Content

What is the Current Amorphous Polyethylene Terephthalate Market Size and Volume?

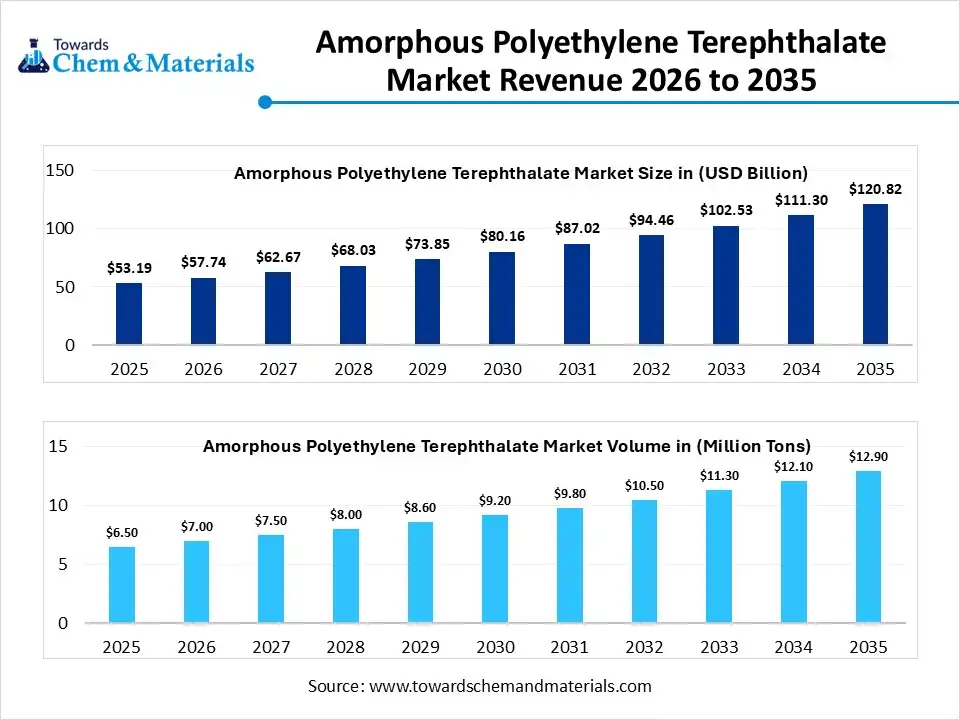

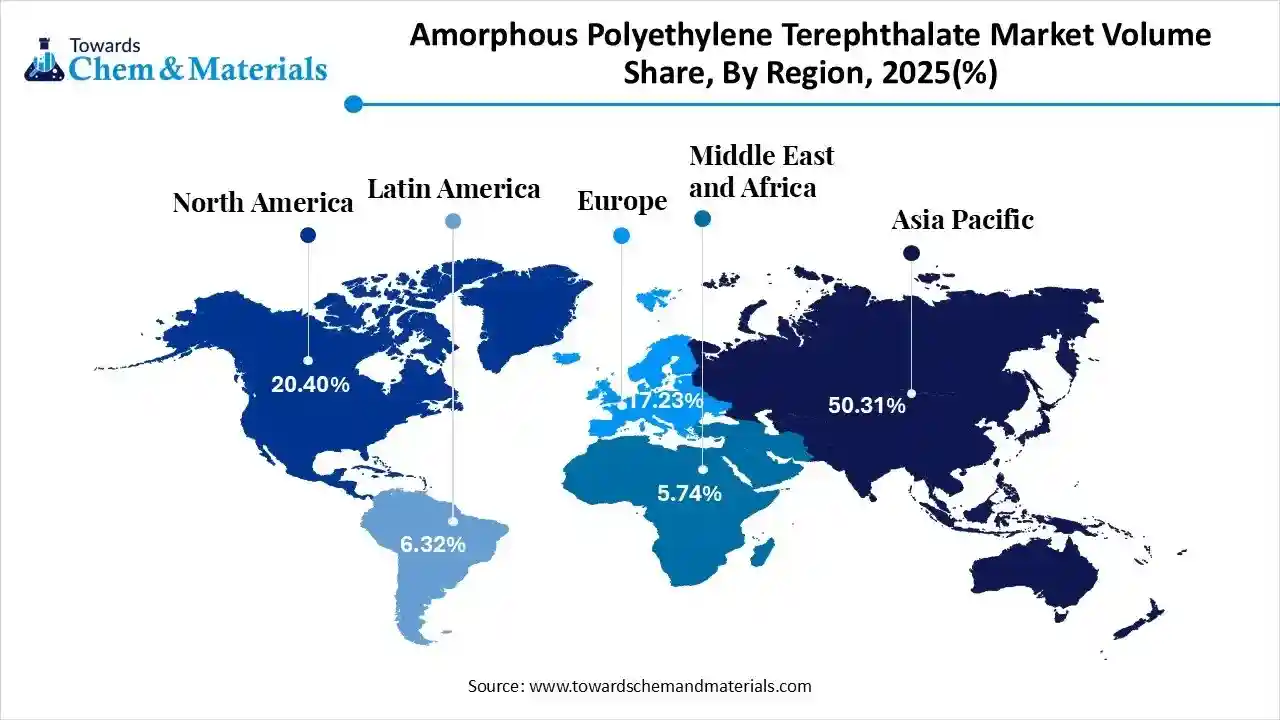

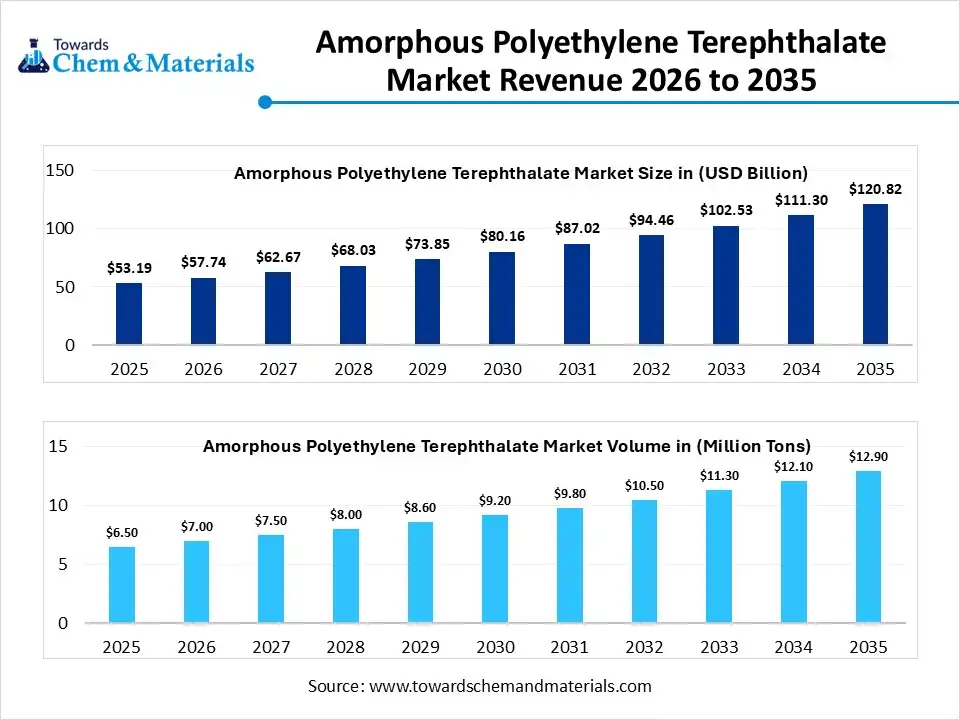

The global amorphous polyethylene terephthalate market size was estimated at USD 53.19 billion in 2025 and is expected to increase from USD 57.74 billion in 2026 to USD 120.82 billion by 2035, growing at a CAGR of 8.55% from 2026 to 2035. In terms of volume, the market is projected to grow from 6.5 million tons in 2025 to 12.9 million tons by 2035. growing at a CAGR of 7.10% from 2026 to 2035. Asia Pacific dominated the amorphous polyethylene terephthalate market with the largest volume share of 50.31% in 2025.The growth of the market is driven by the rising demand for sustainable and lightweight materials, and also by various industries, which fuel the growth.

Market Highlights

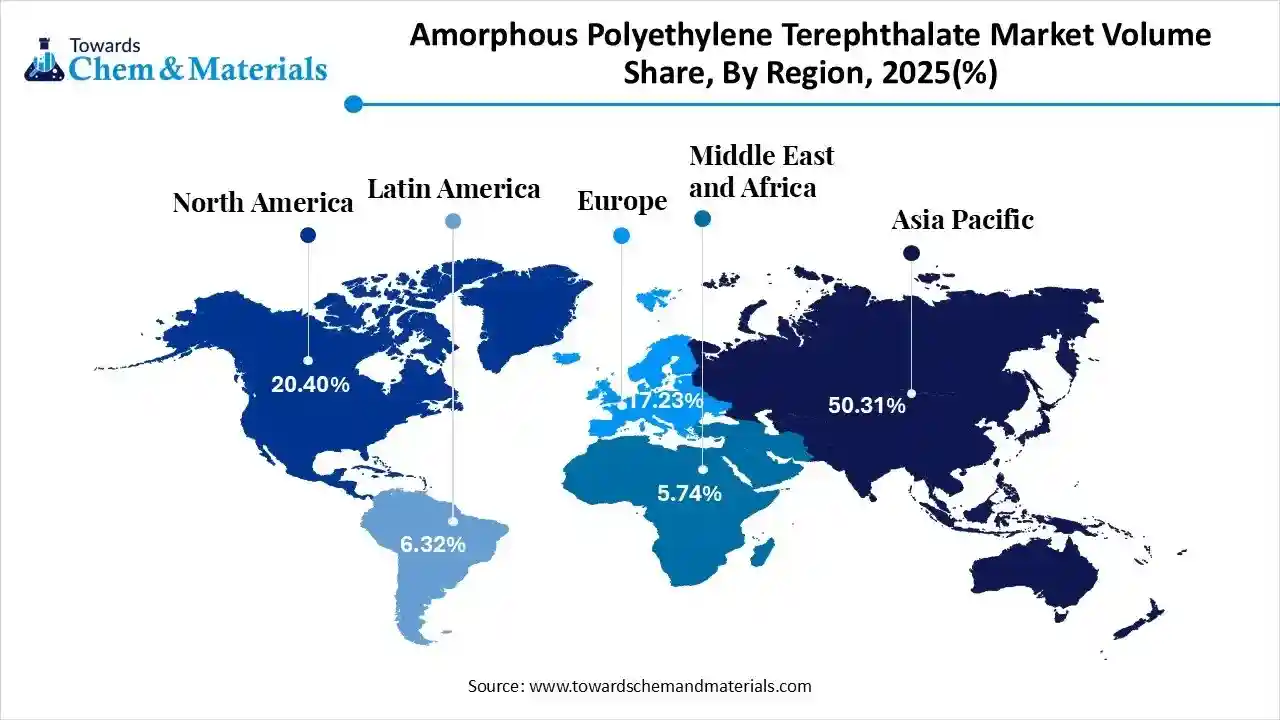

- The Asia Pacific dominated the amorphous polyethylene terephthalate market with the largest volume share of 50.31% in 2025.

- The amorphous polyethylene terephthalate market in North America is expected to grow at a substantial CAGR of 9.00% from 2026 to 2035.

- The Europe amorphous polyethylene terephthalate market segment accounted for the major volume share of 17.23% in 2025.

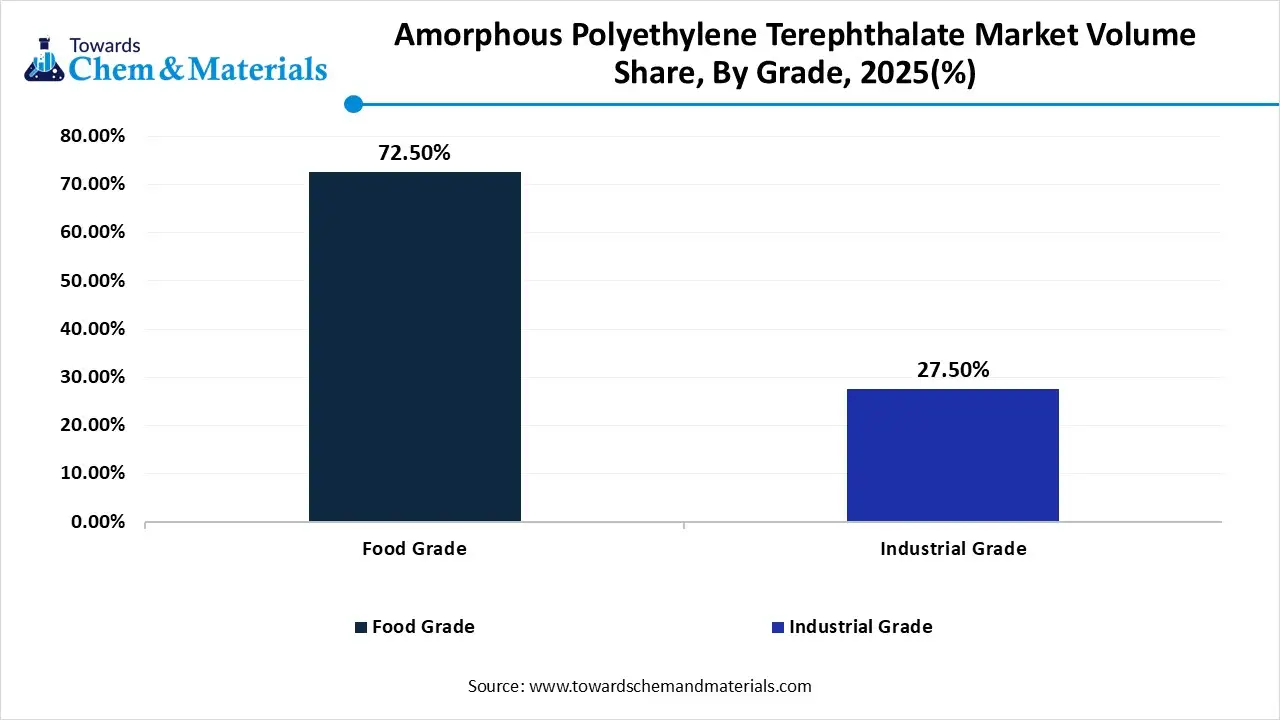

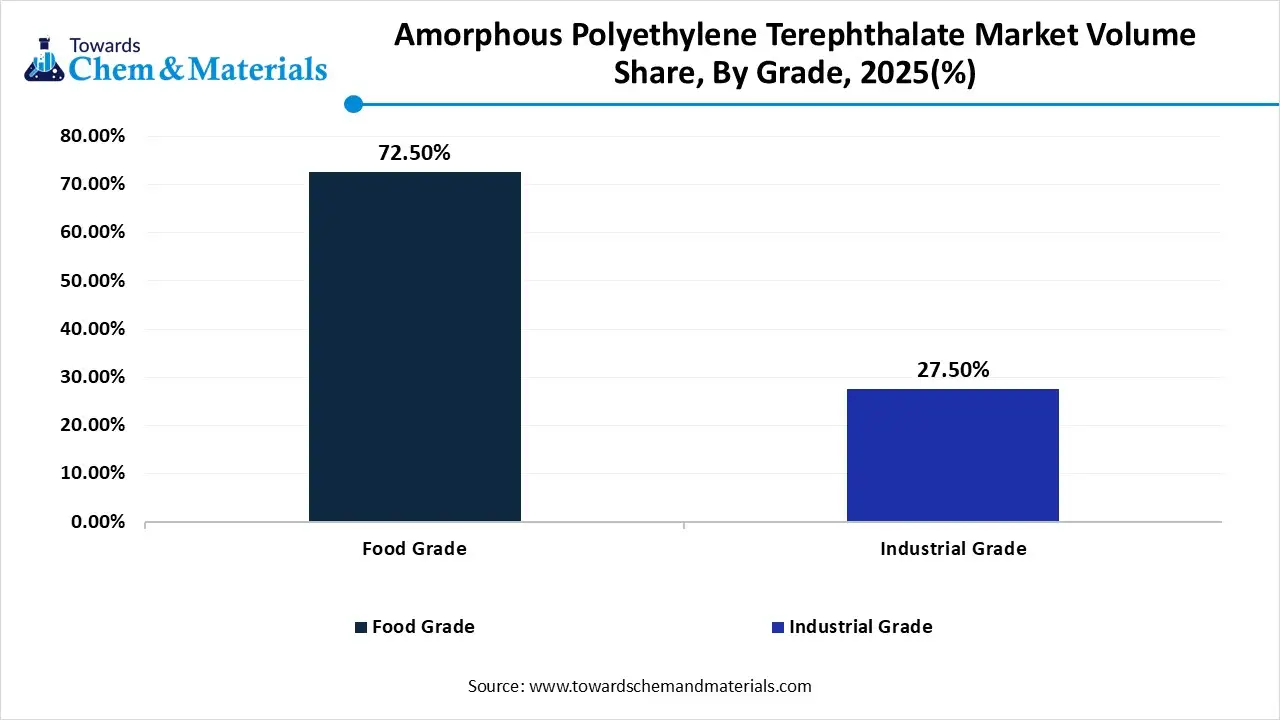

- By grade, the food grade segment dominated the market and accounted for the largest volume share of 72.50% in 2025.

- By grade, the recycled grade segment is expected to grow at the fastest CAGR of 8.92% from 2026 to 2035 in terms of volume.

- By application, the bottles segment led the market with the largest revenue volume share of 52% in 2025.

- By end use, the food & beverage segment dominated the market and accounted for the largest volume share of 58.4% in 2025.

- By processing, the blow molding segment led the market with the largest revenue volume share of 51.8% in 2025.

Market Overview

What Is the Significance of the Amorphous Polyethylene Terephthalate Market?

The amorphous polyethylene terephthalate (APET) market is significant due to various factors, including sustainability and high-clarity packaging for the booming food, beverage, and pharmaceutical industries. The growth of the market is driven by demand for durable, lightweight, recyclable, and transparent materials that offer excellent barrier properties. Its chemical resistance and rigidity make it crucial for blister packaging in the pharmaceutical sector. It is also used in automotive and industrial applications due to its electrical insulating properties.

Amorphous Polyethylene Terephthalate Market Growth Trends:

- Sustainability and rPET Adoption: The shift towards a circular economy is accelerating, with roughly 30% of future film production projected to incorporate recycled materials.

- High-Growth Applications: Beyond food, APET is gaining attention in electronics, personal care, and medical device packaging due to its clarity and rigidity.

- Technological Advancements: Innovations in co-extrusion and multilayer film technologies are improving the performance of APET films.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 57.74 Billion / 7.0 Million Tons |

| Revenue Forecast in 2035 | USD 120.82 Billion / 12.9 Million Tons |

| Growth Rate | CAGR 8.55% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Application, By End-Use Industry, By Grade, By Processing, By Regions |

| Key companies profiled | Indorama Ventures Public Company Limited, JBF Industries Ltd., Reliance Industries Limited, China Petroleum & Chemical Corporation (Sinopec), Covestro AG, Alpek S.A.B. de C.V., Far Eastern New Century Corporation, DAK Americas LLC, Lotte Chemical Corporation, Jiangsu Sanfangxiang Group Co., Ltd., Nan Ya Plastics Corporation, SABIC (Saudi Basic Industries Corp), OCTAL, NEO GROUP, UAB, Invista |

Key Technological Shifts in the Amorphous Polyethylene Terephthalate Market:

Key technological shifts in the APET market are driven by sustainability and enhanced performance, focusing on increased use of recycled content (rAPET), advanced multilayer co-extrusion for improved barrier properties, and high-clarity, lightweight production techniques. These innovations enable APET's expansion into electronics, medical, and sustainable packaging, while production processes focus on efficiency, reduced costs, and circular economy compliance.

Trade Analysis of Amorphous Polyethylene Terephthalate Market: Import & Export Statistics

- According to Global Export Data, the world shipped 131,682 shipments of Polyethylene Terephthalate via 3,998 exporters and 6,432 buyers.

- Additionally, 48,736 shipments of Polyethylene Terephthalate were exported through 132 verified exporters and 1,376 buyers.

- Overall, 3,648 suppliers shipped Polyethylene Terephthalate to 6,012 buyers globally, with 3,444 exporters active from June 2024 to May 2025.

- RELIANCE INDUSTRIES LIMITED: 10,885 shipments (61%)

- FAR EASTERN POLYTEX VIETNAM: 2,439 shipments (14%)

- IVL DHUNSERI PETROCHEM INDUSTRIES PRIVATE LIMITED: 1,817 shipments (10%)

Amorphous Polyethylene Terephthalate Market Value Chain Analysis

Chemical Synthesis and Processing

- APET is produced through polymerization of purified terephthalic acid (PTA) or dimethyl terephthalate (DMT) with monoethylene glycol, followed by extrusion, calendaring, thermoforming sheet production, and grade modification to achieve clarity, stiffness, and barrier properties.

- Key players Indorama Ventures, Eastman Chemical Company, Reliance Industries Limited, and OCTAL.

Quality Testing and Certification

- APET requires certifications ensuring food safety, mechanical strength, optical clarity, and environmental compliance. Key certifications include ISO quality standards, FDA and EU food-contact approvals, REACH compliance, and ASTM material specifications.

- Key players: ISO (International Organization for Standardization), FDA (U.S. Food and Drug Administration), EFSA, ASTM International.

Distribution to Industrial Users

- APET is supplied to packaging manufacturers, thermoformed tray producers, blister packaging suppliers, consumer goods packaging companies, and industrial sheet fabricators.

- Key players: Indorama Ventures, Eastman Chemical Company, OCTAL.

Amorphous Polyethylene Terephthalate Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Policies | Focus Areas |

| United States | EPA (Environmental Protection Agency) FDA (Food and Drug Administration) OSHA (Occupational Safety & Health Administration) |

EPA plastics & waste guidelines FDA food contact material rules (21 CFR) OSHA hazard communication & workplace exposure rules |

Environmental permits, emissions & waste management Compliance for food-contact APET products Worker safety in resin processing plants |

| European Union | European Chemicals Agency (ECHA) European Commission |

REACH (EC 1907/2006) CLP (Classification, Labelling & Packaging) EU Packaging & Packaging Waste Regulation Single-Use Plastics Directive / EPR frameworks |

Chemical safety & registration Hazard labeling Packaging recyclability & waste targets Extended producer responsibility |

| India | Ministry of Environment, Forest & Climate Change (MoEFCC) Central Pollution Control Board (CPCB) FSSAI (Food Safety & Standards Authority of India) |

Air/Water Acts Hazardous waste and plastics waste rules Food contact material guidelines (for recycled PET) |

Emissions & effluent control Plastics waste management (EPR) Safety standards for food packaging (rPET) |

Segmental Insights

Grade Insights

How did the Food Grade Segment Dominate the Amorphous Polyethylene Terephthalate Market in 2025?

The food-grade segment dominated the market with a share of approximately 72.5% in 2025, driven by high demand for sustainable, clear packaging in food and beverages, which fuels the growth of the market. The demand is increased due to its recyclability, lightweight nature, and excellent barrier properties, further fueling the growth and expansion of the market.

The recycled grade segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, due to the increased adoption and demand for sustainable packaging, particularly in food and beverage containers, and the need to reduce landfill waste fuels the growth of the market. The growth is further fueled by driven by corporate sustainability targets and regulatory pressure.

Amorphous Polyethylene Terephthalate Market Volume and Share, By Grade, 2025-2035

| By Grade | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Food Grade | 72.50% | 4.7 | 9.1 | 7.52% | 70.12% |

| Industrial Grade | 27.50% | 1.8 | 3.9 | 8.92% | 29.88% |

Application Insights

Which Application Segment Dominated The Amorphous Polyethylene Terephthalate Market in 2025?

The bottles segment dominated the market with a share of approximately 52% in 2025, due to growing demand for lightweight and transparent packaging in beverages and personal care, which drives the growth of the market. The other key growth drivers are lightweight material demand, high visibility packaging, and recyclability requirements, which further increase the demand and fuel the growth and expansion of the market.

The films and sheets segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, driven by high demand in packaging applications due to superior processing efficiency and operations for food packaging, which fuels the growth of the market. Increasing use in pharmaceutical, food and beverage, and consumer goods packaging also supports the growth and expansion of the market.

End-Use Insights

How did the Food and Beverages Segment Dominate the Amorphous Polyethylene Terephthalate Market in 2025?

The food and beverages segment dominated the market with a share of approximately 58.4% in 2025, due to high demand for protective, lightweight, and clear packaging solutions for food and beverage packaging, which fuels the growth of the market. The rising packaged food consumption and e-commerce due to an increase in disposable income and changing consumer lifestyle fuel the growth of the market.

The pharmaceutical segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, due to packaging demand from the sector due to demand for sterilization compatibility and barrier properties, which drives the growth. The shift towards urbanization and demand for eco-friendly alternatives and lower energy usage drives the growth of the market, supporting expansion.

Processing Insights

Which Processing Segment Dominated The Amorphous Polyethylene Terephthalate Market in 2025?

The blow molding segment dominated the market with a share of approximately 51.8% in 2025, driven by its application in producing PET bottles and containers for beverages, personal care, and household products, which drives the growth of the market. The other key factor is the increased demand for lightweight and low-cost production, further fueling the growth.

The extrusion segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, as it plays a crucial role, particularly in high-speed, high-clarity sheet and tray production, which fuels the growth of the market. The demand for APET in extrusion (such as for sheet and film production) is driven by the need for superior processing efficiency, lower crystallization, and faster cycle times in thermoforming.

Regional Insights

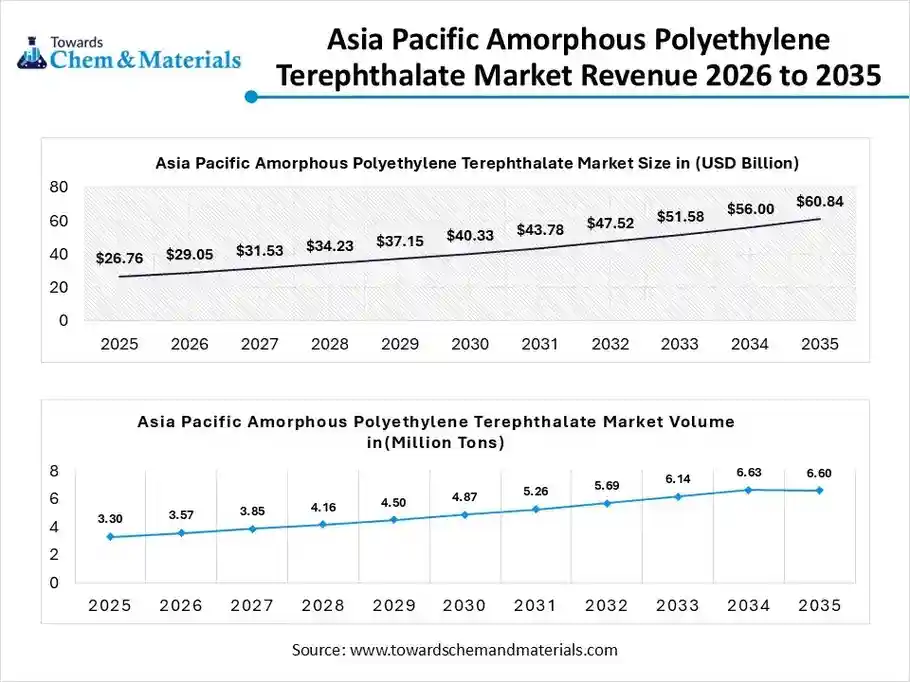

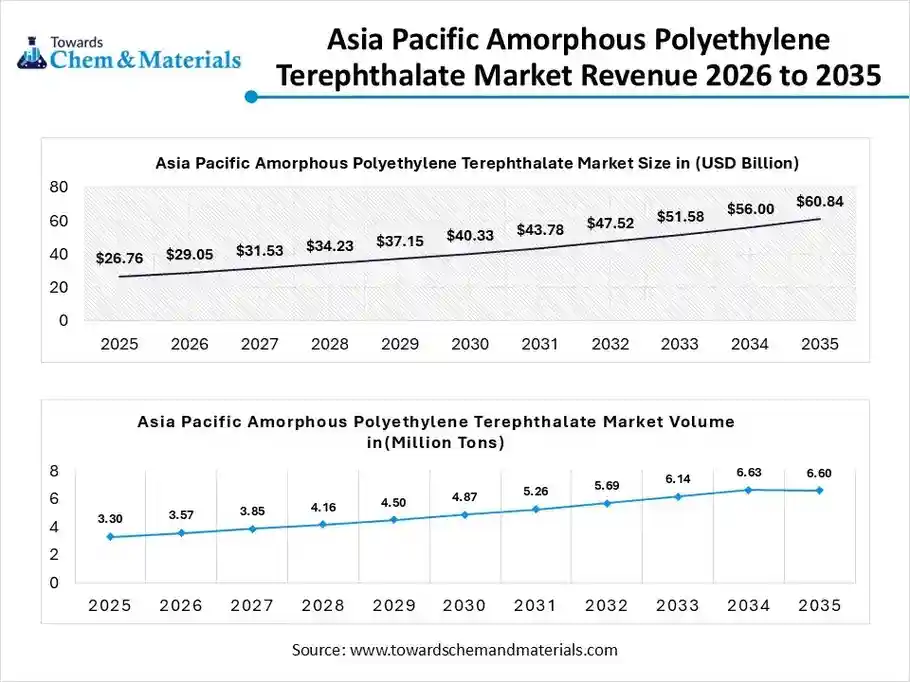

The Asia Pacific amorphous polyethylene terephthalate market size was valued at USD 26.76 billion in 2025 and is expected to be worth around USD 60.84 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 8.57% over the forecast period from 2026 to 2035.

The Asia Pacific amorphous polyethylene terephthalate volume was estimated at 3.3 million tons in 2025 and is projected to reach 6.6 million tons by 2035, growing at a CAGR of 8.05% from 2026 to 2035. Asia Pacific dominated the amorphous polyethylene terephthalate market with a share of approximately 50.31% in 2025, due to high demand for APET in high-clarity trays and containers for food, beverage, and pharmaceutical applications, which increases the demand for the market in the region. The growth is further driven by increased disposable income, shifting consumer lifestyles, and growing awareness of sustainable packaging solutions, supporting the growth of the market.

India Amorphous Polyethylene Terephthalate Market Growth Trends

India is experiencing growth driven by surging demand for sustainable, lightweight, and recyclable food packaging, which fuels the growth of the market. Rapidly evolving food and beverage sectors, alongside increasing consumer demand, are driving this expansion of the market. Increased urbanization and rising disposable income have accelerated the demand for packaged goods, benefiting the APET market, which further influences the growth of the market.

North America Amorphous Polyethylene Terephthalate Market Growth Analysis

North America amorphous polyethylene terephthalate market volume was estimated at 1.3 million tons in 2025 and is projected to reach 2.9 million tons by 2035, growing at a CAGR of 9.00% from 2026 to 2035. North America is expected to have fastest growth in the market in the forecast period between 2026 and 2035, driven by high demand for sustainable, transparent packaging in food, beverage, and consumer goods due to increased use of fuels, and the growth of the market. Increasing consumer preference for clear, convenient packaging in the healthcare and retail sectors is propelling the market forward, supporting expansion.

U.S. Amorphous Polyethylene Terephthalate Market Growth Trends

The U.S. amorphous polyethylene terephthalate (APET) market is experiencing robust growth, driven by high demand for sustainable, recyclable, and transparent packaging in the food, beverage, and pharmaceutical industries, which fuels the growth of the market in the country. The food packaging sector is the fastest-growing application in the country. APET is preferred for its high clarity, durability, and ability to keep food fresh, which is a key growth factor in the country.

Amorphous Polyethylene Terephthalate Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 20.40% | 1.3 | 2.9 | 9.00% | 22.31% |

| Europe | 17.23% | 1.1 | 2.0 | 6.36% | 15.11% |

| Asia Pacific | 50.31% | 3.3 | 6.6 | 8.05% | 50.88% |

| Latin America | 6.32% | 0.4 | 0.9 | 9.13% | 6.99% |

| Middle East & Africa | 5.74% | 0.4 | 0.6 | 5.57% | 4.71% |

Europe Amorphous Polyethylene Terephthalate Market Growth Analysis

Europe amorphous polyethylene terephthalate market volume was estimated at 1.1 million tons in 2025 and is projected to reach 2.0 million tons by 2035, growing at a CAGR of 6.36% from 2026 to 2035. Europe is experiencing notable growth in the market, driven by high demand for Sheet Grade APET in tray and container packaging, as well as Extruded Grade APET for flexible packaging, films, and labels, largely driven by the food, beverage, and pharmaceutical industries, and sustainability initiatives in the region fuel the growth of the market. Key players in the market, like Alpek SAB de CV, Covestro AG, Dow Inc., Indorama Ventures Public Co. Ltd., NEO GROUP UAB, and Polisan Hellas SA, also support the growth of the market.

Germany Amorphous Polyethylene Terephthalate Market Growth Trends

Germany's growth in the market is driven by high demand for food packaging and beverage bottles. The market is expanding due to the need for sustainable, lightweight, and recyclable packaging materials in Europe's largest economy. Stringent environmental regulations in Germany and Europe are driving the adoption of recyclable APET materials, boosting the demand for both virgin and recycled APET, and fueling growth.

Recent Developments

- In October 2025, Amcor introduced AmSecure, a next-generation APET-based packaging solution for healthcare applications designed as a cost-effective and sustainable alternative to PETG. The product is certified for recyclability, offers performance comparable to PETG, and is intended for thermoformed trays and rollstock used with medical devices and pharmaceutical products.(Source: www.packaging-gateway.com)

- In June 2025, Singapore-based Circular Plastics Company (CPC) launched its PET bottle recycling plant in Vung Tau, Vietnam, which has a capacity to produce 25,000 tonnes per year of rPET flakes and 14,000 tonnes per year of rPET pellets. The facility uses a customized washing line from Sorema and produces certified food-grade rPET for domestic and international markets.(Source: www.chemanalyst.com)

Top players in the Amorphous Polyethylene Terephthalate Market & Their Offerings:

- Indorama Ventures Public Company Limited: Indorama is a major global PET producer with integrated capabilities across resin production and recycling. It supplies APET resins and sheets used for high-clarity packaging in food & beverage, personal care, and consumer goods sectors, and is active in expanding rPET feedstock capacity for circular material streams.

- JBF Industries Ltd.: JBF Industries is a key APET manufacturer serving packaging markets with food-grade PET resins, APET sheets, and films. The company’s product portfolio supports thermoformed trays, blister packs, and containers, emphasizing clarity, stiffness, and recyclability.

- Reliance Industries Limited: Reliance produces APET and PET resins through its integrated petrochemical operations, supplying converters in packaging and industrial segments. It focuses on volume supply and regional availability, particularly in South Asia.

- China Petroleum & Chemical Corporation (Sinopec): Sinopec supplies APET resin and sheet materials from its large petrochemical complexes. Its offerings are widely used in bottles, thermoformed packaging, and industrial film applications within China and exporting regions in Asia.

- Covestro AG: Covestro offers high-performance APET materials and specialty PET sheet products tailored to premium packaging and technical applications. It emphasizes quality, consistency, and product customization for brand packaging needs.

- Alpek S.A.B. de C.V.

- Far Eastern New Century Corporation

- DAK Americas LLC

- Lotte Chemical Corporation

- Jiangsu Sanfangxiang Group Co., Ltd.

- Nan Ya Plastics Corporation

- SABIC (Saudi Basic Industries Corp)

- OCTAL

- NEO GROUP, UAB

- Invista

Segments Covered:

By Application

- Bottles

- Films & Sheets

- Food Packaging (Trays/Clamshells)

- Others (Textiles/Industrial)

By End-Use Industry

- Food & Beverage

- Pharmaceuticals

- Personal Care & Cosmetics

- Automotive & Electronics

By Grade

- Food Grade

- Industrial Grade

By Processing

- Blow Molding

- Extrusion

- Injection Molding

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa