Content

Polyvinyl Butyral (PVB) Market Size and Growth 2025 to 2034

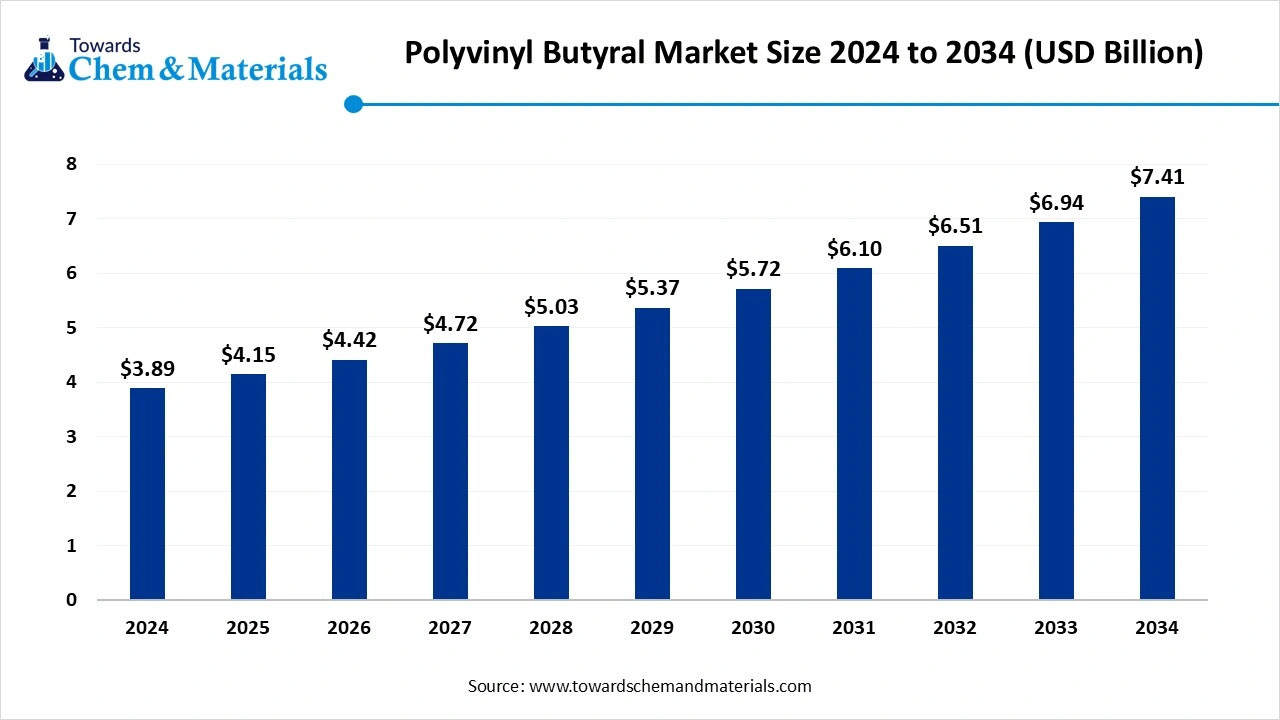

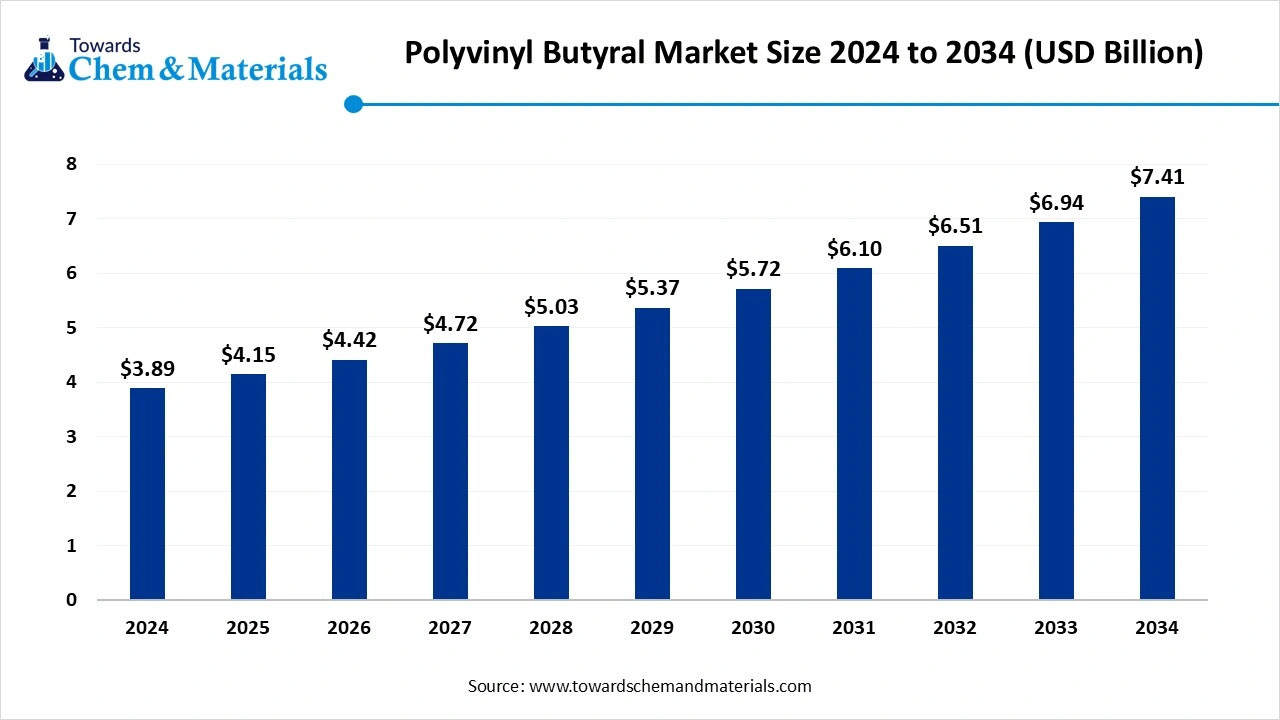

The global polyvinyl butyral (PVB) market size was reached at USD 3.89 billion in 2024 and is expected to be worth around USD 7.41 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period 2025 to 2034. The enlarged expansion of the automotive and construction industries has fueled industry potential in recent years.

Key Takeaways

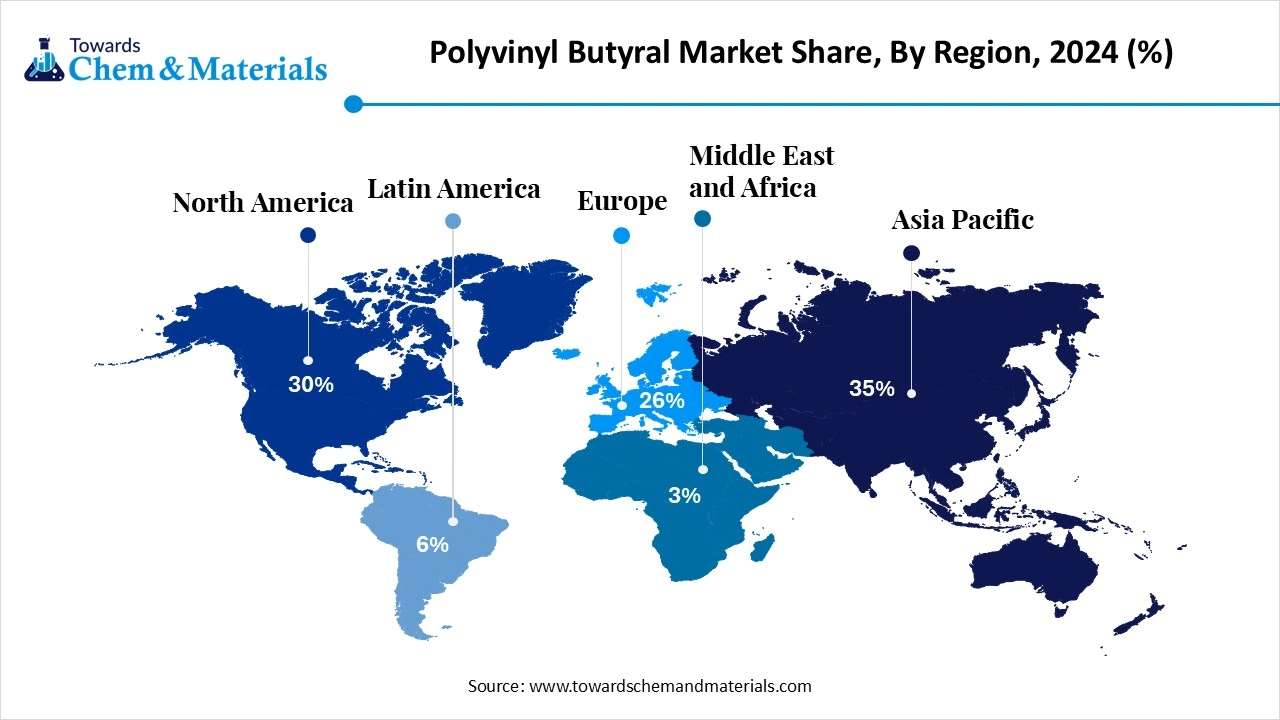

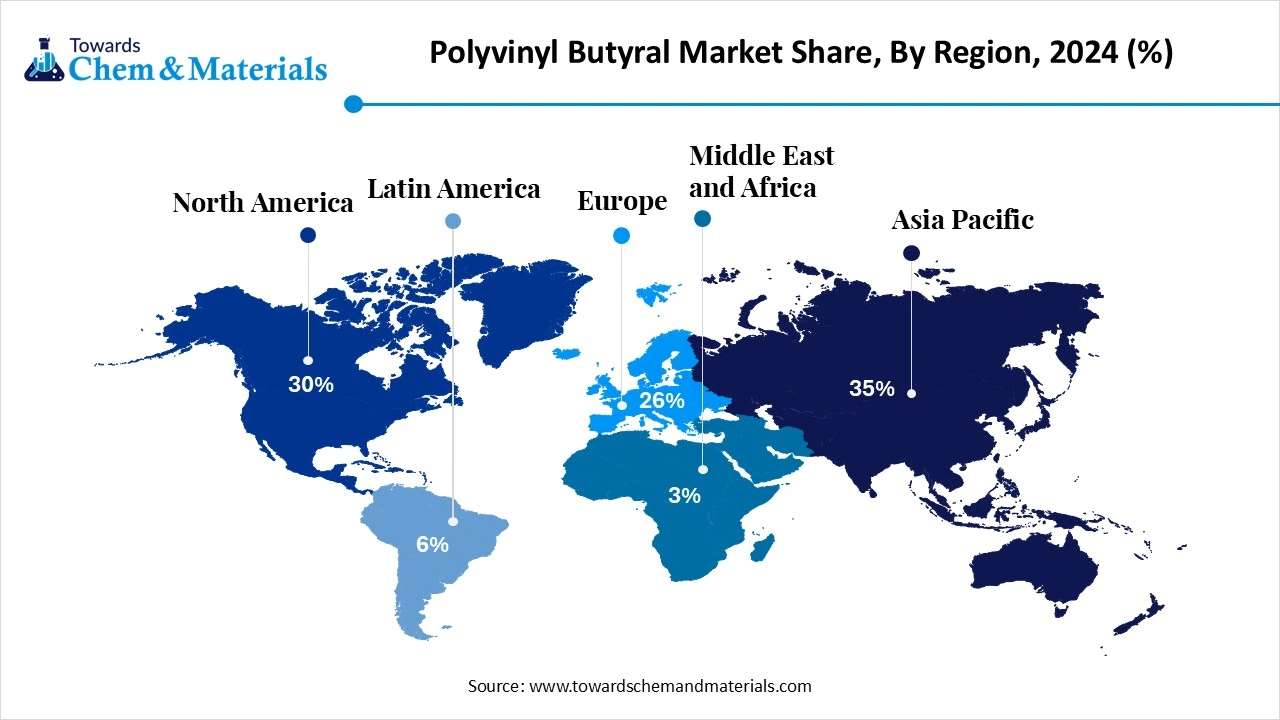

- By region, Asia Pacific dominated the polyvinyl butyral (PVB) market in 2024 with 35% of the industry share, akin to its globally enlarged manufacturing sectors,

- By region, Europe is expected to grow at a notable rate in the future, owing to the greater push for sustainability and renewable energy from the regional government.

- By type, the intermediate grade PVB segment led the market in 2024 with 50% market share, due to the greater demand from the construction and automotive industries for laminated glass.

- By type, the high-performance PVB segment is expected to grow at the fastest rate in the market during the forecast period, akin to the increased need for lightweight and long-lasting parts in the current period.

- By product form, the film segment emerged as the top-performing segment in the market in 2024 with 60% industry share, as it's commonly considered in the production of laminated safety glass.

- By product form, the powder segment is expected to lead the market in the coming years, because it offers greater flexibility for manufacturers to design customized PVB products.

- By processing method, the extrusion segment led the market in 2024 with 55% market share because it is the most common method to produce continuous PVB films used in laminated glass.

- By processing method, the casting segment is expected to capture the biggest portion of the market in the coming years, because it allows greater flexibility in producing specialized PVB products.

- By functionality, the adhesive segment led the market in 2024 with 50% market share, because PVB's primary role in laminated glass is to act as a bonding layer between glass sheets.

- By functionality, the toughening agent segment is expected to grow at the fastest rate in the market during the forecast period, because industries are demanding higher strength and durability in glass products

- By end user, the automotive segment led the market in 2024 with 45% market share by the sales of laminated safety glass, which contains PVB films, and is widely used in car windshields and windows.

- By end user, the solar energy segment is expected to capture the biggest portion of the market in the coming years, because PVB films are widely used as encapsulants in solar panels, protecting them from moisture, impact, and environmental stress.

Market Overview

Polyvinyl Butyral: Powering the Future of Safety Glass and Solar Panels

The polyvinyl butyral (PVB) has experienced significant growth in the past few years as the global demand for the laminated safety glass, solar panels, and adhesives has increased rapidly. Moreover, polyvinyl butyral (PVB) is a polymer primarily used in the manufacturing of safety glass, particularly laminated glass in automotive and architectural applications. PVB is known for its excellent adhesive properties, optical clarity, and high impact resistance.

What Factor is Driving the Polyvinyl Butyral (PVB) Market?

The sudden increased need for laminated safety glass in industries such as automotive and construction is spearheading industry growth in the current period. Moreover, factors such as the increased need for sound insulation and shatter resistance in the automotive sector have contributed to the growth of industry in recent years. Furthermore, the rapid urbanization and the sudden growth of EV vehicle production are likely to create a better industry environment globally, as per the current market overview.

The increased need for high-performance grade PVB has driven industry growth in the past few years, as sectors like automotive and construction have become major consumers.

The sudden shift towards the powder and advanced form of the PVB I contributing to the industry growth in recent years.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 4.15 Billion |

| Expected Size by 2034 | USD 7.41 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Product Form, By Processing Method, By Functionality, By End-use Industry, By Region |

| Key Companies Profiled | Kuraray Co., Ltd., Eastman Chemical Company, Asahi Glass Co., Ltd. , Solutia Inc. , Sekisui Chemical Co., Ltd. , PVB Films Ltd. , Changchun Group, Zhejiang Decent Plastic Co., Ltd. , PPG Industries Inc. , Shanghai Petrochemical Company, Sinorgchem Technology Co., Ltd. , Yunnan Tin Company Limited , Guangzhou Xinyi Glass Co., Ltd. , Vicaima Group , Saflex (Solutia) , Wanhua Chemical Group , Lanxess AG , Taiyo Kogyo Corporation , Covestro AG , Mitsubishi Chemical Holdings Corporation |

Market Opportunity

Government Green Policies Can Boost the Future of PVB

The enlarged expansion of the renewable energy sector is expected to create lucrative opportunities for manufacturers in the upcoming years. Moreover, the PVB films are the crucial element in the production of solar panels, where the manufacturer can build partnerships with the solar panel manufacturer in the coming years. Furthermore, global governments' push for sustainability and renewable energy promotion can surely contribute to the industry's growth during the forecast period.

Market Challenge

Raw Material Volatility Casts Shadows on Polyvinyl Butyral (PVB) Market Growth

The price volatility of the raw materials is expected to hinder the industry's potential in the upcoming years. Moreover, the PVB is mainly derived from polyvinyl alcohol and butyraldehyde, which are considered petrochemicals. These petrochemicals have seen heavy price fluctuations, akin to reasons such as geopolitical tensions and global trade wars.

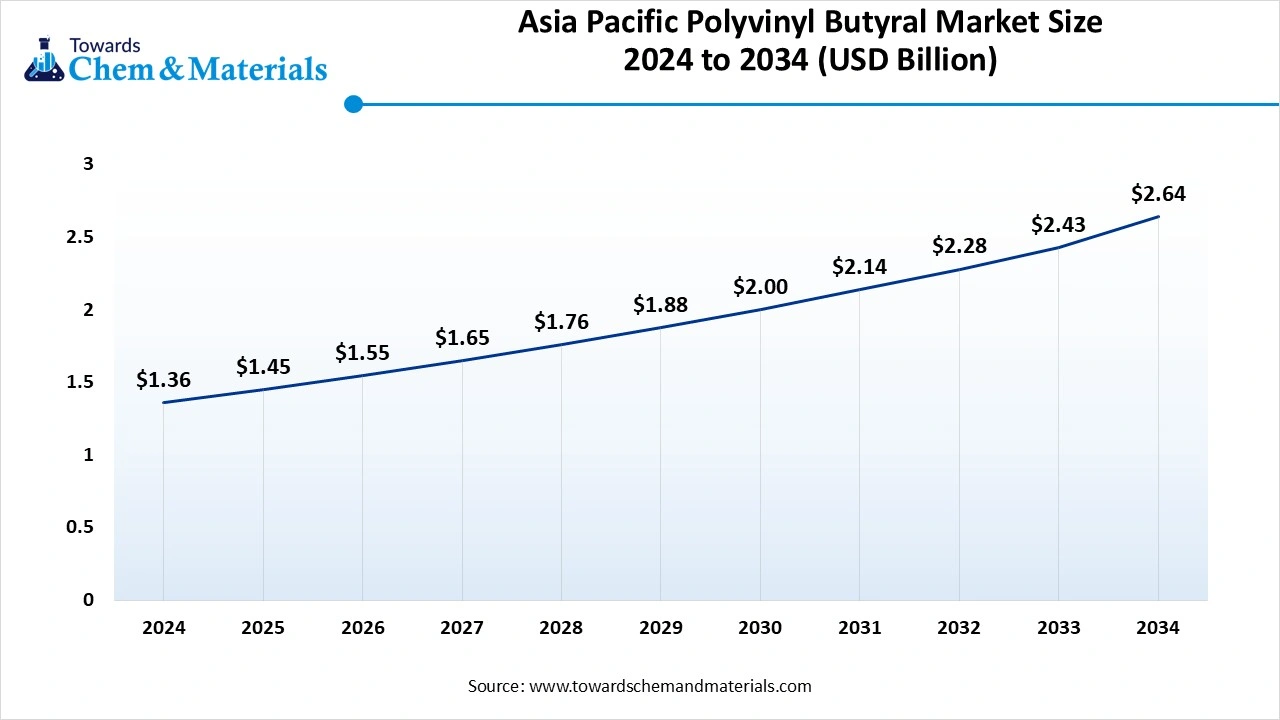

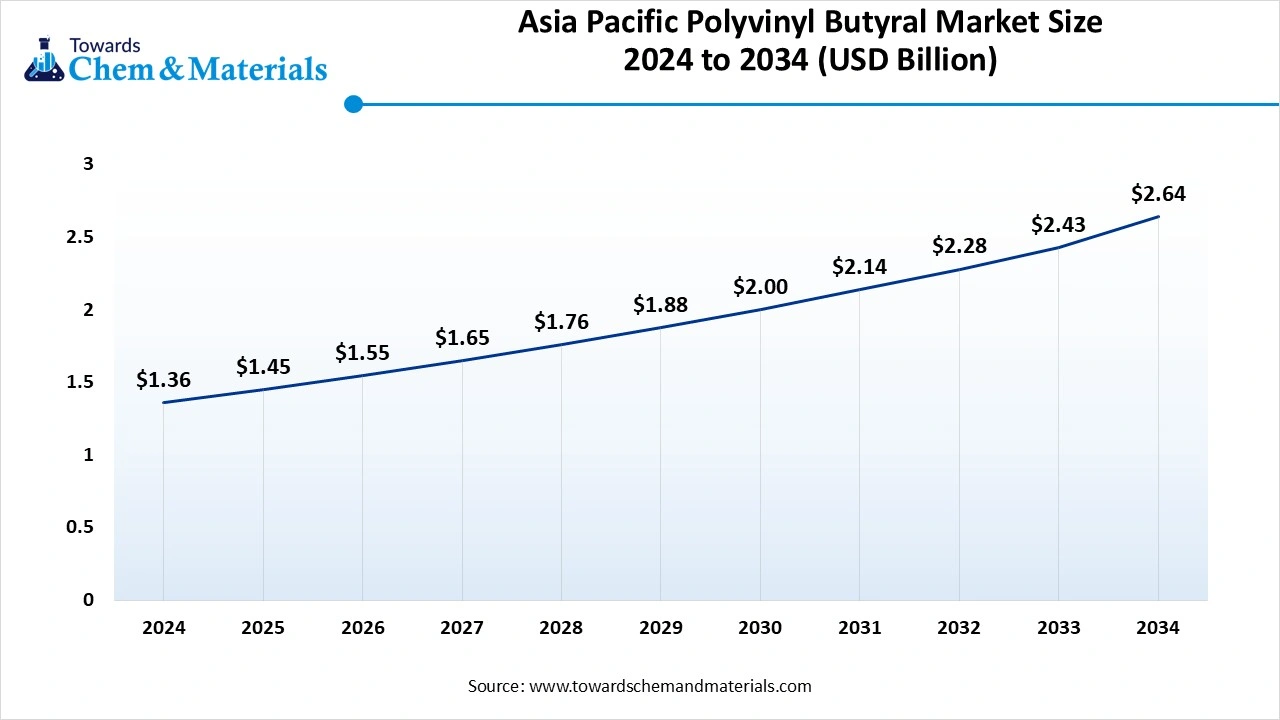

Asia Pacific Polyvinyl Butyral (PVB) Market Size, Share and Industry Analysis

The Asia Pacific polyvinyl butyral (PVB) market size was estimated at USD 1.36 billion in 2024 and is projected to reach USD 2.64 billion by 2034, growing at a CAGR of 6.86% from 2025 to 2034.

Asia Pacific dominated the market in 2024, akin to its globally enlarged manufacturing sectors, such as the automotive, construction, and electronics sectors in the current period. Moreover, the regional countries such India, China, and Japan have seen a heavy requirement of the laminated safety glasses for the vehicle and building sectors, which has led to the market potential in recent years in the region.

Why Does China Continue to Lead the Global Polyvinyl Butyral (PVB) Market?

China maintained its dominance in the market, owing to the country being known for its enlarged automotive and construction industries globally. Moreover, China has observed under a greater demand for the PVB films, which is consistently driving the industry growth in recent years. Furthermore, the sudden shift towards renewable energy, like solar and others, has contributed to the market growth in recent years in China, as per the latest country survey.

Europe Polyvinyl Butyral (PVB) Market Trends

Europe is expected to capture a major share of the market, owing to the greater push for sustainability and renewable energy from the regional government. As the automotive manufacturers are also seeking advanced laminated glasses where the safety and noise reduction of the vehicle is becoming a top priority of the industry in recent years. The growth of the automotive and renewable sectors is expected to provide a sophisticated consumer base to the manufacturer in the coming years.

Segmental Insights

Type Insights

How did the Intermediate Garde PVB Segment Dominate the Polyvinyl Butyral (PVB) Market in 2024?

The intermediate grade PVB segment held the largest share of the market in 2024, due to the greater demand from the construction and automotive industries for laminated glass. Moreover, by providing a better balance of safety, cost-effectivity, and clarity, the intermediate grade PV has gained major industry attention in recnt years. Furthermore, these grades have been intensively used in the production of windshields and windows in the automotive and construction fields.

The high-performance grade PVB segment is expected to grow at a notable rate during the predicted timeframe, akin to the increased need for advanced, stronger, and durable materials in recent years. Moreover, by providing better acoustic insulation, this grade is expected to gain major industry share in the upcoming years, as per the future industry observation.

Product Form Insights

Why Did The Film Segment Dominate The Polyvinyl Butyral (PVB) Market In 2024?

Why does the Film Segment Dominate the Polyvinyl Butyral (PVB) Market by Product Form?

The film segment held the largest share of the market in 2024, as it's commonly considered in the production of laminated safety glass. Moreover, by providing excellent optical clarity while ensuring strong binding with glass layers, the films have gained immense industry attention in the past few years. Also, the rise of renewable energy, such as solar and others, has made them the ideal option in the current period.

The powder segment is expected to grow at a notable rate, because it offers greater flexibility for manufacturers to design customized PVB products. Powders can be processed into films, coatings, or adhesives, giving more options to industries. With growing demand for specialty applications in solar panels, electronics, and smart glass, PVB powders are becoming increasingly valuable

Processing Method Insights

Why Did The Extrusion Segment Dominated The Polyvinyl Butyral (PVB) Market With The Largest Share In 2024?

The extrusion segment dominated the market with the largest share in 2024 because it is the most common method to produce continuous PVB films used in laminated glass. Extrusion is cost-effective, scalable, and suitable for large-volume production, which is important for the automotive and construction industries. The process ensures uniform thickness and strong bonding properties, which are crucial for safety glass applications.

The casting segment is expected to grow at a significant rate because it allows greater flexibility in producing specialized PVB products. Unlike extrusion, casting enables more precise control over thickness, optical clarity, and performance properties. This makes it ideal for advanced applications such as smart glass, acoustic glazing, and high-performance solar panels. With rising demand for customized and premium-quality laminated glass, manufacturers will shift toward casting methods.

Functionality Insights

Why Did The Adhesive Segment Held The Largest Share Of The Polyvinyl Butyral (PVB) Market In 2024?

The adhesive segment held the largest share of the market in 2024 because PVB's primary role in laminated glass is to act as a bonding layer between glass sheets. Its strong adhesion ensures that broken glass pieces remain together upon impact, improving safety in vehicles and buildings. This adhesive property also enhances optical clarity, sound insulation, and UV resistance.

The toughening agent segment is expected to grow at a notable rate during the predicted timeframe because industries are demanding higher strength and durability in glass products. In automotive and aerospace, stronger laminated glass is needed for safety and performance, while in construction, high-rise buildings require advanced impact-resistant glazing. PVB as a toughening agent not only enhances strength but also improves noise reduction and weather resistance.

End User Insights

Why Did The Automotive Segment Dominated The Polyvinyl Butyral (PVB) Market In 2024?

The automotive segment held the largest share of the market in 2024, dominated by the sales of laminated safety glass, which contains PVB films, and is widely used in car windshields and windows. This provides shatter resistance, noise reduction, and better safety during accidents. With the rising global vehicle production, especially in Asia, demand for PVB from the automotive sector surged. Automakers also prefer PVB films for better optical clarity and UV protection, enhancing passenger comfort.

The solar energy segment is expected to grow at a significant rate because PVB films are widely used as encapsulants in solar panels, protecting them from moisture, impact, and environmental stress. With countries worldwide shifting to renewable energy, solar power installations are increasing rapidly.

Polyvinyl Butyral (PVB) Market Value Chain Analysis

- Distribution to Industrial Users : The polyvinyl butyral is generally distributed to sectors such as the construction, photovoltaic, and automotive industries. Key Players: Kuraray, Everlam, and Sekisui Chemicals

- Chemical Synthesis and Processing : The chemical synthesis and processing of the polyvinyl butyral include acetalization and other processes in the presence of an acidic catalyst.

- Regulatory Compliance and Safety Monitoring : Polyvinyl butyral requires rigorous regulatory compliance and safety monitoring to ensure worker safety and product quality, and involves regulatory bodies like the US EPA and European REACH.

Recent Developments

- In November 2024, Eastman introduced their latest production of the PVB for electric vehicles. The newly launched PVB is called the Saflex Evoca RSL PVB, as per the report published by the company recently.(Source: www.glassonweb.com)

- In September 2024, ClearVue created a collaboration with the local technology distributors in South Africa for the project called the power generation from the building facade. Basically, by using novel solar technology, these companies are trying to generate energy from the sunlight reflected from the building facade. Also, these solar panels are made of polyvinyl butyral glass as per the company's claim.(Source: www.engineeringnews.co.za)

Polyvinyl Butyral (PVB) Market Top Companies

- Kuraray Co., Ltd.

- Eastman Chemical Company

- Asahi Glass Co., Ltd.

- Solutia Inc.

- Sekisui Chemical Co., Ltd.

- PVB Films Ltd.

- Changchun Group

- Zhejiang Decent Plastic Co., Ltd.

- PPG Industries Inc.

- Shanghai Petrochemical Company

- Sinorgchem Technology Co., Ltd.

- Yunnan Tin Company Limited

- Guangzhou Xinyi Glass Co., Ltd.

- Vicaima Group

- Saflex (Solutia)

- Wanhua Chemical Group

- Lanxess AG

- Taiyo Kogyo Corporation

- Covestro AG

- Mitsubishi Chemical Holdings Corporation

Segment Covered

By Type

- Intermediate Grade PVB

- High-Performance Grade PVB

- Low-Performance Grade PVB

By Product Form

- Film

- Powder

- Solution

By Processing Method

- Extrusion

- Casting

- Blowing

By Functionality

- Adhesive

- Toughening Agent

- Protective Coating

By End-use Industry

- Automotive

- Construction & Building

- Electronics

- Solar Energy

- Others

- Aerospace

- Medical Devices

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait