Content

U.S. Epoxy Resins Market Size and Forecast 2025 to 2034

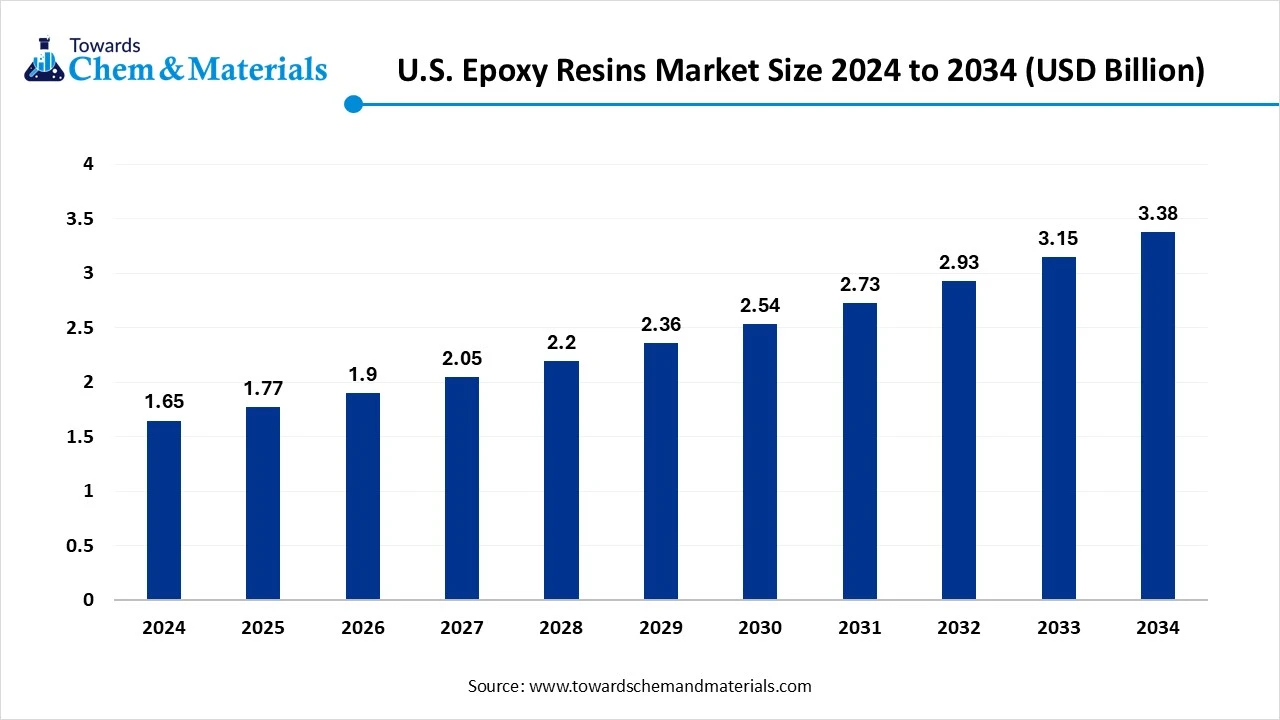

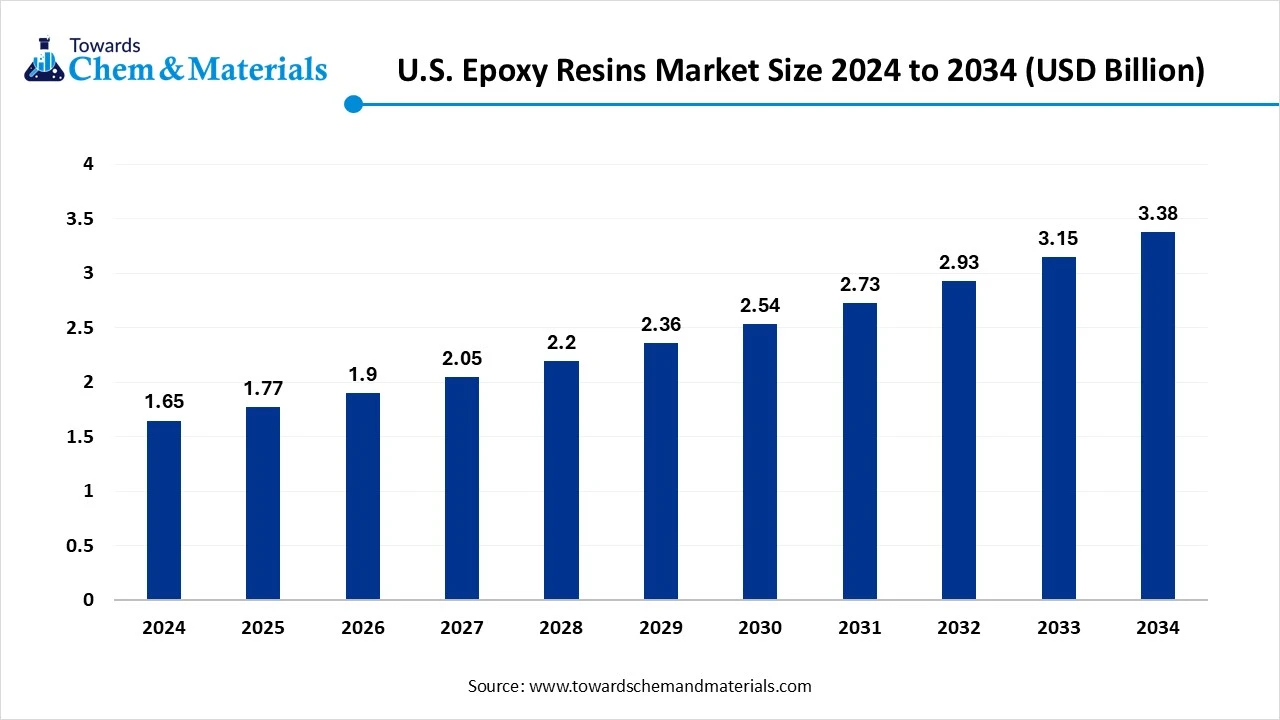

The U.S. epoxy resins market size was reached at USD 1.65 billion in 2024 and is expected to be worth around USD 3.38 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.44% over the forecast period 2025 to 2034. The growing demand for epoxy resins from various sectors is the key factor driving market growth. Also, a surge in infrastructure development projects, coupled with the use of lightweight materials in the production process, can fuel market growth further.

Key Takeaways

- By region, the Midwest region dominated the market with a 50% U.S. epoxy resins market share in 2024. The dominance of the region can be attributed to the innovations in wind energy technology.

- By region, the northeast region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing demand for high-performance materials and rapid infrastructure development.

- By physical form, the liquid epoxy resins segment held a 60% market share in 2024. The dominance of the segment can be attributed to the rising product demand from the automotive and construction sectors.

- By physical form, the solid epoxy resins segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the expansion of renewable energy sources.

- By type, the Bisphenol-A epoxy resins segment dominated the market with 50% market share in 2024. The dominance of the segment can be linked to the rising resin demand from the aerospace and electronics sectors.

- By type, the novolac epoxy resins segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is driven by the increasing need for high-performance coatings and adhesives.

- By raw material, the bisphenol-A segment led the market by holding 55% market share in 2024. The dominance of the segment is owing to the surge in the adoption of lightweight materials.

- By raw material, the bisphenol-F segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the rising demand for high-purity epoxy resins in the construction and electronics sectors.

- By manufacturing process, the epichlorohydrin–bisphenol process segment held a 65% market share in 2024. The dominance of the segment can be attributed to the growing demand for epoxy resins in automotive, construction, aerospace, and electronics sectors.

- By manufacturing process, the aliphatic epoxidation process segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be credited to the increasing demand for epoxides.

- By application, the paints & coatings segment dominated the market with a 35% share in 2024. The dominance of the segment can be linked to the ongoing advancements in epoxy resin formulations.

- By application, the wind energy components segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be driven by the technological innovations in wind turbine design.

- By end-use industry, the building & construction segment held a 40% market share in 2024. The dominance of the segment is owed to the rise in infrastructure development.

- By end-use industry, the renewable energy segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the innovations in turbine technology.

Technological Advancements are Expanding Market Growth

The U.S. epoxy resins market refers to the global industry involved in the production, distribution, and application of epoxy resins thermosetting polymers formed from the reaction between epoxide groups and curing agents.

These resins are valued for their exceptional adhesion, chemical resistance, mechanical strength, and versatility, making them integral in coatings, adhesives, composites, electronics, and construction applications. Ongoing advancements in epoxy resin formulations and production processes can lead to improved performance characteristics with extensive applications.

What Are the Key Trends Influencing the U.S. Epoxy Resins Market?

- Increasing adoption of epoxy resins in the automotive sector is the latest trend in the market. Epoxy resins are widely utilized in the automotive industry, especially for their adhesion to metals, exceptional mechanical properties, and chemical resistance. They are important in different applications such as composite parts, automotive coatings, and structural bonding.

- The rising adoption of bio-based epoxy resin is another major trend impacting positive market growth. The increasing focus on sustainability and the decrease in fossil fuel resources are boosting the need for bio-based epoxy resins. These sustainable alternatives give a reliable solution, as they are obtained from renewable sources like biomass and vegetable oils.

- The increasing adoption of lightweight materials in sectors such as aerospace and automotive is propelling the demand for epoxy resins. Epoxy resins are used to create composite materials that reduce weight and give strength, which leads to enhanced fuel efficiency and performance.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 1.77 Billion |

| Expected Size by 2034 | USD 3.38 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.44% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Physical Form, By Type, By Raw Material, By Manufacturing Process, By Application, By End-Use Industry, By Regional |

| Key Companies Profiled | Chang Chun Group, Jiangsu Sanmu Group Co., Ltd., Sinopec Baling Company Limited, Westlake Epoxy (Westlake Chemical Corporation), 3M Company, Spolchemie, Atul Ltd., NAGASE ChemteX Corporation, LEUNA-Harze GmbH, AnQore B.V., Emerald Performance Materials LLC, DIC Corporation, Mitsubishi Chemical Corporation, Sumitomo Bakelite Co., Ltd. |

Market Opportunity

Growing Transition Towards Waterborne Epoxy Resins

The ongoing regulatory pressures and environmental concerns are fueling a demand for waterborne epoxy resins, which have significantly lowered VOC emissions and provide sustainable alternatives to conventional solvent-based epoxy formulations. Furthermore, epoxy resins are finding applications in 3D printing for the rapid production of intricate parts. This trend very well aligns with the increasing adoption of additive production technologies.

- In June 2025, the Aditya Birla Group extended its production facilities in the U.S. by acquiring Cargill's specialty chemical production plant in Georgia. This initiative is a crucial development in the company's expansion and industrial diversification.(Source: https://hdfcsky.com)

Market Challenges

Raw Material Price Volatility

Epoxy resins production heavily depends on petroleum-based feedstocks such as epichlorohydrin and bisphenol A, which makes the market more prone to fluctuations in oil prices in the overall supply chain. Moreover, these fluctuations affect the manufacturing costs and profitability for manufacturers, hindering market expansion soon.

Country Insight

U.S. Epoxy Resins Market Trends

The Midwest region dominated the market with a 50% share in 2024. The dominance of the region can be attributed to the innovations in wind energy technology, the strong presence of major market players, and the extensive construction sector in this part of the country. Also, the Midwest region has a wide energy sector, with various manufacturing facilities and wind farms. Epoxy resins are crucial for the manufacturing of wind turbine nacelles, blades, and other components.

The northeast region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing demand for high-performance materials and rapid infrastructure development. In addition, the northeast has a high concentration of manufacturing, technology, and construction companies, creating a lucrative demand for epoxy resins, leading to positive regional growth.

Segmental Insight

Physical Form Insight

Which Physical Form Type Segment Dominated the U.S. Epoxy Resins Market in 2024?

The liquid epoxy resins segment held a 60% market share in 2024. The dominance of the segment can be attributed to the rising product demand from the automotive and construction sectors, innovations in resin technology, and increasing focus on sustainable and bio-based solutions. In addition, Liquid epoxy resins are preferred for coating because of their capability to create smooth, uniform finishes.

The solid epoxy resins segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the expansion of renewable energy sources, the rising demand from the automotive and construction sectors, and innovations in electronics manufacturing. Furthermore, the development of bio-based epoxy resins can contribute to positive segment growth soon.

Type Insight

Why Bisphenol-A epoxy Resins Segment Dominated the U.S. Epoxy Resins Market in 2024?

The bisphenol-A epoxy resins segment dominated the market with 50% market share in 2024. The dominance of the segment can be linked to the rising resin demand from the aerospace and electronics sectors, along with the advancements in epoxy resin technology. Specialty BPA epoxy formulations are increasingly gaining popularity in the aerospace sector for high-performance applications, driving segment growth further.

The novolac epoxy resins segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is driven by the increasing need for high-performance coatings and adhesives, especially in the infrastructure and chemical resistance sectors. Additionally, epoxy novolac resins are preferred for their exceptional solvent and chemical resistance properties.

Raw Material Insight

How Much Share Did the Bisphenol-A Segment Held in 2024?

The bisphenol-A segment dominated the market by holding 55% of the market share in 2024. The dominance of the segment is owing to the surge in adoption of lightweight materials, coupled with the innovations in epoxy resin formulations. Epoxy resins are extensively used in powder coatings for different applications like construction and automotive, contributing to the segment growth further.

The bisphenol-F segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the rising demand for high-purity epoxy resins in the construction and electronics sectors and ongoing innovations in epoxy resin technology. Bisphenol F epoxy resins are well known for their exceptional adhesion, strength, heat, and chemical resistance, making them convenient for these demanding applications.

Manufacturing Process Insight

Which Manufacturing Process Segment Dominated U.S. Epoxy Resins Market in 2024?

The epichlorohydrin–bisphenol process segment held a 65% market share in 2024. The dominance of the segment can be attributed to the growing demand for epoxy resins in automotive, construction, aerospace, and electronics sectors, along with its superior properties. Furthermore, these resins are crucial for encapsulation, insulation, and safeguarding electronic components because of their exceptional thermal and electrical properties.

The aliphatic epoxidation process segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be credited to the increasing demand for epoxides and the growing emphasis on sustainability. Moreover, epoxy resins obtained from epoxides such as bisphenol A diglycidyl ether are widely utilized in corrosion-resistant coatings.

Application Insight

Why Did the Paints & Coatings segment Held the Largest U.S. Epoxy Resins Market Share in 2024?

The paints & coatings segment dominated the market with a 35% share in 2024. The dominance of the segment can be linked to the ongoing advancements in epoxy resin formulations, which have led to coatings with improved properties like low VOC (Volatile Organic Compound) content and UV resistance, further increasing its adoption in the industry.

The wind energy components segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be driven by technological innovations in wind turbine design, especially the development of larger turbines, which necessitate more durable and stronger materials. In addition, epoxy resins, particularly in composite materials for composite materials for blades, provide the necessary performance characteristics.

End-Use Industry Insight

Which End-Use Industry Segment Dominated the U.S. Epoxy Resins Market in 2024?

The building & construction segment held a 40% market share in 2024. The dominance of the segment is owed to the rise in infrastructure development, rapid urbanization, and the need for more durable and high-performance materials. Also, the increasing focus on sustainable and energy-efficient construction has propelled the demand for low-VOC epoxy-based coatings further.

The renewable energy segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the innovations in turbine technology, initiatives supporting renewable energy, and the development of more sustainable resin formulations. Additionally, epoxy resins are utilized in various applications within the renewable energy sector, such as solar panel components.

U.S. Epoxy Resins Market Value Chain Analysis

- Feedstock Procurement: It is the process of sourcing the crucial raw materials necessary for manufacturing epoxy resins. The major players are increasingly prioritizing securing high-quality feedstock supplies through agreements with suppliers.

- Chemical Synthesis and Processing: The market heavily depends on chemical synthesis to create its fundamental components, hardeners, and epoxy resins. These two parts are then processed to form the cured and final material with the desired properties.

- Packaging and Labelling: Packaging and labeling play a significant role in the market, fulfilling both regulatory and practical needs. Basically, they are necessary for information dissemination, product protection, and safe handling over the supply chain and end-use applications.

- Regulatory Compliance and Safety Monitoring : The U.S. epoxy resins market confronts a scenario of safety and regulatory protocols aimed at safeguarding human health and the environment. By implementing various regulatory policies, the industry aims to ensure the safety of workers and maintain product quality.

Recent Developments

- In January 2025, Mallinda introduced a Vitrimax, a hot melt (VHM) resin. This new launch features a novel polymer class integrating thermoplastic processability and thermoset performance. Vitrimax VHM provides self-healing properties with improved strength capabilities.(Source: https://www.compositesworld.com)

U.S. Epoxy Resins Market Top Companies

- Hexion Inc.

- Olin Corporation

- Huntsman Corporation

- Nan Ya Plastics Corporation

- Kukdo Chemical Co., Ltd.

- Aditya Birla Chemicals

- Chang Chun Group

- Jiangsu Sanmu Group Co., Ltd.

- Sinopec Baling Company Limited

- Westlake Epoxy (Westlake Chemical Corporation)

- 3M Company

- Spolchemie

- Atul Ltd.

- NAGASE ChemteX Corporation

- LEUNA-Harze GmbH

- AnQore B.V.

- Emerald Performance Materials LLC

- DIC Corporation

- Mitsubishi Chemical Corporation

- Sumitomo Bakelite Co., Ltd.

Segments Covered

By Physical Form

- Solid Epoxy Resins

- Liquid Epoxy Resins

- Solution Epoxy Resins

By Type

- Bisphenol-A Epoxy Resins

- Bisphenol-F Epoxy Resins

- Novolac Epoxy Resins

- Aliphatic Epoxy Resins

- Glycidylamine Epoxy Resins

- Halogenated Epoxy Resins

- Others

By Raw Material

- Bisphenol-A

- Bisphenol-F

- Epichlorohydrin

- Phenols

- Others

By Manufacturing Process

- Epichlorohydrin–Bisphenol Process

- Epichlorohydrin–Novolac Process

- Bromination Process

- Aliphatic Epoxidation Process

- Others

By Application

- Paints & Coatings

- Adhesives

- Composites

- Electrical & Electronics

- Wind Energy Components

- Automotive Components

- Marine Applications

- Flooring & Construction Materials

- Packaging Materials

- Aerospace Components

- Others

By End-Use Industry

- Building & Construction

- Automotive

- Electrical & Electronics

- Aerospace & Defense

- Marine

- Renewable Energy (Wind, Solar)

- Industrial Equipment

- Consumer Goods

- Oil & Gas

- Others

By Regional

- Northeast

- Midwest

- South

- West