Content

Recycled PET (rPET) Market Size & Share Analysis Growth Trends

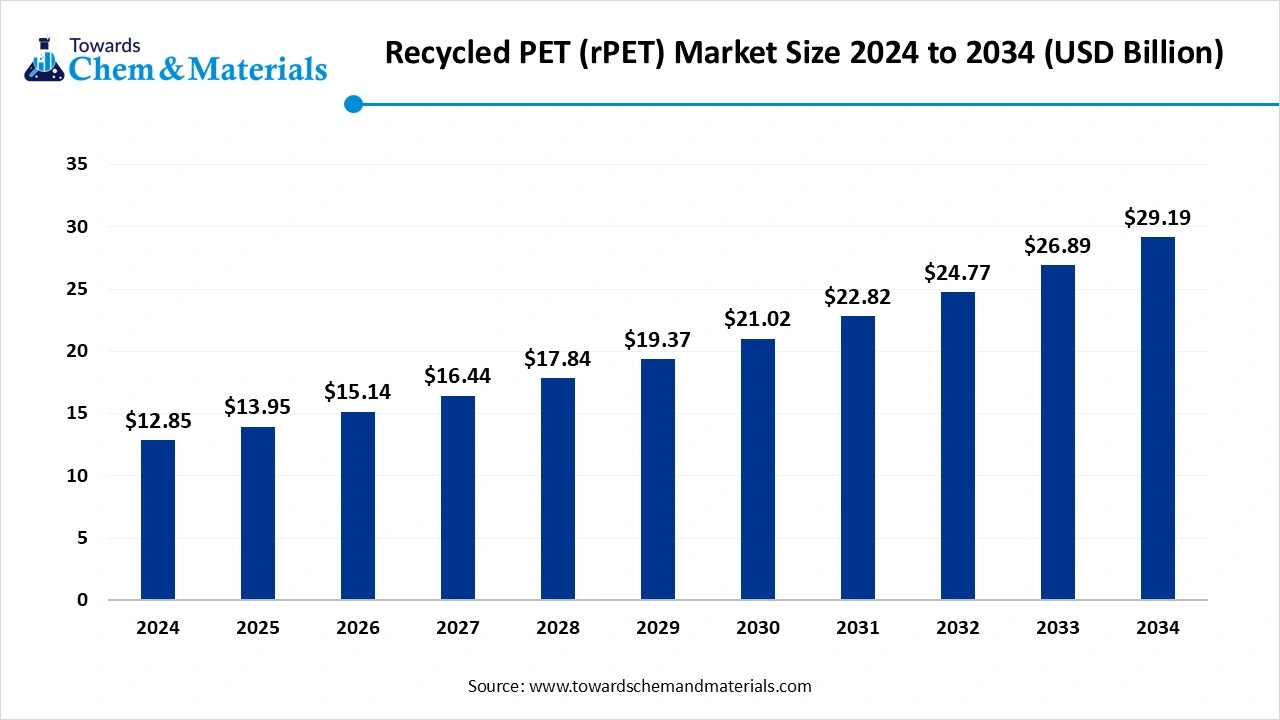

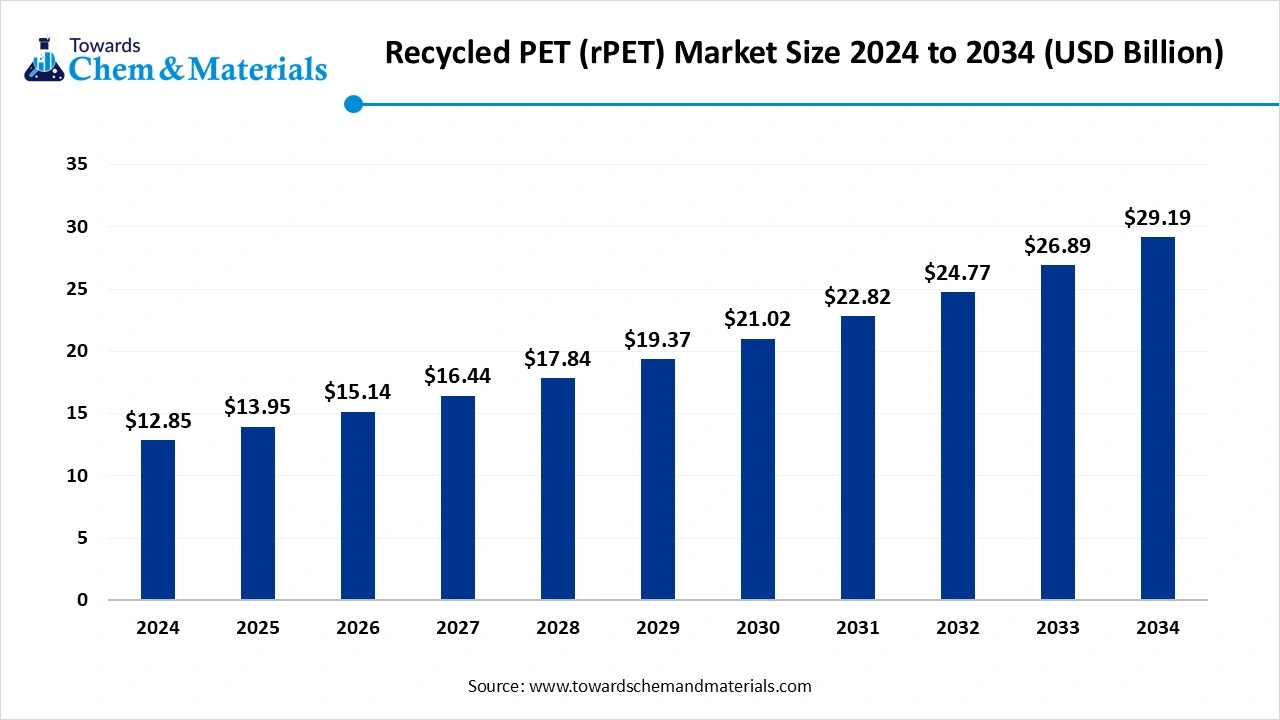

The global recycled PET (rPET) market size was reached at USD 12.85 billion in 2024 and is expected to be worth around USD 29.19 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.55% over the forecast period 2025 to 2034. The growth of the market is driven by the increasing consumer awareness of the environment, and the use of sustainable packaging increases the demand and growth of the market.

Key Takeaways

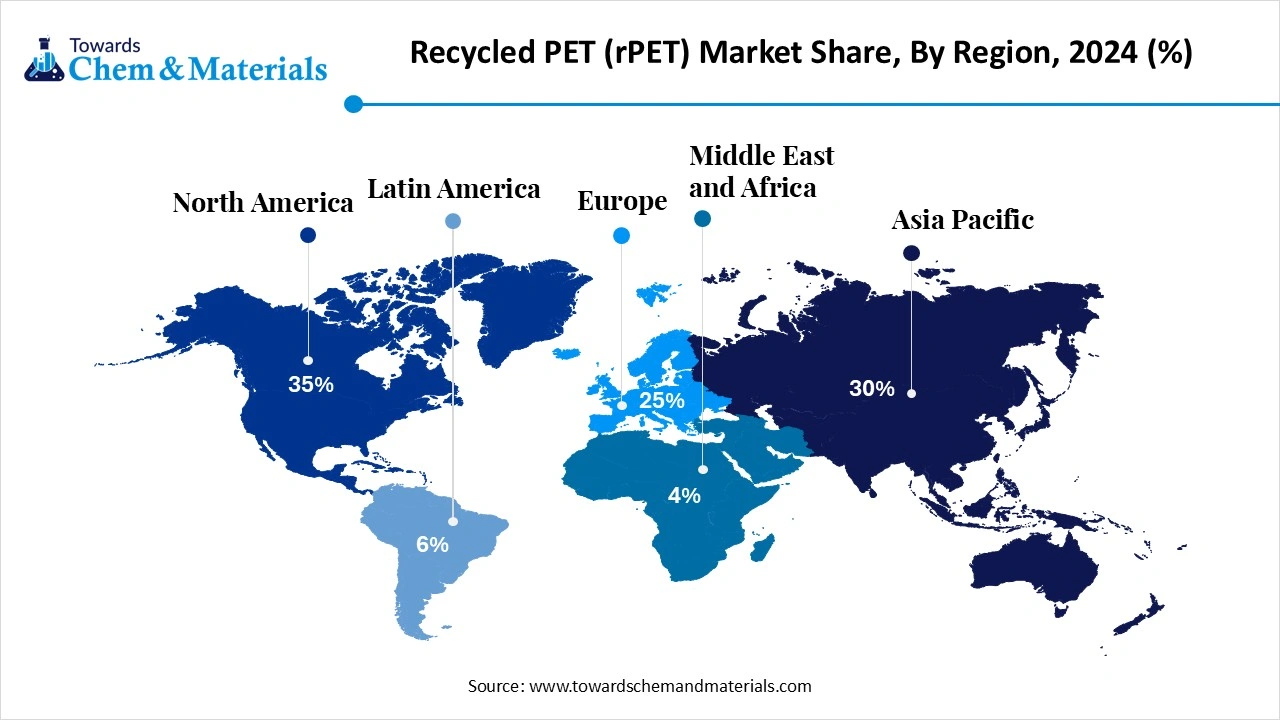

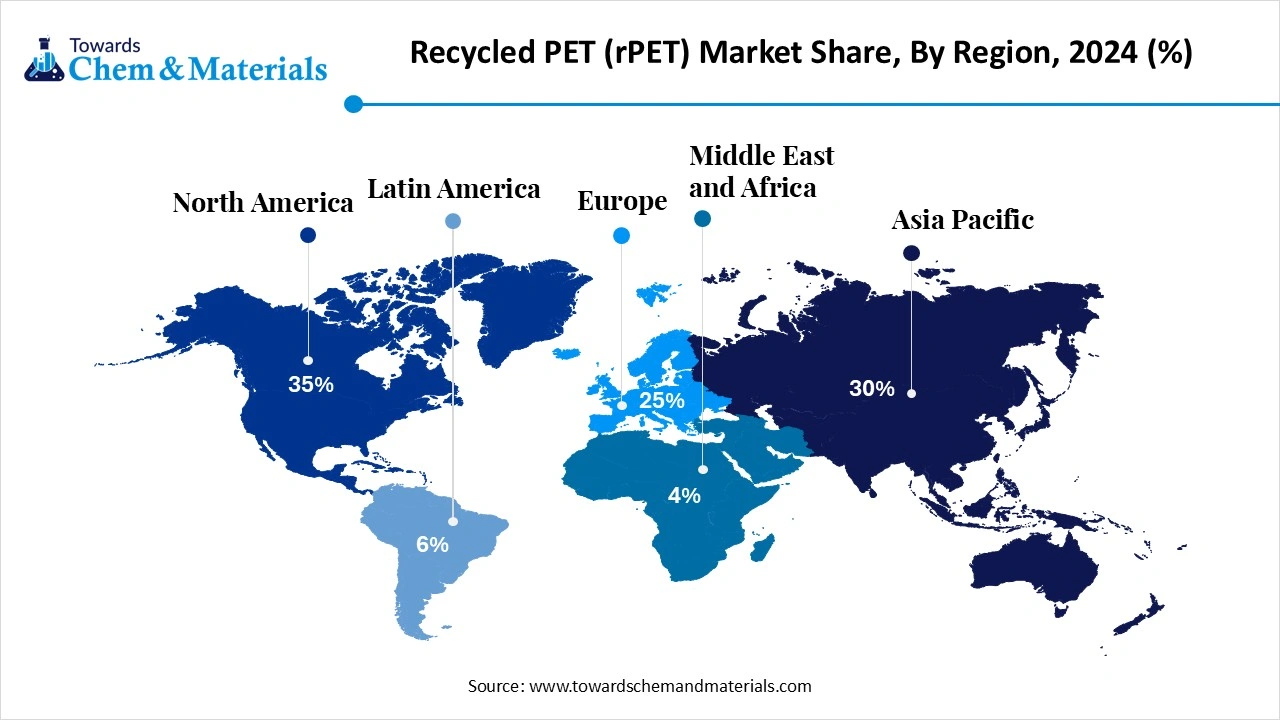

- By region, North America dominated the market in 2024. The North America region held a 35% share in the market in 2024. The growth is driven by increasing awareness in the region, which supports growth.

- By region, the Asia Pacific is expected to have significant growth in the market in the forecast period. The growth is driven by rapid industrialization.

- By source, the post-consumer PET segment dominated the market in 2024. The post-consumer PET segment held a 70% share in the market in 2024. It plays a vital role in sustainable packaging solutions for beverages and consumer goods, which supports growth.

- By source, the post-industrial PET segment is expected to grow significantly in the market during the forecast period. It offers consistent quality and purity, making it highly suitable for fiber production, fueling growth.

- By end-use industry, the packaging segment dominated the market in 2024. The packaging segment held a 55% share in the market in 2024. The food and beverage industry is a major driver.

- By end-use industry, the textile segment is expected to grow in the forecast period. rPET fibers are valued for their strength, versatility, and eco-friendly profile, which drives growth.

- By form, the r-PET resin segment dominated the market in 2024. The r-PET resin segment held a 45% share in the market in 2024. Resin is also used in industrial products where clarity and strength are required.

- By form, the r-PET fiber segment is expected to grow in the forecast period. It supports industries seeking greener alternatives, which increases adoption.

- By application, the bottles segment dominated the market in 2024. The bottles segment held a 60% share in the market in 2024. The growing shift towards sustainability drives the growth.

- By application, the fibers segment is expected to grow in the forecast period. Delivering strong performance characteristics drives growth.

- By the recycling process, the mechanical recycling segment dominated the market in 2024. The recycling process segment held a 75% share in the market in 2024. It is cost-effective, widely adopted, and capable of producing high-quality materials.

- By the recycling process, the chemical recycling segment is expected to grow in the forecast period. Valuable in applications requiring purity and high performance.

Market Overview

Rising Demand For Durable Materials: Recycled PET (rPET) Market To Expand

The recycled PET (rPET) market refers to the industry involved in the production and consumption of recycled polyethylene terephthalate (PET) materials. PET, a widely used plastic, is collected from post-consumer products (such as bottles and packaging) or post-industrial waste, then processed and reformed into new products. rPET is used primarily in the manufacturing of containers, bottles, fibers for textiles, automotive components, and various other consumer goods. The market aims to reduce environmental impact by reusing plastic, reducing the need for virgin PET production, and supporting a circular economy.

What Are The Key Growth Drivers That Support The Growth Of the Recycled PET (rPET) Market?

The growth of the market is driven by the growing consumer awareness and demand for sustainable packaging due to growing environmental concerns, which fuel the growth of the market. The shift towards circular economy and use of reused and recycled materials is increasing focus furling growth. The growing food and beverages industry demand for PET packaging, due to the growing focus on sustainability, fuels the growth. Other key drivers are the supportive government policies and regulations, growth in end-use applications, and emerging market drives the growth and expansion of the market.

Market Trends

- The growing demand for sustainable packaging is a growing trend that supports the growth.

- Technological Developments in recycling processes with advanced technology fuel the growth of the market.

- Stringent regulations and government initiatives for promoting and encouraging the use and adoption of recycled PET are a growing trend.

- The expanding applications in various sectors, especially packaging, fuel the growth and demand for the market.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 13.95 Billion |

| Expected Size by 2034 | USD 29.19 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Source, By End-Use Industry, By Form, By Application, By Recycling Process, By Region |

| Key Companies Profiled | Indorama Ventures, Alpek , UPM-Kymmene Corporation , Plastipak Packaging , M&G Chemicals , Evergreen Plastics , Loop Industries , Origin Materials , Coca-Cola Company , Veolia , CarbonLite Industries , PET Recycling Team , Clear Path Recycling , Green Line Polymers , Suez Group , Stamina Group , KW Plastics , Magnum Group, UltrePET , Nextek Limited |

Market Opportunity

What Are The Key Growth Opportunities That Support The Growth Of The Recycled PET (rPET) Market?

The key growth opportunity for the recycled pet (rPET) market is the growing demand of consumers for sustainable and eco-friendly packaging due to rising environmental concerns among conscious consumers, which supports the growth of the market. The sustainable packaging adoption to meet the sustainability goals and align with the consumers' preferences is a great opportunity for the growth of the market.

The rise of circular economy models is further promoting the use of recycled materials and fostering collaborations between stakeholders to secure stable supply chains. These factors support the growth by creating opportunities for expansion of the market further.

Market Challenge

What Are The Key Challenges That Hinder The Growth Of the Recycled PET (rPET) Market?

The key challenge that hinders the growth of the market is contamination and imperfections in the PET waste, which significantly reduce the quality of the rPET, high processing costs due to new and advanced technologies, inconsistent regulations, availability and quality of feedstock, small bottle recycling, and label adhesives, which limit the growth and expansion of the market.

North America Recycled PET (rPET) Market Size & Share Report, 2034

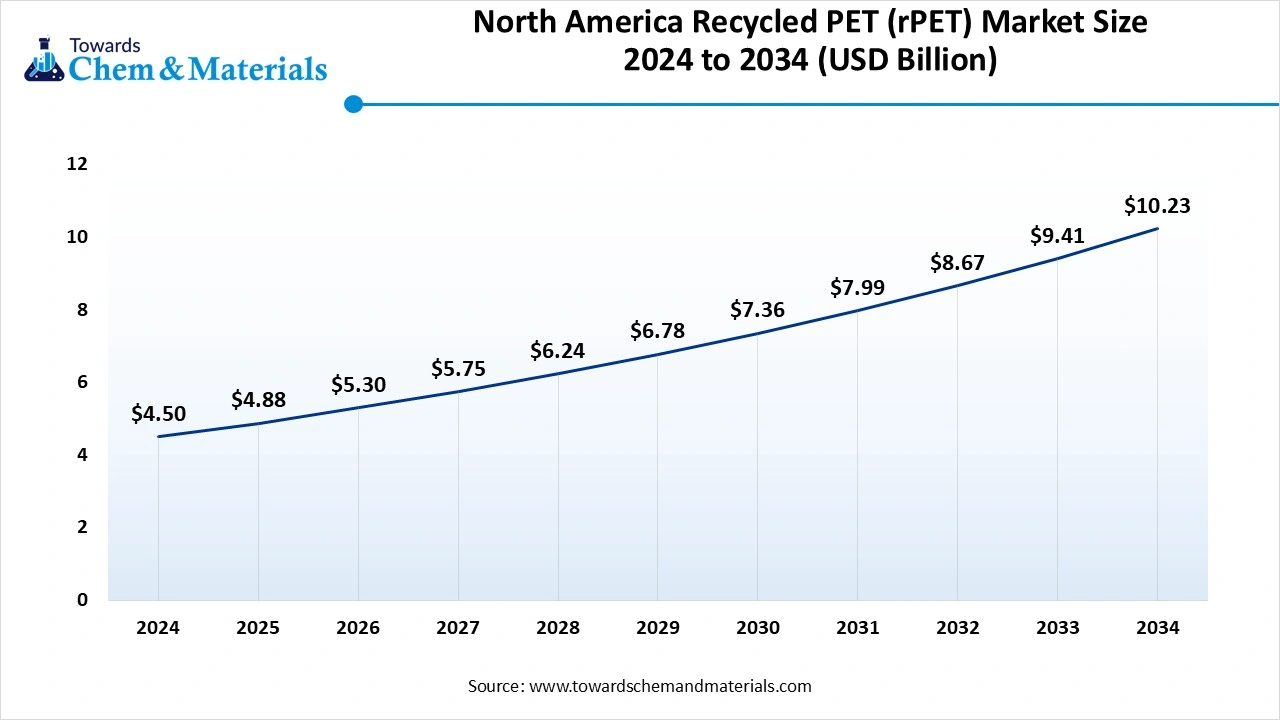

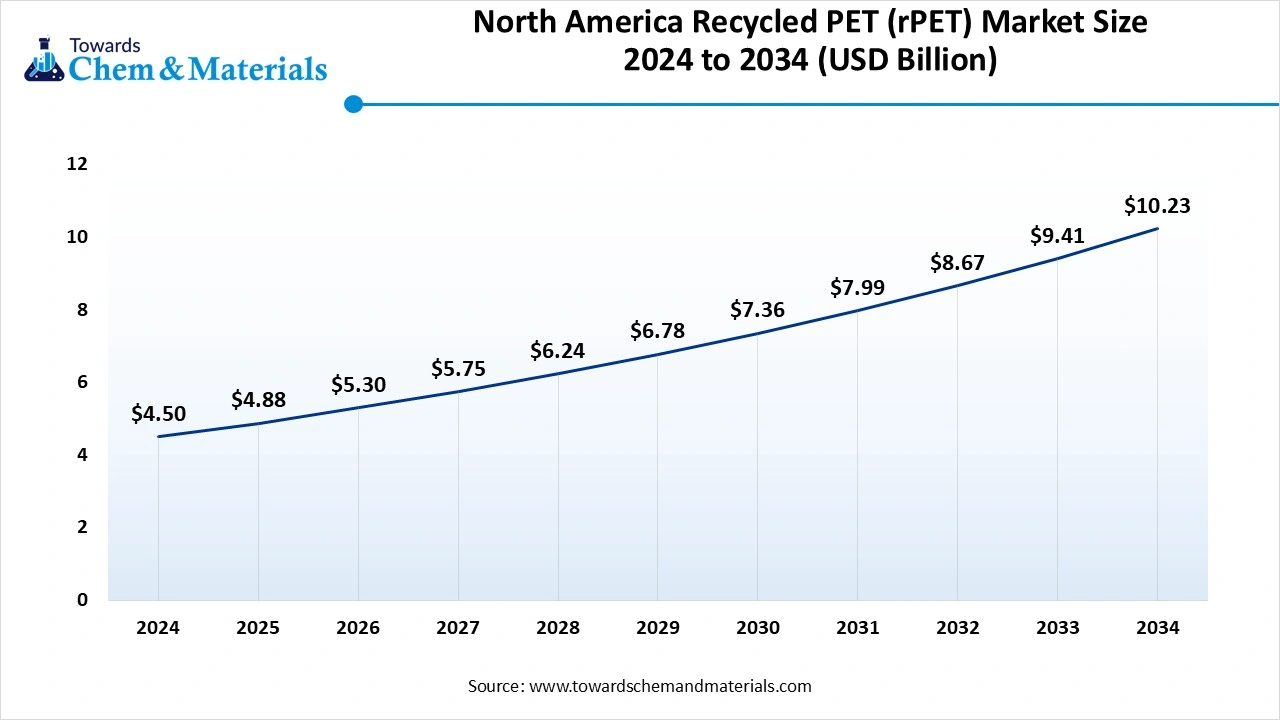

The North America recycled PET (rPET) market size was estimated at USD 4.50 billion in 2024 and is projected to reach USD 10.23 billion by 2034, growing at a CAGR of 8.56% from 2025 to 2034.

North America dominated the recycled PET (rPET) market in 2024. The growth of the market is driven by growing sustainability concerns due to increasing awareness of plastic pollution and landfill overflow, driving the growth and demand for the market in the region.

The government regulations with supportive policies like bottle deposit legislation and mandates for recycled content in packaging are encouraging the use of rPET also contributes to the growth of the market. The key players like Verdeco Recycling Inc., Phoenix Technologies International LLC, Envision Plastics Industries LLC, Unifi Manufacturing Inc., and DAK Americas LLC also play a significant role in the growth and expansion of the market in the region.

Asia Pacific is Experiencing Growth, Driven By Rapid Industrialization

Asia Pacific is expected to witness significant growth in the recycled PET (rPET) market in the forecast period. The growth of the market is driven by rapid industrialization, urbanization, and supportive government initiatives, which fuel the growth. The growing use and application in various industries due to the growing use of recycled materials and shift towards sustainability fuels the growth of the market in the region. The key players also play a significant role in teg growth of the market through innovation and advanced technology for improving the efficiency and quality of rPET production fuels the growth and expansion of the market in the region.

India Has Seen Significant Growth, Driven By The Growing Packaging Industry.

India has seen significant growth, driven by the growing textile industry with increased demand in the market. Companies like Hindustan Unilever are increasing the use of rPET in packaging, further boosting demand for the market in the country. The growing consumer awareness about the impact of environmental impact of plastic waste increases the adoption of more sustainable packaging solutions, which fuels the growth of the market in the country.

Segmental Insights

Source Insights

Which Source Segment Dominated the Recycled PET (rPET) Market in 2024?

The post-consumer PET segment dominated the market in 2024. Post-consumer PET is the primary source of recycled PET, collected from used bottles, packaging, and containers. It plays a vital role in sustainable packaging solutions as the beverage and consumer goods industries aim to reduce plastic waste. The growing adoption of closed-loop recycling and eco-friendly initiatives by global brands is boosting demand for post-consumer PET, making it the largest contributor to rPET production.

The post-consumer PET segment expects significant growth in the market during the forecast period. Post-industrial PET is obtained from factory waste, including scraps and rejected PET products. It offers consistent quality and purity, making it highly suitable for fiber production and technical applications. Manufacturers increasingly prefer post-industrial PET due to its reliability, cost efficiency, and minimal contamination levels. As industries focus on waste reduction and resource efficiency, the utilization of post-industrial PET continues to grow across the packaging and textile sectors.

End-Use Industry Insights

How did the Packaging Segment Dominate the Recycled PET (rPET) Market in 2024?

The packaging segment dominated the market in 2024. Packaging is the leading end-use segment for recycled PET, widely applied in bottles, containers, and thermoformed products. The food and beverage industry is a major driver, with companies incorporating rPET into packaging to align with sustainability targets. The demand for lightweight, durable, and environmentally friendly packaging materials is accelerating rPET adoption. This segment plays a central role in global efforts to replace virgin plastics with recycled alternatives.

The textile segment expects significant growth in the market during the forecast period. The textile industry represents a significant market for rPET, particularly in clothing, sportswear, and home furnishings. rPET fibers are valued for their strength, versatility, and eco-friendly profile, making them a preferred choice for sustainable fashion. Major apparel brands are actively incorporating rPET into their product lines to meet consumer expectations for ethical and green materials. This has established textiles as one of the fastest-growing segments for rPET applications.

Form Insights

Which Form Segment Dominated the Recycled PET (rPET) Market in 2024?

The r-pet resin segment dominated the market in 2024. rPET resin serves as a versatile raw material, used extensively in bottles, containers, and sheet extrusion. It has become increasingly important in the beverage industry, where brand owners integrate recycled resin into packaging to meet environmental goals. Resin is also used in industrial products where clarity and strength are required. Its adaptability across applications makes it a crucial force driving the expansion of the market.

The r-pet fiber segment expects significant growth in the market during the forecast period. rPET fiber is a major form used in textiles, carpets, automotive interiors, and nonwoven fabrics. Known for durability, recyclability, and cost-effectiveness, it supports industries seeking greener alternatives. The apparel sector, in particular, is expanding the use of rPET fibers to create sustainable clothing lines. With increasing consumer preference for environmentally conscious products, rPET fibers have become an important material choice in both fashion and industrial markets.

Application Insights

How did the Bottle Segment Dominate the Recycled PET (rPET) Market in 2024?

The bottles segment dominated the market in 2024. Bottles are the largest application segment for rPET, particularly in food and beverage packaging. Global companies are committing to higher recycled content in plastic bottles, driving sustained demand for rPET. This application supports circular economy practices by reintroducing used PET bottles into production cycles. The segment is strongly influenced by regulatory pressures, sustainability goals, and consumer awareness, making rPET bottles central to plastic waste reduction strategies.

The fibers segment expects significant growth in the market during the forecast period. Fibers represent a substantial application area for recycled PET, used in textiles, upholstery, and industrial fabrics. rPET fibers offer a sustainable alternative to virgin polyester, reducing environmental impact while delivering strong performance characteristics. Fashion, home décor, and technical textiles industries are major contributors to this demand. The growing awareness of eco-friendly products and the rising popularity of sustainable fabrics have made fibers a key driver of the market.

Recycling Process Insights

Which Recycling Process Segment Dominated the Recycled PET (rPET) Market in 2024?

The mechanical recycling segment dominated the market in 2024. Mechanical recycling is the most common process used for converting PET waste into rPET products. It is cost-effective, widely adopted, and capable of producing high-quality materials for packaging and textiles. This method involves cleaning, shredding, and reprocessing PET waste into usable pellets or flakes. Although dependent on clean input material, its efficiency and established infrastructure make it the dominant recycling method in the recycled PET industry.

The chemical recycling segment expects significant growth in the market during the forecast period. Chemical recycling is gaining momentum as a cutting-edge process for producing high-quality rPET. Breaking PET down into its base monomers allows for nearly infinite recyclability and the production of food-grade rPET. This technology is particularly valuable in applications requiring purity and high performance, such as beverage bottles and advanced packaging. Growing investment in chemical recycling facilities highlights its potential to complement mechanical recycling in the market.

Recycled PET (rPET) Market Value Chain Analysis

Chemical Synthesis and Processing : The recycled PET (rPET) is synthesised and processed through methanolysis, glycolysis, and hydrolysis.

- Key players Indorama Ventures, SK Chemicals, and JB Ecotex

Quality Testing and Certification : The recycled PET (rPET) requires the Global Recycled Standard certification and the Recycled Claim Standard (RCS).

- Key players: National Accreditation Board for Testing and Calibration Laboratories (NABL) or the International Laboratory Accreditation Cooperation (ILAC),

Distribution to Industrial Users : The recycled PET (rPET) is distributed to the packaging, automotive, textile, and construction industries.

- Key players: JB ECOTEX, Pluto Intero, Rosuni, and ReCircle

Recent Developments

- In May 2025, Drive was launched to ensure the limiting the sunlight exposure of packaged drinks to avoid any harm from the PET bottles. The aim is to limit the harmful effects of sunlight on plastic bottles containing water and soft drinks/juices.(Source: kashmirobserver.net)

- In November 2024, Bayer, a Switzerland-based company, launched polyethylene terephthalate (PET) blister packaging for their healthcare brand. The collaboration was done with the pharmaceutical company Liveo Research for the product development.(Source: www.recyclingtoday.com)

Recycled PET (rPET) Market Top Companies

- Indorama Ventures

- Alpek

- UPM-Kymmene Corporation

- Plastipak Packaging

- M&G Chemicals

- Evergreen Plastics

- Loop Industries

- Origin Materials

- Coca-Cola Company

- Veolia

- CarbonLite Industries

- PET Recycling Team

- Clear Path Recycling

- Green Line Polymers

- Suez Group

- Stamina Group

- KW Plastics

- Magnum Group

- UltrePET

- Nextek Limited

Segments Covered

By Source

- Post-consumer PET

- Post-industrial PET

By End-Use Industry

- Packaging

- Food & Beverage

- Personal Care & Cosmetics

- Household

- Textile

- Apparel

- Home Furnishings

- Automotive

- Consumer Goods

- Electronics

By Form

- R-PET Resin

- R-PET Fiber

- R-PET Sheet

By Application

- Bottles

- Films & Sheets

- Fibers

- Others

By Recycling Process

- Mechanical Recycling

- Chemical Recycling

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait