Content

U.S. Nitrile Butadiene Rubber Market Size, Share & Industry Analysis

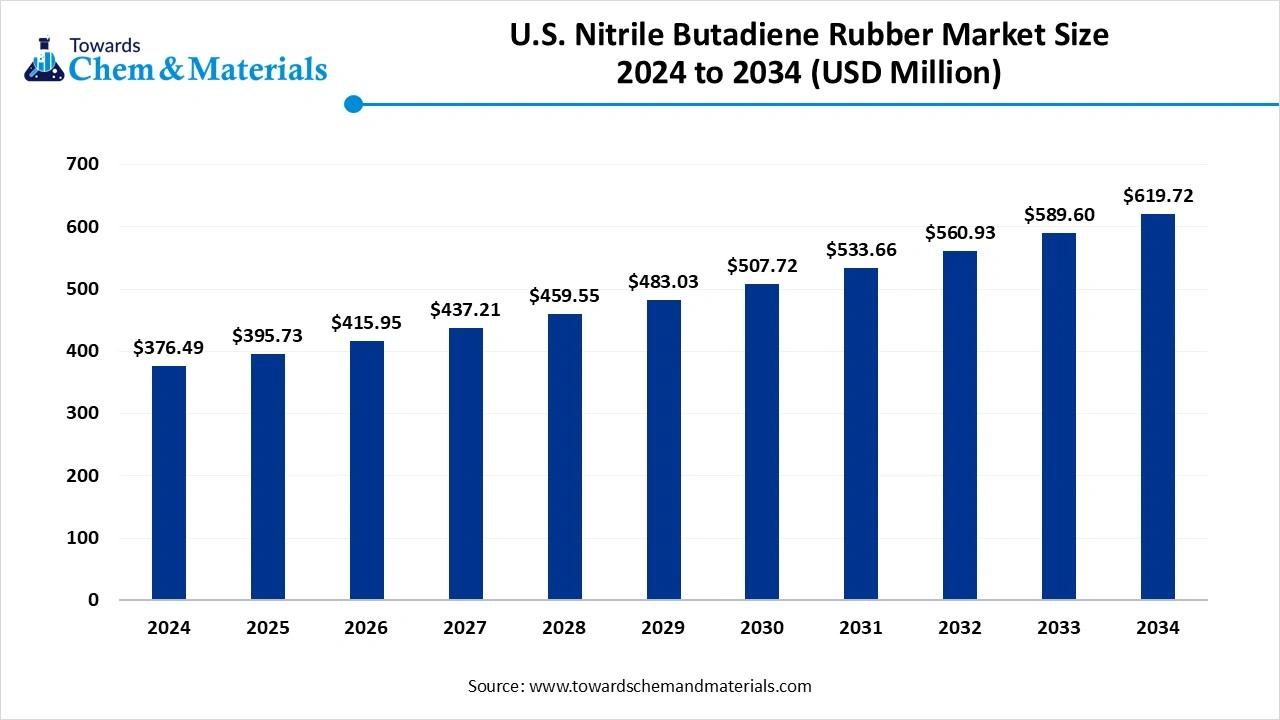

The U.S. nitrile butadiene rubber-market size was valued at USD 376.49 million in 2024, grew to USD 395.73 million in 2025, and is expected to hit around USD 619.72 million by 2034, growing at a compound annual growth rate (CAGR) of 5.11% over the forecast period from 2025 to 2034. The increased expansion of the automotive industry is projected to support stronger cash flows for manufacturing enterprises.

Key Takeaways

- By type, the standard NBR segment led the U.S. nitrile butadiene rubber market with approximately 70% industry share in 2024, due to factors such as cost-effectiveness, performance, and wide availability.

- By type, the hydrogenated NBR segment is expected to grow at the fastest rate in the market during the forecast period, owing to superior heat and chemical resistance.

- By physical form, the solid bales/blocks segment emerged as the top-performing segment in the market with approximately 55% industry share in 2024, owing to the benefits like easy transportation, processing, and storage.

- By physical form, the latex dispersion segment is expected to lead the market in the coming years, because of the fast-growing demand for medical gloves, coatings, adhesives, and specialty applications in the U.S. market.

- By end-use industry, the automotive and transportation segment led the market with approximately 32% share in 2024, because NBR is widely used in seals, gaskets, belts, and hoses that withstand oil, fuel, and mechanical stress.

- By end-use industry, the healthcare and medical segment is expected to capture the biggest portion of the market in the coming years, due to the rising demand for medical gloves, catheters, and seals with strong resistance to chemicals and pathogens.

- By distribution channel, the direct sales segment emerged as the top-performing segment in the market with approximately 50% industry share in 2024, because large automotive and industrial companies prefer to source rubber directly from producers, ensuring consistency, traceability, and bulk pricing advantages.

- By distribution channel, the distribution and dealers segment is expected to lead the market in the coming years, because smaller and medium-sized manufacturers are entering the ecosystem.

- By sustainability category, the petroleum-derived NBR segment led the U.S. nitrile butadiene rubber market with approximately 92% share in 2024, because it is cost-effective, well-established, and supported by large-scale petrochemical infrastructure.

- By sustainability category, the recycled and bio-based NBR segment is expected to capture the biggest portion of the market in the coming years, as U.S. industries shift toward circular economy models and carbon reduction goals.

Market Overview

The Transformation of U.S. Elastomers: NBR at the Forefront

The U.S. nitrile butadiene rubber market has experienced sophisticated growth in recent years, owing to its wide usage in various sectors like healthcare, oil and gas, and industrial applications. Moreover, the increased shift towards specialty elastomers is driving strategic transformation and sectoral scalability in recent years in the United States.

- Furthermore, the NBR for EV batteries has raised awareness among venture and corporate backers in recent years in the country.

- In January 2024, the government of the United States has planned to buy 55,555,500 boxes of nitrile gloves for pharmaceutical purposes. Also, these gloves are disposable.(Source: www.madeinamerica.gov)

The Rise of NBR in U.S. EVs and Medical Products

The sudden shift towards sustainable mobility solutions has been the key enabler of the industry's development in recent years. Moreover, the adoption of the electric vehicle has been actively attracting market investment attention in the past few years, as per the regional survey.

The automotive manufacturer in the United States has been heavily developing EV-compatible sealing material, where the NBR has been considered a crucial material. Also, the healthcare industry is majorly contributing to the growth of the industry by using NBR-made medical gloves and biopharma components in the country.

- In April 2025, the FORD Motor Company launched its latest long-term program for carbon neutrality by 2050. Also, in between this program company has aimed to develop sustainable mobility solutions in the coming years in the United States.(Source: esgnews.com)

Market Trends

- The integration of the NBR in clean energy systems has emerged as the key point of interest in industry as manufacturers use NBR in hydrogen fuel cell systems.

- The increased need for the customized medical-grade NBR products has actively strengthened the foundation for future sector growth in recent years.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 395.73 Million |

| Expected Size by 2034 | USD 619.72 Million |

| Growth Rate from 2025 to 2034 | CAGR 5.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Physical Form, By End-Use Industry, By Distribution Channel, By Sustainability Category |

| Key Companies Profiled | ARLANXEO, Zeon Corporation ,LANXESS , Kumho Petrochemical Co., Ltd. , JSR Corporation , Tosoh Corporation , Synthomer PLC , ExxonMobil Chemical , Sinopec, Dynasol Group , LG Chem , Versalis (ENI) , Sibur , Nitriflex , PetroChina , ENEOS Materials Corporation , Denka Company Limited , OMNOVA Solutions, Emerald Performance Materials LLC , AirBoss of America Corp. |

Market Opportunity

Future Proofing with Biobased NBR and Sustainable Innovation

The development of the biobased NBR grades is likely to create a competitive advantage in the production space during the projected period. Also, the awareness of sustainability in manufacturing and the government's push for environmentally friendly manufacturing practices will likely aid in business diversification for producers in the upcoming years. Also, manufacturers can provide eco-friendly grade NBR to specific companies, which can provide them with long-term profit margins in the coming years.

Market Challenge

Raw Material Volatility Puts NBR Industry Under Strain

The unstable pricing of the raw materials could create financial headwinds for the industry in the coming years. Moreover, butadiene is mainly developed from petroleum, which is always seen under the high price fluctuation akin to factors like trade wars and geopolitical tension. Also, the greater support for the sustainability initiatives by the United States government can create growth barriers for the industry in the coming years.

Segmental Insights

Type Insights

How did the Standard NBR Segment Dominate the U.S. Nitrile Butadiene Rubber Market in 2024?

The standard NBR segment held the largest share of the market in 2024, due to factors such as cost-effectiveness, performance, and wide availability. Moreover, having properties like oil resistance and durability, the standard NBR has gained popularity among automotive parts, gloves, and seals in recent years. Also, the wide adoption among the industries, the standard NBR maintained its dominance.

The hydrogenated NBR segment is expected to grow at a notable rate during the predicted timeframe, owing to superior heat and chemical resistance. Also, the expansion of aerospace, automotive, and oilfield applications is likely to create lucrative opportunities for the hydrogenated NBR while making it ideal for advanced applications. Also, the increased need for high-performance elastomers in electric vehicles is likely to contribute to the segment growth in the coming years.

Physical Form Insights

Why Does The Solid Bales/Blocks Segment Dominate The U.S. Nitrile Butadiene Rubber Market By Physical Form?

The solid bales/blocks segment held the largest share of the U.S. nitrile butadiene rubber market in 2024, owing to the benefits like easy transportation, processing, and storage. Also, the high-volume industries such as the automotive and manufacturing are actively providing immense industry attention in the current period. The manufacturers in the United States are increasingly preferring the solid bales over the traditional times, akin to their low handling cost.

The latex dispersion segment is expected to grow at a notable rate during the forecast period, because of the fast-growing demand for medical gloves, coatings, adhesives, and specialty applications in the U.S. market. Unlike solid forms, latex allows direct use in dipping, coating, and spraying processes, saving time and improving efficiency. The healthcare industry's focus on infection control and the surge in cleanroom applications are fueling demand for latex NBR.

End Use Industry Insights

How did the Automotive and Transportation Segment Dominate the U.S. Nitrile Butadiene Rubber Market in 2024?

The automotive and transportation segment dominated the market in 2024 due to NBR is widely used in seals, gaskets, belts, and hoses that withstand oil, fuel, and mechanical stress. The United States’s automotive industry's reliance on durable rubber components made NBR an essential material. With millions of vehicles requiring long-lasting parts, standard NBR remains cost-effective and reliable.

The healthcare and medical segment is expected to grow at a significant rate during the forecast period, due to the rising demand for medical gloves, catheters, and seals with strong resistance to chemicals and pathogens. Post-pandemic, the United States has strengthened its healthcare infrastructure, increasing investment in protective equipment and medical devices. NBR latex is a key raw material in exam gloves, surgical gloves, and healthcare consumables.

Distribution Channel Insights

How did the Direct Sales Segment Dominate the U.S. Nitrile Butadiene Rubber Market in 2024?

The direct sales segment held the largest share of the U.S. nitrile butadiene rubber market in 2024, because large automotive and industrial companies prefer to source rubber directly from producers, ensuring consistency, traceability, and bulk pricing advantages. Direct sales reduce the middleman cost, allowing big manufacturers to maintain long-term supplier partnerships. U.S.-based NBR producers also benefit from stable demand contracts with OEMs and Tier-1 suppliers, making direct distribution more efficient.

The distributors and dealers segment is expected to grow at a notable rate during the forecast period, because smaller and medium-sized manufacturers are entering the ecosystem. These buyers lack the scale for direct sourcing but require flexible quantities and faster delivery. Dealers can offer customized packaging, smaller batch orders, and quick access to specialty grades like HNBR or latex dispersions.

Sustainability Category Insights

How Long Can Cost-Effective Petroleum NBR Maintain Its Lead?

The petroleum-derived NBR segment dominated the market in 2024 because it is cost-effective, well-established, and supported by large-scale petrochemical infrastructure. Most NBR plants are integrated into petroleum supply chains, making fossil-based NBR cheaper and more readily available. U.S. automotive and industrial manufacturers historically optimized production lines for conventional NBR, reinforcing dependence on petroleum-derived grades.

The recycled/bio-based NBR segment is expected to grow at a significant rate during the predicted period, as U.S. industries shift toward circular economy models and carbon reduction goals. Automotive and medical device manufacturers are under increasing pressure to lower their environmental footprint. Bio-based feedstocks from renewable sources and recycling technologies that recover NBR from used gloves and automotive parts are gaining traction.

U.S. Nitrile Butadiene Rubber Market Value Chain Analysis

- Distribution to Industrial Users: The nitrile butadiene rubber in the United States is distributed by the major chemical companies.

- Key Players: OMNOVA Solutions Inc. and Zeon Chemicals L.P

- Chemical Synthesis and Processing: Mainly, the nitrile butadiene rubber is made up by polymerization, like emulsion polymerization of acrylonitrile and butadiene, as per the industry survey.

- Regulatory Compliance and Safety Monitoring: In the United States, the manufacturers of nitrile butadiene rubber can follow the OSHA standards for safety and government policies for regulatory affairs.

Recent Development

- In December 2024, Trelleborg Sealing Solutions unveiled its latest portfolio of Stefa seals. The newly launched shaft seal, called the Stefa which is high high-pressure radial shaft. Also, the company has plans to test the capabilities of its product globally, including the United States.(Source: oilreviewmiddleeast.com)

U.S. Nitrile Butadiene Rubber Market Top Companies

- ARLANXEO

- Zeon Corporation

- LANXESS

- Kumho Petrochemical Co., Ltd.

- JSR Corporation

- Tosoh Corporation

- Synthomer PLC

- ExxonMobil Chemical

- Sinopec

- Dynasol Group

- LG Chem

- Versalis (ENI)

- Sibur

- Nitriflex

- PetroChina

- ENEOS Materials Corporation

- Denka Company Limited

- OMNOVA Solutions

- Emerald Performance Materials LLC

- AirBoss of America Corp.

Segment Covered

By Product Type

- Standard NBR

- High-Acrylonitrile NBR (High-AN)

- Low-Acrylonitrile NBR (Low-AN)

- Hydrogenated NBR (HNBR)

- Nitrile Latex

- Carboxylated/Modified NBR

By Physical Form

- Solid Bales/Blocks

- Latex Dispersion

- Powder NBR

By End-Use Industry

- Automotive & Transportation

- Oil & Gas / Energy

- Healthcare & Medical

- Industrial Manufacturing

- Construction

- Electrical & Electronics

- Consumer Goods

- Footwear

- Aerospace & Defense

- Agriculture & Heavy Equipment

By Distribution Channel

- Direct Sales (to OEMs & large industrials)

- Distributors/Dealers

- Compounders & Mixers

By Sustainability Category

- Conventional Petroleum-derived NBR

- Recycled/Partially Bio-based NBR