Content

U.S. Biomaterials Market Size, Share and Industry Analysis

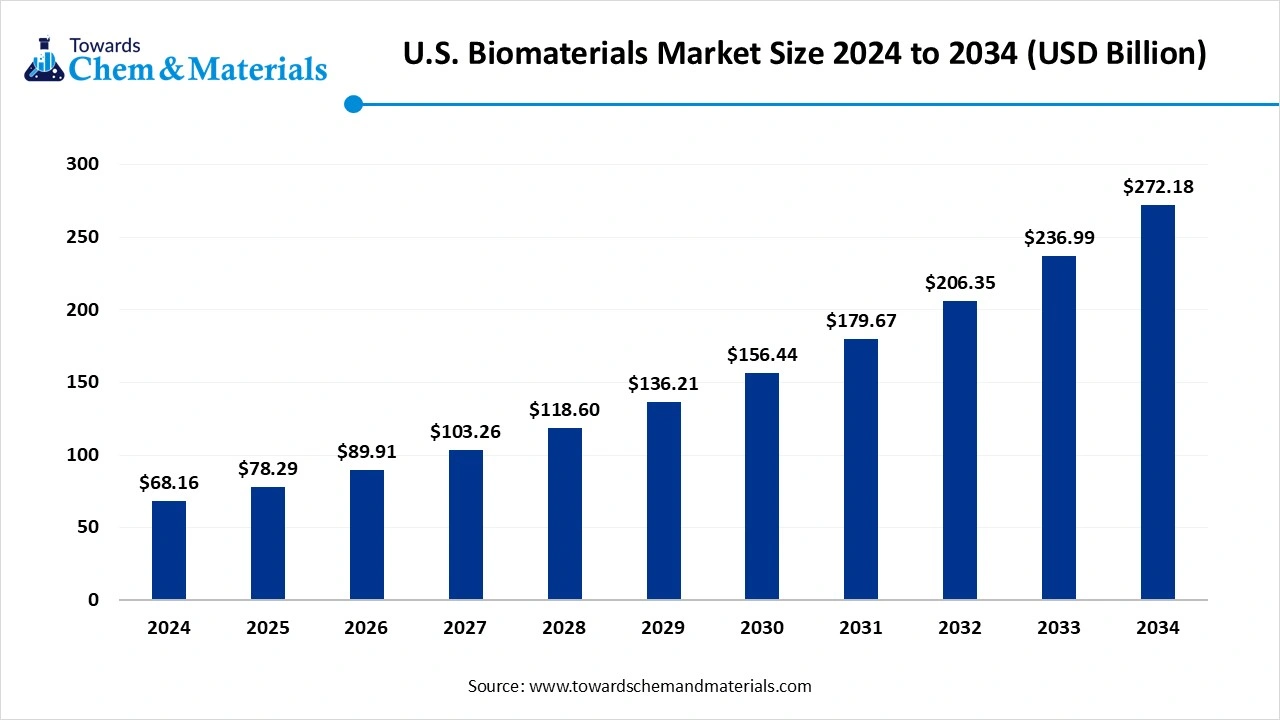

The U.S. biomaterials market size was valued at USD 68.16 billion in 2024, grew to USD 78.29 billion in 2025, and is expected to hit around USD 272.18 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.85% over the forecast period from 2025 to 2034. The increasing manufacturing of medical implants, focus on personalised medicine, and development of cardiovascular devices drive the market growth.

Key Takeaways

- By material type, the polymers segment held a 32% share in the U.S. biomaterials market in 2024 due to its biocompatibility.

- By material type, the hydrogels segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing wound care demand.

- By product type, the implantable devices & materials segment held a 40% share in the market in 2024 due to the rising prevalence of chronic disorders.

- By product type, the scaffolds & tissue engineering segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing rate of organ transplants.

- By application area, the orthopedics segment held a 30% share in the market in 2024 due to the growth in musculoskeletal disorders.

- By application, the aesthetic & reconstructive surgery segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing rate of cosmetic surgery.

- By end user, the hospitals & surgical centers segment held a 46% share in the market in 2024 due to the growing rate of surgeries.

- By end user, the pharmaceutical & biotech companies segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing personalized implants customization.

- By form factor, the solid implants segment held a 38% share in the U.S. biomaterials market in 2024 due to the increasing sport-related injuries.

- By form factor, the 3D printed constructs segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing medical device customization.

- By manufacturing technology, the conventional processing segment held a 50% share in the market in 2024 due to the well-established production infrastructure.

- By manufacturing technology, the additive manufacturing segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing development of surgical tools.

What are the U.S. Biomaterials?

U.S. biomaterials are natural materials that interact with biological systems to treat, augment, diagnose, enhance, & replace biological functions in various devices. Biomaterials possess characteristics like excellent chemical properties, biocompatibility, and interaction with biological systems. The various types of biomaterials include metals, composites, polymers, natural materials, and ceramics. The biomaterials are widely used in applications like hip replacements, tissue engineering, drug delivery, prosthetics, knee replacements, and dental fillings.

Factors like the presence of advanced healthcare infrastructure, strong focus on personalised medicine, increasing age-related issues, growth in orthopedic surgery, rise in development of regenerative medicine, and advancement in wound healing contribute to the growth of the U.S. biomaterials market.

Biomaterials Product Export

- Solventum Inc. is the leading supplier of wound care in the United States.(Source: www.volza.com)

- The United States exported 9726 shipments of orthopedic implants.(Source: www.volza.com)

- The United States exported 4919 shipments of surgical implants.(Source: www.volza.com)

- The United States exported 62055 shipments of medical devices.(Source: www.volza.com)

Growing Prevalence of Chronic Disease Drives Market Growth

The growing elderly population and the increasing rate of age-related chronic disorders like arthritis and osteoporosis increase the demand for biomaterials for various processes like replacement of joints & bone repair. The growing chronic issues like hip replacements, musculoskeletal disorders, wear & tear of joints, and others increase demand for biomaterials. The growing demand for chronic devices like vascular grafts, heart valves, and stents uses biomaterials.

The high prevalence of diseases like cancer & diabetes increases demand for therapeutic devices that require biomaterials. The growth in the development of bone regeneration technologies and knee prosthetics increases the adoption of biomaterials. The growing prevalence of chronic disease is a key driver for the growth of the U.S. biomaterials market.

Market Trends

- Growing Medical Device Development: The increasing development of various medical devices like wound care, orthopedic implants, prosthetics, pacemakers, and dental implants increases the adoption of biomaterials.

- Technological Advancements: The ongoing technological advancements, like the development of customized implants, targeted drug delivery systems, bioactive scaffolds, stereolithography, and stem cell science, increase demand for biomaterials.

- Growing Elderly Population: The growing age-related disorders like cardiovascular diseases, arthritis, & osteoporosis, and high prevalence of diseases like joint problems & heart diseases increase demand for biomaterials.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 78.29 Billion |

| Expected Size by 2034 | USD 272.18 Billion |

| Growth Rate from 2025 to 2034 | CAGR 14.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Material Type, By Product Type, By Application Area, By End-User, By Form Factor, By Manufacturing Technology |

| Key Companies Profiled | Medtronic, Johnson & Johnson, Stryker, Zimmer Biomet, Baxter International, 3M, W. L. Gore & Associates, B. Braun, Abbott Laboratories, Integra LifeSciences, Organogenesis, Corbion, Evonik Industries, DSM Biomedical, Terumo Corporation, Collagen Matrix, Orthofix Medical, Surmodics, CorMatrix Cardiovascular, Becton, Dickinson and Company |

Market Opportunity

Growing Plastic Surgery Surges Demand for Biomaterials

The growing influence of social media and the focus on maintaining a youthful appearance increase demand for plastic surgery. The growing surgeries like breast augmentation, rhinoplasty, and facelifts increases demand for biomaterials. The increasing surgeries, such as gaping holes, soft tissue wounds, and burns, increase the adoption of plastic surgery, which requires advanced biomaterials.

The aging population and growing demand for cosmetic procedures increase demand for biomaterials. The focus on lowering infection rates and enhancing healing rates increases the adoption of biomaterials. The focus on enhancing the aesthetics of skin and the growing adoption of plastic surgery in men increases demand for biomaterials. The growing plastic surgery creates an opportunity for the growth of the U.S. biomaterials market.

Market Challenge

High Development Cost Halts Biomaterials Expansion in the U.S.

Despite several applications of biomaterials in various industries, the high development cost restricts the market growth. Factors like complex manufacturing processes, stricter regulations, long research timelines, high investment in R&D, high-cost raw materials, and the need for consistent materials are responsible for the high production cost. The expensive raw materials like metal, polymers, and ceramics increase the development cost. The energy-intensive manufacturing process and the need for extensive testing increase the cost.

The long-term clinical trials and stricter regulatory environments require a high cost. The need for standardization and various regulatory hurdles increases the cost. The high development cost hampers the growth of the U.S. biomaterials market.

Country Insights

South U.S. Biomaterials Market Trends

The South region dominated the U.S. biomaterials market in 2024. The well-established healthcare infrastructure and presence of a skilled workforce increase demand for biomaterials. The increasing investment in research & development and supportive regulatory policies increases the production of biomaterials.

The increasing prevalence of chronic diseases and advancements in tissue engineering increase the adoption of biomaterials. The growing development of regenerative medicine and a strong focus on tissue engineering increase demand for biomaterials, supporting the overall growth of the market.

West U.S. Biomaterials Market Trends

The West region is experiencing the fastest growth in the market during the forecast period. The growing prevalence of chronic diseases and a strong focus on regenerative medicine increase demand for biomaterials.

The increasing adoption of medical devices like pacemakers & dental implants and the growing plastic surgery application, increases demand for biomaterials. The increasing need for wound healing products and focus on personalized medicine increases demand for biomaterials. The supportive government policies and strong presence of manufacturing facilities support the overall growth of the market.

Segmental Insights

Material Type Insights

Why did the Polymers Segment Dominate the U.S. Biomaterials Market?

The polymers segment dominated the U.S. biomaterials market in 2024. The focus on minimizing inflammation risks and on biocompatibility increases demand for polymers. The growing development of heart devices and orthopedic implants increases demand for polymers. The rising rate of chronic disorders and increasing tissue engineering scaffolds increases demand for polymers. The increasing manufacturing of drug delivery systems and innovations in medical treatment increase demand for polymers, driving the overall market growth.

The hydrogels segment is the fastest-growing in the market during the forecast period. The growing demand for wound dressing and focus on releasing & encapsulating therapeutic agents increases demand for hydrogels. The increasing adoption of regenerative medicine and growing utilization of soft contact lenses increase the adoption of hydrogels. The increasing need for aesthetic cosmetic products and growth in dermal fillers increases demand for hydrogels. The growing musculoskeletal disorders and advancements in wound care increase demand for hydrogels, supporting the overall growth of the market.

Product Type Insights

How Implantable Devices & Materials Segment Held the Largest Share in the U.S. Biomaterials Market?

The implantable devices & materials segment held the largest revenue share in the U.S. biomaterials market in 2024. The increasing rate of chronic disorders like musculoskeletal disorders, heart diseases, and osteoarthritis increases the demand for implantable devices. The strong presence of advanced healthcare facilities and increasing discovery in clinical applications increases the development of implantable devices and materials. The growing dental issues and increasing need for orthopedic implants drive the market growth.

The scaffolds & tissue engineering segment is experiencing the fastest growth in the market during the forecast period. The growing demand for organ transplants and the growth in diseases like traumatic injuries, cancer, & others increases demand for tissue engineering. The growing patients with non-functioning organs disorder and a high preference for personalised medicine increases demand for tissue engineering. The applications, such as plastic surgery, repairing heart valves, and wound healing, increase the adoption of scaffolds, supporting the overall market growth.

Application Area Insights

Which Application Area Segment Dominated the U.S. Biomaterials Market?

The orthopedics segment dominated the U.S. biomaterials market in 2024. The growing musculoskeletal disorders like osteoporosis & osteoarthritis increase demand for orthopedic biomaterials. The growing elderly population and growth in chronic skeletal health disorders increase the adoption of orthopedic biomaterials. The increasing utilization of processes like fracture fixation, joint reconstruction, and spinal fusion increases demand for orthopedic biomaterials. The presence of key players like Johnson & Johnson, Stryker, and Zimmer Biomet drives the overall market growth.

The aesthetic & reconstructive surgery segment is the fastest-growing in the market during the forecast period. The rise in cosmetic and plastic surgery increases demand for aesthetic biomaterials. The increasing need for wound healing and the growing rate of soft tissue loss in elderly people increase demand for aesthetic & reconstructive biomaterials. The growing focus on facial rejuvenation and advancements in wound dressing increases demand for aesthetic & reconstructive biomaterials, supporting the overall market growth.

End-User Insights

How Hospitals & Surgical Centers Segment Held the Largest Share in the U.S. Biomaterials Market?

The hospitals & surgical centers segment held the largest revenue share in the U.S. biomaterials market in 2024. The growing surgeries like reconstructive surgery, joint replacements, and cardiovascular issues increases demand for hospitals. The strong presence of advanced healthcare infrastructure and the need for modern medical equipment help the market growth. The growing rate of plastic surgery and the increasing need for advanced medical procedures increase demand for surgical centers, driving the overall market growth.

The pharmaceutical & biotech companies segment is experiencing the fastest growth in the market during the forecast period. The growth in cardiovascular diseases and joint degeneration increases demand for advanced biomaterials, which requires pharma & biotech companies. The growing customization of personalised implants and the rise in regenerative medicine require pharma & biotech companies. The ongoing innovation in drug delivery systems and increasing need for implants requires pharma & biotech companies to develop biomaterials, supporting the overall market growth.

Form Factor Insights

Why did Solid Implants Segment Dominate the U.S. Biomaterials Market?

The solid implants segment dominated the U.S. biomaterials market in 2024. The growing rate of osteoarthritis and the need for load-bearing implants increase demand for solid implants. The growing surgical volume and high need for joint replacements increase demand for solid implants. The growth in hip & knee replacements and increasing sport-related surgeries increases demand for solid implants. The growing development of implantable devices and increasing bone fractures require solid implants, driving the overall market growth.

The 3D printed constructs segment is the fastest-growing in the market during the forecast period. The growing customization of medical devices and a strong focus on regenerative medicine increase demand for 3D printed constructs. The increasing development of drugs and the high need for cosmetic testing increase demand for 3D printed constructs. The growing rate of organ transplants and the development of biomimetic scaffolds increase the adoption of 3D printed constructs.

Manufacturing Technology Insights

Which Manufacturing Technology Held the Largest Share in the U.S. Biomaterials Market?

The conventional processing segment held the largest revenue share in the U.S. biomaterials market in 2024. The growth in applications like dentistry, orthopedics, and cardiovascular diseases increases demand for conventional processing. The increasing large-scale production of biomaterials and cost-effectiveness increase the adoption of conventional processing. The growing creation of joint replacements, screws, and plates increases demand for conventional processing. The strong presence of conventional processing infrastructure drives the market growth.

The additive manufacturing segment is experiencing the fastest growth in the market during the forecast period. The growing development of surgical tools and the customization of implants increases demand for additive manufacturing. The need for rapid creation of prototypes and increasing development of various medical products increases the demand for additive manufacturing. The rise in regenerative medicine and growth in tissue engineering increase the adoption of additive manufacturing, supporting the overall market growth.

U.S. Biomaterials Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for biomaterials in the United States includes forestry residue such as bark, sawdust, & others, agricultural residue, algae, waste streams, dedicated energy crops, and algae.

- Chemical Synthesis and Processing: The chemical synthesis and processing involve methods like polymerization, in vivo synthesis, sol-gel process, plasma processing, and chemical vapor deposition.

- Quality Testing and Certification: The quality testing involves testing of qualities like mechanical property, contamination testing, shelf life testing, functional testing, degradation testing, performance testing, sterility testing, chemical property testing, & biocompatibility testing and certifications like RSB & ISCC Plus.

Recent Developments

- In April 2025, Northern Illinois University launched the biomaterials & tissue engineering lab. It is a wet lab at CEET and supports biological matter, liquids, and chemical experiments. The lab is equipped with a cell culture incubator, a microplate reader, an oven, a freeze dryer, a biosafety cabinet, several types of microscopes, fabrication equipment, and a ductless fume hood.(Source: cleanroomtechnology.com)

- In April 2025, Covation Biomaterials launched sustainable biobased PTMEG. It lowers environmental impact and is used in applications like thermoplastic elastomers, spandex, & polyurethanes. It lowers greenhouse gas emissions and minimizes carbon footprint.(Source: worldbiomarketinsights.com)

- In September 2025, IFF launched a biomaterial laundry detergent solution for sustainable consumer products. It is useful in industries like nutrition, packaging, health, and beauty. The solution uses DEB platforms and enhances fabric softness.(Source: worldbiomarketinsights.com)

U.S. Biomaterials Market Top Companies

- Medtronic

- Johnson & Johnson

- Stryker

- Zimmer Biomet

- Baxter International

- 3M

- W. L. Gore & Associates

- B. Braun

- Abbott Laboratories

- Integra LifeSciences

- Organogenesis

- Corbion

- Evonik Industries

- DSM Biomedical

- Terumo Corporation

- Collagen Matrix

- Orthofix Medical

- Surmodics

- CorMatrix Cardiovascular

- Becton, Dickinson and Company

Segments Covered

By Material Type

- Polymers (PEEK, UHMWPE, PLGA, PLA, PCL, etc.)

- Metals & Alloys (Titanium, Stainless Steel, Cobalt-Chromium)

- Ceramics & Glasses (Alumina, Zirconia, Bioactive Glass, Calcium Phosphates)

- Natural Biomaterials (Collagen, Chitosan, Alginate, Silk, Elastin)

- Hydrogels (Synthetic, Natural)

- Composites (Polymer-Ceramic, Fiber-Reinforced)

- Decellularized Matrices & ECM-based Materials

- Bioinks (for Bioprinting)

By Product Type

- Implantable Devices & Materials (orthopedic, cardiovascular, dental, ophthalmic, neurological, reconstructive)

- Scaffolds & Tissue Engineering Matrices

- Wound Care Biomaterials (dressings, films, foams)

- Drug-Delivery Biomaterials (microparticles, nanoparticles, implants)

- Diagnostic & Assay Substrates (biosensors, immobilization supports)

- Medical Device Components (tubing, films, membranes, seals)

- Adhesives & Hemostats (fibrin, synthetic adhesives)

- Cell Culture Substrates (plates, coatings, hydrogels)

By Application Area

- Orthopedics

- Cardiovascular

- Dental

- Wound Care & Skin Regeneration

- Ophthalmology

- Neurology & Neuroprosthetics

- Aesthetic & Reconstructive Surgery

- Drug Delivery

- Diagnostics & Biosensors

- Research & Academic Use

By End-User

- Hospitals & Surgical Centers

- Clinics & Ambulatory Care Centers

- Pharmaceutical & Biotechnology Companies

- Contract Research & Manufacturing Organizations (CROs/CMOs)

- Academic & Government Research Institutes

- Medical Device Manufacturers

By Form Factor

- Solid Implants (screws, plates, prostheses)

- Powders & Particulates (bone grafts, HA powders)

- Films & Membranes (barriers, dressings)

- Liquids & Gels (injectables, hydrogels)

- 3D Printed & Prefabricated Constructs

By Manufacturing Technology

- Conventional Processing (injection molding, sintering, machining)

- Additive Manufacturing / 3D Bioprinting

- Electrospinning & Fiber Technologies

- Coating & Surface Modification (drug-eluting, antimicrobial, bioactive)

- Sol-Gel & Advanced Chemistry Methods

List of Figures

- Figure 1: U.S. Biomaterials Market Size (2024–2034) (USD 68.16 Billion in 2024, CAGR 14.85%)

- Figure 2: U.S. Biomaterials Market by Material Type, 2024 (%) – Polymers (32%), Metals & Alloys (20%), Ceramics & Glasses (15%), Natural Biomaterials (12%), Hydrogels (10%), Composites (6%), Decellularized Matrices & ECM (3%), Bioinks (2%)

- Figure 3: U.S. Biomaterials Market by Product Type, 2024 (%) – Implantable Devices & Materials (40%), Scaffolds & Tissue Engineering (15%), Wound Care Biomaterials (12%), Drug-Delivery Biomaterials (10%), Diagnostic & Assay Substrates (8%), Medical Device Components (6%), Adhesives & Hemostats (5%), Cell Culture Substrates (4%)

- Figure 4: U.S. Biomaterials Market by Application Area, 2024 (%) – Orthopedics (30%), Cardiovascular (20%), Dental (12%), Wound Care & Skin Regeneration (10%), Ophthalmology (8%), Neurology & Neuroprosthetics (6%), Aesthetic & Reconstructive Surgery (7%), Drug Delivery (5%), Diagnostics & Biosensors (2%)

- Figure 5: U.S. Biomaterials Market by End-User, 2024 (%) – Hospitals & Surgical Centers (46%), Clinics & Ambulatory Care Centers (20%), Pharmaceutical & Biotechnology Companies (15%), Contract Research & Manufacturing Organizations (8%), Academic & Government Research Institutes (6%), Medical Device Manufacturers (5%)

- Figure 6: U.S. Biomaterials Market by Form Factor, 2024 (%) – Solid Implants (38%), Powders & Particulates (18%), Films & Membranes (15%), Liquids & Gels (14%), 3D Printed & Prefabricated Constructs (15%)

- Figure 7: U.S. Biomaterials Market by Manufacturing Technology, 2024 (%) – Conventional Processing (50%), Additive Manufacturing (20%), Electrospinning & Fiber Technologies (12%), Coating & Surface Modification (10%), Sol-Gel & Advanced Chemistry Methods (8%)

- Figure 8: U.S. Biomaterials Market by Region, 2024 (%) – South (40%), West (25%), Midwest (20%), Northeast (15%)

- Figure 9: Competitive Landscape – Market Share of Leading Companies, 2024 (%) – Medtronic (10%), Johnson & Johnson (9%), Stryker (8%), Zimmer Biomet (7%), Baxter International (6%), Others (60%)

- Figure 10: Recent Developments in the U.S. Biomaterials Market (2024–2025)

List of Tables

- Table 1: U.S. Biomaterials Market Size (2024–2034) (USD 68.16 Billion in 2024, CAGR 14.85%)

- Table 2: U.S. Biomaterials Market by Material Type, 2024 (%) – Polymers (32%), Metals & Alloys (20%), Ceramics & Glasses (15%), Natural Biomaterials (12%), Hydrogels (10%), Composites (6%), Decellularized Matrices & ECM (3%), Bioinks (2%)

- Table 3: U.S. Biomaterials Market by Product Type, 2024 (%) – Implantable Devices & Materials (40%), Scaffolds & Tissue Engineering (15%), Wound Care Biomaterials (12%), Drug-Delivery Biomaterials (10%), Diagnostic & Assay Substrates (8%), Medical Device Components (6%), Adhesives & Hemostats (5%), Cell Culture Substrates (4%)

- Table 4: U.S. Biomaterials Market by Application Area, 2024 (%) – Orthopedics (30%), Cardiovascular (20%), Dental (12%), Wound Care & Skin Regeneration (10%), Ophthalmology (8%), Neurology & Neuroprosthetics (6%), Aesthetic & Reconstructive Surgery (7%), Drug Delivery (5%), Diagnostics & Biosensors (2%)

- Table 5: U.S. Biomaterials Market by End-User, 2024 (%) – Hospitals & Surgical Centers (46%), Clinics & Ambulatory Care Centers (20%), Pharmaceutical & Biotechnology Companies (15%), Contract Research & Manufacturing Organizations (8%), Academic & Government Research Institutes (6%), Medical Device Manufacturers (5%)

- Table 6: U.S. Biomaterials Market by Form Factor, 2024 (%) – Solid Implants (38%), Powders & Particulates (18%), Films & Membranes (15%), Liquids & Gels (14%), 3D Printed & Prefabricated Constructs (15%)

- Table 7: U.S. Biomaterials Market by Manufacturing Technology, 2024 (%) – Conventional Processing (50%), Additive Manufacturing (20%), Electrospinning & Fiber Technologies (12%), Coating & Surface Modification (10%), Sol-Gel & Advanced Chemistry Methods (8%)

- Table 8: U.S. Biomaterials Market by Region, 2024 (%) – South (40%), West (25%), Midwest (20%), Northeast (15%)

- Table 9: Competitive Landscape – Market Share of Leading Companies, 2024 (%) – Medtronic (10%), Johnson & Johnson (9%), Stryker (8%), Zimmer Biomet (7%), Baxter International (6%), Others (60%)

- Table 10: Recent Developments and Strategic Initiatives in the U.S. Biomaterials Market (2024–2025)