Content

What is the Current Polyisobutylene Market Size and Volume?

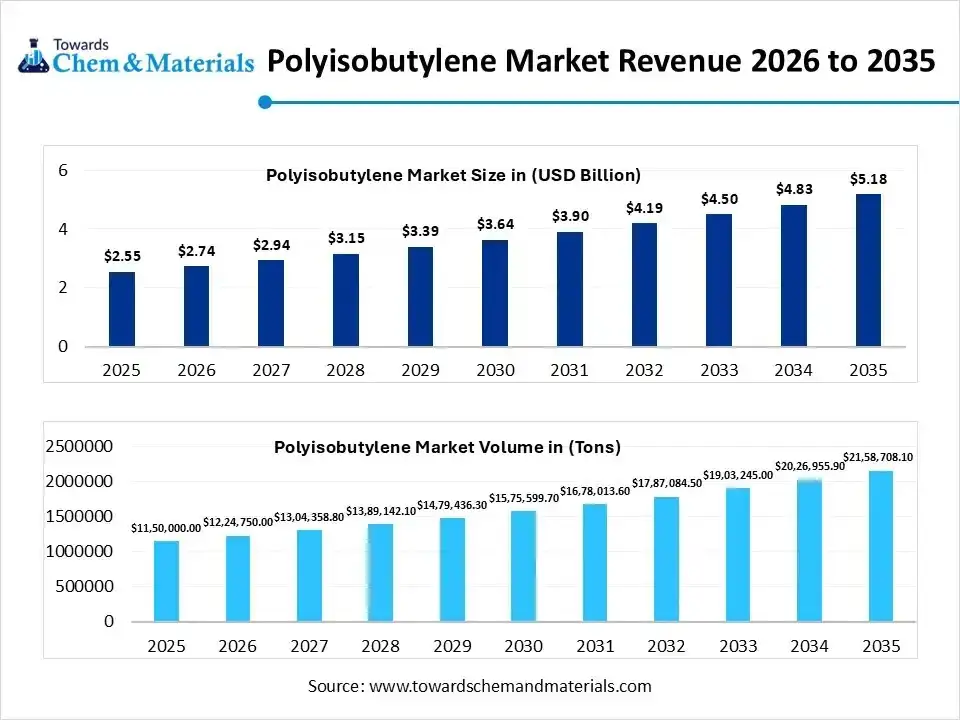

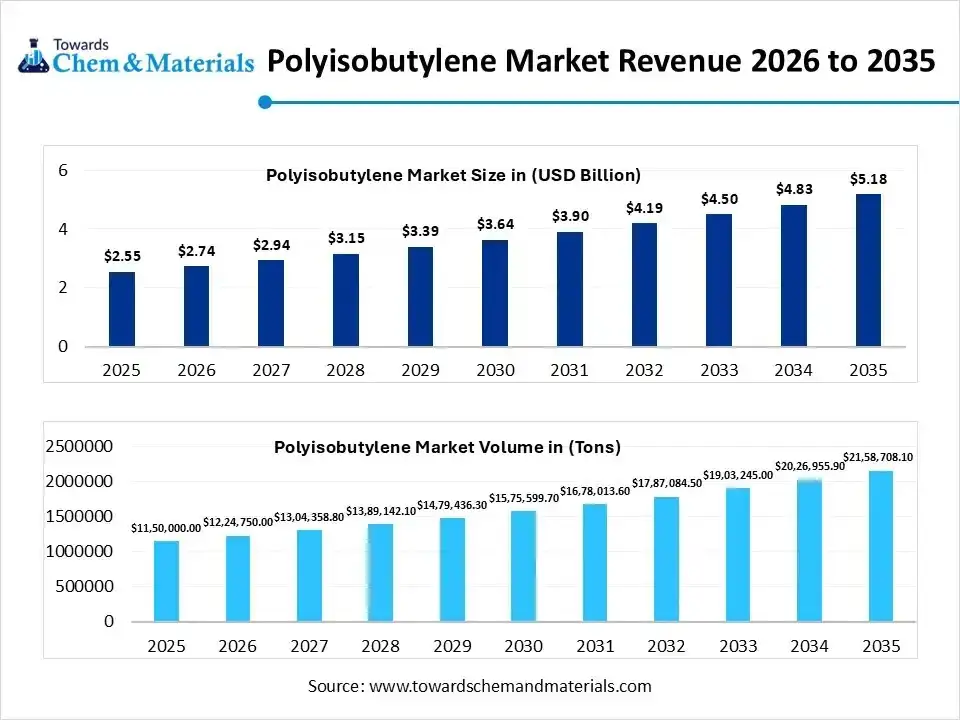

The global polyisobutylene market size was estimated at USD 2.55 billion in 2025 and is expected to increase from USD 2.74 billion in 2026 to USD 5.18 billion by 2035, growing at a CAGR of 7.35% from 2026 to 2035. In terms of volume, the market is projected to grow from 1,150,000 tons in 2025 to 2,158,708.10 tons by 2035. growing at a CAGR of 6.50% from 2026 to 2035. Asia Pacific dominated the polyisobutylene market with the largest volume share of 40.00% in 2025.The growth of the market is driven by the growing demand from various sectors due to its applications and advancements.

Market Highlights

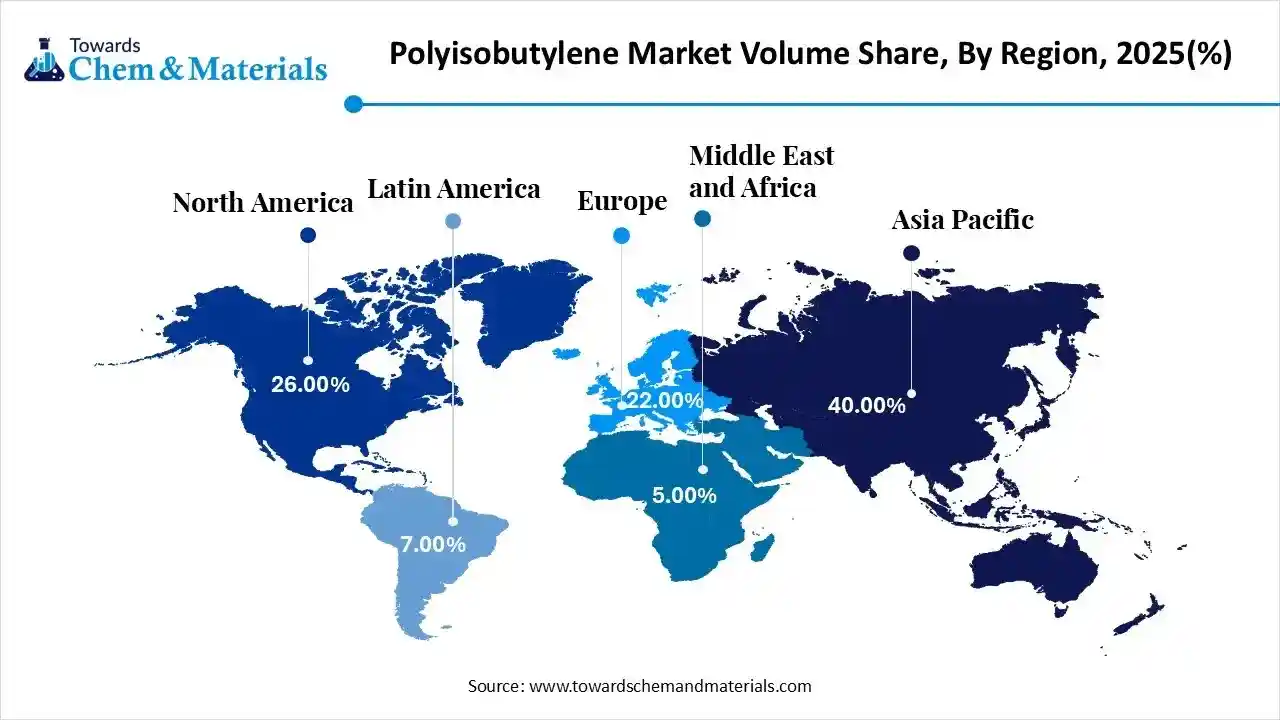

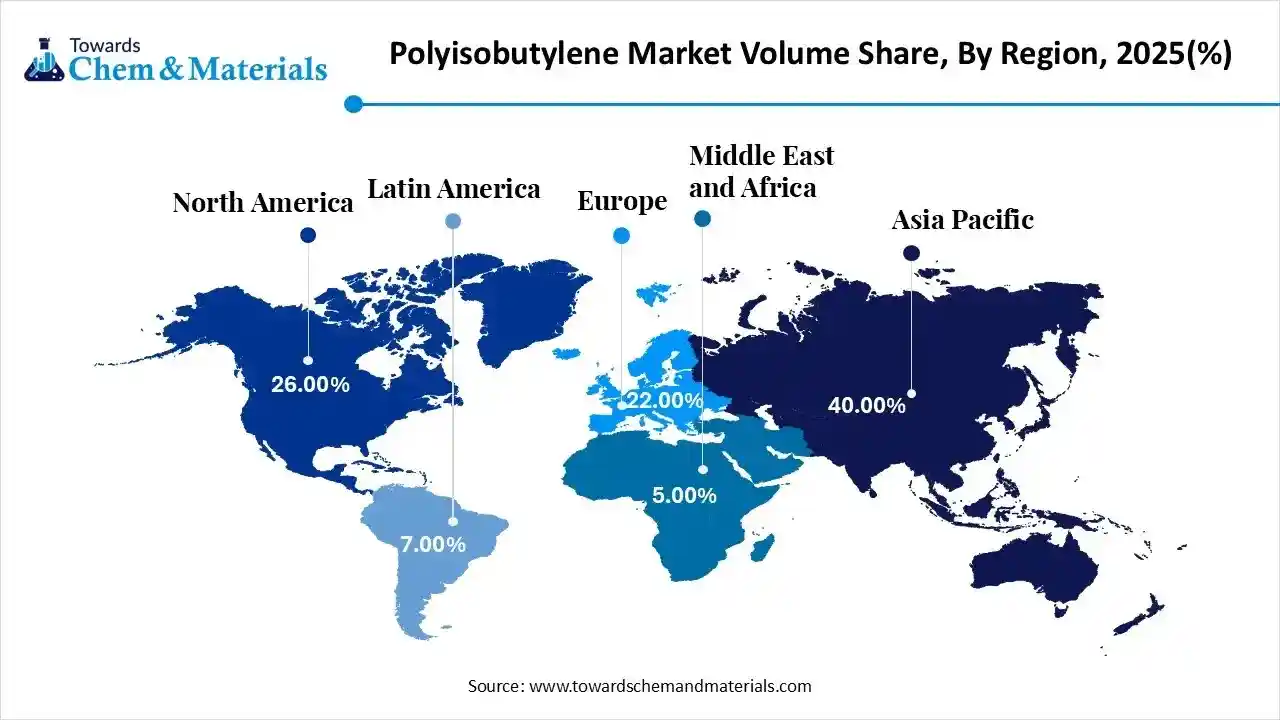

- The Asia Pacific dominated the global polyisobutylene market with the largest volume share of 40% in 2025.

- The polyisobutylene market in North America is expected to grow at a substantial CAGR of 8.19% from 2026 to 2035.

- The Europe polyisobutylene market segment accounted for the major volume share of 22.00% in 2025.

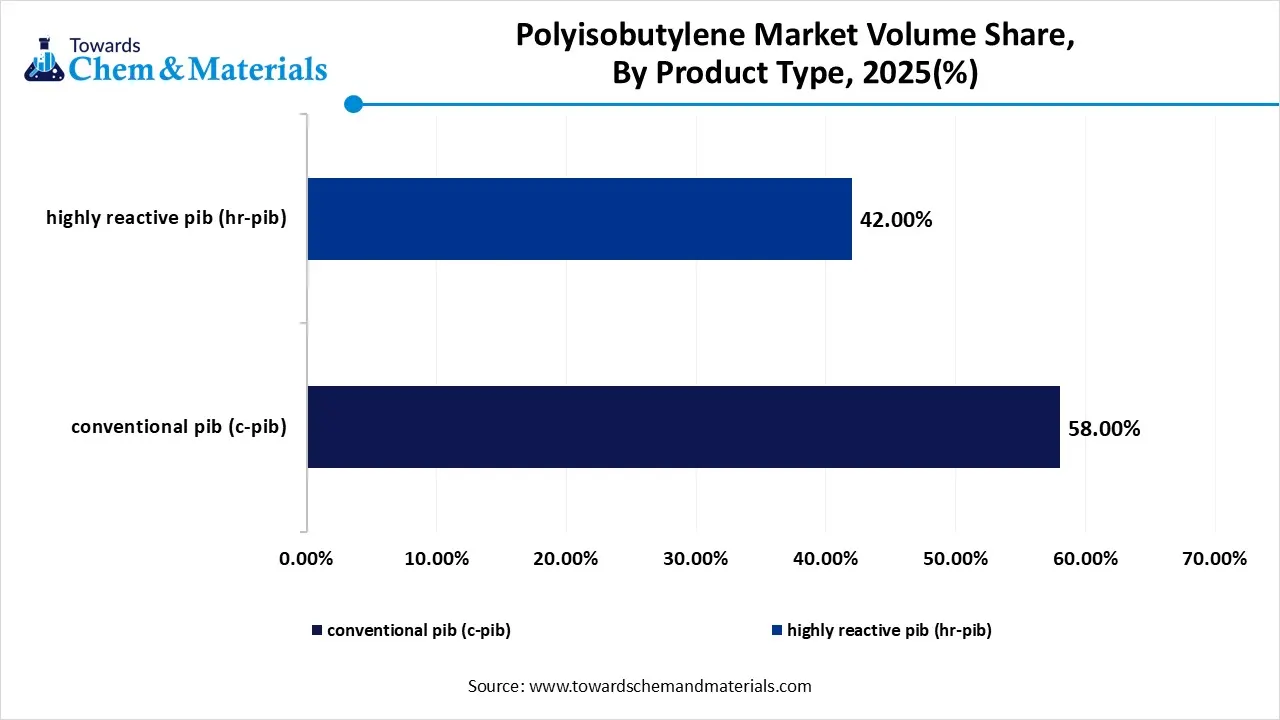

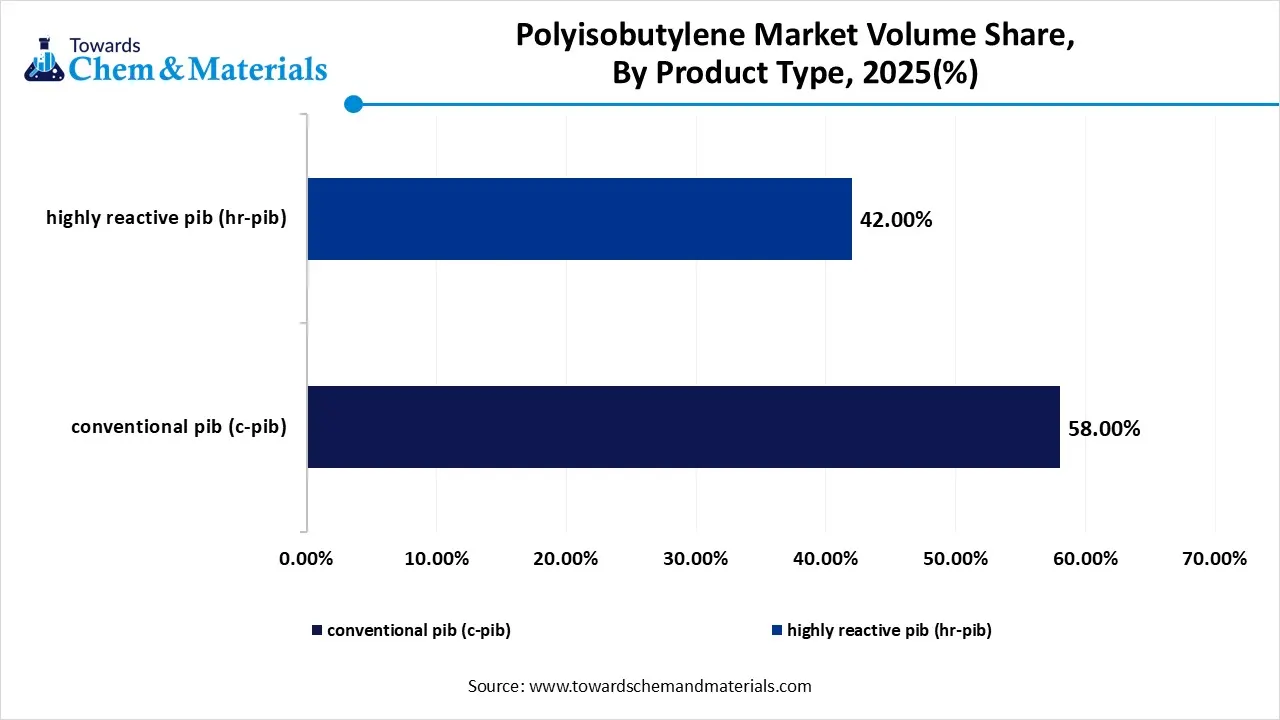

- By product type, the conventional PIB (C-PIB) segment led the market with the largest revenue volume share of 58.00% in 2025.

- By product type, the highly reactive pib (hr-pib) segment is expected to grow at the fastest CAGR of 8.22% from 2026 to 2035 in terms of volume.

- By molecular weight, the high molecular weight segment dominated the market and accounted for the largest volume share of 64% in 2025.

- By application, the lubricant additives segment dominated the market and accounted for the largest volume share of 44% in 2025.

- By end-user industry, the automotive & transportation segment led the market with the largest revenue volume share of 48% in 2025.

Market Overview

What Is The Significance Of The Polyisobutylene Market?

The significance of the polyisobutylene (PIB) market lies in its versatile, high-performance properties like gas impermeability, tackiness, and chemical resistance making it crucial for growing automotive, construction (sealants, adhesives), and industrial sectors (lubricants). Driven by industrialization, urbanization, and demand for fuel efficiency, PIB's role in enhancing product performance solidifies its market importance, especially in the booming Asia Pacific region.

Polyisobutylene Market Growth Trends:

- Shift to HR-PIB: Formulators are adopting High-Reactive PIB for lower treat rates in lubricants and fuels, meeting stringent emissions targets.

- Automotive Industry Growth: Increased use of lubricants, fuel additives, sealants, and tire/tube manufacturing is a major driver.

- Sustainability Focus: Demand for eco-friendly, recyclable PIB for applications like food/pharma packaging, drug delivery, and green manufacturing.

- Infrastructure & Construction: Growth in construction boosts demand for PIB in adhesives, sealants, and asphalt modification.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 2.74 Billion / 1,224,750.0 Tons |

| Revenue Forecast in 2035 | USD 5.18 Billion / 2,158,708.1 Tons |

| Growth Rate | CAGR 7.35% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Molecular Weight, By Product Type, By Application, By End-User Industry, By Regions |

| Key companies profiled | BASF SE, SABIC, TotalEnergies SE, ExxonMobil Chemical, Ineos Group Limited, TPC Group, The Lubrizol Corporation, Daelim Industrial Co., Ltd., Chevron Oronite Company LLC, Infineum International Limited, Kothari Petrochemicals Limited, Braskem S.A., ENEOS Corporation, Zhejiang Shunda New Material Co., Ltd., Shandong Hongrui New Material Technology Co., Ltd., Lanxess AG, Sibur Holding |

Key Technological Shifts In The Polyisobutylene Market:

The polyisobutylene (PIB) market is undergoing several key technological shifts, primarily driven by demands for sustainability, enhanced product performance, and the integration of Industry 4.0 automation. A major shift is the push for "greener" alternatives to reduce dependency on petrochemical feedstocks and meet stringent environmental regulations.

Trade Analysis Of Polyisobutylene Market: Import & Export Statistics

- According to Global Export data, the world shipped a total of 1,591 shipments of Polyisobutylene, exported by 165 suppliers to 110 buyers. The majority of these exports are sent to the United States, the United Kingdom, and China.

- On a global scale, the top three exporters are the United States, South Korea, and China. The U.S. leads with 676 shipments, followed by South Korea with 320 shipments, and China with 136 shipments.

- Based on China Export data, China exported 136 shipments of Polyisobutylene, involving 25 Chinese exporters supplying 30 buyers. Most Chinese exports go to the United States, Brazil, and Russia.

Polyisobutylene Market Value Chain Analysis

- Polymerization and Processing: Polyisobutylene is produced through cationic polymerization of isobutylene using specialized catalysts, followed by molecular weight control, hydrogenation, compounding, and packaging to serve applications.

- Key players: BASF SE, Lanxess AG, ExxonMobil Chemical, TPC Group

- Quality Testing and Certification: Polyisobutylene requires certifications ensuring molecular weight consistency, purity, performance characteristics, and regulatory compliance. Key certifications include ISO 9001 quality standards, ASTM material specifications, REACH compliance, and food-contact approvals for applicable grades.

- Key players: ISO (International Organization for Standardization), ASTM International, ECHA (REACH), FDA (U.S. Food and Drug Administration).

- Distribution to Industrial Users: Polyisobutylene is supplied to tire and rubber product manufacturers, adhesives and sealants producers, lubricant and fuel additive formulators, pharmaceutical packaging companies, and chewing gum manufacturers.

- Key players: BASF SE, Lanxess AG, ExxonMobil Chemical.

Polyisobutylene Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | U.S. Environmental Protection Agency (EPA) | TSCA (Toxic Substances Control Act) Clean Air Act (CAA) – VOC & HAP limits Clean Water Act (CWA) – NPDES Resource Conservation and Recovery Act (RCRA) |

Chemical inventory & risk evaluation Emissions control for production & processing Wastewater/effluent management Waste classification & disposal |

| European Union | European Chemicals Agency (ECHA) / European Commission | REACH Regulation (EC 1907/2006) CLP Regulation (EC 1272/2008) Industrial Emissions Directive (IED) |

Chemical registration & hazard classification Emission/effluent limits for plants Worker protection & labeling (CLP) |

| China | Ministry of Ecology and Environment (MEE) | MEE Order No. 12 (New Chemical Substance Registration) Air & Water Pollution Prevention Law |

New chemical registration Emission & effluent controls Hazardous waste oversight |

| India | Ministry of Environment, Forest & Climate Change (MoEFCC) Central Pollution Control Board (CPCB) |

Proposed Chemicals (Management & Safety) Rules Hazardous & Other Wastes Rules Air/Water Acts |

Chemical safety & assessment Emission & effluent control Hazardous waste handling |

Segmental Insights

Molecular Weight Insights

Which Molecular Weight Segment Dominated The Polyisobutylene Market In 2025?

The high molecular weight segment dominated the market with a share of 64% in 2025. High molecular weight polyisobutylene is widely used in applications requiring superior elasticity, gas impermeability, and long-term durability. Growth is driven by rising automotive production, demand for high-performance lubricants, and increased use in industrial sealing and vibration-damping applications.

The medium molecular weight segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Medium molecular weight polyisobutylene offers a balanced combination of viscosity, tackiness, and processability, making it suitable for fuel additives, adhesives, and coating formulations. Demand is reinforced by fuel efficiency regulations and the need for improved additive compatibility in modern engine and fuel systems.

Product Type Insights

How Did The Conventional PIB (C-PIB) Segment Dominated The Polyisobutylene Market In 2025?

The conventional PIB (C-PIB) segment volume was valued at 667,000.0 tons in 2025 and is projected to reach 1,175,416.6 tons by 2035, expanding at a CAGR of 6.50% during the forecast period from 2025 to 2035. The conventional PIB (C-PIB) segment dominated the market with a share of 58% in 2025. Conventional polyisobutylene is primarily used in lubricants, sealants, chewing gum bases, and industrial adhesives due to its stable chemical structure and cost efficiency. While growth is steady, market expansion is relatively moderate as industries gradually shift toward higher-performance PIB variants for advanced automotive and specialty chemical applications.

The highly reactive PIB (HR-PIB) segment volume was valued at 483,000.0 tons in 2025 and is projected to reach 983,291.5 tons by 2035, expanding at a CAGR of 8.22% during the forecast period from 2025 to 2035. The highly reactive PIB (HR-PIB) segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Highly reactive polyisobutylene is experiencing strong demand due to its superior reactivity and effectiveness in producing high-performance dispersants and detergent additives. Stricter emission norms and demand for premium engine oils significantly support this segment’s growth.

Polyisobutylene Market Volume and Share, Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume ( Tons)2025 | Market Volume ( Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| conventional pib (c-pib) | 58.00% | 667,000.0 | 1,175,416.6 | 6.50% | 54.45% |

| highly reactive pib (hr-pib) | 42.00% | 483,000.0 | 983,291.5 | 8.22% | 45.55% |

Application Insights

Which Application Segment Dominated The Polyisobutylene Market In 2025?

The lubricant additives segment dominated the market with a share of 44% in 2025. Polyisobutylene plays a crucial role in lubricant additives by enhancing viscosity control, dispersancy, and oxidation resistance. The segment benefits from rising vehicle ownership, extended oil drain intervals, and increasing use of high-performance engine oils. Growth is further supported by industrial machinery lubrication needs across manufacturing and energy-intensive sectors.

The fuel additives segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. In fuel additive applications, PIB helps improve combustion efficiency, reduce engine deposits, and enhance fuel economy. Rising regulatory pressure to reduce emissions and improve fuel performance is driving adoption. This segment benefits from expanding automotive fleets and increasing use of additive-enhanced fuels worldwide.

End-User Industry Insights

How Did Automotive And Transportation Segment Dominate The Polyisobutylene Market In 2025?

The automotive & transportation segment dominated the market with a share of 48% in 2025. The automotive and transportation sector represents the largest end user of polyisobutylene, driven by its extensive use in lubricants, fuels, sealants, and rubber components. Growth is supported by rising global vehicle production, increasing demand for fuel-efficient engines, and ongoing advancements in automotive material performance and durability requirements.

The packaging & consumer goods segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. In packaging and consumer goods, polyisobutylene is used in adhesives, sealants, and flexible packaging materials due to its non-toxicity and moisture resistance. Demand is supported by growth in food packaging, personal care products, and household goods, along with rising emphasis on product safety, shelf-life extension, and material flexibility.

Regional Insights

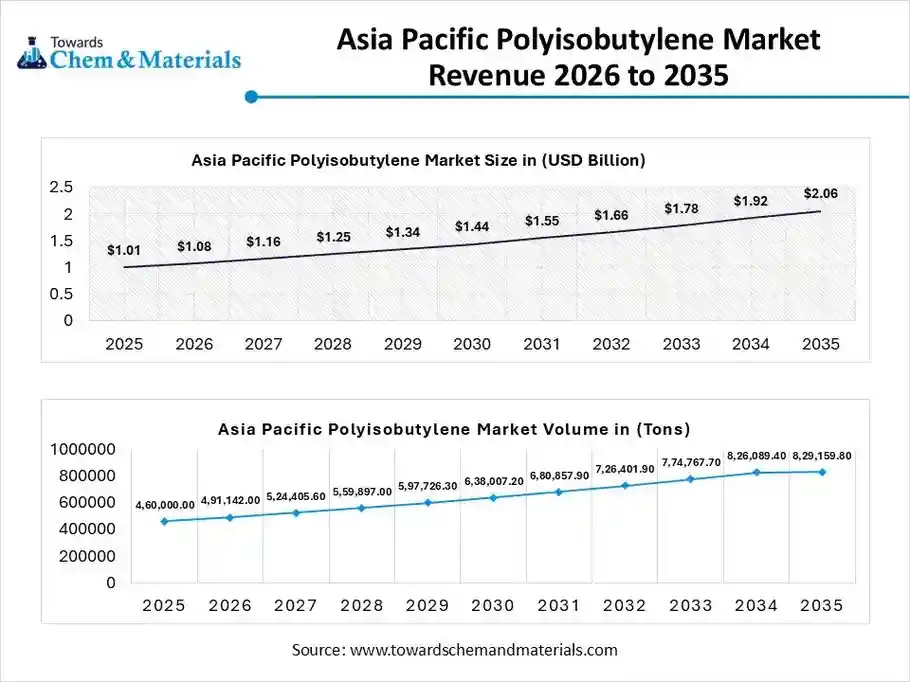

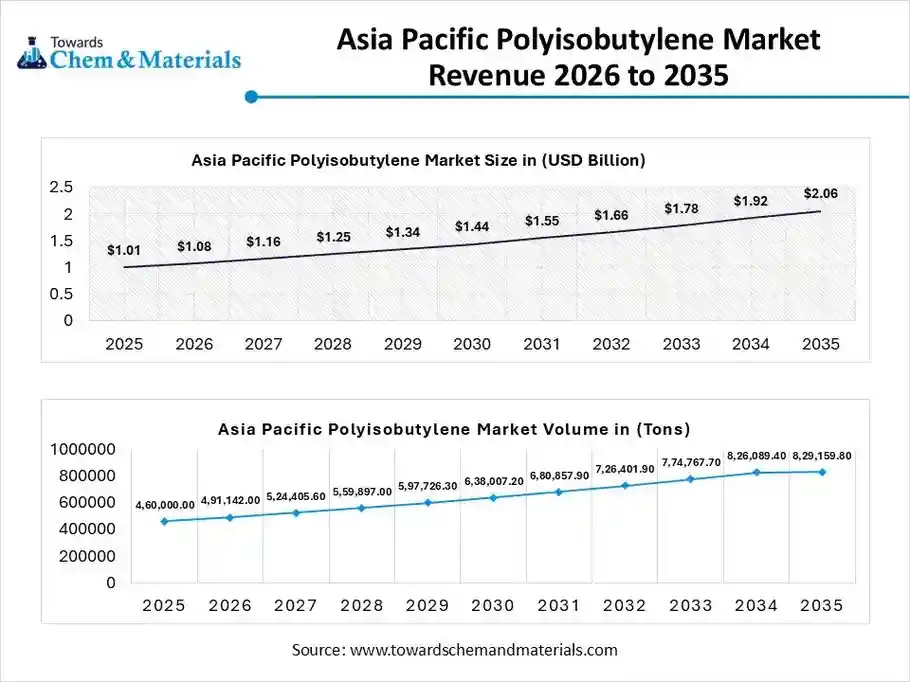

The Asia Pacific polyisobutylene market size was valued at USD 1.01 billion in 2025 and is expected to be worth around USD 2.06 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.37% over the forecast period from 2026 to 2035.

The Asia Pacific polyisobutylene volume was estimated at 460,000.00 tons in 2025 and is projected to reach 829,159.80 tons by 2035, growing at a CAGR of 6.77% from 2026 to 2035. Asia Pacific dominated the market with a share of 40% in 2025, driven by strong demand from automotive lubricants, fuel additives, adhesives, sealants, and construction applications. Rapid industrialization, rising vehicle production, expanding packaging industries, and infrastructure investments support PIB consumption. Cost-competitive manufacturing, availability of raw materials, and expanding downstream chemical capacity further strengthen regional market growth.

China: Polyisobutylene Market Growth Trends

China dominates the Asia Pacific polyisobutylene market due to its massive automotive fleet, lubricant production base, and construction sector scale. PIB demand is fueled by its use in fuel efficiency additives, tire inner liners, and sealants. Government emphasis on industrial self-sufficiency, growing synthetic rubber production, and expanding chemical manufacturing clusters continue to support steady domestic PIB consumption.

North America Polyisobutylene Market Is Experiencing Growth Driven By The Advanced Infrastructure

North America polyisobutylene volume was estimated at 299,000.0 tons in 2025 and is projected to reach 607,244.6 tons by 2035, growing at a CAGR of 8.19% from 2026 to 2035. North America is expected to have fastest growth in the market in the forecast period between 2026 and 2035, supported by stable demand from lubricants, fuel additives, pharmaceutical packaging, and specialty elastomers. The region benefits from advanced refining infrastructure, strong automotive aftermarket demand, and stringent performance standards that favor high-purity PIB grades. Technological advancements and sustainability initiatives further shape product innovation and premium pricing.

United States: Polyisobutylene Market Growth Trends

The United States leads regional PIB consumption due to strong demand from automotive lubricants, sealants, adhesives, and medical packaging applications. Additionally, ongoing research in high-performance elastomers and barrier materials supports the adoption of advanced PIB formulations.

Europe Polyisobutylene Market Growth Is Driven By The Strong Demand

Europe polyisobutylene volume was estimated at 253,000.0 tons in 2025 and is projected to reach 496,718.7 tons by 2035, growing at a CAGR of 7.78% from 2026 to 2035. Europe’s polyisobutylene market is characterized by strong demand for high-performance, specialty, and environmentally compliant materials. Growth is driven by automotive lightweighting, energy-efficient construction materials, and premium lubricant formulations. Strict regulatory standards promote innovation in low-volatility and high-purity PIB products, while strong recycling and sustainability initiatives influence long-term market development.

Germany: Polyisobutylene Market Growth Trends

Germany serves as a key European hub for polyisobutylene consumption, supported by its advanced automotive manufacturing, engineering excellence, and chemical processing capabilities. PIB demand is strong in sealants, adhesives, and fuel-efficient lubricant formulations. The country’s emphasis on high-performance materials, regulatory compliance, and export-oriented manufacturing enhances market stability and technological advancement.

Polyisobutylene Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume ( Tons)2025 | Market Volume ( Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 26.00% | 299,000.0 | 607,244.6 | 8.19% | 28.13% |

| Europe | 22.00% | 253,000.0 | 496,718.7 | 7.78% | 23.01% |

| Asia Pacific | 40.00% | 460,000.0 | 829,159.8 | 6.77% | 38.41% |

| Latin America | 7.00% | 80,500.0 | 136,214.5 | 6.02% | 6.31% |

| Middle East & Africa | 5.00% | 57,500.0 | 89,370.5 | 5.02% | 4.14% |

Recent Developments

- In January 2024, Kraton Corporation launched a new line of bio-based polyisobutylene products, aligning with the growing demand for sustainable materials. This initiative aims to strengthen Kraton's market presence and cater to environmentally conscious consumers.

- In February 2025, LyondellBasell Industries Holdings B.V. formed a strategic partnership with a leading automotive manufacturer to develop innovative polyisobutylene (PIB) formulations tailored for electric vehicles (EVs). This collaboration is part of LyondellBasell's broader strategy to enhance EV component performance and accelerate the adoption of high-performance materials in the mobility sector.

Top players in the Polyisobutylene Market & Their Offerings:

- BASF SE: BASF is a leading producer of polyisobutylene (PIB) and its derivatives, supplying high-performance PIB grades used in adhesives, sealants, petroleum additives, and rubber applications. The company focuses on consistent quality, customized molecular weight distributions, and sustainability through improved process efficiency.

- SABIC: SABIC offers PIB and related products that serve a variety of applications, including fuel and lubricant additives, insulation materials, and packaging elastomers. Its global production footprint and strong petrochemical capabilities support reliable supply and product innovation.

- TotalEnergies SE: TotalEnergies supplies polyisobutylene under its advanced chemical product lines, targeting energy sector applications (fuel additives), pressure-sensitive adhesives, and specialty elastomers. The company emphasizes performance, stability, and compatibility with various compound systems.

- ExxonMobil Chemical: ExxonMobil provides a range of PIB products used in lubricant additives, industrial adhesives, sealants, and rubber compounding. Its offerings are backed by strong technical support and integration with broader base oil and additive portfolios.

- Ineos Group Limited: Ineos produces polyisobutylene, and PIB blends used in fuel and lubricant additive applications, adhesives, and rubber products. The company’s global petrochemical infrastructure supports consistent quality and competitive pricing.

- TPC Group

- The Lubrizol Corporation

- Daelim Industrial Co., Ltd.

- Chevron Oronite Company LLC

- Infineum International Limited

- Kothari Petrochemicals Limited

- Braskem S.A.

- ENEOS Corporation

- Zhejiang Shunda New Material Co., Ltd.

- Shandong Hongrui New Material Technology Co., Ltd.

- Lanxess AG

- Sibur Holding

Segments Covered:

By Molecular Weight

- High Molecular Weight (HMW)

- Low Molecular Weight (LMW)

- Medium Molecular Weight (MMW)

By Product Type

- Conventional PIB (C-PIB)

- Highly Reactive PIB (HR-PIB)

By Application

- Lubricant Additives

- Tires & Tubes

- Adhesives & Sealants

- Fuel Additives

- Others (Food/Cosmetics)

By End-User Industry

- Automotive & Transportation

- Industrial & Energy

- Construction

- Packaging & Consumer Goods

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa