Content

What is the Current Organic Peroxide Market Size and Share?

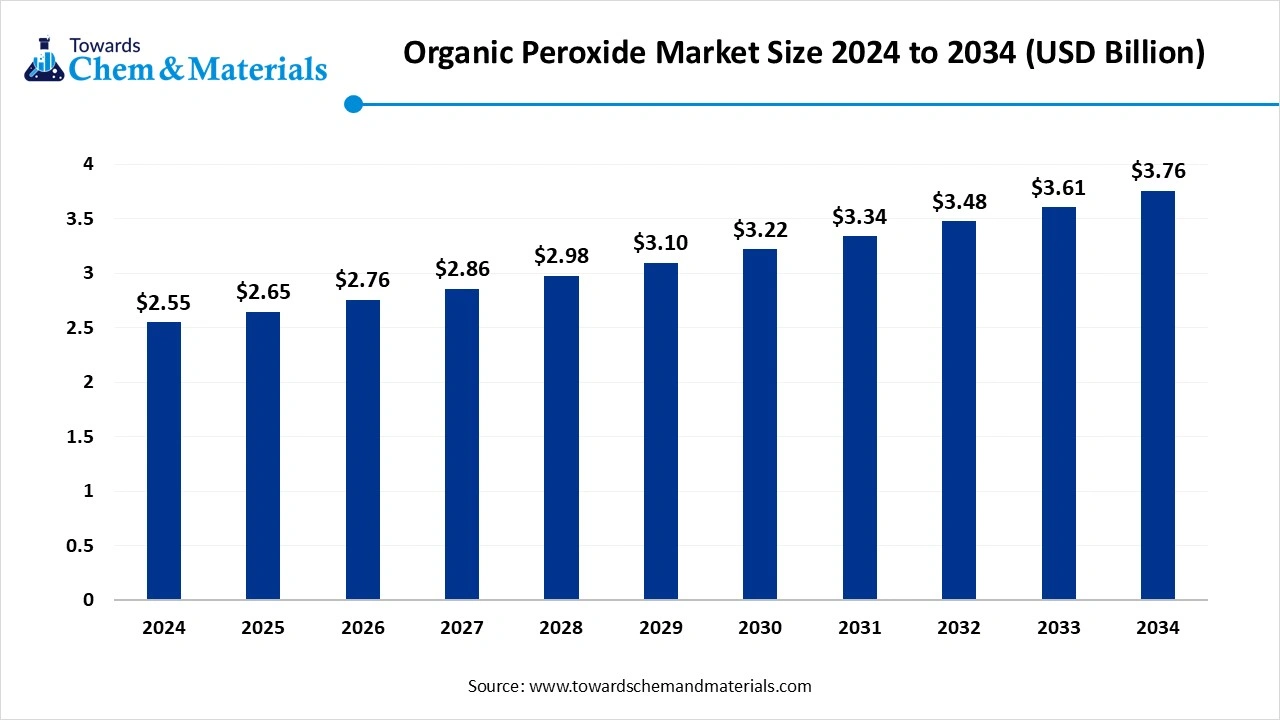

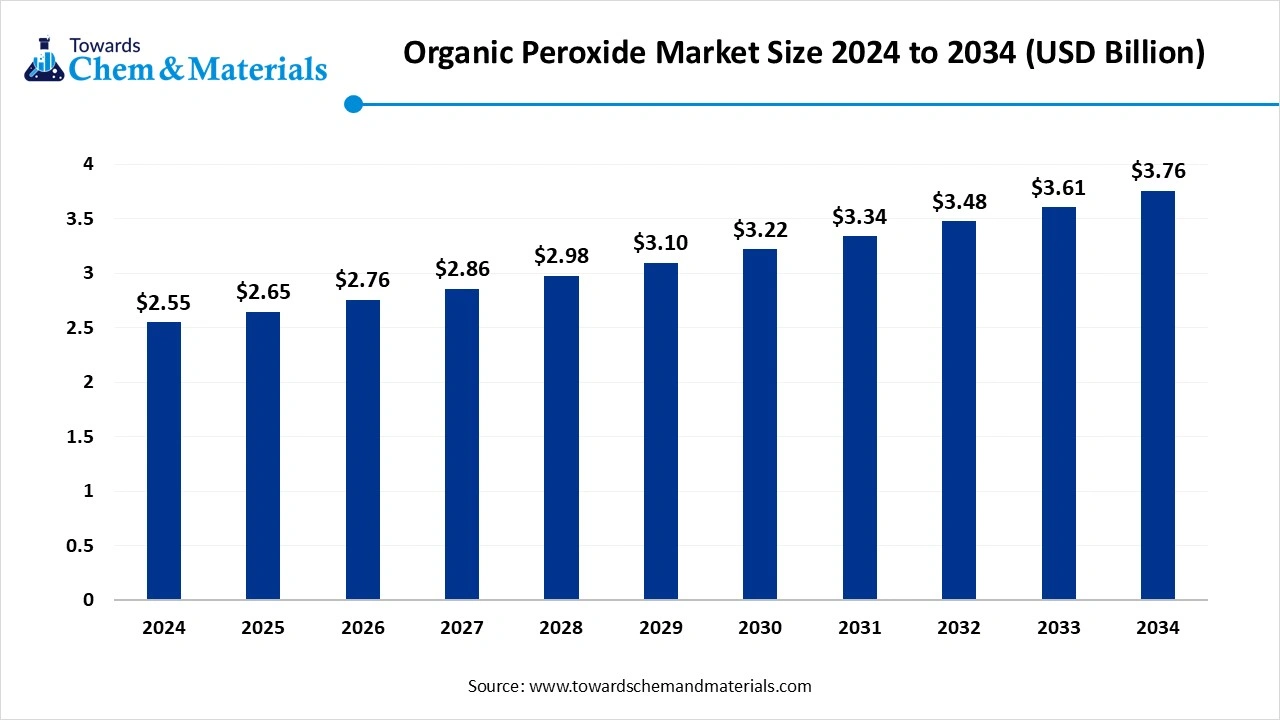

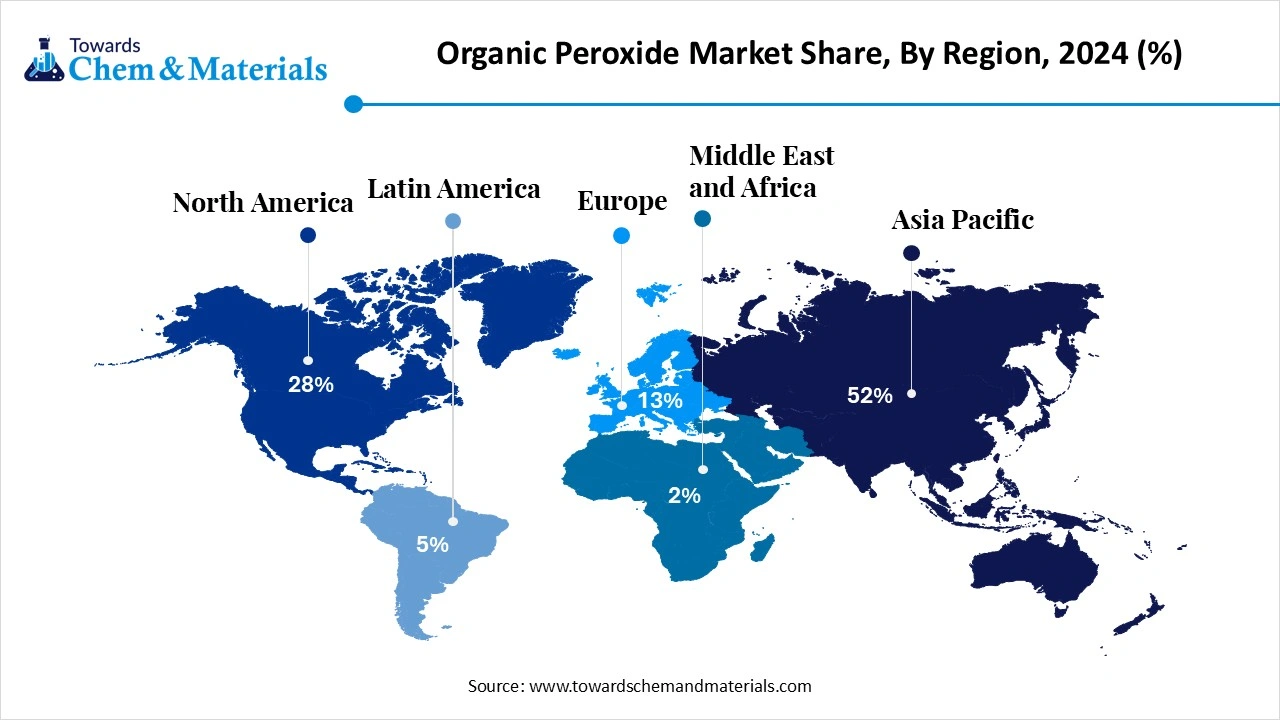

The global organic peroxide market size was approximately USD 2.65 billion in 2025 and is projected to Reach approximately USD 3.90 billion by 2035 growing at a CAGR of 3.95% from 2026 to 2035. Asia Pacific dominated the organic peroxide market with the largest volume share of 52.11% in 2025. The growth of the market is driven by the growing demand for lightweight and eco-friendly products by the industrial sector, as demand for high-performance materials drives the growth of the market.

Key Takeaways

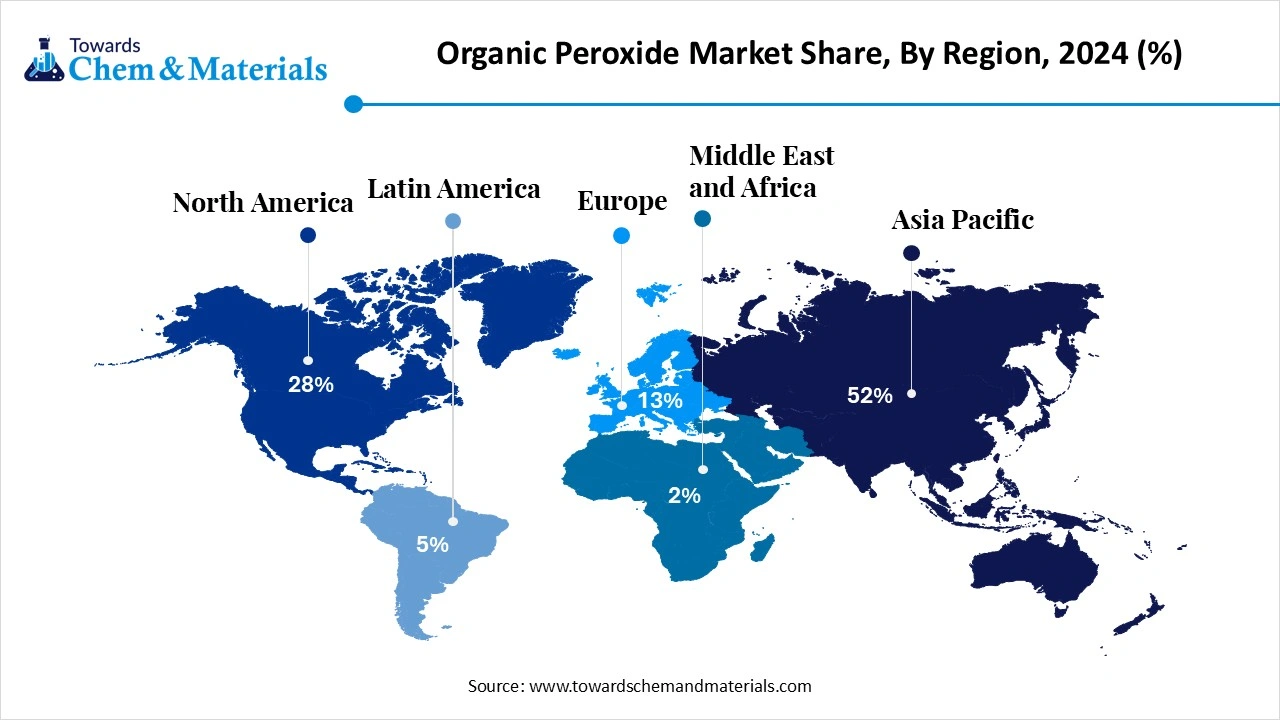

- The Organic Peroxide market in Asia Pacific dominated the global industry with a revenue share of 52.11% in 2025

- By type, the diacyl peroxides – benzoyl peroxide segment dominated the market and accounted for the largest revenue share of 28.23% in 2025.

- By function, the initiator segment led the market with the largest revenue share of 35.19% in 2025.

- By end use, the polymer & plastic – polyethylene segment dominated the market and accounted for the largest revenue share of 40.78% in 2025.

- By form, the liquid organic peroxide segment led the market with the largest revenue share of 55.95% in 2025.

Market Overview

Rising demand for durable materials: Organic Peroxide Market to expand

Organic peroxides are organic compounds containing the peroxide functional group (–O–O–). They are used primarily as initiators, catalysts, curing agents, and cross-linking agents in various polymerization and chemical synthesis processes. Due to their highly reactive and unstable nature, they require careful handling, storage, and transportation. The demand is largely driven by polymer manufacturing, composites, and specialty chemicals.

What Are the Key Growth Drivers Responsible for The Growth of The Organic Peroxide Market?

The market is mainly fueled by rising demand for polymers and plastics in industries such as automotive, construction, textile, and packaging. This surge is driven by the necessity for lightweight, high-performance materials, strict regulations, and advancements in polymer and coating technologies. Additionally, increased emphasis on renewable raw materials and sustainable development is encouraging the use of organic peroxides in environmentally friendly processes.

Market Trends

- Growing demand from various industries for various applications like polymer production, rubber manufacturing, coatings, and adhesives drives the growth of the market.

- The growing shift towards sustainability and the use of eco-friendly and organic materials is a growing trend in the market, which fuels the growth.

- Demand for high-performance materials, especially in the automotive and electronics industry, drives the demand for the market.

- The technological advancements, like innovation in formulations and applications, contribute to the growth of the market.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 2.75 Billion |

| Market Size by 2035 | USD 3.90 Billion |

| Growth rate from 2026 to 2035 | CAGR 3.95% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026 - 2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Function/Application, By End-Use Industry, By Form, By Region |

| Key Companies Profiled | Arkema S.A., Akzo Nobel N.V. (now Nouryon) , United Initiators GmbH , Pergan GmbH , NOF Corporation , Chinasun Specialty Chemicals Co., Ltd., MPI Chemie B.V., Vanderbilts Chemicals, LLC, Novichem , Kawaguchi Chemical Industry Co., Ltd. , Plasti Pigments Pvt. Ltd. , LANXESS AG, Reaxis Inc., Atul Ltd. , Shandong Liyang New Material Co., Ltd. , Riddhi Siddhi Chemicals, Promox S.p.A., Haike Chemical Group , Zibo Zhenghua Auxiliary Co., Ltd., Hubei XINTE Polymer Materials Co., Ltd. |

Market Dynamics

Market Drivers

The organic peroxide market is driven by sustained demand from polymer manufacturing, particularly for polyethylene, polypropylene, PVC, and unsaturated polyester resins used in packaging, construction, automotive, and electrical applications. Regulatory and industrial standards enforced by agencies such as the U.S. Occupational Safety and Health Administration and the European Chemicals Agency require controlled and efficient initiators for polymerization and cross-linking processes, supporting continued use of organic peroxides.

Growth in infrastructure development across Asia Pacific and the Middle East is increasing consumption of polymer-based pipes, insulation, and composites, which rely on peroxide-initiated curing systems. In addition, expansion of wind energy, marine composites, and fiberglass-reinforced plastics is reinforcing demand for organic peroxides in thermoset resin applications.

Market Restraints

The market faces restraints related to the hazardous nature of organic peroxides, which are subject to strict storage, transport, and handling regulations due to their thermal instability and explosion risk. Compliance requirements imposed by regulators such as the U.S. Department of Transportation and national chemical safety authorities increase logistics costs and limit flexibility in distribution. Fluctuations in raw material availability, particularly alcohols, ketones, and hydrogen peroxide derivatives sourced from petrochemical value chains, also affect production economics. Smaller manufacturers face additional barriers due to high insurance costs, specialized containment infrastructure requirements, and mandatory safety training for personnel.

Market Opportunities

Opportunities are emerging from growing demand for lightweight composite materials in electric vehicles, renewable energy systems, and aerospace structures, where organic peroxides are essential curing and cross-linking agents. Government-supported renewable energy programs in the European Union, China, and the United States are expanding wind turbine blade manufacturing, directly increasing peroxide consumption in epoxy and polyester resins.

The shift toward high-performance elastomers and specialty polymers in medical devices and electronics is also creating demand for tailored peroxide formulations with controlled decomposition profiles. In parallel, investments in domestic polymer production capacity in India, Southeast Asia, and the Middle East are opening new regional markets for peroxide suppliers.

Market Challenges

A major challenge for the organic peroxide market is balancing performance efficiency with tightening environmental and worker safety regulations. Authorities are increasingly scrutinizing emissions, waste handling, and lifecycle impacts associated with peroxide manufacturing and use, requiring continuous reformulation and process optimization. Supply chain disruptions related to hazardous material transport restrictions can lead to delivery delays, particularly for temperature-sensitive products. Additionally, the limited availability of skilled personnel trained in peroxide chemistry and safe handling practices constrains scale-up, especially in emerging markets expanding polymer and composites manufacturing capacity.

Value Chain Analysis

- Research & Development (R&D) : This focuses on developing new, safer, and more stable peroxide formulations, improving efficiency, and creating specialized grades for niche applications.

- Key Players: Nouryon, Arkema, United Initiators, NOF Corporation, and Pergan GmbH.

- Raw Material Sourcing and Regulatory Compliance : This involves securing volatile raw materials and ensuring compliance with stringent safety and transportation regulations.

- Key Suppliers: Solvay and Evonik.

- Manufacturing : This involves highly controlled, exothermic chemical reactions, such as the anthraquinone process, to synthesize organic peroxides.

- Key Players: Arkema, Nouryon, BENOX, CUROX, NOF Corporation, and Pergan.

- Specialized Logistics and Distribution : This is due to the unstable and hazardous nature of organic peroxides; specialized, temperature-controlled logistics are required to prevent premature decomposition.

- Key Players: Nouryon and Arkema.

- Application, Treatment, and Commercialization : This involves the administration of the peroxide as an initiator or cross-linking agent in downstream industries, primarily plastics, rubbers, and coatings.

- Key Players: LyondellBasell, Nouryon, Arkema SA, and United Initiators GmbH.

Segmental Insights

Type Insights

Which Type Segment Dominated the Organic Peroxide Market In 2025?

The diacyl peroxides – benzoyl peroxide segment dominated the market in 2025. Diacyl peroxides, specifically benzoyl peroxide, are a prominent type in the market, widely used as initiators in polymerization processes and as curing agents for resins. Benzoyl peroxide is also valued in pharmaceuticals and cosmetics, particularly in acne treatment products, due to its strong antibacterial properties. Its versatility, high reactivity, and effectiveness in both industrial and personal care applications drive robust demand, supporting market growth and the expansion of its use across various sectors globally.The peroxyesters (esp. tert-butyl peroxyacetate) segment expects significant growth in the organic peroxide market during the forecast period.

Peroxyesters, especially tert-butyl peroxyacetate, represent a significant type in the market, known for their high efficiency as initiators in polymerization and as crosslinking agents in the production of plastics and elastomers. These compounds offer excellent thermal stability and controlled decomposition rates, making them ideal for applications requiring precise processing conditions. The growing demand for high-performance polymers and advanced composite materials drives the use of peroxyesters like tert-butyl peroxyacetate, supporting market growth and technological advancements in various industries.

Function Insights

How did the Initiator Segment Dominated the Organic Peroxide Market in 2025?

The initiator segment dominated the organic peroxide market in 2025. The organic peroxides are extensively used as initiators in free-radical reactions, this is especially in the production of plastics and rubbers sector, due to their wide application, which fuels the growth of the market. They are extensively used in applications such as polymer production, thermoset curing, and polymer modification, which increases the demand. The commonly used initiators are diacyl peroxides, dialkyl peroxides, peroxydicarbonates, and peroxyesters, attracting the consumers for growing application, which boosts the growth and expansion of the market.

The crosslinking agent segment expects significant growth in the market during the forecast period. The growth of the market is driven by the growing applications like cable manufacturing, the automotive industry, photovoltaic devices, and general polymer modification, which boost the growth of the market. The growing advantages like enhanced properties, cost effectiveness, controlled reactivity, and controlled reactivity are the major factor that influences the growth of the market, contributing to its expansion.

End Use Insights

Which End-Use Segment Dominated the Organic Peroxide Market in 2025?

The polymer & plastic – polyethylene segment dominated the organic peroxide market in 2025. Polymer and plastic manufacturing, particularly polyethylene production, is a major end-use segment in the market. Organic peroxides act as essential initiators and crosslinking agents in the polymerization process, enhancing product strength, flexibility, and heat resistance. In polyethylene production, they help achieve desired molecular structures and improve material performance for applications like films, pipes, and packaging. The rising global demand for high-quality polyethylene products fuels the consumption of organic peroxides, driving market growth and technological development in this segment.

The composites (UPR & fiberglass) segment expects significant growth in the organic peroxide market during the forecast period. The composites segment, including unsaturated polyester resins (UPR) and fiberglass, is a key end use in the market. Organic peroxides serve as vital curing agents, enabling crosslinking and hardening of resins to produce strong, lightweight, and durable composite materials. These composites are widely used in automotive, marine, construction, and wind energy applications. The growing demand for high-performance, corrosion-resistant, and lightweight materials drives the use of organic peroxides in composites, supporting market expansion and innovation.

Form Insights

How Did Liquid Organic Peroxide Segment Dominate the Organic Peroxide Marke In 2025?

The liquid organic peroxide segment dominated the organic peroxide market in 2025. The growth of the market is driven by the key characteristics of liquid organic peroxides, like reactive nature, thermal instability, hazardous properties, a wide range of applications, and safety considerations are the factors that increase the demand for the market. The growing application drives the use and demand for the market, like curing agents, polymerisation initiators, pharmaceuticals, and cosmetics, and other applications like bleaching agents, also used in manufacturing of explosives, and in specialized chemical processes, which further fuels the growth of the market.

The paste/gel form segment expects significant growth in the market during the forecast period. The growing use of organic peroxides in gel and pastes are for specific applications like polymerization, crosslinking, thermoset composites, adhesives and sealants, paints and coatings and other applications like in chemical anchoring, car body fillers and as hardeners in various applications which increases the demand and helps in growth of the market and supports expansion of the market.

Distribution Insights

Which Distribution Segment Dominated the Organic Peroxide Market In 2025?

The direct sales segment dominated the organic peroxide market in 2025. Direct sales play a significant role in the distribution of organic peroxides, allowing manufacturers to supply products directly to large-scale industrial users, such as polymer producers and composite manufacturers. This channel ensures customized solutions, consistent quality, and strong technical support tailored to specific production needs. Direct sales help build long-term partnerships, improve supply chain efficiency, and reduce intermediary costs. The increasing demand for specialized formulations and reliable supply drives the preference for direct sales, supporting market growth and customer loyalty.

The online procurement channels segment expects significant growth in the market during the forecast period. Online procurement is an emerging distribution channel in the market, providing a convenient, flexible, and efficient way for customers to source products. Through digital platforms, buyers can compare specifications, check real-time availability, and place orders quickly, streamlining purchasing processes. This approach benefits small and medium-sized manufacturers looking for a reliable supply in smaller quantities. The rising trend toward digitalization, ease of access, and faster transactions supports the growth of online procurement, enhancing market reach and supply chain responsiveness.

Regional Insights

How Did Asia Pacific Dominate the Organic Peroxide Market In 2025?

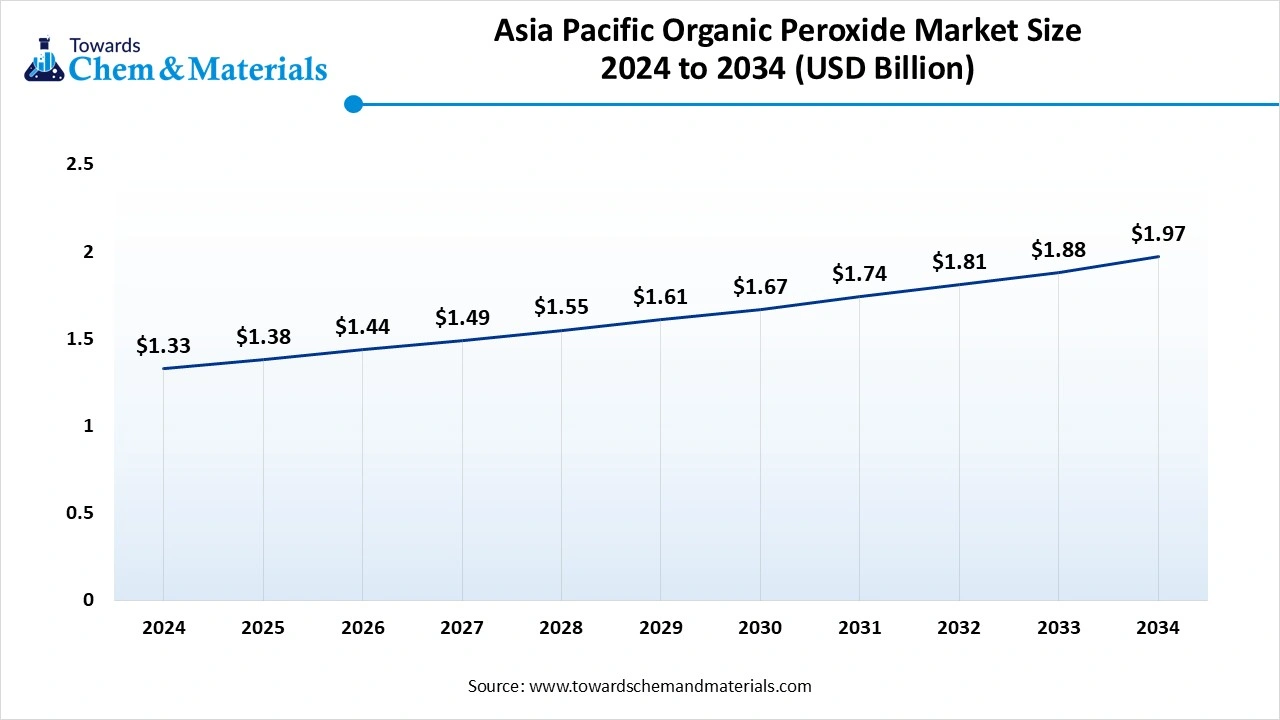

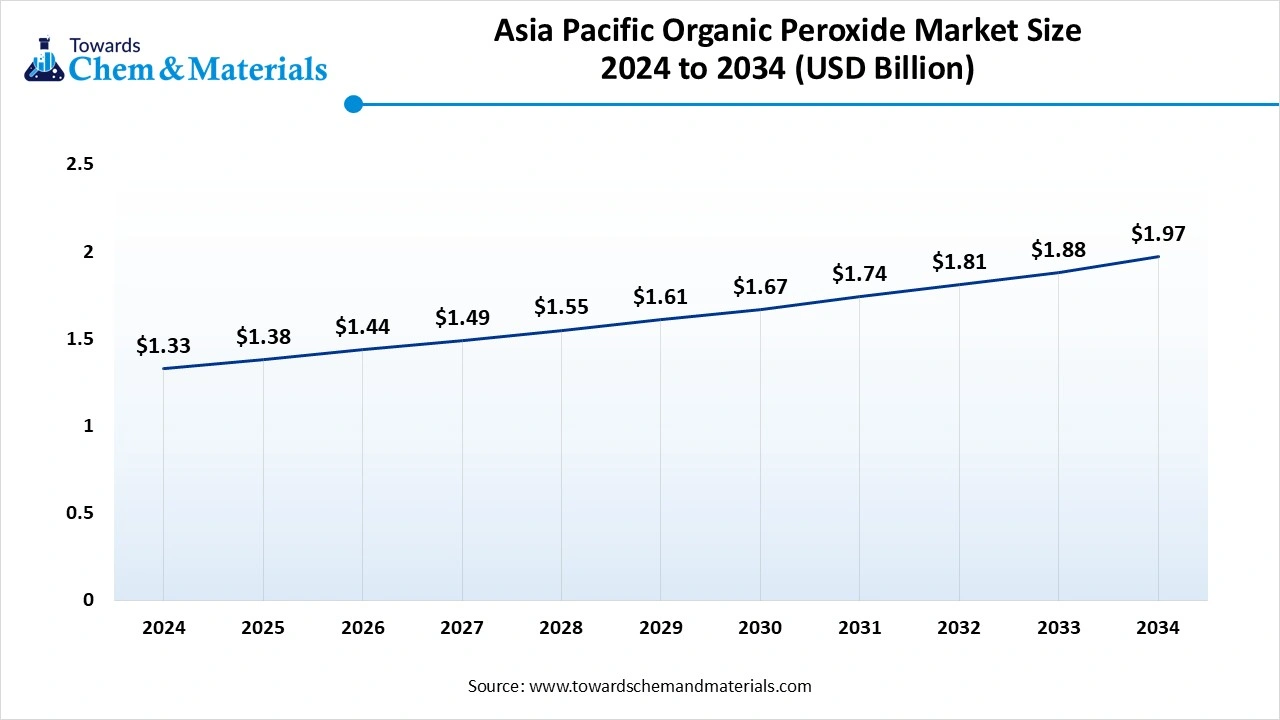

The Asia Pacific organic peroxide market size accounted for USD 1.38 billion in 2025 and is forecasted to hit around USD 2.04 billion by 2035, representing a CAGR of 4.01% from 2025 to 2034. Asia Pacific dominated the market in 2025

The growth of the market is driven by key drivers like rapid industrialization, growing end-use industries, increased polymer production, increased sustainable practices, and unassured adoption of eco-friendly materials from companies, which aligns with the growing environmental concerns, which fuels the growth of the market in the region. The large production capacities for polymers and plastics further propel the growth of the market in the region, contributing to the expansion of the market.

- Globally, the United States, China, and Germany are the top exporters of Organic Peroxide. The United States is the leading Organic Peroxide exporter with 5,660 shipments, followed by China having 3,085 shipments, and Germany in 3rd with 1,514 shipments.(Source: www.volza.com)

China's Large-Scale Manufacturing Industries Drive the Growth.

The growth of the market in China is driven by the key application in the production of polymers, including polyethylene and polypropylene, as well as in rubber vulcanization. The growth is also driven by large-scale manufacturing industries in the country, which increases the demand for polymer and rubber due to their applications, which fuels the growth of the market in the country. The key players like Arkema, NOF Corporation, Nouryon, and United Initiators play a crucial role in the growth and expansion of the market in the country.

North America Has Seen Growth Due To Demand from Various Industries.

North America is expected to have a notable growth in the organic peroxide market during the forecast period. The growth of the market is driven by the growing polymer production due to demand for initiators, crosslinking agents, and curing agents to produce various polymers, due to increasing demand in the region. The growth is propelled by the rapidly growing automotive, construction, and electronic industry in the region, which demands high-performance organic peroxides which aligning with the growth shift towards sustainability, which increases the growth of the market in the region.

The Growing Demand for The Market in the U.S. drives The Growth.

The U.S. market is seeing significant growth driven by the needs of various industries and the versatility of organic peroxides as chemical intermediates and additives, which fuels the demand for the market. The key application due to growing industries like plastics, rubber, adhesives, and coatings also plays a major role, along with the key players like BASF, AkzoNobel, Arkema, Evonik, and Dow Chemicals, further boosting the growth of the market in the country.

How will Europe be considered a Notable Region in the Organic Peroxide Market?

Europe is a notably growing region in the global market, primarily due to its advanced industrial sector, stringent environmental regulations that encourage innovation, and high demand from key end-use industries such as automotive and construction. There is a strong demand for high-performance adhesives, UV-curable coatings, and low-VOC coatings in construction and manufacturing, which is driving the consumption of specialized peroxides. Germany, France, and the UK have a robust industrial infrastructure that relies on high-purity organic peroxides for premium plastics, rubber processing, and advanced manufacturing.

Germany Organic Peroxide Market Trends

Germany plays a distinctive role in this region because its chemical processing sectors function as centralized facilities for producing oxidizing compounds, supported by a strong, high-tech industrial base. Additionally, Germany is home to major industry players, including United Initiators GmbH and PERGAN GmbH, which are crucial to the global competitive landscape. The country is also a leader in adopting green and eco-friendly chemical regulations, advocating for sustainable and non-toxic alternatives.

Emergence of Latin America in the Organic Peroxide Market

Latin America is emerging as a significant market, driven by expanding industrialization, particularly in the plastics, rubber, and coatings sectors in Brazil and Mexico. The increasing demand for engineered plastics and synthetic rubber for automotive tires and industrial goods is propelling the need for organic peroxides. Furthermore, rising public and private investments in infrastructure projects throughout the region are boosting the consumption of construction materials and coatings that rely on organic peroxides for production.

Brazil Organic Peroxide Market Trends

Brazil serves as the primary hub in this region, largely due to the growing demand for initiators used in composites for wind turbines and civil construction. The market for peroxides is also supported by Brazil's strong pulp and paper sector, with companies like Solvay expanding their presence in the area. Additionally, Arkema has strengthened its supply chain in South America by increasing the production of Luperox organic peroxides in Brazil.

How will the Middle East and Africa contribute to the Organic Peroxide Market?

The Middle East and Africa region is a key contributor to this market, driven by its extensive petrochemical infrastructure, rapid industrialization, and high-growth construction and automotive sectors. Significant investments in construction, infrastructure, and urban development across the GCC countries and Africa are fueling high demand for polymers, plastics, and composites, where organic peroxides serve as essential curing and crosslinking agents. Additionally, the growing focus on water treatment and sanitation projects is further boosting the market.

UAE Organic Peroxide Market Trends

The UAE plays a significant role in this region, primarily due to the rapid expansion of its construction, automotive, and packaging industries, which drives demand for specialized polymer-based materials requiring high-quality peroxide initiators. Global players such as Arkema and Nouryon are active in this market. The UAE’s specialized chemical zones facilitate the import and export of peroxide products, addressing the increasing need for specialized curing agents.

Recent Developments

- In October 2025, global specialty chemicals leader Nouryon announced important investments in China to support the country’s increasing demand for high-performance polymers and grow alongside its customers in one of the world’s fastest-growing polymer markets. Additionally, in 2026, the company will open an organic peroxides innovation center in Tianjin to provide specialized polymer application capabilities for faster product development and enhanced customer support.(Source: www.indianchemicalnews.com)

- In October 2025, During the KShow, Arkema introduced Luperox® NeatCure®, a new generation of formulated organic peroxide granules developed to enable faster and safer curing of elastomers and polymers.(Source: www.arkema.com)

Top Companies List

- Arkema S.A.

- Akzo Nobel N.V. (now Nouryon)

- United Initiators GmbH

- Pergan GmbH

- NOF Corporation

- Chinasun Specialty Chemicals Co., Ltd.

- MPI Chemie B.V.

- Vanderbilts Chemicals, LLC

- Novichem

- Kawaguchi Chemical Industry Co., Ltd.

- Plasti Pigments Pvt. Ltd.

- LANXESS AG

- Reaxis Inc.

- Atul Ltd.

- Shandong Liyang New Material Co., Ltd.

- Riddhi Siddhi Chemicals

- Promox S.p.A.

- Haike Chemical Group

- Zibo Zhenghua Auxiliary Co., Ltd.

- Hubei XINTE Polymer Materials Co., Ltd.

Segments Covered

By Type

- Diacyl Peroxides

- Benzoyl Peroxide (BPO)

- Lauroyl Peroxide (LPO)

- Others

- Dialkyl Peroxides

- Di-tert-butyl Peroxide

- Di-cumyl Peroxide

- Others

- Peroxyesters

- Tert-butyl Peroxyacetate

- Tert-butyl Peroxybenzoate

- Others

- Hydroperoxides

- Cumene Hydroperoxide

- Tert-butyl Hydroperoxide

- Ketone Peroxides

- Methyl Ethyl Ketone Peroxide (MEKP)

- Others

- Peroxyketals

- Others

- Peroxydicarbonates

- Peroxymonocarbonates

By Function/Application

- Initiator

- Curing Agent

- Crosslinking Agent

- Polymerization Agent

- Bleaching Agent

- Oxidizing Agent

By End-Use Industry

- Polymer & Plastic

- Polyethylene

- Polypropylene

- Polystyrene

- Rubber Industry

- Composite & Reinforced Plastics

- Unsaturated Polyester Resins (UPR)

- Fiberglass

- Adhesives & Sealants

- Paints & Coatings

- Textile

- Pharmaceuticals

- Cosmetics & Personal Care

- Pulp & Paper

- Others

- Water Treatment

- Agrochemicals

By Form

- Solid Organic Peroxide

- Liquid Organic Peroxide

- Paste/Gel Organic Peroxide

By Distribution Channel

- Direct Sales

- Distributors

- Online Retail/Procurement Portals

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait