Content

Polyglycolic Acid Market Size, Share | Industry Report, 2034

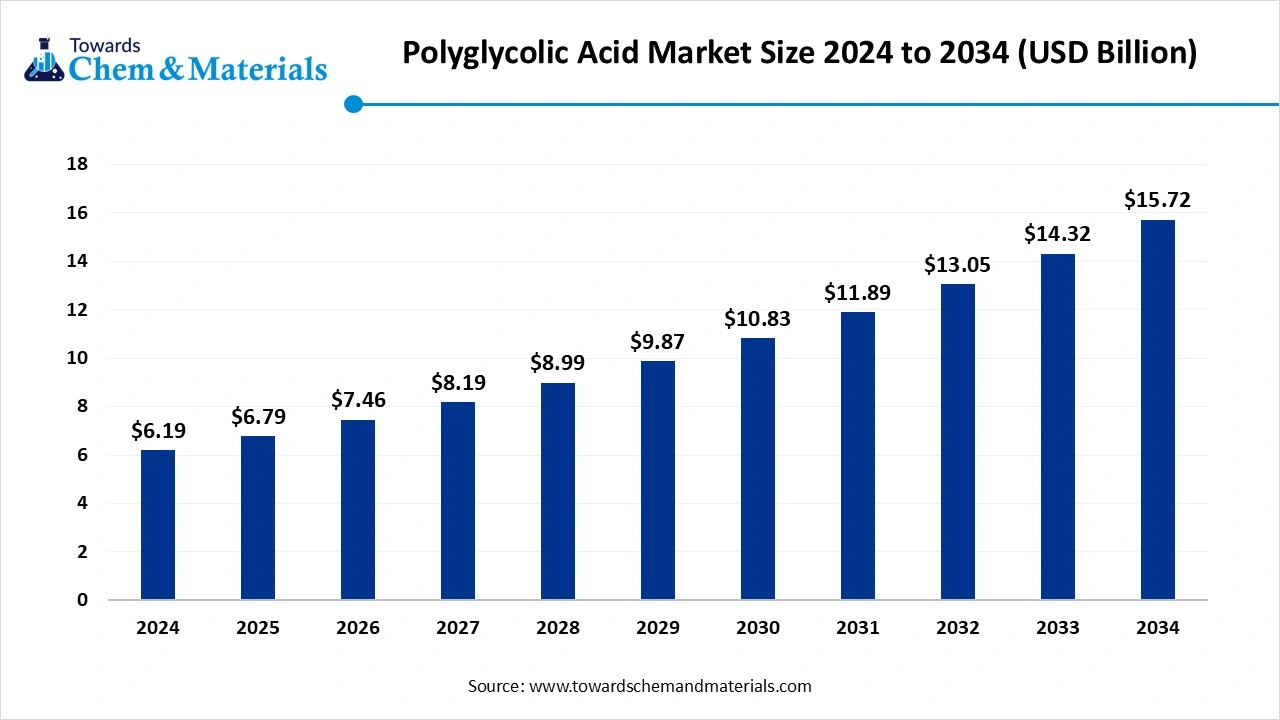

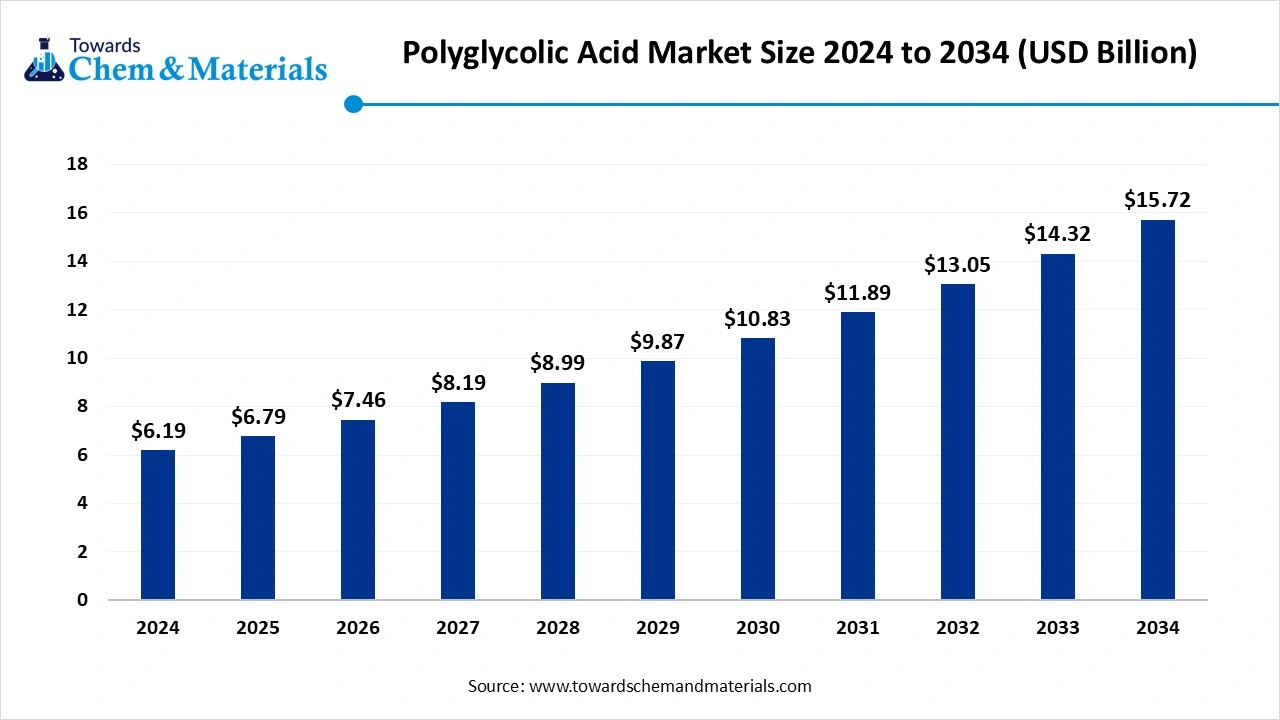

The global polyglycolic acid market size was estimated at USD 6.19 billion in 2024 and is predicted to increase from USD 6.79 billion in 2025 to approximately USD 15.72 billion by 2034, expanding at a CAGR of 9.77% from 2025 to 2034. The growing expansion of the packaging industry and rising demand across medical applications drive the market growth.

Key Takeaways

- By region, North America held a 38% share in the market in 2024 due to the well-established healthcare infrastructure.

- By region, Asia Pacific is growing at the fastest rate with 10.2% CAGR in the market during the forecast period due to the growing packaging applications.

- By form, the fiber segment held a 35% share in the market in 2024 due to the growing textile sector.

- By form, the film segment is expected to grow at the fastest rate with 9% CAGR in the market during the forecast period due to the focus on sustainability.

- By purity level, the high-purity segment held a 50% share in the market in 2024 due to the growing demand in tissue engineering.

- By purity level, the industrial grade segment is expected to grow at the fastest CAGR in the market during the forecast period due to the excellent gas barrier resistance.

- By manufacturing, the ring-opening polymerization segment held a 70% share in the market in 2024 due to the rising biomedical applications.

- By manufacturing, the direct polycondensation segment is expected to grow at the fastest CAGR in the market during the forecast period due to the lower molecular weight.

- By application, the medical segment held a 40% share in the market in 2024 due to the growing demand for tissue regeneration and medical devices.

- By application, the oil & gas segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing focus on enhancing oil recovery.

- By molecular weight, the high molecular weight segment held a 50% share in the polyglycolic acid market in 2024, due to the higher tensile strength.

- By molecular weight, the medium molecular weight segment is expected to grow at the fastest CAGR in the market during the forecast period due to the low production cost.

Role of Polyglycolic Acid in Sustainability and Biomedical Innovation

Polyglycolic acid (PGA) is an aliphatic polyester with high crystallinity. It is a thermoplastic, synthetic, and biodegradable polymer. Polyglycolic acid has high tensile strength and is a stiff material. PGA is a relatively brittle, biodegradable, and degrades quickly. It consists of a high melting point and has a glass transition temperature around 35-40 0C. It can be reshaped multiple times and is insoluble in organic solvents. PGA is widely used in surgical sutures due to its flexibility and strength.

The biomedical applications, like orthopaedic devices, drug delivery systems, and dental implants, increase demand for PGA due to its biodegradability & biocompatibility. The increasing medical applications like tissue engineering, surgical sutures, and bioresorbable implants, increase demand for PGA. The growing expansion packaging industry fuels demand for polyglycolic acid. The growing demand across various end-user industries like healthcare, oil & gas, consumer goods, and agriculture contributes to the overall growth of the market.

- Peru exported 3,617 shipments of the polyglycolic acid sutures.(Source: www.volza.com)

- TAGUMEDICA S A is the leading supplier of polyglycolic acid in the world.(Source: www.volza.com)

- South Korea exported 1,204 shipments of the polyglycolic acid sutures.(Source: www.volza.com)

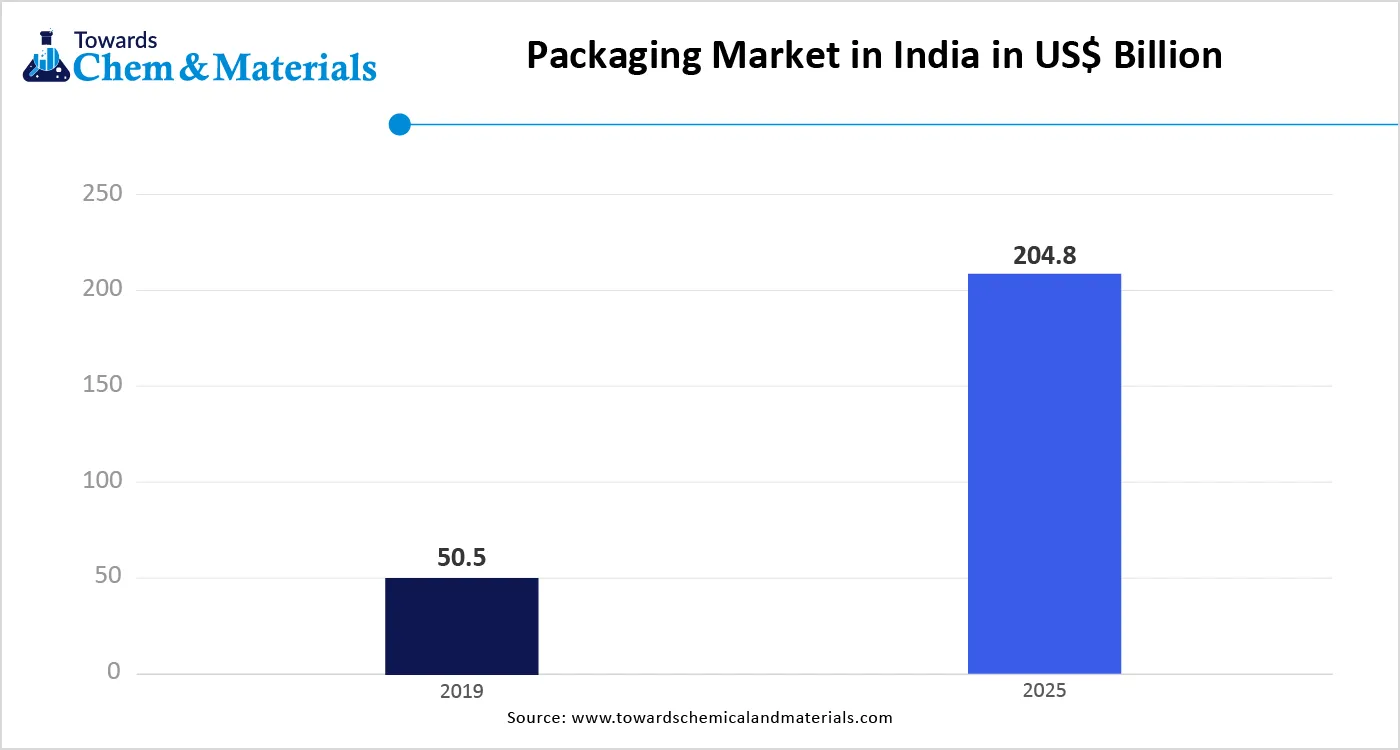

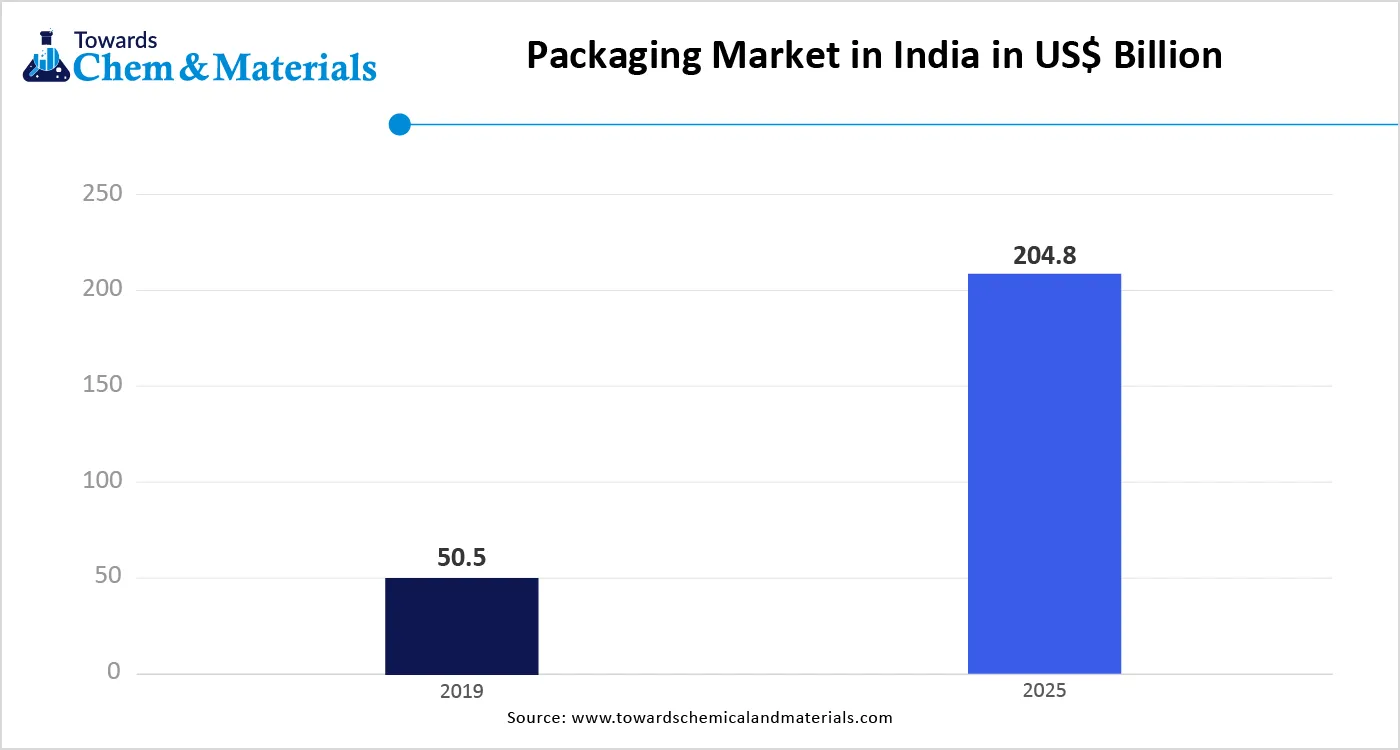

Growing Expansion of the Packaging Industry Propels Market Growth

The growing expansion of the packaging industry leads to higher demand for sustainable packaging solutions. The increasing focus on lowering plastic waste is fueling demand for PGA for packaging. The rising demand for packaged food and consumer goods creates demand for PGA packaging to ensure freshness. The increasing pharmaceutical packaging fuel demand for PGA for biodegradability and to maintain integrity. The growing focus on eco-friendly packaging solutions increases the adoption of PGA to lower plastic waste.

PGA provides a wide range of packaging formats, like containers and films. PGA extends shelf life, maintains product quality, and has excellent gas barrier properties. It offers a good barrier against gases, oxygen, and moisture. The increasing consumer demand for eco-friendly packaging increases the adoption of the PGA. The increasing demand for packaging medical applications fuels demand for PGA due to its biocompatibility. The growing expansion of the packaging industry is a key driver for the polyglycolic acid market.

Market Trends

- Growing Focus on Sustainability: The growing environmental concerns and rising focus on sustainability increase the adoption of the PGA. The increasing industries and consumer demand for sustainable products fuel the adoption of PGA for various applications.

- Technological Advancements in PGA Production Technology: The ongoing research & development in the PGA production technology focuses on enhancing properties like molecular weight, synthesis methods, and new applications.

- Booming Oil & Gas Industry: The booming oil & gas industry fuels demand for PGA for applications like plugs and frac balls to isolate zones. The increasing use of filtration systems in the oil & gas industry fuels demand for PGA due to its biodegradability.

Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 6.79 Biliion |

| Market Size by 2034 | USD 15.72 Billion |

| Growth rate from 2024 to 2025 | CAGR 9.77% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Form, By Application, By Molecular Weight, By Region |

| Key Companies Profiled | Kureha Corporation, Corbion N.V., BMG Incorporated, Teleflex Incorporated, Huizhou Foryou Medical Devices Co., Ltd., Foryou Medical, Samyang Holdings Corporation, Evonik Industries AG, Shenzhen Polymtek Biomaterial Co., Ltd., Mitsui Chemicals, Inc., BASF SE, Mitsubishi Chemical Group, Abbott Laboratories, Henan Tuoren Medical Device Co., Ltd., Ashland Global Holdings Inc., Zhejiang Hisun Biomaterials Co., Ltd., AmerisourceBergen Corporation, EMS-Grivory (EMS-CHEMIE Holding AG), W.L. Gore & Associates, Inc., DSM Biomedical |

Market Opportunity

The Thriving Healthcare Sector

The thriving healthcare sector in various regions increases the adoption of polyglycolic acid. The increasing focus on using biodegradable materials in the healthcare industry is fueling demand for PGA. The growing prevalence of chronic diseases like orthopaedic and cardiovascular conditions increases demand for PGA to be utilized in various medical products. The ongoing advancements in medical technology focus on the development of PGA-based medical therapies and devices. The growth in surgical procedures increases demand for PGA for the development of absorbable sutures.

The increasing focus on wound care has fueled the adoption of PGA due to its controlled degradation rate and strength. The rising demand for tissue regeneration in tendon, bone, and cartilage repair increases demand for PGA for scaffolds. The focus on the development of controlled-release drug delivery systems increases demand for PGA for enhancing patient compliance and treatment efficacy. The thriving healthcare sector creates opportunities for the polyglycolic acid market.

Market Challenge

High Production Cost Limits Expansion of Polyglycolic Acid

Despite several benefits of the polyglycolic acid in various industries, the high production cost restricts the market growth. Factors like limited scalability of production, high cost of raw materials, and complex manufacturing processes are responsible for high production costs. The multi-step energy-intensive process, like the production of glycolide, increases the production cost. The complex manufacturing process, like direct polycondensation and ring-opening polymerization, increases the production cost. The requirement of specialized equipment leads to higher production costs. Fluctuations in raw materials prices directly affect the production cost. The limited scalability of production technology makes it expensive. The high production cost hampers the growth of the polyglycolic acid market.

Regional Insights

How North America Dominated the Polyglycolic Acid Market?

North America dominated the polyglycolic acid market in 2024. The well-established and advanced healthcare infrastructure, like clinics & hospitals, fuels demand for polyglycolic acid. The strong presence of the pharmaceutical industry and increasing production of medical devices help the market growth. The strong focus on sustainability increases the demand for polyglycolic acid. The increasing expansion of the packaging industry is fueling demand for polyglycolic acid. The stringent government regulations increase the adoption of eco-friendly products like PGA. The presence of a robust oil & gas sector drives the overall growth of the market.

The United States Polyglycolic Acid Market Trends

The United States is a major contributor to the polyglycolic acid market. The strong presence of key medical device and pharmaceutical companies increases the demand for polyglycolic acid. The well-established healthcare sector helps in the market growth. The increasing awareness about environmental concerns and a strong focus on sustainability increases demand for polyglycolic acid. The thriving oil & gas industry fuels demand for polyglycolic acid for production and exploration. The increasing prevalence of orthopaedic and cardiovascular conditions fuels demand for PGA for performing implants and sutures, supporting the overall growth of the market.

Why is Asia Pacific the Fastest-Growing in the Polyglycolic Acid Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The increasing consumer demand for consumer goods and packaged food increases the adoption of PGA for packaging applications. The growing expansion of the healthcare sector in countries like India, China, and Japan fuels demand for PGA for various applications, helping the market growth. The increasing awareness about environmental concerns increases demand for sustainable options like PGA. The strong government support for sustainable packaging is leading to the adoption of PGA. The rapid industrialization and the growing energy sector drive the overall growth of the market.

What are the Trends of the Polyglycolic Acid Market in India?

India is growing in the polyglycolic acid market. The growing expansion of the healthcare sector, like medical advancements and surgical procedures, increases the demand for polyglycolic acid. The strong government support for PGA production helps the market growth. The rapid industrialization and technological advancements in PGA production increase the adoption of PGA for various industrial applications. The expansion of the food and beverage industry increases demand for PGA for packaging. The rising textile industry supports the overall growth of the market.

- India exported 2,145 shipments of the polyglycolic acid sutures.(Source: www.volza.com )

- Orion Sutures India Pvt Ltd holds the maximum export share in polyglycolic acid. (Source: www.volza.com)

Segmental Insights

Form Insights

Why did Fiber Segment dominate the Polyglycolic Acid Market?

The fiber segment dominated the polyglycolic acid market in 2024. The growing medical industry increases demand for PGA fiber for absorbable surgical sutures, helping the market growth. PGA fiber consists of excellent stiffness and tensile strength. PGA fibers are biodegradable, biocompatible, and offer controlled degradation. The growing textile industry increases the demand for PGA fibers. The growing surgical procedures like gynecology, general surgery, and orthopaedics fuel demand for PGA fibers, driving the overall growth of the market.

The film segment is the fastest growing in the market during the forecast period. The growing consumer demand for sustainable packaging and increasing focus on sustainability increases demand for the PGA films. The rising demand across food packaging applications helps the market growth. PGA films offer an excellent barrier against moisture & gases and are highly biodegradable. The ongoing advancements in film production help the market growth. The growing medical applications, like tissue engineering and surgical sutures, support the overall growth of the market.

Purity Level Insights

How High-Purity Segment Held the Largest Share of the Polyglycolic Acid Market?

The high-purity (>99%) segment held the largest revenue share of the polyglycolic acid market in 2024. The growing development of medical devices increases demand for high-purity PGA, helping the market growth. High purity ensures less inflammation and tissue reaction. It consists of controlled degradation rates and high tensile strength. The growing textile industry fuels demand for high-purity PGA due to its biodegradability and strength. The increasing demand across applications like tissue engineering, sutures, surgical applications, and medical implants drives the overall growth of the market.

The industrial grade segment is experiencing the fastest growth in the market during the forecast period. The increasing demand for building and construction materials fuels demand for industrial-grade PGA. It consists of a good gas barrier resistance, high strength, and excellent stiffness. The growing expansion of the oil & gas industry increases the demand for industrial-grade PGA. The increasing focus on the process of shale gas and oil extraction supports the overall growth of the market.

Manufacturing Process Insights

How Ring-Opening Polymerization Segment Dominates the Polyglycolic Acid Market?

The ring-opening polymerization segment dominated the polyglycolic acid market in 2024. The growing biomedical applications, like tissue engineering, sutures, and drug delivery systems, increase demand for ring-opening polymerization synthesized PGA. It offers precise control over the molecular weight of polymers and does not produce any unwanted byproducts. It creates polymers with specific functionalities. The growing demand for biodegradable packaging drives the overall growth of the market.

The direct polycondensation segment is the fastest growing in the market during the forecast period. The growing demand for a cost-effective way to produce PGA increases the adoption of the direct polycondensation manufacturing process. The increasing demand for biodegradable polymers helps the market growth. Direct polycondensation is a simpler process and requires less specialized equipment. It consists of lower production cost and generally produces lower molecular weight PGA. The growing demand across healthcare applications supports the market growth.

Application Insights

Which Application Segment Dominated the Polyglycolic Acid Market?

The medical segment dominated the polyglycolic acid market in 2024. The rising demand for biocompatible and biodegradable materials in the medical sector increases the adoption of PGA. The increasing production of absorbable sutures helps the market growth. The growing demand for tissue repair and regeneration increases the adoption of polyglycolic acid due to its biocompatibility. The increasing production of implantable medical devices fuels demand for PGA. The growing focus on the drug delivery system increases the adoption of PGA. The growing prevalence of minimally invasive and general surgeries fuels demand for PGA, driving the overall growth of the market.

The oil & gas segment is experiencing the fastest growth in the market during the forecast period. The regulatory pressure to reduce the environmental footprint in the oil and gas industry increases demand for PGA for various applications. The growing investment in the oil & gas infrastructure helps the market growth. The increasing demand for hydraulic fracturing and drilling fluids in oil & gas fuels the adoption of the PGA. The rising focus on enhancing operational efficiency, like drilling fluids and enhancing oil recovery, increases the adoption of the PGA. The increasing production of oil & gas reserves supports the overall growth of the market.

Molecular Weight Insights

Why did High Molecular Weight Segment Dominate the Polyglycolic Acid Market?

The high molecular weight dominated the polyglycolic acid market in 2024. The increasing demand for applications like drug delivery systems and sutures increases the demand for high molecular weight PGA. The favorable regulatory environment for sustainable materials helps the market growth. High molecular weight PGA enhances the barrier properties and has higher tensile strength. It is processed through various methods like fil extrusion, thermoforming, and fiber spanning. It consists of a higher modulus of elasticity and is suitable for melt processing. The growing demand across biomedical applications and packaging drives the market growth.

The medium molecular weight is the fastest growing in the market during the forecast period. The growing medical applications, like tissue engineering, sutures, and scaffolds, increase demand for medium molecular weight PGA. It has a high barrier against gases, oxygen, and carbon dioxide. The rising production of packaging fibers and films fuels demand for medium molecular weight. It consists of good biodegradability and has a lower production cost. Solid-phase polymerization is used in the production of medium molecular weight PGA. The growing expansion of the packaging industry supports the market growth.

Recent Developments

- In March 2023, Deconstruct launched three products to fight dryness, pigmentation, and aging. The product range includes Hyaluronic Acid & Squalane Moisturizer, Pigmentation Control Serum, and Retinol Night Cream. The serum consists of 2% glycolic acid and 3% tranexamic acid. Glycolic acid exfoliates pigmented cells from the skin.(Source: www.apnnews.com)

- In February 2024, L'Oréal Paris launched Glycolic Bright Dark Circle eye serum. The serum improves puffiness & hyperpigmentation of the eye and is designed for Indian skincare. It is made from 3% niacinamide, glycolic acid, and vitamin C.(Source: infashionbusiness.com)

- In December 2024, Ashley Tisdale extends Frenshe into a hair care line. The products support hair hydration and scalp health. The line includes scalp serums, shampoos, and conditioners. The collection is made up of glycolic acid and sea moss.(Source: cosmeticsbusiness.com)

Top Companies List

- Kureha Corporation

- Corbion N.V.

- BMG Incorporated

- Teleflex Incorporated

- Huizhou Foryou Medical Devices Co., Ltd.

- Foryou Medical

- Samyang Holdings Corporation

- Evonik Industries AG

- Shenzhen Polymtek Biomaterial Co., Ltd.

- Mitsui Chemicals, Inc.

- BASF SE

- Mitsubishi Chemical Group

- Abbott Laboratories

- Henan Tuoren Medical Device Co., Ltd.

- Ashland Global Holdings Inc.

- Zhejiang Hisun Biomaterials Co., Ltd.

- AmerisourceBergen Corporation

- EMS-Grivory (EMS-CHEMIE Holding AG)

- W.L. Gore & Associates, Inc.

- DSM Biomedical

Segments Covered

By Form

- Fiber

- Film

- Powder

- Granules

- Pellets

By Purity Level

- High Purity (>99%)

- Industrial Grade

- Low Purity (<95%)

By Manufacturing Process

- Ring-Opening Polymerization

- Direct Polycondensation

By Application

- Medical

- Sutures (Tier 1, ~60% of medical)

- Orthopaedic devices

- Drug delivery systems

- Tissue engineering scaffolds

- Oil & Gas

- Frac balls

- Degradable plugs

- Packaging

- Food contact films

- Disposable items

- Agriculture

- Controlled release of fertilizers

- 3D Printing

- Temporary supports or sacrificial materials

- Others (Cosmetics, Biodegradable composites)

By Molecular Weight

- High Molecular Weight

- Medium Molecular Weight

- Low Molecular Weight

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait