Content

What is the Current Polypropylene Random Copolymer Market Size and Volume?

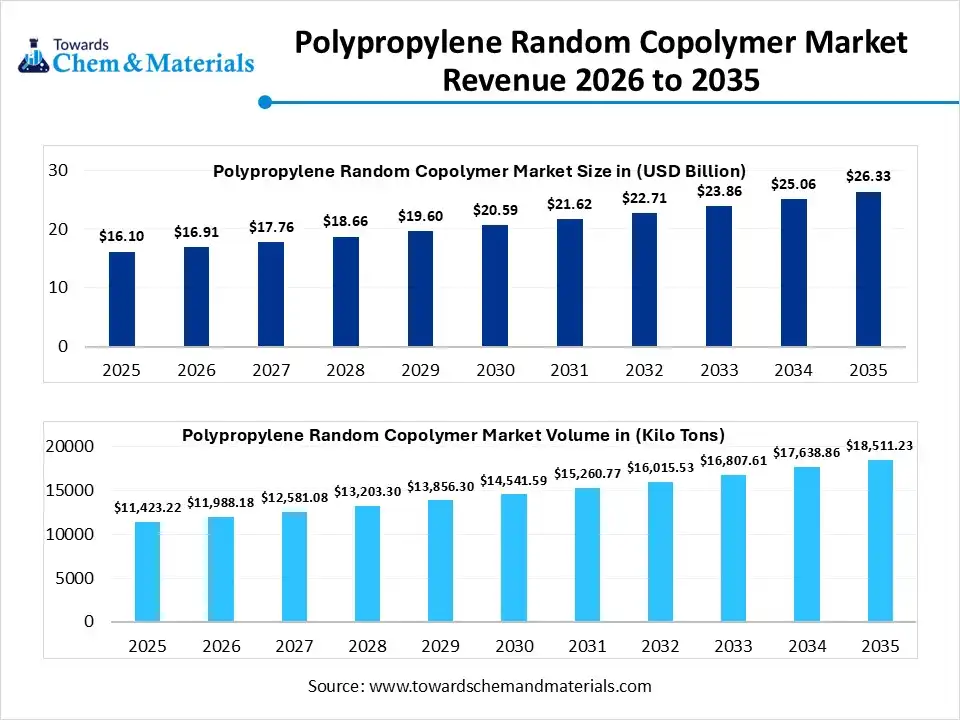

The global polypropylene random co-polymer market size was estimated at USD 16.10 billion in 2025 and is expected to increase from USD 16.91 billion in 2026 to USD 26.33 billion by 2035, growing at a CAGR of 5.04% from 2026 to 2035. In terms of volume, the market is projected to grow from 11,423.22 kilo tons in 2025 to 18,511.23 kilo tons by 2035. growing at a CAGR of 4.95% from 2026 to 2035. Asia Pacific dominated the polypropylene random copolymer market with the largest volume share of 44.01% in 2025. The growth of the market is driven by the infrastructure development, sustainability initiative and demand for eco-friendly products fuels the growth of the market.

Market Highlights

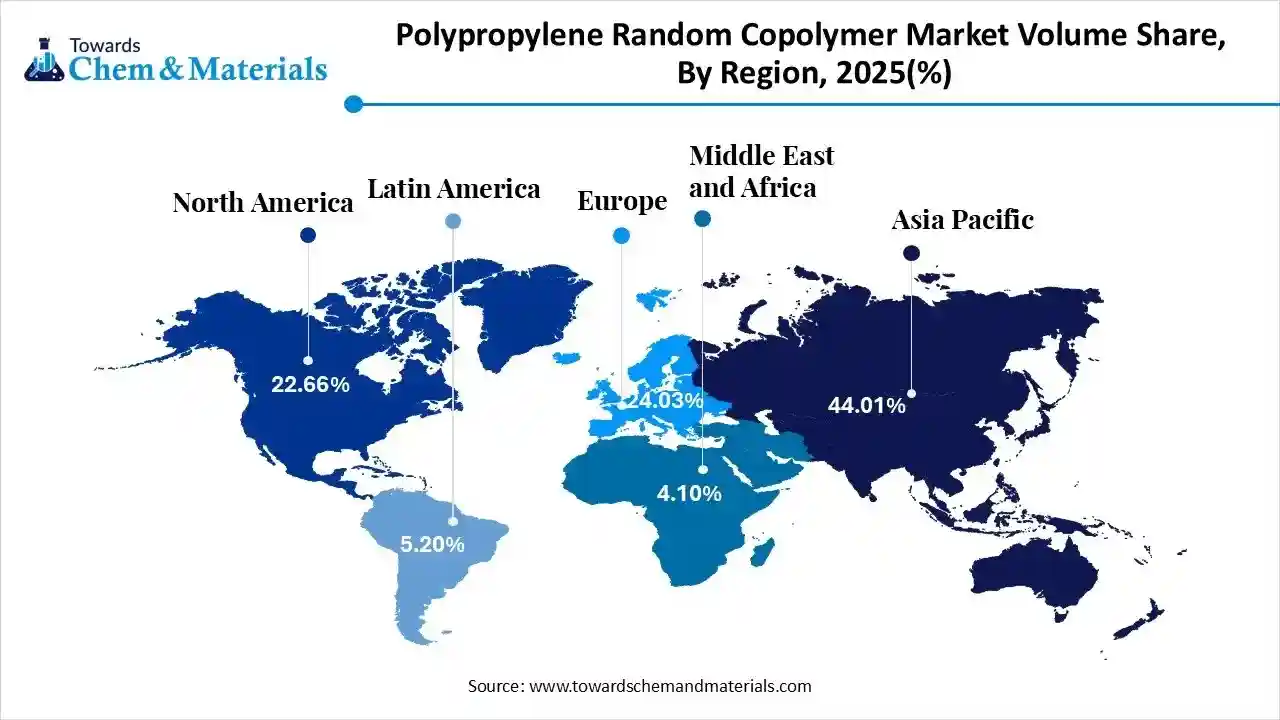

- The Asia Pacific dominated the polypropylene random copolymer market with the largest volume share of 44.01% in 2025.

- The polypropylene random copolymer market in North America is expected to grow at a substantial CAGR of 5.21% from 2026 to 2035.

- The Europe polypropylene random copolymer market segment accounted for the major volume share of 24.03% in 2025.

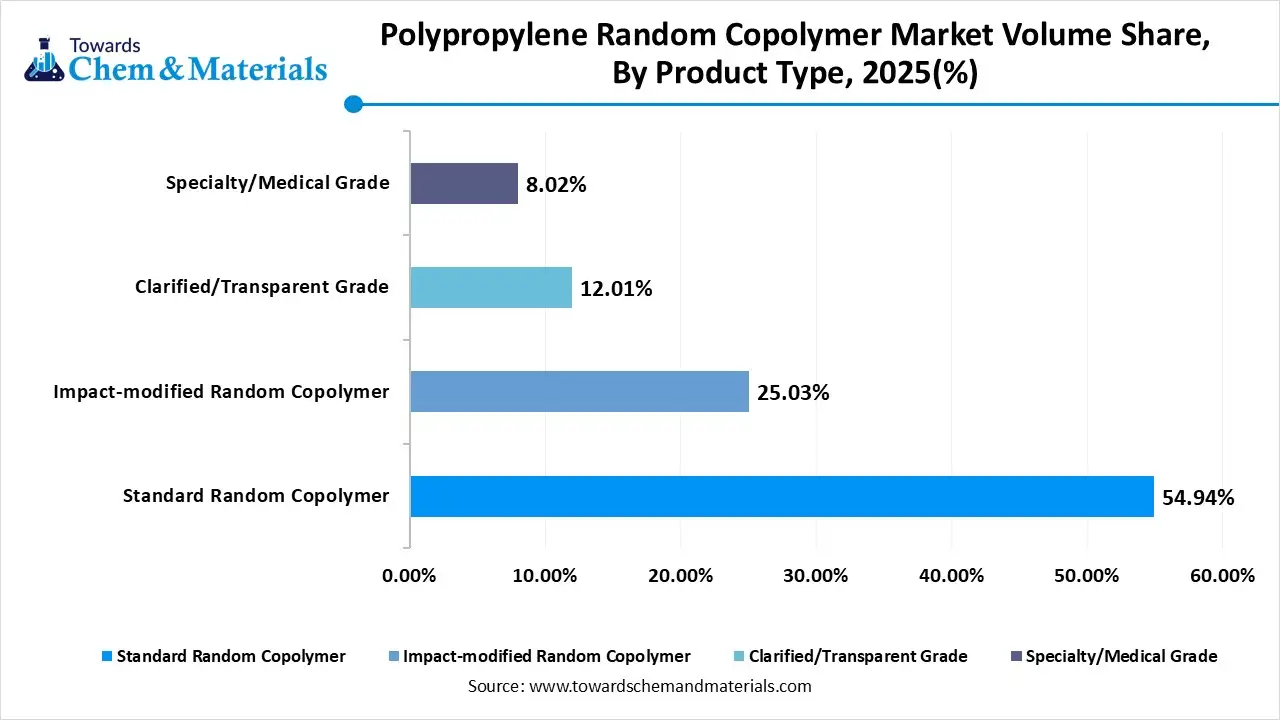

- By product type, the standard random copolymer segment dominated the market and accounted for the largest volume share of 54.94% in 2025.

- By product type, the specialty & medical grade segment is expected to grow at the fastest CAGR of 7.03% from 2026 to 2035 in terms of volume.

- By processing, the injection molding segment led the market with the largest revenue volume share of 40% in 2025.

- By end-user, the packaging segment dominated the market and accounted for the largest volume share of 48% in 2025.

- By application, the rigid packaging containers segment led the market with the largest revenue volume share of 35% in 2025.

Market Overview

What Is The Significance Of The Polypropylene Random Copolymer Market?

The polypropylene random copolymer (PPR) market is significant due to its versatility, driven by demand for lightweight, recyclable, and high-performance materials, especially in the dominant packaging sector, offering superior clarity, chemical resistance, and flexibility. Its importance extends to durable piping systems, automotive components, and household goods, fueled by sustainability trends, innovation, and expansion in the Asia-Pacific region, replacing traditional materials like glass and PET.

Polypropylene Random Copolymer Market Growth Trends:

- Enhanced Properties: Development of PPR with improved impact resistance, clarity, and processing.

- Sustainability Focus: Manufacturers developing biodegradable and recyclable products to meet regulations and demand.

- Technological Advancements: Innovations in production processes for better performance.

- 3D Printing: A growing application in prototyping and functional parts.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 16.91 Billion / 11988.18 Kilo Tons |

| Revenue Forecast in 2035 | USD 26.33 Billion / 18511.23 Kilo Tons |

| Growth Rate | CAGR 5.04% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Processing Technology, By End-User Industry, By Application, By Regions |

| Key companies profiled | LyondellBasell Industries, SABIC, ExxonMobil Chemical, Borealis AG, Braskem S.A., TotalEnergies Corbion, INEOS Olefins & Polymers, Reliance Industries Limited, Formosa Plastics Corporation, LG Chem, Sinopec, PetroChina, Lotte Chemical, Indian Oil Corporation, PTT Global Chemical, Versalis |

Key Technological Shifts In The Polypropylene Random Copolymer Market:

The key technological shifts in the polypropylene random copolymer market are primarily centered on sustainability, enhanced material performance through advanced catalysts, and integration of smart manufacturing processes. These innovations are driven by regulatory pressures and increasing demand for eco-friendly, high-performance materials across diverse applications.

Trade Analysis Of Polypropylene Random Copolymer Market: Import & Export Statistics

- According to Global Export data, the world exported 16,641 shipments of Polypropylene Copolymer from June 2024 to May 2025 (TTM). These exports are handled by 1,515 Exporters to 2,363 Buyers, with the growth rate of 3% compared to the previous twelve months.

- Most of the Polypropylene Copolymer exports from the World destined to the Vietnam, Mexico, and Turkey.

- Globally, the top three exporters of Polypropylene Copolymer are South Korea, Thailand, and Vietnam. South Korea leads the world in Polypropylene Copolymer exports with 8,208 shipments, Thailand with 7,784 shipments, and Vietnam with 6,212 shipments.

Polypropylene Random Copolymer Market -- Value Chain Analysis

- Polymer Production and Processing: Polypropylene random copolymer is produced through catalytic polymerization of propylene with ethylene using Ziegler–Natta or metallocene catalysts, followed by pelletization, compounding, and grade modification to achieve enhanced clarity, flexibility, and impact resistance.

- Key players: LyondellBasell Industries, Borealis AG, SABIC, and Reliance Industries Limited.

- Quality Testing and Certification: Polypropylene random copolymer requires certifications ensuring mechanical performance, clarity, thermal stability, and regulatory compliance for industrial and consumer applications. Key certifications include ISO 9001 quality standards, ASTM material specifications, FDA food-contact approval, and REACH compliance.

- Key players: ISO (International Organization for Standardization), ASTM International, FDA (U.S. Food and Drug Administration), ECHA (REACH).

- Distribution to Industrial Users: Polypropylene random copolymer is supplied to packaging manufacturers, medical device producers, household goods manufacturers, piping system suppliers, and consumer product OEMs.

- Key players: SABIC, Borealis AG, LyondellBasell Industries.

Polypropylene Random Copolymer Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | U.S. Environmental Protection Agency (EPA) OSHA (Occupational Safety & Health Administration) FDA (Food and Drug Administration) DOT (Department of Transportation) |

TSCA (Toxic Substances Control Act) Clean Air Act (CAA) – VOC/HAP control Clean Water Act (CWA) – NPDES OSHA Hazard Communication Standard FDA 21 CFR (if food-contact) DOT Hazardous Materials Regulations (49 CFR) |

Chemical inventory & risk evaluation Emissions and effluent control at polymer plants Worker safety & hazard communication Compliance for food-contact grades Packaging and transport of additives/monomers |

| European Union | European Chemicals Agency (ECHA) European Commission |

REACH Regulation (EC 1907/2006) CLP Regulation (EC 1272/2008) EU Plastics Regulation (Food Contact) Industrial Emissions Directive (IED) |

Chemical registration & hazard classification Emission & effluent limits Worker safety & labeling Migration limits for food contact |

| China | Ministry of Ecology and Environment (MEE) SAMR (Standardization Administration) |

MEE Order No. 12 – New Chemical Substance Registration Air & Water Pollution Prevention Laws National product standards (GB) |

New chemical registration for monomers/modified polymers Emission & effluent compliance Standards for food contact and plastics quality |

| India | MoEFCC (Ministry of Environment, Forest & Climate Change) CPCB (Central Pollution Control Board) FSSAI (Food Safety and Standards Authority of India) |

Proposed Chemicals (Management & Safety) Rules Air/Water Acts Hazardous & Other Wastes (Management & Transboundary Movement) Rules FSSAI Food Contact Material Regulations |

Chemical safety & registration Emissions & discharge control at plants Hazardous waste handling Compliance for food contact applications |

Segmental Insights

Product Type Insights

How did High Impact Strength Segment Dominate the Polypropylene Random Copolymer Market in 2025?

The standard random copolymer segment volume was valued at 6275.92 kilo tons in 2025 and is projected to reach 10079.36 kilo tons by 2035, expanding at a CAGR of 5.41% during the forecast period from 2025 to 2035.The standard random copolymer segment dominated the market with a share of approximately 54.94% in 2025, they are widely used due to their balanced mechanical strength, optical clarity, and ease of processing. These grades are commonly adopted in packaging, household goods, and consumer applications where flexibility, impact resistance, and transparency are essential.Their cost-effectiveness and compatibility with multiple processing techniques make them a preferred choice for high-volume manufacturing.

The specialty & medical grade segment volume was valued at 916.14 kilo tons in 2025 and is projected to reach 1688.22 kilo tons by 2035, expanding at a CAGR of 7.03% during the forecast period from 2025 to 2035, as they are engineered to meet stringent regulatory, purity, and performance requirements. These grades offer enhanced chemical resistance, sterilization compatibility, and low extractables, making them suitable for medical devices, pharmaceutical packaging, and healthcare disposables. Growing demand for safe, lightweight, and recyclable medical materials continues to drive adoption of these high-value grades.

Polypropylene Random Copolymer Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Standard Random Copolymer | 54.94% | 6275.92 | 10079.36 | 5.41% | 54.45% |

| Impact-modified Random Copolymer | 25.03% | 2859.23 | 4296.46 | 4.63% | 23.21% |

| Clarified/Transparent Grade | 12.01% | 1371.93 | 2447.18 | 6.64% | 13.22% |

| Specialty/Medical Grade | 8.02% | 916.14 | 1688.22 | 7.03% | 9.12% |

Processing Insights

Which Material Grade Segment Dominated the Polypropylene Random Copolymer Market in 2025?

The injection molding segment dominated the market with a share of approximately 40% in 2025. This process is extensively used in packaging, medical disposables, and consumer products due to its high productivity, dimensional accuracy, and material efficiency. The polymer’s flow properties and thermal stability make it well-suited for high-speed injection molding operations.

The thermoforming segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, due to packaging applications that require clarity, flexibility, and lightweight structures. The material’s excellent heat resistance and uniform thickness distribution allow efficient production of trays, containers, and lids. Demand for recyclable and food-safe packaging solutions is further supporting the growth of thermoformed random copolymer products.

End-User Industry Insights

How did the Packaging Segment Dominated the Polypropylene Random Copolymer Market in 2025?

The packaging segment dominated the market with a share of approximately 48% in 2025, due to their lightweight nature, chemical resistance, and food-grade safety. These materials are widely used in food containers, caps, closures, and films, supporting demand from growing packaged food consumption and increasing preference for recyclable plastic materials.

The medical & healthcare segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, as they are used in diagnostic components, syringes, medical containers, and single-use disposables. Their biocompatibility, sterilization resistance, and regulatory compliance make them suitable for critical healthcare applications. Rising healthcare expenditure and increased use of disposable medical products are key growth drivers for this segment.

Application Insights

Which Application Segment Dominated the Polypropylene Random Copolymer Market in 2025?

The rigid packaging containers segment dominated the market with a share of approximately 35% in 2025, since it offer excellent clarity, toughness, and resistance to chemicals and heat. These containers are widely used for food storage, dairy products, ready-to-eat meals, and consumer goods. Growing preference for reusable and recyclable rigid packaging formats is significantly boosting demand for random copolymer-based solutions.

The medical devices & disposables segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. The material’s high purity, low leachability, and compatibility with sterilization methods ensure patient safety and regulatory acceptance. Expanding global healthcare infrastructure and increased focus on infection control are accelerating demand in this application segment.

Regional Insights

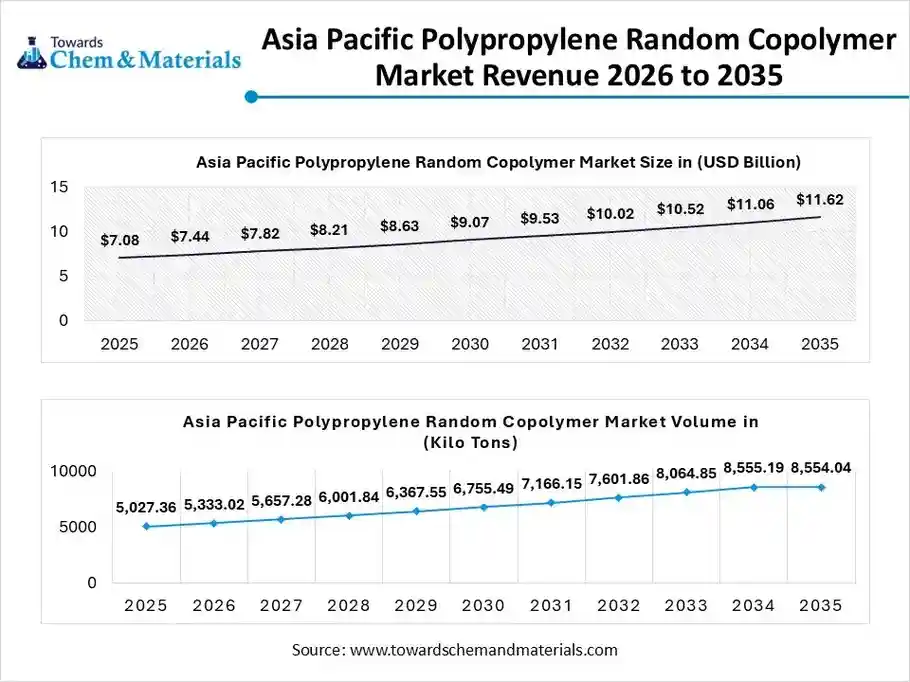

The Asia Pacific polypropylene random copolymer market size was valued at USD 7.08 billion in 2025 and is expected to be worth around USD 11.62 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.08% over the forecast period from 2026 to 2035.

The Asia Pacific polypropylene random copolymer volume was estimated at 5027.36 kilo tons in 2025 and is projected to reach 8554.04 kilo tons by 2035, growing at a CAGR of 6.08% from 2026 to 2035. Asia Pacific dominated the market with a share of approximately 44.01% in 2025, driven by strong demand from packaging, consumer goods, healthcare, and piping applications. Rapid urbanization, expanding middle-class consumption, and large-scale polymer manufacturing capacities in the region support sustained volume growth.

China: Polypropylene Random Copolymer Market Growth Trends

China dominates regional demand owing to its massive packaging, medical disposables, and household products industries. Growing use of random copolymers in food packaging, transparent containers, and healthcare applications aligns with regulatory emphasis on material safety and performance. Domestic capacity expansions by state-owned and private petrochemical producers continue to reduce import dependence and strengthen supply security.

North America Polypropylene Random Copolymer Market Analysis

The North America polypropylene random copolymer market volume was estimated at 2588.50 kilo tons in 2025 and is anticipated to reach 4089.13 kilo tons by 2035, growing at a CAGR of 5.21% from 2026 to 2035. North America is expected to have fastest growth in the market in the forecast period between 2026 and 2035, supported by strong demand from medical devices, rigid packaging, and consumer applications. Sustainability initiatives and recycling-compatible resin development are influencing product innovation across end-use industries.

United States: Polypropylene Random Copolymer Market Growth Trends

The U.S. market is characterized by high-value applications, particularly in medical packaging, pharmaceutical containers, and food-grade products. Demand is driven by performance requirements such as clarity, impact resistance, and regulatory compliance. Investments in advanced compounding, lightweight packaging solutions, and circular polymer initiatives continue to shape long-term growth prospects.

Europe: Polypropylene Random Copolymer Market Analysis

The Europe polypropylene random copolymer market volume was estimated at 2745.00 kilo tons in 2025 and is anticipated to reach 4096.54 kilo tons by 2035, growing at a CAGR of 4.55% from 2026 to 2035. Europe’s polypropylene random copolymer market is driven by sustainability regulations, high-quality manufacturing standards, and strong demand from healthcare and packaging sectors. Growth is moderate but stable, supported by technological advancements and premium application demand.

Germany: Polypropylene Random Copolymer Market Growth Trends

Germany plays a pivotal role in the European market due to its advanced plastics processing industry and strong automotive, medical, and packaging sectors. The country’s focus on high-performance and sustainable materials supports demand for premium random copolymer grades. R&D-driven innovation and compliance with EU circular economy policies further strengthen market positioning.

Polypropylene Random Copolymer Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 22.66% | 2588.50 | 4089.13 | 5.21% | 22.09% |

| Europe | 24.03% | 2745.00 | 4096.54 | 4.55% | 22.13% |

| Asia Pacific | 44.01% | 5027.36 | 8554.04 | 6.08% | 46.21% |

| South America | 5.20% | 594.01 | 988.50 | 5.82% | 5.34% |

| Middle East & Africa | 4.10% | 468.35 | 783.03 | 5.88% | 4.23% |

Recent Developments

- In September 2025, Formosa Plastics Corporation, U.S.A., commissioned North America's largest horizontal polypropylene reactor at its facility in Point Comfort, Texas.(Source: www.chemanalyst.com)

- In October 2024, Truflo by Hindware launched its new line of PPRC (Polypropylene Random Copolymer) pipes, designed for high-pressure, hot, and cold water plumbing applications, especially in areas with extreme weather conditions.(Source: www.dailyexcelsior.com)

Top players in the Polypropylene Random Copolymer Market & Their Offerings:

- LyondellBasell Industries: LyondellBasell is a global leader in polypropylene production, including polypropylene random copolymer marketed under brands like Hifax® and ProFort™. These copolymers are widely used in flexible packaging, consumer goods, automotive components, and film applications due to their balance of stiffness, clarity, and impact resistance.

- SABIC: SABIC supplies a comprehensive range of polypropylene materials, including random copolymers tailored for packaging films, consumer products, and industrial applications. The company emphasizes product consistency, processing stability, and sustainability efforts linked to circular plastics initiatives.

- ExxonMobil Chemical: ExxonMobil produces high-quality random copolymer polypropylene grades designed for durable packaging, automotive interiors, fibers, and injection molded parts. Its product lines offer excellent processability, impact performance, and optical properties.

- Borealis AG

- Braskem S.A.

- TotalEnergies Corbion

- INEOS Olefins & Polymers

- Reliance Industries Limited

- Formosa Plastics Corporation

- LG Chem

- Sinopec

- PetroChina

- Lotte Chemical

- Indian Oil Corporation

- PTT Global Chemical

- Versalis

Segments Covered

By Product Type

- Standard Random Copolymer

- Impact-Modified Random Copolymer

- Clarified / Transparent Grade

- Specialty & Medical Grade

By Processing Technology

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

By End-User Industry

- Packaging

- Consumer Goods

- Medical & Healthcare

- Automotive

- Building & Construction

- Others

By Application

- Medical Devices & Disposables

- Caps & Closures

- Pipes & Fittings

- Others

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa