Content

What is the Current Thermoplastic Polyimides Market Size and Share?

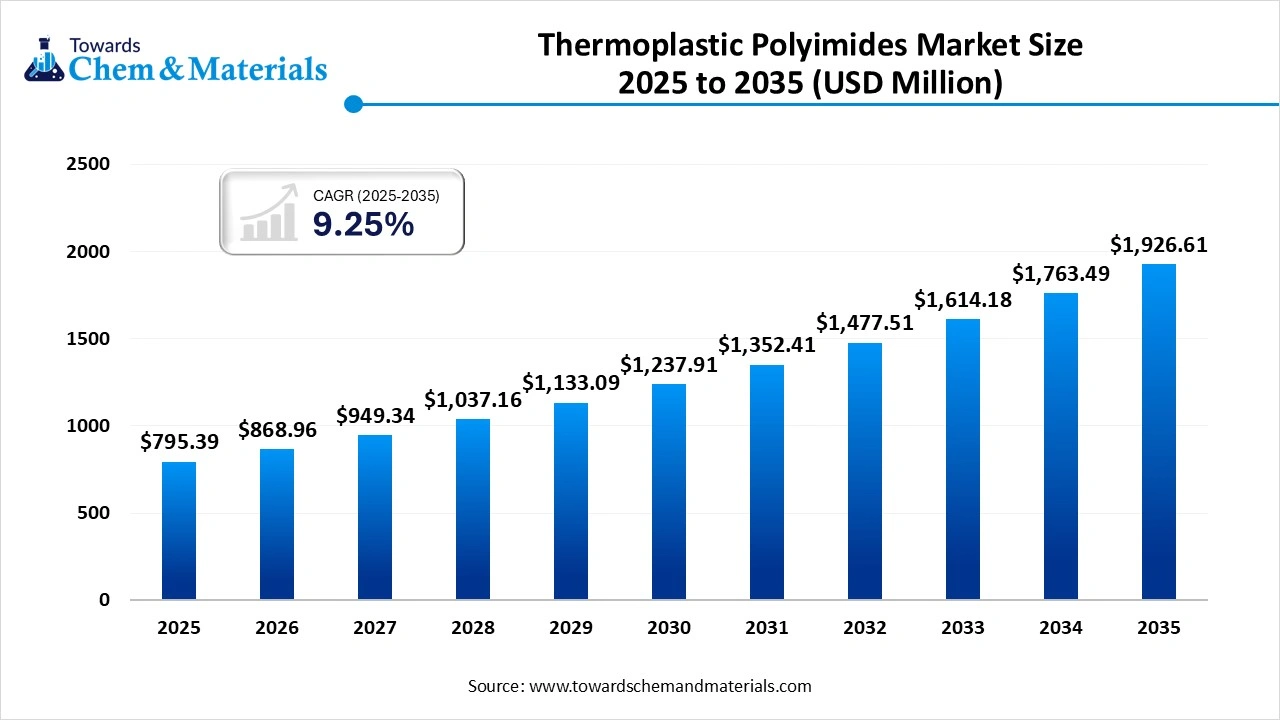

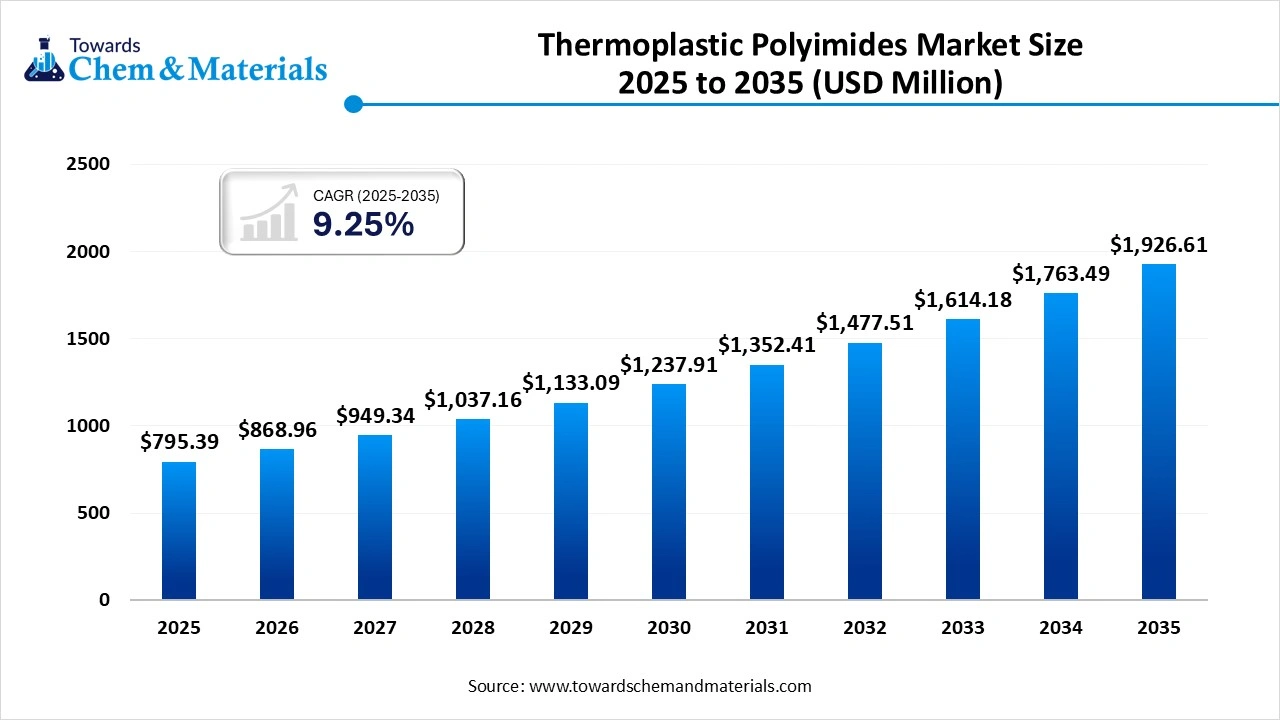

The global thermoplastic polyimides market size is calculated at USD 795.39 million in 2025 and is predicted to increase from USD 868.96 million in 2026 and is projected to reach around USD 1,926.61 million by 2035, The market is expanding at a CAGR of 9.25% between 2026 and 2035. North America dominated the thermoplastic polyimides market with a market share of 35.48% the global market in 2025. The market is fueled by demand for high-performance materials, with applications in advanced electronics, lightweight aerospace components, and heat-resistant automotive parts.

Key Takeaways

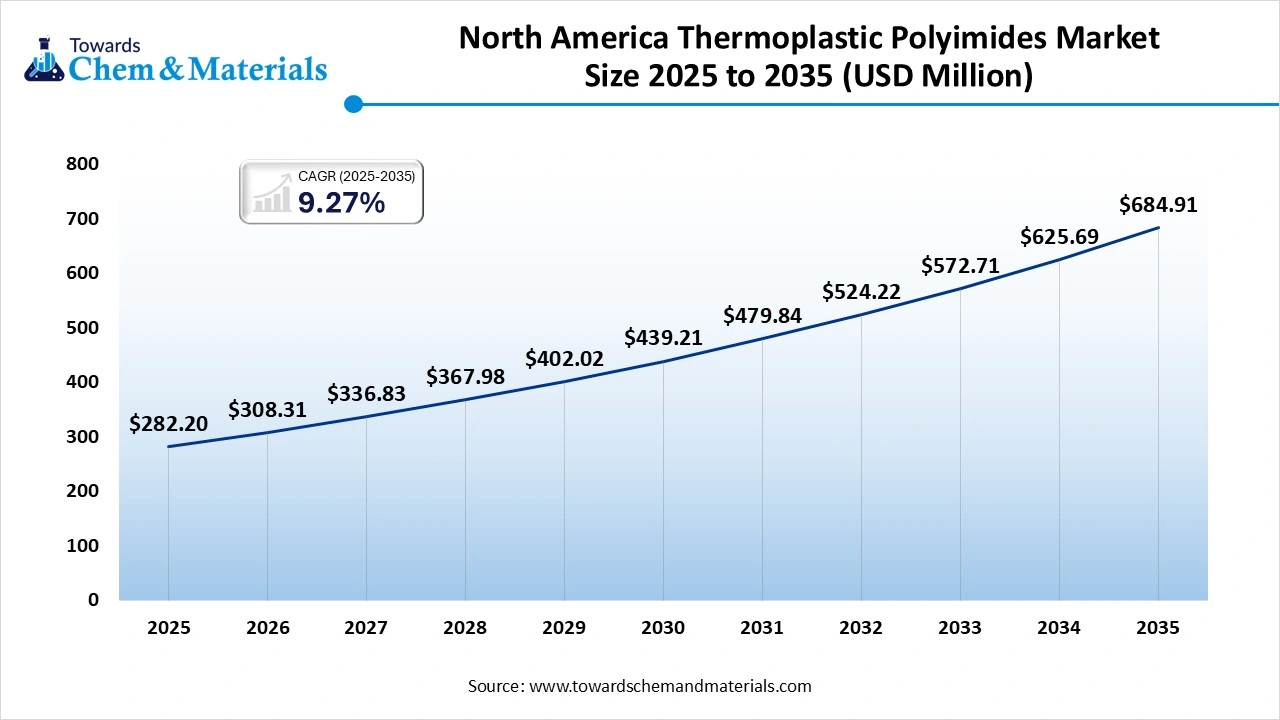

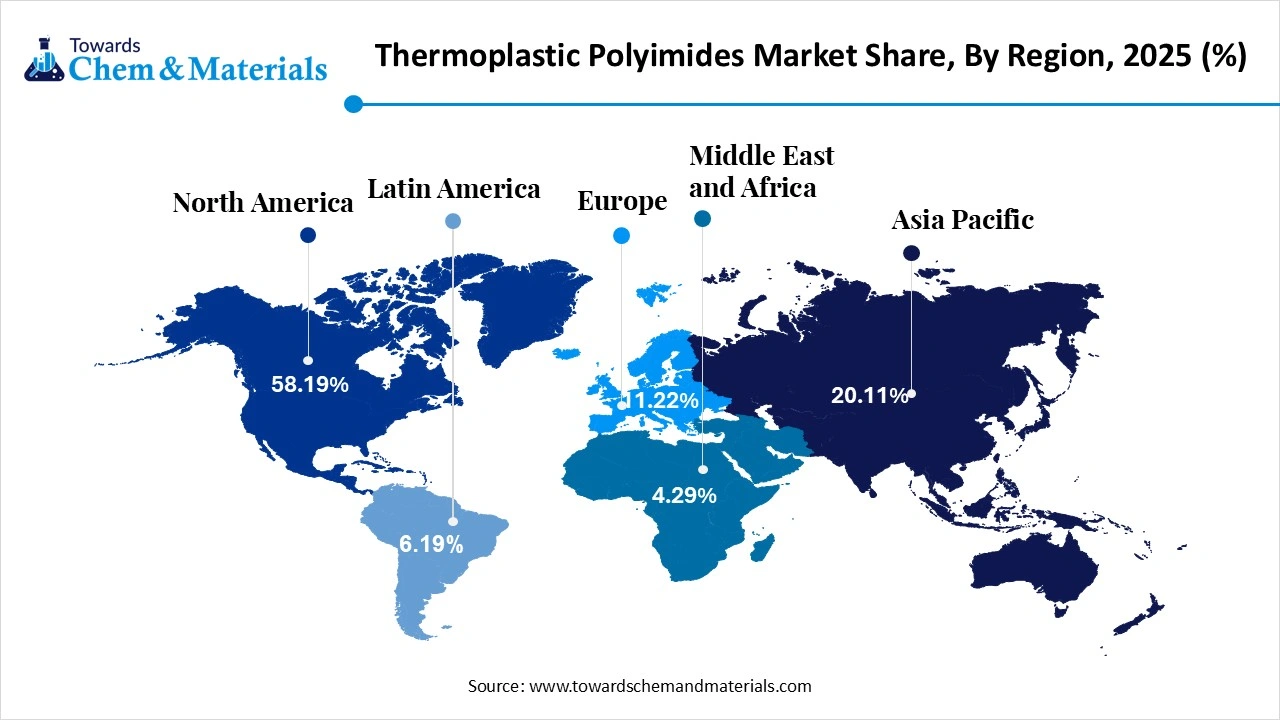

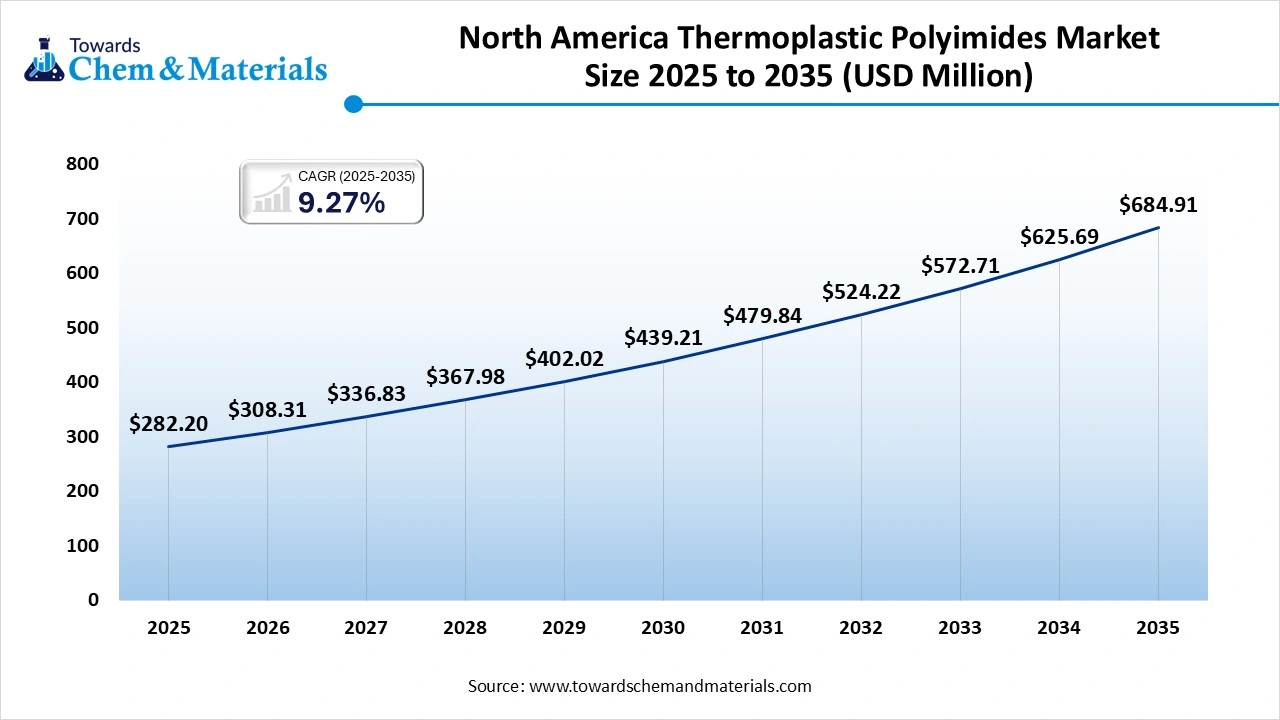

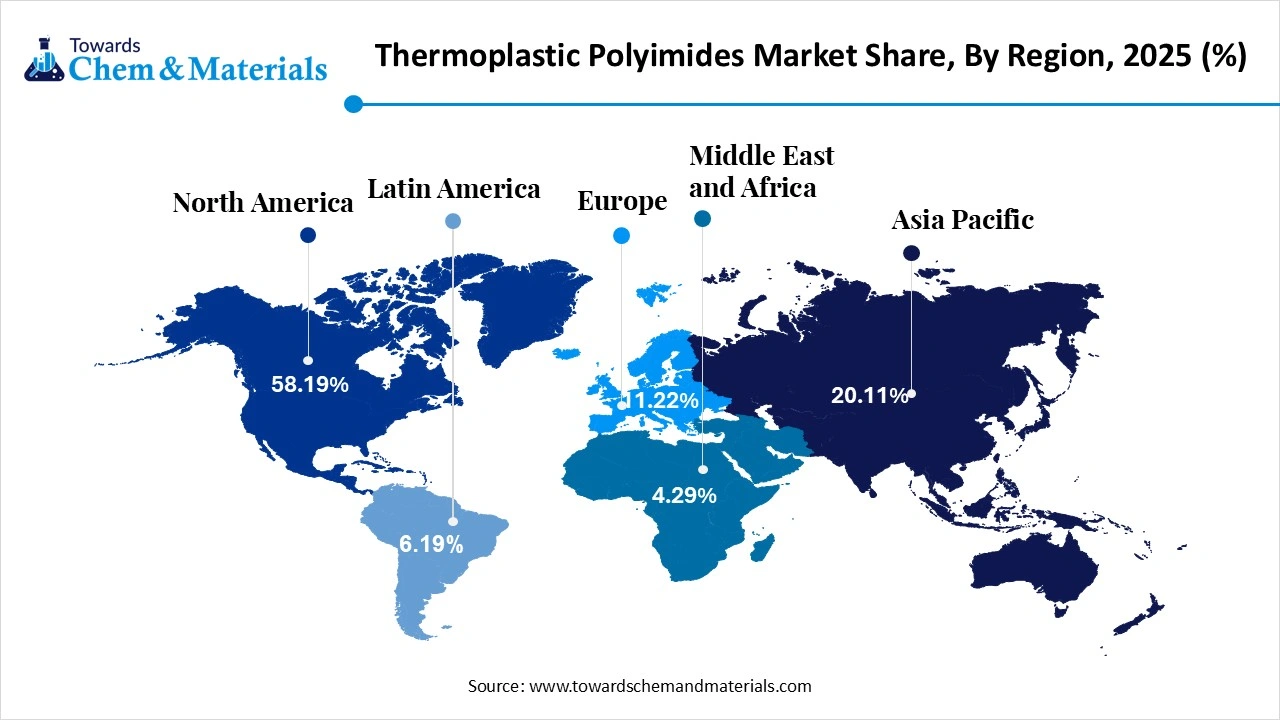

- By region, North America led the thermoplastic polyimides market with the largest revenue share of over 35.48% in 2025.

- By product type, the film/sheets segment led the market with the largest revenue share of 41% in 2025.

- By application, the electronics & electrical segment led the market with the largest revenue share of 36.12% in 2025.

- By technology/ processing type, the injection molding segment accounted for the largest revenue share of 31.11% in 2025.

- By distribution channel, the direct sales segment dominated with the largest revenue share of 51.48% in 2025.

Market Overview

The Thermoplastic Polyimides (TPI) Market refers to the global industry of high-performance polymers known for their exceptional thermal stability, chemical resistance, mechanical strength, and electrical insulation properties. Thermoplastic polyimides are widely used in demanding applications across aerospace, automotive, electronics, electrical, and industrial sectors where high heat resistance, lightweight structures, and durability are critical.

What Is The Significance Of The Thermoplastic Polyimides Market?

The significance of the thermoplastic polyimides (TPIs) market lies in its role as a high-performance material crucial for industries like aerospace, electronics, and automotive. TPIs offer superior thermal stability, dimensional stability, and chemical resistance, which are essential for advanced applications such as flexible circuits, high-temperature insulation, and lightweight components. The market's growth is driven by increasing demand from sectors like electric vehicles, wearable electronics, and medical devices.

Thermoplastic Polyimides Market Growth Trends:

- Electronics: Growing demand for TPI in flexible electronics, advanced semiconductor packaging, and 5G infrastructure is a major driver.

- Automotive: The shift to EVs is boosting TPI use due to its ability to handle high temperatures and mechanical loads in components like bushings and traction control systems.

- Aerospace: TPI's high thermal stability and chemical resistance are leading to increased use in lightweight, fuel-efficient aircraft components.

- Sustainability: There is a growing focus on developing more sustainable and recyclable TPI resins, including bio-based options, to meet environmental regulations and consumer demand.

- Innovation in processing: Advances in processing techniques and additive manufacturing (3D printing) are expanding the application horizons for TPI.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 868.96 Million |

| Revenue Forecast in 2035 | USD 1,926.61 Million |

| Growth Rate | CAGR 9.25% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments covered | By Product Type, By Application, By Technology / Processing Type, By Distribution Channel, By Regions |

| Key companies profiled | Solvay S.A., Evonik Industries AG , SABIC, Mitsui Chemicals, Inc., Ensinger GmbH, DuPont de Nemours, Inc. , Toray Industries, Inc. , BASF SE , Ascend Performance Materials , Solvay Speciality Polymers , Kaneka Corporation , Mitsubishi Gas Chemical Company, Inc., Arkema S.A. , Zhejiang Jingxin Polymer Materials Co., Ltd. , UBE Industries, Ltd. , Polyplastics Co., Ltd. , Hitachi Chemical Co., Ltd. , Kolon Industries, Inc. , Celanese Corporation , DSM Engineering Materials , Jiangsu Blue Star New Materials Co., Ltd. |

Key Technological Shifts In The Thermoplastic Polyimides Market:

The thermoplastic polyimides (TPI) market is being shaped by several key technological shifts aimed at enhancing material performance, processability, and sustainability. These shifts are driven by increasing demand from high-tech industries such as electronics, aerospace, and automotive, especially for electric vehicles (EVs).

These polymers offer processability advantages over traditional thermoset polyimides, allowing for injection moulding, extrusion, and film fabrication. The market is driven by the rising demand for advanced materials in high-temperature electronics, electric vehicles, aerospace components, and other industrial applications, alongside increasing adoption of high-performance polymers in energy-efficient and miniaturised systems.

Trade Analysis Of the Thermoplastic Polyimides Market

- According to Global Export data, the world shipped 949 shipments of Thermoplastic Polymer, involving 175 exporters and 172 buyers.

- Most exports go to the United States, Mexico, and Vietnam.

The leading exporters are South Korea, China, and Germany, with South Korea at the top with 458 shipments, - China with 146 shipments, and Germany with 109.

- Based on India Export data, India exported 457 shipments of Thermoplastic, with 60 exporters supplying 106 buyers.

- The thermoplastics exports from India is majorly destined to the United States, Bangladesh, and Nepal.

- Globally, the top exporters of thermoplastics are Vietnam, China, and Taiwan, with Vietnam leading at 90,808 shipments, China with 25,391, and Taiwan with 8,352.

Thermoplastic Polyimides Market -- Value Chain Analysis

- Chemical Synthesis and Processing: Thermoplastic polyimides are produced through polycondensation and high-temperature polymerisation of dianhydrides and diamines, followed by melt processing methods such as injection molding, extrusion, compression molding, and film casting.

- Key players: SABIC, Solvay S.A., Evonik Industries AG, Mitsui Chemicals, Toray Industries Inc

- Quality Testing and Certification:Thermoplastic polyimides undergo evaluation for heat resistance, tensile strength, dielectric properties, and long-term durability under standards like ASTM D638, ISO 9001, and AS9100 for aerospace-grade quality.

- Key players: ASTM International, UL Solutions, SGS, TÜV SÜD.

- Distribution to Industrial Users:These high-performance polymers are supplied to aerospace, electronics, automotive, and industrial machinery sectors through speciality polymer distributors, direct OEM supply, and material solution providers.

- Key players: Solvay S.A., SABIC, Evonik Industries AG, Toray Industries Inc.

Thermoplastic Polyimides Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. EPA; OSHA; FDA (for certain end-uses) | TSCA; OSHA Chemical Safety Standards; FDA Material Compliance (for food/medical-grade applications) | Chemical registration; worker safety; thermal polymer processing standards | High-performance polymers like polyimides undergo additional scrutiny for emissions, workplace exposure, and speciality aerospace/defence approvals. |

| European Union | ECHA; European Commission; EFSA (for food-contact) | REACH; CLP Regulation; Food Contact Materials Regulation (EC) 1935/2004 | Registration; hazard classification; restrictions; end-use safety | Polyimides used in electrical, aerospace and food-contact applications must undergo REACH evaluation; strict VOC and thermal degradation guidelines apply. |

| China | Ministry of Ecology & Environment (MEE); SAMR | MEE Order No. 12; GB Standards; Product Quality Law | New chemical registration; environmental risk review; industrial standards | China requires a local agent appointment for foreign polyimide suppliers; GB standards define heat/chemical resistance benchmarks. |

| India | MoEFCC; BIS | Hazardous Chemicals Rules; BIS Standards for Engineering Plastics | Import approvals; environmental safety; product quality | India mandates compliance for speciality engineering plastics; local testing may be required for high-temperature polymers. |

| Japan | METI; MHLW | CSCL; Industrial Safety and Health Law | Pre-market evaluation; worker exposure control; polymer safety review | Japan has one of the most detailed polymer safety classifications; high-temp engineered plastics undergo strict CSCL screening. |

| South Korea | MoE; MSS | K-REACH; Chemical Control Act | Chemical inventory notification; risk assessment | Thermoplastic polyimides used in electronics must comply with South Korea’s strong regulatory oversight on polymer emissions and thermal decomposition by-products. |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated The Thermoplastic Polyimides Market In 2025?

The film/sheets segment led the market with the largest revenue share of 41% in 2025.Thermoplastic polyimide films and sheets are widely used in high-performance environments due to their exceptional thermal stability, chemical resistance, and mechanical strength. Their ability to maintain performance under extreme conditions supports strong industrial demand and continuous material innovation.

The coatings segment expects significant growth in the thermoplastic polyimides market during the forecast period. Thermoplastic polyimide coatings provide superior surface protection, high dielectric strength, and long-term durability. Increasing use in advanced manufacturing, microelectronics, and protective layering technologies is driving consistent growth for this product segment.

The rods/tubes segment has seen notable growth in the market. Rods and tubes made from thermoplastic polyimides are valued for their dimensional stability, machinability, and resistance to wear and solvents. Their ability to perform reliably in high-load and high-heat environments makes them indispensable in precision engineering and specialised industrial applications.

Application Insights

How Did the Electronics And Electricals Segment Dominated The Thermoplastic Polyimides Market In 2025?

The electronics & electrical segment led the market with the largest revenue share of 36.12% in 2025. In electronics and electrical systems, thermoplastic polyimides support applications. They are used in flexible printed circuits, connectors, semiconductor manufacturing, and insulation films. Their stability at high operating temperatures and compatibility with advanced fabrication processes make them a preferred material for next-generation electronic components.

The aerospace and defense segment expects significant growth in the market during the forecast period. The aerospace sector uses thermoplastic polyimides for lightweight structural components, insulation materials, and parts exposed to extreme heat or chemical environments. Increasing emphasis on high-performance polymers enhances adoption in modern aerospace designs.

The automotive segment has seen notable growth in the thermoplastic polyimides market. In automotive applications, these materials are used in components requiring heat resistance, electrical insulation, and long-term durability. Their ability to withstand aggressive environmental stress and maintain strength across wide temperature ranges positions thermoplastic polyimides as a key material in modern vehicle engineering.

Technology/ Processing Type Insights

Which Technology/Processing Type Segment Dominated The Thermoplastic Polyimides Market In 2025?

The injection molding segment accounted for the largest revenue share of 31.11% in 2025.Injection moulding is widely used for manufacturing precise and complex thermoplastic polyimide components. The process enables high-volume production while retaining material integrity and thermal performance. Growing demand for lightweight and durable engineered components supports this segment’s expansion.

The extrusion segment expects significant growth in the thermoplastic polyimides market during the forecast period. Extrusion technology is essential for producing continuous thermoplastic polyimide. Its advantages include consistent material distribution, high throughput, and compatibility with multiple downstream processing steps. Applications in industries continue to drive the adoption of extruded polyimide products, especially in custom engineering solutions.

The coating/lamination segment has seen notable growth in the market. Coating and lamination processes enhance the surface properties and performance of substrates in electronics, aerospace, and industrial applications. Laminated structures provide enhanced strength and multilayer functionality. The rise in flexible electronics and high-end protective materials fuels growth in this segment.

Distribution Channel Insight

How Did the Direct Sales Segment Dominated The Thermoplastic Polyimides Market In 2025?

The direct sales segment dominated with the largest revenue share of 51.48% in 2025.Direct sales remain the dominant channel for high-performance materials like thermoplastic polyimides due to the need for technical customisation, certification support, and long-term supply partnerships. Manufacturers prefer direct procurement to ensure quality consistency and tailored specifications. This channel also facilitates stronger collaboration with material producers.

The online/ digital platforms segment expects significant growth in the thermoplastic polyimides market during the forecast period. Online and digital platforms are gaining traction as procurement channels for smaller batches, prototyping needs, and global accessibility. Engineers and R&D teams use online platforms to source speciality grades and compare technical data more efficiently. The rise of digital commerce in industrial materials is improving transparency and accelerating procurement cycles.

The distributors and resellers segment has seen notable growth in the market. Distributors and resellers play an important role in servicing regional markets, smaller manufacturers, and industries requiring diversified inventory. This channel supports broad market penetration, particularly in emerging markets and sectors seeking easier access to speciality polymer materials.

Regional Insights

The North America thermoplastic polyimides market size was valued at USD 282.20 million in 2025 and is expected to reach USD 684.91 million by 2035, growing at a CAGR of 9.27% from 2026 to 2035. North America led the market with 35.48% share in 2025. North America holds a significant share of the thermoplastic polyimides market, supported by the strong presence of industries. The region’s advanced R&D capabilities and high adoption of high-performance polymers drive consistent market expansion. Increasing investment in EV components, industrial automation, and next-generation electronics continues to accelerate demand.

US: Thermoplastic Polyimides Market Growth Trends

The U.S. dominates North America’s market due to its large aerospace manufacturing base, extensive defence-sector applications, and strong presence of semiconductor fabrication and high-end automotive production. Demand is fueled by the need for high-temperature polymer components in aircraft, EVs, industrial machinery, and precision electronics, supported by a robust technological infrastructure.

The Asia Pacific Is Expected To Grow Significantly Due To Growing Demand

Asia Pacific is expected to experience significant growth in the market in the forecast period. Asia-Pacific is the fastest-growing region, driven by large-scale electronics production, automotive expansion, and rapid advancements in semiconductor fabrication. Cost-efficient production and rising investment in advanced materials continue to propel growth.

China: Thermoplastic Polyimides Market Growth Trends

China is the dominant market within Asia-Pacific, supported by massive consumer electronics manufacturing, rapid EV production, and expanding aerospace capabilities. The country’s strong focus on technological self-reliance, semiconductor ecosystem growth, and adoption of high-temperature engineering polymers significantly boosts the demand for thermoplastic polyimides.

Europe's Growth In The Market Is Driven By The Strong Presence Of Manufacturing Hubs

Europe represents a mature and innovation-driven market for thermoplastic polyimides, led by aerospace, automotive engineering, and advanced industrial manufacturing. The region’s stringent quality and performance regulations, along with strong R&D activity in speciality polymers, enhance adoption across high-reliability electrical, mechanical, and thermal applications. Growing emphasis on lightweight materials in mobility and industrial systems further supports market growth.

Germany: Thermoplastic Polyimides Market Growth Trends

Germany leads the European market due to its powerful automotive sector, precision engineering ecosystem, and strong electronics manufacturing capabilities. The country’s focus on high-performance materials in EVs, industrial robotics, and aerospace components drives steady consumption of thermoplastic polyimides across key manufacturing clusters.

South America Market Growth Is Driven By Strong Presence Of Production Capacity

South America is an emerging market where the adoption of thermoplastic polyimides is gradually increasing across automotive parts manufacturing, industrial processing, and electronics assembly. Growth is supported by expanding production capacity, modernisation of industrial operations, and gradual adoption of speciality polymers for high-performance engineering applications. Overall demand is improving but remains in early development stages.

Brazil: Thermoplastic Polyimides Market Growth Trends

Brazil drives the South American market with its large automotive production base, growing industrial machinery sector, and increasing adoption of advanced materials for durable and heat-resistant components. Government-led manufacturing competitiveness initiatives and rising interest in high-performance polymers support steady demand growth.

Middle East & Africa Growth Is Driven By The Increased Investments

The Middle East & Africa market is at a nascent stage, with demand led primarily by industrial processing, energy-sector equipment, and aerospace maintenance operations. Increased investments in advanced manufacturing technologies, particularly in GCC countries, are gradually promoting the adoption of high-temperature polymer materials for specialised applications.

United Arab Emirates: Thermoplastic Polyimides Market Growth Trends

The UAE shows rising demand driven by its industrial diversification efforts, expansion of aerospace maintenance and engineering operations, and investments in advanced manufacturing. The need for reliable, high-performance materials in energy, aviation, and industrial components contributes to the growing adoption of thermoplastic polyimides.

Recent Developments

- In February 2025, Arkema showcased its range of polyimide (PI) films from its affiliate PI Advanced Materials at JEC World 2025. They also unveiled several other innovations, including new solutions for battery recycling, Elium resins for circular economy applications, and UDX tapes combining carbon fibres with bio-based polymers.(Source: www.arkema.com)

- In July 2025, Arkema and PI Advanced Materials launched the new brand name Zenimid for their high-performance polyimide product range.(Source: www.arkema.com)

- In September 2025, BASF launched Ultramid H33 L, the world's first thermoplastic polyamide with high water permeability. This innovative material is designed for artificial sausage casings, allowing them to be smoked and dried while maintaining strength and thin walls.(Source: www.indianchemicalnews.com)

Top Players in the Thermoplastic Polyimides Market & Their Offerings:

- Solvay S.A.: Solvay is a leading global producer of high-performance thermoplastic polyimides, known for its KetaSpire® and AvaSpire® product families. The company focuses on aerospace, automotive, and electronics applications that demand exceptional thermal stability and mechanical strength. Strong R&D capabilities and a broad speciality polymers portfolio enhance its market leadership.

- Evonik Industries AG: Evonik offers advanced high-temperature engineering polymers, including thermoplastic polyimides tailored for extreme environments.

- SABIC: SABIC provides high-performance thermoplastic solutions with growing capabilities in the polyimides segment. Its materials are engineered for applications requiring durability, heat resistance, and dimensional stability. The company’s global presence and strategic focus on speciality polymers make it a significant vendor in this market.

- Mitsui Chemicals, Inc.: Mitsui Chemicals develops advanced polyimide-based materials that cater to the semiconductor, automotive, and aerospace industries. The company strengthens its position through technology-driven innovations, high-performance formulations, and partnerships across the value chain.

- Ensinger GmbH: Ensinger manufactures a wide range of high-performance polymers, including thermoplastic polyimides for demanding industrial applications. The company is recognised for its precision machining capabilities, consistent material quality, and strong presence in European engineering plastics markets.

Top Companies in the Thermoplastic Polyimides Market

- DuPont de Nemours, Inc.

- Toray Industries, Inc.

- BASF SE

- Ascend Performance Materials

- Solvay Speciality Polymers

- Kaneka Corporation

- Mitsubishi Gas Chemical Company, Inc.

- Arkema S.A.

- Zhejiang Jingxin Polymer Materials Co., Ltd.

- UBE Industries, Ltd.

- Polyplastics Co., Ltd.

- Hitachi Chemical Co., Ltd.

- Kolon Industries, Inc.

- Celanese Corporation

- DSM Engineering Materials

- Jiangsu Blue Star New Materials Co., Ltd.

Segments Covered

By Product Type

- Film / Sheets

- Rods / Tubes

- Coatings

- Fibres / Filaments

- Others

By Application

- Electronics & Electrical

- Automotive

- Aerospace & Defense

- Industrial Machinery

- Medical Devices

- Others

By Technology / Processing Type

- Injection Molding

- Extrusion

- Coating / Lamination

- Others

By Distribution Channel

- Direct Sales

- Distributors & Resellers

- Online / Digital Platforms

- Others

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa