Content

Monochloroacetic Acid Market Volume and Growth 2025 to 2034

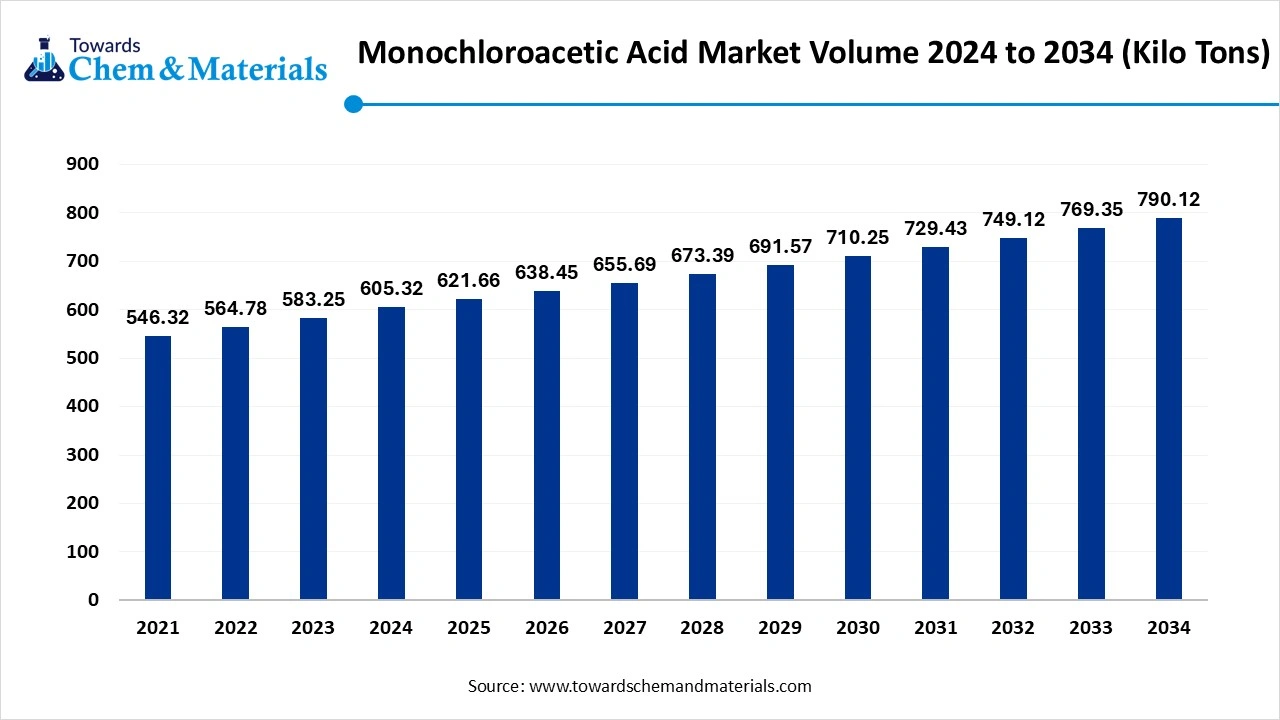

The global monochloroacetic acid market volume was reached at 605.32 kilo tons in 2024 and is expected to be worth around 790.12 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 2.70% over the forecast period 2025 to 2034. the growing demand across key sectors like pharmaceuticals and agriculture drives the market growth.

Key Takeaways

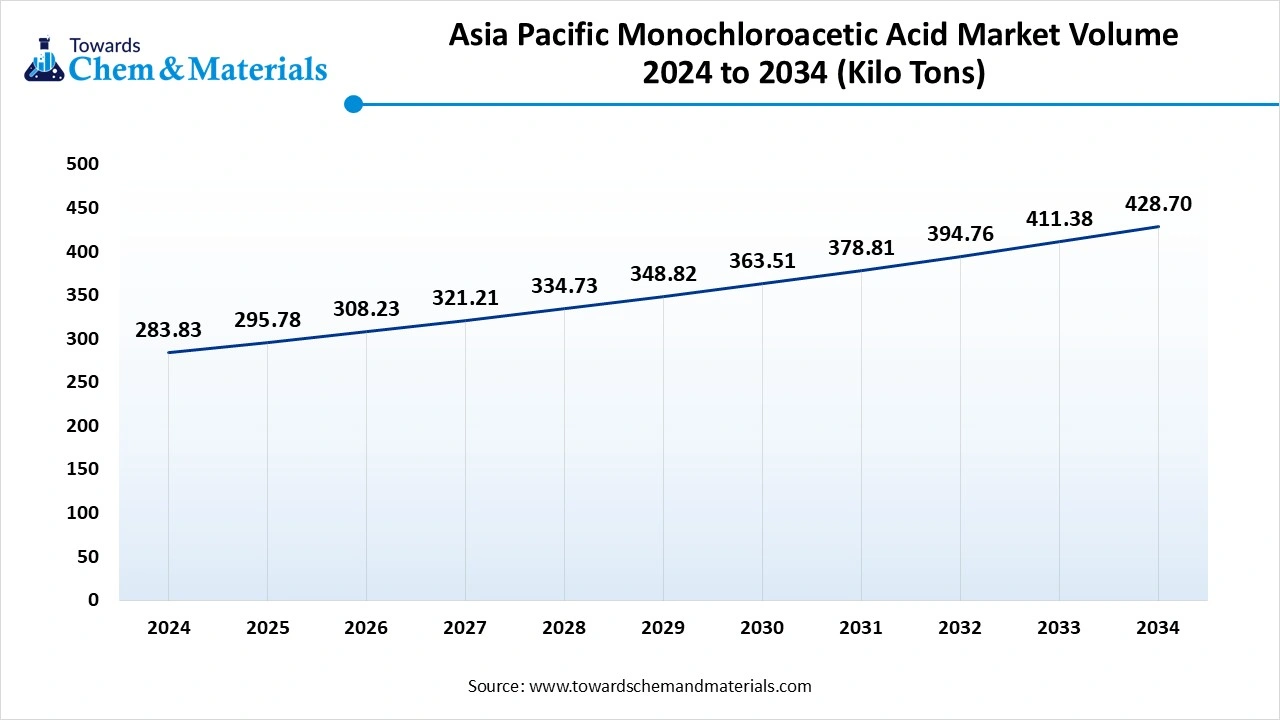

- The Asia Pacific monochloroacetic acid market volume was estimated at 283.83 Kilo Tons in 2024 and is expected to reach 428.70 Kilo Tons by 2034, growing at a CAGR of 4.21% from 2025 to 2034.

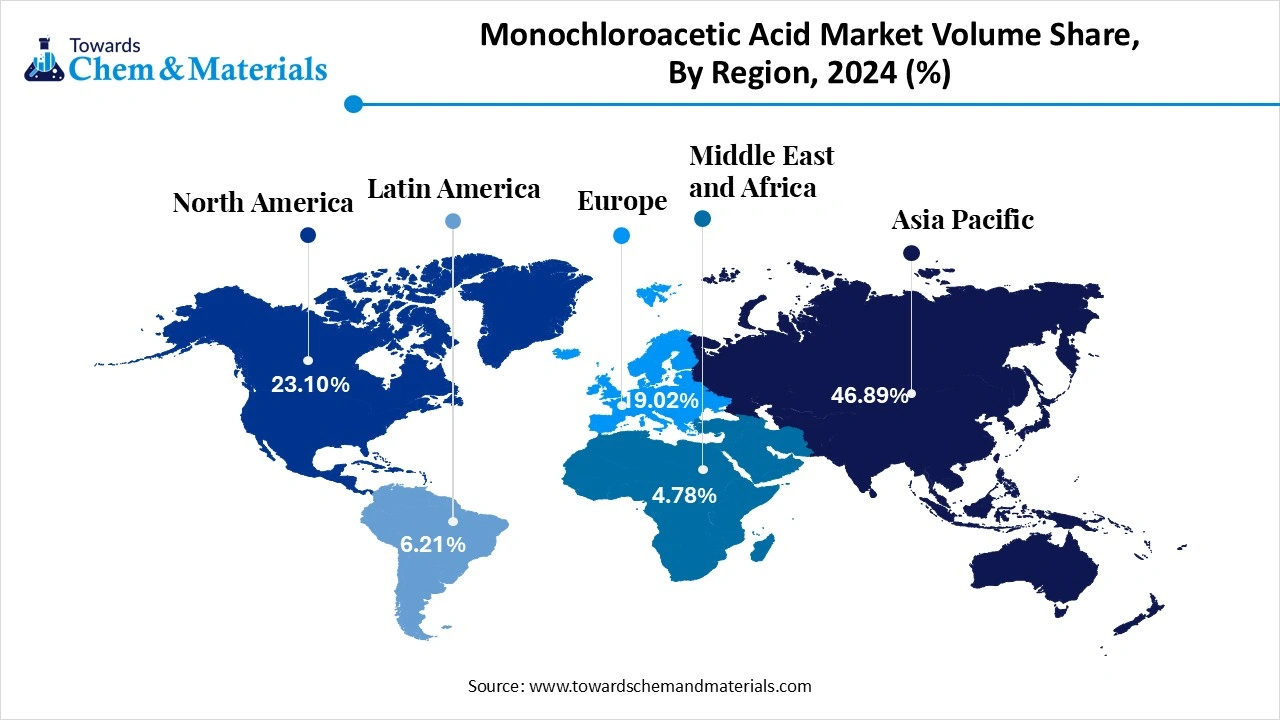

- By region, Asia Pacific dominated the monochloroacetic acid market held the largest Volume Share of 46.89% the global market in 2024. due to the thriving agriculture sector.

- By region, the North America has held a volume share of around 23.10% in 2024.is growing at a significant CAGR 1.70% in the market during the forecast period due to the well-established chemical industry.

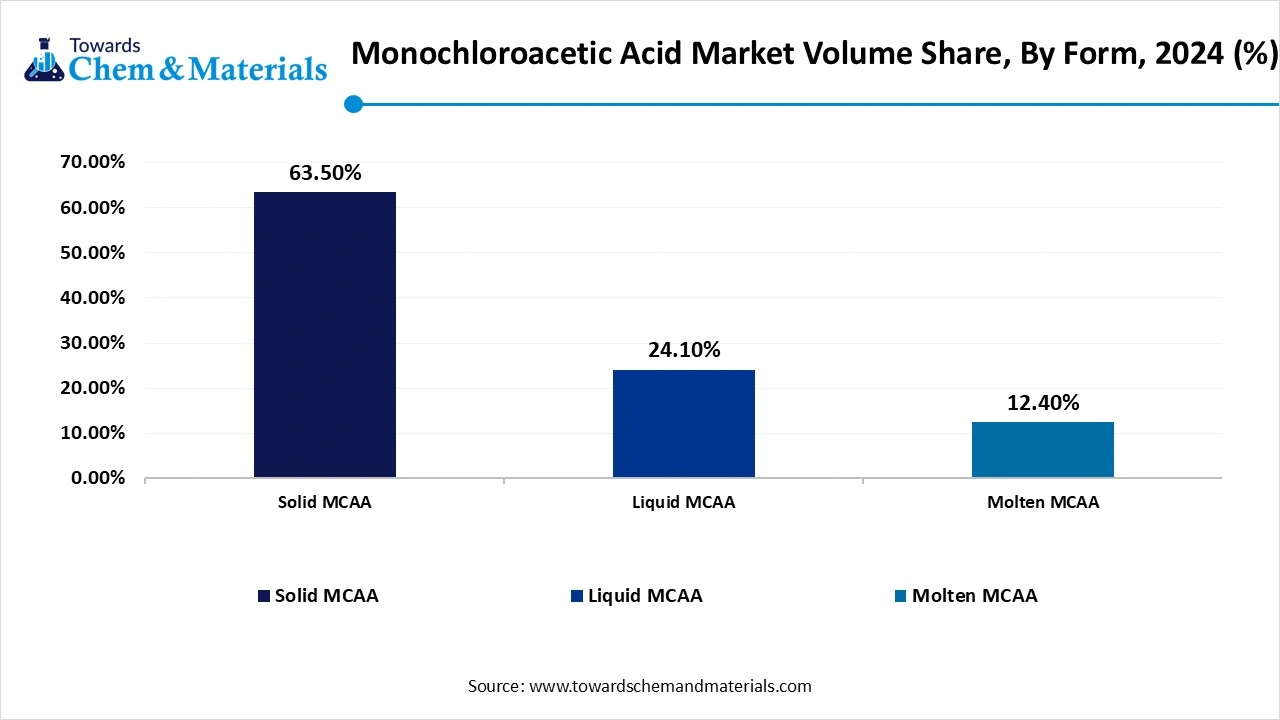

- By form, the solid MCAA segment has recorded a Volume Share of around 63.50% in 2024, due to the growing production of agrochemicals.

- By form, the liquid MCAA segment has captured a volume share of 24.10% in 2024 is expected to grow at a significant CAGR in the market during the forecast period due to the growing production of surfactants and carboxymethyl cellulose.

- By production process, the chlorination of acetic acid segment held a 65% share in the market in 2024 due to the increasing demand for large-scale production of MCAA.

- By production process, the hydrolysis of trichloroethylene segment is expected to grow at a significant CAGR in the market during the forecast period due to the increasing demand for highly pure MCAA.

- By application, the CMC production segment held a 35% share in the market in 2024 due to the increasing demand in the food & beverage industry.

- By application, the agrochemicals segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand for various agrochemicals.

- By end-use industry, the agriculture segment held a 32% share in the monochloroacetic acid market in 2024 due to the increasing demand for food production.

- By end-use industry, the pharmaceuticals segment is expected to grow at a significant CAGR in the market during the forecast period due to the growing production of various drugs.

- By distribution channel, the direct sales segment held a 70% share in the market in 2024, due to the growing consumer demand for customized solutions.

- By distribution channel, the distributors segment is expected to grow at a significant CAGR in the market during the forecast period due to the increasing demand for well-established supply chains.

Monochloroacetic Acid: Backbone of Everyday Products and Industries

Monochloroacetic acid (MCA) is a chemical compound with carboxylic acid and an organochlorine. The chemical formula is CICH2COOH and is a toxic & corrosive substance. It is produced through various processes, like the hydrolysis of trichloroethylene and the chlorination of acetic acid. MCA is soluble in water and is a crystalline, colorless solid. It is also known as chloroacetic acid or 2-chloroacetic acid. The molecular weight of MCA is 94.49 g/mol, and the density is 1.58g/cm3. It is widely used as a bacteriostat, preservative, herbicide, and chemical intermediate. The growing production of a wide range of agrochemicals like herbicides, pesticides, and many more fuels demand for monochloroacetic acid. The increasing synthesis of various pharmaceutical products fuels demand for MCA.

The rising production of detergents, shampoos, and soaps increases demand for MCA. The growing demand across key end-user industries like pharmaceuticals, personal care products, agrochemicals, food & beverage, and textiles contributes to the growth of the monochloroacetic acid market.

- Shandong Minji New Material Technology Co., Ltd is the leading supplier of monochloroacetic acid in the world. (Source: www.volza.com)

- China exported 896 shipments of monochloroacetic acid.(Source: www.volza.com)

- The Netherlands exported 1,496shipments of monochloroacetic acid.(Source: www.volza.com)

- Germany exported 842 shipments of monochloroacetic acid.(Source: www.volza.com)

The Growing Personal Care Sector Surge Demand for Monochloroacetic Acid

The growing expansion of the personal care sector and increasing demand for various personal care products fuel demand for MCA. The rising consumer disposable incomes increase spending on various personal care products. The increasing demand for body washes, conditioners, shampoos, and other products fuels demand for MCA due to its cleansing capabilities and excellent foaming. The growing consumer demand for straightening treatments and permanent hair-waving fuels demand for MCA for the synthesis of thioglycolic acid. The increasing use of various skin care and hair care products fuels demand for MCA.

The personal care products, like liquid soaps and shampoos, increase demand for MCA to produce betaines. The increasing focus on personal hygiene and changing lifestyle increases the demand for personal care products. The growing demand for hair care and skin care products is fueling demand for MCA. The growing personal care sector is a key driver for the monochloroacetic acid market.

Market Trends

What are the Trends for the Monochloroacetic Acid Market?

- Growing Demand for Agrochemicals: The increasing demand for agrochemicals like plant growth regulators, herbicides, and pesticides in the agriculture sector increases demand for the monochloroacetic acid.

- Rising Production of CMC and Surfactants: The increasing demand for surfactants and CMC in various industries fuels demand for monochloroacetic acid. The growing demand for CMC in industries like personal care products, pharmaceuticals, and textiles fuels demand for MAC.

- Technological Advancements: The ongoing technological advancements, like AI-driven process optimization and green chemistry, increase demand for MCA to expand applications, improve production efficiency, and develop sustainable processes.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 621.66 Kilo tons |

| Expected Volume by 2034 | 790.12 Kilo Tons |

| Growth Rate from 2025 to 2034 | CAGR 2.70% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Form, By Production Process, By Application, By End-use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | AkzoNobel N.V., CABB Group GmbH, Denak Co. Ltd. (Denka Company Limited), Shandong Minji Chemical Co., Ltd., Merck KGaA (Sigma-Aldrich), Niacet Corporation, Daicel Corporation, Jubilant Life Sciences, Hubei Shuanghuan Science and Technology Stock Co., Ltd., IOL Chemicals and Pharmaceuticals Ltd., Anugrah In-Org (P) Ltd., Dow Chemical Company, Xuchang Dongfang Chemical Co., Ltd., S.R. Drugs and Intermediates Pvt. Ltd., Shijiazhuang Banglong Chemical Co., Ltd., Puyang Tiancheng Chemical Co., Ltd., Archit Organosys Ltd., Aceto Corporation, Chongqing Seayo Chemical Industry Co., Ltd., Tianjin Bohua Yongli Chemical Industry Co., Ltd |

Market Opportunity

Growing Expansion of Pharmaceutical Industry Unlocks Market Opportunity

The growing expansion of the pharmaceutical industry in various regions increases the demand for monochloroacetic acid. The increasing synthesis of pharmaceutical compounds and APIs in pharmaceutical production fuels demand for MCA. The increasing production of various drugs like anti-inflammatory drugs, anti-diabetic medicines, analgesics, vitamins, and various specialty pharmaceuticals increases the demand for MCA. The growing age-related conditions and increasing demand for various medications fuel the demand for MCA.

The rise in conditions like muscle spasms, pain management, and epilepsy increases demand for finished drug products that require MCA. The stringent standard qualities of pharmaceutical production increase the adoption of MCA. The ongoing research & development to formulate new drugs requires the key ingredient MCA. The increasing synthesis of diclofenac sodium and ibuprofen is fueling demand for MCA. The growing expansion of the pharmaceutical industry creates an opportunity for the growth of the monochloroacetic acid market.

Market Challenge

Raw Material Price Fluctuations Limit Expansion of Market

Despite several benefits of the monochloroacetic acid in various sectors, the fluctuating raw materials costs restrict the market growth. Factors like supply chain disruptions, feedstock prices, and various economic conditions are responsible for fluctuating raw materials costs. The production of MCA depends on raw materials like acetaldehyde, ethanol, and methanol, which require natural gas & crude oil. The fluctuating price of crude oil and natural gas directly affects the market. The fluctuations in the price of acetic acid increase the cost of MCA. The volatility in the price of chlorine directly affects the MCA prices. Factors like conflicts, trade restrictions, and political instability affect the cost of raw materials. The raw material price fluctuations hamper the growth of the monochloroacetic acid market.

Regional Insights

How Asia Pacific Dominated the Monochloroacetic Acid Market?

The Asia Pacific monochloroacetic acid market volume was estimated at 283.83 Kilo Tons in 2024 and is anticipated to reach 428.70 Kilo Tons by 2034, growing at a CAGR of 4.21% from 2025 to 2034. Asia Pacific dominated the monochloroacetic acid market in 2024

The region is observed to sustain the position during the forecast period. The rapid industrialization and growing investment in the manufacturing sector increase the demand for monochloroacetic acid. The higher demand for chemicals like monochloroacetic acid helps the market growth. The booming agriculture sector and increasing production of crop protection materials increase the demand for monochloroacetic acid. The presence of a well-established chemical industry increases the production of monochloroacetic acid. The growing adoption of modern farming practices increases demand for monochloroacetic acid. The rising demand across key industries like textiles, pharmaceuticals, and personal care drives the market growth.

India’s Monochloroacetic Acid Market Trends

India is growing in the market. The growing production of agrochemicals like herbicides increases the demand for monochloroacetic acid. The increasing demand for various pharmaceuticals like specialty medications, pain relievers, and anti-inflammatory drugs helps the market growth. The growing need for various personal care products like soaps, conditioners, and shampoos increases demand for monochloroacetic acid. The increasing production of food and the expansion of the agriculture sector drive the market growth.

- India exported 144 shipments of monochloroacetic acid.(Source: www.volza.com)

Why is North America Growing in the Monochloroacetic Acid Market?

North America is significantly growing in the monochloroacetic acid market. The presence of a well-developed chemical industry increases the production of monochloroacetic acid. The increasing demand for specialty chemicals like surfactants, CMC, and herbicides helps in the market growth. The rising expansion of the personal care sector increases demand for monochloroacetic acid. The strong focus on improving the quality of monochloroacetic acid and government support for chemical processing help the market growth. The growing demand across end-user industries like agrochemical and pharmaceutical supports the market growth.

Monochloroacetic Acid Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume(Kilo Tons) 2024 | Volume Share, 2034 (%) | Market Volume(Kilo Tons) 2034 | CAGR(2025 - 2034) |

| North America | 23.10% | 139.83 | 20.60% | 162.76 | 1.70% |

| Europe | 19.02% | 115.13 | 17.02% | 134.48 | 1.74% |

| Asia Pacific | 46.89% | 283.83 | 52.08% | 411.49 | 4.21% |

| Latin America | 6.21% | 37.59 | 6.50% | 51.36 | 3.53% |

| Middle East & Africa | 4.78% | 28.93 | 3.80% | 30.02 | 0.41% |

| Total | 100.00% | 605.32 | 100.00% | 790.12 | 3.00% |

United States Monochloroacetic Acid Market Trends

The United States is a major contributor to the monochloroacetic acid. The growing consumer demand for personal care products like shampoos, conditioners, and soaps increases the adoption of monochloroacetic acid. The strong presence of the chemical industry increases the production of the monochloroacetic acid. The increasing production of various drugs and the expansion of the pharmaceutical industry fuel demand for monochloroacetic acid. The growing demand for agrochemicals in the agriculture sector drives the overall growth of the market.

Segmental Insights

Form Insights

How Solid MCAA Segment Dominates the Monochloroacetic Acid Market?

The solid MCAA segment dominated the market in 2024, the segment is observed to sustain the position during the forecast period. The growing production of chemical intermediates, pesticides, and herbicides increases the demand for solid MCAA. The growing demand across the food processing industry helps the market growth. Solid MCAA is easier to handle and allows control over the release of MCAA. Solid MCAA is a stable and popular choice for industrial settings. The growing demand for Solid MCAA across the pharmaceutical and agrochemical industries drives the market growth.

The liquid MCAA segment expects the significant growth in the market during the forecast period. The growing demand for liquid MCAA in industrial settings helps the market growth. Liquid MCAA avoids the need for a dilution process and supports large-scale production. It can be easily mixed and is widely used in various applications. The growing production of surfactants, pharmaceuticals, carboxymethyl cellulose, and agrochemicals increases demand for liquid MCAA. The growing demand across industries like adhesives, food & beverage, textiles, and detergents supports the market growth.

Monochloroacetic Acid Market Volume Share, By Form, 2024-2034 (%)

| By Form | Volume Share, 2024 (%) | Market Voluem(Kilo Tons) 2024 | Volume Share, 2034 (%) | Market Voluem(Kilo Tons) 2034 | CAGR(2025 - 2034) |

| Solid MCAA | 63.50% | 384.38 | 73.20% | 578.37 | 4.64% |

| Liquid MCAA | 24.10% | 145.88 | 26.80% | 211.75 | 4.23% |

| Molten MCAA | 12.40% | 75.06 | 14.21% | 112.28 | 4.58% |

| Total | 100% | 605.32 | 100% | 790.12 | 3.00% |

Production Process Insights

Why did the Chlorination of Acetic Acid Segment Dominate the Monochloroacetic Acid Market?

The chlorination of acetic acid segment dominated the monochloroacetic acid market in 2024, the segment is observed to sustain the position during the forecast period. The growing demand for high-purity MCA in various applications uses the chlorination of acetic acid production process. This process handles hazardous materials and offers efficiency. Chlorination of acetic acid has a lower impurity profile and is a simple chemical reaction. The process is applicable for large-scale production and can be easily scaled up. The growing demand for high-purity MCA in various applications like agrochemicals, pharmaceuticals, and cosmetics drives the market growth.

The hydrolysis of trichloroethylene segment expects the significant growth in the market during the forecast period. the growing demand for MCA across various industries increases the demand for the hydrolysis of trichloroethylene production process. The process produces highly pure monochloroacetic acid and releases hydrogen chloride as a byproduct. The growing demand for highly pure monochloroacetic acid in various industrial processes helps the market growth.

Application Insights

How CMC Production Segment Dominated the Monochloroacetic Acid Market?

The CMC production segment dominated the market in 2024. The growing production of food products like processed foods, sauces, and ice cream increases the demand for CMC production to enhance stability & texture. CMC is a binder, water-soluble thickener, and stabilizer in various products. The growing demand for tablet binders and viscosity enhancers in the pharmaceutical industry helps the market growth. The increasing demand for improving the texture of shampoo and cream increases the demand for CMC production. The growing demand across key industries like pharmaceuticals, textiles, food & beverage, cosmetics, agrochemicals, and construction drives the market growth.

The agrochemicals segment is the fastest growing in the market during the forecast period. The increasing demand for weed control in the agriculture sector increases demand for agrochemicals. The rapid growth in population and increasing production of food fuel demand for agrochemicals, which helps the market growth. The growing focus on intensive agriculture and maximizing crop output increases demand for agrochemicals. The increasing production of glyphosate, which is used in herbicides, fuels demand for monochloroacetic acid. The growing production of agrochemicals like plant growth regulators, herbicides, and insecticides supports the market growth.

End-use Industry Insights

Which End-User Segment Dominated the Monochloroacetic Acid Market?

The agriculture segment dominated the monochloroacetic acid market in 2024, the segment is observed to sustain the position during the forecast period. The growing population and rising demand for food increase demand for various agrochemicals, which require monochloroacetic acid. The increasing demand for crop protection from insects, weeds, and other pests increases the adoption of monochloroacetic acid, helping the market growth. The increasing need for optimizing crop yield increases the utilization of monochloroacetic acid. The growing demand for agrochemicals like insecticides and herbicides in the agriculture sector drives the market growth.

The pharmaceuticals segment expects the significant growth in the market during the forecast period. The growing prevalence of chronic disease and rising demand for various pharmaceuticals increases demand for monochloroacetic acid. The growing production of vitamins and painkillers helps the market growth. The rising production of glycine, ibuprofen, and caffeine derivatives increases demand for monochloroacetic acid. The increasing healthcare awareness and the rising expansion of the pharmaceutical industry support the overall growth of the market.

Distribution Channel Insights

Why did the Direct Sales Segment Dominate the Monochloroacetic Acid Market?

The direct sales segment dominated the monochloroacetic acid market in 2024, the segment is observed to sustain the position during the forecast period. The increasing consumer demand for technical support and tailored solutions increases the adoption of direct sales. The strong focus on loyalty and customer satisfaction helps market growth. The growing demand of manufacturers for control over pricing increases the adoption of direct sales. The strong focus on developing stronger relationships drives the market growth.

The distributors segment expects the significant growth in the market during the forecast period. The expertise in the complaint and safe transportation of MCA increases the adoption of distributors' methods. The growing focus on bridging the gap between regional markets and production centers increases the adoption of distributors, helping the market growth. The well-established supply chain and distribution network support the market growth.

Recent Developments

- In December 2023, Nouryon gets ISCC PLUS certification for green monochloroacetic acid. The green MCA facility is present at Delfzijl, Netherlands, and is derived from sustainably sourced raw materials. It lowers the carbon footprint and offers the same performance.(Source: www.nouryon.com)

- In September 2024, FMC Corporation launched crop protection products, Ambriva, Velzo, and Vayobel in India. Velzo fungicide helps in preventing Oomycete diseases in potatoes, grapes, & tomatoes, and Vayobel herbicide helps in weed control.(Source: www.global-agriculture.com)

Top Companies List

- AkzoNobel N.V.

- CABB Group GmbH

- Denak Co. Ltd. (Denka Company Limited)

- Shandong Minji Chemical Co., Ltd.

- Merck KGaA (Sigma-Aldrich)

- Niacet Corporation

- Daicel Corporation

- Jubilant Life Sciences

- Hubei Shuanghuan Science and Technology Stock Co., Ltd.

- IOL Chemicals and Pharmaceuticals Ltd.

- Anugrah In-Org (P) Ltd.

- Dow Chemical Company

- Xuchang Dongfang Chemical Co., Ltd.

- S.R. Drugs and Intermediates Pvt. Ltd.

- Shijiazhuang Banglong Chemical Co., Ltd.

- Puyang Tiancheng Chemical Co., Ltd.

- Archit Organosys Ltd.

- Aceto Corporation

- Chongqing Seayo Chemical Industry Co., Ltd.

- Tianjin Bohua Yongli Chemical Industry Co., Ltd

Segments Covered

By Form

- Solid MCAA

- Liquid MCAA

- Molten MCAA

By Production Process

- Chlorination of Acetic Acid

- Hydrolysis of Trichloroethylene

By Application

- Carboxymethyl Cellulose (CMC) Production

- Agrochemicals

- Glyphosate

- 2,4-D herbicides

- Surfactants

- Pharmaceuticals

- Ibuprofen

- Caffeine derivatives

- Dyes and Pigments

- Thioglycolic Acid Production

- Other Fine Chemicals (intermediates in polymers, etc.)

By End-use Industry

- Agriculture

- Personal Care & Cosmetics

- Pharmaceuticals

- Food & Beverage (via CMC as a stabilizer)

- Chemicals/Industrial Manufacturing

- Textiles

- Paints & Coating

By Distribution Channel

- Direct Sales

- Distributors

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait