Content

U. S. Polyglycolic Acid Market Size, Price, Demand and Forecast, 2034

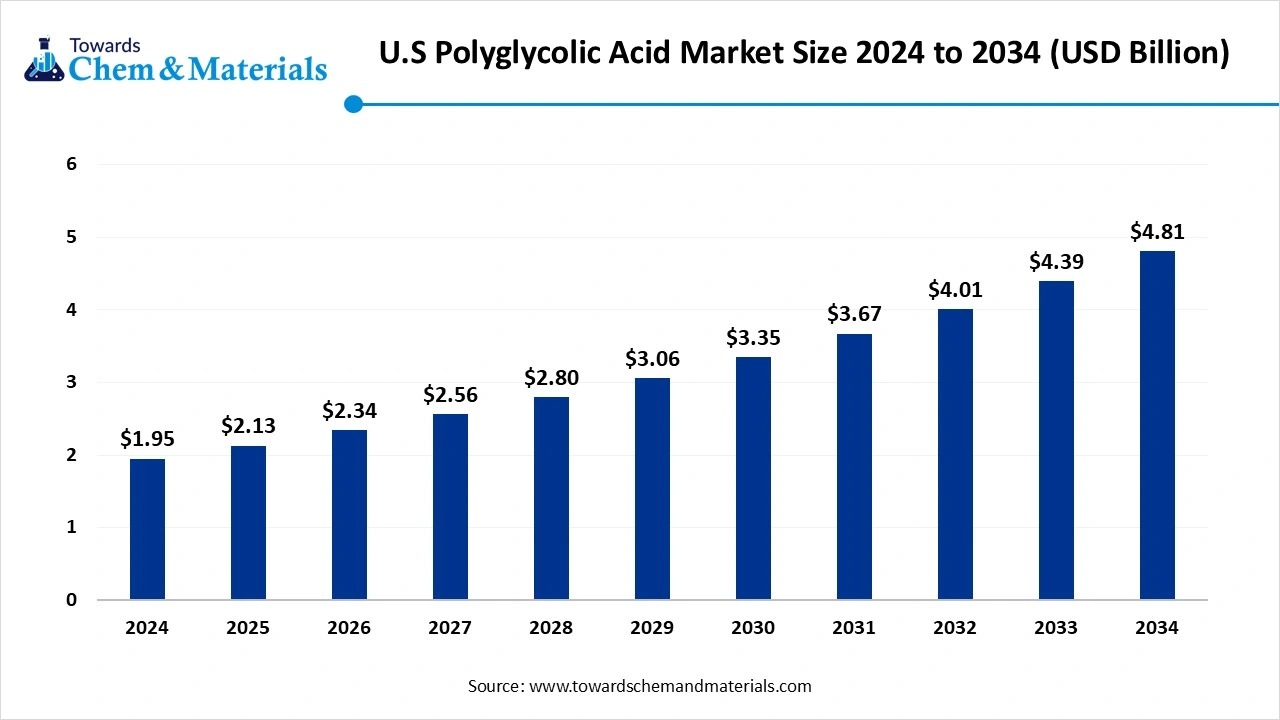

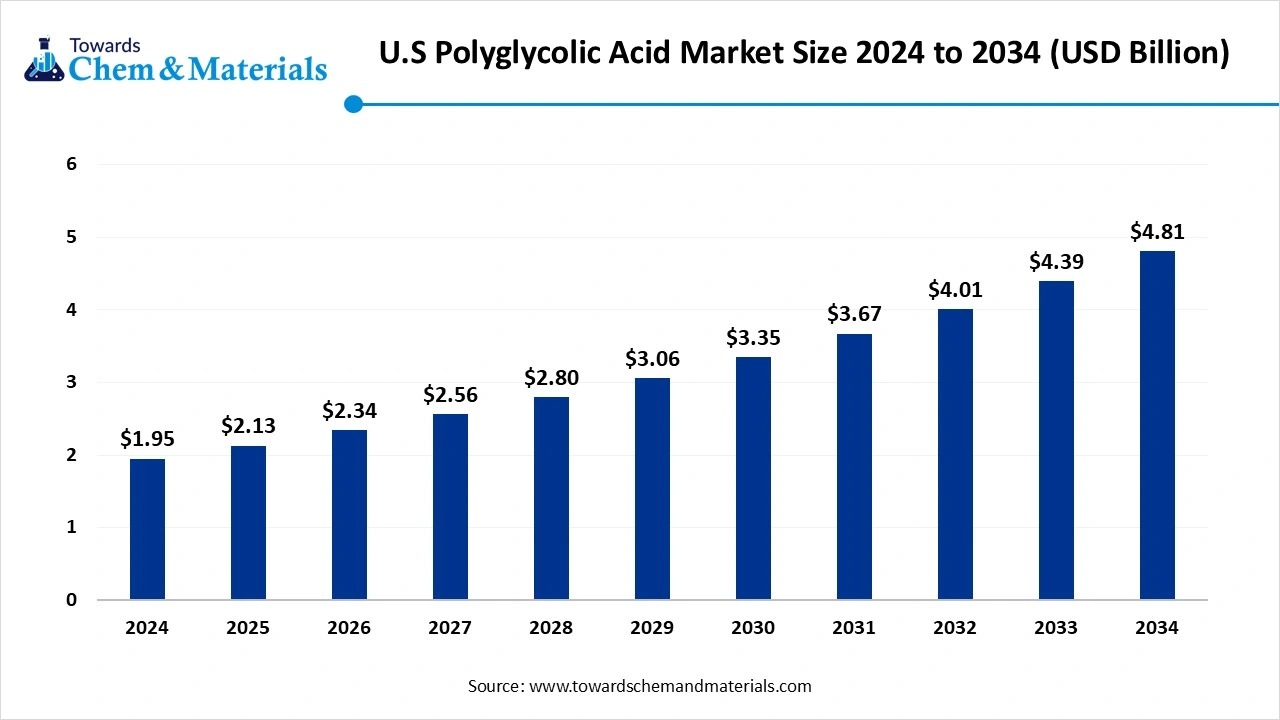

The U. S. polyglycolic acid market size was valued at USD 1.95 billion in 2024 and is expected to reach around USD 4.81 billion by 2034, growing at a CAGR of 5.75% from 2025 to 2034. The growth of the market is driven by the increasing use of polyglycolic acid in the medical and packaging industry due to its properties, and the regulation promoting biodegradable materials drives the growth of the market.

Key Takeaways

- By application, the medical segment dominated the market in 2024. The medical segment held a 45% share in the market in 2024.

- By application, the oil and gas segment is expected to grow in the forecast period. The demand for biodegradable and eco-friendly materials drives the growth.

- By form, the granules/pellets segment dominated the market in 2024. The granules/pellets segment held a 40% share in the market in 2024.

- By form, the sutures segment is expected to grow significantly in the market during the forecast period. The demand from the medical sector hastens growth.

- By raw material source, the petroleum-based glycolic acid segment dominated the market in 2024. The petroleum-based glycolic acid segment held a 75% share in the market in 2024.

- By raw material source, the bio-based glycolic acid segment is expected to grow in the forecast period. The growth is driven due to sustainability trends and demand.

- By end use, the healthcare & medical devices segment dominated the market in 2024. The healthcare & medical devices segment held a 42% share in the market in 2024.

- By end use, the oil & gas segment is expected to grow in the forecast period. The growing industry and innovation in technology fuel the growth.

- By processing technology, the extrusion segment dominated the market in 2024. The extrusion segment held a 50% share in the market in 2024.

- By processing technology, the electrospinning segment is expected to grow in the forecast period. Increasing biomedical applications fuel the growth.

- By degradation time, the moderate (30–90 days) segment dominated the market in 2024. The moderate (30–90 days) segment held a 60% share in the market in 2024.

- By degradation time, the slow (> 90 days) segment is expected to grow in the forecast period. Demand from the medical sector for orthopedic fixation fuels the growth.

- By distribution channel, the direct sales (OEM contracts) segment dominated the market in 2024. The direct sales (OEM contracts) segment held a 65% share in the market in 2024.

- By distribution channel, the medical supply chains segment is expected to grow in the forecast period. The growing demand fuels the growth.

Market Overview

Rising demand for durable materials: U.S. Polyglycolic Acid Market to expand

Polyglycolic acid (PGA) is a synthetic, biodegradable, thermoplastic polymer. It is the simplest linear aliphatic polyester and is commonly used in biomedical fields, especially as a surgical suture material. PGA is recognized for its high strength, biodegradability, and compatibility with biological tissues. Typical uses include surgical sutures PGA is a main ingredient in synthetic absorbable sutures like vicryl, used for wound closure and tissue approximation; drug delivery PGA and its copolymers serve as carriers for controlled drug release; bone surgery employed in implants such as screws and nails for fracture stabilization; tissue engineering used in scaffold materials that support cell growth and tissue regeneration; additional applications including dental and orthopaedic procedures. Its key properties include biodegradability, thermoplastic, high strength, crystalline structure, and biocompatibility.

What Are the Key Growth Drivers Responsible for The Growth of The U.S. Polyglycolic Acid Market?

The U.S. polyglycolic acid (PGA) market is mainly propelled by its expanding role in medical and packaging sectors, alongside heightened environmental awareness and regulations encouraging biodegradable materials. The healthcare industry's need for PGA in sutures, tissue engineering, and drug delivery, combined with increasing demand for sustainable packaging, significantly contributes to market growth. Major drivers include medical applications, expanding packaging industry, environmental policies, rising energy use and industrialization, and technological innovations. Additionally, the use of PGA in biodegradable frac balls and plugs for oil and gas extraction further boosts market demand.

Market Trends

- The growing trend towards the use of biodegradable materials and eco-friendly solutions amid rising environmental concerns drives the growth.

- The properties like biocompatibility and biodegradability make it a preferred choice by the medical sector, which increases the demand.

- The advancements in PGA production technology increase the growth and adoption of the market, fueling the growth.

- The rising adoption in agriculture for the protection and control of fertilizers further boosts the growth of the market.

Market Report

| Report Attributes | Details |

| Market Size in 2025 | USD 2.13 Billion |

| Market Size by 2034 | USD 4.81 Billion |

| Growth rate from 2024 to 2025 | CAGR 5.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Application, By Form, By Raw Material Source, By End-Use Industry, By Processing Technology, By Degradation Time, By Distribution Channel |

| Key Companies Profiled | Kureha Corporation (Kuredux™ PGA), Corbion N.V., Evonik Industries AG , Teleflex Incorporated , BMG Incorporated, Mitsui Chemicals, BASF SE , DSM Biomedical, Ashland Global Holdings Inc.,AbbVie (Allergan), Medtronic plc, B. Braun Melsungen AG, Stryker Corporation, Boston Scientific Corporation, Zimmer Biomet , Lubrizol LifeSciences, Arkema Inc., Poly-Med Inc., Tepha Inc., Sinopec (U.S. Subsidiary Presence for Feedstock Supply) |

Market Opportunity

What Is The Key Growth Opportunity Responsible For The Growth Of The U.S. Polyglycolic Acid Market?

The U.S. polyglycolic acid market is poised for continued growth, the growth is fueled by the increasing demand for sustainable packaging due to rising concerns for the environment, boosting the demand for the market, advancements in medical applications due to demand from the industry for development of sutures, implants and drug delivery systems also helps in the growth of the market, and the expanding bioplastics market also contributes to the growth. Innovations in production technology and the development of new applications will further drive market expansion in the coming years.

Market Challenge

What Are The Key Challenges That Hinder The Growth Of The U.S. Polyglycolic Acid Market?

The key challenge which hinders the growth of the market is the high cost of raw material polyglycolic acid, which results in high production cost of the product, affecting the final cost of the product, which results in affecting the profitability of the market, especially in the price-sensitive market. The complex and high-end manufacturing processes also result in a high cost of the product, which is a challenge that hinders the growth of the market.

Segmental Insights

Application Insights

Which Application Segment Dominated the U.S. Polyglycolic Acid Market In 2024?

The medical segment dominated the U.S. polyglycolic acid market in 2024. Polyglycolic acid is a versatile material with a wide range of applications in medicine, from sutures and tissue engineering to drug delivery and bone regeneration, which increases the demand for the market, supporting the growth. Its properties, such as biocompatibility, hydrophilicity, strength, flexibility, controlled degradation, and biodegradability, make it a valuable tool for improving patient outcomes and advancing medical treatments, boosting the growth and expansion of the market.

The oil and gas segment expects significant growth in the market during the forecast period. The use of PGA in the oil and gas industry offers a sustainable and efficient approach to various downhole and production processes, driven by the need for environmentally friendly solutions and the challenges associated with deep and unconventional drilling operations, which fuels the growth of the market. The growth is also driven by the growing applications like drilling muds, gypsum removal, metal naphthenate dissolution, removal of water-soluble organics, and in pressure management systems in the oil and gas industry, fueling the growth and expansion.

Form Insights

How Did Granules/Pellets Segment Dominated The U.S. Polyglycolic Acid Market In 2024?

The granules/pellets segment dominated the U.S. polyglycolic acid market in 2024. Granules or pellets are a widely used form of polyglycolic acid (PGA) due to their excellent processability and versatility. They are commonly utilized in manufacturing absorbable sutures, orthopaedic implants, and other medical devices, as well as in packaging applications. Their ease of molding and consistent quality drive demand, supporting the growth of the PGA market across various high-performance and medical applications.

The sutures segment is expected to experience significant growth in the market during the forecast period. Sutures represent a major application segment of the polyglycolic acid (PGA) market, valued for their high tensile strength, excellent knot security, and predictable absorption rates. PGA-based sutures are widely used in surgical procedures because they minimize tissue reaction and eliminate the need for removal. Their proven safety, reliability, and effectiveness drive strong demand in hospitals and clinics, significantly supporting the growth and expansion of the PGA market globally.

Raw Material Insights

Which Raw Material Segment Dominated The U.S. Polyglycolic Acid Market In 2024?

The petroleum-based glycolic acid segment dominated the U.S. polyglycolic acid market in 2024. The growth of the market is driven by the growing demand from various industries due to its application and properties offered, like oil and gas, and medical, which fuels the demand. The growing demand, especially from the oil and gas industry for cleaning, desalination, well treatment, corrosion inhibition, and metal complexation, further fuels he demand for the market. The growth is also driven due to the key properties offered, like small molecular structure, which helps in penetration, low corrosiveness, and biodegradability, boosting the growth of the market.

The bio-based glycolic acid segment expects significant growth in the market during the forecast period. The growth of the market is driven by the growing shift of consumers towards sustainability and demand for eco-friendly products, which increases the demand for biobased products with properties like sustainability, reduced carbon footprint, and potential growth in the industries, which boosts the growth and expansion of the market.

End Use Insights

How Did Healthcare and Medical Devices Segment Dominated The U.S. Polyglycolic Acid Market In 2024?

The healthcare & medical devices segment dominated the U.S. polyglycolic acid market in 2024. The growth of the market is driven by the growing demand from the industry due to its biocompatibility and biodegradable nature, and due to its other key properties like high tensile strength, crystallinity, and thermal stability, which increases the demand, contributing to the growth of the market. The use and application of PGA also attract the consumer and increase the adoption, like in surgical sutures, tissue engineering scaffolds, and drug delivery systems, which fuel the growth and expansion of the market.

The oil and gas segment expects significant growth in the market during the forecast period. The growth of the market is driven by the growing demand for PGA due to its benefits offered, like reduced operational costs and time, environmental sustainability, enhanced operational efficiency, and reduced environmental impact amid rising environmental concerns increases the demand for the product and supports the growth and expansion of the market.

Processing Technology Insights

Which Processing Technology Segment Dominated The U.S. Polyglycolic Acid Market In 2024?

The extrusion segment dominated the U.S. polyglycolic acid market in 2024. Extrusion is a key processing technology in the polyglycolic acid (PGA) market, enabling the production of high-quality fibers, films, and molded components with precise dimensions and uniform properties. This method enhances the material’s strength and flexibility, making it ideal for applications such as absorbable sutures, biomedical implants, and packaging materials. The efficiency and scalability of extrusion technology drive its widespread adoption, supporting PGA market growth and meeting diverse industry demands for advanced biodegradable products.

The electrospinning segment expects significant growth in the market during the forecast period. Electrospinning is an advanced processing technology in the polyglycolic acid (PGA) market, used to create ultra-fine, nanofibrous structures with high surface area and excellent porosity. This technique is particularly valuable for biomedical applications, such as tissue engineering scaffolds, wound dressings, and drug delivery systems, where precise control over fiber morphology is crucial. The growing demand for innovative, high-performance medical materials fuels the adoption of electrospinning, supporting PGA market expansion and technological advancement.

Degradation Time Insights

How Moderate (30–90 days) Segment Dominated The U.S. Polyglycolic Acid Market In 2024?

The moderate (30–90 days) segment dominated the market in 2024. Polyglycolic acid (PGA) with moderate degradation time is highly valued for applications that require temporary support before being safely absorbed by the body. This characteristic makes it ideal for surgical sutures, tissue scaffolds, and certain implants, where gradual strength loss and predictable resorption are crucial for proper healing. The balanced degradation profile ensures reduced post-operative complications and eliminates the need for removal, driving demand and supporting the growth of the PGA market in medical applications.

The slow (> 90 days) segment expects significant growth in the market during the forecast period. Polyglycolic acid (PGA) with a slow degradation time is preferred for applications that require longer-term mechanical support and stability within the body. This type is especially useful in orthopedic implants, long-term scaffolds, and certain surgical meshes, where extended strength retention is critical for proper tissue regeneration and healing. The ability to provide sustained support while eventually being absorbed drives demand for slow-degrading PGA, supporting market growth and expanding its use in advanced medical applications.

Distribution Channel Insights

Which Distribution Channel Segment Dominated the U.S. Polyglycolic Acid Market In 2024?

The direct sales (OEM contracts) segment dominated the U.S. polyglycolic acid market in 2024. Direct sales through OEM contracts play a significant role in the distribution of polyglycolic acid (PGA), allowing manufacturers to supply high-quality materials directly to medical device companies and other industrial users. This channel ensures reliable, large-volume supply agreements, greater customization, and stronger partnerships between PGA producers and end users. The preference for direct, long-term collaborations supports cost efficiency, product consistency, and faster innovation cycles, driving PGA market growth and expanding its applications in specialized sectors like healthcare and packaging.

The medical supply chains segment expects significant growth in the market during the forecast period. Medical supply chains are a crucial distribution channel for polyglycolic acid (PGA), especially for applications in surgical sutures, implants, and other bioresorbable medical products. This channel ensures the timely availability of high-quality PGA materials to hospitals, clinics, and healthcare providers worldwide. By leveraging established distribution networks and regulatory-compliant logistics, medical supply chains help maintain product safety and traceability. The growing demand for advanced surgical and biomedical materials fuels reliance on this channel, supporting the PGA market’s expansion and accessibility.

Recent Developments

- In December 2024, Acme Mills Company, a global leader in textile innovation, announced and introduced the launch of Natura, a line of bio-based polylactic acid (PLA) fabrics. The product is of high quality and an alternative line for the petroleum-based products such as PP, Nylon, and PET. This is a step towards sustainability amid growing environmental concerns without compromising performance or quality.(Source: www.prnewswire.com)

Top Companies List

- Kureha Corporation (Kuredux™ PGA)

- Corbion N.V.

- Evonik Industries AG

- Teleflex Incorporated

- BMG Incorporated

- Mitsui Chemicals

- BASF SE

- DSM Biomedical

- Ashland Global Holdings Inc.

- AbbVie (Allergan)

- Medtronic plc

- B. Braun Melsungen AG

- Stryker Corporation

- Boston Scientific Corporation

- Zimmer Biomet

- Lubrizol LifeSciences

- Arkema Inc.

- Poly-Med Inc.

- Tepha Inc.

- Sinopec (U.S. Subsidiary Presence for Feedstock Supply)

Segments Covered

By Application

- Medical

- Absorbable Sutures

- Tissue Engineering Scaffolds

- Orthopedic Fixation Devices

- Drug Delivery Systems

- Oil & Gas

- Fracturing Plug Components

- Downhole Tools

- Packaging

- Food Packaging Films

- Biodegradable Containers

- Coatings for Paper & Cartons

- Agriculture

- Controlled Release Fertilizers

- Mulch Films

- Others

- Textile Finishing

- 3D Printing Filaments

- Electronics (e.g., temporary substrates)

By Form

- Fiber

- Film

- Granules/Pellets

- Powder

- Sutures

By Raw Material Source

- Petroleum-Based Glycolic Acid

- Bio-based Glycolic Acid

By End-Use Industry

- Healthcare & Medical Devices

- Oil & Gas

- Packaging Industry

- Agriculture

- Textiles

- Others (Automotive, Electronics)

By Processing Technology

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

- Electrospinning

By Degradation Time

- Ultra-Fast (< 30 Days)

- Moderate (30–90 Days)

- Slow (> 90 Days)

By Distribution Channel

- Direct Sales (OEM Contracts)

- Distributors

- Online Platforms

- Medical Supply Chains