Content

Polyethylene Glycol (PEG) Market Volume, Share, Growth, Report 2025 to 2034

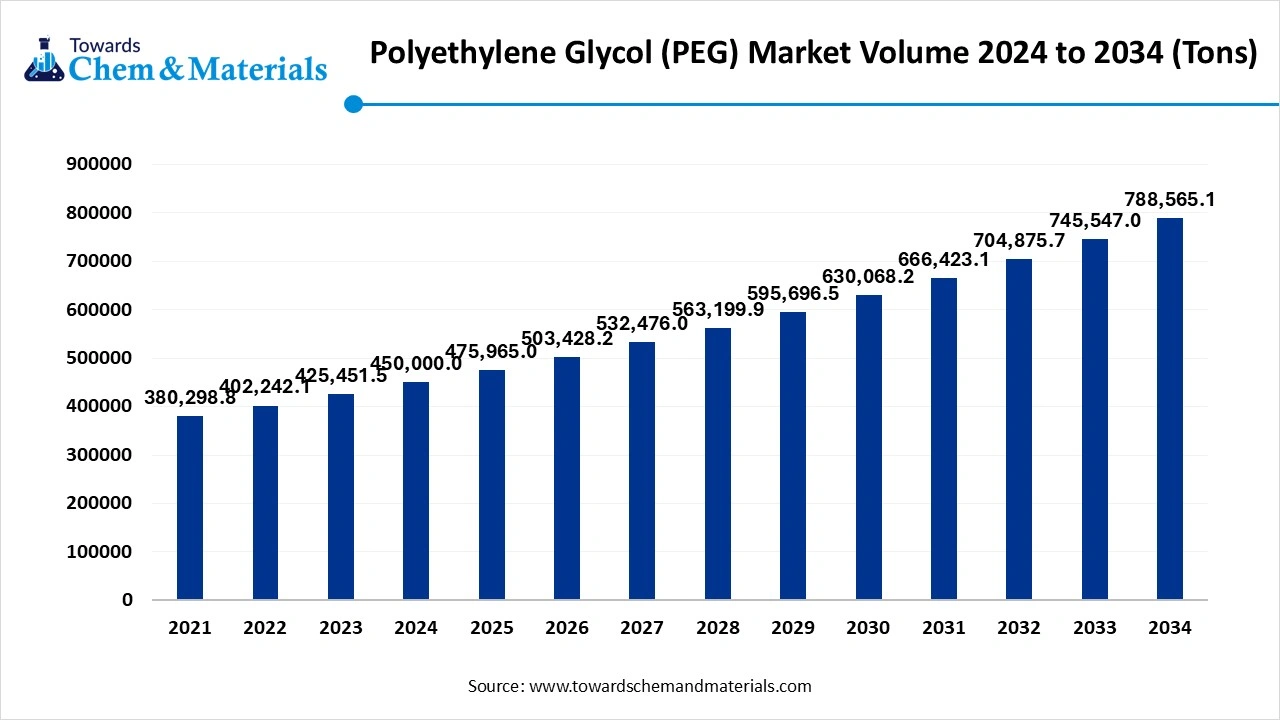

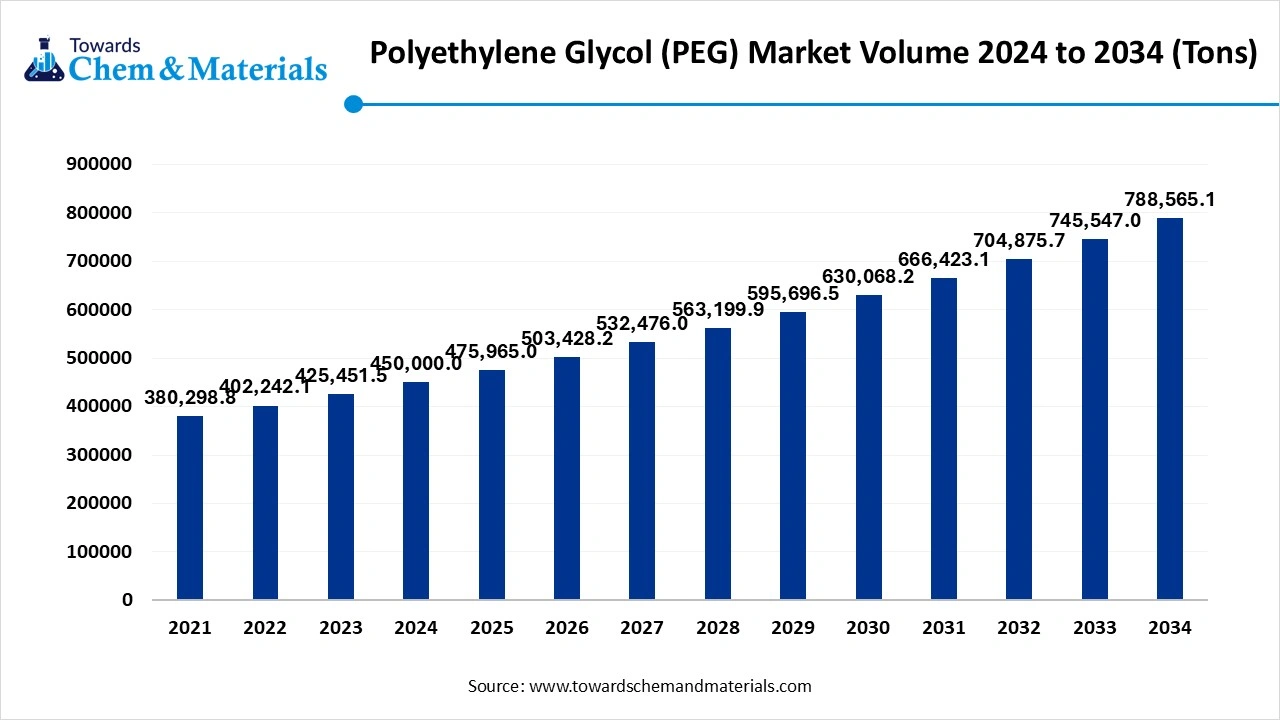

The global polyethylene glycol (PEG) market volume was reached at 450,000 tons in 2024 and is expected to be worth around 788,565.1 tons by 2034, growing at a compound annual growth rate (CAGR) of 5.77% over the forecast period 2025 to 2034. the increased attention towards cosmetic and personal care products and medications has accelerated the industry's potential in recent years.

Key Takeaways

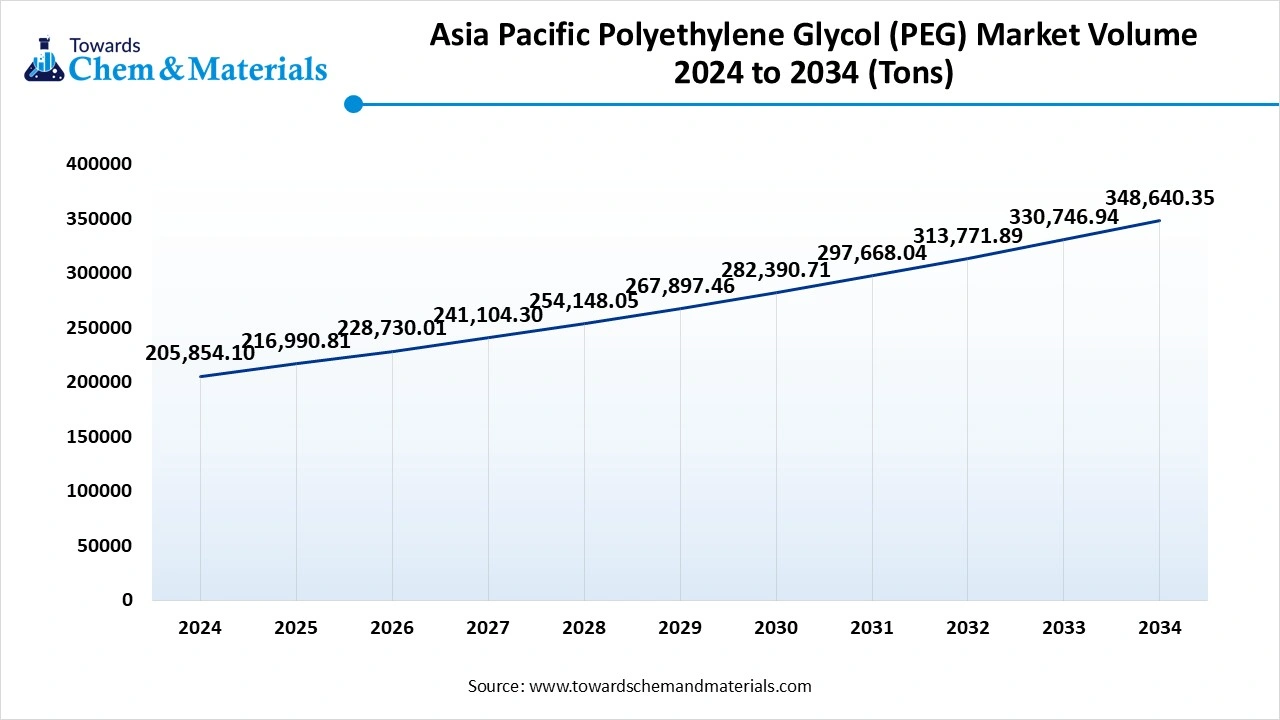

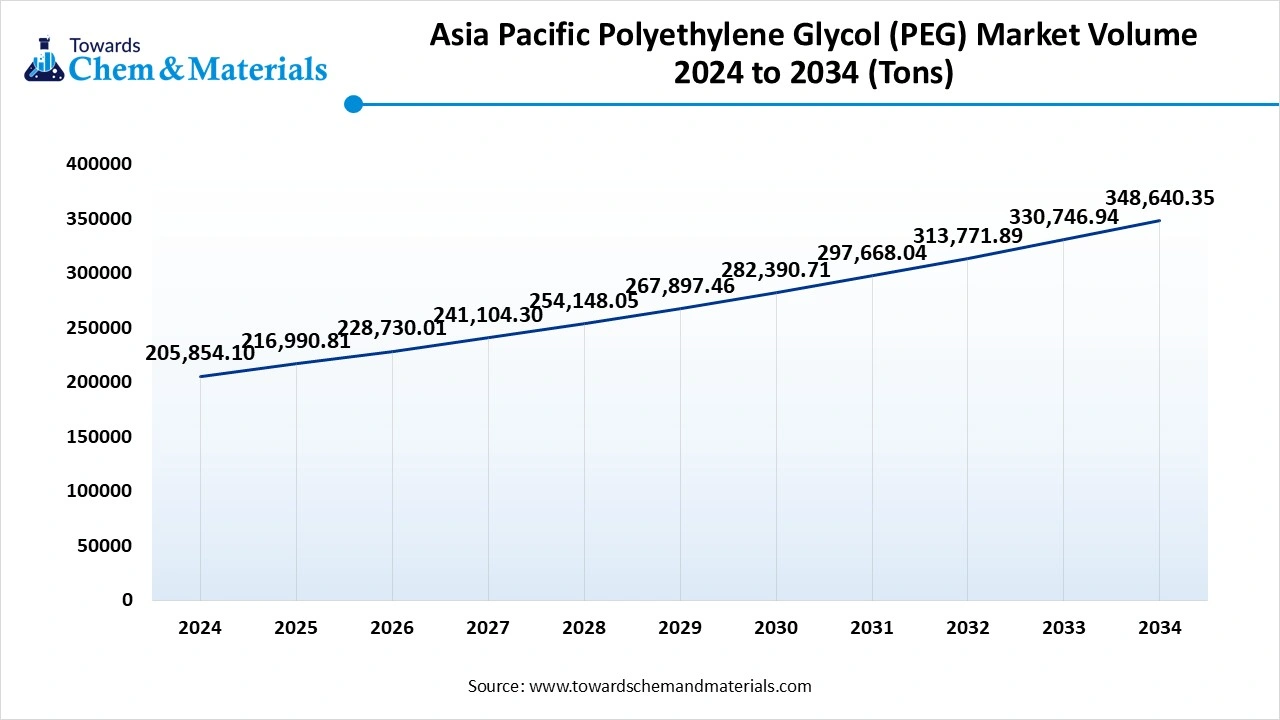

- The Asia Pacific polyethylene glycol (PEG) market volume was estimated at 205,854.10 tons in 2024 and is expected to reach 348,640.35 tons by 2034, growing at a CAGR of 5.41% from 2025 to 2034.

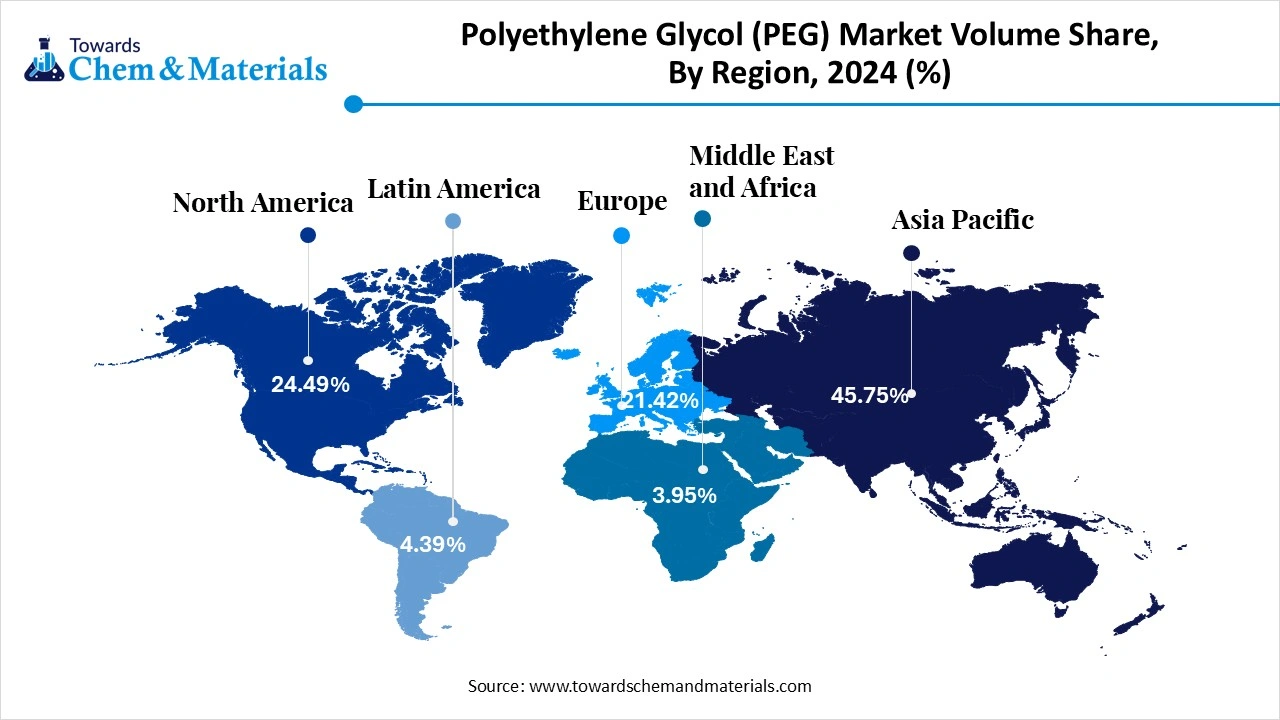

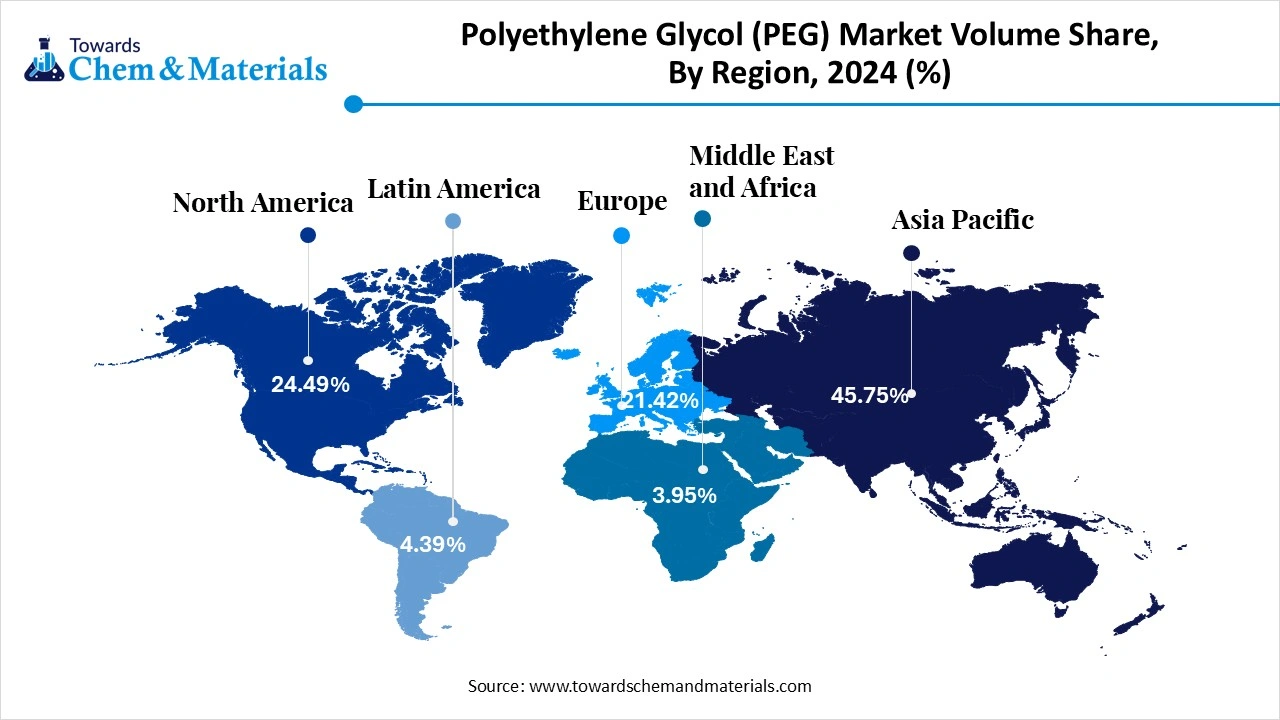

- By region, Asia Pacific dominated the polyethylene glycol (PEG) market held the largest Volume Share of 45.75% the global market in 2024. owing to the heavy demand from sectors such as cosmetics, pharmaceuticals, and industrial manufacturing.

- By region, Europe has held a volume share of around 21.42% in 2024 is expected to grow at a notable rate in the future, akin to increased green initiatives, with the pharmaceutical demand in the coming years.

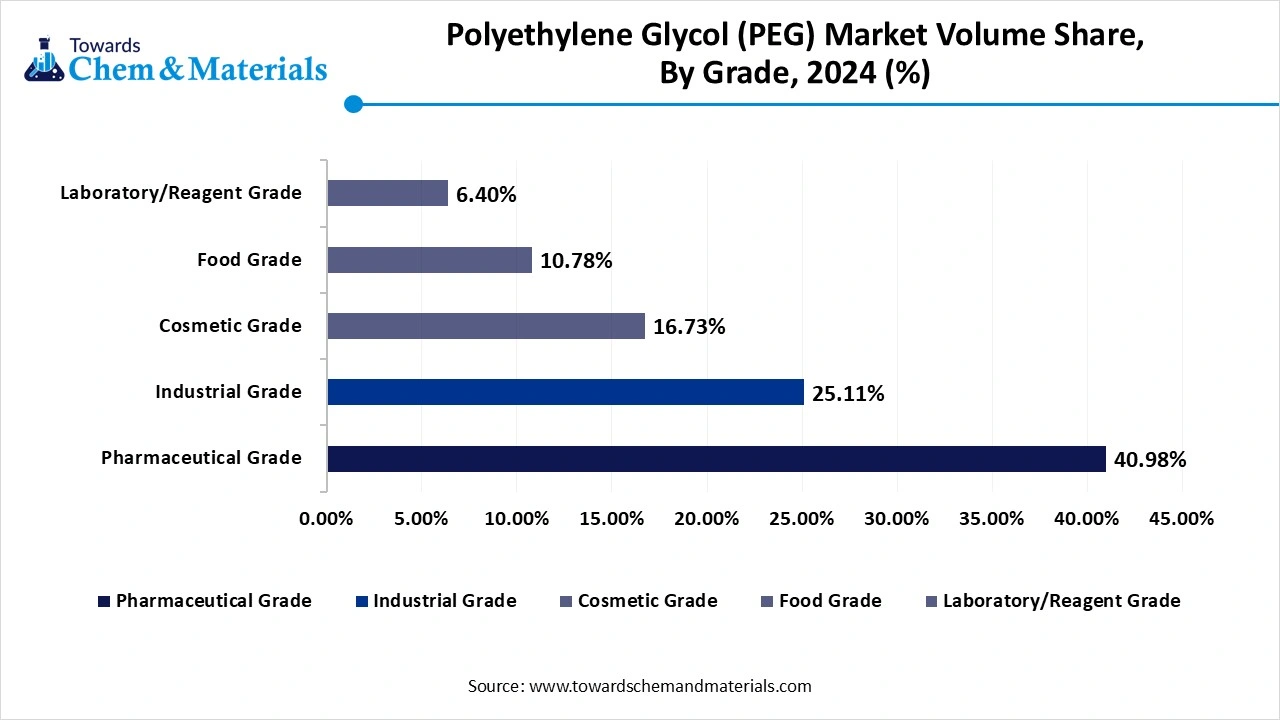

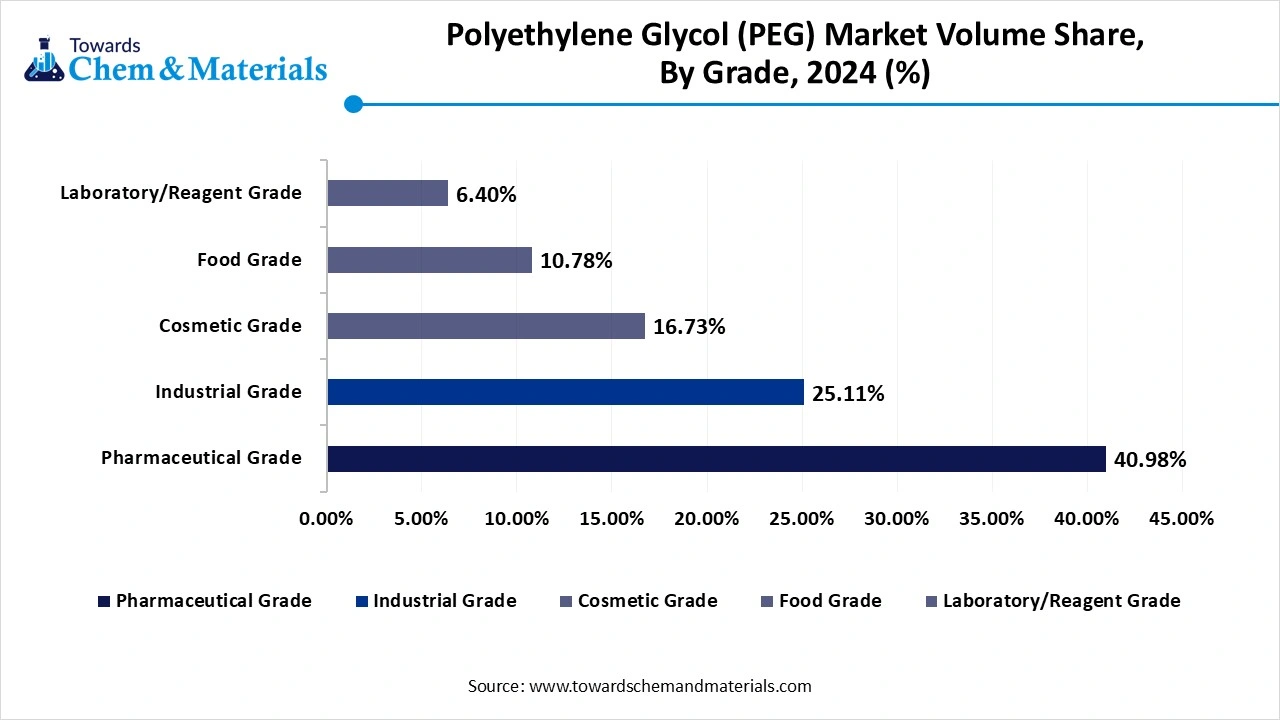

- By grade type, the pharmaceutical grade segment led the polyethylene glycol (PEG) market largest Volume Share of 40.98% in 2024, due to pharmaceutical grade PEG is widely used in medicines, creams, ointments, and tablets.

- By grade type, the cosmetic grade segment has captured a volume share of 16.73% in 2024 is expected to grow at the fastest rate in the market during the forecast period, as its daily application, like skincare, shampoos, toothpaste, and others.

- By molecular weight type, the medium molecular weight (600-1000) segment emerged as the top-performing segment in 2024 as the PEG with a medium molecular weight (600-1000) is widely used because it has a good balance of thickness and flow

- By molecular weight type, the high molecular weight (3350-8000) segment is expected to lead the market in the coming years, as the increased demand for medications across the world.

- By form, the liquid segment led the polyethylene glycol (PEG) market in 2024, as liquid PEG is the most used form because it's easy to mix, spread, and apply. .

- By form, the powder segment is likely to experience notable growth during the expected period, akin to having a longer shelf life and easy transportation properties.

- By application, the pharmaceutical segment captured the biggest portion of the market in 2024, because the pharmaceutical industry is the largest user of PEG because it is used in many medicines, including laxatives, creams, tablets, and injections.

- By application, the cosmetic & personal care segment is anticipated to expand at the highest rate in the coming years akin to the ongoing personal care shift and lifestyle trends.

- By end use, the healthcare & pharmaceutical segment led the market in 2024 because PEG is used in medical creams, oral medicines, and injections.

- By end use, the cosmetic & personal care segment is expected to grow at the fastest rate in the market during the forecast period. As cosmetic brands, skincare companies, and personal hygiene product makers are using more PEG in shampoos, soaps, face creams, and makeup

- By distribution channel, the direct sales segment emerged as the top consumer of the market in 2024, as direct sales include bulk sales from PEG manufacturers to big pharmaceutical, cosmetic, or chemical companies.

- By distribution channel, online retail segment is likely to witness the most rapid growth in market in the years ahead, as online platforms make it easy for small businesses and consumers to buy PEG in small amounts

Market Overview

PEG: A Silent Powerhouse in Pharmaceutical, Cosmetics, and Beyond

Polyethylene glycol (PEG) is a polyether compound derived from ethylene oxide and water. It is non-toxic, odorless, and water-soluble, with a wide range of applications due to its molecular weight variations. PEG is commonly used in pharmaceuticals, personal care, industrial processing, and food additives. It acts as a lubricant, solvent, binding agent, surfactant, and plasticizer. The sectors such as cosmetics, pharmaceuticals, and industrial processing will further extend industry potential in the coming years.

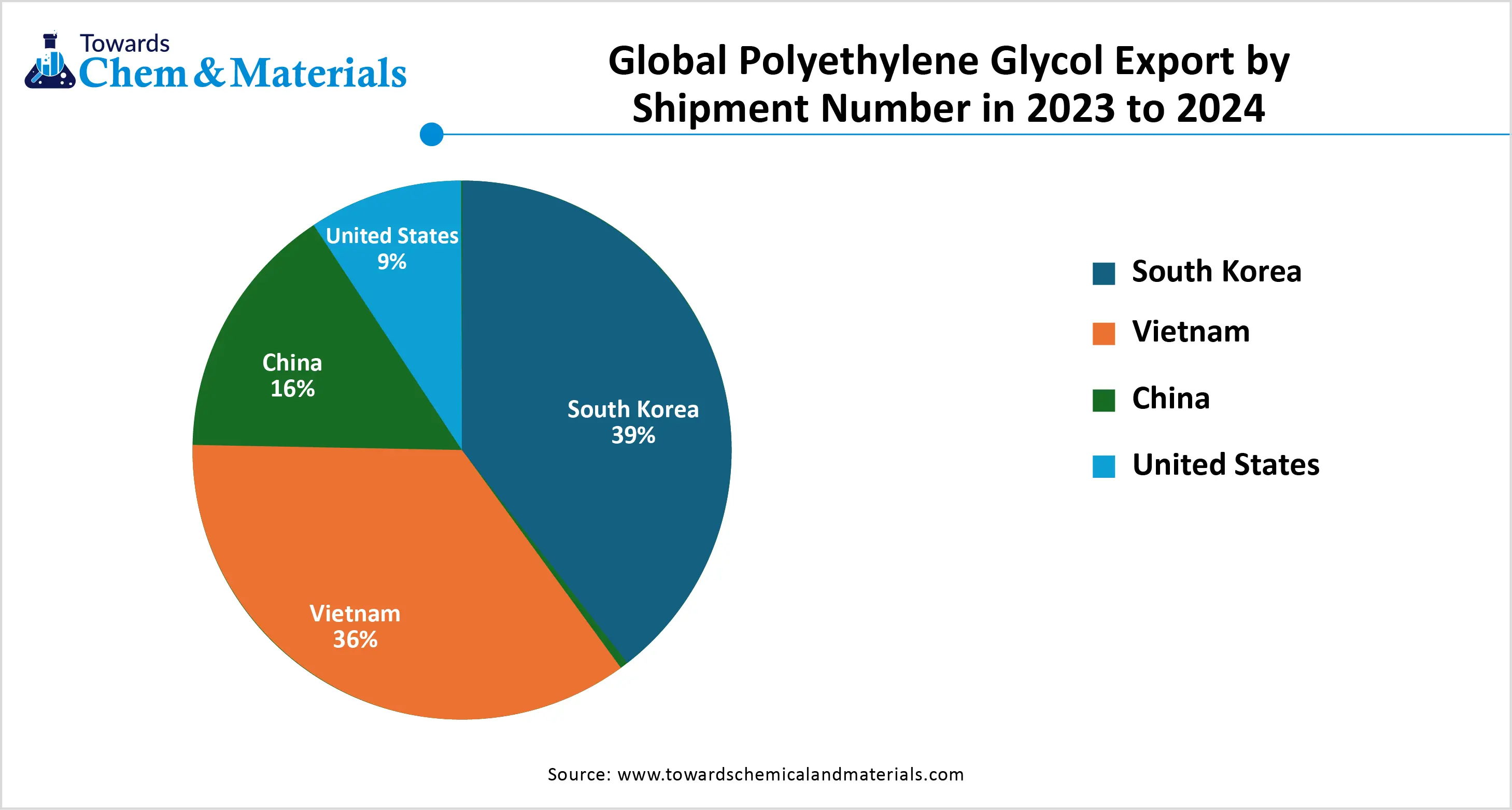

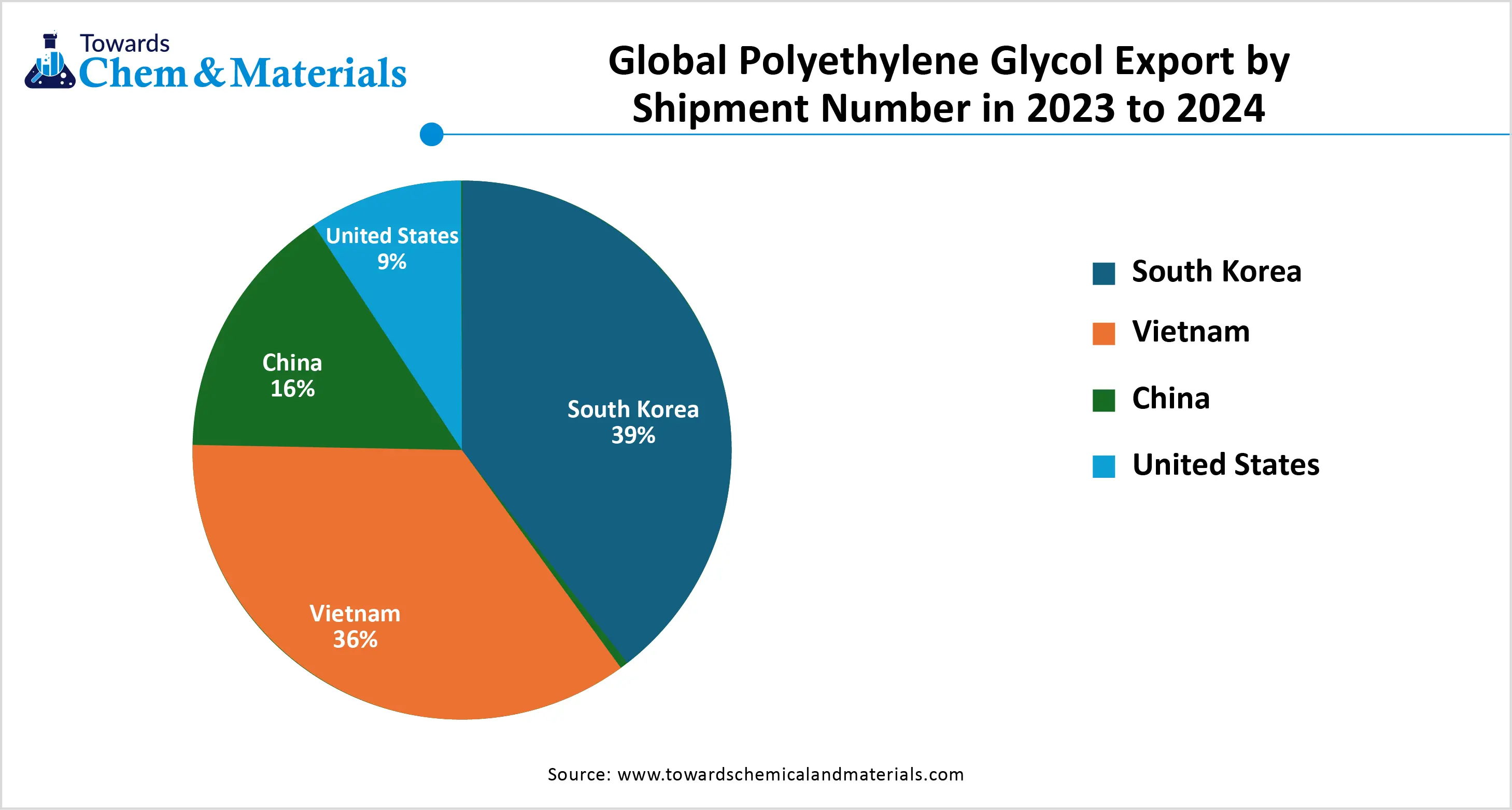

Soth Korea maintained its dominance with a huge polyethylene glycol export. Additionally, Vietnam ranks second in these exports. Other countries also have higher shipment numbers during these years, according to the diagram.

Which Factor Is Driving the Polyethylene glycol (PEG) Market?

The sudden increased use of polyethylene glycol in pharmaceutical applications is spearheading industry growth in the current period. PEG is seen in applications such as ointments, drug delivery ingredients, and laxatives. Also, the need for the improvement of drug absorption and controlling release time has been actively providing immense attention towards polyethylene glycol in the past few years, as glycol has unique properties.

Market Trends

- The increased demand for the cosmetic grade PEG is driving industry growth in recent years. With smooth texture and moisture-retaining ability, several major cosmetics brands are increasingly using PEG in their beauty and personal care products.

- The sudden shift towards bio-based PEG has led to market potential over the past few years, as manufacturers are seen putting investment in the development of the bio-based and plant-derived PEG.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 475,965 Tons |

| Expected Volume by 2034 | 788,565.1 Tons |

| Growth Rate from 2025 to 2034 | CAGR 5.77 % |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade, By Molecular Weight, By Form, By Application, By End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | Dow Chemical Company, BASF SE , Croda International Plc, Ineos Oxide, Clariant AG, Lotte Chemical Corporation, India Glycols Ltd. , Liaoning Oxiranchem Inc., Shanghai Taijie Chemical Co., Ltd., Huntsman Corporation, Merck KGaA, Jiangsu Haian Petrochemical Plant , NOF Corporation, KAO Corporation, SABIC, PCC Rokita SA ,Oxiteno, Nippon Shokubai Co., Ltd., Yixing Hongbo Fine Chemical Co., Ltd., Dowell Science |

Market Opportunity

Strategic PEG Expansion in Emerging Regions Boosts Profit Potential

The increasing need for the PEG in the developing countries is expected to create lucrative opportunities for the manufacturers in the coming years. As several developing regions is seen under the heavy modern shift such as the cosmetic use, and expansion of the industrial activities in recent years. Also, by exporting or local manufacturing of PEG, the manufacturers can gain substantial market attention and profit margins in the coming years.

Market Challenge

Tightening Regulations Cast Shadows Over PEG Market Growth

The implementation of the regulatory standards is anticipated to hinder the industry growth for the certain grades of PEG which are detained as harmful for the environment in the coming years. Also, stricter quality standards can lead the product delay and expensiveness which can create growth barriers for the small and mid-size business during the forecast period.

Regional Insights

The Asia Pacific polyethylene glycol (PEG) market volume was estimated at 205,854.10 tons in 2024 and is anticipated to reach 348,640.35 tons by 2034, growing at a CAGR of 5.41% from 2025 to 2034.

The Asia Pacific dominated the market in 2024, akin to the heavy demand from sectors such as cosmetics, pharmaceuticals, and industrial manufacturing. Moreover, the regional countries such as India, China, and Japan are seen under the heavy usage of the PEG for major industries like personal care, chemical processing, and pharmaceuticals in recent years. Furthermore, the huge population and lower cost local production have played an ideal role in the development of the PEG industry in the past few years.

How Has China Become the Powerhouse of PEG Production and Demand?

China maintained its dominance in the PEG market, owing to the enlarged pharmaceutical and cosmetics manufacturing infrastructure in the current period. Moreover, the laxatives, personal care items, and creams have gained immense attention, akin to the changes in modern lifestyle in recent years.

Europe expects the fastest growth in the market during the forecast period, owing to increased green initiatives, with the pharmaceutical demand in the coming years. Moreover, the region is observed as having undergone heavy investment in research and development activities in recent years. Furthermore, the manufacturers are actively providing the high-purity PEG grade for medical use as per the recent regional observation.

Is Germany Set to Lead the PEG Market with Its Strong Pharma and Chemical Backbone?

Germany is expected to rise as a dominant country in the region in the coming years, owing to having a strong pharmaceutical and chemical infrastructure. Also, the presence of major PEG-based cream and industrial chemical producer companies is likely to create significant opportunities in the coming years, as per future industry observation. Furthermore, the increased need for sustainability and precision can create the demand for the high-purity PEG grade in the coming years, as per the industry expectations.

Polyethylene Glycol (PEG) Market Volume Share, By Region, 2024- 2034 (%)

| By Region | Market Volume Shares (%)2024 | Market Volume (Tons)(2024) | Market Volume Shares (%)2034 | Market Volume (Tons)(2034) | CAGR (2025- 2034) |

| North America | 24.49% | 110,215.0 | 24.02% | 189,381.8 | 5.56% |

| Europe | 21.42% | 96,391.2 | 22.42% | 176,827.8 | 6.26% |

| Asia Pacific | 45.75% | 205,854.1 | 44.23% | 348,782.3 | 5.41% |

| South America | 4.39% | 19,747.7 | 5.12% | 40,374.5 | 7.41% |

| Middle East | 3.95% | 17,792.0 | 4.21% | 33,198.6 | 6.44% |

Segmental Insights

By Grade Type

How the Pharmaceutical Grade Segment Dominated the Polyethylene Glycol (PEG) Market in 2024?

The pharmaceutical grade segment held the largest share of the market in 2024, due to pharmaceutical grade PEG is widely used in medicines, creams, ointments, and tablets. It is safe, water-soluble, and works well as a laxative or drug delivery agent. Drug companies prefer this grade because it meets strict safety and purity standards. It is also used in making capsules and injections. The growing demand for PEG-based medications around the world has made the pharmaceutical grade segment the biggest in the market. Its use in hospital and over-the-counter drugs ensures steady demand and solidifies its leading position in the PEG market.

The cosmetic grade segment is expected to grow at a notable rate during the predicted timeframe due to its daily application, like skincare, shampoos, toothpaste, and others. Moreover, the student shift for the personal care initiatives can create a greater industry environment for the segment as the PEG acts as the moisturizer and emulsifier.

Polyethylene Glycol (PEG) Market Volume Share, By Grade, 2024- 2034 (%)

| By Grade | Market Volume Shares (%)2024 | Market Volume (Tons)(2024) | Market Volume Shares (%)2034 | Market Volume (Tons)(2034) | CAGR (2025- 2034) |

| Pharmaceutical Grade | 40.98% | 184,417.6 | 37.61% | 296,579.3 | 4.86% |

| Industrial Grade | 25.11% | 112,994.4 | 24.23% | 191,069.3 | 5.39% |

| Cosmetic Grade | 16.73% | 75,284.4 | 18.51% | 145,963.4 | 6.84% |

| Food Grade | 10.78% | 48,511.8 | 12.23% | 96,441.5 | 7.11% |

| Laboratory/Reagent Grade | 6.40% | 28,791.8 | 7.42% | 58,511.5 | 7.35% |

Molecular Weight Insights

Why Do Medium Molecular Weight (600-1000) Segments Dominated the Polyethylene Glycol (PEG) Market by Molecular Type?

The medium molecular weight 600-1000 segment held the largest share of the polyethylene glycol (PEG) market in 2024. PEG with a medium molecular weight (600-1000) is widely used because it has a good balance of thickness and flow. It is used in creams, ointments, personal care products, and lubricants. This range works well in both pharmaceutical and industrial settings, making it very versatile. It is easy to mix with other substances and is mild on the skin, which makes it suitable for daily-use products. Because it fits so many applications and is cost-effective, this molecular weight range has become the most popular in the global PEG market.

The high molecular weight (3350-8000) segment is expected to grow at a notable rate, as the increased demand for medications across the world. The high molecular weight is likely to capture the largest share of the market in the coming years as it is used in the growing applications such as laxatives, long-lasting creams, and ongoing drug delivery systems.

Form Type Insights

Why Did Liquid Segment Dominate the Polyethylene Glycol (PEG) Market in 2024?

The liquid segment dominated the market with the largest share in 2024. Liquid PEG is the most used form because it's easy to mix, spread, and apply. It's widely used in skin creams, hair products, oral solutions, and lubricants. Liquid PEG flows smoothly, making it perfect for topical applications and injectable drugs. It is also simple to store and transport. Because of its convenience and compatibility with many ingredients, liquid PEG is the preferred choice in cosmetics, healthcare, and industrial uses. Its wide use across many sectors makes it the leading form in the market today.

The powder segment is expected to grow at a notable rate due to having a longer shelf life and easy transportation properties. Also, having unique characteristics such as flexibility and mixability, several pharmaceutical companies prefer the powder form for the development of their capsule and tablets in the current period, which drives the industry demand in the future.

Application Type

How Pharmaceutical Segment Maintain Dominance in Application Type?

The pharmaceutical segment held the largest share of the market in 2024. The pharmaceutical industry is the largest user of PEG because it is used in many medicines, including laxatives, creams, tablets, and injections. PEG helps drugs dissolve better, stay stable, and get absorbed in the body. It's also non-toxic and safe for internal use. As global demand for healthcare rises, PEG continues to be a key ingredient in many common and life-saving drugs. Its strong role in both prescription and over-the-counter medications ensures that the pharmaceutical application segment remains the biggest in the PEG market today.

The cosmetic and personal care segment is expected to grow at the fastest rate during the forecast period, owing to the ongoing personal care shift and lifestyle trends. The younger population has seen in demand the good quality lotions and well-textured moisture, where the PEG is considered the crucial element in the development of these lotions. Furthermore, the world's changing trends can create huge opportunities for cosmetic and personal care manufacturers in the coming years.

End User Insights

Why is the Healthcare and Pharmaceutical Segment Dominating the Polyethylene Glycol (PEG) Market in 2024?

The healthcare and pharmaceutical segment led the market in 2024. Hospitals, clinics, and drug companies are the main users of PEG because it is used in medical creams, oral medicines, and injections. PEG helps improve how drugs work and is safe for patients of all ages. As more people seek medical treatment for chronic conditions and health awareness grows, PEG demand in the healthcare sector remains high. It is also used in diagnostic equipment and as a coating for pills. This widespread use makes healthcare and pharmaceuticals the top end-users in the PEG market today.

The cosmetics and personal care segment is expected to grow at the fastest rate in the market during the forecast period. Cosmetic brands, skincare companies, and personal hygiene product makers are using more PEG in shampoos, soaps, face creams, and makeup.

Consumers now focus on appearance, self-care, and daily grooming, creating a fast-growing demand. PEG is valued for making products smooth, gentle, and effective. As personal care brands expand online and globally, this end-user segment will grow quickly. Beauty trends, especially in developing countries, will drive PEG usage, making this segment the top future end-user in the market.

Distribution Channel Insights

How the Direct Sales Segment Dominated the Polyethylene Glycol (PEG) Market in 2024?

The direct sales segment held the largest share of the market in 2024. Direct sales include bulk sales from PEG manufacturers to big pharmaceutical, cosmetic, or chemical companies. These businesses buy large quantities through contracts and long-term deals. It helps them save money and ensures a consistent supply. Direct sales are common in industrial settings where large volumes are needed for production. Since most of the PEG demand comes from industries like healthcare and chemicals, this channel currently leads the market. Bulk buyers prefer dealing directly with suppliers to get better control over pricing and quality.

The online retail segment is expected to grow at a notable rate during the predicted timeframe. As online platforms make it easy for small businesses and consumers to buy PEG in small amounts. Cosmetic startups, DIY skincare makers, and researchers now buy PEG online. E-commerce allows access to a wide range of PEG grades with doorstep delivery and easy comparison. As digital platforms grow, especially in regions such as Asia and Europe, more buyers will shift online. With better logistics and user-friendly websites, online retail is expected to dominate the PEG distribution market in the coming years.

Recent Developments

- In March 2025, Glenmark Therapeutics introduced its latest polyethylene glycol. The newly launched product is named polyethylene glycol 3350, and it comes in powder form, as per the company's claim. (Source : www.prnewswire.com)

- In 2025, the LUBRIDON ULTRA unveiled their latest product called the polyethylene glycol 400. This comes with the propylene glycol ophthalmic solution eye drop, as per the report published by the company recently.(Source: https://geneticpharma.in)

Top Companies List

- Dow Chemical Company

- BASF SE

- Croda International Plc

- Ineos Oxide

- Clariant AG

- Lotte Chemical Corporation

- India Glycols Ltd.

- Liaoning Oxiranchem Inc.

- Shanghai Taijie Chemical Co., Ltd.

- Huntsman Corporation

- Merck KGaA

- Jiangsu Haian Petrochemical Plant

- NOF Corporation

- KAO Corporation

- SABIC

- PCC Rokita SA

- Oxiteno

- Nippon Shokubai Co., Ltd.

- Yixing Hongbo Fine Chemical Co., Ltd.

- Dowell Science & Technology Co., Ltd.

Segment Covered

By Grade

- Pharmaceutical Grade

- Industrial Grade

- Cosmetic Grade

- Food Grade

- Laboratory/Reagent Grade

By Molecular Weight

- Low Molecular Weight (200–400 g/mol)

- Medium Molecular Weight (600–1000 g/mol)

- High Molecular Weight (3350–8000+ g/mol)

By Form

- Liquid

- Flake

- Powder

- Paste

By Application

- Pharmaceuticals

- Laxatives

- Drug Delivery Systems

- Tablet Coating

- Cosmetics & Personal Care

- Skin Creams

- Toothpaste

- Hair Care Products

- Industrial

- Lubricants

- Surfactants

- Ceramics Processing

- Food & Beverage

- Food Additives

- Anti-foaming Agents

- Others

- Paints and Coatings

- Resin Modifiers

- Detergents

By End-Use Industry

- Healthcare & Pharmaceuticals

- Cosmetics & Personal Care

- Chemical Industry

- Food Industry

- Paper & Packaging

- Automotive

- Textiles

- Construction

By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Online Retail

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE