Content

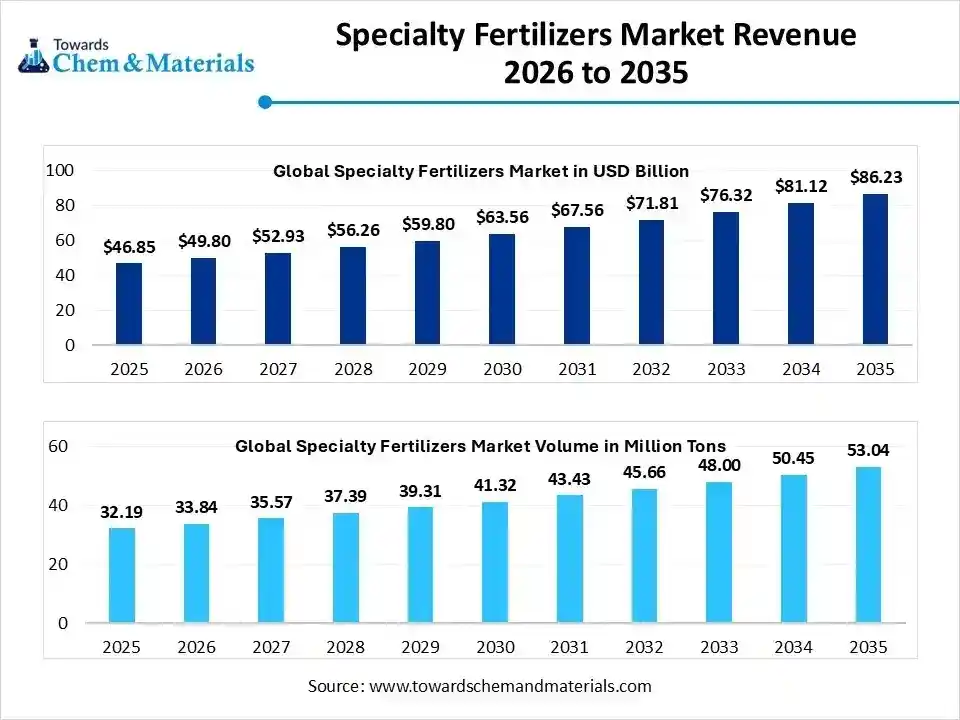

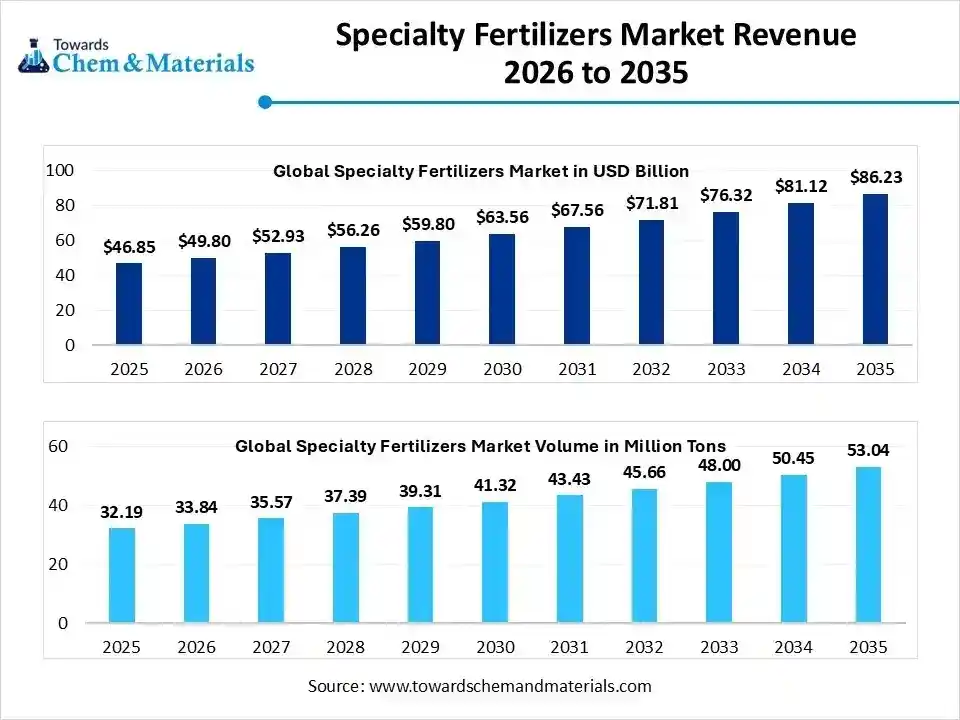

What is the Current Specialty Fertilizers Market Size and Volume?

The global specialty fertilizers market size was estimated at USD 46.85 billion in 2025 and is expected to increase from USD 49.80 billion in 2026 to USD 86.23 billion by 2035, growing at a CAGR of 6.29% from 2026 to 2035. In terms of volume, the market is projected to grow from 32.19 million tons in 2025 to 53.04 million tons by 2035. growing at a CAGR of 5.12% from 2026 to 2035. Asia Pacific dominated the specialty fertilizers market with the largest volume share of 45.09 in 2025.The increasing global food demand, growing need for improved nutrient efficacy, growing awareness of fertilizers' efficacy, and growing demand for high-quality crops drive the market growth.

Key Takeaways

- The Asia pacific specialty fertilizers market volume is estimated at 45.09 million tons in 2025, and is expected to reach 22.76 million tons by 2034, at a CAGR of 5.44% during the forecast period 2025-2034

- Asia Pacific dominated the specialty fertilizers industry with the largest volume share of 44.33% in 2025

- The North America has held Volume share of around 21.08% in 2025.

- The Europe specialty fertilizers industry is expected to grow at a CAGR of over 4.89% from 2026 to 2035

- By technology, the controlled-release fertilizers segment accounted for the largest market volume share of 35.22% in 2025

- By technology, the water-soluble fertilizers segment is expected to witness a significant CAGR of over 3.98% from 2026 to 2035.

- By type, the urea ammonium nitrate (UAN) fertilizer segment accounted for the largest market volume share of 17.83% in 2025

- By type, The micronutrient fertilizers segment is expected to grow at the fastest CAGR during the forecast period.

- By crop type, the cereals & grains segment dominated the market with a volume share of over 45.65% in 2025

- By crop type, the software segment is expected to witness a significant CAGR of over 7.57% from 2026 to 2035.

- By application, the fertigation segment led the market with the largest volume share of 48.53% in 2025.

- By application, the foliar segment segment is expected to witness the highest CAGR of over 7.91% from 2026 to 2035.

Specialty Fertilizers Power Behind the Agricultural Industry

Specialty fertilizers are fertilizers designed to provide targeted nutrients to specific crop yields. They offer controlled release, enhance efficiency, and provide various benefits to soil & crops. Specialty fertilizers are developed to address nutrient deficiency in particular plants or crops. Specialty fertilizers are categorized into various types, including controlled-release fertilizers, water-soluble fertilizers, slow-release fertilizers, micronutrient fertilizers, customized fertilizers, and fortified fertilizers.

Controlled-release fertilizers are fertilizers that release nutrients gradually over a specific period and lower waste. Slow-release fertilizers consist of a broader release window. Water-soluble fertilizers dissolve in water quickly and make nutrients readily available to the plant. The growing demand for high-quality crops increases demand for specialty fertilizers. The growing adoption of sustainable agriculture and stringent environmental regulations drive the market growth. Factors like growing demand from soil & plants, increasing adoption of precision agriculture, growing population, technological advancement in fertilizer technology, government support, and growing demand for food contribute to the specialty fertilizers market.

- Russia exported $15.3 B of fertilizers in 2023.

- Canada exported $10.4 B of fertilizers in 2023.

- The United States exported 67732 shipments of fertilizers.

- Russia exported 67544 shipments of fertilizers.

- Japan exported 8250 shipments of organic fertilizers.

- Growing demand from the agricultural industry drives market growth

The growing agriculture industry in various regions increases demand for specialty fertilizers. The growth in world population increases the demand for food security and agricultural production, which fuels demand for specialty fertilizers. The changing dietary habits increase demand for efficient agriculture practices. The growing demand for high-quality crops like fruits, cereals, grains, and vegetables increases demand for specialty fertilizers to enhance crop quality. The growing adoption of precision agriculture techniques to optimize agricultural practices increases demand for specialty fertilizers to tailor specific soil & crop needs.

The growing urbanization and the growing demand for healthier eating options increase demand for a wider range of agricultural products. The growing adoption of new technologies like drones & Artificial Intelligence (AI) increases demand for specialty fertilizers to improve agricultural productivity. The growing demand for high-quality crops and rapid growth in the agricultural sector are key drivers for the specialty fertilizers market growth.

Recent Market Trends in the Specialty Fertilizers Market

- Growing Adoption of Precision Agriculture: Increased use of soil mapping, GPS-guided application, and variable-rate technology is encouraging farmers to adopt specialty fertilizers that improve nutrient use efficiency and reduce wastage.

- Shift Toward Enhanced-Efficiency Nutrients: Rising demand for controlled-release, slow-release, and stabilized nutrient formulations is driven by the need to minimize nutrient losses, reduce environmental impact, and improve crop response under varying soil and climate conditions.

- Expansion of High-Value Crop Cultivation: Increased cultivation of fruits, vegetables, nuts, and plantation crops in emerging and developed regions is boosting demand for crop-specific specialty fertilizer blends tailored to micronutrient requirements and yield optimization.

- Regulatory Emphasis on Sustainability: Governments and environmental bodies are promoting nutrient stewardship practices that reduce runoff and greenhouse gas emissions, leading to greater preference for low-loss and environmentally compliant fertilizer technologies.

- Rising Demand for Organic and Bio-Based Fertilizers: Growing consumer preference for sustainable and organically produced food is increasing adoption of biofertilizers, microbial inoculants, and organic nutrient enhancers that complement specialty fertilizer use.

Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | 31.75 Million Tons |

| Expected Size in 2034 | 49.33 Million Tons |

| Growth Rate from 2025 to 2034 | CAGR 5.02% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Technology, By Type, By Crop Type, By Application, By Region |

| Key Company Profiled | ICL, Nutrien Ltd, The Mosaic Company, Yara, Nufarm, SQM SA, CF Industries and Holdings, Inc., OCP Group, K+S Aktiengesellschaft, Sociedad Quimica y Minera de Chile SA, Eurochem Group |

Value Chain Analysis

- Research & Development (R&D): This focuses on understanding specific crop nutritional requirements, soil conditions, and environmental impacts to develop novel, high-efficiency formulations.

- Key Players: Haifa Group, Yara International, ICL Group, Nutrien Ltd., and OCP Group.

- Raw Material Sourcing & Processing: This involves the procurement of essential raw materials such as nitrogen, phosphorus, and potassium compounds, as well as micronutrients.

- Key Players: The Mosaic Company, SQM S.A, CF Industries Holdings, Inc., and EuroChem Group.

- Manufacturing & Formulation: In this, the sourced materials are transformed into finished specialty products in specialized facilities to ensure high purity and consistent performance.

- Key Players: Haifa Group, COMPO EXPERT GmbH, ICL Group, Yara International, and Kingenta Ecological Engineering Group.

- Distribution & Logistics: This involves warehousing, packaging, and transporting products through extensive dealer and retail networks to reach farmers efficiently.

- Key Players: Nutrien Ltd., Coromandel International, Yara International, ICL Group, and Wilbur-Ellis Company.

- Marketing, Sales & Application: This involves marketing the specific benefits of the products to farmers to ensure optimal results and value creation.

- Key Players: Nutrien Ltd., Haifa Group, Coromandel International, Yara International, and Verdesian Life Sciences.

Specialty Fertilizers Market Opportunity

Growing demand for food surges demand for specialty fertilizers

The growing civilization and increasing population in various regions increase the demand for food. The growing demand for food creates an opportunity for market growth. The changing dietary habits increase the consumption of fruits and vegetables, which increases demand for specialty fertilizers for higher crop yields. Specialty fertilizers provide plants with specific nutrients at the right time. The growing disposable incomes allow for spending on healthy dietary foods like salads, which require a wide range of vegetables.

The growing awareness regarding the importance of healthy foods and nutrient-rich foods promotes healthy agricultural practices, which increases demand for specialty fertilizers. The growing food production in various regions increases demand for specialty fertilizers. The growing demand for food in developing countries increases demand for specialty fertilizers, which creates an opportunity for the growth of the specialty fertilizers market.

Market Challenge

High cost limits the expansion of the market

Despite several advantages of specialty fertilizers, high cost restricts the growth of the market. Specialty fertilizers require complex manufacturing processes to tailor to specific plant needs. It requires precise delivery methods and nutrient ratios increases the cost. The high-quality raw materials, like specialized ingredients, specific plant needs, and organic matter, are expensive. The specialty fertilizer production needs specialized processes and unique formulations, which increases the overall cost.

The higher prices can limit access to specialty fertilizers for small-scale farmers, which restrains the market growth. Factors like geopolitical tensions and increasing energy prices increase the cost of raw materials, fueling the total cost of specialty fertilizers. Factors like complex manufacturing processes, specialized formulations, and the use of high-quality raw materials increase the overall cost, which hampers the growth of the specialty fertilizers market.

Segmental Insights

Technology Insights

The controlled-release segment dominated the specialty fertilizers largest market volume share of 35.22% in 2025. The growing awareness about the benefits of controlled-release fertilizers among farmers helps in the market growth. The growing adoption of sustainable agricultural practices and government regulations about environmental protection & fertilizer efficiency increases demand for controlled-release fertilizers. Technological advancements in controlled-release fertilizers, like biocomposite materials and polymer coatings, help in the market growth. Additionally, a growing population and high food demand support the overall market growth.

The water-soluble segment is experiencing the fastest growth in the market CAGR of over 3.98% from 2026 to 2035. The growing adoption of sustainable farming practices and adoption of precision farming techniques helps in the market growth. Water-soluble fertilizers lower runoff & soil pollution and promote efficient nutrient absorption. The growing demand for better water management in agricultural practices increases demand for water-soluble fertilizers. The growing requirement for specialty fertilizers to improve crop quality and address nutrient deficiencies increases demand for water-soluble fertilizers. Additionally, government subsidies and policies promote sustainable agricultural practices, supporting the overall growth of the market.

Type Insights

The urea ammonium nitrate segment held the largest share of the specialty fertilizers the largest market volume share of 17.83% in 2025. The growing demand for lowering nutrient losses and quick nutrient availability helps in the market growth. Urea ammonium nitrate is essential for plant development & growth, and it ensures efficient nutrient uptake in plants. The growing demand for versatility, such as applied to foliar spray & soil, and easy adaptability with other chemicals like pesticides, increases demand for urea ammonium nitrate. Additionally, easy application, pumped & stored, and growing demand from various climatic zones like dry climates in regions Asia Pacific, North America, and Europe contribute to the market growth.

The micronutrient fertilizers segment is the fastest growing in the market during the forecast period. The growing demand for healthy plant development increases the demand for micronutrients like manganese, zinc, copper, and many more. The growing awareness about micronutrient deficiencies in crop yields and the importance of soil health increases demand for micronutrient fertilizers. The government's programs & policies promoting sustainable agriculture increase the adoption of micronutrient fertilizers. The technological advancements in fertilizer technology and the growing demand from various crops help in the market growth. Furthermore, growing demand from high-value crops like specialty crops, fruits & vegetables supports the overall growth of the market.

Crop Type Insights

The fruits & vegetables segment dominated the specialty fertilizers market in 2024. The changing consumer preferences, like the adoption of healthier diets, increase demand for fruits & vegetables, which helps in the growth of the market. The growing demand to meet the nutritional requirements of fruits & vegetables increases demand for specialty fertilizers. The growing export and production of high-quality fruits & vegetables increases demand for specialty fertilizers. The growing demand for high-nutrient-density fruits and vegetables in various regions contributes to the overall market growth.

By crop type, the Cereals & Grains segment dominated the market with a volume share of over 45.65% in 2025. The growing demand from the large world population for high-nutrient foods increases demand for cereals & grains, which helps in the market growth. The growing population in some regions and rapid civilization increases demand for cereals & grains, which increases demand for specialty fertilizers. The growing industrial applications of cereals & grains drive the market growth. The growing health consciousness among consumers increases demand for nutrient-rich diets, which increases demand for cereals like muesli & oats and various grains, fueling the overall market growth.

Application Insights

The fertigation segment held the largest volume share of 48.53% in 2025. The increasing population and growing production of food help in the market growth. The growing demand for targeted nutrient delivery into the root zone and lowering waste increases demand for specialty fertilizers. Fertigation provides precise control over concentration, timing, and quantity of nutrients, lowers nutrient deficiency risk, and optimizes crop growth. The growing adoption of sustainable agriculture increases demand for fertigation, which promotes water conservation and lowers fertilizer waste. The growing adoption of modern agricultural practices and technological innovation in fertilizers & irrigation systems drives the overall growth of the market.

The foliar segment is the fastest growing in the market with highest CAGR of over 7.91% from 2026 to 2035.. The growing consumer demand for high-quality crops puts pressure on farmers, which helps in the market growth. The growing population increases demand to improve crop yields, fueling demand for foliar.

The growing demand for environmental alternatives to conventional fertilizers increases demand for foliar fertilizers. The government policies & initiatives promoting the adoption of sustainable farming practices drive the market growth. Additionally, the growing demand for agricultural productivity globally supports the overall growth of the market.

Specialty Fertilizers Market Volume & Share, By Application, 2025 (%)

| By Application | Market Volume Share, 2025 (%) | Market Volume Million Tons - 2025 | Market Volume Share, 2035 (%) | Market Volume Million Tons - 2025 | CAGR |

| Fertigation | 48.19% | 14.34 | 40.38% | 19.43 | 3.08% |

| Foliar | 32.85% | 9.78 | 41.12% | 19.79 | 7.31% |

| Soil | 18.96% | 6.12 | 18.50% | 10.11 | 5.16% |

Regional Insights

The Asia pacific specialty fertilizers market volume is estimated at 14.13 million tons in 2025, and is expected to reach 22.76 million tons by 2034, at a CAGR of 5.44%% during the forecast period 2025-2034. Asia Pacific powerhouse of the specialty fertilizers market, Asia Pacific dominated the specialty fertilizers market. The significant amount of arable land and the presence of a large-scale agricultural industry in the region help in the market growth. The large population in the region increases demand for food, fueling demand for specialty fertilizers, and the presence of a vast agricultural landscape drives the market growth. The growing demand for specialized fertilizers in the region is to improve soil health and provide targeted nutrients to crop yield helps in the market growth. The growing demand for sustainable agricultural practices and soil deficiencies in some regions increases demand for specialty fertilizers. The high production of fruits, cereals, vegetables, and grains increases demand for specialty fertilizers like phosphorus-based fertilizers. The presence of key players in countries like Japan, China & India, and major fertilizers companies contributes to the overall growth of the market.

China Specialty Fertilizers Market Trends, China is a major contributor to the specialty fertilizers market. The diverse and large agriculture sector and the presence of a wide range of crops in the country help in the market growth. The strong commitment to food productivity and security increases demand for specialty fertilizers to improve crop yield quality. The government initiative to promote efficient and sustainable agricultural practices increases demand for specialty fertilizers. The increasing adoption of precision farming techniques like soil testing and modern irrigation systems increases demand for specialty fertilizers. The well-established distribution network for agriculture and a growing population drive the overall growth of the market.

- China exported $10.9 B of fertilizers in 2023.

- China exported 92524 shipments of fertilizers.

- China exported 9935 shipments of water-soluble fertilizer.

India specialty fertilizers market trends, India is rapidly growing in the specialty fertilizers market. The growing awareness about the benefits of specialty fertilizers, like efficient nutrient management, enhances crop yields, and improves soil health, which helps in the market growth. The rapid growth in the population increases demand for food production, fueling demand for specialty fertilizers. The strong focus on sustainable farming practices and growing environmental concerns increases demand for specialty fertilizers. The extensive government support, like government subsidies and promoting the use of specialty fertilizers, helps in the market growth. Additionally, the presence of key players like Rashtriya Chemicals & Fertilizers and Coromandel

- International Limited contributes to the market growth.

- India exported 1257 shipments of bio fertilizer.

Specialty Fertilizers Market Volume & Share, By Region, 2025 - 2035 (%)

| By Region | Market Volume Share, 2025 (%) | Market Volume Million Tons- 2025 | Market Volume Share, 2035 (%) | Market Volume Million Tons - 2035 | CAGR |

| North America | 21.08% | 6.14 | 19.21% | 8.98 | 3.87% |

| Europe | 19.45% | 4.60 | 15.21% | 7.01 | 4.31% |

| Asia Pacific | 45.09% | 13.40 | 47.14% | 22.76 | 5.44% |

| Latin America | 10.22% | 3.63 | 14.23% | 6.53 | 6.03% |

| Middle East & Africa | 4.16% | 2.45 | 4.21% | 4.05 | 5.13% |

Europe’s Role in the Specialty Fertilizers Market, Europe is experiencing the notable growth in the market during the forecast period. The growing adoption of sustainable & organic farming in the region helps in the growth of the market. The growing adoption of precision farming techniques like lower fertilizer overuse and data & technology to optimize nutrient management increases demand for specialty fertilizers. The favorable regulatory environment for promoting sustainable farming and strong government support help in the market growth.

For instance, the European Union’s Common Agricultural Policy aims to promote sustainable agricultural practices, support farmers, ensure food security, and promote the use of customized and innovative fertilizer formulations. Additionally, growing demand for high-quality crops and technological advancements in fertilizer development contribute to the overall growth of the market.

Germany Specialty Fertilizers Market Trends, Germany is a key contributor to the specialty fertilizers market. The strong emphasis on precision farming and sustainable agricultural practices helps in the market growth. The growing research & development for innovative fertilizer solutions and varying crop needs drive market growth. The country is a major exporter of fertilizer and has diverse soil types, which increases demand for specialty fertilizers. The favorable government policies and strong support for sustainable agriculture drive the overall growth of the market.

Germany exported $3.61 B of fertilizers in 2023.

Recent Developments

- In August 2025, researchers from the Soluble Fertilizer Industry Association announced the development of the first indigenous water-soluble fertilizer technology after seven years of research. The initiative was undertaken as part of the country’s ‘Make in India’ program and backed by the Ministry of Mines. This development is poised to help India reduce its heavy dependence on Chinese imports for specialty fertilizers.(Source: economictimes.indiatimes.com)

- In January 2025, Haifa Group launched Haifa India Fertilizers and Technologies Private Limited, a subsdiary aimed at strengthening its presence in India by offering innovative, precision-focused fertilizers tailored to local agricultural needs. With the country becoming one of the world's fastest-growing markets for water-soluble fertilizers, Haifa Group planned to introduce a wider product portfolio and cutting-edge fertilizers.(Source: krishijagran.com)

Top Companies List

- ICL

- Nutrien Ltd

- The Mosaic Company

- Yara

- Nufarm

- SQM SA

- CF Industries and Holdings, Inc.

- OCP Group

- K+S Aktiengesellschaft

- Sociedad Quimica y Minera de Chile SA

- Eurochem Group

Segments Covered in the Report

By Technology

- Controlled-Release Fertilizers

- Water-Soluble Fertilizers

- Liquid Fertilizers

- Micronutrients

- Others

By Type

- Urea Ammonium Nitrate

- Monoammonium Phosphate

- Potassium Nitrate

- Calcium Ammonium Nitrate

- Sulfate Of Potash

- Urea Derivatives

- Blends Of NPK

- Others

By Crop Type

- Fruits & Vegetables

- Cereals & Grains

- Oilseeds & Pulses

- Others

By Application

- Fertigation

- Foliar

- Soil

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait