Content

What is the Current Polyglycerol Market Size and Share?

The global polyglycerol market size is calculated at USD 7.96 billion in 2025 and is predicted to increase from USD 8.82 billion in 2026 and is projected to reach around USD 22.30 billion by 2035, The market is expanding at a CAGR of 10.85% between 2026 and 2035. Asia Pacific dominated the polyglycerol market with a market share of 39.66% the global market in 2025. This market is growing due to its increasing use as an emulsifier, stabilizer, and surfactant across the food, cosmetics, and pharmaceutical industries.

Key Takeaways

- By region, North America dominated the market with the largest revenue share of over 39.66% in 2025.

- By product grade, the PG-3 segment held the largest revenue share of 34% in 2025 in terms of value.

- By product type, the polyglycerol esters segment led the market with the largest revenue share of 40% in 2025.

- By application/end use sector, the personal care & cosmetics segment led the market with the largest revenue share of 39–50% in 2025.

Market Dynamics

The polyglycerol market is experiencing steady growth, driven by its many uses as a thickener, stabilizer, emulsifier, and surfactant in sectors like polymers, food and beverage, cosmetics, and pharmaceuticals. Its use is being accelerated by the growing demand for sustainable natural and plant-based ingredients, especially in clean-label food products and environmentally friendly personal care formulas.

- Further bolstering market expansion are techniques and growing applications in specialty chemicals. However, variables like fluctuations in the price of raw materials and difficulties with regulations could somewhat restrict growth.

Market Trends

- Strong Market Growth: The polyglycerol market continues to gain momentum as industries from food to pharmaceuticals embrace its multifunctional nature. Its versatility, acting as an emulsifier, surfactant, and texture modifier, drives its adoption across applications, while manufacturers expand capacity to meet demand.

Demand for Clean-Label Food Products: Polyglycerol is seeing great growth in applications in dairy confections and bakeries due to growing consumer demand for natural, non-GMO, and plant-based emulsifiers. It is particularly useful in processed foods due to its capacity to increase product stability, prolong shelf life, and improve texture. By using polyglycerol-based emulsifiers in place of synthetic one's manufacturers are capitalizing on clean label trends.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 8.82 Billion |

| Revenue Forecast in 2035 | USD 22.30 Billion |

| Growth Rate | CAGR 10.85% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments covered | By Product Grade (Polymerization Level), By Product Type, By Application / End-Use Sector, By Region |

| Key companies profiled | Cargill, Incorporated, Sakamoto Yakuhin Kogyo Co., Ltd., Solvay, Spiga Nord S.p.A., The Good Scents Company, Lonza, Stepan Company, Savannah Surfactants, Palsgaard, NIKKO CHEMICALS CO., LTD., Procter & Gamble |

Shift toward natural & clean label ingredients

Cleaner, biodegradable, and plant-based ingredient labels are becoming more popular as environmentally friendly substitutes for synthetic emulsifiers. Polyglycerol fits in well with industry-wide trends towards greater health and environmental consciousness. Brands are being product safety and environmental impact. Food and cosmetics are two industries where this trend is most pronounced, as clean label certifications are now influencing consumer choice. For nature formulations, polyglycerol is positioned as the preferred option since governments are also promoting the sourcing of sustainable ingredients.

Value Chain Analysis of the Polyglycerol Market:

- Distribution to Industrial Users: The polyglycerol market is primarily distributed among the food & beverage, personal care & cosmetics, and pharmaceutical industries, with key players including major chemical and food ingredient corporations.The primary industrial demand for polyglycerol is driven by its function as a versatile emulsifier, stabilizer, and texture modifier, mainly in the form of polyglycerol esters (PGEs) and polyglycerol polyricinoleate (PGPR).

- Key Players: Cargill, Incorporated and Sakamoto Yakuhin Kogyo Co., Ltd.

- Chemical Synthesis and Processing: The chemical synthesis of polyglycerol (PG) involves the dehydration and polymerization of raw glycerin using either acid or base catalysts under high heat and reduced pressure in an industrial reactor.This initial PG product is typically processed further into value-added derivatives, primarily polyglycerol esters (PGEs), which are the main commercial products in the market.

- Key Players: Spiga Nord S.p.A. and Lonza Group

- Regulatory Compliance and Safety Monitoring: Polyglycerol and its derivatives are subject to rigorous regulatory compliance and safety monitoring by key international and national agencies to ensure their safe use in food, cosmetic, and pharmaceutical products.The primary regulatory focus is on specific derivatives, namely polyglycerol esters of fatty acids (PGE or E475) and polyglycerol polyricinoleate (PGPR or E476).

- Key agencies- U.S. Food and Drug Administration (FDA) and European Food Safety Authority (EFSA), More international and national agencies.

Segments Insights

Product Grade Insights

How PG-3 Segment Dominated the Polyglycerol Market in 2025?

PG-3 segment dominated the polyglycerol market in 2025, due to its affordability, adaptability, and reliable performance in a variety of applications. It is frequently utilized in food, cosmetic, and personal care products for texturizing, stabilizing, and emulsifying. Because of its consistent compatibility with other ingredients and versatility in formulation, manufacturers favor it. Because of its broad industrial acceptance, PG-3 is the standard option for large-scale production.

PG-6 and PG-10 are observed to grow at the fastest rate during the forecast period, driven by the need for high-performance applications that need better emulsification stability and solubility qualities. Adoption is being fueled by specialty formulations found in high-end personal care, functional foods, and industrial products. Developing optimized PG-6 and PG-10 variants to satisfy formulation requirements is the main goal of R&D efforts. Growing consumer preference for premium, useful ingredients also contributes to growth.

Product Type Insights

Which Product Type Segment Held the Dominating Share of the Polyglycerol Market in 2025?

Polyglycerol esters segment dominated the polyglycerol market in 2025, because they are widely used in personal care cosmetics and food. Their superior stabilizing and emulsifying qualities make them appropriate for a variety of formulations. Their adoption is facilitated by their reliable performance, manageability, and compatibility with other ingredients. Polyglycerol esters are a common ingredient in product lines that need to have a long shelf life and high stability, according to many manufacturers.

Polyglycerol polyricinoleate (PGPR) segment is observed to grow at the fastest rate during the forecast period. It is crucial in specialty formulations due to its exceptional emulsifying and flow-improving qualities. The growth of the PGPR is supported by the rising demand for processed foods and confections. PDPR-based solutions are being developed by manufacturers to enhance texture stability and consumer appeal. Accelerated adoption is also being caused by growing awareness of useful and valuable ingredients.

Application/End Use Sector Insights

How the Personal Care & Cosmetics Segment Dominated the Polyglycerol Market in 2025?

Personal care & cosmetics segment dominated the market in 2025, because of their emulsifying, stabilizing, and moisturizing qualities, polyglycerols are frequently used in skincare, haircare, and cosmetic formulations. Customers support growth by demanding stable ingredients, high quality, and kind to the skin. Market dominance is further strengthened by innovations in premium and natural formulations. Additionally, companies use polyglycerols to enhance the texture, shelf life, and sensory appeal of their products.

Food & beverages segment is observed to grow at the fastest rate during the forecast period, because of rising demand for convenience bakery confectionery and processed foods. These days, polyglycerols are crucial in formulations because they enhance texture stability and shelf life. Growing consumer knowledge of clean label ingredients and functional foods promotes expansion. Adoption is further accelerated by the growth of packaged and ready-to-eat foods in emerging economies.

Regional Insights

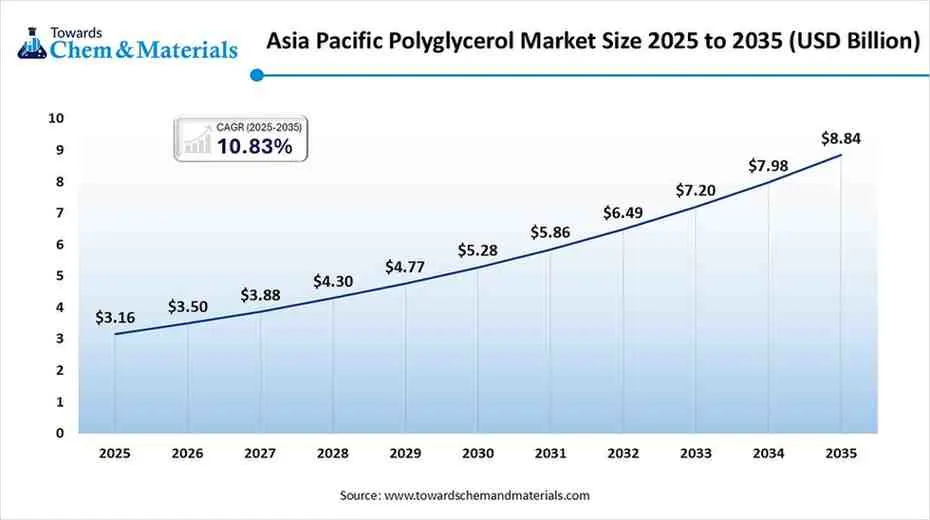

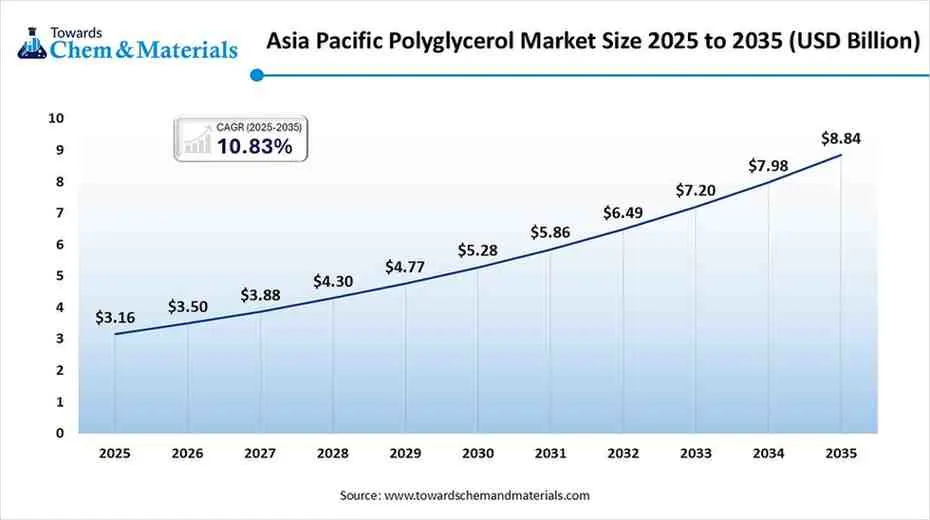

The Asia Pacific polyglycerol market size was valued at USD 3.16 billion in 2025 and is expected to reach USD 8.84 billion by 2035, growing at a CAGR of 10.83% from 2026 to 2035. Asia Pacific dominated the polyglycerol market in 2024, driven by processed foods, personal hygiene items, and industrial uses for polyglycerols are becoming increasingly common in emerging economies.

Demand is being driven by factors such as urbanization, rising disposable income, and awareness of high-quality ingredients. Investment in R&D facilities and local production capacities is growing quickly. Additionally, the expansion of the confectionery and cosmetics industries is speeding up market penetration.

India Polyglycerol Market Trends

The India polyglycerol market is experiencing strong growth, driven by the growing demand for sustainable, plant-based, and natural ingredients in industrial cosmetic and food applications. To meet clean-label requirements while enhancing stability, flavor, and shelf-life, polyglycerol esters are being widely used as emulsifiers in dairy confections and baked goods. The use of polyglycerol-based esters in skincare, haircare, and natural formulations is also growing in the Indian cosmetics and personal care sector because of their gentleness, non-toxicity, and biodegradability. Further driving demand for polyglycerols as sustainable and multipurpose ingredients is the fast growth of India's processed food sector and consumers' increasing preference for environmentally friendly raw materials in industrial and chemical processes. This pattern is consistent with the nation's larger move toward recycling and green chemistry.

North America dominated the polyglycerol market in 2024, driven by its strong consumer demand for high-quality products, established supply chains, and robust industrial infrastructure. Support from regulations for sustainable and safe ingredients promotes innovation in food, cosmetics, and personal care products. The adoption of advanced polyglycerol grades is also influenced by the presence of major manufacturers and research and development facilities. Dominance in the market is further reinforced by expanding trends in eco-friendly products and clean label formulations.

Canada Polyglycerol Market Trends

The Canada polyglycerol market is witnessing steady growth driven by the growing need for natural emulsifiers, clean-label food ingredients, and environmentally friendly personal care products. Polyglycerol esters are being used increasingly by the nation's food and beverage producers as multipurpose emulsifiers to improve the texture stability and shelf life of dairy confections and baked goods. In line with consumers' strong preference for environmentally friendly and plant-derived products, the personal care and cosmetics industry is also using polyglycerol-based ingredients because of their mildness, biodegradability, and compatibility with natural formulations.

Polyglycerols are also becoming increasingly popular in Canada because of the increased emphasis on bio-based and renewable raw materials in chemical manufacturing. As a result, they are becoming an essential component of the transition to sustainable product innovation in a variety of industries.

Asia Pacific region is the fastest growing in the market during the forecast period, driven by processed foods, personal hygiene items, and industrial uses for polyglycerols are becoming increasingly common in emerging economies. Demand is being driven by factors such as urbanization, rising disposable income, and awareness of high-quality ingredients. Investment in R&D facilities and local production capacities is growing quickly. Additionally, the expansion of the confectionery and cosmetics industries is speeding up market penetration.

India Polyglycerol Market Trends

The India polyglycerol market is experiencing strong growth, buoyed by the growing need for sustainable plant-based and natural ingredients in industrial cosmetic and food applications. To meet clean-label requirements while enhancing stability, flavor, and shelf-life, polyglycerol esters are being widely used as emulsifiers in dairy confections and baked goods. The use of polyglycerol-based esters in skincare, haircare, and natural formulations is also growing in the Indian cosmetics and personal care sector because of their gentleness, non-toxicity, and biodegradability. Further driving demand for polyglycerols as sustainable and multipurpose ingredients is the fast growth of India's processed food sector and consumers' increasing preference for environmentally friendly raw materials in industrial and chemical processes. This pattern is consistent with the nation's larger move toward recycling and green chemistry.

The polyglycerol market in Europe is growing steadily. This growth is driven by rising demand for natural, sustainable and clean-label ingredients in food, cosmetics, personal care and pharmaceuticals, underpinned by strict regulatory and environmental standards. Food and confectionery manufacturers increasingly use polyglycerol-based emulsifiers and stabilizers to improve product texture, shelf life and clean-label credentials, while cosmetics and personal care sectors favor polyglycerols for their biocompatibility and eco-friendly profile.

UK Polyglycerol Market Trends

The United Kingdom (UK) market for Polyglycerol (and its esters) is expected to grow faster than many European peers rising demand for clean-label, plant-based food and cosmetics fuels uptake. The UK segment of the European market is poised for robust growth in the coming years, supported by rising consumer awareness of sustainability, regulatory encouragement, and increasing clean-label food and cosmetic launches.

Middle east and Africa expects the significant growth in the market. Demand drivers include growing consumption of processed foods (bakery, confectionery, dairy), increasing popularity of “clean-label” and plant-based products, rising use of polyglycerols as emulsifiers/stabilizers in food and as skin-friendly, biodegradable ingredients in cosmetics and personal care.

UAE Polyglycerol Market Trends

The polyglycerol market in the UAE is small but steadily expanding. The market is driven by rising demand for clean-label, plant-based ingredients. The food industry, especially bakery, confectionery, and dairy accounts for the largest share, relying on polyglycerol esters as emulsifiers, stabilizers, and thickeners. Growth is also supported by increasing use in cosmetics and personal-care products, where natural, biodegradable emulsifiers are preferred.

The South America expects the notable growth in the market. The growth is driven largely by rising demand in food, cosmetics, and personal-care industries, as South American consumers increasingly prefer natural, biodegradable, and clean-label ingredients.

Brazil Polyglycerol Market Trends

The Brazil market for Polyglycerol is modest but growing steadily. The largest demand comes from the food-grade segment, especially bakery, confectionery, dairy, frozen desserts and other processed food categories where PGEs are used as emulsifiers, stabilizers or thickeners to improve texture, shelf-life and clean-label appeal.

Recent Developments

- In April 2025, Arxada introduced a new line of versatile, non-iconic emulsifiers and surfactants based on naturally derived and customizable polyglycerol ester chemistry. These Geomulse esters are designed to deliver an enhanced sensorial experience across all personal care leave-on and rinse-off applications, providing an easy-to-formulate chassis option.(Source: www.arxada.com)

- In September 2025, Stephenson Group Ltd introduced the “Durasoft” range of naturally derived polyglycerol esters for skin and hair care. (Source: www.cosmeticsandtoiletries.com)

Polyglycerol Market Top Companies

Croda International Plc

Corporate Information

- Croda International Plc is a British specialty chemicals company, headquartered in Snaith (East Yorkshire), UK.

- It is listed on the London Stock Exchange and is part of the FTSE 100 index.

- As of 2025, Croda’s revenues were around £1.6 billion.

- It employs roughly 5,800 people globally (2025) across ~94 locations in 36–39 countries.

History and Background

- Croda was founded in 1925 by George William Crowe and Henry James Dawe. The name “Croda” is a portmanteau of their surnames.

- Their first product was lanolin a natural grease derived from sheep’s wool produced in a small facility in Yorkshire

Key Developments and Strategic Initiatives

- In 1997, Croda acquired Sederma bringing in skincare active ingredient capabilities (ceramides, etc.) that strengthened its presence in personal care.

- In 2006, Croda acquired Uniqema (from ICI), which significantly expanded its manufacturing capacity, surfactants, sun care ingredients, plant care, polymer additives cementing Croda’s leadership in specialty chemicals.

Mergers & Acquisitions

- As above, acquisitions like Sederma (1997), Uniqema (2006) were pivotal in boosting personal care and specialty chemicals capacity.

- More recently: in 2020, Croda acquired Avanti Polar Lipids, Inc. a US based leader in lipid based drug delivery technologies for next generation pharmaceuticals. This more than doubled Croda’s R&D capability in drug delivery.

Partnerships & Collaborations

- In November 2025, Croda announced a strategic supply partnership with Amino GmbH (a manufacturer of pharmaceutical grade amino acids) strengthening Croda’s global supply of high purity amino acids for pharmaceutical formulations and biomanufacturing.

Product Launches / Innovations

- In 2025 (its centenary year), Croda refreshed its brand identity reflecting its evolution from a wool grease (lanolin) business to a global specialty chemicals firm focused on sustainable, bio based ingredients.

- In recent years, Croda has launched many bio based and biotech derived ingredients: e.g. bio-based non ionic surfactants; active plant derived cosmetic actives; peptides and plant stem-cell derived actives for skin/hair care.

Key Technology Focus Areas

- Croda emphasizes bio based raw materials, aims to be “Climate, Land and People Positive by 2030,” and works to deliver eco friendly, renewable resource-based solutions to customers an increasingly important differentiator in global markets.

R&D Organisation & Investment

Croda’s long-term strategy emphasises “smart science, innovation, sustainability”: its R&D is spread across multiple global labs, often co-located with manufacturing sites.

The acquisitions of Avanti Polar Lipids and Solus Biotech significantly expanded Croda’s internal R&D capability in lipid-based drug delivery, excipients, phospholipids especially for the pharmaceutical/biopharma segment.

SWOT Analysis

Strengths

- Strong heritage & experience: nearly 100 years of operation, deep know how of oleochemicals, specialty chemicals.

- Global footprint: presence in ~37–39 countries, 90+ sites, global supply chain, diversified markets (personal care, pharma, crop care, etc.)

- Innovation & R&D capabilities: internal labs, acquisitions of leading biotech/lipid delivery firms, broad ingredient portfolio, ability to serve high value segments (cosmetics, pharmaceuticals, sustainable chemicals).

Weaknesses / Challenges

- Shift from traditional industrial chemicals reduces diversity: by divesting its industrial chemicals and PTIC divisions, Croda depends more on growth in consumer care, pharma and specialty segments; this exposes it to demand fluctuations in those markets.

- Market competition & regulatory pressures: specialty chemicals, personal care, pharma ingredients markets are highly competitive, and increasing regulatory scrutiny (especially in pharma, cosmetics) demands high compliance and R&D investment.

Opportunities

- Growing demand for sustainable and bio based ingredients: global trends toward “clean beauty,” eco friendly, natural and sustainable products. Croda is well positioned to capitalize on that demand.

- Expansion in pharmaceuticals and biotech: with Croda Pharma, and capabilities in lipid based drug delivery, vaccine adjuvants, excipients, Croda can tap into rising demand for advanced therapies, vaccines, biopharma.

Threats / Risks

- Raw material price volatility: fluctuations in cost of natural/bio-based raw materials, supply disruptions, geopolitical/regulatory issues could affect margins.

- Competition from other specialty chemical companies and smaller niche player: high innovation pace means new entrants or existing competitors could challenge Croda’s market share.

Recent News & Strategic Updates

- 2025 Centenary & Brand Evolution: As Croda marks 100 years in business, it unveiled a new brand identity: the rebrand underscores its journey from lanolin refining to being a global specialty ingredients player.

- Strong Q1 2025 Performance: The company reported robust first-quarter sales growth (year-on-year), driven by increased demand for sustainable, bio-based ingredients in personal care and health. The share price rose ~10.7% on that news.

Other Top Companies

- Cargill, Incorporated: supplies industrial glycerin and vegetable-oil based polyglycerol derivatives (e.g. polyols), enabling sustainable feedstock supply and broad availability across food, personal care and industrial sectors.

- Sakamoto Yakuhin Kogyo Co., Ltd.: provides high-purity polyglycerols, often for cosmetics and personal-care applications, supporting market growth in Asia-Pacific.

- Solvay: offers polyglycerol derivatives for industrial and specialty applications, contributing to diversification of polyglycerol usage beyond just food and cosmetics.

- Spiga Nord S.p.A.: produces vegetable-derived, GMO-free polyglycerols used in surfactants, detergents, lubricants and technical fluids, boosting polyglycerol demand in industrial and sustainable lubricant markets.

- The Good Scents Company: listed among leading global polyglycerol suppliers; supports the market by offering polyglycerol-based ingredients broadly across segments.

- Lonza

- Stepan Company

- Savannah Surfactants

- Palsgaard

- NIKKO CHEMICALS CO., LTD.

- Procter & Gamble

Segments Covered

By Product Grade (Polymerization Level)

- PG‑3

- PG‑6 and PG‑10

- Other grades

By Product Type

- Polyglycerol Esters

- Polyglycerol Polyricinoleate (PGPR)

- Polyglycerol Sebacate

By Application / End-Use Sector

- Personal Care & Cosmetics

- Food & Beverages

- Pharmaceuticals

- Industrial Applications

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa