Content

Polyvinylpyrrolidone (PVP) Market Size and Forecast 2025 to 2034

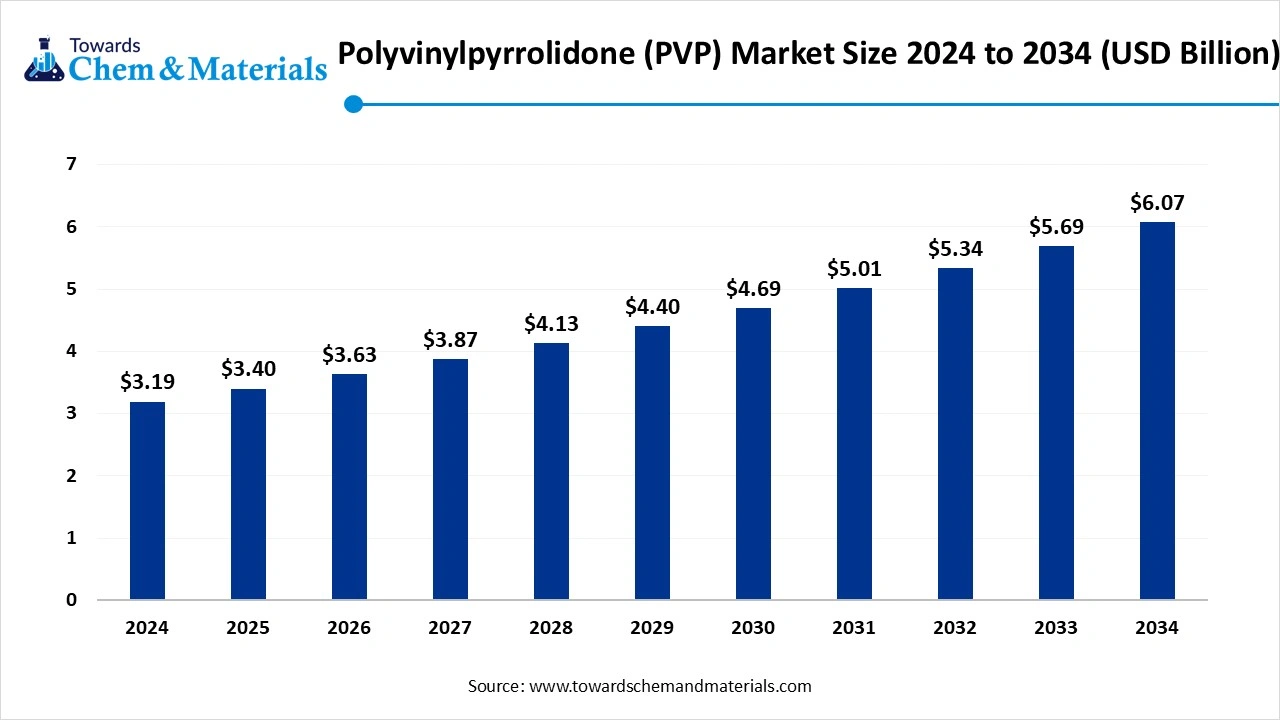

The global polyvinylpyrrolidone (PVP) market size was valued at USD 3.19 billion in 2024, grew to USD 3.40 billion in 2025, and is expected to hit around USD 6.07 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period from 2025 to 2034. The enlarged expansion of the pharmaceutical industry is building a strong foundation for upcoming sector growth.

Key Takeaways

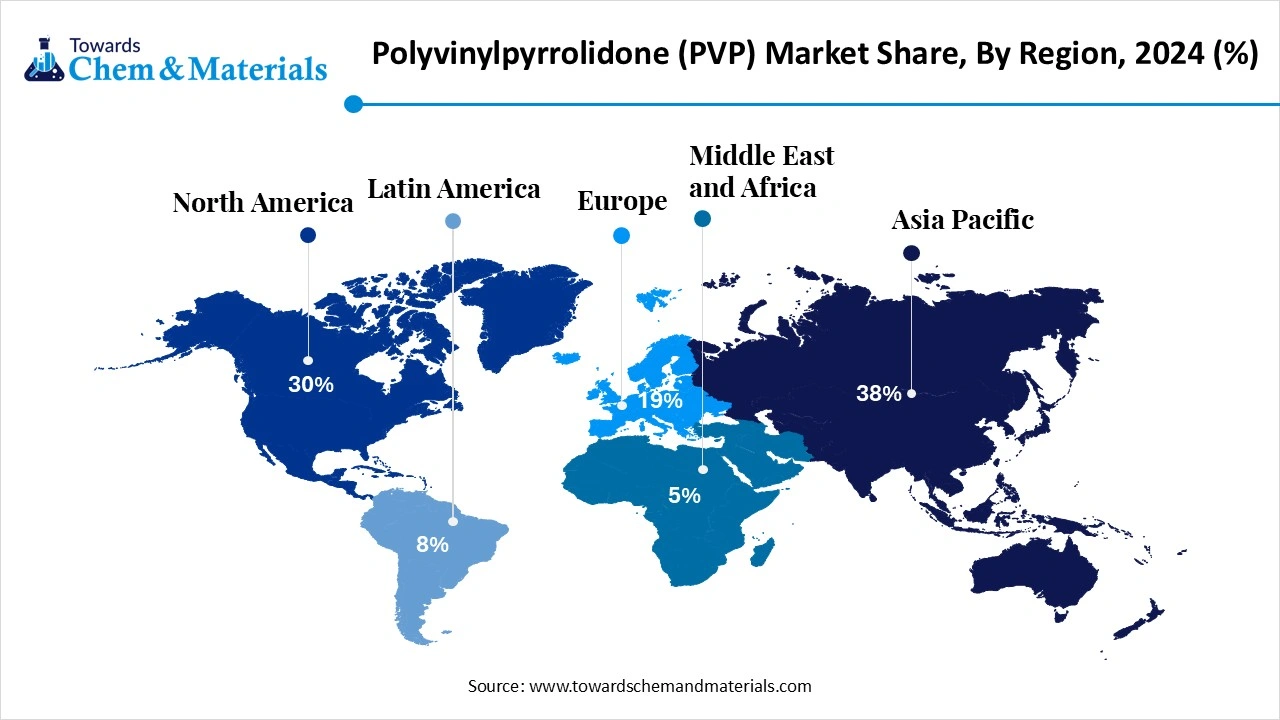

- By region, Asia Pacific dominated the market with approximately 38% industry share in 2024, owing to the presence of major industries like pharmaceuticals, food processing, and cosmetics.

- By region, Europe is expected to grow at a notable rate in the future, akin to the increased need for clean-label cosmetics and premium pharmaceuticals.

- By type, the medium molecular weight segment led the market with approximately 45% industry share in 2024, due to factors like viscosity, best balancing solubility, and binding properties of the medium molecular weight.

- By type, the high molecular weight segment is expected to grow at the fastest rate in the market during the forecast period, owing to the increased need for hydrogel, advanced pharmaceutical formulations.

- By form type, the powder segment emerged as the top-performing segment in the market with approximately 55% industry share in 2024, owing to its characteristics such as easy transportation and longer shelf life.

- By form type, the aqueous solution segment is expected to lead the market in the coming years, as the aqueous solution growth is attributed to its offerings, such the ready-to-use convenience and faster production cycles.

- By grade type, the industrial grade segment led the market with approximately 40% share in 2024, because of its wide-scale usage in adhesives, coatings, textiles, and ceramics.

- By grade type, the pharmaceutical grade segment is expected to capture the biggest portion of the market in the coming years, due to expanding global drug development and rising regulatory focus on safety and purity.

- By packaging type, the bags segment led the market with approximately 50% industry share in 2024, because smaller, flexible packaging is cost-effective, easier to handle, and suited for varied batch sizes.

- By packaging type, the bulk IBC/Tanker segment is expected to grow at the fastest rate in the market during the forecast period, due to rising large-scale manufacturing in pharmaceuticals, cosmetics, and adhesives.

- By distribution channel, the distributors/wholesalers segment led the market with approximately 45% share in 2024, because they bridge the gap between manufacturers and diverse end users across pharmaceuticals, cosmetics, food, and industrial applications.

- By distribution channel, the direct sales segment is expected to capture the biggest portion of the market in the coming years, because large pharmaceutical and cosmetic brands want transparency, cost savings, and direct partnerships with producers.

- By end-use industry, the pharmaceutical and biotechnology segment led the polyvinylpyrrolidone (PVP) market with approximately 35% industry share in 2024, because PVP is widely used as a binder, stabilizer, and solubilizer in drug formulations.

- By end-use industry, the personal care and cosmetics segment is expected to grow at the fastest rate in the market during the forecast period, because of rising consumer spending on beauty, hair care, and skincare products worldwide.

Market Overview

PVP’s Rise to Prominence in Pharma, Beauty, and Beyond

The polyvinylpyrrolidone (PVP) market has experienced sophisticated growth in recent years. The growth is mainly attributed to its multi-industry versatility. Polyvinylpyrrolidone is a synthetic, water-soluble polymer used as a stabilizer, binder, dispersant, film former, and thickening agent across number of applications.

Additionally, the sectors such as pharmaceuticals, cosmetics, and food and beverage act as primary growth providers of the market. Furthermore, the enlarged combined demand from pharmaceutical and consumer goods is expected to catch investors’ attention in the upcoming years, as per the recent industry survey.

Redefining Industry Standards: PVP’s Role in Next Gen Pharma

The sudden shift towards advanced drug delivery and biologics has increasingly allowed the stakeholders to capitalize on growth opportunities in the current period. Moreover, by offering better flexibility than the traditional binders, the PVP is earning attention for reshaping industry norms in recent years. Also, the ability the adoption of next-gen pharmaceuticals is projected to enable access to untapped or underserved markets in the upcoming years.

Market Trends

- The increased adoption of clean-label beauty products is closely improving the financial performance of the sector as individuals are demanding beauty products which did not contain synthetic and harmful chemicals in recent years.

- The rising need for liquid PVP solutions is positively impacting revenue potential and industry scalability in the present period. Due to the reduction in time, the liquid polyvinylpyrrolidone used in the pharma and cosmetics applications.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 3.40 Billion |

| Expected Size by 2034 | USD 6.07 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Form, By Grade, By Packaging, By Distribution Channel, By End-User Industry, By Region |

| Key Companies Profiled | BASF SE , Jungbunzlauer Suisse AG , Sekisui Chemical Co., Ltd. , Ashland (ISP Technologies), Kao Corporation , Nippon Shokubai Co., Ltd. , Lotte Fine Chemical , Clariant AG , Aicello Corporation , Shandong Xiangsheng Pharmaceutical Co., Ltd. , Wacker Chemie AG , Dow Chemical Company , Mitsubishi Chemical Corporation , Shaanxi Yanchang Petroleum Group , Kuraray Co., Ltd. , Shin-Etsu Chemical Co., Ltd. , Avantor Inc. , Zhejiang Baichuan Chemical Co., Ltd. , Boai NKY Pharmaceuticals Ltd. , Hangzhou Motto Science & Technology Co., Ltd. |

Market Opportunity

Natural PVP Emerges as Key Player in the Sustainability Revolution

The development of the natural or biobased PVP could result in high-yield outcomes for industry in the coming years. Moreover, several regions are increasingly pushing sustainability initiatives by imposing bans on petroleum-based products, where the manufacturer can launch their eco-friendly product line. Also, the manufacturers can enter green cosmetics, which is likely to elevate earning potential for producers during the projected period.

Market Challenge

PVP Industry Faces Headwinds from Raw Material Price Instability

The volatile price of raw materials is likely to obstruct innovation and development efforts in the coming years. Moreover, materials like vinylpyrrolidone monomer and others have seen high pricing volatility with supply chain disruption in the past few years. Furthermore, these price fluctuations can create pressure on mid-scale and small-scale businesses which has relatively low budgets or limited budgets.

Regional Insights

Asia Pacific Polyvinylpyrrolidone (PVP) Market Size, Industry Report 2034

The Asia Pacific polyvinylpyrrolidone (PVP) market size was estimated at USD 1.21 billion in 2024 and is projected to reach USD 2.34 billion by 2034, growing at a CAGR of 6.82% from 2025 to 2034. Asia Pacific dominated the market in 2024, owing to the presence of major industries like pharmaceuticals, food processing, and cosmetics.

-market-size.webp)

Moreover, factors such as the abundant raw material supply and availability, and greater demand for personal care products have contributed to favorable market economics for the industry in recent years. Furthermore, the regional countries like Japan, China, and India have seen the heavy use of polyvinylpyrrolidone as a stabilizer and binder.

China’s Chemical Strength Solidifies its PVP Market Leadership

China maintained its dominance in the polyvinylpyrrolidone (PVP) market, owing to an enlarged manufacturing infrastructure and a leading chemical industry. Also, China has not only been considered as the major exporter of polyvinylpyrrolidone, but also known as the leading consumer, which is actively driving the investor’s confidence in the industry’s future in China.

- Furthermore, the hair care and skin care product manufacturers are increasingly positioning the industry for long-term expansion by consuming a heavy amount of PVP in recent years.

Europe Polyvinylpyrrolidone (PVP) Market Trends

Europe is expected to capture a major share of the market during the forecast period, akin to the increased need for clean-label cosmetics and premium pharmaceuticals. Also, the major brands are demanding the safe, sustainable, and high-purity grade PVP in the region, which is likely to be considered as the higher growth potential segment in the region for the upcoming years.

- Moreover, the major manufacturers that are observed in heavy R&D investments are likely to result in enhanced brand positioning and product offerings during the projected period.

Segmental Insights

Type Insights

How did the Medium Molecular Weight PVP Segment Dominate the Polyvinylpyrrolidone (PVP) Market in 2024?

The medium molecular weight PVP segment held the largest share of the market in 2024, due to factors like viscosity, best balancing solubility, and binding properties of the medium molecular weight. Moreover, the major sectors like personal care, pharmaceutical tablets, and adhesives are seen using the molecular weight PVP in their formulations as per the recent industry observation. Also, by having an easy procedure and affordability, the medium molecular weight PVP has evolved into a key area of focus in the industry in recent years.

The high molecular weight segment is expected to grow at a notable rate during the predicted timeframe, owing to the increased need for hydrogel, advanced pharmaceutical formulations. Moreover, by having the film-forming ability and superior viscosity, the high-molecular-weight PVP segment is anticipated to create favorable conditions for long-term business planning in the coming years.

Form Type Insights

Why does the Powder Segment Dominate the Polyvinylpyrrolidone (PVP) Market by Form Type?

The powder segment held the largest share of the polyvinylpyrrolidone (PVP) market in 2024, owing to its characteristics such as easy transportation and longer shelf life. Furthermore, by providing control over concentration level to the manufacturers, the powder segment has gained major industry share in recent years. Also, several pharmaceutical companies are seen majorly mainly on powder forms due to the traditional culture of powder forms.

The aqueous solution segment is expected to grow at a notable rate during the predicted period, The aqueous solution growth is attributed to its offerings, such as the ready-to-use convenience and faster production cycles. Industries like pharmaceuticals and cosmetics are moving towards pre-dissolved solutions to save processing time and reduce formulation errors. Aqueous PVP solutions also ensure uniformity, improving efficiency in large-scale manufacturing of syrups, injectables, and topical gels. In personal care, liquid forms are becoming popular for smoother blending in shampoos and lotions.

Grade Type Insights

How did the Industrial/Technical Grade Segment Dominate the Polyvinylpyrrolidone (PVP) Market in 2024?

The industrial/technical grade segment dominated the market with the largest share in 2024. These industries demand large volumes of PVP at lower costs, making technical grade the most consumed category. It is particularly valuable in adhesives where strong binding and water solubility are crucial.

The pharmaceutical grade segment is expected to grow at a significant rate during the predicted timeframe, due to expanding global drug development and rising regulatory focus on safety and purity. Unlike industrial-grade, pharmaceutical PVP undergoes rigorous testing to meet FDA and EMA standards, making it essential for tablets, injectables, and oral drugs.

Packaging Type Insights

How did the Bags Segment Dominate the Polyvinylpyrrolidone (PVP) Market in 2024?

The bags segment held the largest share of the market in 2024 because smaller, flexible packaging is cost-effective, easier to handle, and suited for varied batch sizes. Pharmaceutical and cosmetic companies often purchase PVP in medium quantities, making bags the preferred option. Bags also minimize contamination risks and allow better storage in warehouses compared to bulk tankers.

The bulk IBC/Tanker segment is expected to grow at a notable rate during the predicted timeframe due to rising large-scale manufacturing in pharmaceuticals, cosmetics, and adhesives. As multinational companies expand production, they prefer bulk deliveries to reduce logistics costs and ensure uninterrupted supply chains. Tankers and IBCs provides enhance efficiency, reduce packaging waste, minimize manual handling, and align with sustainability goals.

Distribution Channel Insights

How did the Distributors/Wholesalers Segment Dominate the Polyvinylpyrrolidone (PVP) Market in 2024?

The distributors/wholesalers segment dominated the market with the largest share in 2024 because they bridge the gap between manufacturers and diverse end users across pharmaceuticals, cosmetics, food, and industrial applications. Many smaller buyers rely on distributors for flexible quantities, regional availability, and technical support. Distributors also manage inventory, reducing supply chain complexity for manufacturers.

The direct sales segment is expected to grow at a significant rate during the predicted timeframe, because large pharmaceutical and cosmetic brands want transparency, cost savings, and direct partnerships with producers. By cutting out middlemen, companies can negotiate better pricing, ensure consistent quality, and collaborate on custom formulations. Increasing digital platforms also enable easier direct procurement.

End Use Industry Insights

Why does the Pharmaceutical and Biotechnology Segment Dominate the Polyvinylpyrrolidone (PVP) Market by End Use Industry?

The pharmaceutical and biotechnology segment held the largest share of the polyvinylpyrrolidone (PVP) market in 2024, because PVP is widely used as a binder, stabilizer, and solubilizer in drug formulations. Its role in enhancing bioavailability and enabling controlled release makes it indispensable in tablets, injectables, and syrups. Biotech companies also use PVP in protein stabilization and advanced drug delivery systems.

The personal care and cosmetic segment is expected to grow at a notable rate during the predicted timeframe, because of rising consumer spending on beauty, hair care, and skincare products worldwide. PVP is increasingly valued in cosmetics for its film-forming, styling, and texture-enhancing properties. It provides hold in hair sprays, smoothness in creams, and stability in lotions.

Polyvinylpyrrolidone (PVP) Market Value Chain Analysis

- Distribution to Industrial Users: The distribution and usage of polyvinylpyrrolidone is mainly handled by the major chemical or pharmaceutical companies.

- Key Players: Nippon Shokubai, Ashland, and BASF SE

- Chemical Synthesis and Processing: The processing of the polyvinylpyrrolidone includes monomer production, initiation, and polymerization.

- Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring of the polyvinylpyrrolidone has mainly received the safety guidelines from the respective regional safety associations, like in United States FDA and Europe, EFSA.

Recent Developments

- In July 2024, Johnson & Johnson Vision introduced their latest contact lens in Australia. Moreover, the newly launched contact lens called the ACUVUE OASYS MAX 1-Day includes polyvinylpyrrolidone as a wetting agent.(Source: www.insightnews.com)

Polyvinylpyrrolidone (PVP) Market Top Companies

-market-companies-.webp)

- BASF SE

- Jungbunzlauer Suisse AG

- Sekisui Chemical Co., Ltd.

- Ashland (ISP Technologies)

- Kao Corporation

- Nippon Shokubai Co., Ltd.

- Lotte Fine Chemical

- Clariant AG

- Aicello Corporation

- Shandong Xiangsheng Pharmaceutical Co., Ltd.

- Wacker Chemie AG

- Dow Chemical Company

- Mitsubishi Chemical Corporation

- Shaanxi Yanchang Petroleum Group

- Kuraray Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Avantor Inc.

- Zhejiang Baichuan Chemical Co., Ltd.

- Boai NKY Pharmaceuticals Ltd.

- Hangzhou Motto Science & Technology Co., Ltd.

Segment Covered

By Type

- Low molecular weight PVP (K-10 to K-30)

- Medium molecular weight PVP (K-30 to K-60)

- High molecular weight PVP (K-60 and above)

- Crosslinked PVP (PVPP)

- Copolymer variants (e.g., PVP-VA, PVP-VA64)

By Form

- Powder

- Aqueous solution

- Paste/gel

- Dispersion

By Grade

- Pharmaceutical grade

- Food grade

- Cosmetic/personal care grade

- Industrial/technical grade

By Packaging

- Bulk (tanker / IBC)

- Drums (200–1000 L)

- Bags (25 kg)

- Small packs (<5 kg)

By Distribution Channel

- Direct sales

- Distributors/wholesalers

- Online/e-commerce

By End-User Industry

- Pharmaceuticals & biotechnology

- Personal care & cosmetics

- Food & beverage

- Adhesives & sealants

- Paints, coatings & inks

- Paper & packaging

- Textiles

- Oil & gas

- Agriculture

- Water treatment

- Construction & building materials

- Electronics & energy storage

- Household & cleaning products

- Industrial chemicals

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait