Content

U.S. Detergent Alcohols Market Size and Growth 2025 to 2034

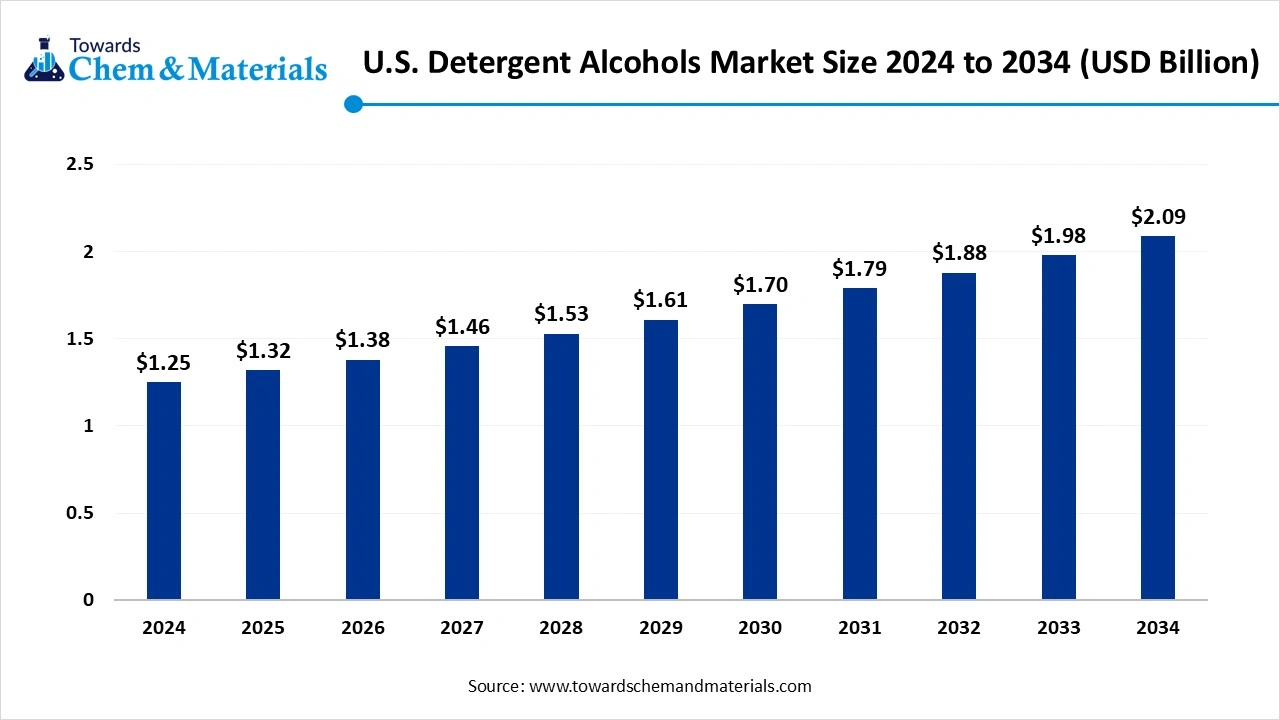

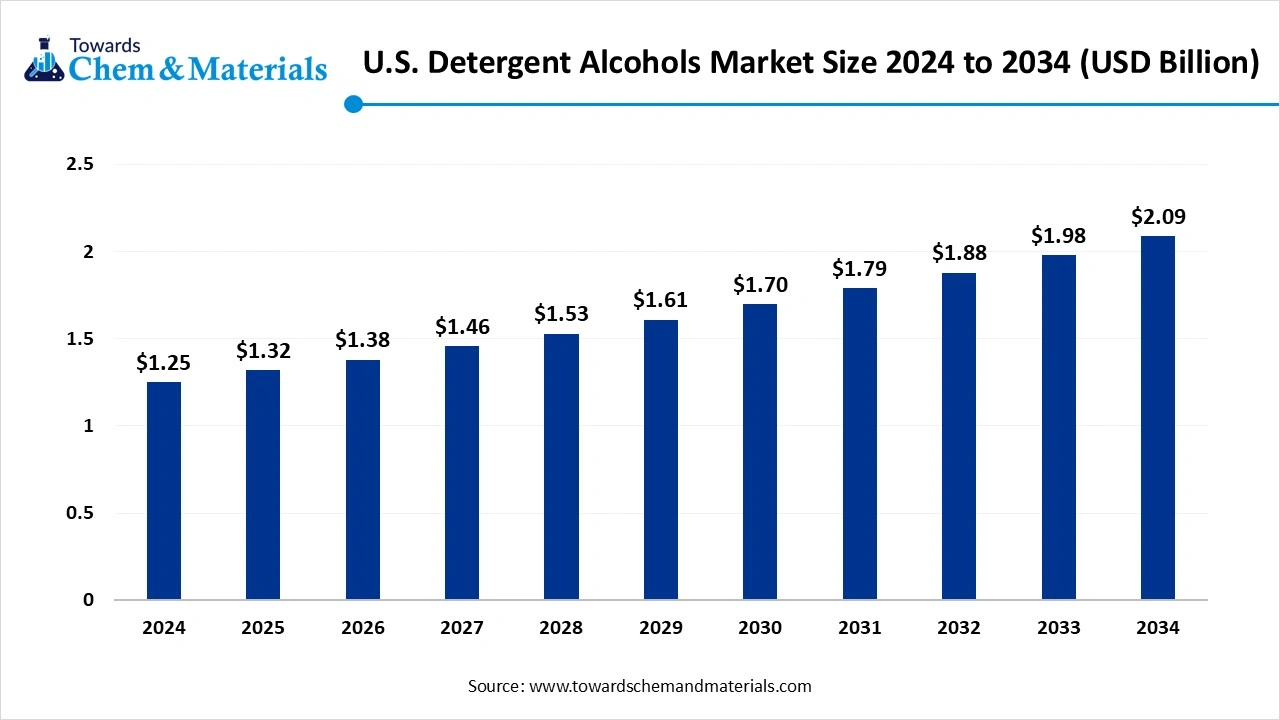

The U.S. detergent alcohols market size is calculated at USD 1.25 billion in 2024, grew to USD 1.32 billion in 2025, and is projected to reach around USD 2.09 billion by 2034. The market is expanding at a CAGR of 5.25% between 2025 and 2034.The increasing demand for bio-based cleaning products is the key factor driving market growth. Also, the ongoing shift towards concentrated formulations coupled with the surge in personal care applications can fuel market growth further.

The market encompasses the use and trade of fatty alcohols, both synthetic and natural in different personal care and cleaning products. This alcohol, generally having a carbon chain distant between C12 and C18, is important for manufacturing surfactants utilized in soaps, detergents, and other cleaning agents. They are also key elements in body washes, hand soaps, shampoos, and other personal care items, contributing to foaming and cleansing action. Stringent regulations on chemical use in cleaning products are pushing producers towards more natural and sustainable options, further propelling the market demand.

Key Takeaways

- By source, the natural alcohol detergent segment dominated the U.S. detergent alcohols market in 2024. The dominance of the segment is credited to the growing consumer demand for eco-friendly products.

- By source, the synthetic alcohol detergent segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be linked to the surge in the need for cleaning products, especially in the industrial and residential sectors.

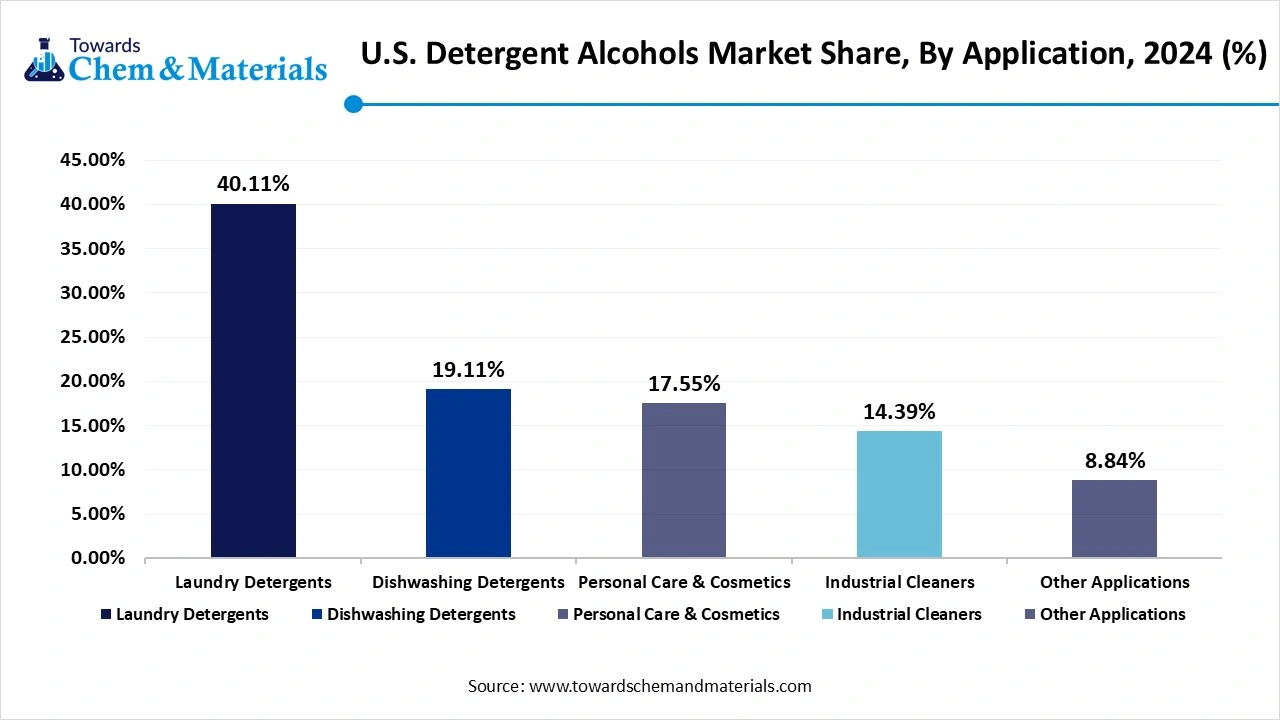

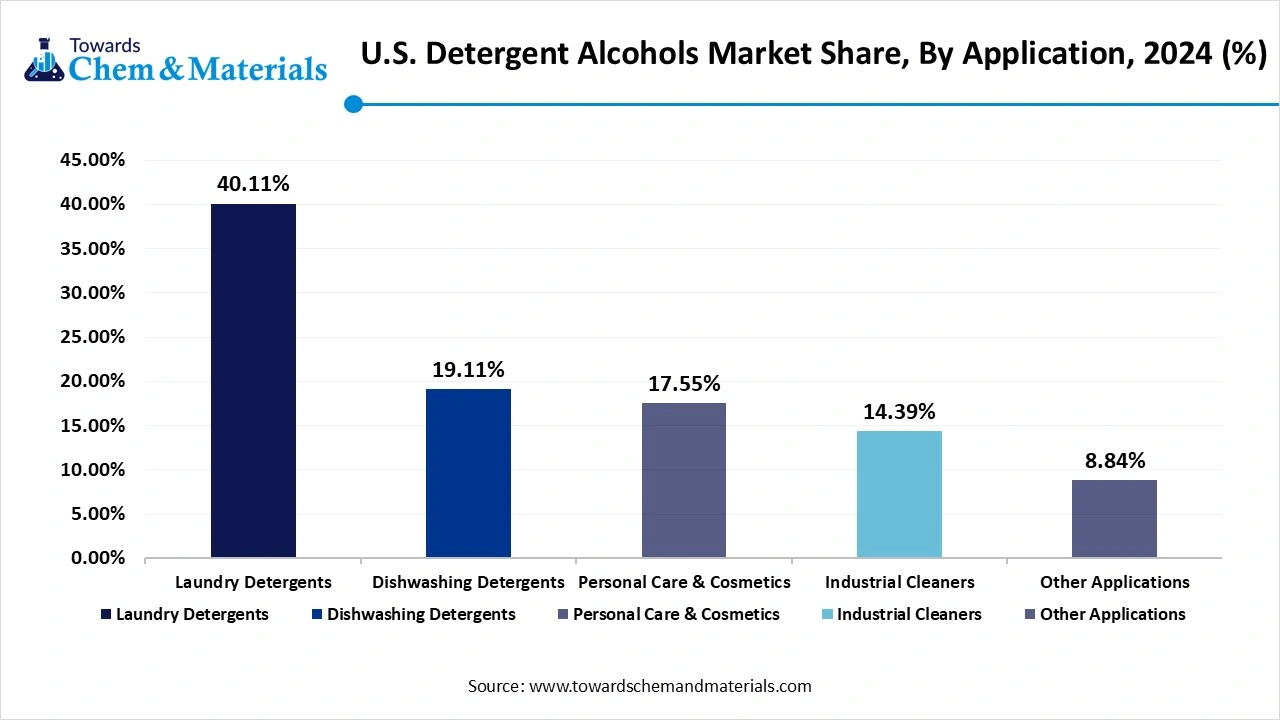

- By application, the laundry detergent segment held the largest market share in 2024. The dominance of the segment can be driven by rapid urbanization, growing hygiene awareness, and the demand for concentrated and sustainable cleaning products.

- By application, the personal care and cosmetic segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is owing to the growing focus on sanitation and personal hygiene, particularly after the COVID-19 pandemic.

What Are the Key Trends Influencing the U.S. Detergent Alcohols Market?

- The growing utilization and consumption of household detergents is the latest trend in the market driving market growth. Detergent alcohol acts as a crucial raw material in the manufacturing of surfactants and detergents, to meet the demand of households across the globe. The increased emphasis on health and hygiene has increased capital spending on these products.

- The rising inclination towards organic and natural ingredients in personal care and cosmetics products is another trend impacting positive market growth. The change in demand is anticipated to fuel the market expansion soon. Also, the demand for organic and biodegradable content is set to generate a significant surge in the demand for bio-based detergent alcohols.

- The increasing awareness about the side effects of artificially derived products coupled with the shift towards environmental safety are escalating the adoption of sustainable and natural products. These factors have influenced many sectors like the detergent alcohol industry. The consumer preference for DA that are created with the help of natural ingredients is growing naturally.

| Report Attributes | Details |

| Market Size in 2024 | USD 1.25 Billion |

| Expected Size by 2025 | USD 1.32 Billion |

| Growth Rate | CAGR of 5.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 to 2034 |

| Segment Covered | By Application, By Source |

| Key Companies Profiled | Stepan Company, Kraton Corporation, Procter & Gamble, Vantage Specialty Chemicals, Inc., Colonial Chemical, Pilot Chemical Company, Oleon NV, Essential Labs, Rita Corporation |

How is the Government Supporting the U.S. Detergent Alcohols Market?

The US government supports the market through different avenues, including promoting research and development of biodegradable products, supporting environmental sustainability, and incorporating regulations that optimize green chemistry practices. The US government, through agencies such as the Environmental Protection Agency (EPA), promotes the adoption of green chemistry solutions in detergent production. The market for detergent alcohols is facilitated by the expanding personal care and home care industries.

Market Opportunity

Use of Advanced Products

Technological enhancement and development are the major factors creating lucrative opportunities in the market, allowing consumers to obtain an extensive range of requests in the market. Technological innovations will enhance the performance and expand the market growth. Furthermore, the market is witnessing raised demand for concentrated tablets and liquid detergents which provide superior skin-friendly and cleaning properties.

- In May 2025, Soane Materials introduced the SoaneClean a Laundry Detergent Sheet technology platform, which is an innovative cleaning solution created to improve performance, minimize carbon emission, and eliminate plastic waste.(Source: fox59.com)

Market Challenge

Sustainability Concerns and Regulations

Increasing ethical and environmental concerns, especially regarding palm oil production, are leading to stringent sustainability certifications and standards. Fulfilling these needs can be complex and costly, potentially hampering market growth for certain players. Moreover, the market extensively depends on natural oils such as coconut and palm oil, which are subject to price volatility due to factors like climate change, crop yields, and geopolitical events. These fluctuations can substantially affect the production profitability and costs.

Country Insight

The growth of the U.S. detergent alcohols market is attributed to the strict regulations encouraging eco-friendly and biodegradable surfactants along with the increasing shift towards high-performance and concentrated dishwashing detergents. Furthermore, Ongoing innovation in formulation technologies and chemical synthesis will improve product effectiveness and minimize environmental impact.

What are the Household Cleaning Products Export Data of United States in 2024?

| Quantity | Price (USD) |

| 345 KGS | 18,432.79 |

| 17590 KGM | 34,828.2 |

| 16104 KGM | 31,563.84 |

| 19195 KGM | 38,390 |

| 25160 KGM | 49,816.8 |

(Source: Volza.com)

Segmental Insight

Source Insights

Which Source Type Segment Dominated the U.S. Detergent Alcohols Market in 2024?

The natural detergent alcohol segment dominated the market in 2024. The dominance of the segment is credited to the growing consumer demand for eco-friendly products, innovations in biotechnology for natural alcohol production, and the rising regulatory pressures for sustainability. Also, natural alcohol is extensively used in home care and personal care applications, with manufacturers emphasizing certifications and traceability like USDA and RSPO.

- In November 2023, Amazon Launchpad announced Ops Clean, a natural laundry detergent solution, as the 2023 European Startup of the Year. This natural product effectively cleans all kinds of laundry with just one ingredient.(Source: aboutamazon.eu)

The synthetic detergent alcohol segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be linked to the surge in the need for cleaning products, especially in the industrial and residential sectors coupled with the increasing awareness of hygiene and the demand for efficient cleaning solutions. Moreover, the growing regulatory scrutiny and environmental concerns on fossil-based inputs are impelling market players to adopt more greener alternatives.

Application Insights

Why Laundry Segment Held The Largest U.S. Detergent Alcohols Market Share in 2024?

The laundry detergents segment led the market in 2024. The dominance of the segment can be driven by rapid urbanization, growing hygiene awareness, and the demand for concentrated and sustainable cleaning products. In addition, changing consumer lifestyles, like raised disposable income and inclination towards effective and convenient cleaning solutions, contribute to the segment growth further in the market.

The personal care and cosmetics segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is owing to the growing focus on sanitation and personal hygiene, particularly after the COVID-19 pandemic. Detergent alcohols are utilized in a few personal care products like shampoos, lotions, and hair care products, fuelling the demand across various formulations.

Recent Developments

- In April 2025, WSP Systems, a laundry system integrator provider in the Netherlands, stepped into the North American laundry market. The company further says this will mark the arrival of the latest independent system integrator in the U.S. market.(Source: americanlaundrynews.com)

- In July 2023, Carbona entered the detergent market with the launch of new laundry detergent sheets. The sheets completely dissolve and leave no residue behind in short wash or regular cycles in warm, cold, or hot water, according to the company.(Source: happi.com)

Top Companies List

- Stepan Company

- Kraton Corporation

- Procter & Gamble

- Vantage Specialty Chemicals, Inc.

- Colonial Chemical

- Pilot Chemical Company

- Oleon NV

- Essential Labs

- Rita Corporation

Segments Covered

By Application

- Laundry Detergents

- Dishwashing Detergents

- Personal Care & Cosmetics

- Industrial Cleaners

- Other Applications

By Source

- Natural

- Synthetic