Content

Aluminum Oxide Market Volume and Growth 2025 to 2034

The global aluminum oxide market volume was reached at 160.12 million tons in 2024 and is expected to be worth around 215.45 million tons by 2034, growing at a compound annual growth rate (CAGR) of 3.01% over the forecast period from 2025 to 2034. the growing demand for high-purity alumina (HPA) in various industries is the key factor driving market growth. Also, surging investments in the pharmaceutical and medical sectors, coupled with innovations in electronics, can fuel market growth further.

Key Takeaways

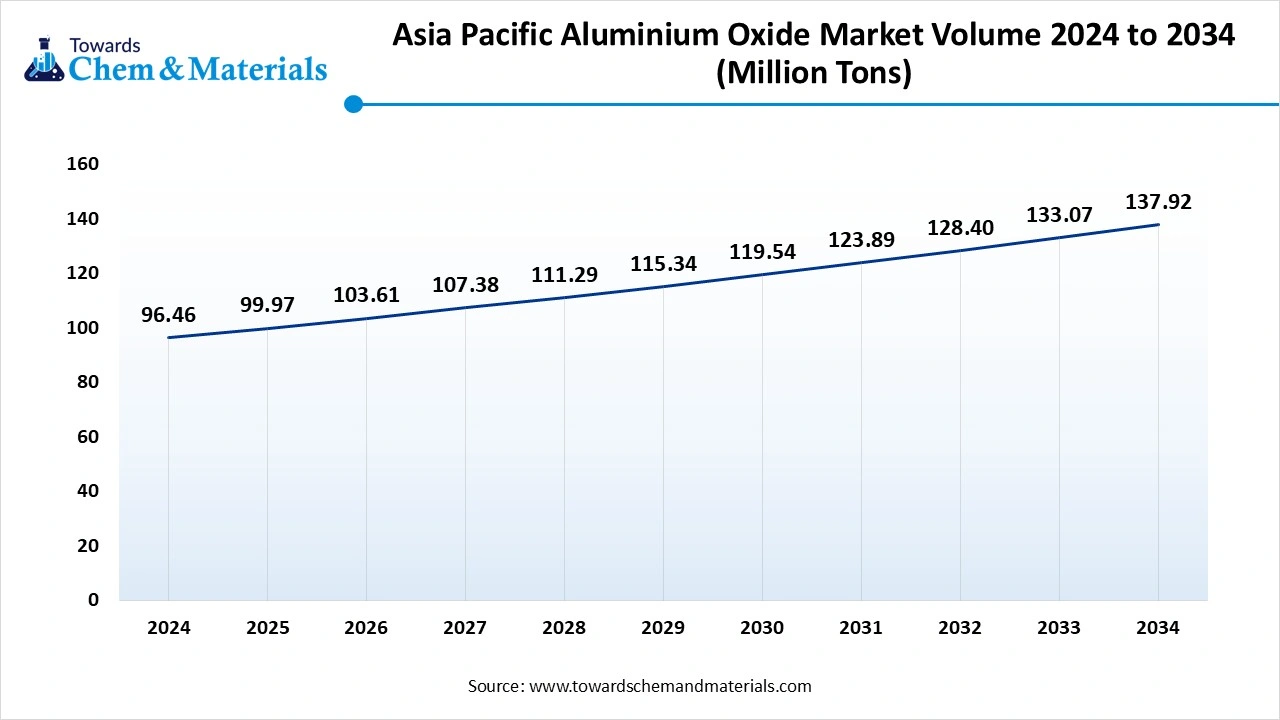

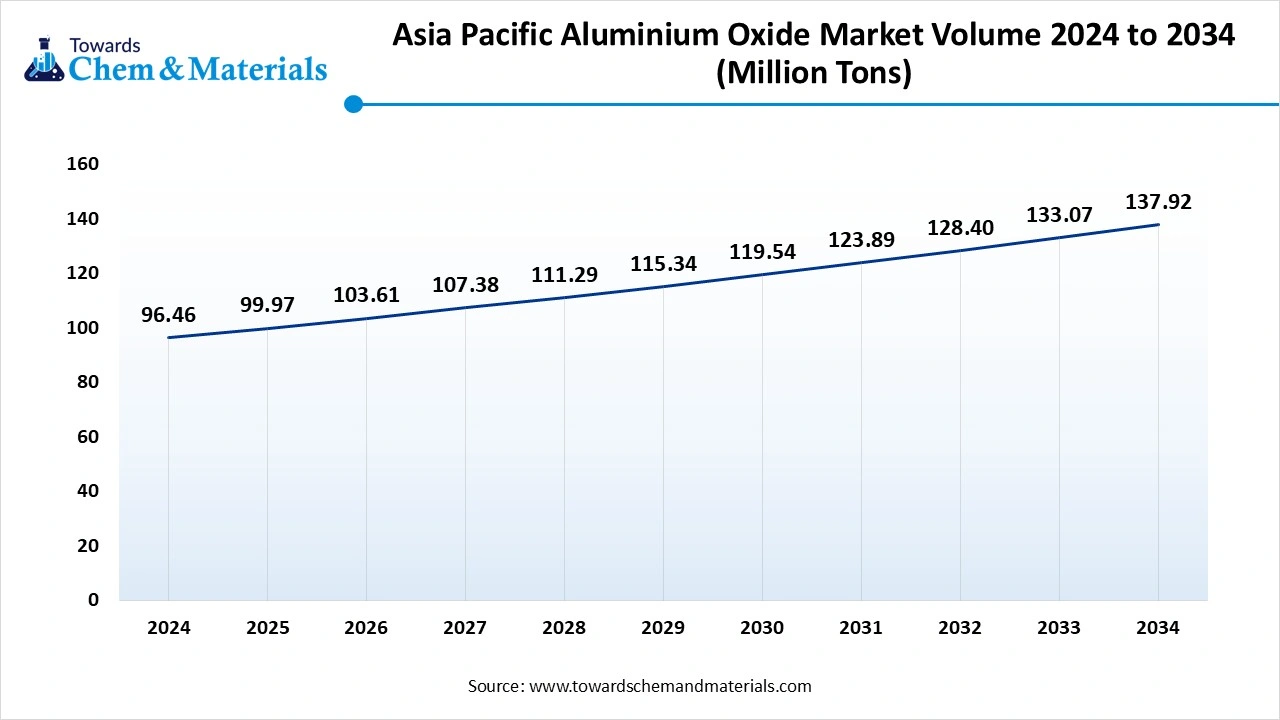

- The Asia Pacific aluminum oxide market volume was estimated at 96.46 Million Tons in 2024 and is expected to reach 137.92 Million Tons by 2034, growing at a CAGR of 3.64% from 2025 to 2034.

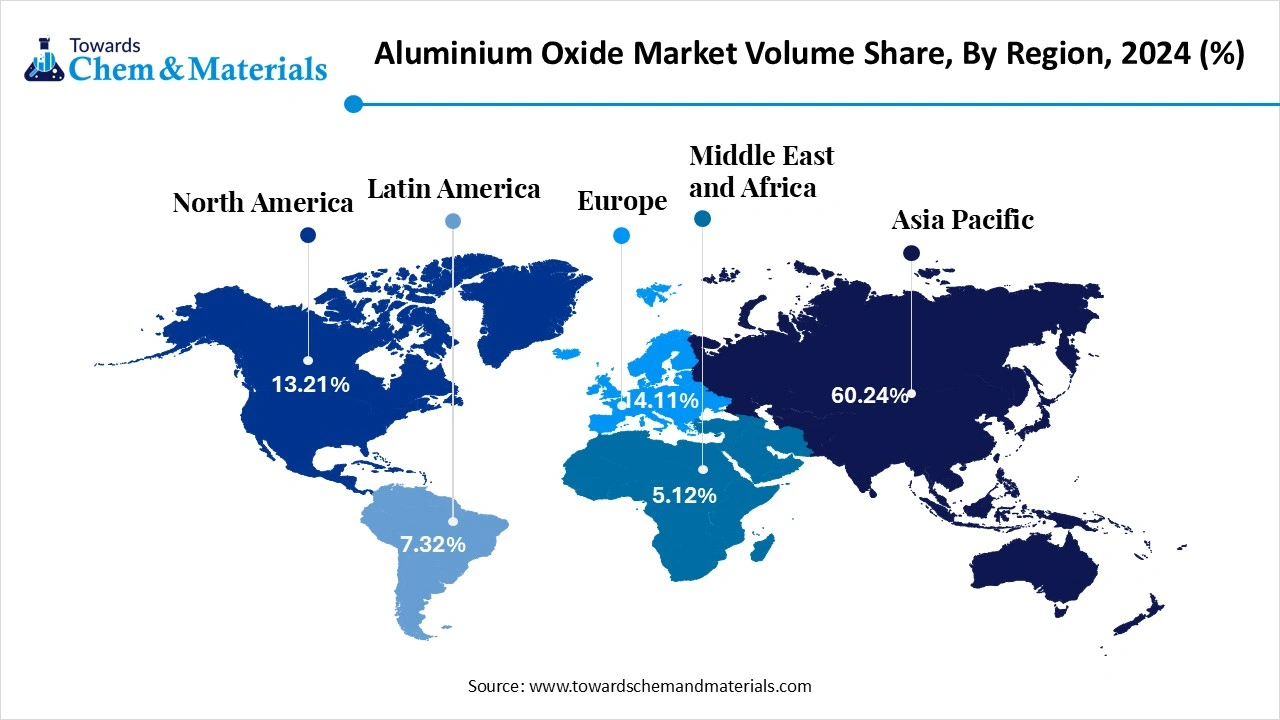

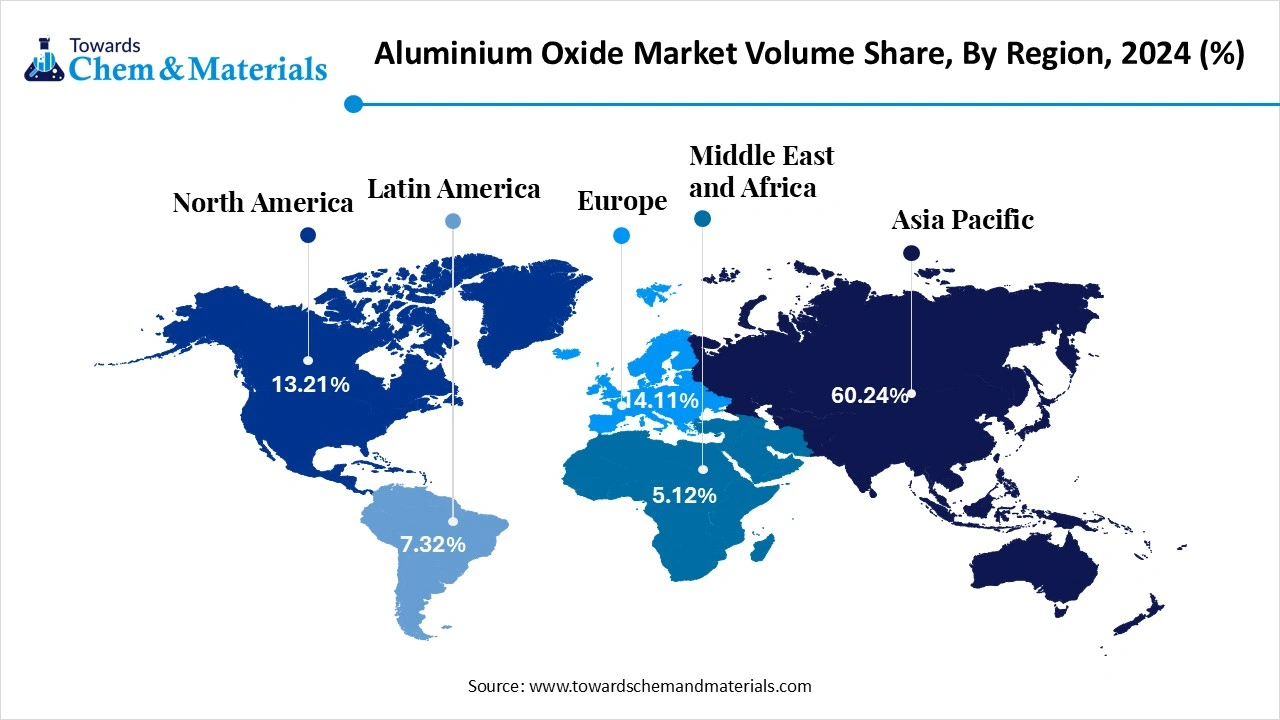

- By region, Asia Pacific dominated the aluminum oxide market held the largest Volume Share of 60.24% of the global market in 2024. The growth of the region can be attributed to the strong presence of major market players.

- By region, the North America has held Volume Share of around 13.21% in 2024. The growth of the region can be credited to the extensive demand for aluminum oxide from the ceramic sector.

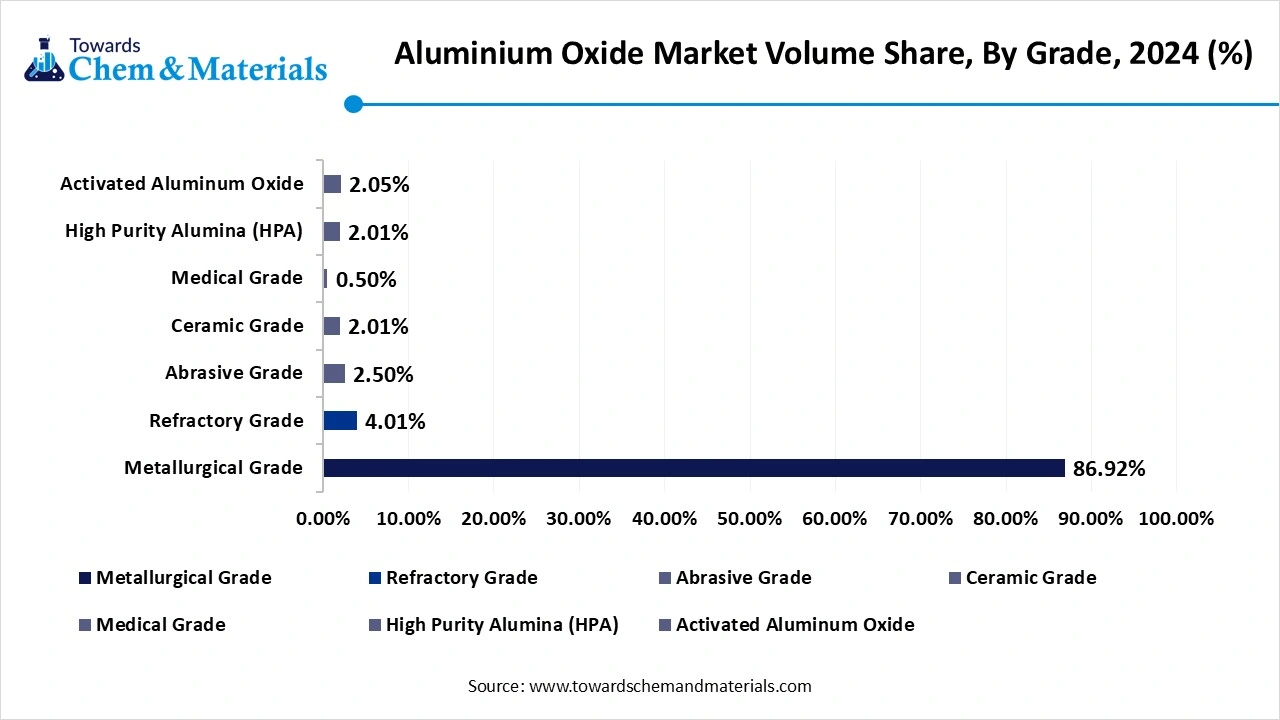

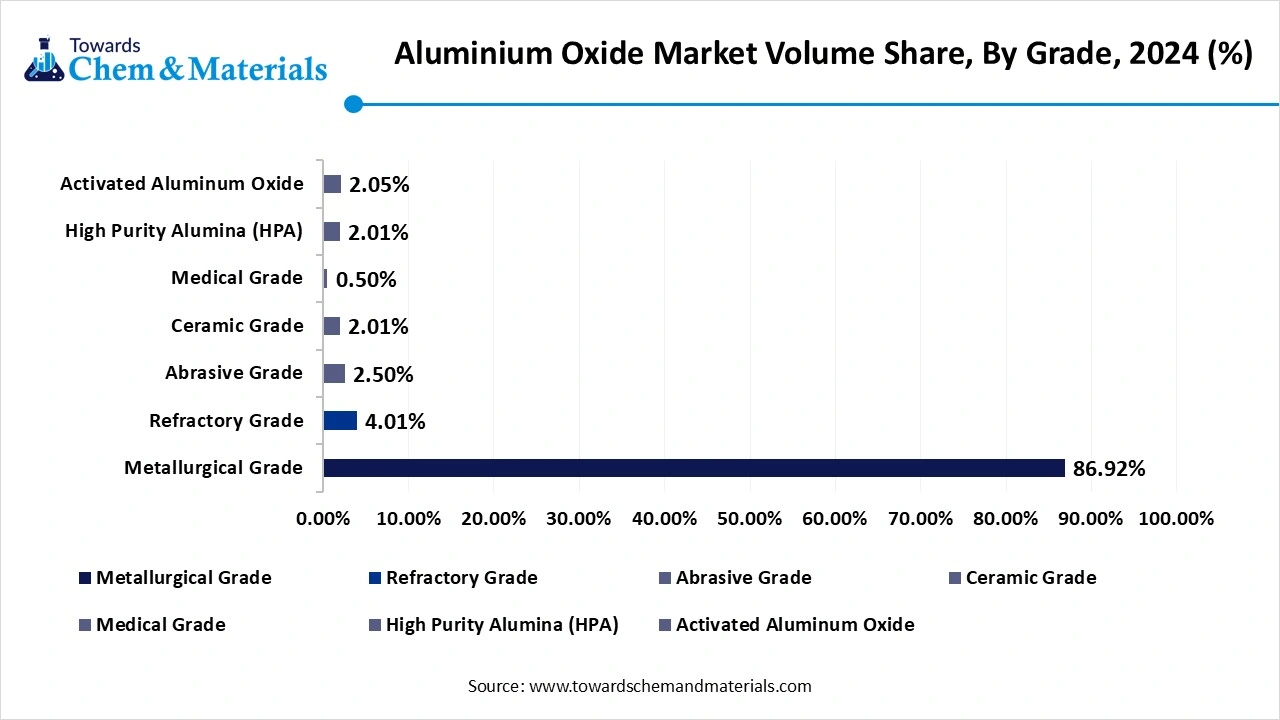

- By grade type, the metallurgical grade segment dominated the market with the largest Volume Share of 86.92% in 2024. The dominance of the segment can be attributed to the increasing demand from various industries such as aerospace, automotive, and the construction sector.

- By grade type, the high purity alumina (HPA) segment has captured a volume share of 2.01% in 2024. The growth of the segment can be credited to the rising demand for lithium-ion batteries.

- By form, the powder segment led the market in 2024. The dominance of the segment can be linked to the rising demand from the ceramics and electronics industries, where high-purity alumina is necessary.

- By form, the nanoparticles segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by its extensive range of applications in different sectors, such as healthcare, because of its unique properties.

- By application, the aluminum smelting segment held the largest market share in 2024. The dominance of the segment is owed to the growing demand for lightweight materials, especially in packaging.

- By application, the electrical & electronics segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing demand for high-purity alumina (HPA) in different electronics devices and components.

- By end-use industry, the Industrial/metallurgy segment led the market by holding the largest market share in 2024, The dominance of the segment can be attributed to the growing demand for lightweight materials in the aerospace and automotive industries.

- By end-use industry, the medical devices & healthcare segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be linked to its strength, biocompatibility, and resistance to corrosion.

Surge in Construction Activities is Expanding Market Growth

The market encompasses the trade and consumption of aluminum oxide, which is a diverse compound with a range of industrial applications. The market also includes the manufacturing, distribution, and utilisation of aluminum oxide in different forms such as pellets, powder, nanoparticles, and sputtering targets, fuelled by its use in abrasives, ceramics, electronics, and refractories. The market is primarily driven by the rising need for high-purity alumina (HPA) in various applications, technological innovations, along the expansion of end-use industries such as electronics and automotive.

What Are the Key Trends Influencing the Aluminum Oxide Market?

- The rising demand for aluminum oxide from the automotive industry is the latest trend in the market. It is extensively utilized in the automotive industry for different applications, including brake systems, electrical connectors, engine components, and coatings. The growing need for fuel-efficient and lightweight vehicles has led to the greater usage of aluminum oxide in automotive production.

- Aluminum oxide is used in numerous industrial production processes such as polishing, grinding, and metal fabrication. The growth of industries like machinery, aerospace, and metalworking has contributed to the increased demand for aluminum oxide in the manufacturing sector.

- Advancements in nanotechnology are generating new applications for nano-alumina in sectors such as catalysis, coatings, and energy storage. Also, the industry is focusing on recyclable materials, green synthesis methods, and minimizing environmental impact, which will impact positive market growth further.

How is the Government Supporting the Aluminum Oxide Market?

For example, the Indian government is promoting the market through various initiatives aimed at fuelling domestic production, optimising the use of aluminum and its related products, along with supporting sustainable practices. The initiatives, such as "Make in India," are emphasizing resource efficiency and encouraging the recycling of aluminum products. Policies and programs such as " Zero Effect-Zero Defect" are highlighting the role of resource efficiency in the aluminum market.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 164.94 Million Tons |

| Expected Volume by 2034 | 215.45 Million Tons |

| Growth Rate from 2025 to 2034 | 3.01% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade / Type, By Form, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | Alcoa Corporation (U.S.), Norsk Hydro ASA (Norway), Rio Tinto Alcan Inc. (Canada), Rusal (Russia), Chalco (China), Emirates Global Aluminium (EGA) (U.A.E.), Hindalco Industries Limited (India), Showa Denko K.K. (Japan), Sumitomo Chemical Co., Ltd. (Japan), UC RUSAL |

Market Opportunity

Growing Demand for High-Purity Aluminium Oxide

The rising demand for high-purity aluminum oxide in several industries is the major factor creating lucrative opportunities in the market. High-purity aluminum oxide, also called alumina, is preferred for its exceptional chemical resistance, hardness, and heat resistance properties. Furthermore, it is extensively used in applications including refractories, ceramics, abrasives, and electronics, among others.

- In February 2025, Russian aluminum announced that it is setting up a manufacturing facility for metal scandium (at least 1.5 tonne-a-year) with the capacity to raise the production up to 19 metric tonnes a year. Scandium is utilised as an alloying agent with aluminum. (Source: www.mining.com)

Market Challenges

Stringent Environmental Regulations

The market confronts increasing pressure to minimize waste and emissions, necessitating investments in cleaner processes and technologies, which hinders market expansion. Moreover, the manufacturing process can generate waste and contribute to pollution, requiring waste management and sustainable practices solutions. Also, Prolonged exposure to aluminum oxide dust can cause respiratory diseases, requiring safety measures.

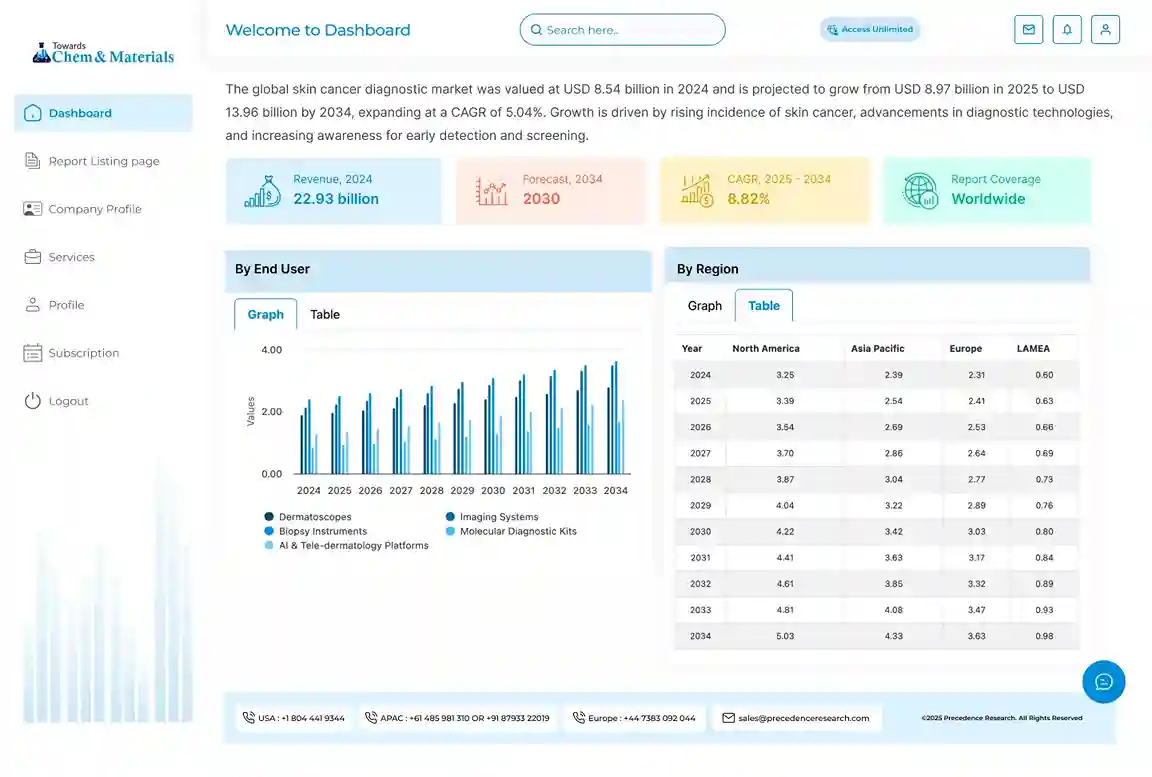

Regional Insights

The Asia Pacific aluminum oxide market volume was estimated at 96.46 million tons in 2024 and is anticipated to reach 137.92 million tons by 2034, growing at a CAGR of 3.64% from 2025 to 2034. Asia-Pacific dominated the aluminum oxide market volume share of 60.24% in 2024.

The growth of the region can be attributed to the strong presence of major market players along with a surge in industrial activities, particularly in emerging nations such as China and India. Additionally, a surge in investments in the medical sector and the unique properties of aluminium oxide are propelling its use in dental applications, medical implants, and pharmaceutical manufacturing in the region.

Global Aluminium Oxide Market Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Voume (Million Tons)- 2024 | Volume Share, 2034 (%) | Market Volume (Million Tons) 2034 | CAGR (2025 - 2034) |

| North America | 13.21% | 21.15 | 12.34% | 26.59 | 2.57% |

| Europe | 14.11% | 22.59 | 13.21% | 28.46 | 2.60% |

| Asia Pacific | 60.24% | 96.46 | 61.77% | 133.08 | 3.64% |

| Latin America | 7.32% | 11.72 | 6.12% | 13.19 | 1.32% |

| Middle East & Africa | 5.12% | 8.20 | 6.56% | 14.13 | 6.24% |

| Total | 100% | 160.12 | 100% | 215.45 | 3.35% |

Aluminum Oxide Market in China

In the Asia Pacific, China led the market owing to the country's robust industrial production sector and innovations in electronics and medical technologies. Also, China's "Made in China 2025" policy fuels growth in different sectors such as AI, robotics, and smart production, which directly propels the demand for aluminum oxide in the country.

North America is expected to grow at a notable rate over the forecast period. The growth of the region can be credited to the extensive demand for aluminum oxide from the ceramic sector, coupled with the rapid urbanization, favorable government initiatives, and surge in infrastructure projects. Moreover, ongoing efforts to minimize the carbon footprint of manufacturing processes and the development of sustainable aluminum oxide products are positively impacting regional expansion further.

Aluminum Oxide Market in the U.S.

In North America, the U.S. dominated the market in 2024 by holding the largest market share, due to increasing demand from the automotive and aerospace industry, along with the increased manufacturing of lightweight materials for high-performance components and fuel efficiency, often necessitating aluminium oxide. Government regulations supporting the use of sustainable materials can impact positive market growth further.

Who is the Top Aluminum Exporters Countries in the World In 2024?

| Country | Exports in Billion |

| Canada | $8.3 billion |

| Russia | $6.9 billion |

| United Arab Emirates | $6.4 billion |

| India | $4.8 billion |

| Malaysia | $4.6 billion |

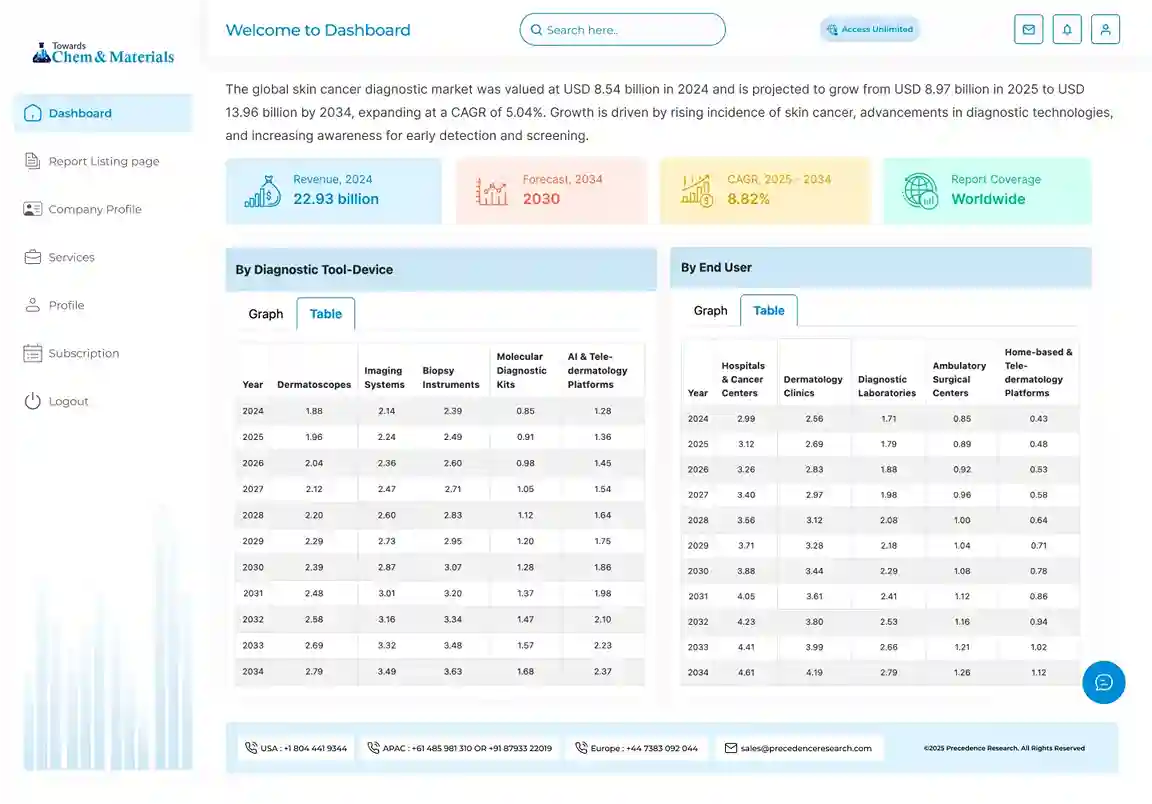

Segmental Insight

Grade Type Insight

Which Grade Type Segment Dominated the Aluminum Oxide Market in 2024?

The metallurgical grade segment dominated the market in 2024. The dominance of the segment can be attributed to the increasing demand from various industries such as aerospace, automotive, and the construction sector. In addition, technological innovations and rising emphasis on recycling aluminum contribute to segment expansion shortly. Aluminium’s versatility is optimizing its adoption in emerging and new technologies like electric vehicles and 3D printing.

High high-purity alumina (HPA) segment is expected to grow at fastest CAGR over the forecast period. The growth of the segment can be credited to the rising demand for lithium-ion batteries, LEDs, and innovations in consumer electronics. Moreover, HPA is utilised in the fabrication of semiconductors, which are crucial components in different electronic devices. HPA is also finding the latest applications in sectors such as advanced ceramics.

Global Aluminium Oxide Market Share, By Grade, 2024-2034 (%)

| By Grade | Volume Share, 2024 (%) | Market Volume (Million Tons) 2024 | Volume Share, 2034 (%) | Market Volume(Million Tons) 2034 | CAGR(2025 - 2034) |

| Metallurgical Grade | 86.92% | 139.18 | 94.99% | 204.66 | 4.38% |

| Refractory Grade | 4.01% | 6.42 | 5.01% | 10.79 | 5.94% |

| Abrasive Grade | 2.50% | 4.00 | 3.02% | 6.51 | 5.55% |

| Ceramic Grade | 2.01% | 3.22 | 2.50% | 5.39 | 5.89% |

| Medical Grade | 0.50% | 0.80 | 1.02% | 2.20 | 11.87% |

| High Purity Alumina (HPA) | 2.01% | 3.22 | 3.50% | 7.54 | 9.92% |

| Activated Aluminum Oxide | 2.05% | 3.28 | 1.80% | 3.88 | 1.87% |

| Total | 100.00% | 160.12 | 100.00% | 215.45 | 3.35% |

Form Insight

Why Powder Segment Dominated the Aluminum Oxide Market in 2024?

The powder segment led the market in 2024. The dominance of the segment can be linked to the rising demand from the ceramics and electronics industries, where high-purity alumina is necessary. Additionally, aluminium oxide, in its fine powder form, is used in the processing of food and beverages. The increasing use of lithium-ion batteries also boosts the demand for aluminum oxide, particularly in the spherical powder form.

The nanoparticles segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by its extensive range of applications in different sectors, such as healthcare, because of its unique properties. Furthermore, these nanoparticles are used in electronics due to their electrical and thermal insulating properties, important for electronic and semiconductor coatings.

Application Insight

How Did the Aluminum Smelting Segment Held the Largest Aluminum Oxide Market Share in 2024?

The aluminum smelting segment held the largest market share in 2024. The dominance of the segment is owed to the growing demand for lightweight materials, especially in the packaging and automotive industries, along with the innovations in smelting technologies. Also, advancements in smelting technologies, such as energy-efficient processes and automation, are fuelling efficiency and minimizing overall costs.

The electrical & electronics segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing demand for high-purity alumina (HPA) in different electronics devices and components. The electronics industry is a crucial driver, with Al2O3's exceptional insulating properties, which make it necessary for circuit boards, semiconductors, and other electronic components.

End-Use Industry Insight

Why Did the Industrial/Metallurgy Segment Dominated the Aluminum Oxide Market in 2024?

The Industrial/metallurgy segment led the market by holding the largest market share in 2024. The dominance of the segment can be attributed to the growing demand for lightweight materials in the aerospace and automotive industries, coupled with the rising need for innovative electronics and ceramics. Metallurgy plays a key role in developing sustainable solutions, driving segments growth soon.

The medical devices & healthcare segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be linked to its strength, biocompatibility, and resistance to corrosion. Aluminum oxide can be utilized in dental materials, implants, and various other medical devices because of its ability to improve biocompatibility and durability. Aluminum oxide is well-adjusted by the body, which makes it more suitable for implants such as knee and hip replacements.

Recent Developments

- In July 2025, Aluminium Federation (ALFED) launched the UK Aluminium Alliance (UKAA) initiative. This step is taken to generate a future-proof aluminium sector. The collaboration emerges as UK organizations adapt to a shifting regulatory environment.(Source: www.alcircle.com)

- In June 2025, RX, a world leader in exhibitions and events, introduced the ALUMINIUM Arabia, an exhibition showcasing Saudi Arabia's rapidly expanding aluminium sector. The event will bring together manufacturers, processors, and technology providers from all over the world.(Source: www.foundry-planet.com)

Top Companies List

- Alcoa Corporation (U.S.)

- Norsk Hydro ASA (Norway)

- Rio Tinto Alcan Inc. (Canada)

- Rusal (Russia)

- Chalco (China)

- Emirates Global Aluminium (EGA) (U.A.E.)

- Hindalco Industries Limited (India)

- Showa Denko K.K. (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

- UC RUSAL (Russia)

Segments Covered

By Grade / Type

- Metallurgical Grade

- Refractory Grade

- Abrasive Grade

- Ceramic Grade

- Medical Grade

- High Purity Alumina (HPA)

- Activated Aluminum Oxide

By Form

- Powder

- Granules / Pellets

- Tablets

- Nanoparticles

By Application

- Aluminum Smelting

- Refractories

- Abrasives

- Ceramics

- Catalysts

- Electrical & Electronics

- Medical & Pharmaceuticals

- Water Treatment

By End-Use Industry

- Industrial / Metallurgy

- Electronics & Semiconductors

- Automotive

- Medical Devices & Healthcare

- Chemicals

- Water & Wastewater Treatment

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait