Content

What is the Current Ammonia Market Size and Volume?

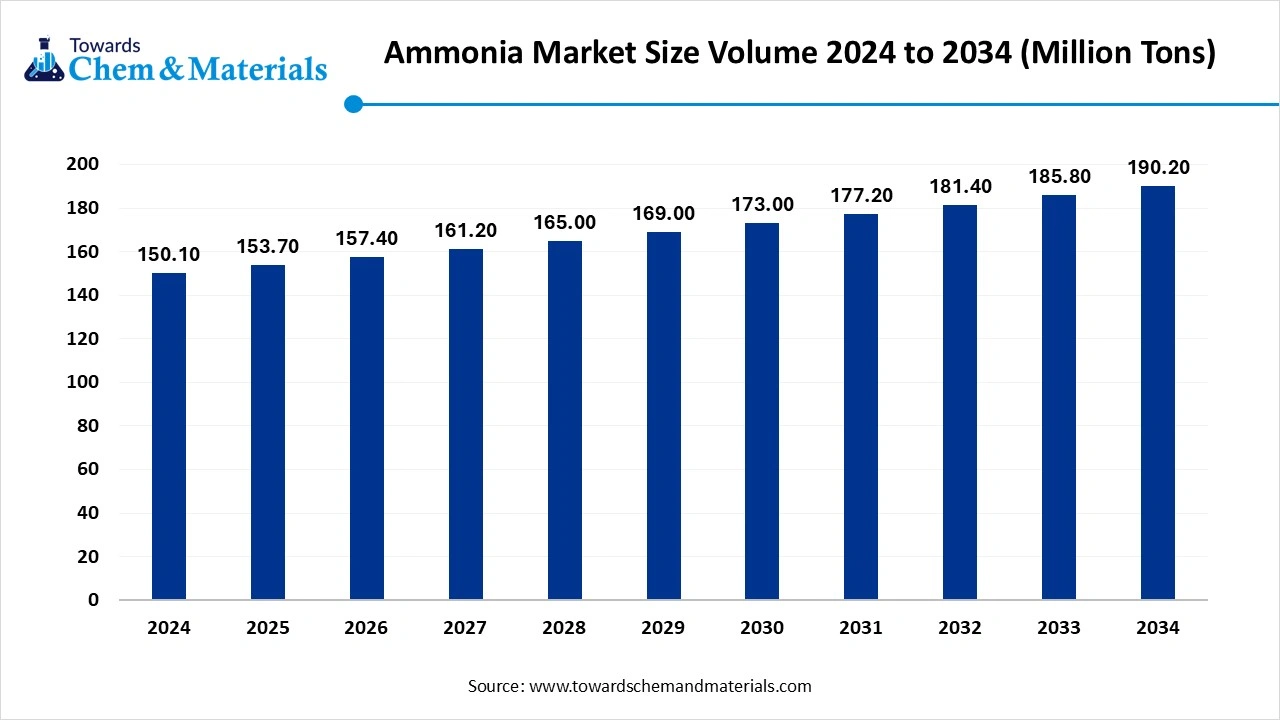

The global ammonia market size was estimated at USD 99.85 billion in 2025 and is expected to increase from USD 106.20 billion in 2026 to USD 184.98 billion by 2035, growing at a CAGR of 6.36% from 2026 to 2035. In terms of volume, the market is projected to grow from 174.42 million tons in 2025 to 271.92 million tons by 2035. growing at a CAGR of 4.54% from 2026 to 2035. Asia Pacific dominated the ammonia market with the largest volume share of xx% in 2025. The increasing need for fertilizers and green ammonia adoption is accelerating the industry's growth in the recent period.

Key Takeaways

- The Asia Pacific led the ammonia market with the largest volume share of over xx% in 2025.

- By Form, the anhydrous ammonia segment accounted for the largest market volume share of 86.12% in 2025 and is expected to continue to dominate the industry over the forecast period.

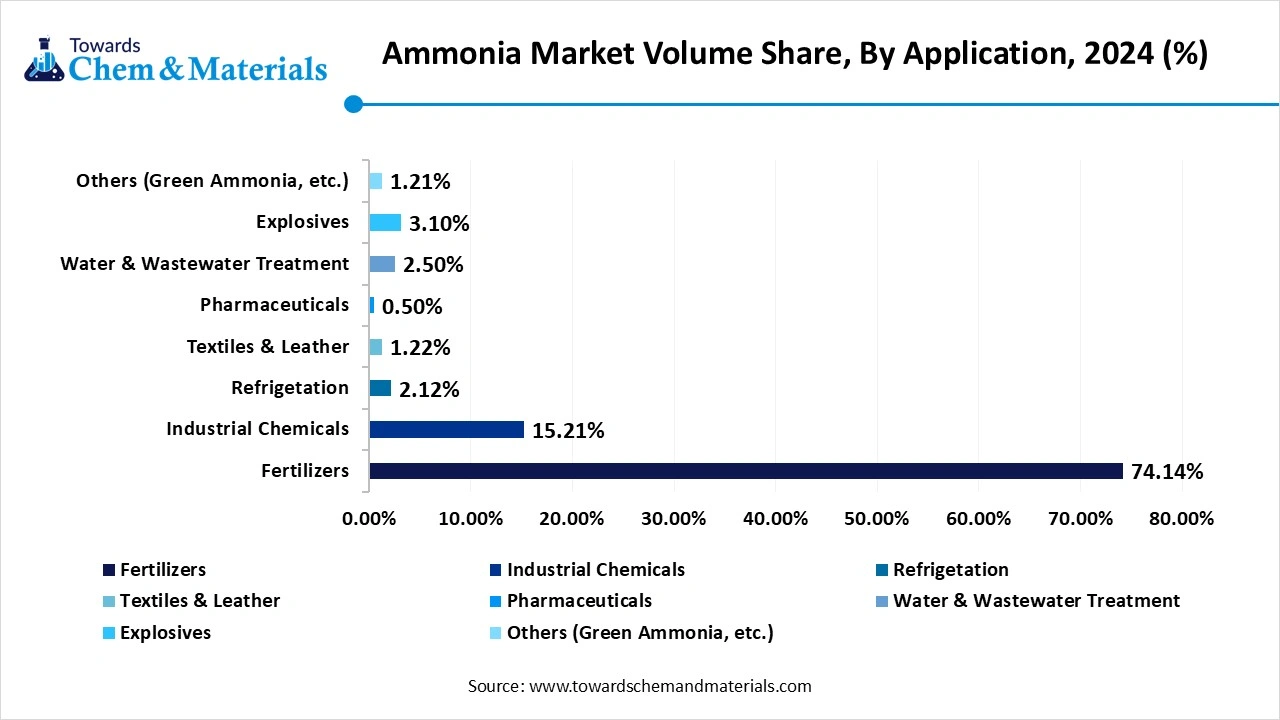

- By Application, the fertilizers segment accounted for the largest market volume share of 74.22% in 2025 and is expected to grow significantly during the forecast period.

- By Technology, the Haber-Bosch Process segment accounted for the largest market Volume share of 93.70% in 2024.

From Fields to Freezers: Ammonia’s Expanding Role in Modern Industry

The ammonia market has witnessed steady growth in the recent period. The sectors like industrial and agriculture are seen in heavy usage of ammonia in the current period. Ammonia provides greater agricultural productivity, ensuring crop protection and healthy growth. Moreover, the sudden shift toward the prevalence of disease and sustainability is majorly contributing to the growth of the market in the current market scenario.

Ammonia is used in wastewater management activities as an acidic containment neutralizer element during the process. Also, with the growing popularity of green ammonia, several industries have been investing in research and development activities for their ammonia production while creating strategic collaborations in recent years.

The extending use of ammonia in food processing industries is driving the market growth in the current period. Ammonia is used as a refrigerant in the sector. The increasing demand for packaged food and the paced lifestyle is leading the growth in the sector recently. Thus, ammonia has risen as an ideal solution for efficient refrigeration of these products. Moreover, technological advances are expected to rise as a game changer for the ammonia industry by developing innovative ammonia-based cooling systems during the forecast period.

Ammonia Market Trends

- The increasing need for green ammonia is driving industry growth in the current market environment. Several industries are actively using alternatives to traditional ammonia, which is basically dependent on natural gases. Moreover, favorable government initiatives toward sustainability are heavily contributing to the green ammonia sector.

- The expansion of the shipping industry is spread heading the market growth in recent times. As ships are heavy, they rely on fuel oils, which apparently release CO2. Thus, the marine industry is seen as shifting toward low-carbon emitting fuels such as green ammonia and others. Thus, ammonia is expected to rise as the ideal solution for alternative fuel in the current period.

- The increasing technological advancements in hydrogen energy are propelling industry growth in the current period. Several major brands are heavily investing in research and development activities for catalysts and reactor designs for making ammonia cracking more efficient. These advancements are basically for the hydrogen energy transportations in which ammonia can play a major role in this process in the future.

Ammonia Market Report Scope

| Report Attributes | Details |

| Market Volume in 2025 | 153.70 Million Tons |

| Expected Volume in 2034 | 190.20 Million Tons |

| Growth Rate | CAGR of 2.40% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Form, By Application, By Technology ,By Region |

| Key Companies Profile | Acron,Koch Fertilizers, LLC,Yara International,CF Industries Holdings, Inc.,Nutrien Ltd.,Qatar Fertiliser Company,Togliattiazot,SABIC,Sumitomo Chemical Co., Ltd.,Mitsui Chemicals, Inc.,BASF SE,Asahi Kasei Corp |

Ammonia Market Opportunity

Chemical Storage Breakthrough: Ammonia’s Role in Powering the Renewable Future

The increasing need for renewable power storage and grid balancing is expected to create lucrative opportunities for ammonia market expansion during the forecast period, as solar and wind energy is not available all the time and needs to be stored for future energy generations.

Thus, the storge needs batteries such as lithium ion and others where ammonia is expected to become a game changer by acting as a chemical energy storage medium in the coming years. Also, researchers have been testing ammonia-based energy storage systems in recent years. This initiative is anticipated to provide major market attraction for the ammonia producer companies during the forecast period.

Fossil Fuel Dependency Threaten Future of Traditional Ammonia

The dependence on fossil fuels for the making of conventional ammonia is anticipated to hamper the ammonia market in the future. As per observation, 80% of ammonia is produced by the chemical process, which requires natural gas such as methane and others. This use of natural gases can create sustainability challenges in the coming period.

With increasing government initiatives toward an eco-friendly environment, the manufacturer can face challenges such as carbon taxes and strict regulation for ammonia production during the projected period. However, ammonia producers can gain leverage in the market by promoting ammonia production, which is eco-friendly and suitable for governmental regulations in the future.

Ammonia Market Segmental Insights

By Form Insights

The anhydrous ammonia segment led the ammonia market in 2025. anhydrous ammonia serves critical roles in industrial processes such as refrigeration, nitric acid production, and solvent applications adding to its extensive market usage. Its cost-effectiveness, concentrated form, and broad applicability ensure it remains the fastest-growing and most valuable segment, outpacing aqueous ammonia across both agricultural and industrial sectors.

On the other hand, the aqueous segment is seen to grow at the forecast period. Unlike anhydrous ammonia, aqueous ammonia a water-based solution of ammonia—is easier to handle and poses fewer safety risks, making it a preferred choice in industries such as wastewater treatment, power generation, and chemical manufacturing. Its effectiveness in NOx emission control systems (e.g., Selective Catalytic Reduction in power plants and industrial boilers) is particularly fueling demand amid tightening global environmental regulations. Additionally, its role in producing cleaning agents, textiles, and pharmaceuticals is contributing to steady adoption.

By Application Insights

The fertilizers segment led the ammonia market in 2024. The increased use of nitrogen-based fertilizers by individuals is primarily driving the growth of the segment in the current period. Nitrogen is known as one of three beneficial nutrients after potassium and phosphorus in healthy crop growth. Also, the use of ammonia is seen in increased modern agriculture practices, making it a crucial element for today's farming. Also, ammonia is gaining popularity by becoming a major backbone for fertilizer development, such as ammonium nitrate, Urea, and diammonium phosphate in the current market conditions.

Moreover, favorable government initiatives toward farming communities have been heavily pushing the industry growth for ammonia for the past years. Farmers are actively receiving subsidies and other benefits for fertilizer use, especially in economically weaker regions.

The refrigerants segment is expected to grow at a significant rate during the forecast period. Having excellent thermodynamic properties, ammonia is expected to gain popularity in the refrigerator industry in the coming years. Moreover, the increasing need for packaged food and its freshness maintenance is anticipated to lead the segment sales during the forecast period. Also, ammonia was seen in heavy usage in cold storage warehouses, ice rinks, food processing plants, and beverage production facilities as a refrigerant agent in the past period.

Ammonia Market Volume Share,By Application , 2025 (%)

| By Application | Market Volume Share, 2025 (%) | Market Volume- 2025 (Million Tons ) | Market Volume Share, 2035 (%) | Market Volume- 2035 (Million Tons ) | Market CAGR(2026 - 2035) |

| Fertilizers | 74.22% | 111.85 | 70.65% | 134.90 | 1.89% |

| Industrial Chemicals | 15.28% | 22.90 | 14.62% | 28.2 | 1.78% |

| Refrigetation | 2.01% | 4.20 | 1.99% | 4.60 | 1.28% |

| Textiles & Leather | 1.25% | 2.80 | 1.51% | 2.90 | 0.48% |

| Pharmaceuticals | 0.55% | 1.80 | 1.10% | 2.10 | 2.40% |

| Water & Wastewater Treatment | 2.55% | 4.81 | 4.41% | 8.62 | 7.35% |

| Explosives | 3.12% | 5.71 | 2.90% | 5.84 | 0.22% |

| Others (Green Ammonia, etc.) | 1.02% | 2.81 | 5.21% | 9.9 | 18.49% |

By Technology Insights:

The Haber-Bosch Process segment led the ammonia market in 2024. Considered as a major industrial process, it uses catalyst to speed up the reaction between nitrogen and hydrogen to produce ammonia. The process is seen as a method that transformed entire agriculture sector by offering a reliable and efficient way to produce ammonia.

The electrochemical segment is seen to grow at the fastest rate during the forecast period. Electrochemical sensors are more precise and safer than alternatives like catalytic or infrared sensors. Electrochemical ammonia production avoids high temperatures and pressures, opening doors for modular, distributed systems.

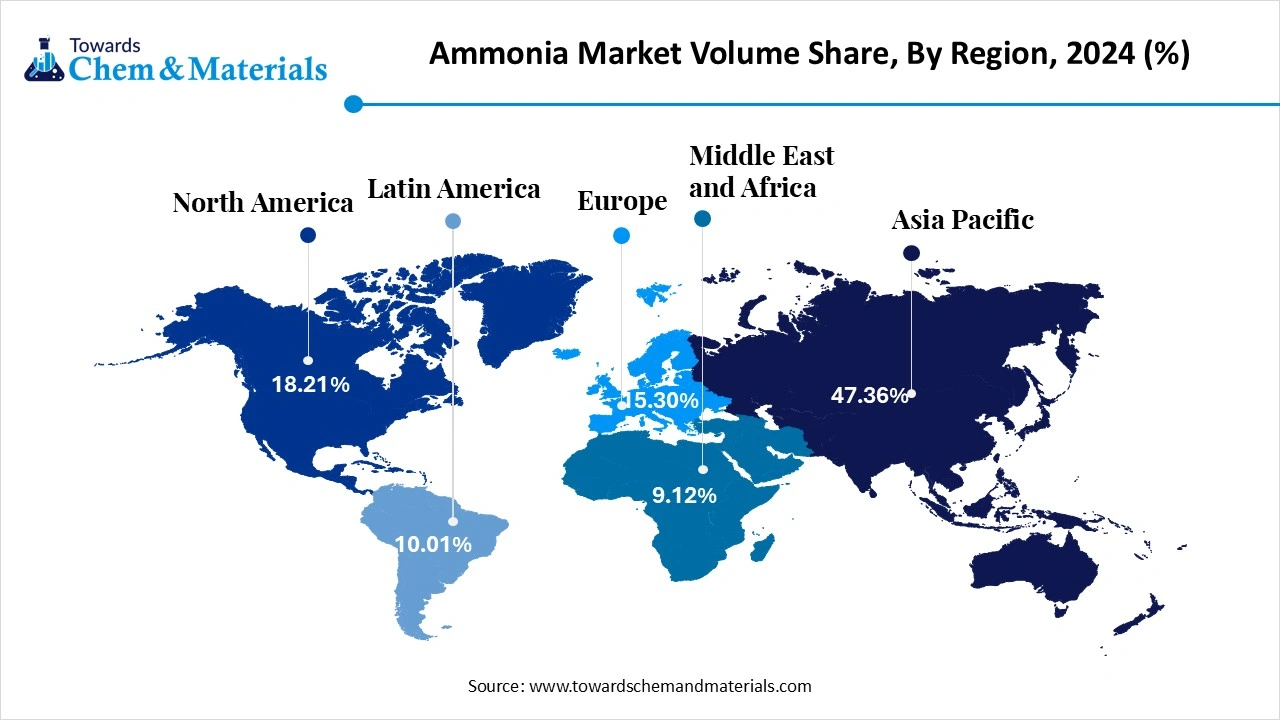

Ammonia Market Regional Insights

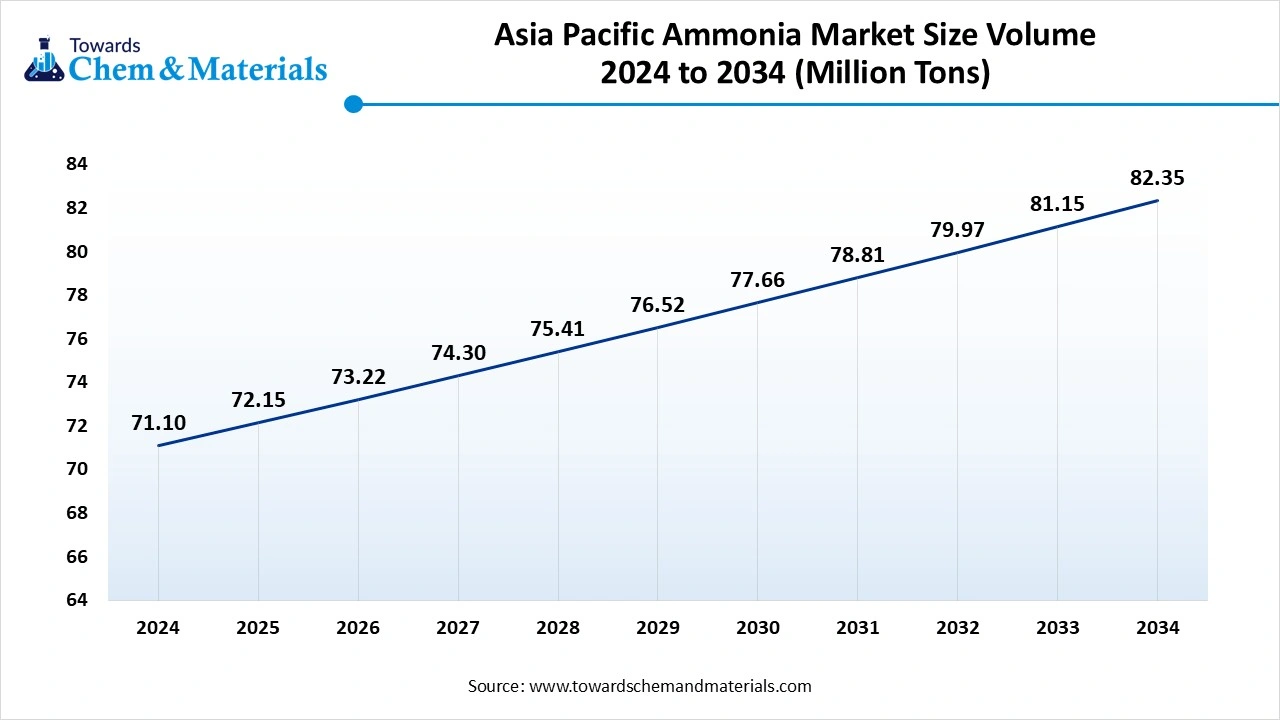

The Asia Pacific ammonia market size was valued at USD 41.79 billion in 2025 and is expected to be worth around USD 77.58 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.38% over the forecast period from 2026 to 2035.

The ammonia market volume was estimated at 72.55 million tons in 2025 and is projected to reach 92.69 million tons by 2035, growing at a CAGR of 2.48% from 2026 to 2035.

Countries such as Indonesia, India, Thailand, and Vietnam are seen in the usage of ammonia-based products in modern agriculture practices. Also, rapid industrialization is contributing to the growth of the market, as ammonia isn’t just used for fertilizers in these countries. It is also used as base material for the chemical production of chemicals such as ammonium sulfate and nitric acid while providing wide industrial application in the current market scenario.

Policy Support and Green Tech Fuel China’s Ammonia Market Forward

China is at the forefront of the ammonia industry. China is the top global producer of ammonia in the current period. Also, the enlarged chemical manufacturing industry and export potential are heavily pushing ammonia market growth in the country. Also, government policies such as self-reliance in food and chemicals are encouraging the sales of ammonia in the country recently. Moreover, technological advances in green ammonia production are expected to provide an enlarged global consumer rate during the forecast period.

North America is expected to grow at a significant pace in the market during the predicted period.

The expansion of the industrial advancements in the region is anticipated to lead the market potential in the coming years. Also, the presence of the natural gas reserves is expected to contribute to the region's growth during the forecast period. The region has hydrogen gas reserves, which play a major role in ammonia production via a process called steam methane reforming. Also, the agriculture sector is projected to create significant opportunities for ammonia producers in the region.

United States Emerges as a Key Player in Global Ammonia Industry with Strong Agriculture Backbone

The United States is expected to rise as a global leader for the ammonia industry akin to its crop productions such as corn and others. The United States is one of the top exporters of corn, which leads to the increasing use of ammonia-based fertilizers in the current period. Also, the strong presence of domestic ammonia production infrastructure is expected to drive the ammonia industry potential in the coming years. Also, the country is heavily investing in green and blue ammonia, as per observation. The country's focus on the production of renewable energy can apparently be beneficial for green ammonia sales in the future.

Ammonia Market Volume and Share, By Region, 2025 (%)

| By Region | Market Volume Share, 2025 (%) | Market Volume- 2025 (Million Tons ) | Market Volume Share, 2035 (%) | Market Volume- 2035 (Million Tons ) | CAGR(2026 - 2035) |

| Asia Pacific | 47.41% | 71.1 | 43.29% | 82.3 | 1.48% |

| North America | 18.35% | 27.3 | 16.50% | 31.4 | 1.39% |

| Europe | 15.35% | 23 | 17.21% | 32.7 | 3.61% |

| South America | 10.18% | 15 | 9.50% | 18.1 | 1.86% |

| Middle East & Africa | 8.71% | 13.7 | 13.50% | 25.7 | 6.49% |

Ammonia Market Recent Developments

Anglo-Eastern

- Station establishment: In 2025, Anglo-Eastem established an ammonia bunkering station skid at Karjat, Mumbai, India, recently announced in Anglo-Eastern’s 2025 Mumbai Conference. This establishment aims to focus on the improvement of hands-on training for ammonia-powered vessels. Also, this station has cryogenic fueling technology, which enables a controlled environment for the training in ammonia transfer operation and LNG.

Hygenco and REC Ltd

- Collaboration: In 2024, Hygenco and REC Ltd made a strategic collaboration. The collaboration aims to lead a green ammonia project for environmentally friendly energy. The companies invested 280 million dollars. Also, the company aims to promote sustainable energy solutions in the upcoming years.

CF Industries, JERA CO., Inc, and Mitsui & CO., Inc

- Collaboration: In 2025, CF Industries made a partnership with JERA CO., Inc., and Mitsui & CO., Inc. The main motive of this partnership is to improve focus on the construction of a low-carbon ammonia facility.

Top Companies List in Ammonia Market

- Acron

- Koch Fertilizers, LLC

- Yara International

- CF Industries Holdings, Inc.

- Nutrien Ltd.

- Qatar Fertiliser Company

- Togliattiazot

- SABIC

- Sumitomo Chemical Co., Ltd.

- Mitsui Chemicals, Inc.

- BASF SE

- Asahi Kasei Corp

Segment Covered in the report

By Form

- Anhydrous Ammonia

- Aqueous Ammonia

By Application

- Fertilizers

- Industrial Chemicals

- Refrigetation

- Textiles & Leather

- Pharmaceuticals

- Water & Wastewater Treatment

- Explosives

- Others (Green Ammonia, etc.)

By Technology

- Haber-Bosch Process

- Electrochemical

- Partial Oxidation

- Steam Reforming

By Regional

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait