufacturers. In addition, the Midwest possesses a skilled workforce with a favorable regulatory environment for production, which makes it attractive for PVB manufacturing and processing.

The south region is expected to grow at the fastest CAGR during the forecast period. The growth of the region can be credited to the surge in construction activity, especially in residential and commercial buildings, coupled with the increasing adoption of solar energy. Furthermore, the south region has implemented regulations and standards that support the use of safety glass in construction, driving regional growth shortly.

Segmental Insight

Form Insight

Which Form Type Segment Dominated the U.S. Polyvinyl Butyral Market in 2024?

The PVB films & sheets segment dominated the market with a 65% share in 2024. The dominance of the segment can be attributed to the rising product demand in the construction and automotive sectors, propelled by safety regulations and the demand for high-performance building materials. Also, innovations in PVB film formulation, such as improved durability, UV resistance, and adhesion to glass surfaces, are contributing to segment growth.

The PVB resin segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing adoption of PVB in solar panel lamination, along with its use in sound-attenuating interlayers for buildings.PVB is also used in architectural applications such as laminated safety glass for facades and windows, offering various benefits like noise reduction and energy saving.

Application Insight

Why Automotive Laminated Glass Segment Led the U.S. Polyvinyl Butyral Market in 2024?

The automotive laminated glass segment held a 55% market share in 2024. The dominance of the segment can be linked to the innovations in automotive glass technology and the surge in vehicle production across the globe. Furthermore, PVB can also be used in architectural laminated glass, especially in hurricane-prone regions, which can lead to segment growth soon.

The photovoltaic (Solar) modules segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rising adoption of solar energy and global shift towards renewable energy sources, especially in solar power. Supportive government policies like the renewable energy mandates and tax credits are optimizing the adoption of solar energy modules.

End-Use Industry Insight

How Much Share Did the Automotive Segment Held in 2024?

The automotive segment led the market by holding a 58% share in 2024. The dominance of the segment is owed to the surge in vehicle production, especially autonomous and electric vehicles, along with the integration of cutting-edge glazing technologies. Advancements such as anti-reflective and self-healing coating is also anticipated to increase the utilisation of PVB in automotive glass.

The renewable energy segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the rise in adoption of solar energy, with the material's key properties, which make it necessary for solar panel manufacturing. In addition, the ongoing shift towards sustainable energy sources is another factor boosting the segment's growth further.

Distribution Channel Insight

Which Direct Sales Segment Dominated the U.S. Polyvinyl Butyral Market in 2024?

The direct sales to the OEM segment dominated the market with a 70% share in 2024. The dominance of the segment can be attributed to the growing demand for laminated safety glass, coupled with the rising urbanisation and disposable income in developing countries. Direct sales to OEMs ensure a proper supply chain, enabling a cater solution that meets specific OEM requirements, leading to expansion of the segment.

The specialty chemical distributors segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the rising demand for PVB films in different applications, especially in the construction and automotive sectors. Furthermore, PVB films are used in laminated glass for architectural use, offering security, safety, and acoustic insulation in buildings.

U.S. Polyvinyl Butyral Market-Value Chain Analysis

- Feedstock Procurement : In this process, the market players acquire the raw materials important for manufacturing PVB resin, PVB films, and sheets. The basic feedstocks for PVB production are polyvinyl alcohol (PVA), butyraldehyde, and plasticizers.

- Chemical Synthesis and Processing : Polyvinyl butyral (PVB) is an important synthetic resin with a robust market presence in the U.S., especially within the laminated glass industry. The synthesis process involves a chemical reaction, accompanied by various processing steps to achieve the desired product.

- Packaging and Labelling : In the market, packaging and labelling play an essential role in ensuring product safety, quality, and compliance with regulations.PVB is generally sold in the form of resin, films & sheets, and solutions.

- Regulatory Compliance and Safety Monitoring : The regulations and monitoring involve adherence to different regulations set by agencies like the Environmental Protection Agency (EPA) and the Department of Transportation (USDOT).

Recent Developments

- In April 2023, Kuraray signed an agreement with Gehring-Montgomery. Kuraray is expanding its international distribution of MOWITAL PVB resins for the North American market. Kuraray has a robust sustainability policy and emphasizes the use of renewable raw materials.(Source: www.coatingsworld.com)

Companies List

- Eastman Chemical Company

- Kuraray America, Inc.

- Sekisui Specialty Chemicals America, LLC

- Everlam USA

- Huakai Plastic (Chongqing) Co., Ltd.

- Chang Chun Plastic (USA), Inc.

Segments Covered

By Form

- PVB Resin (Pellets/Powder)

- PVB Films & Sheets

By Application

- Automotive Laminated Glass

- Architectural/Construction Laminated Glass

- Photovoltaic (Solar) Modules

- Paints, Coatings & Adhesives

- Others (Specialty Films, Electronics)

By End-Use Industry

- Automotive

- Construction & Infrastructure

- Renewable Energy (Solar)

- Industrial Coatings & Adhesives

- Electronics & Specialty Products

By Distribution Channel

- Direct Sales to OEMs

- Specialty Chemical Distributors

By Region (U.S. Focus)

- Midwest

- Northeast

- South

- West