Content

What is the Current Asia Pacific Polymer Foam Market Size and Volume?

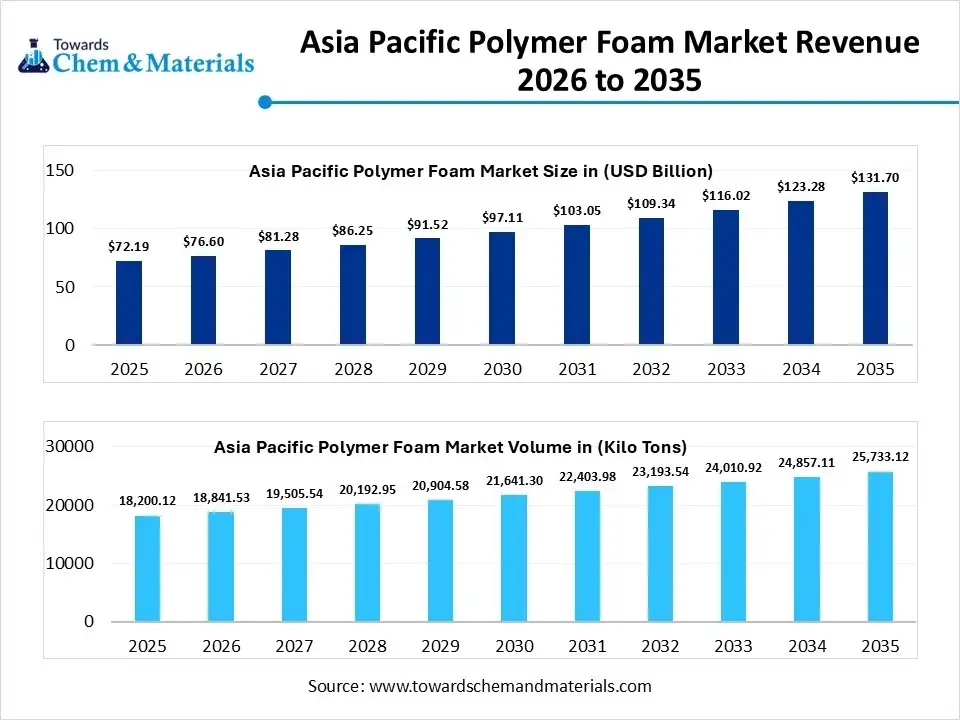

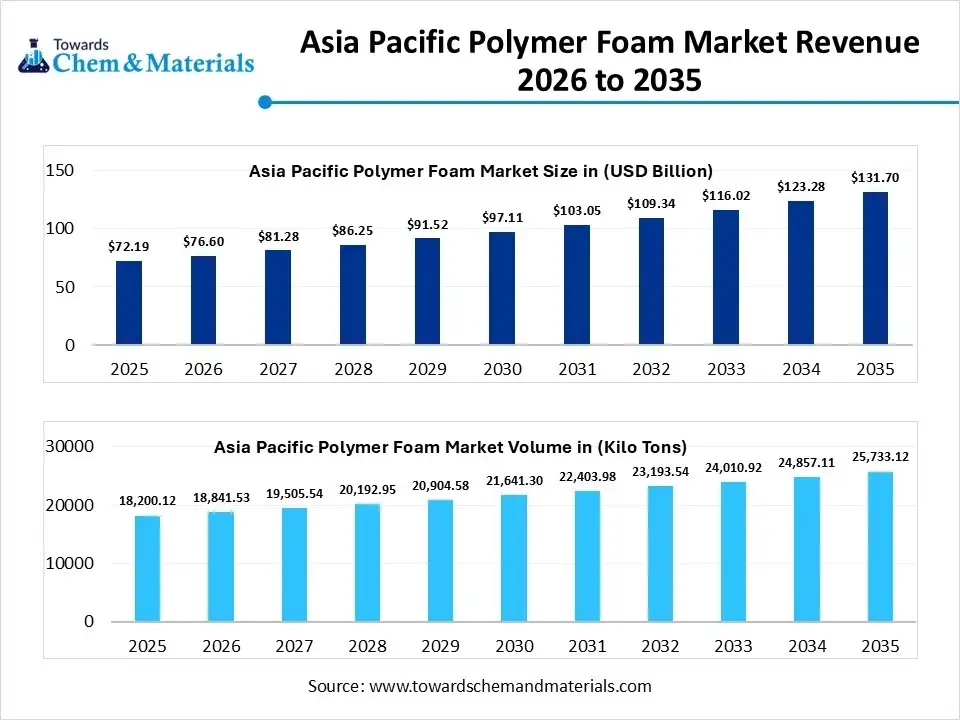

The Asia Pacific polymer foam market size was estimated at USD 72.19 billion in 2025 and is expected to increase from USD 76.6 billion in 2026 to USD 131.7 billion by 2035, growing at a CAGR of 6.12% from 2026 to 2035. In terms of volume, the market is projected to grow from 18200.12 kilo tons in 2025 to 25733.12 kilo tons by 2035. growing at a CAGR of 3.52% from 2026 to 2035. The growing development of large-scale housing and the increasing use of protective foam packaging drive the market growth.

Market Highlights

- By country, China held approximately a 55% share in the market in 2025 due to the growing automobile production.

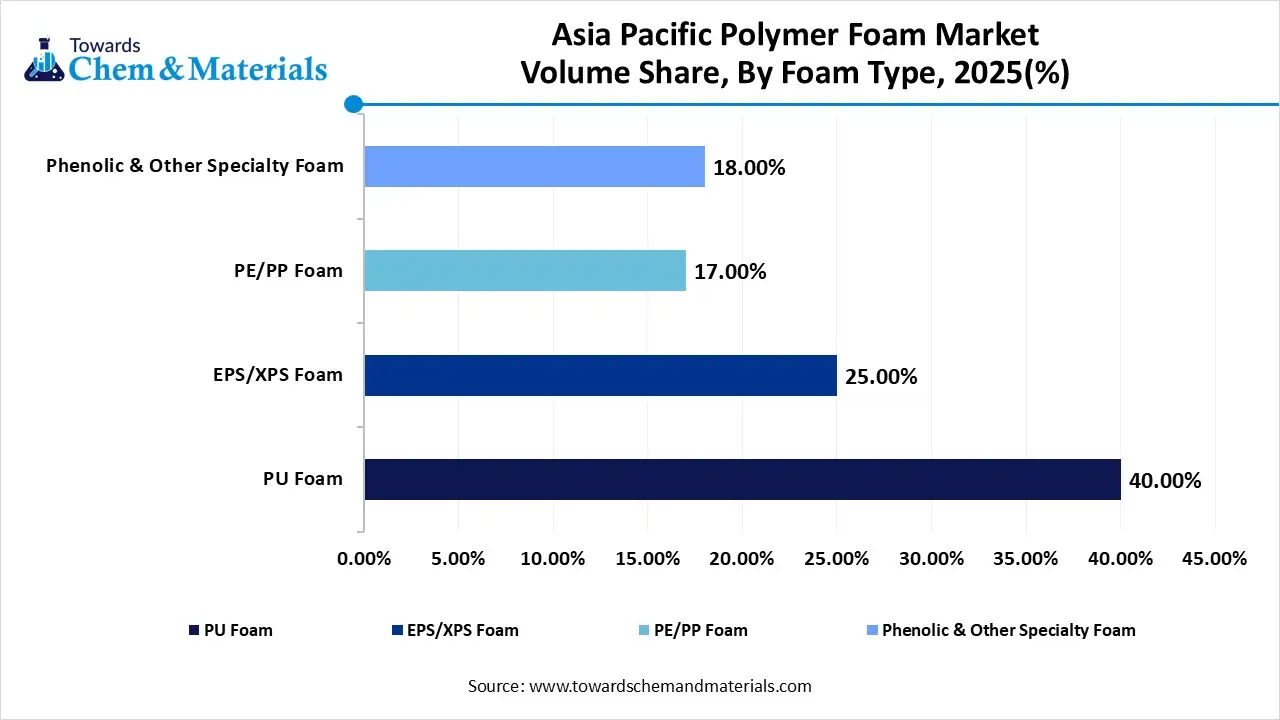

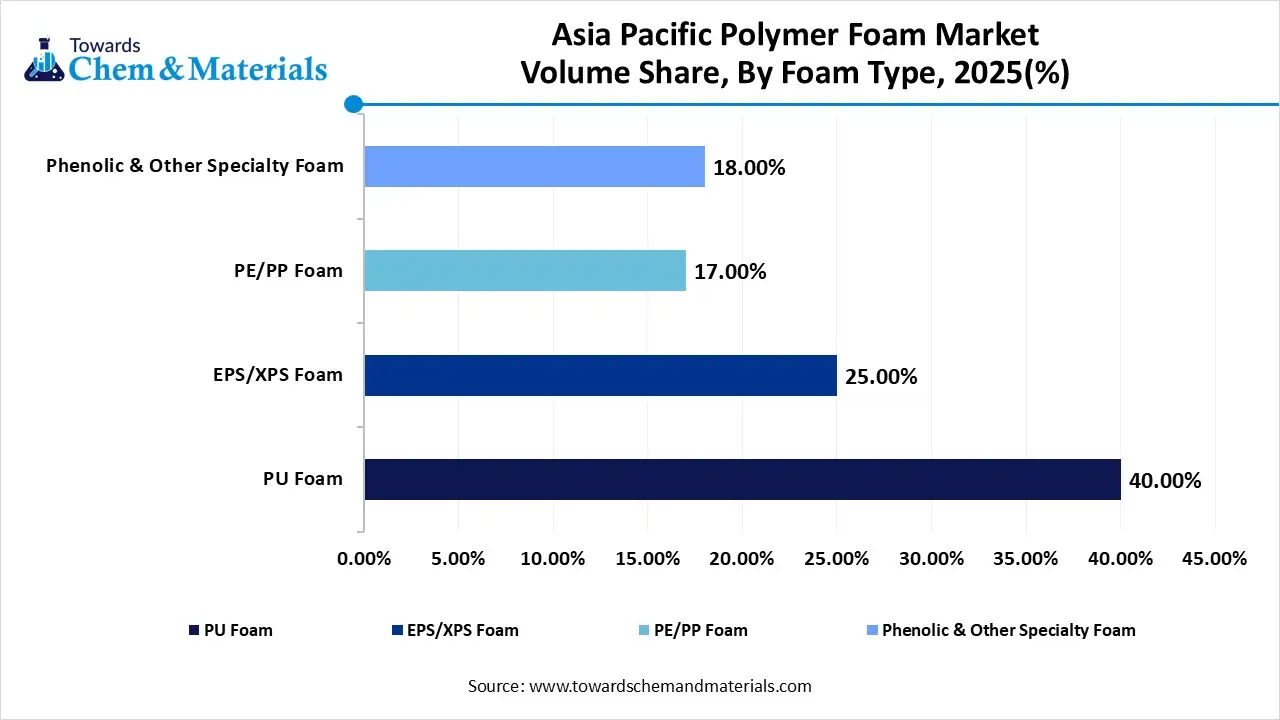

- By foam type, the polyurethane (PU) foam segment dominated the market and accounted for the largest volume share of 40% in 2025.

- By foam type, the polystyrene foam segment is expected to grow at the fastest CAGR of 3.39% from 2026 to 2035 in terms of volume.

- By structure, the flexible foam segment led the market with the largest revenue volume share of 55% in 2025.

- By end-user, the building & construction segment dominated the market and accounted for the largest volume share of 36.5% in 2025.

- By sales channel, the direct sales segment led the market with the largest revenue volume share of 65% in 2025.

What Drives the Growth of the Asia Pacific Polymer Foam Market?

Asia Pacific polymer foam market growth is driven by online retail sector expansion, increased spending on consumer goods, growing building activities, expanding appliance manufacturing, innovations in foam technologies, growth in electronics manufacturing, increased demand for passenger comfort vehicles, automotive industry expansion, and rising use of furniture.

The strong focus on lowering the consumption of energy and increasing the production of lighter materials increases demand for polymer foam. The sustainability focus increases the development of polymer foams using bio-based or recycled materials. The growing use of polyurethane foam and the focus on enhancing local production capabilities help market growth.

Asia Pacific Polymer Foam Market Trends:

- Electronics Manufacturing Growth:- The strong focus on preventing overheating and the focus on lowering the overall weight of the electronic product increase demand for polymer foam.

- Automotive Manufacturing Expansion:- The strong focus on enhancing passenger experience and rising vehicle production increases demand for polymer foam. The need for enhancing vehicle component safety and the development of lightweight structural parts requires polymer foam.

- Growing Furniture Demand:- The increasing need for enhancing acoustic insulation in furniture and the development of long-lasting furniture increase demand for polymer foam. The growing furniture purchases help market expansion.

- Government Initiatives:- The stringent automotive emission regulations and the energy-saving initiatives increase demand for polymer foam. The circular economy policies and the focus on domestic manufacturing create a higher demand for polymer foam.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 76.6 Billion / 18841.53 Kilo Tons |

| Revenue Forecast in 2035 | USD 131.7 Billion / 25733.12 Kilo Tons |

| Growth Rate | CAGR 6.12% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Segment Covered | By Foam / Resin Type, By Foam Structure, By End-User Industry, By Sales Channel |

| Key companies profiled | BASF SE, Dow Inc., Huntsman Corporation, Sekisui Chemical Co., Ltd., Covestro AG,JSP Corporation, Saint-Gobain, Wanhua Chemical Group, INOAC Corporation, Recticel, Rogers Corporation, Trelleborg Group |

Key Technological Shifts in the Asia Pacific Polymer Foam Market:

The Asia Pacific polymer foam market is undergoing key technological shifts driven by the demand for high performance, regulations, and energy efficiency. The various technological innovations, such as digitalization, advanced manufacturing, machine learning, simulation, data analytics, and IoT, increase efficiency and lower waste. The key technological change is the implementation of AI boosts innovations and automates the manufacturing process.

Artificial Intelligence easily predicts properties of polymer foam and minimizes trial-and-error time. AI produces a better throughput of polymer foam and focuses on consistent product quality. AI develops customized foams for certain uses and lowers the manufacturing time of specialized polymer foam. AI monitors the manufacturing parameters and guides the development of bio-based polymer foam. AI manages resource efficiency and inspects the foam products. Overall, AI enhances performance and creates new opportunities.

Trade Analysis of Asia Pacific Polymer Foam Market: Import & Export Statistics

- China exported 5,660 shipments of PE foam.

- South Korea exported 2,073 shipments of PE foam.

- China exported 256 shipments of expanded polystyrene foam.

- Malaysia exported 65 shipments of expanded polystyrene foam.

- China exported 3,616 shipments of polyurethane foams.

- From June 2024 to May 2025, India imported 284 shipments of polyethylene foam.

Asia Pacific Polymer Foam Market Value Chain Analysis

- Feedstock Procurement: The process sources raw materials like polyols, metal catalysts, polystyrene resin, linear PP, isocyanates, blowing agents, vinyl chloride monomers, and bio-based feedstocks like lignocellulosic biomass & raw vegetable oils.

- Key Players:- Covestro AG, Huntsman Corporation, Sekisui Chemical Co., Ltd, Borealis AG, Toray Industries, BASF SE, Dow Inc.

- Chemical Synthesis and Processing: The chemical synthesis involves methods like chemical blowing agents, mechanical foaming, & in-situ polymerization. The chemical processing involves steps like foam extrusion molding, foam injection molding, batch foaming, and slabstock production.

- Key Players:- Huntsman Corporation, Toray Industries, SABIC, BASF SE, Dow Inc., Mitsui Chemicals, Kaneka Corporation

- Quality Testing and Certifications: The stage focuses on evaluating qualities like load-bearing capacity, tear strength, thermal conductivity, tensile strength, dynamic fatigue, flammability, & elongation. Certification includes ISCC PLUS, EcoVadis, UL Standards, and ISO.

- Key Players:- Intertek, Asia Polyurethane, Armacell, SGS, TUV Rheinland

Country-Level Analysis of the Asia Pacific Polymer Foam Industry 4x 5

| Country | Major Polymer Foam | Key Applications | Companies |

|

|

|

|

| China |

|

|

|

| South Korea |

|

|

|

| Japan |

|

|

|

Segmental Insights

Foam Insights

Why the Polyurethane (PU) Foam Segment Dominates the Asia Pacific Polymer Foam Market?

The polyurethane (PU) foam segment volume was valued at 7280.05 kilo tons in 2025 and is projected to reach 10892.83 kilo tons by 2035, expanding at a CAGR of 4.58% during the forecast period from 2025 to 2035. The polyurethane (PU) foam segment dominated the Asia Pacific polymer foam market with a 40% share in 2025. The rapid growth in infrastructure projects and the growing vehicle manufacturing increases demand for PU foam. The growing modern furniture consumption and booming protective packaging increase demand for PU foam. The well-established manufacturing industry and increased production of structural components require PU foam, driving overall market growth.

The polystyrene foam segment volume was valued at 3094.02 kilo tons in 2025 and is projected to reach 4176.49 kilo tons by 2035, expanding at a CAGR of 3.39% during the forecast period from 2025 to 2035. The expansion of online shopping and the growth in smart city development increase demand for polystyrene foam. The focus on lowering vehicle emissions and the growing energy-efficiency standards increases demand for polystyrene foam. The superior thermal insulation, cost-effectiveness, and lightweight properties of polystyrene foam support the overall market growth.

Asia Pacific Polymer Foam Market Volume and Share, By Foam Type, 2025-2035

| By Foam Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| PU Foam | 40.00% | 7280.05 | 10892.83 | 4.58% | 42.33% |

| EPS/XPS Foam | 25.00% | 4550.03 | 6229.99 | 3.55% | 24.21% |

| PE/PP Foam | 17.00% | 3094.02 | 4176.49 | 3.39% | 16.23% |

| Phenolic & Other Specialty Foam | 18.00% | 3276.02 | 4433.82 | 3.42% | 17.23% |

Foam Structure Insights

How did the Flexible Foam Segment hold the Largest Revenue Share in the Asia Pacific Polymer Foam Market?

The flexible foam segment held the largest revenue share of approximately 55% share in the Asia Pacific polymer foam market in 2025. The growing demand for comfortable home furnishing and the increased production of large cars increase the demand for flexible foam. The excellent vibration damping, sustainability, and customizability of flexible foam help market expansion. The increasing need for protective cushioning and retail expansion increases demand for flexible foam, driving the overall market growth.

The rigid foam segment is experiencing the fastest growth in the market during the forecast period. The high compressive strength and good sound-damping of rigid foam help market expansion. The development of lightweight components and expanded electronics manufacturing increases demand for rigid foam. The increased insulation activities and the rapid growth in consumer goods increase demand for rigid foam, supporting the overall market growth.

End-User Industry Insights

Which End-User Industry Dominated the Asia Pacific Polymer Foam Market?

The building & construction segment dominated the Asia Pacific polymer foam market with a 36.5% share in 2025. The strong focus on energy efficiency in commercial buildings and the growing development of new buildings increase demand for polymer foam. The focus on sealing gaps in windows and the development of lighter buildings increases demand for polymer foam. The growth in green building practices and increasing investment in transportation corridors increases demand for polymer foam, driving the overall market growth.

The packaging segment is the fastest-growing in the market during the forecast period. The massive online shopping expansion and the focus on lowering shipping expenses increase demand for polymer foam. The increasing use of shock-absorbing packaging and the expansion of packaged goods require polymer foam. The growing demand for protective packaging and the push for sustainable packaging increases demand for polymer foam, supporting the overall market growth.

Sales Channel Insights

How did the Direct Sales Segment hold the Largest Share in the Asia Pacific Polymer Foam Market?

The direct sales segment held the largest revenue share of approximately 65% share in the Asia Pacific polymer foam market in 2025. The strong focus on direct collaboration and the growing bulk purchases increase demand for direct sales. The increasing need for customized products and the focus on streamlining supply increases demand for direct sales. The technical support presence and integrated logistics of direct sales drive the overall market growth.

The indirect sales segment is experiencing the fastest growth in the market during the forecast period. The customer relationship development and the well-established distribution infrastructure increase demand for indirect sales. The specialized service availability and the focus on streamlining logistics increase demand for indirect sales. The well-established indirect sales networks and testing new products support the overall market growth.

Country-Level Insights

China’s Strong Grip: Growing Influence of Polymer Foam

China dominated the market with approximately 55% share in 2025. The increasing investment in the development of smart cities and growing industrial fuel consumption increases the demand for polymer foam. The increased production of automobile parts and the government's focus on the development of energy-efficient buildings increase demand for polymer foam. The surging expansion of e-commerce platforms and a strong manufacturing base increases the demand for polymer foam, driving the overall market growth.

- China exported 7,393 shipments of polyether foam.

Foaming Hub: India’s Rise in Polymer Foam Production

India is experiencing the fastest growth in the market during the forecast period. The increased spending on the development of transportation infrastructure and the strong presence of an auto manufacturing hub increase demand for polymer foam. The shift towards online shopping and the focus on domestic manufacturing activities create higher demand for polymer foam. The growing use of furniture and the stringent energy codes in buildings increases demand for polymer foam, supporting the overall market growth.

Industrial Expansion: Japan’s Excellence in Polymer Foam Production

Japan is a key contributor to the market. The presence of a robust industrial base and the infrastructure project growth increases demand for polymer foam. The rise of e-commerce and the strong focus on digital transformation increase demand for polymer foam. The expansion of packaging and the focus on enhancing energy efficiency in construction projects increase demand for polymer foam. The growing development of bio-based and lightweight polymer foams drives the overall market growth.

Recent Developments

- In September 2025, Rogers Corporation launched polyurethane foam, PORON 40V0. The foam consists of superior compression set resistance and is widely used for cushioning applications. Polymer foam halogen-free material and ultra-soft in nature.(Source: www.rogerscorp.com)

- In December 2025, BASF launched WALLTITE RSB spray polyurethane foam insulation. The foam minimizes the carbon footprint and is a sustainable solution. The foam enhances the energy efficiency and is suitable for construction projects with low-carbon mandates.(Source: www.basf.com)

- In July 2025, Covestro launched flame-retardant polyurethane foam technology, Baysafe BEF, for EV batteries. The foam lowers the thermal propagation and increases the battery safety. The foam is widely used in applications like portable battery generators, new energy vehicles, and e-bikes. (Source: www.indianchemicalnews.com)

Top Companies List

- BASF SE:- The company develops PU foam systems like Autopour and Autofroth to support industries like automotive, refrigeration, and construction.

- Dow Inc.:- The company manufactures various types of polyurethane foams, like rigid, microcellular, flexible, and semi-rigid foams for applications like bedding, appliance insulation, footwear, automotive seating, and others.

- Huntsman Corporation:- The company manufactures spray polyurethane foam to support applications like insulation, footwear, furniture, seating, and bedding.

- Covestro AG:- The company supplies raw materials for the production of integral skin, flexible, and rigid polyurethane foams to serve key industries like mobility, healthcare, construction, and furniture.

- Sekisui Chemical Co., Ltd.:- The company produces polyolefin foam like Softlon, and it operates 10 foam manufacturing plants globally. The company supports industries like building & construction, consumer goods, automotive, and electronics.

- JSP Corporation

- Saint-Gobain

- Wanhua Chemical Group

- INOAC Corporation

- Recticel

- Rogers Corporation

- Trelleborg Group

Segments Covered

By Foam / Resin Type

- Polyurethane (PU) Foam

- Polystyrene (EPS/XPS) Foam

- Polyolefin Foam (PE/PP)

- Phenolic & Other Specialty Foams

By Foam Structure

- Flexible Foam

- Rigid Foam

By End-User Industry

- Building & Construction

- Bedding & Furniture

- Packaging

- Automotive & Transportation

- Footwear, Sports & Recreation

- Others (Appliances, Industrial, Consumer Goods)

By Sales Channel

- Direct Sales

- Indirect Sales (Distributors)