Content

Polyethylene Wax Market Size and Growth 2025 to 2034

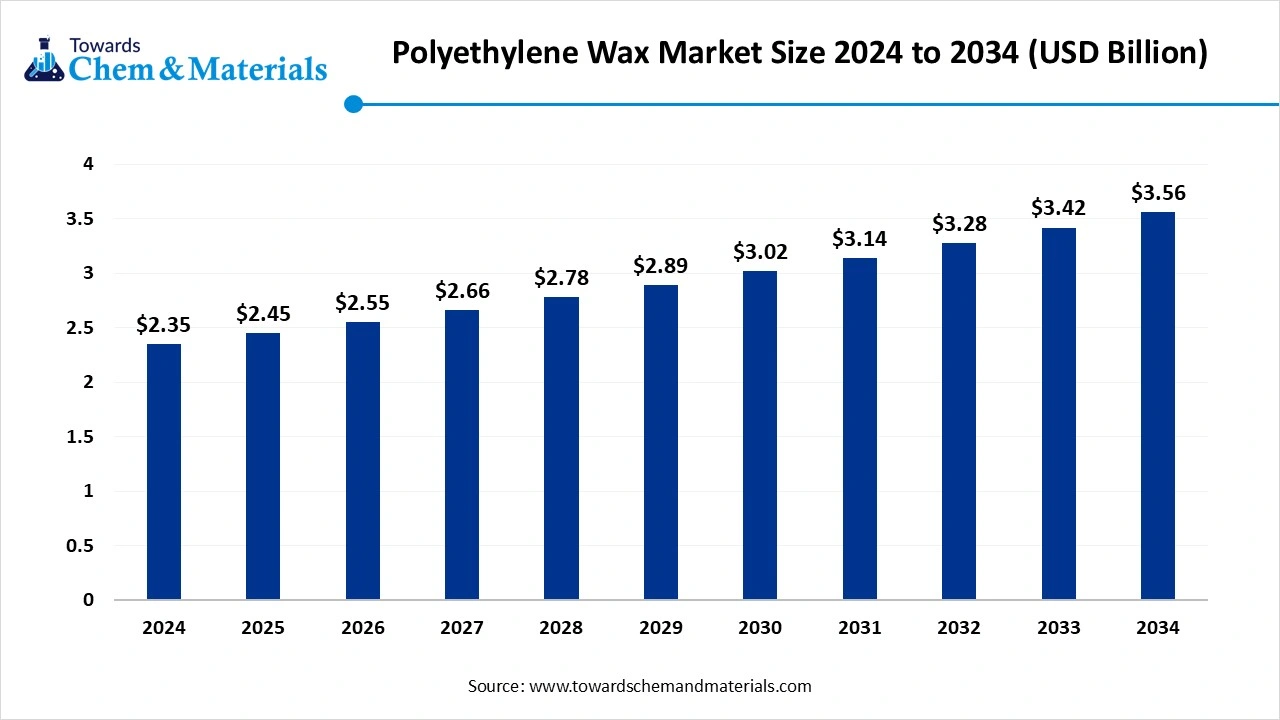

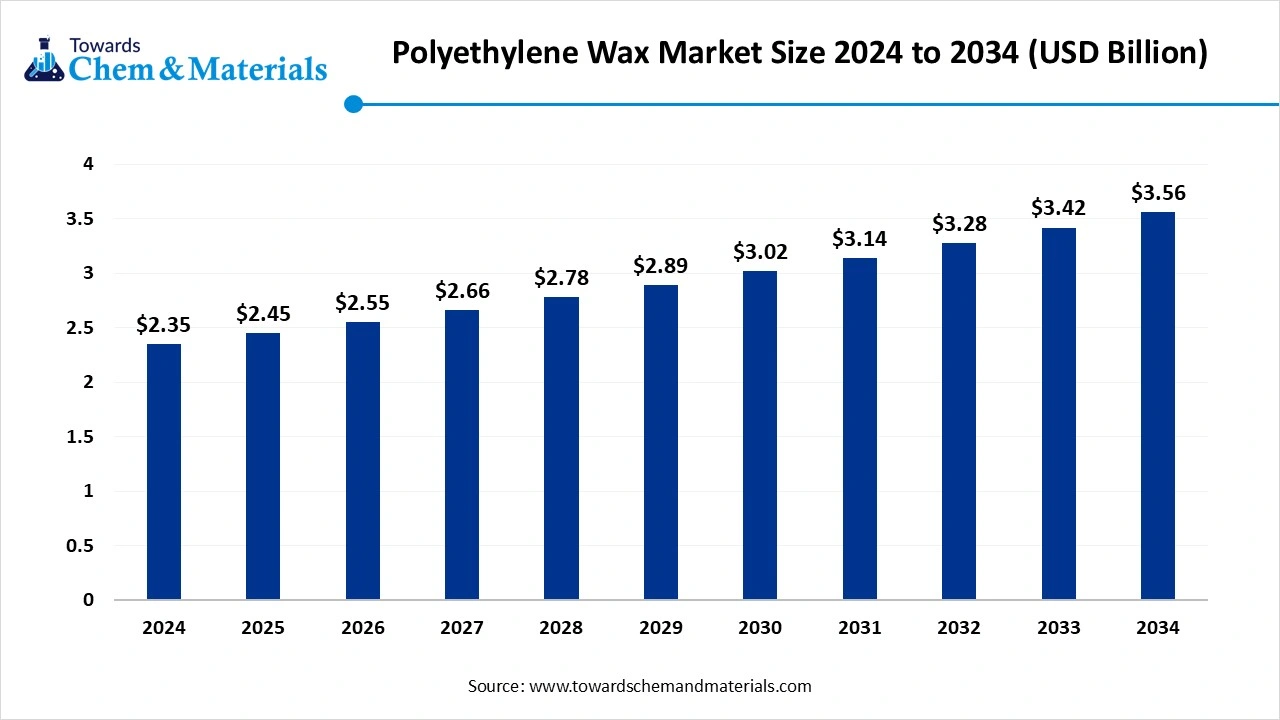

The global polyethylene wax market size was valued at USD 2.35 billion in 2024 and is expected to hit around USD 3.56 billion by 2034, growing at a CAGR of 4.25% from 2025 to 2034. The growing demand and applications from various industries like textile, plastics, coating, and adhesives due to its versatility fuel the growth of the market.

Key Takeaways

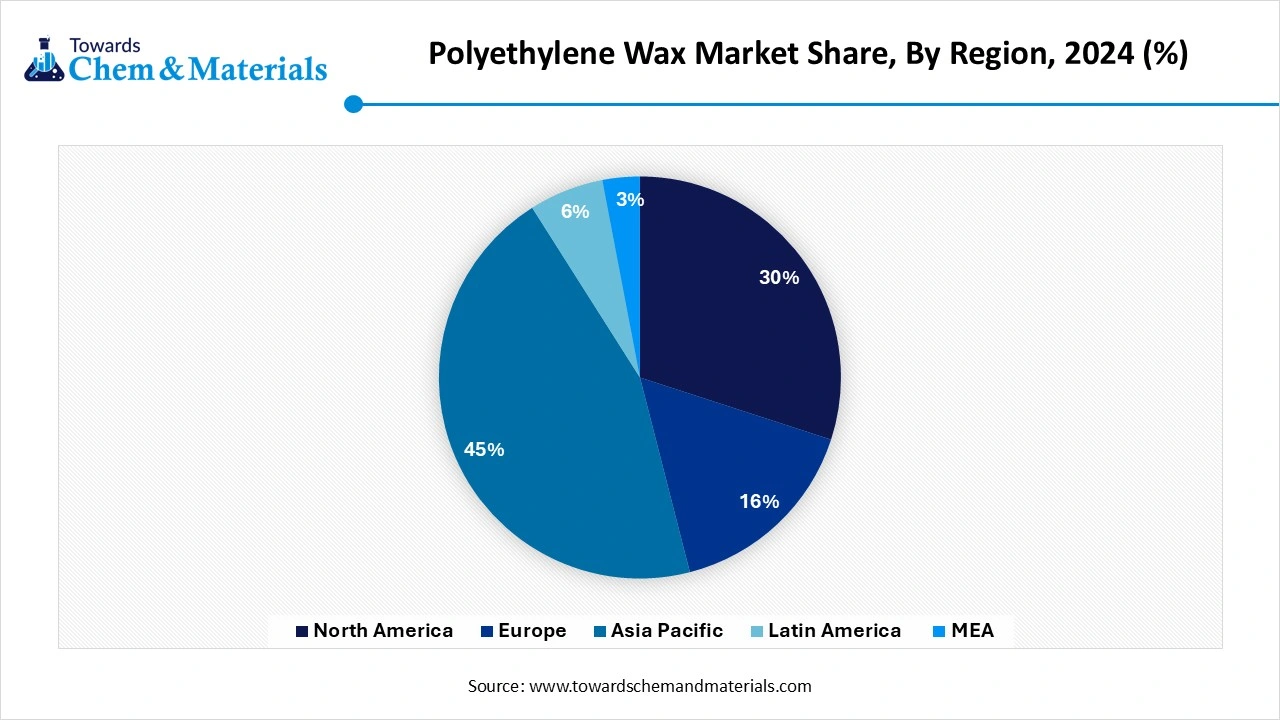

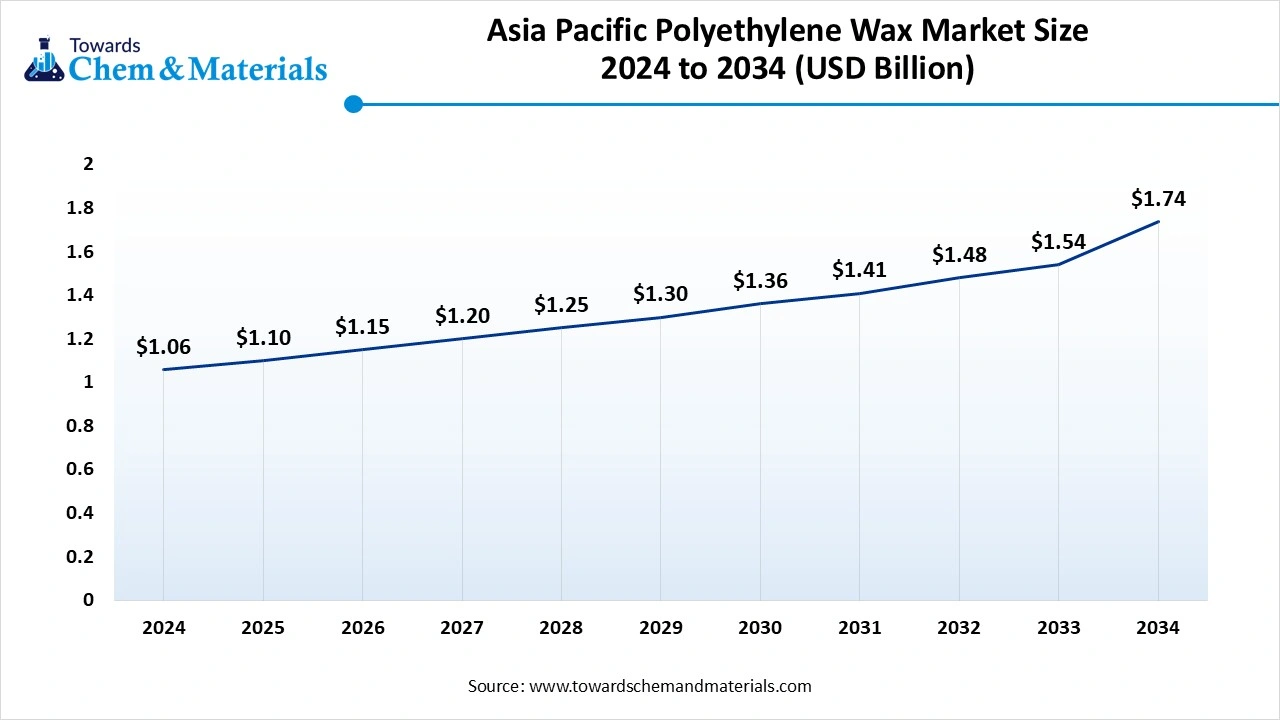

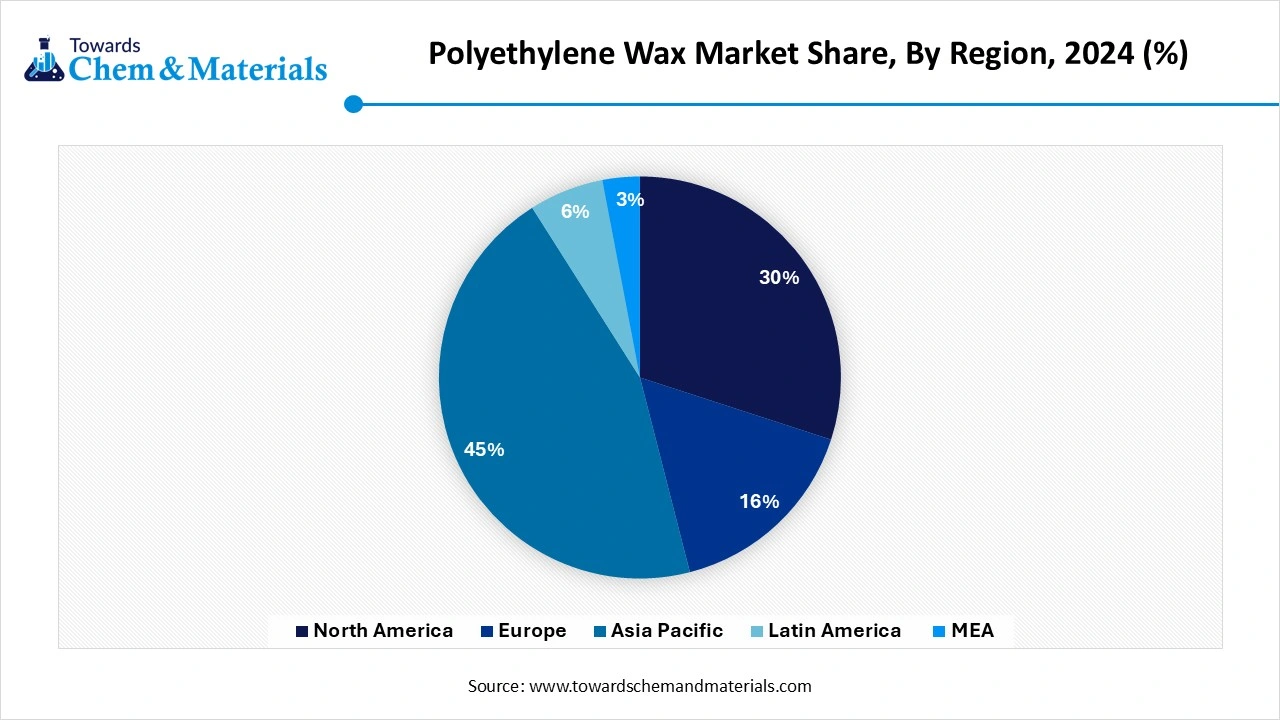

- By region, The Asia Pacific polyethylene wax market held the largest Share of 45% of the global market in 2024, The Asia Pacific region held a 45% share in the market in 2024.

- By type, the oxidized polyethylene wax segment dominated the market in 2024. The oxidized polyethylene segment held a 30% share in the market in 2024.

- By type, the micronized polyethylene wax segment is expected to grow significantly in the market during the forecast period. Application in plastics and coating fuels the growth.

- By process, the polymerization-based segment dominated the market in 2024. The polymerization-based segment held a 35% share in the market in 2024.

- By process, the metallocene catalyst-based segment is expected to grow in the forecast period. The demand for industries fuels the demand.

- By form, the flakes segment dominated the market in 2024. The flakes segment held a 40% share in the market in 2024.

- By form, the micronized form segment is expected to grow in the forecast period. The key benefits offered drive the growth.

- By application, the plastics processing segment dominated the market in 2024. The plastics processing segment held a 40% share in the market in 2024.

- By application, the printing inks segment is expected to grow in the forecast period. The key properties offered drive the growth.

- By end use, the plastics and polymers segment dominated the market in 2024. The plastics and polymers segment held a 35% share in the market in 2024.

- By end use, the printing and packaging segment is expected to grow in the forecast period. The wide applications drive the growth.

Market Overview

Rising Demand for Durable Materials: Polyethylene Wax Market to Expand

Polyethylene Wax (PE Wax) is a low molecular weight polyethylene polymer or oligomer used primarily as a performance additive or lubricant in applications such as plastics processing, inks, coatings, adhesives, rubber, and textiles. PE wax is produced via direct polymerization of ethylene, thermal degradation of high molecular weight polyethylene, or by synthesis using Ziegler-Natta or metallocene catalysts. It offers features like high hardness, low solubility, low melt viscosity, and excellent chemical resistance.

What Are the Key Growth Drivers Responsible for The Polyethylene Wax Growth of The Market?

The polyethylene wax market is mainly fueled by rising demand across the packaging, printing ink, and coating sectors, along with increased plastic usage in various applications. Key regions include America and China, where there's also a shift toward sustainable, eco-friendly materials. The industry is seeing a growing interest in sustainable options, with polyethylene wax available in biorenewable and recycled forms. This move toward greener materials is likely to further propel market growth as industries aim to reduce their environmental footprint. Additionally, the construction sector is expanding rapidly, especially in emerging markets, driving up the need for adhesives and coatings that utilize polyethylene wax.

Market Trends

- The technological advancements, like polymerization and modification, for the development of specialized polyethylene wax with enhanced properties, drive the demand.

- The growing focus on sustainability and alternative products that offer environmental benefits, like Fischer-Tropsch wax, drives the growth of the market.

- The growing and expanding applications like plastics, hot-melt adhesives, inks and coatings, pharmaceutical and cosmetic textiles are a growing trend driving the growth.

- The growing demand from various regions due to increasing manufacturing and infrastructure development supports the growth.

Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 2.45 Billion |

| Market Size by 2034 | USD 3.56 Billion |

| Growth rate from 2024 to 2025 | CAGR 4.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Process / Production Method, By Form, By Application, By End-Use, By Regional |

| Key Companies Profiled | SCG Chemicals Co., Ltd. , BASF SE , Westlake Chemical Corporation , Clariant AG Mitsui Chemicals, Inc., Honeywell International Inc. , Lion Specialty Chemicals Co., Ltd. Cosmic Petrochem Pvt. Ltd. ,Trecora Resources , Marcus Oil & Chemical , Innospec Inc. , Euroceras S.A. , WIWAX (WIWAX GmbH & Co. KG) , Sanyo Chemical Industries, Ltd. Paramelt B.V. , Deurex AG , Shamrock Technologies, Inc. , GE Specialty Chemicals , Kerax Limited , BYK-Chemie GmbH |

Market Opportunity

What Are the Key Growth Opportunities Responsible for The Growth of The Polyethylene Wax Market?

The key growth opportunities responsible for the growth of the market are that the packaging industry heavily relies on polyethylene wax, utilized in films, containers, and closures. Rising e-commerce and online shopping boost the need for efficient, sustainable packaging solutions, further increasing demand for polyethylene wax to enhance packaging quality. The beverage sector, especially in emerging regions, is also expanding rapidly, driving up polyethylene wax requirements in packaging. Additionally, polyethylene wax plays a vital role in printing inks and coatings, offering improved slip, rub resistance, and scratch resistance. The increased application of coatings across sectors like construction, automotive, and industrial equipment is also contributing to the growing demand for polyethylene wax.

Market Challenge

What Are the Key Challenges Responsible for Limiting the Growth of The Polyethylene Wax Market?

The key challenge that limits the growth of the market is the high initial cost and maintenance costs, which affect the price-sensitive regions and market, especially for small businesses, which is a barrier to the growth of the market. Additionally, the supply chain disruptions are also a challenge, and the rising raw material costs impact the production and distribution of polyethylene wax, which leads to delays and increased expenses, limiting the growth and hindering the expansion of the market.

Segmental Insights

Type Insights

Which Type of Segment Dominated the Polyethylene Wax Market In 2024?

The oxidized polyethylene wax segment dominated the market in 2024. Oxidized polyethylene wax is widely used in the plastic and rubber industries due to its unique properties, which enhance product performance and processing efficiency. It acts as an excellent lubricant and dispersing agent, improving pigment dispersion, Mold release, and surface gloss in plastic products. Additionally, it provides anti-blocking and anti-scratch properties, making it valuable in coatings and inks. These versatile advantages boost demand for oxidized polyethylene wax, supporting market growth and broader application adoption.

The micronized polyethylene wax segment expects significant growth in the market during the forecast period. Micronized polyethylene (PE) wax is highly valued in various industries because of its fine particle size and excellent performance-enhancing properties. It is widely used in coatings, inks, and plastic processing to improve scratch resistance, abrasion resistance, and surface smoothness. Additionally, it enhances the dispersion of pigments and additives, ensuring uniformity and better final product quality. The unique benefits offered by micronized PE wax drive its demand, supporting market growth and expanding its use across multiple applications.

Process Insights

How Did Polymerization-Based Segment Dominate the Polyethylene Wax Market In 2024?

The polymerization-based segment dominated the market in 2024. Polymerization-based polyethylene wax is produced through a controlled polymerization process, resulting in wax with a uniform molecular structure and consistent quality. This type of PE wax offers excellent hardness, high melting point, and superior thermal stability, making it ideal for use in hot melt adhesives, coatings, and plastic processing. Its ability to enhance surface properties, improve lubrication, and ensure smooth processing fuels its demand, supporting the overall growth and expansion of the market.

The metallocene catalyst-based segment expects significant growth in the polyethylene wax market during the forecast period. Metallocene catalyst-based polyethylene wax is produced using advanced metallocene catalyst technology, resulting in wax with precise molecular weight distribution and uniform structure. This type of PE wax offers superior performance, including excellent hardness, high gloss, and improved thermal stability. It enhances lubrication, dispersibility, and surface smoothness in applications like plastic processing, coatings, and inks. The exceptional quality and performance advantages drive the demand for metallocene catalyst-based PE wax, fueling market growth and supporting diverse industrial applications.

Form Insights

Which Form Segment Dominated the Polyethylene Wax Marker In 2024?

The flakes segment dominated the polyethylene wax market in 2024. The polyethylene wax flakes are a synthetic wax that is derived from polyethylene, a polymer made from ethylene monomers. The growth of the market is driven by its key characteristics and uses, like solubility and dispersibility, versatility, and release agents, which drive the growth of the market. The key applications in industries like plastics, rubber, inks, coating, and cosmetics, which fuel the growth and expansion of the market.

The micronized form segment expects significant growth in the market during the forecast period. Micronized polyethylene wax is are specialized form of polyethylene wax that is finely ground into particles in the micrometre range. The growth of the market is driven due to its key properties and benefits, like improved dispersibility, enhanced surface properties, anti-settling, and anti-blocking, with improved adhesion and rheology modification, which improves processability, fueling the growth of the market, supporting the expansion.

Application Insights

How Did the Plastics Processing Segment Dominate the Polyethylene Wax Market In 2024?

The plastics processing segment dominated the market in 2024. The growth of the market is driven by its crucial role as an additive in the processing of plastic due to its properties and benefits offered, like lubrication, processing aid to improve flow, reduced friction, and enhanced surface properties, which fuel the growth of the market. It is used in various plastic manufacturing processes like extrusion, injection molding, and blow molding, which increases the demand for the market. Its key application increases the adoption of PVC products, wood-plastic composites, foamed plastics, coating and inks, adhesives and sealants, and in rubber compounding, which fuels the growth and expansion of the market.

The printing inks segment expects significant growth in the polyethylene wax market during the forecast period. The growth of the market is driven by the use of additives in printing inks to enhance their properties, like scratch resistance, pigment dispersion, and slip, which increases the adoption of the product. The growth is also driven by its use and application in a wide range of ink types, like oil-based, solvent-based, water-based, and in color toners, which attracts consumers and increases the demand for the product.

End Use Insights

Which End-Use Segment Dominated the Polyethylene Wax Market In 2024?

The plastics and polymers segment dominated the market in 2024. The polypropylene wax is used in the plastic industry to enhance the processing and to improve the properties of plastic products, which increases the demand for the product. The growth is also driven due to its application in plastic processing, like reduced friction, improved flow, enhanced Mold release, reduced viscosity, pigment dispersion, improved surface properties, and other applications like release agents, strength, and toughness improvement, which fuels the growth of the market, supporting the expansion.

The printing and packaging segment expects significant growth in the polyethylene wax market during the forecast period. The growth of the market is driven using polypropylene in the printing and packaging industry to enhance the properties of inks, coatings, and packaging materials. The key properties offered, like moisture resistance, durability, heat sealability, barrier properties, and slip properties in packaging, increase the adoption and support the growth of the market. Additionally, in printing, rub resistance, gloss, slip properties, ink compatibility, and dispersant nature further help in the growth and expansion of the market.

Regional Insights

How Did Asia Pacific Dominate the Polyethylene Wax Market In 2024?

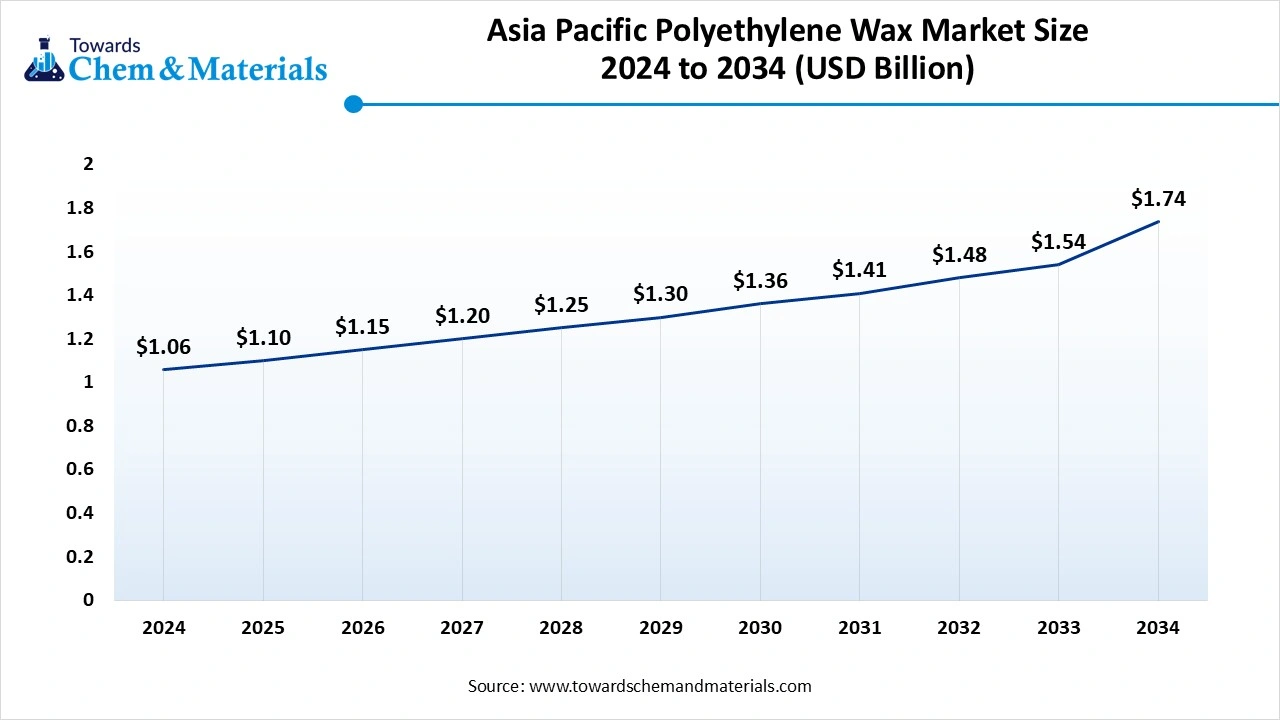

The Asia Pacific polyethylene wax market size accounted for USD 1.10 billion in 2025 and is forecasted to hit around USD 1.74 billion by 2034, representing a CAGR of 5.08% from 2025 to 2034.

Asia Pacific dominated the polyethylene wax market in 2024. The growth of the market is driven by the rising and rapid industrialization due to the growing and expanded industrial sector in the region, which increases the demand for the market in the region. The increasing demand for polyethylene was due to various applications, along with high polyethylene supply due to increased production capacity fuels the growth of the market. The region is also experiencing growth due to increasing demand from various industries such as packaging, automotive, construction, and textiles, which fuels the growth and demand for the market. The major companies like BASF, Clariant, Mitsui Chemicals, and Trecora Resources of Asia Pacific contribute significantly to the growth of the market and support expansion.

- The world shipped out 898 Pe Wax Polyethylene Wax shipments from October 2023 to September 2024 (TTM). These exports were handled by 219 Indian exporters to 309 buyers. (Source : volza.com )

- Globally, China, Uzbekistan, and Germany are the top three exporters of Pe Wax Polyethylene Wax. China is the global leader in Pe Wax Polyethylene Wax exports with 975 shipments, followed closely by Uzbekistan with 453 shipments, and Germany in third place with 220 shipments. (Source : volza.com )

China Is Experiencing Growth Driven by Various Applications.

The growth of the market is driven by the increasing demand in various applications, like plastic processing, as it plays a crucial role in PVC manufacturing, hot melt adhesives, and inks and coatings drive the growth of the market. China is experiencing growth due to its strong packaging industry and increasing manufacturing capabilities, which fuel the growth of the market. Several companies are actively involved in the polyethylene wax market in China, including both domestic and international players, which fuels the growth of the market and supports the expansion of the market in the country.

Recent Developments

In March 2025, Gulbrandsen, a renowned leader and position holder in the producer of specialty polyethylene waxes and polymers, launched a manufacturing unit with increased capacity and a new functionality polymer plant in Dahej, India. (Source: indianchemicalnews.com )

Top Companies List

- SCG Chemicals Co., Ltd.

- BASF SE

- Westlake Chemical Corporation

- Clariant AG

- Mitsui Chemicals, Inc.

- Honeywell International Inc.

- Lion Specialty Chemicals Co., Ltd.

- Cosmic Petrochem Pvt. Ltd.

- Trecora Resources

- Marcus Oil & Chemical

- Innospec Inc.

- Euroceras S.A.

- WIWAX (WIWAX GmbH & Co. KG)

- Sanyo Chemical Industries, Ltd.

- Paramelt B.V.

- Deurex AG

- Shamrock Technologies, Inc.

- GE Specialty Chemicals

- Kerax Limited

- BYK-Chemie GmbH

Segments Covered

By Type

- Low-Density Polyethylene (LDPE) Wax

- High-Density Polyethylene (HDPE) Wax

- Oxidized Polyethylene Wax (OPE Wax)

- Micronized Polyethylene Wax

- Modified PE Wax

- Synthetic PE Wax

- Recycled PE Wax

By Process / Production Method

- Polymerization-based

- Thermal Cracking / Degradation

- Ziegler-Natta Catalyst-based

- Metallocene Catalyst-based

- Byproduct Wax (from LDPE/HDPE production)

- Custom-blended / Tailored Waxes

By Form

- Flakes

- Powder

- Granules / Beads

- Micronized Form

- Pastilles

By Application

- Plastics Processing

- PVC Lubricants

- Masterbatches and Compounds

- Injection Molding Additives

- Printing Inks

- Flexographic Inks

- Gravure Inks

- Digital Printing

- Paints and Coatings

- Powder Coatings

- Liquid Coatings

- Wood Coatings

- Adhesives

- Hot Melt Adhesives

- Pressure-sensitive Adhesives

- Rubber Industry

- Processing Aids

- Mold Release Agents

- Textiles

- Yarn Lubricants

- Finishing Agents

- Polishes and Cleaners

- Automotive Polish

- Floor Care Products

- Cosmetics & Personal Care (Niche)

- Lipsticks, Creams

- Others

- Cable Fillers

- Packaging Films

By End-Use Industry

- Plastics & Polymers

- Printing & Packaging

- Automotive

- Construction

- Textile

- Cosmetics & Personal Care

- Paper & Board

- Chemical Manufacturing

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait