Content

What is the Current Polypropylene Non-Woven Fabrics Market Size and Volume?

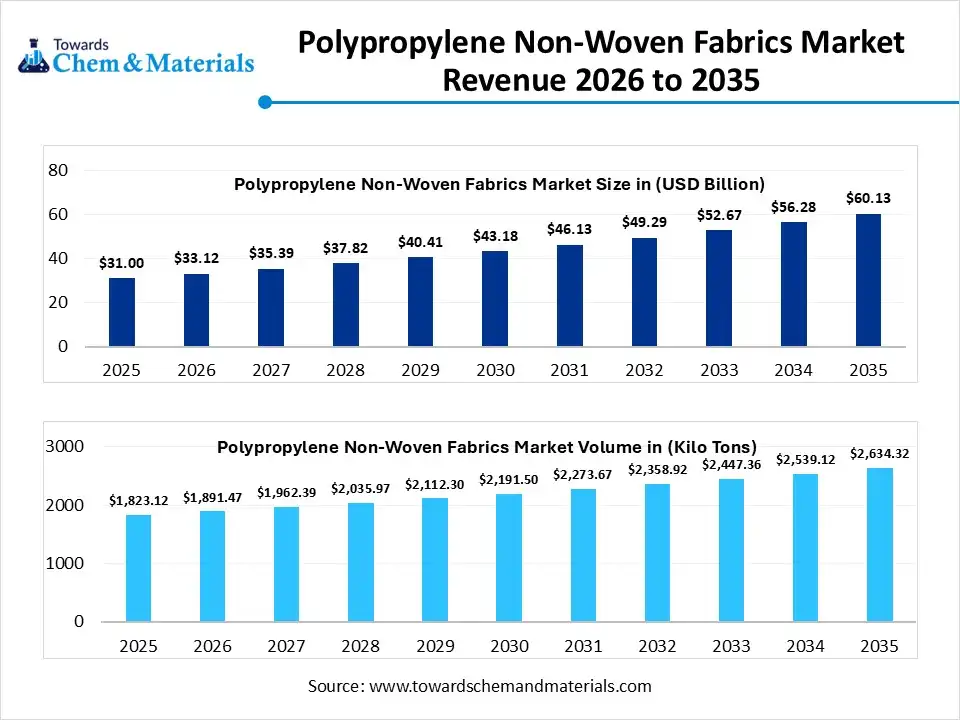

The global polypropylene non-woven fabrics market size was estimated at USD 31.00 billion in 2025 and is expected to increase from USD 33.12 billion in 2026 to USD 60.13 billion by 2035, growing at a CAGR of 6.85% from 2026 to 2035. In terms of volume, the market is projected to grow from 1823.12 kilo tons in 2025 to 2634.32 kilo tons by 2035. growing at a CAGR of 3.75% from 2026 to 2035. Asia Pacific dominated the polypropylene non-woven fabrics market with the largest volume share of 42.03% in 2025.The greater shift towards better medical and hygiene products has accelerated market growth in recent years.

Key Takeaways

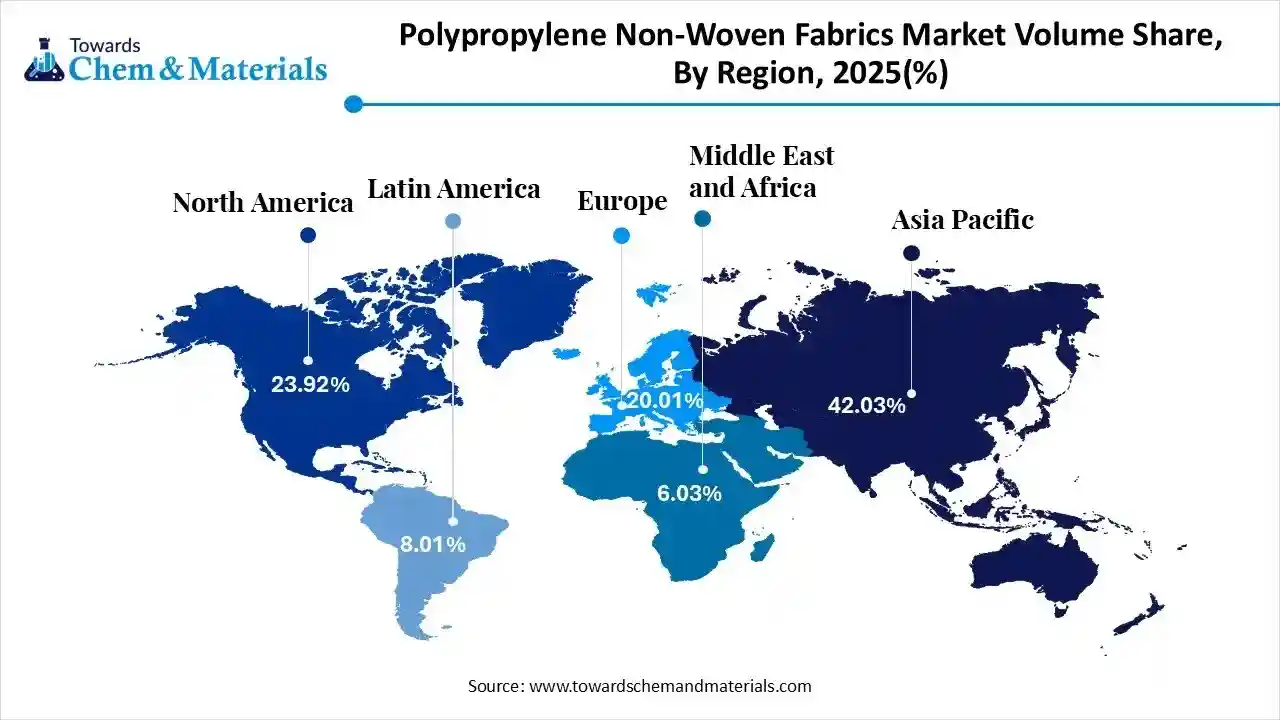

- The Asia Pacific dominated the polypropylene non-woven fabrics market with the largest volume share of 42.03% in 2025.

- The polypropylene non-woven fabrics market in North America is expected to grow at a substantial CAGR of 5.61% from 2026 to 2035.

- The Europe polypropylene non-woven fabrics market segment accounted for the major volume share of 20.01% in 2025.

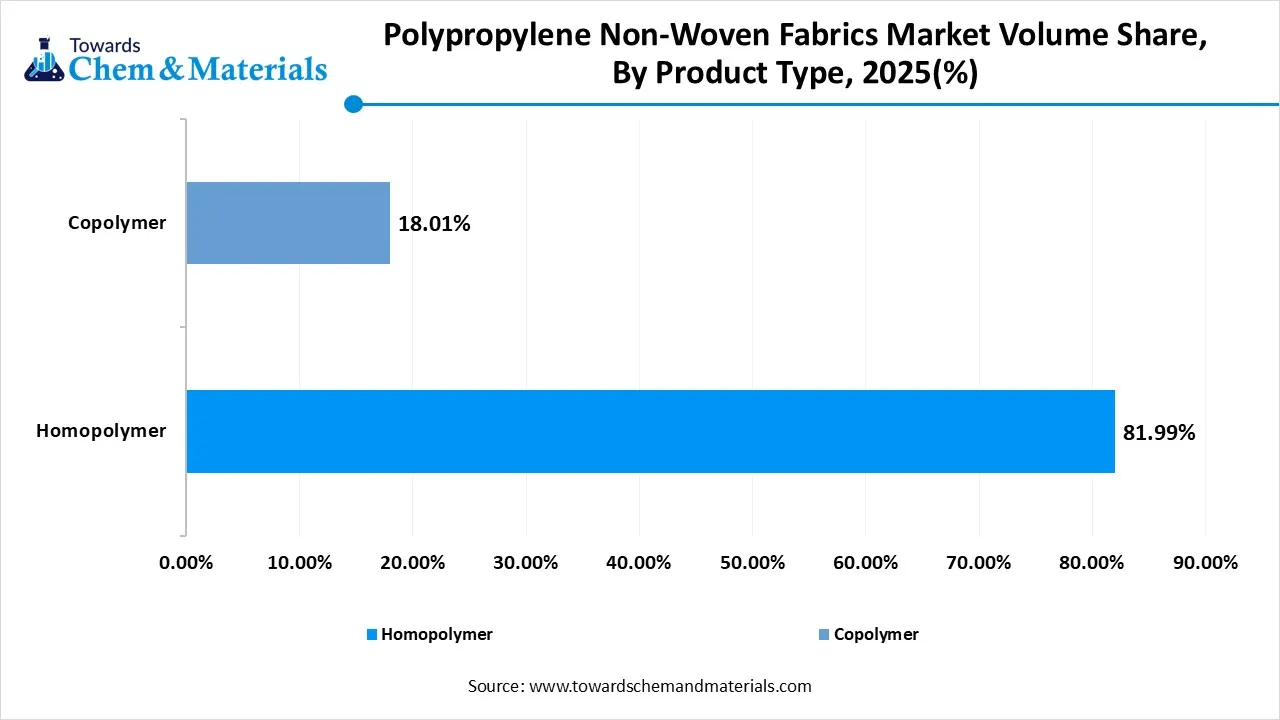

- By product, the homopolymer segment dominated the market and accounted for the largest volume share of 81.99% in 2025.

- By technology, the radiation-cured (UV) segment is expected to grow at the fastest CAGR of 7.21% from 2026 to 2035 in terms of volume.

- By product, the copolymer segment led the market with the largest revenue volume share of 52% in 2025.

- By application, the hygiene segment dominated the market in 2025, akin to consistent, large-scale demand and strict performance requirements.

Polypropylene Nonwovens Fabrics: Efficient and Versatile

The fabric, which is primarily made from polypropylene fibres that are bonded together without knitting or weaving, is called the polypropylene non-woven fabric. Moreover, having specific characteristics like breathable, lightweight, and cost-effective, the polypropylene non-woven fabrics have emerged as the ideal solution in the major industries nowadays.

Polypropylene Non-Woven Fabrics Market Trends:

- The greater global demand for medical and hygiene products has offered substantial growth prospects for manufacturing firms in recent years. Also, the manufacturers are heavily using polypropylene non-woven fabrics in applications such as surgical gowns, masks, and wipes akin to their lightweight, safety, and affordability.

- The trend towards the recyclable and sustainable no-wovens is expected to support the long-term expansion of manufacturing operations in the coming years. Also, several major brands are observed in promoting their sustainable and eco-friendly fabrics on social media and popular websites nowadays.

- The shift towards the customized fabric for the specific applications is likely to generate value-added opportunities for industry participants in the coming years. Also, the buyers have seen in seeking specific fabrics that have softness, thickness, and strength in the current period.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 33.12 Billion / 1891.47 Kilo Tons |

| Revenue Forecast in 2035 | USD 60.13 Billion / 2634.32 Kilo Tons |

| Growth Rate | CAGR 6.85% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By Application, By Region |

| Key companies profiled | Kimberly-Clark Corporation, Berry Global, Inc., Lydall, Inc., First Quality Nonwovens Inc, PFNonwovens a.s., Schouw & Co., Mitsui Chemicals Inc., FITESA, Toray Industries Inc., Freudenberg Group, Ahlstrom-Munksjo Oyj, Johns Manville Corporation, Suominen Corporation, Asahi Kasai Corporation |

Future Fabrics Built on Precision

The transition toward advanced fiber engineering and process control is seen as a driver of future opportunities for manufacturers. Also, the manufacturers are improving the flow precision, fiber diameter uniformity, and bonding accuracy to enhance fabric performance. This shift enables better control over breathability, strength, and filtration efficiency. Automation and real-time monitoring are increasingly used to reduce defects and material waste.

Trade Analysis of the Polypropylene Non-woven Fabrics Market:

Import, Export, Consumption, and Production Statistics

- China has observed a heavy export of textiles in the year of 2024, and the value of the export was $299 billion. Also, the major buyers include South Korea, Japan, the United States, and Bangladesh, as per the published report.

- The United States has observed a greater non-woven textiles export, valued at $1.86 billion in 2024, and major buyers listed are Canada with $432 million, Mexico with $572 million, and China with $120 million, as per the survey.

Value Chain Analysis of the Polypropylene Non-Woven Fabrics Market:

- Distribution to Industrial Users: The industrial distribution is heavily concentrated in the hygiene and medical sectors, which demand specialized, often disposable, materials with properties like high strength-to-weight performance and excellent barrier functions.

- Key Players: Magnera Corporation and Kimberly-Clark Corporation.

- Chemical Synthesis and Processing: Polypropylene (PP) non-woven fabrics are produced by converting propylene monomer into a thermoplastic polymer via chain-growth polymerization, followed by mechanical processing methods like spunbond and meltblown extrusion.

- Key Players: Freudenberg Group and Toray Industries, Inc

- Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring in the polypropylene non-woven fabrics market are critical, especially given their extensive use in sensitive applications like medical and hygiene products.

- Safety Standards- ISO Certifications and FDA Compliance (U.S. Food and Drug Administration)

Polypropylene Non-Woven Fabrics Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Food & Drug Administration (FDA) | 21 CFR Part 177.1520 | Migration Safety |

| European Union | European Commission | Regulation (EU) 2017/745 (MDR) | Sustainability & Recycling |

| China | SAMR (State Administration for Market Regulation) | GB 18401 |

|

Segmental Insights

Product Insights

How did the Homopolymer Segment Dominate the Polypropylene Non-woven Fabrics Market in 2025?

The homopolymer segment volume was valued at 1494.78 kilo tons in 2025 and is projected to reach 2019.73 kilo tons by 2035, expanding at a CAGR of 3.40% during the forecast period from 2025 to 2035. The homopolymer segment dominated the market in 2025. These homo-polymer segments form highly crystalline domains within the fiber structure, providing strength, stiffness, and dimensional stability to the non-woven fabric. During processes like spunbond or meltblown, the homopolymer segments crystallize efficiently, helping the fibers retain their shape and withstand thermal and mechanical stresses. As a result, fabrics with a higher proportion of homopolymer segments show better tensile strength, heat resistance, and process consistency, making them suitable for applications such as hygiene, medical, and industrial non-wovens where structural integrity and durability are essential.

The copolymer segment volume was valued at 328.34 kilo tons in 2025 and is projected to reach 614.59 kilo tons by 2035, expanding at a CAGR of 7.21% during the forecast period from 2025 to 2035.The copolymer segment expects the fastest growth in the market during the forecast period. The copolymer segment consists of propylene units combined with small amounts of comonomers such as ethylene, which modify the polymer’s structure and properties. These copolymer segments disrupt the regular crystalline arrangement of polypropylene, leading to lower crystallinity and increased amorphous regions within the fibers. This results in improved softness, flexibility, and impact resistance compared to pure homopolymer PP. In non-woven applications, copolymer segments help enhance fabric drape, comfort, and low-temperature toughness, which are especially important in hygiene and medical products.

Polypropylene Non-Woven Fabrics Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Homopolymer | 81.99% | 1494.78 | 2019.73 | 3.40% | 76.67% |

| Copolymer | 18.01% | 328.34 | 614.59 | 7.21% | 23.33% |

Application Insights

How did the Hygiene Segment Dominate the Polypropylene Non-woven Fabrics Market in 2025?

The hygiene segment dominated the market in 2025, due to consistent, large-scale demand and strict performance requirements. Hygiene products such as diapers, sanitary products, and wipes require materials that are lightweight, breathable, skin-friendly, and cost-efficient. Polypropylene non-woven fabrics meet these criteria while supporting high-speed manufacturing processes.

The industrial segment is expected to grow, as polypropylene non-woven fabrics gain importance in construction, filtration, automotive, and infrastructure applications. Also, the industrial users demand materials with durability, strength, and long service life rather than disposability. Polypropylene non-wovens meet these needs through customization, layering, and surface treatments. Moreover, the industrial applications deliver higher value per unit and longer contracts.

Regional Insights

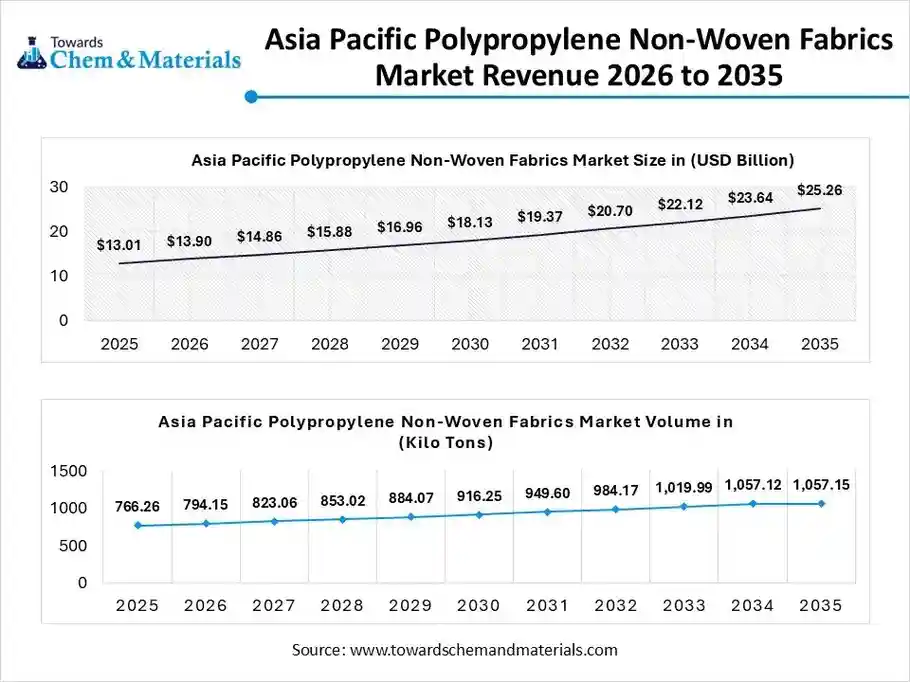

The Asia Pacific polypropylene non-woven fabrics market size was valued at USD 13.01 billion in 2025 and is expected to be worth around USD 25.26 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.86% over the forecast period from 2026 to 2035.

The Asia Pacific polypropylene non-woven fabrics volume was estimated at 766.26 kilo tons in 2025 and is projected to reach 1057.15 kilo tons by 2035, growing at a CAGR of 3.64% from 2026 to 2035. Asia Pacific dominated the market in 2025, due to unique factors such as the heavy manufacturing infrastructure and greater export of the textiles in the current period. Moreover, the region has seen a heavy consumption of packaging and hygiene products, which has boosted the revenue potential across the manufacturing landscape in recent years in the region. Also, the regional countries such as India, China, and Japan have observed abundant raw material availability.

Strong Domestic Demand Fuels Growth

China maintained its dominance in the market, owing to the vast domestic demand and advanced textile manufacturing infrastructure. Also, China has a greater number of spunbond and staple non-woven fabric makers, which has enabled the high return ventures for the country in recent years. Moreover, factors like ongoing healthcare investment and rising hygiene awareness have driven the country’s growth over the years.

North Americ Polypropylene Non-Woven Fabrics Market Evaluation

The North America polypropylene non-woven fabrics volume was estimated at 436.09 kilo tons in 2025 and is projected to reach 712.85 kilo tons by 2035, growing at a CAGR of 5.61% from 2026 to 2035, owing to the increasing demand for high-performance and specialized materials. From a formal industry perspective, the region emphasizes product quality, regulatory compliance, and advanced applications. Growth in healthcare innovation, sustainable packaging, and industrial filtration is driving demand. Manufacturers are investing in automation and advanced fabric engineering rather than volume production.

United States Manufacturing Prioritizes Performance

The United States is expected to emerge as a prominent country for the market in the coming years due to a strong industrial demand and technological leadership. Furthermore, the country focuses on innovation in medical textiles, filtration systems, and infrastructure materials. The manufacturers in the United States prioritize performance, safety, and sustainability over cost-based production. Increased investment in domestic manufacturing and supply chain security further supports market expansion.

Europe Polypropylene Non-Woven Fabrics Market Examination

The Europe polypropylene non-woven fabrics volume was estimated at 364.81 kilo tons in 2025 and is projected to reach 530.03 kilo tons by 2035, growing at a CAGR of 4.24% from 2026 to 2035. Europe is notably growing in the market, owing to rising demand for sustainable and high-quality materials. Also, the region prioritizes environmental responsibility, product durability, and regulatory compliance. Increased use of nonwoven fabrics in healthcare, automotive, and construction applications supports steady growth. European manufacturers focus on innovation, recycling compatibility, and material efficiency

Precision Engineering Drives German Dominance

Germany is expected to gain a major industry share due to its strong industrial base and engineering expertise. Moreover, the German manufacturers specialize in high- performance nonwoven fabrics for automotive, filtration, medical, and construction applications. The country underlines precision manufacturing, product reliability, and sustainability.

South America Polypropylene Non-Woven Fabrics Market

The South America polypropylene non-woven fabrics volume was estimated at 146.03 kilo tons in 2025 and is projected to reach 193.62 kilo tons by 2035, growing at a CAGR of 3.18% from 2026 to 2035. The South America polypropylene non-woven fabrics market is experiencing steady growth, driven mainly by rising demand from hygiene, healthcare, and industrial applications. Increasing population, urbanization, and improving healthcare infrastructure have significantly boosted consumption of PP non-wovens in products such as diapers, sanitary napkins, medical masks, gowns, wipes, and filtration materials. Among manufacturing technologies, spunbond dominates the market due to its cost-effectiveness and wide usage across hygiene, construction, and agriculture, while meltblown fabrics are the fastest-growing segment because of their critical role in medical and filtration applications.

In Brazil, the market holds the largest share in South America, supported by strong demand from the hygiene, healthcare, and industrial sectors. The country’s large population, rising awareness of personal hygiene, and expanding healthcare infrastructure drive high consumption of PP non-wovens in products such as diapers, sanitary products, medical masks, gowns, and wipes.

Middle East and Africa Polypropylene Non-Woven Fabrics Market

The Middle East and Africa polypropylene non-woven fabrics volume was estimated at 109.93 kilo tons in 2025 and is projected to reach 140.67 kilo tons by 2035, growing at a CAGR of 2.78% from 2026 to 2035.

In the Middle East and Africa (MEA), the polypropylene non-woven fabrics market is growing steadily, driven by increasing demand from hygiene, healthcare, construction, and industrial applications. Rapid population growth, rising urbanization, and improving living standards particularly in Gulf Cooperation Council (GCC) countries and parts of Africa are boosting consumption of disposable hygiene products such as diapers, sanitary napkins, and wipes, which rely heavily on PP non-woven fabrics.

In the United Arab Emirates (UAE), the market is witnessing steady growth, supported by strong demand from the healthcare, hygiene, construction, and filtration sectors. The country’s well-developed healthcare infrastructure and high standards for hygiene drive the use of PP non-wovens in medical products such as masks, gowns, drapes, and disposable wipes.

Polypropylene Non-Woven Fabrics Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 23.92% | 436.09 | 712.85 | 5.61% | 27.06% |

| Europe | 20.01% | 364.81 | 530.03 | 4.24% | 20.12% |

| Asia Pacific | 42.03% | 766.26 | 1057.15 | 3.64% | 40.13% |

| South America | 8.01% | 146.03 | 193.62 | 3.18% | 7.35% |

| Middle East & Africa | 6.03% | 109.93 | 140.67 | 2.78% | 5.34% |

Recent Developments

- In December 2024, The Acme Mills introduced the biobased PLA fabrics, which are called Natura. Also, the company has specifically designed to minimize the dependence of petroleum based non wovens as per the published report by the company.(Source : www.prnewswire.com)

- In January 2024, The Mitsui Chemicals Asahi Life Materials Co., Ltd. Has unveiled the PLA spunbond non-woven called ECORISE TM. Also, this PLA is likely to be used in the packaging of tennis racquets by Yonex Co. Ltd as per the published report.(Source: jp.mitsuichemicals.com)

Top Vendors in the Polypropylene Non-Woven Fabrics Market & Their Offerings:

- Kimberly-Clark Corporation: A global manufacturer of personal care and consumer tissue products, known for brands like Huggies®, Kotex®, and Kleenex®.

- Berry Global, Inc.: A leading global supplier of innovative plastic packaging and engineered materials, including non-woven specialty materials for health, hygiene, and industrial markets.

- Lydall, Inc.: A manufacturer of specialty engineered products and materials, providing filtration, thermal/acoustical solutions, and advanced materials for various industrial applications.

- First Quality Nonwovens Inc: A manufacturer of high-quality non-woven fabrics and finished products for personal care, hygiene (diapers, feminine care), and industrial applications (packaging, tissue).

- PFNonwovens a.s.

- Schouw & Co.

- Mitsui Chemicals Inc.

- FITESA

- Toray Industries Inc.

- Freudenberg Group

- Ahlstrom-Munksjo Oyj

- Johns Manville Corporation

- Suominen Corporation

- Asahi Kasai Corporation

Segments Covered in the Report

By Product

- Homopolymer

- Copolymer

By Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa