Content

What is the Current Polymer Coated Fabrics Market Size and Share?

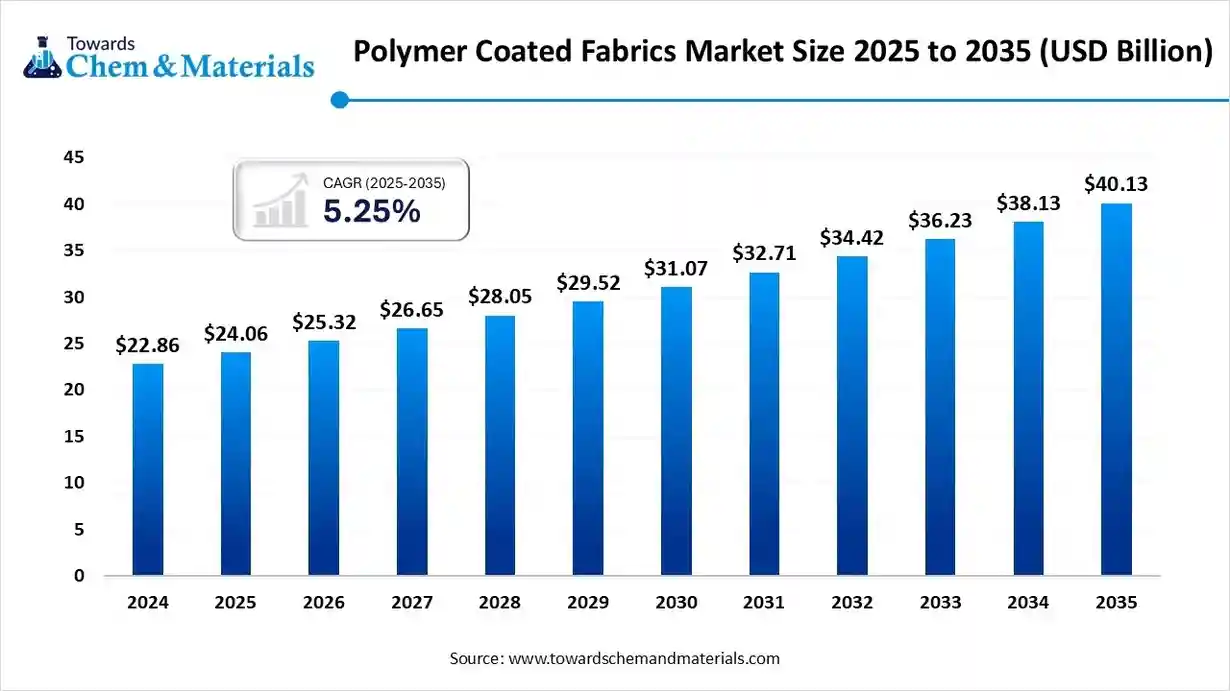

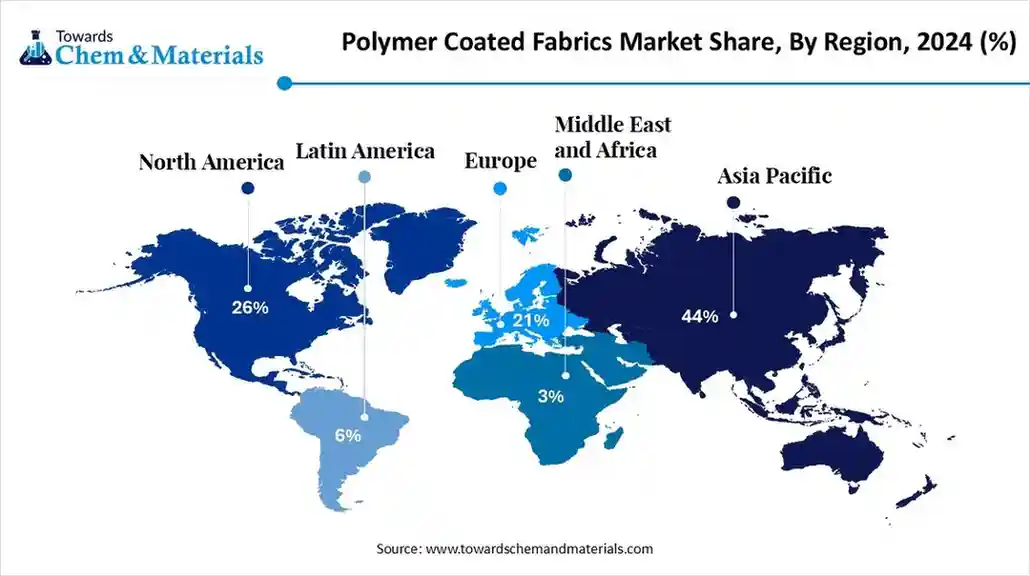

The global polymer coated fabrics market size is calculated at USD 24.06 billion in 2025 and is predicted to increase from USD 25.32 billion in 2026 and is projected to reach around USD 40.13 billion by 2035, The market is expanding at a CAGR of 5.25% between 2025 and 2035. Asia Pacific dominated the polymer coated fabrics market with a market share of 44% the global market in 2024.Growing demand for polymer-coated fibers in different sectors is the key factor driving market growth. Also, innovations in sustainable production processes coupled with the demand for durable, lightweight, and cost-effective materials can fuel market growth further.

Key Takeaways

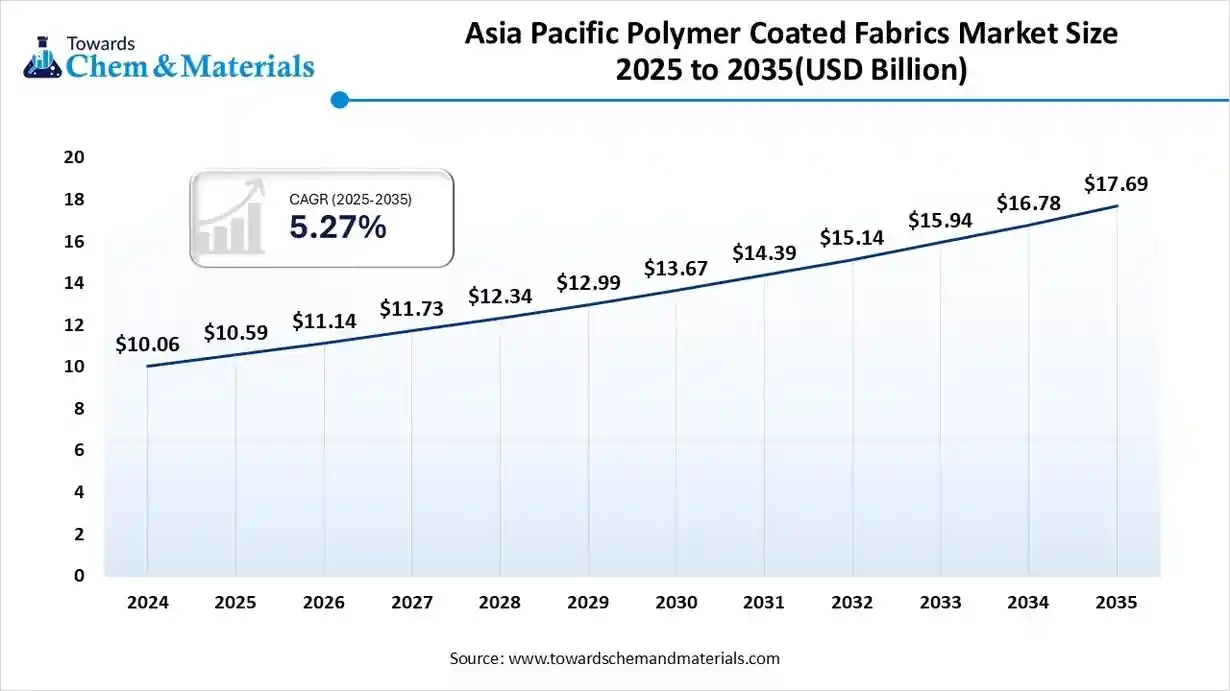

- By region, the Asia Pacific dominated the market with the share of 44% in 2024. The dominance of the region can be attributed to the ongoing expansion of automotive production, along with rapid industrialization.

- By region, Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the strong presence of established market players.

- By polymer type, the PVC-coated fabrics dominated the market with a 40% share in 2024. The dominance of the segment can be attributed to the surge in textile production, coupled with the unique properties of PVC coatings.

- By polymer type, the PU-coated fabrics segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be credited to the increasing product demand from the protective clothing and automotive industries.

- By fabric substrate, the polyester segment held a 45% market share in 2024. The dominance of the segment can be linked to the growing need for high-performance and durable materials.

- By fabric substrate, the nylon segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a surge in the implementation of safety protocols in transportation.

- By coating process, the direct/knife over roll segment led the market by holding 38% market share in 2024. The dominance of the segment is owed to the capability of coated fibers to provide a performance balance at less cost.

- By coating process, the extrusion coating segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the growing demand for durable and lightweight materials across various sectors.

- By application, the transportation segment led the market by holding 35% market share in 2024. The dominance of the segment can be attributed to the rising safety standards and rapid surge in vehicle production.

- By application, the protective clothing segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the ongoing innovations in coating technologies.

Technological Advancements are Expanding Market Growth

The Polymer Coated Fabrics Market consists of textile substrates coated or impregnated with polymer materials to enhance performance characteristics such as waterproofing, chemical resistance, abrasion resistance, UV stability, and durability. These fabrics are used across industries, including transportation, protective clothing, building & construction, industrial equipment, and furniture. Common polymer coatings include PVC, PU, PE, PTFE, and others. Ongoing innovations in coating technologies, such as nano coatings, are expected to impact positive market growth soon.

What Are the Key Trends Influencing the Polymer Coated Fabrics Market?

- The growing product demand from the automotive sector and other industrial applications is the latest trend driving market growth. In the industrial sector, these fibers are crucial for conveyor belts, protective clothing, and equipment covers because of their strength and chemical resistance.

- Increasing regulatory pressures and environmental awareness have led to a rise in demand for sustainable polymer-coated fabrics in many sectors. Manufacturers and consumers are rapidly shifting away from PVC-based coatings toward bio-based, water-based, and solvent-free options that minimize the overall environmental impact.

- Rising investment in residential and commercial buildings boosts the adoption of coated fabrics for awnings, roofing membranes, and architectural applications, expanding market growth further. Also, industries such as chemicals and construction, oil and gas, necessitate chemical-resistant, flame-retardant materials, contributing to market expansion.

Market Opportunity

Rising Demand for Protective Clothing

A surge in the application of coated fabrics in protective clothing is creating lucrative opportunities in the market. Industries such as chemical, healthcare, oil & gas, and construction are rapidly increasing their dependence on coated fabrics for protective gear because of their resistance to abrasions, chemicals, and flames. Furthermore, organizations such as OSHA are implementing regulations that necessitate the use of protective clothing, propelling market growth soon.

- In October 2024, Fenner Precision Polymers announced the launch of its latest strategic initiatives emphasizing global product families. The company's transformation is created to benefit consumers by improving their experience. The global family of brands can be categorized into three product families.(Source: www.textileworld.com)

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 25.32 Billion |

| Expected Size by 2035 | USD 40.13 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Leading Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segment Covered | By Polymer Type, By Fabric Substrate, By Coating Process, By Application, By Region |

| Key Companies Profiled | BASF, Covestro, Dow, DuPont, Eastman, Evonik, Huntsman, Solvay |

Market Challenges

Lack of Awareness Among Emerging Markets

Limited awareness regarding the use of polymer-coated fibers in the emerging countries is the major factor hindering the market growth. In developing economies, industries still heavily depend on traditional or less durable materials or fabrics. Moreover, the strong presence of various international and regional players in the market leads to pricing pressure and decreased profit margins for market players.

Regional Insight

The Asia Pacific polymer coated fabrics market size was valued at USD 10.59 billion in 2025 and is expected to reach USD 17.69 billion by 2035, growing at a CAGR of 5.27% from 2025 to 2035. Asia Pacific dominated the polymer coated fabrics market with a 44% share in 2024. The dominance of the region can be attributed to the ongoing expansion of automotive production, along with rapid industrialization. Moreover, the expanding construction industry in regions such as China and India is leading to increased use of coated fabrics in awnings, architectural membranes, and roofing materials, driving market growth shortly.

China Polymer Coated Fabrics Market

In the Asia Pacific, China led the market due to the rapid infrastructure development and surging sectors such as construction and automotive. Also, China is a major consumer and producer of coated fabrics, especially coated fabrics, and is anticipated to retain its position during the forecast period.

Europe Polymer Coated Fabrics Market Trends

Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the strong presence of established market players like BMW, Volkswagen, and Renault in the developed countries in Europe. Additionally, there is increasing emphasis on recyclable coated fabrics, especially in response to environmental shifts and regulations towards eco-friendly materials.

Germany Polymer Coated Fabrics Market

In Europe, Germany dominated the market by holding the largest market share due to ongoing advancements, a strong manufacturing base, and stringent regulations implemented by the government. Furthermore, Germany's strong focus on R&D leads to continuous innovations in polymer coating technologies, enhancing product functionality and quality.

Who are the Top Polyethylene Exporters in 2023?

| Exporter Company | Export Quantity in 2023 |

| SABIC | 8.2 million tons |

| Dow Chemical Company | 6.9 million tons |

| ExxonMobil Chemical | 6.1 million tons |

| LyondellBasell Industries | 5.4 million tons |

| INEOS Group | 4.9 million tons |

Segmental Insight

Polymer Type Insight

Which Polymer Type Segment Dominated the Polymer Coated Fabrics Market in 2024?

The PVC-coated fabrics dominated the market with a 40% share in 2024. The dominance of the segment can be attributed to the surge in textile production, coupled with the unique properties of PVC coatings. In addition, PVC coatings provide a combination of chemical resistance, durability, and waterproofing, which makes them suitable for demanding applications. PVC-coated fabrics are also used in construction applications such as renovation projects and building construction.

The PU-coated fabrics segment is expected to grow at a faster CAGR during the forecast period. The growth of the segment can be credited to the increasing product demand from the protective clothing and automotive industries and innovations in coating technologies. Ongoing funding in infrastructure development projects such as channels, roads, and low embankment dams is generating demand for geotextiles made with PU-coated fabrics.

Fabric Substrate Insight

Why Polyester Segment Dominated the Polymer Coated Fabrics Market in 2024?

The polyester segment held a 45% market share in 2024. The dominance of the segment can be linked to the growing need for high-performance and durable materials, especially in construction, automotive, and protective clothing sectors. Furthermore, ongoing innovations in coating technologies, like the development of sustainable coatings with enhanced formulations, are enabling polymer-coated fabrics to be more appealing and versatile to an extensive range of industries.

The nylon segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a surge in the implementation of safety protocols in transportation and the rapid growth of the automotive sector in emerging economies. Moreover, the construction sector's use of geotextiles, which generally include coated fabrics like nylon, is expected to drive positive market growth soon.

Coating Process Insight

How Much Share Did the Direct/Knife Over Roll Segment?

The direct/knife over roll segment led the market by holding 38% market share in 2024. The dominance of the segment is owed to the capability of coated fibers to provide a performance balance at less cost. The knife-over-roll coating is preferred for its ability to deliver uniform and consistent coatings, especially for high-performance applications, leading to further segment growth.

The extrusion coating segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the growing demand for durable and lightweight materials across various sectors, especially in automotive, construction, and packaging. Extrusion-coated fabrics are necessary for creating protective clothing in many sectors such as healthcare, oil & gas, and chemical manufacturing.

Application Insight

Which Application Segment Dominated the Polymer Coated Fabrics Market in 2024?

The transportation segment led the market by holding 35% market share in 2024. The dominance of the segment can be attributed to the rising safety standards, rapid surge in vehicle production, and growing demand for durable and lightweight materials. Also, governments across the globe are implementing stringent regulations about vehicle safety, such as compulsory airbag installation and other key features.

The protective clothing segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the ongoing innovations in coating technologies and the expanding automotive, construction, and chemical industries. In addition, the use of polymer-coated fabrics in medical settings, such as equipment covers, hospital beds, and surgical gowns, is also impacting positive market growth.

Recent Developments

- In August 2024, Trelleborg Engineered Coated Fabrics introduced a cutting-edge healthcare fabric at the Healthcare Design (HCD) Conference and Expo. This new fabric is from Dartex® Endurance range. This advanced fabric utilized innovative polymer technology to increase the lifespan of products and is created from 100% recycled yarn.(Source: www.textileworld.com)

Polymer Coated Fabrics Market Top Companies

Segments Covered

By Polymer Type

- Polyvinyl Chloride (PVC) Coated Fabrics

- Standard PVC Coating

- Low-Phthalate/Phthalate-Free PVC

- Polyurethane (PU) Coated Fabrics

- Solvent-Based PU

- Water-Based PU

- Polyethylene (PE) Coated Fabrics

- Polytetrafluoroethylene (PTFE) Coated Fabrics

- Others

- Silicone-Coated Fabrics

- Acrylic-Coated Fabrics

By Fabric Substrate

- Polyester

- Nylon

- Cotton

- Fiberglass

- Blends & Specialty Fabrics

By Coating Process

- Direct/Knife Over Roll Coating

- Calender Coating

- Hot Melt Coating

- Extrusion Coating

- Transfer Coating

By Application

- Transportation

- Automotive Seating & Interiors

- Truck Tarpaulins & Covers

- Marine Upholstery

- Protective Clothing

- Industrial Safety Apparel

- Military & Tactical Gear

- Building & Construction

- Roofing Membranes

- Awnings & Canopies

- Industrial

- Conveyor Belts

- Machine Covers

- Furniture & Upholstery

- Indoor Furniture

- Outdoor Furniture

- Others

- Inflatable Structures

- Tents & Recreational Equipment

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait