Content

Bio-based Propylene Glycol Market Volume and Growth 2025 to 2034

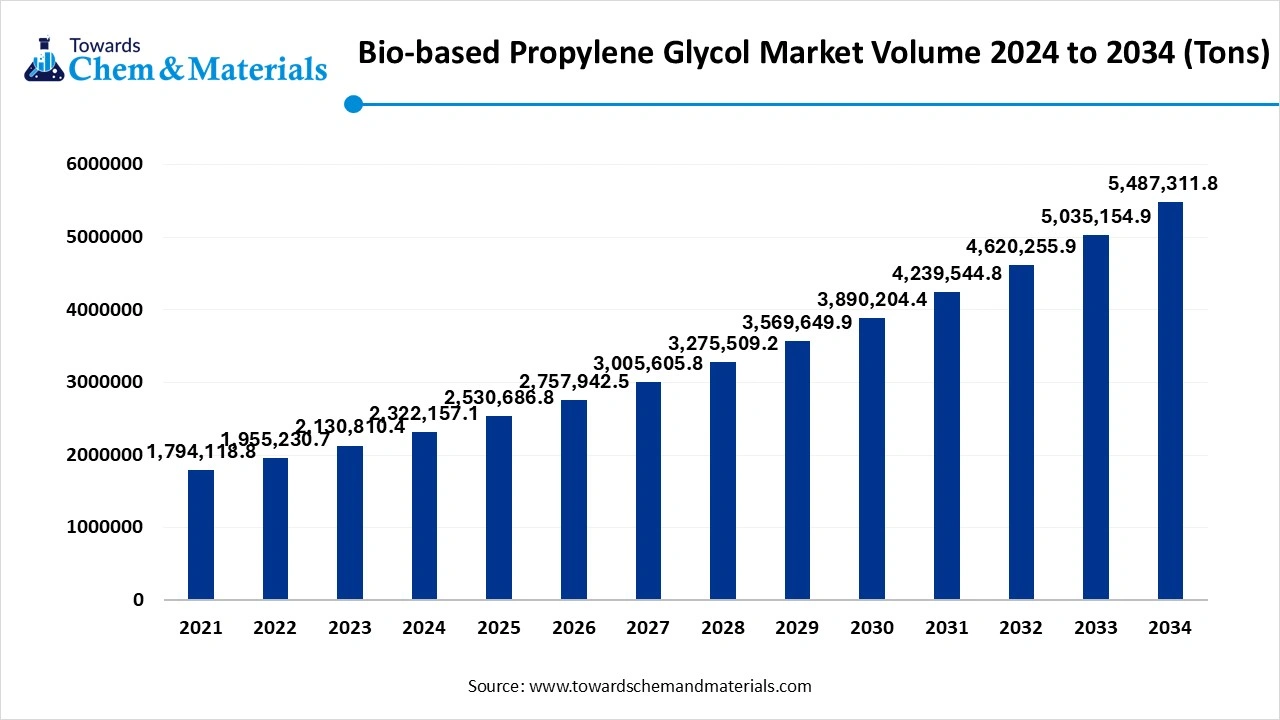

The global bio-based propylene glycol market volume accounted for 2,322,157.1 tons in 2024, grew to 2,530,686.8 Tons in 2025, and is expected to be worth around 5,487,311.8 Tons by 2034, poised to grow at a CAGR of 8.98% between 2025 and 2034. The growth of the market is driven by the growing demand from various industries due to increasing adoption of biobased and greener alternatives due as rising awareness about the environment fuels the growth.

Key Takeaways

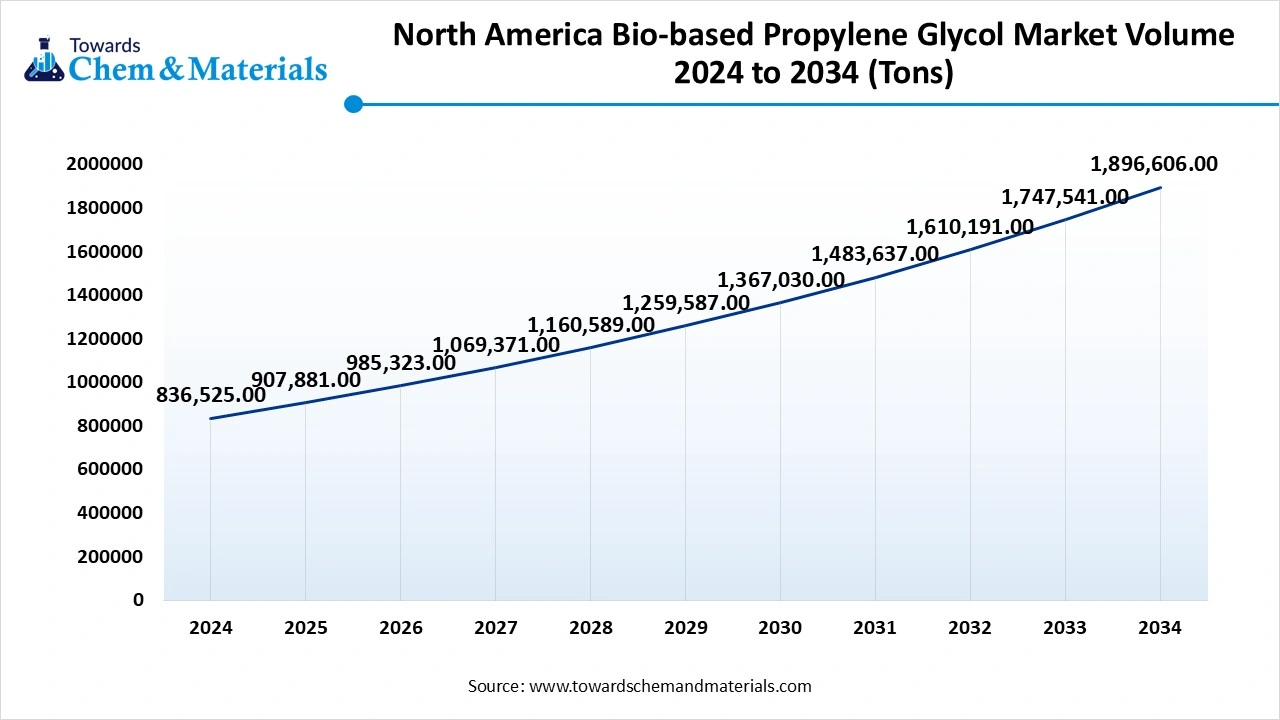

- The North America bio-based propylene glycol market Volume was estimated at 836,525.3 tons in 2024 and is expected to reach 1,897,573.9 tons by 2034, growing at a CAGR of 8.53% from 2025 to 2034.

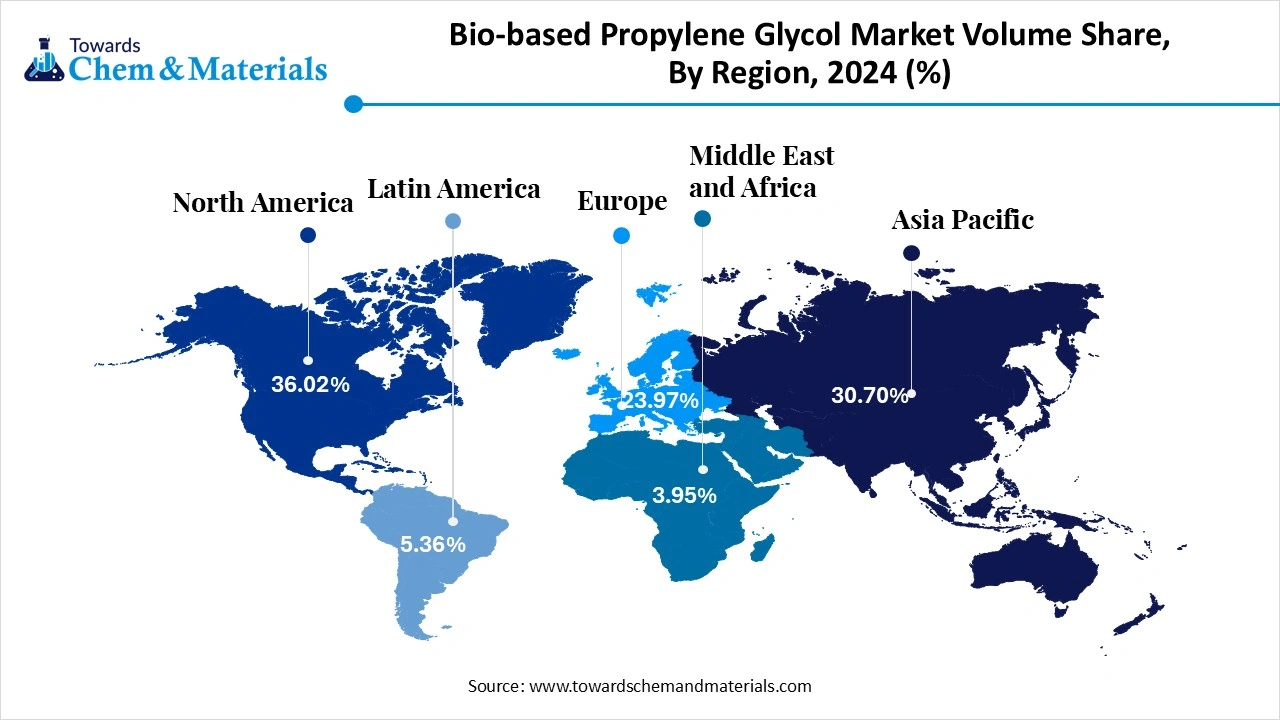

- By region,North America dominated the bio-based propylene glycol market held the largest Volume Share of 36.02% the global market in 2024. The growth is driven by the increasing demand for sustainable products.

- By region, Asia Pacific has held a volume share of around 30.70% in 2024 is expected to have significant growth in the market in the forecast period. The growing environmental awareness fuels the growth of the market.

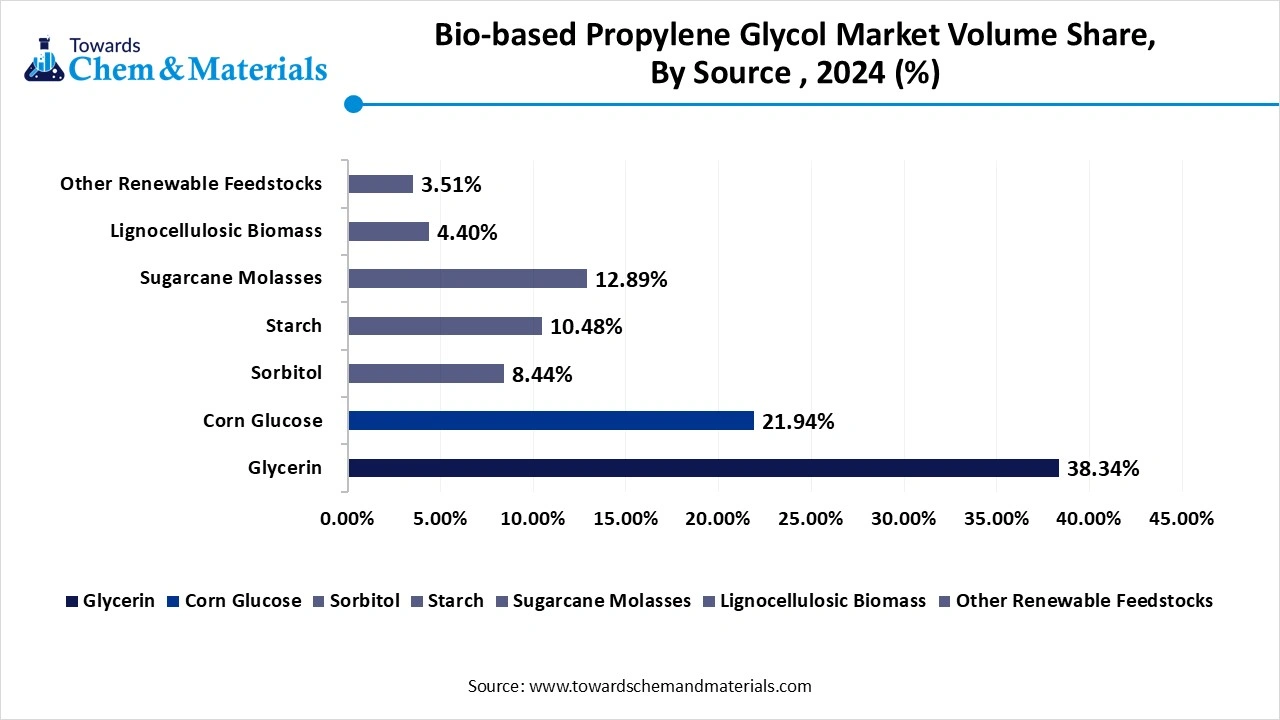

- By source, the glycerine segment dominated the market in 2024. The glycerine segment held a 38.34% Volume Share in the market in 2024. The demand for safe and sustainable products drives the growth.

- By source, the corn glucose segment has captured a volume share of 21.94% in 2024 is expected to grow significantly in the market during the forecast period. The growing demand from the pharmaceutical and cosmetic industry drives the growth.

- By application, the unsaturated polyester resins segment dominated the market in 2024. The unsaturated polyester resins segment held a 32% share in the market in 2024. The eco-friendly and sustainable products increase the growth.

- By application, the personal care and cosmetics segment is expected to grow in the forecast period. The changing consumer preferences and use of biobased products fuel the growth.

- By grade, the industrial grade segment dominated the market in 2024. The industrial grade segment held a 35% share in the market in 2024. Demand from various industries for sustainable and green products drives the growth.

- By grade, the food grade segment is expected to grow in the forecast period. The growth is driven by the growing demand and safety associated with it.

- By production process, the hydrogenolysis of glycerol segment dominated the market in 2024. The hydrogenolysis of glycerol segment held a 35% share in the market in 2024. The growing demand for glycerin source fuels the growth.

- By production process, the fermentation of the glucose segment is expected to grow in the forecast period. For the products of food application demand for the fermentation process.

- By end use, the automotive segment dominated the market in 2024. The automotive segment held a 35% share in the market in 2024. The demand for coolant and antifreeze drives the growth.

- By end use, the pharmaceutical segment is expected to grow in the forecast period. The demand for biobased products drives the growth of the market.

- By distribution channel, the direct sales (B2B) segment dominated the market in 2024. The direct sales (B2B) segment held a 35% share in the market in 2024. The need and demand for the supply of large volume products.

- By distribution channel, the online platforms segment is expected to grow in the forecast period. The convenience and availability drive the growth.

Market Overview

Rising demand for durable materials: Bio-based Propylene Glycol market to expand

Bio-based Propylene Glycol (Bio-PG) is a sustainable, renewable alternative to petroleum-based propylene glycol. It is primarily produced from plant-based feedstocks such as glycerin, sorbitol, glucose, and starch through hydrogenolysis or fermentation processes. Bio-PG serves as a versatile intermediate and solvent used in a wide array of applications, including personal care, pharmaceuticals, antifreeze, de-icing fluids, food additives, and unsaturated polyester resins (UPRs).

What Are the Key Trends Associated with The Growth of The Bio-Based Propylene Glycol Market?

The bio-based propylene glycol market is mainly propelled by rising consumer interest in sustainable products, technological improvements in production methods, and government incentives promoting bio-based materials. Furthermore, increasing awareness of chemical safety and the push for eco-friendly options contribute significantly to market expansion. The growth is also supported by the expanding end-use sectors such as automotive, pharmaceuticals, food and beverages, and cosmetics and personal care, which further drive market demand.

Market Trends

- Rising demand for sustainable products due to growing awareness of environmental impact and demand for greener alternatives drives the growth.

- Government regulations and initiatives for the use of bio-based products, promoting an environmental and sustainable approach, drive the growth of the market.

- The wide range of applications and demand is a growing trend in pharmaceuticals, food and beverage, and many other industries.

- The technological advancements in bio-refineries and production processes, with innovation, fuel the growth of the market.

Report Scope

| Report Attributes | Details |

| Market Volume in 2025 | 2,530,686.8 Tons |

| Market Volume by 2034 | 5,487,311.8 Tons |

| Growth rate from 2024 to 2025 | CAGR 8.98% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Source (Feedstock Type), By Application, By Grade, By Production Process, By End-use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | Archer Daniels Midland Company (ADM), BASF SE, The Dow Chemical Company, Global Bio-Chem Technology Group Co., Ltd., LyondellBasell Industries N.V. , DuPont Tate & Lyle Bio Products Company, LLC , Oleon NV (part of Avril Group) , Cargill, Incorporated , Manali Petrochemicals Ltd., Repsol S.A., Tokyo Chemical Industry Co., Ltd., Ashland Inc., Shell Chemicals, Huntsman Corporation, SK picglobal, INEOS Oxide , Shenzhen Simeiquan Biotechnology Co., Ltd., Mitsubishi Chemical Group, AGC Chemicals, Solvay S.A. |

Market Opportunity

What Are the Key Growth Opportunities Responsible for The Growth of The Bio-Based Propylene Glycol Market?

The key growth opportunity responsible for the growth of the market is the growing demand for sustainable products, increasing preference for bio-based and renewable materials from various industries fuels the growth of the market. Consumers are actively seeking products with a lower environmental impact, and the adoption of sustainable ingredients and materials by the industries also fuels and boosts the growth of the market.

Market Challenge

What Are the Key Challenges Responsible for The Hindrance of The Bio-Based Propylene Glycol Market Growth?

The key challenge is the limited feedstock availability and price fluctuations. This is due to fluctuating agricultural conditions and competition from other industries, which impact the stability and biobased propylene production, causing price fluctuation, which is a challenge in the growth of the market. The high production costs due to the use of advanced and complex technologies require high investments for setup, which is a challenge hindering the growth of the market.

Regional Insights

How Did North America Dominate the Bio-Based Propylene Glycol Market In 2024?

The North America bio-based propylene glycol Market Volume was estimated at 836,525.3 tons in 2024 and is anticipated to reach 1,897,573.9 tons by 2034, growing at a CAGR of 8.53% from 2025 to 2034. market with a market volume share of 36.02% in 2024

North America dominated the bio-based propylene glycol market in 2024. The growth of the market is driven by the growing awareness of environmental impact and demand for the use of biobased products fuels the growth of the market in the region. Key players of the region also contribute to the growth like The Dow Chemical Company, BASF SE, Archer Daniels Midland Company (ADM), Cargill, and LyondellBasell Industries N.V. The growing demand for sustainable products across industries, supportive regulation in the region, and well-established infrastructure for the development of bio-based products boost the growth of the market in the region.

The U.S. Has Seen a Rapid Growth Due To the Presence of a Mature Market.

The growth of the market is driven by the growing and key application of biobased products and expanding industries in the fields like cosmetics and personal care, pharmaceutical, food and beverages, automotive, and construction. These companies demand biobased products due to increased adoption resulting from increased environmental awareness amid rising environmental concerns associated with the use of hazardous and chemical products, which boosts the growth of the market in the country.

- The world shipped out 27,833 Propylene Glycol shipments from November 2023 to October 2024 (TTM). These exports were handled by 4,787 Indian exporters to 5,699 buyers, showing a growth rate of 17% over the previous 12 months.(Source : www.volza.com)

- Globally, China, South Korea, and the United States are the top three exporters of Propylene Glycol. China is the global leader in Propylene Glycol exports with 27,132 shipments, followed closely by South Korea with 20,371 shipments, and the United States in third place with 16,379 shipments.(Source: www.volza.com)

Asia Pacific Is Seeing Growth in The Market Driven by The Growing Awareness.

Asia Pacific is expected to experience significant growth in the bio-based propylene glycol market in the forecast period. The growth of the market is driven by the growing demand from the industries due to the increased adoption of biobased and green alternatives, due to rising demand for environmentally friendly and sustainable products in the region fuels the growth of the market. The growth is also fueled by the rapid industrialization, urbanization, and a strong focus on sustainability in the region, which boosts the growth of the market.

China Has Seen Significant Growth, Driven by The Strong Industrial Base.

The growth of the market in China is driven by the presence of a strong industrial base in the country, which the demand for biobased product adoption supports by the government initiatives and policies promoting green building materials also supports the growth, which also supports the growth of the market in the country. The key drivers in the country are the sustainability focus, pharmaceutical industry growth, and automotive industry demand; food and beverages applications also contribute to the growth of the market.

Global Bio-based Propylene Glycol Market Volume Share, By Region, 2024-2034 (%)

| By Region Volume (Tons) | Market Volume Shares (%)2024 | Volume (Tons)(2024) | Market Volume Shares (%)2034 | Volume (Tons)(2034) | CAGR |

| North America | 36.02% | 836,525.3 | 34.14% | 1,897,573.9 | 8.53% |

| Europe | 23.97% | 556,602.6 | 23.12% | 1,285,058.8 | 8.73% |

| Asia Pacific | 30.70% | 712,901.8 | 32.32% | 1,796,414.4 | 9.68% |

| South America | 5.36% | 124,496.4 | 6.21% | 345,165.0 | 10.74% |

| Middle East | 3.95% | 91,630.9 | 4.21% | 234,000.8 | 9.83% |

Segmental Insights

Source Insights

Which Source Segment Dominated the Bio-Based Propylene Glycol Market In 2024?

The glycerine segment dominated the bio-based propylene glycol market in 2024. The biobased propylene glycol is produced by the process of hydrogenolysis, in which glycerine reacts with the hydrogen gas under specific temperature and pressure that is the product is produced by converting glycerine into propylene glycol through a process called hydrogenolysis. The glycerine is a byproduct of biodiesel production. Propylene glycol is extensively used as a humectant in cosmetics, as a solvent, which increases the demand due to its sustainability and being less reliant on fossil fuel sources, fueling the growth of the market.

The corn glucose segment expects significant growth in the market during the forecast period. The biobased propylene glycol is produced from corn glucose through a process of fermentation and chemical conversion. In this, the corn glucose is fermented by using the microorganisms, which is then subjected to chemical reaction and then purified through distillation and other separation techniques. Propylene glycol is extensively used due to its benefits, offered as reduced carbon footprint, renewable feedstock, and meeting the standards for 100% bio-based renewable carbon content.

Global Bio-based Propylene Glycol Market Volume Share, By Source Volume, 2024-2034 (%)

| By Source Volume (Tons) | Volume Share, 2024 (%) | Volume (Tons)(2024) | Volume Share, 2034 (%) | Volume (Tons)(2034) | CAGR |

| Glycerin | 38.34% | 890,323.1 | 37.22% | 2,068,766.8 | 8.79% |

| Corn Glucose | 21.94% | 509,399.7 | 21.31% | 1,184,455.2 | 8.80% |

| Sorbitol | 8.44% | 195,874.3 | 8.83% | 490,790.2 | 9.62% |

| Starch | 10.48% | 243,447.9 | 11.12% | 618,073.3 | 9.76% |

| Sugarcane Molasses | 12.89% | 299,358.4 | 12.13% | 674,211.2 | 8.46% |

| Lignocellulosic Biomass | 4.40% | 102,139.3 | 5.01% | 278,466.5 | 10.55% |

| Other Renewable Feedstocks | 3.51% | 81,614.5 | 4.38% | 243,449.7 | 11.55% |

Application Insights

How Did Unsaturated Polyester Resins Segment Dominate the Bio-Based Propylene Glycol Market In 2024?

The unsaturated polyester resins (UPR) segment dominated the bio-based propylene glycol market in 2024. The growth of the market is driven by the growing demand for sustainable alternatives. They are extensively used in construction in products like paints, coatings, and electric elements, which increases the demand for the market. The versatile applications like composite materials, coating and adhesives, chemical anchoring, putties, fillers, and stucco also increase the demand for the market, supporting the growth and expansion of the market.

The personal care & cosmetics segment expects significant growth in the during the forecast period. The growth of the market is driven by the increasing demand for bio-based products due as changing preferences of the consumers for natural and eco-friendly products increase the adoption of biobased propylene glycol in the sector. It is used as a humectant, solvent, moisturizer, ingredient stabilizer, and as a preservative in cosmetics and personal care products, which increases the growth of the market.

Grade Insights

Which Grade Segment Dominated the Bio-Based Propylene Glycol Market In 2024?

The industrial grade segment dominated the bio-based propylene glycol market in 2024. The industry uses bio-based propylene glycol as it offers a sustainable and versatile solution for various industrial applications due to its eco-friendly nature and sustainable approach, which attracts consumers in diverse sectors. The benefits offered, like environmental regulations, sustainability, and reduced carbon footprint, also align with regulations. Industries like automotive, construction, and cosmetics demand the product due to its versatile properties and applications offered, which contribute to the growth and expansion of the market.

The food grade segment expects significant growth in the market during the forecast period. The growing demand for plant-based sources and ingredients increases the demand for the biobased product, which is used as a humectant, solvent, and stabilizer in various food products due to its safety, versatility, and sustainability, which boosts the growth of the market. They are commonly used and found in items like cold drinks, soft drinks, cake mixes, and even as food colorants. This drives the growth of the market and supports its expansion of the market.

The Production Process Insights

How Did Hydrogenolysis of Glycerol Segment Dominate the Bio-Based Propylene Glycol Market In 2024?

The hydrogenolysis of glycerol segment dominated the bio-based propylene glycol market in 2024. Hydrogenolysis of glycerol is a key production process in the biobased propylene glycol market, utilizing renewable glycerol often derived as a byproduct from biodiesel production, to produce eco-friendly propylene glycol. This process involves breaking down glycerol under hydrogen pressure in the presence of catalysts, yielding high-purity propylene glycol with reduced environmental impact. The rising demand for sustainable, low-carbon chemicals and increasing glycerol availability drive the adoption of this process, supporting market growth and promoting greener industrial practices.

The fermentation of glucose segment is expected to experience significant growth in the market during the forecast period.

Fermentation of glucose is an important production process in the biobased propylene glycol market, leveraging renewable plant-based feedstocks like corn or sugarcane. In this method, glucose undergoes microbial fermentation to produce propylene glycol in an environmentally friendly and sustainable way. The growing demand for green chemicals in food, cosmetics, and pharmaceutical applications drives the adoption of glucose fermentation, supporting market expansion and advancing circular bioeconomy initiatives.

End Use Insights

Which End-Use Segment Dominated the Bio-Based Propylene Glycol Market In 2024?

The automotive segment dominated the bio-based propylene glycol market in 2024. The growing use in the automotive industry is due to sustainable alternatives to the traditional petroleum-based propylene glycol, offering environmental benefits and aligning with the growing demand for green solutions in the automotive sector. It is extensively used as antifreeze and coolant in the automotive industry as it lowers the freezing point and prevents the engine from damage, which fuels the demand for the product. The government regulations and standards also help in meeting the need and demand for the product, boosting the growth and expansion of the market.

The pharmaceutical segment expects significant growth in the market during the forecast period. The growing and expanding pharmaceutical industry is increasingly using the biobased propylene glycol as it is a safe and sustainable alternative Along with this, the variety of applications and benefits, like use as solvent and stabilizer, growing demand, reduced environmental impact, consumer preference and government regulation supports the growth and expansion of the market.

Distribution Channel Insights

How Did the Direct Sales Segment Dominate the Bio-Based Propylene Glycol Market In 2024?

The direct sales (B2B) segment dominated the bio-based propylene glycol market in 2024. Direct sales (B2B) is a key distribution channel in the biobased propylene glycol market, enabling manufacturers to supply large volumes directly to industrial end users such as chemical, pharmaceutical, cosmetic, and food processing companies. This approach offers benefits like tailored solutions, competitive pricing, and strong customer relationships. The increasing demand for sustainable, bio-based ingredients in various sectors drives the preference for direct B2B sales, supporting market growth, improving supply chain efficiency, and ensuring consistent product quality and availability.

The online platforms segment expects significant growth in the market during the forecast period. Online platforms are an emerging distribution channel in the biobased propylene glycol market, offering manufacturers and suppliers a flexible, accessible way to reach a broader range of customers. These platforms enable small and medium-sized businesses to easily procure bio-based propylene glycol in varying quantities, streamlining purchasing processes and reducing lead times. The convenience, transparency, and global reach of online sales channels support market growth, meet the rising demand for sustainable products, and enhance supply chain agility and responsiveness.

Recent Developments

- In October 2024, Argent Energy, a Leading European biofuels manufacturer, launched a new plant to produce glycerine in Amsterdam. The product is a byproduct of waste-based biodiesel, keeping in mind environmental sustainability.(Source : www.ofimagazine.com)

Top Companies List

- Archer Daniels Midland Company (ADM)

- BASF SE

- The Dow Chemical Company

- Global Bio-Chem Technology Group Co., Ltd.

- LyondellBasell Industries N.V.

- DuPont Tate & Lyle Bio Products Company, LLC

- Oleon NV (part of Avril Group)

- Cargill, Incorporated

- Manali Petrochemicals Ltd.

- Repsol S.A.

- Tokyo Chemical Industry Co., Ltd.

- Ashland Inc.

- Shell Chemicals

- Huntsman Corporation

- SK picglobal

- INEOS Oxide

- Shenzhen Simeiquan Biotechnology Co., Ltd.

- Mitsubishi Chemical Group

- AGC Chemicals

- Solvay S.A.

Segments Covered

By Source (Feedstock Type)

- Glycerin

- Corn Glucose

- Sorbitol

- Starch

- Sugarcane Molasses

- Lignocellulosic Biomass

- Other Renewable Feedstocks

By Application

- Personal Care & Cosmetics

- Moisturizers

- Hair Care Products

- Oral Care

- Makeup Products

- Pharmaceuticals

- Drug Formulations

- Topical Solutions

- Oral Suspensions

- Food & Beverage

- Food Additives

- Flavor Carrier

- Humectant

- Antifreeze & De-icing

- Automotive Coolants

- Aircraft De-icing Fluids

- Industrial & Manufacturing

- Unsaturated Polyester Resins (UPR)

- Functional Fluids

- Paints and Coatings

- Detergents and Cleaning Products

- Household Cleaners

- Industrial Cleaners

By Grade

- Industrial Grade

- Pharmaceutical Grade

- Food Grade

- Cosmetic Grade

By Production Process

- Hydrogenolysis of Glycerol

- Fermentation of Glucose

- Catalytic Conversion from Sugars

By End-use Industry

- Automotive

- Food & Beverage

- Personal Care

- Pharmaceutical

- Building & Construction

- Textiles

- Agriculture

- Electronics

By Distribution Channel

- Direct Sales (B2B)

- Distributors/Wholesalers

- Online Platforms

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait