Content

Nitrogenous Fertilizer Market Size and Growth 2025 to 2034

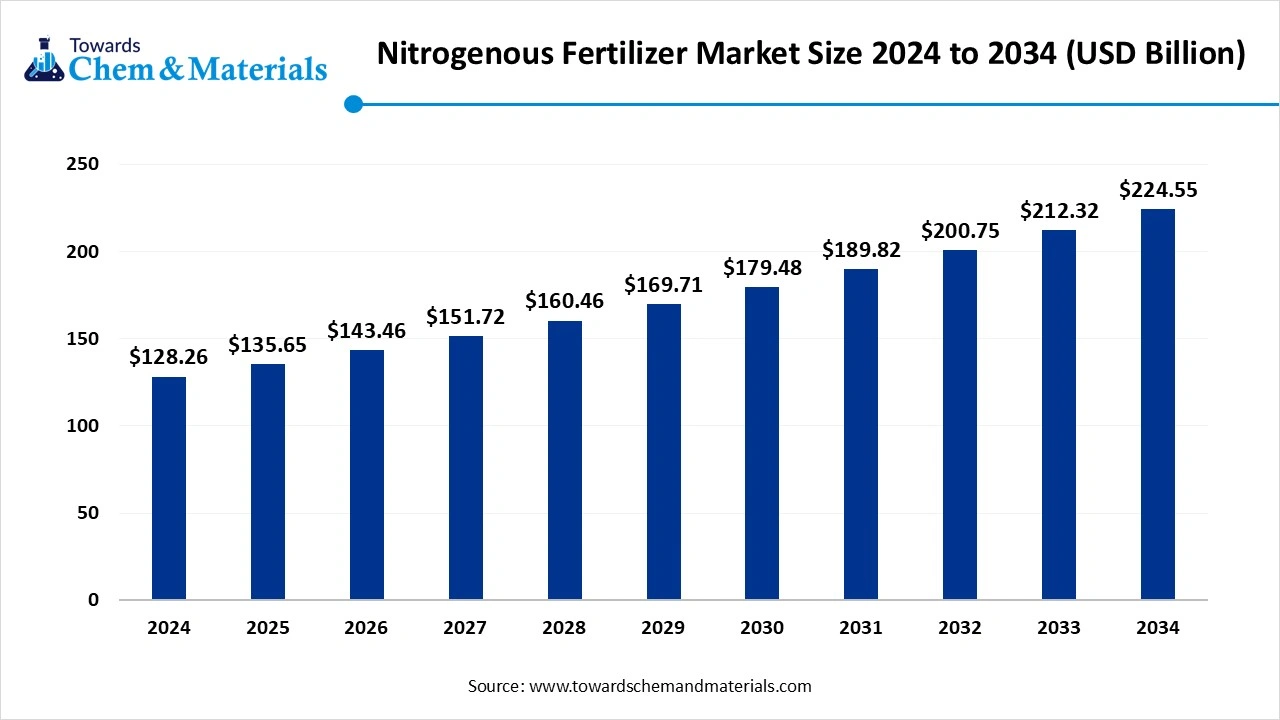

The global nitrogenous fertilizer market size was reached at USD 128.26 billion in 2024 and is expected to be worth around USD 224.55 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 5.76% over the forecast period from 2025 to 2034. Increasing health awareness and innovation in the textile industry have driven market growth. The growing expansion of the agricultural industry and increasing global food demand drive the overall growth of the market.

Key Takeaways

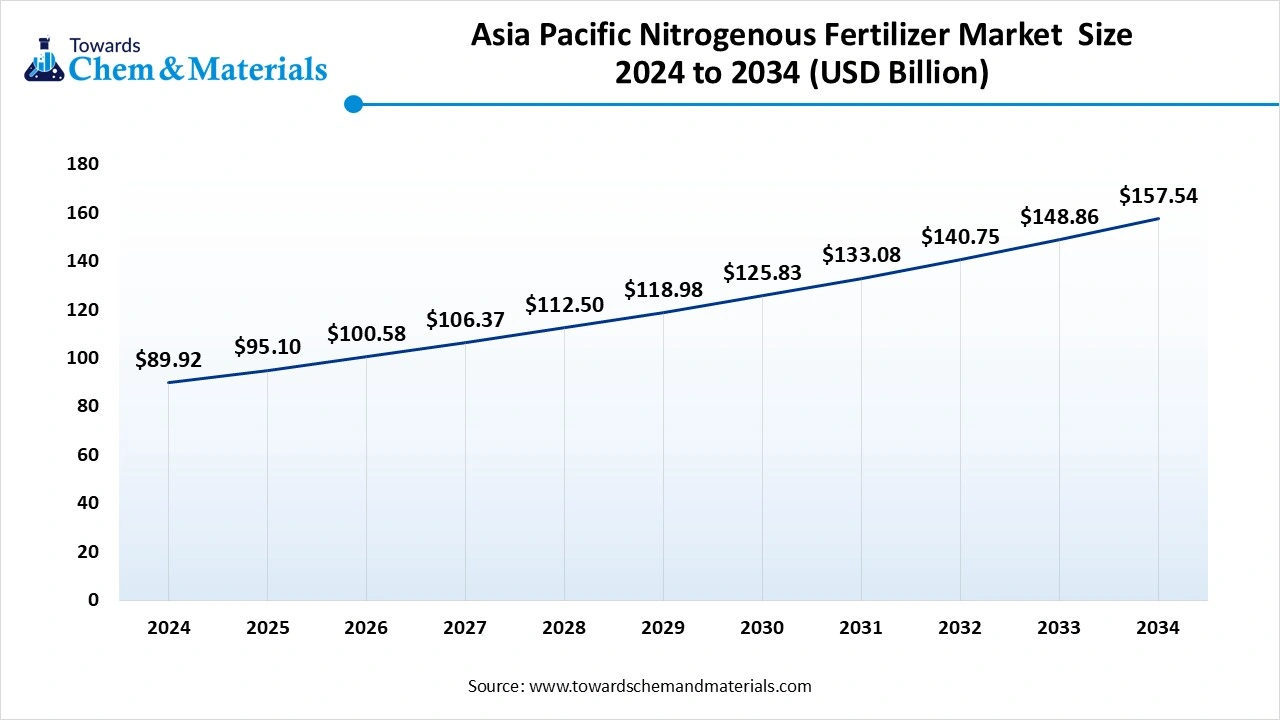

- The Asia Pacific nitrogenous fertilizer industry is expected to grow from USD 95.10 billion in 2025 to USD 157.54 billion by 2034, at a CAGR of 5.77% during this period.

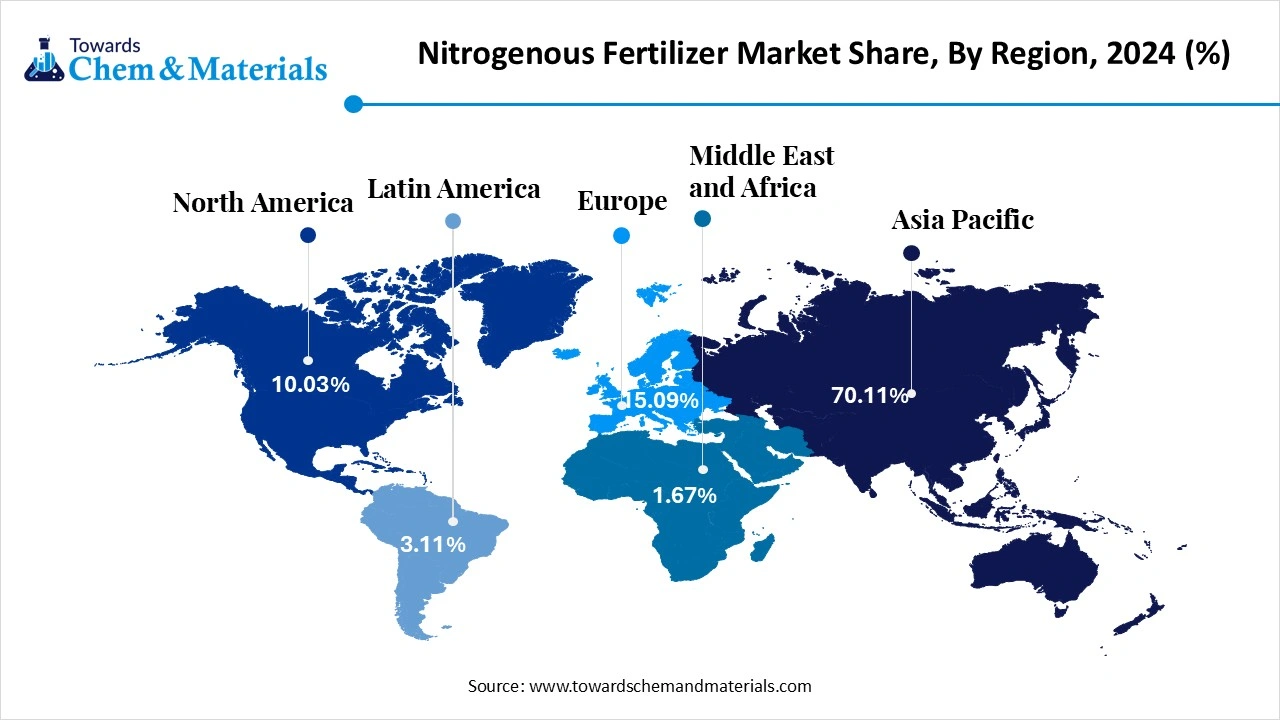

- The Asia Pacific dominated the nitrogenous fertilizer market with the largest revenue share of 70.11% in 2024.

- The Europe market is expected to witness the fastest CAGR of 7.33% over the projected period.

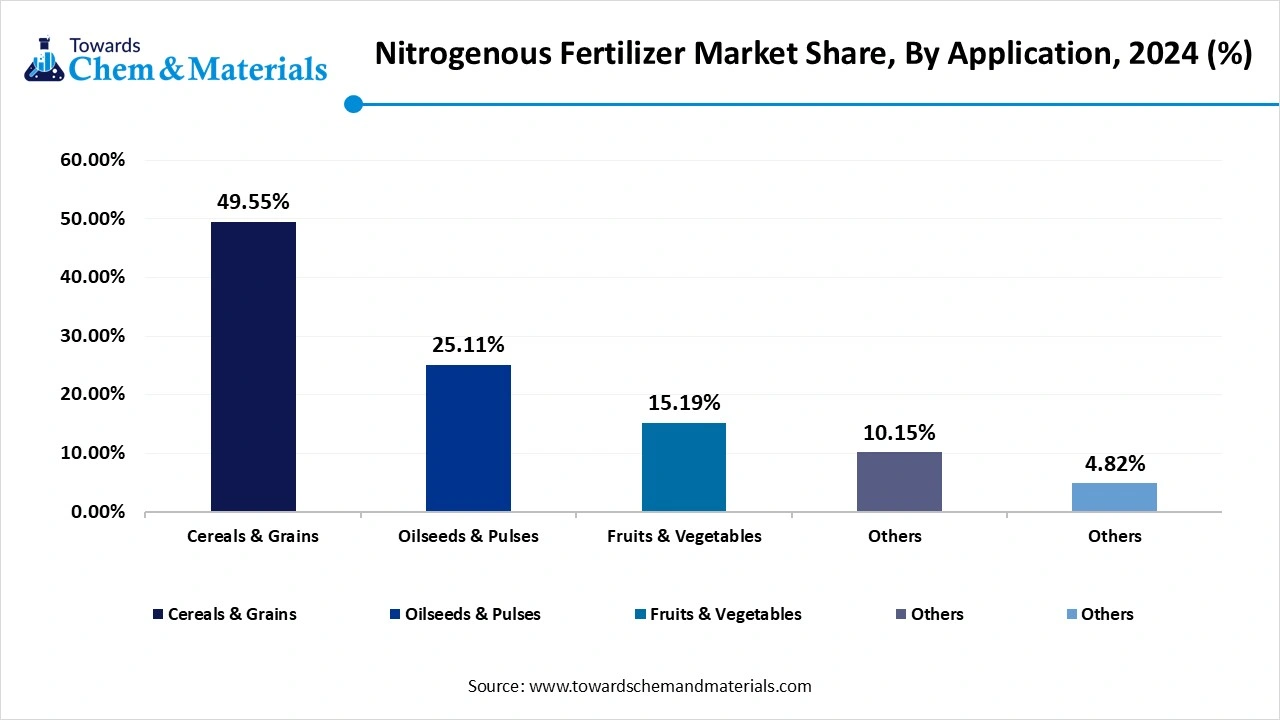

- By application, the cereals & grains segment held the highest revenue share of over 49.55% in 2024.

- By application, the oilseeds & pulses segment is expected to register the fastest CAGR of 6.11% during the forecast period,

- By product, the urea product segment accounted for the highest share of over 39.11% in terms of revenue in 2024.

- By product, the ammonia product segment stood in the second position in 2024 accounting for around 30.19% of the revenue share.

Role of Nitrogenous Fertilizer in Agricultural Productivity

Nitrogenous fertilizers are nitrogen-rich substances that provide plants with the essential nutrient nitrogen. These fertilizers increase crop yields, enhance plant growth, and promote the healthy development of plants. Nitrogenous fertilizers are available in organic and inorganic forms. The organic nitrogenous fertilizers include organic or natural materials like green manure, manure, and compost, and offer various nutrients other than nitrogen. The inorganic nitrogenous fertilizers are available in the form of liquids, salts, and powders. The various nitrogenous fertilizers are ammonia, ammonium, urea, ammonium nitrate, ammonium sulfate, methylene urea, calcium ammonium sulfate, and many more. Ammonia offers benefits to bacteria, and this nitrogen is converted into nitrate in the soil. Urea is a widely used nitrogenous fertilizer and is a highly concentrated fertilizer.

Anhydrous ammonia consists of 82% nitrogen and is a concentrated liquid. Ammonium nitrate has 34% nitrogen, and it consists of ammonium and nitrate forms of nitrogen. The growing population increases demand for food, helping the market grow. The growing problems like soil nutrient depletion, fuel demand for nitrogenous fertilizers. Factors like strong government subsidies, technological advancements in agriculture, various crops production, and growing demand from farmers contribute to the nitrogenous fertilizer market growth.

- Russia exported $5.34 B of nitrogenous fertilizer in 2023. (Source: oec.world )

- Oman exported $2.61 B of nitrogenous fertilizer in 2023. (Source: oec.world )

- Spain exported $342 M of nitrogenous fertilizer in 2024. (Source: oec.world )

- The United States exported $1.12 B of nitrogenous fertilizer in 2024. (Source: oec.world)

- Canada exported $920 M of nitrogenous fertilizer in 2024. (Source: oec.world )

A Growing Population is Driving the Nitrogenous Fertilizer Market Growth

The rapid growth in population increases the demand for the production of food. The growing population increases food consumption, which increases demand for high-quality food, leading to higher demand for nitrogenous fertilizers. The growing demand for high nutritional quality and the growing pressure on agricultural production increases demand for nitrogenous fertilizers.

The growing demand for various foods like cereals, grains, pulses, fruits, vegetables, and oilseeds increases the demand for nitrogenous fertilizers to enhance nutritional quality. The growing agricultural production leads to soil nutrient depletion, which increases demand for nitrogenous fertilizers to enhance the quality of the soil. Nitrogenous fertilizers help in the healthier growth of crop yields and produce better-quality crop yields. The growing population and strong focus on health increase demand for various crop yields. The consumers' growing focus on healthy food habits increases demand for agricultural production, leading to higher demand for nitrogenous fertilizers. The growing population is a key driver for the growth of the market.

Market Trends

- Growing global food demand: The growing global population increases demand for food, which puts pressure on the agricultural sector. The growing food demand increases the demand for producing more crops increases the adoption of nitrogenous fertilizers to enhance crop yields.

- Technological advancements: The growing technological advancements like the use of nitrification, controlled release fertilizers, and nano-fertilizers, increase the adoption of nitrogenous fertilizers. The growing advancements in farming technologies like precision farming increase demand for nitrogenous fertilizers to enhance crop yields.

- Increasing crop diversification: The growing production of diverse crops like high-quality fruits and vegetables increases demand for nitrogenous fertilizers to offer a high level of nitrogen to crops.

- The growing demand for specialty nitrogenous fertilizers: The growing adoption of specialty nitrogenous fertilizers like controlled release fertilizers and urea-based fertilizers helps in the market growth.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 135.65 Billion |

| Market Size by 2034 | USD 224.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.76% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | North America |

| Segment Covered | By Product Type, By Application, By Region |

| Key Companies Profiled | 3M Company, Momentive Performance Materials Inc., BASF SE, DowDuPont Inc., Morgan Advanced Materials, Hanwha Group, PyroGenesis Canada Inc., Cytech Products Inc., Akzo Nobel N.V., Hexcel Corporation |

Market Opportunity

The Growing Expansion of the Agricultural Sector is Expanding Market Growth

The growing expansion of the agricultural sector leads to the production of various agricultural products. The expansion of the agricultural sector in various regions increases demand for nitrogenous fertilizers for better quality crop yields. The expanding agricultural sector increases the cultivation of crops, leading to demand for nitrogenous fertilizers for maximizing land utilization. The growing disposable incomes increase demand for various agricultural products like vegetables, fruits, legumes, and many more, increasing demand for expansion of the agricultural sector. The growing production of various crops leads to soil fertility problems, increasing demand for nitrogenous fertilizer to produce high crop yields.

The technological advancements in the agricultural sector, like precision agriculture and advanced farming technologies, are fueling demand for nitrogenous fertilizers. The strong government support for various agricultural practices helps in the expansion of the agricultural sector. The growing expansion of the agricultural sector creates opportunities for the growth of the nitrogenous fertilizer market.

Market Challenge

Growing Environmental Concerns Limit the Expansion of the Market

Despite several benefits of nitrogenous fertilizer in the agriculture sector, growing environmental concerns restrict the market growth. Environmental concerns like air pollution, climate change, water pollution, and soil degradation can be due to nitrogenous fertilizers. Excess utilization of nitrogen creates water pollution and causes problems for aquatic life. It creates survival problems for aquatic life, like dead zones and oxygen depletion. Nitrogen oxide and ammonia increases air pollution and create smog in the environment. The high use of nitrogen fertilizers creates problems like soil acidification, which lowers the fertility of the soil. The production, decomposition, and utilization of nitrous oxide led to greenhouse gas emissions and climate change problems. The growing various environmental concerns hamper the growth of the nitrogenous fertilizer market.

Regional Insights

Why Did Asia Pacific Dominate the Nitrogenous Fertilizer Market in 2024?

The Asia Pacific nitrogenous fertilizer market size was valued at USD 89.92 billion in 2024 and is expected to be worth around USD 157.54 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 5.77% over the forecast period 2025 to 2034. Asia Pacific dominated the market in 2024.

The well-established agricultural base in countries like China & India increases demand for nitrogenous fertilizer. The large population in the region increases demand for the production of food helps in the market growth. The strong government support, like subsidies & initiatives, increases the adoption of nitrogenous fertilizers in agricultural activities. The growing advancements in agriculture, like fertigation & precision farming, increase demand for nitrogenous fertilizers. The growing consumption and manufacturing of nitrogenous fertilizers in the region drive the market growth. The growing demand for enhancing crop yields and increasing demand for food availability helps in the market growth. The presence of well-established manufacturing hubs in Japan, China, and India drives the overall growth of the market.

China’s Nitrogenous Fertilizer Market Trends

China is a major contributor to the nitrogenous fertilizer market. The growing production of food & livestock products increases demand for nitrogenous fertilizer. The strong government support and focus on agricultural sufficiency help in the market growth. The growing production of cereals and oilseeds increases demand for urea nitrogenous fertilizer. The strong investment in the agricultural sector and major distribution networks drive the market growth. The well-established agriculture sector and policies to promote nitrogenous fertilizer usage contribute to overall market growth.

- China exported $5.05 B of nitrogenous fertilizer in 2023. (Source: oec.world )

- China exported $230 M of nitrogenous fertilizer in March 2025. (Source: oec.world)

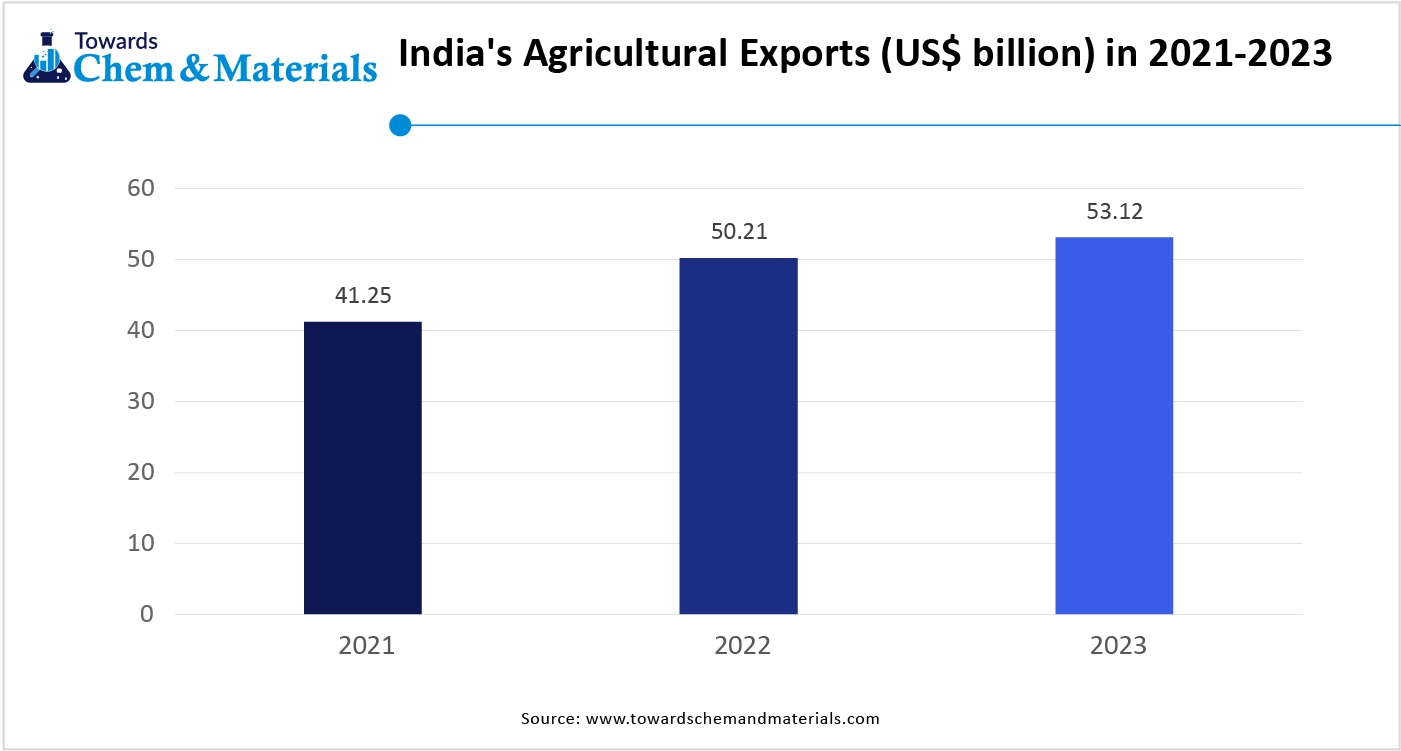

Why Nitrogenous Fertilizer Market Growing in India?

India is significantly growing in the nitrogenous fertilizer market. The rapid population and growing demand for food production increase the demand for nitrogenous fertilizers. The adoption of modern farming technologies like smart fertilization methods and precision farming helps in the market growth. The strong government support, like a nutrient-based subsidy, increases the production of nitrogenous fertilizer. The strong distribution and production of nitrogenous fertilizer help in the market growth. Additionally, the growing production of fruits & vegetables and the increasing agricultural sector promote overall growth of the market.

- India exported $48.2 M of nitrogenous fertilizer in 2023. (Source: oec.world )

- In February 2025, the Central Government of India announced Rs.10000 crore investment in the Urea Plant in Assam’s Namrup to boost the production of fertilizer. The plant has a production capacity of 12.7 lakh metric tonnes of urea per year. The project will create 1950 new job opportunities and enhance fertilizer availability in Eastern & Northeast India. (Source: boroktimes.com )

Why is Europe Rapidly Growing in the Nitrogenous Fertilizer Market?

Europe is experiencing the fastest growth in the market during the forecast period. The growing production of vegetables, cereals, livestock, and fruits increases demand for nitrogenous fertilizer. The technological advancements, like precision farming, fuel demand for nitrogenous fertilizers, which helps in the market growth. The growing production of feed crops like forage and maize grasses increases demand for nitrogenous fertilizer. The growing export of agricultural products from countries like France & Spain helps in the market growth. The growing demand for food and the increasing production of high-value crops drive the overall growth of the market.

France Nitrogenous Fertilizer Market Trends

France is a major contributor to the nitrogenous fertilizer market. The well-established agricultural sector and growing production of field crops like ornamental plants, field crops, and turf increase demand for nitrogenous fertilizers. The growing advancements in fertilizer application, like fertigation, help in the market growth. The growing adoption of modern and traditional agricultural practices increases demand for nitrogenous fertilizers. Additionally, increasing demand for efficient and high-quality fertilizers drives the overall market growth.

- France exported $308 M of nitrogenous fertilizer in 2023. (Source: oec.world )

Segmental Insights

Product Insights

Why Urea Segment Dominated the Nitrogenous Fertilizer Market in 2024?

The urea product segment dominated the nitrogenous fertilizer market in 2024. The growing demand for high percentage nitrogen content for plant growth increases demand for urea nitrogenous fertilizer. Urea consists of 46% nitrogen content, which is important for plant growth. It is affordable, and it is widely used for various agricultural applications. It is used for a variety of soil and crop types. Urea releases nitrogen naturally, which supports healthy development & growth of the plant. The growing demand for convenient and easy storage & transportation fertilizer options for farmers increases demand for nitrogenous fertilizers. It is present in various forms, like prilled and granular. The growing worldwide demand for food production and technological advancements in urea production drive the overall market growth.

The ammonia product segment is the fastest growing in the market during the forecast period. The growing demand for higher crop yields and high-nutritional-quality foods increases demand for ammonia products. Ammonia is a key source of nitrogen, and it produces various nitrogenous fertilizers. It consists of high nutrient density and is affordable for farmers. It is directly applied through the soil by using an irrigation system. Anhydrous ammonia consists of the highest nitrogen content. The growing demand from small-scale and large-scale agricultural applications helps in the market growth. The growing production of green ammonia using renewable energy drives the overall growth of the market.

Application Insights

Why Cereals & Grains Dominate The Nitrogenous Fertilizer Market?

The cereals & grains segment led the nitrogenous fertilizer market. The growing global population and increasing consumption of cereals & grains increase demand for nitrogenous fertilizer. It is a key component in the growth of cereals and grains. The growing cultivation of cereals & grains, especially in the Asia Pacific region, helps in the market growth. The fertilizers, like anhydrous ammonia, urea, and ammonium nitrate, are widely used for the production of cereals & grains. The growing population and rising middle-class population increase demand for cereals & grains, fueling demand for nitrogenous fertilizers. Additionally, a growing focus on diet and increasing consumption of food increases demand for cereals & grains, supporting the overall market growth.

The oilseeds and pulses segment is experiencing the fastest growth in the market during the forecast period. The growing demand for protein and fat sources increases the production of oilseeds and pulses. The growing urbanization and rapid growth in population increase demand for food production, helping the growth of the market. The growing disposable incomes increase demand for various foods and pulses. The focus on plant-based diets increases demand for protein-rich foods, fueling demand for pulses & oilseeds. Oilseeds & Pulses are rich in essential nutrients, protein & fibre. The shift towards healthier eating habits and growing consumption of oilseeds & pulses supports the overall market growth.

Recent Developments

- In February 2025, Wilbur-Ellis launched a new organic nitrogen fertilizer, BenVireo teralux 10-0-0. The fertilizer is 100% plant-available fertilizer and consists of ammonium nitrate. It is a liquid formulation, a weed formulation, and sustainably derived. It lowers greenhouse gas emissions. The pH is neutral and has 270-gallon totes, bulk packaging. (Source: growingproduce.com )

- In February 2025, FFC launched Sona Urea Zinc Coated fertilizer. The fertilizer consists of 1% zinc and 42% nitrogen. It offers benefits like minimal nitrogen losses and prolonged availability. The fertilizer enhances the efficiency of the fertilizer and enhances zinc availability. (Source: tradechronicle.com )

- In February 2025, HortiContact launched water-soluble fertilizer, Haifa Soluble DUO. The fertilizer is designed for fertigation purposes to optimize cultivation strategies. It is available in two formulas: 3-0-9+34 CaO and 10-0-35+10 CaO. These formulas combine calcium, nitrate nitrogen, and potassium to strengthen plant cell structure and improve nutrient uptake. (Source: hortidaily.com )

Top Companies List

- Sorfert

- Nutrien Ltd.

- Omnia Holdings Limited

- Kynoch Fertilizer

- Bunge Ltd.

- Yara

- Sasol

- TriomfSA

- OCI Nitrogen

- Aquasol Nutri

- Rolfes Agri (Oty) Ltd.

- ICL Fertilizers

- CF Industries Holdings Inc.

- Hellagrolip SA

- Eurochem Group AG

- Koch Fertilizers, LLC

- Coromandel International Limited

- Notore Chemical Industries Plc

- Haifa Group

Segments Covered in the Report

By Product

- Urea

- Ammonium

- Methylene Urea

- Ammonium Nitrate

- Ammonium Sulfate

- Calcium Ammonium Nitrate

- Others

By Application

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait