Content

U.S. Synthetic Resin Market Size and Forecast 2025 to 2034

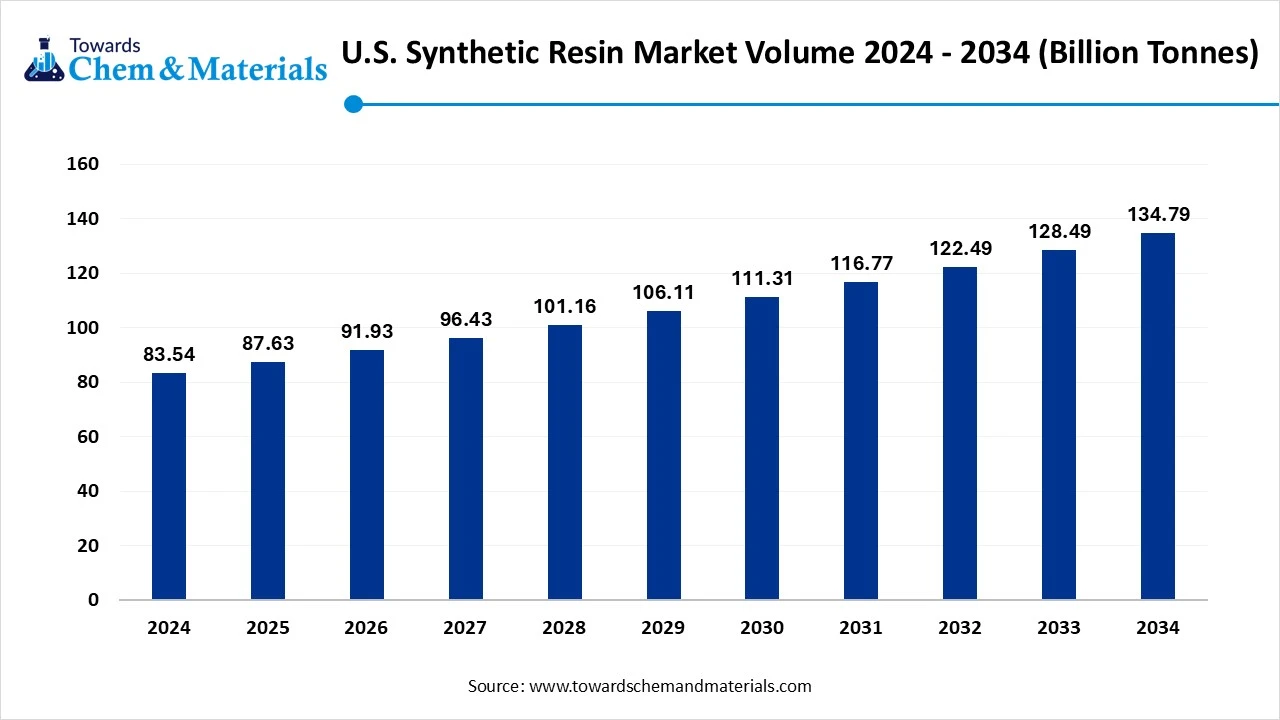

The U.S. synthetic resin market size was reached at USD 83.54 billion in 2024 and is expected to be worth around USD 134.79 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.9% over the forecast period 2025 to 2034. Growing demand for durable and high-performance materials is the key factor driving market growth. Also, technological advancements in the resin industry, coupled with the rapid urbanisation in the country, can fuel market growth further.

Key Takeaways

- By product, the thermosetting resins segment dominated the market with the largest share in 2024. The dominance of the segment can be attributed to the increasing synthetic resin demand from the construction and automotive sectors.

- By product, the thermoplastic segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing product demand from electronics, automotive, and packaging sectors.

- By form, the solid/granules/powder segment held the largest market share in 2024. The dominance of the segment can be linked to the versatility and cost-effectiveness of these materials.

- By form, the liquid/resin solutions (solventborne) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the increasing demand for fast cure and superior wetting profiles.

- By application, the packaging segment led the market by holding the largest market share in 2024. The dominance of the segment is owed to the growing resin demand from the food & beverage and e-commerce sectors.

- By application, the composites segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the growing need for high-performance lightweight materials in the aerospace and transportation sectors.

- By manufacturing, the additives & compounding segment dominated the market with the largest share in 2024. The growth of the segment can be credited to the rapid innovations in compounding technologies.

- By manufacturing, the polymerization route segment is expected to grow at the fastest CAGR during the projected period. The dominance of the segment can be attributed to the growing adoption of recycled materials and bio-based resins as a sustainable alternative to plastic.

Technological Advancements Are Expanding Market Growth

Synthetic resins are industrially manufactured organic polymers (thermoplastic or thermosetting) supplied as liquids, powders, or pellets that cure, set, or melt to form plastics, coatings, adhesives, and composite matrices; used across packaging, construction, automotive, electronics, adhesives & coatings, and industrial applications.

Advancements in resin formulations create materials with enhanced properties like electrical insulation and high thermal stability for the electronics industry, which will lead to market growth soon.

What Are the Key Trends Influencing the U.S. Synthetic Resin Market?

- The expanding end-user industries in the country, like consumer goods/lifestyle, building & construction, and automotive & transportation, are the latest trend in the market. These sectors use the product due to its measure properties like moisture resistance, chemical resistance, and cost-effectiveness.

- The rise in need for high-performance coatings in commercial and industrial infrastructure is another trend impacting positive market growth, as the concerns associated with abrasion, corrosion, and chemical resistance rise, which are pushing industries towards more advanced formulations of polyurethane, epoxy, and acrylic resin coatings.

- The surge in environmental awareness is boosting the shift from conventional petrochemicals to bio-based resins extracted from renewable sources like agricultural waste and plant oils. Also, heavy investment in recycling infrastructure is driving the market growth soon.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 87.63 Billion |

| Expected Size by 2034 | USD 134.79 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.9% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Form, By Application, By Manufacturing, |

| Key Companies Profiled | Dow Inc., ExxonMobil Chemical , LyondellBasell Industries , BASF SE , SABIC (and U.S. operations) , Chevron Phillips Chemical , DuPont / Chemours (split businesses) , Celanese Corporation , Eastman Chemical Company , Formosa Plastics (USA) , Westlake Chemical , INEOS (including INEOS Olefins & Polymers) , Arkema (U.S. operations) , Huntsman Corporation , Solvay / Toray / Mitsubishi Chemical |

Market Opportunity

Circular Economy Initiatives

The ongoing investment in recycling infrastructure, along with the rapid integration of post-consumer recycled materials, is creating lucrative opportunities in the market. This initiative addresses regulatory mandates regarding plastic waste by aligning with sustainability goals. Furthermore, advancements in polymer chemistry, like innovative waterborne and UV-curable resins, decrease volatile organic compound (VOC) emissions.

Market Challenges

Competition From Alternatives

The market is witnessing growing competition from alternative materials such as metals, bioplastics, and natural composites, which creates a threat to traditional resin use. Moreover, this high competition can facilitate pricing pressure, which impacts profit margins, especially for commoditized or less-differentiated products.

Country Insight

U.S. Synthetic Resin Market Trends

The Gulf Coast region dominated the market with the largest market share in 2024. The dominance of the region can be attributed to its strong petrochemical infrastructure, which offers cost-effective and abundant raw materials such as petrochemical derivatives. In addition, the region's overall growth is also propelled by high demand from major sectors like construction, automotive, and packaging, where resins give crucial properties.

The West Coast region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the robust product demand from sectors such as electronics, transportation, and construction. Furthermore, strong e-commerce growth on the West Coast requires protective, efficient, and lightweight packaging solutions, boosting demand for high-performance resins soon.

Segmental Insight

Product Insight

Which Product Type Segment Dominated the U.S. Synthetic Resin Market in 2024?

The thermosetting resins segment dominated the market with the largest share in 2024. The dominance of the segment can be attributed to the increasing synthetic resin demand from the construction and automotive sectors for durable, lightweight, and high-performance materials. Additionally, rapid advancements in developing sustainable and cutting-edge bio-based thermosetting resins lead to further segment growth.

The thermoplastic segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing product demand from electronics, automotive, and packaging sectors, due to the need for more high-performance and lightweight materials. Also, the low weight of thermoplastics makes them an attractive choice over heavier materials such as steel.

Form Insight

Why Solid/Granules/Powder Segment Dominated the U.S. Synthetic Resin Market in 2024?

The solid/granules/powder segment held the largest market share in 2024. The dominance of the segment can be linked to the versatility and cost-effectiveness of these materials, along with the advancements in high-performance specialty resins. Moreover, these form resins are preferred for their long shelf life and ease of handling, which makes them a favoured choice in many demanding sectors.

The liquid/resin solutions (solventborne) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the increasing demand for fast cure and superior wetting profiles, coupled with the factors promoting high-throughput lines. Liquid solventborne resins give exceptional wetting properties, which make them convenient for industrial applications.

Application Insight

How Much Share Did the Packaging Segment Held in 2024?

The packaging segment led the market by holding the largest market share in 2024. The dominance of the segment is owing to the growing resin demand from the food & beverage and e-commerce sectors and the need to improve shelf life and product protection. Furthermore, an increasing emphasis on eco-friendly solutions is growing the demand for biodegradable and recyclable resins, supporting the adoption of mono-material packaging.

The composites segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the growing need for high-performance lightweight materials in the aerospace and transportation sectors, along with the ongoing investment in bio-based resin production. In addition, these composites offer exceptional moisture and chemical resistance and are highly valued in the medical industry.

Manufacturing Insight

Which Additives & Compounding Segment Dominated U.S. Synthetic Resin Market in 2024?

The additives & compounding segment dominated the market with the largest share in 2024. The growth of the segment can be credited to the rapid innovations in compounding technologies and the development of specialized and high-performance formulations. Additives and compounding optimise the properties such as flexibility and strength in many applications, impacting positive segment growth further.

The polymerization route segment is expected to grow at the fastest CAGR during the projected period. The dominance of the segment can be attributed to the growing adoption of recycled materials and bio-based resins as a sustainable alternative to plastic. Sectors such as automotive, packaging, electronics, and construction largely depend on synthetic resins manufactured through polymerization processes.

U.S. Synthetic Resin Market -Value Chain Analysis

- Feedstock Procurement : It is the acquisition of raw materials required for manufacturing synthetic resins in the market. These raw materials are generally derived from petrochemicals and hold a substantial portion of the major players' production costs.

- Chemical Synthesis and Processing : It is the industrial-scale production process that converts monomers into finished resin products. It is a crucial market stage that includes polymerization reactions and modification of the resins to achieve tailored properties for various applications.

- Packaging and Labelling : This stage refers to the use of synthetic resins in manufacturing packaging materials and labels for industrial and consumer goods. The integration of smart technologies is creating more reliable packaging solutions.

Regulatory Compliance and Safety Monitoring

This stage involves complex rules and frameworks from several federal agencies. These regulations are meant to ensure worker safety, protect human health, and reduce overall environmental impact throughout the resin lifecycle.

Recent Developments

- In June 2024, Ecolabs Purolite resin business, in collaboration with Repligen Corporation, unveiled Purolite's DurA Cycle, a resin used for large-scale purification. This current advancement marks a substantial step in Purolite's strategic partnership with Repligen.(Source: pharmaceuticalmanufacturer.media)

U.S. Synthetic Resin Market Top Companies

- Dow Inc.

- ExxonMobil Chemical

- LyondellBasell Industries

- BASF SE

- SABIC (and U.S. operations)

- Chevron Phillips Chemical

- DuPont / Chemours (split businesses)

- Celanese Corporation

- Eastman Chemical Company

- Formosa Plastics (USA)

- Westlake Chemical

- INEOS (including INEOS Olefins & Polymers)

- Arkema (U.S. operations)

- Huntsman Corporation

- Solvay / Toray / Mitsubishi Chemical

Segments Covered

By Product Type

- Thermoplastics

- Thermosetting resins

By Form

- Liquid / resin solutions (solventborne)

- Solid/Granules/Powder

By Application

- Packaging (rigid & flexible films, bottles, containers)

- Transportation & Automotive (interiors, structural composites, coatings)

- Construction & Building (pipes, insulation, coatings, adhesives)

- Electrical & Electronics (insulation, encapsulants, PCB laminates)

- Adhesives & Sealants (construction, industrial)

- Coatings & Paints (industrial, architectural)

- Composites (wind blades, aerospace, marine)

By Manufacturing

- Polymerization route (Ziegler/Natta, metallocene, suspension, emulsion, solution)

- Additives & compounding (fillers, flame retardants, stabilizers, colorants)